0001232582false00012325822024-12-042024-12-040001232582us-gaap:CommonStockMember2024-12-042024-12-040001232582us-gaap:SeriesDPreferredStockMember2024-12-042024-12-040001232582us-gaap:SeriesFPreferredStockMember2024-12-042024-12-040001232582us-gaap:SeriesGPreferredStockMember2024-12-042024-12-040001232582us-gaap:SeriesHPreferredStockMember2024-12-042024-12-040001232582aht:SeriesIPreferredStockMember2024-12-042024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): December 4, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS employer identification number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

ITEM 7.01 REGULATION FD DISCLOSURE.

On December 4, 2024, Ashford Hospitality Trust, Inc. (the “Company”) issued a press release announcing that it has signed a definitive agreement to sell the 315-room Courtyard Boston Downtown located in Boston, Massachusetts for $123.0 million ($390,500 per key). The sale is expected to be completed in January 2025 and is subject to normal closing conditions. The Company provides no assurances that the sale will be completed on these terms or at all. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 7.01 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: December 4, 2024 | By: | /s/ Deric S. Eubanks |

| | Deric S. Eubanks |

| | Chief Financial Officer |

NEWS RELEASE

| | | | | | | | | | | | | |

| Contact: | Deric Eubanks | Laken Avonne Rapier | Joseph Calabrese | | |

| Chief Financial Officer | Media Contact | Financial Relations Board | | |

| (972) 490-9600 | LRapier@ashfordinc.com | (212) 827-3772 | | |

ASHFORD HOSPITALITY TRUST ANNOUNCES AGREEMENT TO SELL THE

COURTYARD BOSTON DOWNTOWN

DALLAS – December 4, 2024 – Ashford Hospitality Trust, Inc. (NYSE: AHT) (“Ashford Trust” or the “Company”) announced today that it has signed a definitive agreement to sell the 315-room Courtyard Boston Downtown located in Boston, Massachusetts for $123.0 million ($390,500 per key). The sale is expected to be completed in January 2025 and is subject to normal closing conditions. The Company provides no assurances that the sale will be completed on these terms or at all.

When adjusted for the Company’s anticipated capital expenditures, the sale price represents a 5.9% capitalization rate on net operating income for the trailing twelve months ended September 30, 2024, or 14.3x Hotel EBITDA for the same time period. Excluding the anticipated capital spend, the sale price represents a 6.9% capitalization rate on net operating income for the trailing twelve months ended September 30, 2024, or 12.3x Hotel EBITDA for the same time period.

“We are pleased to announce the signed agreement to sell the Courtyard Boston Downtown at a very attractive cap rate,” commented Stephen Zsigray, Ashford Trust’s President and Chief Executive Officer. “This sale will not only deleverage our BAML Highland Pool loan, but will also result in significant capital expenditure savings. We continue to have several assets in the market at various stages of the sales process and are encouraged by the improved sentiment we are seeing in the transaction market.”

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

| | | | | | | | |

| Ashford Hospitality Trust, Inc. |

| Courtyard Boston Downtown |

| Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net Operating Income |

| (Unaudited, in millions) |

| | |

| | 12 Months Ended |

| | September 30, 2024 |

| Net income (loss) | | $ | (1.8) | |

| Interest expense | | 8.7 | |

| | |

| Depreciation and amortization | | 3.1 | |

| | |

| Hotel EBITDA | | $ | 10.0 | |

| Capital reserve | | (1.5) | |

| Hotel Net Operating Income | | $ | 8.5 | |

| | |

_________

All information in this table is based upon unaudited operating financial data for the twelve month period ended September 30, 2024. This data has not been audited or reviewed by the Company’s independent registered public accounting firm. The financial information presented could change.

EBITDA is defined as net income (loss), computed in accordance with generally accepted accounting principles, before interest, taxes, depreciation and amortization. Hotel EBITDA multiple is defined as the purchase price divided by the trailing 12 month EBITDA. A capitalization rate is determined by dividing the property’s annual net operating income by the purchase price. Net operating income is the property’s hotel EBITDA minus a capital expense reserve of 5% of gross revenues.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company's common stock; and the Company's ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company's filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

v3.24.3

Document and Entity Information

|

Dec. 04, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 04, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

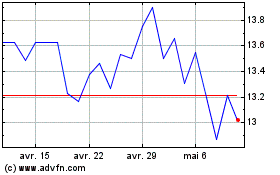

Ashford Hospitality (NYSE:AHT-I)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ashford Hospitality (NYSE:AHT-I)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025