Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: July 11, 2023

On Tuesday, July 11, 2023, AltC Acquisition Corp. (“AltC”)

and Oklo Inc. (“Oklo”) entered into an agreement for a business combination (the “Transaction”).

That afternoon, Oklo and AltC held a joint investor webcast to discuss the Transaction. The following is a transcript of the webcast:

| Bonita Chester |

Good morning. My name is Bonita Chester, and I am the Director of Communications and Media at Oklo. Thank you for joining us today, it is my pleasure to welcome you to the Oklo and AltC Acquisition Corp Business Combination Webcast. The webcast will be available for replay at oklo.com/investor, where you will also find a copy of the investor presentation. Please note that this morning's webcast contains forward-looking statements regarding future events, and the future performance of Oklo and AltC. These forward-looking statements are based upon information available to Oklo and AltC today, and reflect the current views and expectations of Oklo and AltC. Actual results could differ materially from those contemplated by these forward-looking statements, including but not limited to the timing of development milestones, potential future customers and revenues, competitive industry outlook and the timing and completion of the business combination. Please refer to the press release issued this morning, and the presentation accompanying this webcast for more information on the risks regarding these forward-looking statements that could cause actual results to differ materially. I now invite Michael Klein, Co-Founder and Chairman of AltC to share greater detail of the business combination. Michael, when you're ready, please begin your presentation. |

| Michael Klein: |

Good morning. And thank you all for joining the call today to learn about the merger between AltC Acquisition Corp. and Oklo. I'd like to thank all of the AltC investors and the other investors who join the call today. And we will be sharing with you why we think this company is extraordinary. And this investment opportunity is even more so. We have four people on the call today. Some you will recognize, some will be new to you. Sam Altman, who is my partner in the creation of AltC is well known to many of you from the incredible progress at OpenAI and ChatGPT. Some of you may also know that even before that, as the CEO, President of Y Combinator, he's been our partner since investing with us in Churchill 4 which was the creation of Lucid and has stayed our partner and this vehicle was specifically created to find a company that sat in one of his two core domain expertise areas, artificial intelligence and energy technology. That has been where we have built upon Sam's expertise. And that is why we're presenting Oklo to you today. Sam has been the lead investor initially in Oklo, and the chairman since 2015 of Oklo, and he brought Oklo through Y Combinator. He has helped the management team envision and develop this extraordinary business. And as a result, in addition to the one year that we've spent, with Jake and Caroline, we have the benefit of the nearly one decade that Sam has worked collectively with this company to build not only its technology readiness, and its regulatory readiness, but its public market ready -- readiness. We are equally fortunate to have Jake and Caroline on the call. They are the co-founders and CEO and COO respectively of Oklo. They founded this business one decade ago almost to the day. They have however, nearly two decades of experience in nuclear technology coming out of highly advanced programs at MIT. Jake has had experiences not just within the various different important nuclear labs in the U.S. but also commercially at GE. And Caroline, who's been a member of the U.S. Department of Energy Nuclear Energy Advisory Committee, working with also the Defense Department's and the Office of the Secretary of Defense. They have an incredible understanding of the technology, the regulatory world, and the commercial world that they are operating in today. And they have found a technology that is unusual because it has already been in operation for in excess of three decades, and plants that have been built on this technology have somewhere in the range of 400 combined reactor years, the longest of which was a reactor that was in place for 30 plus years. This is a proven technology now built to be an extraordinary commercial success. Our combination of Oklo with AltC has the benefit of being precisely what we intended to do with this vehicle. When we launched this vehicle, and brought in the initial investors in AltC, we intended to work with Sam to find a company that he believed in, that he had assisted in building and developing and proving the technology in a hard tech opportunity, but also that he had worked incredibly closely with the management team and had trust that they were ready not just to complete the technology plan, but also the commercial plan and be in the public market format. We've had the opportunity, because nuclear was one of the core areas of Sam's expertise and thus, one of the core verticals that AltC has reviewed, we've had the ability to review every nuclear opportunity that has come to market. And we were looking very hard, because we believe nuclear is critical for the transition to a net zero world. But it also is critical, because the new next generation fast reactor technologies are stunningly inexpensive, in providing clean, reliable, and affordable energy. That's very exciting. And it's very necessary. What Oklo does, is build plants and sells power as a service. Rather than being a developer of large-scale plants. Large scale plants that are in some cases in publicly traded companies are still multi billions of dollars to spend. And

