Corebridge Financial Announces Launch of Secondary Offering of Common Stock by AIG

07 Novembre 2024 - 11:30PM

Business Wire

Corebridge Financial, Inc. (NYSE: CRBG) today announced the

launch of a secondary offering of its common stock by American

International Group, Inc. (NYSE: AIG). AIG, as the selling

stockholder, is offering 30 million existing shares of common stock

(out of approximately 568 million total shares of common stock

outstanding) of Corebridge Financial and has granted a 30-day

option to the underwriters to purchase up to an additional 4.5

million shares. All of the net proceeds from the offering will go

to AIG. The last reported per share sale price of Corebridge

Financial common stock on November 6, 2024 was $33.37.

J.P. Morgan and Morgan Stanley are acting as the underwriters

for the offering. The underwriters may offer the shares of common

stock from time to time for sale in one or more transactions on the

NYSE, in the over-the-counter market, through negotiated

transactions or otherwise, at market prices prevailing at the time

of sale, at prices related to prevailing market prices or at

negotiated prices.

The proposed offering of common stock is being made only by

means of a prospectus and accompanying prospectus supplement.

Copies of the prospectus and accompanying prospectus supplement

relating to the offering may be obtained from: J.P. Morgan

Securities LLC, c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, NY 11717, or by email at

prospectus-eq_fi@jpmchase.com and

postsalesmanualrequests@broadridge.com, or Morgan Stanley & Co. LLC via mail at 180

Varick Street, 2nd Floor, New York, NY, 10014.

A registration statement relating to these securities was filed

with the U.S. Securities and Exchange Commission (“SEC”) on

November 6, 2023, and became effective automatically. The

registration statement may be obtained free of charge at the SEC’s

website at www.sec.gov (EDGAR/Company Filings) under “Corebridge

Financial, Inc.” This press release does not constitute an offer to

sell or the solicitation of an offer to buy these securities, and

shall not constitute an offer, solicitation or sale in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that state or jurisdiction. Any offers,

solicitations or offers to buy, or any sales of securities will be

made in accordance with the registration requirements of the

Securities Act of 1933, as amended.

About Corebridge Financial

Corebridge Financial, Inc. makes it possible for more people to

take action in their financial lives. With more than $410 billion

in assets under management and administration as of September 30,

2024, Corebridge Financial is one of the largest providers of

retirement solutions and insurance products in the United States.

We proudly partner with financial professionals and institutions to

help individuals plan, save for and achieve secure financial

futures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107746250/en/

Işıl Müderrisoğlu (Investors):

investorrelations@corebridgefinancial.com Matt Ward (Media):

media.contact@corebridgefinancial.com

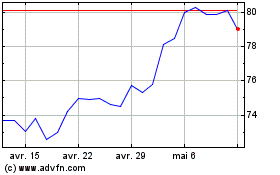

American (NYSE:AIG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

American (NYSE:AIG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024