they are decades in preparation rather than weeks, months or years. This technology, where the typical provision of energy comes with a $60 million investor in their Oklo unit or more a powerhouse is available in a commercialized form to target on addressed decentralized grid use cases, take datacenters as an example. And this will be an owner operated model, long term contracts with customers and models that we've seen in wind, we've seen it in solar, we've seen it in the electricity market and the [cogent] market for many years, which provides long term high margin recurring revenues, rather than lumpy capital asset sales. This company also has a benefit, because it has a second business line because they have the ability to recycle elements of the fuel both spent uranium and certain other essential elements that they are uniquely capable and have been tested in order to recycle this, which is both important vis-a-vis long term waste and storage, but also cost structure. This provides new revenue streams and provides a significant margin uplift. Now as you'll see in a moment, when I go through a little more detail, we've created this company on the basis that it will be shareholder friendly with a clear alignment of interests. And as you'll see in a moment, the first and most important thing is that it's a great company and a great position with substantial value creation ahead. Secondly, we've set it up at an extremely attractive $850 million pre money equity value. Third, all of the proceeds are going into the business to accelerate the business plan and to fund the deployment of the Aurora Powerhouse. No capital will go to selling shareholders. We've done this for the benefit of creating a clean, simple structure that is built around value creation. I'm going to spend just a moment more on the valuation here, and the investor friendly structure we put in place. As I stated, first and most important is to find a great company. So first, a great company, second, a very attractive valuation for all of us sponsor investor alike to enter at $850 million pre money equity value, just simply on the numbers. It is half of the value of the next closest currently trading, next generation nuclear company. That company has the same type of forecast timeline of being in the market and relatively similar attempted customer dynamics. But they're large plant developers rather than ongoing providers of high margin recurring cash flows in selling power. The third, company we show is another nuclear play coming public X-energy which is in the market as we speak. And as you can see, we've set this company up at less than half of that valuation as well. But because we think Oklo is a critical player in the entire energy transition landscape, we've also looked across at the technology driven area within natural gas net power, which recently has gone public through a similar structure, again, valued at close to $2 billion, not dissimilar to the X-energy transaction, not dissimilar to where new scale has traded, although it's now at a $1.5 billion value. And we have set this up at $850 million. And because we have a lower capital cost us at $60 million per unit of cost-efficient business model, we've got a very large unaddressed target market. And these plants can be put up much more quickly. Because both the space, the land and the regulatory structure to put in place this size of a plant and be an owner operator selling power to a datacenter or a given specific industrial park as an example, is much more frictionless and much more expedited. The owner operator model will allow us to have recurring revenues and high margins. And like the others that are currently publicly traded, we will be able to be in the market with our first plant in the 2026 or 2027 time period. And as I said, you have to not only set the value, but you also have to be very shareholder friendly. First, in terms of governance, this will be a single class of stock. And it will be a strong Board with proven business leaders value creators and participants who will help this

company build out it's already sizable scale of corporate relationships, all the capital goes to Oklo and will be used for building out to business Oklo shareholders are rolling 100% of their shares. AltC sponsor has subjected 100% of its shares to performance vesting. Oklo founders and AltC sponsor all have long duration lockups. And we don't have any complex structures that you might see in other transactions that are merged with vehicles wiped out. We don't have warrants. This was a transaction raised without private warrants. We don't have complex, corporate governance or special shareholder tax agreements that pull capital out of the company. This is set up to invest, build, develop, and create value for all of us in a company whose mission we're all proud to be allied with, and a company whose management we're excited to support. And in a company that we intend to just as we've done with each of our other companies be a generational holder of investments as this company grows, and develops. AltC was created in order to have the benefit of both all of Churchill's experience in finding public company ready, great investments, evaluating them and turning them into successful public companies. We formed the partnership with Sam Altman, because of his unique knowledge in several areas of the technology landscape, many of which he had invested in and some of which he had not. But he was clearly knowledgeable about the quality of their technology, the ability for their management to commercialize. That joint partnership was core, and has allowed us to look at hundreds of companies that were potentially attractive for AltC, and we selected Oklo. |

| Sam Altman |

AltC was launched in 2021, is a partnership between me and Churchill Capital, with the objective to provide public investors access to a compelling heart tech opportunity. Our goal is to find a great opportunity from our unique network of innovative companies. And we look to partner with a company where we felt we could add value in multiple ways. One, in helping to prepare them for success in the public markets, and two, utilize our collective strategic and financial networks to help unlock growth opportunities. And of course, we're going to define a great company with an important mission that we were excited to partner with. With today's announcement, we're on a path to deliver exactly what we set out to do. I had been focused on the importance of abundant energy, and particularly on nuclear as a way to get there for a long time. I think the two most important technological trends to happen in this decade, are abundant, inexpensive energy, and abundant, inexpensive intelligence. These are two things that I think drive almost everything else in our economy, everything else that we need to have great lives for people. And if these radically change if the availability of inexpensive, accessible, safe, clean energy, and inexpensive, accessible, powerful intelligence, if those -- if the structure of those change, the economy can really change too, and I think it can be a quite remarkable future for people. Obviously, AI requires lots of energy, but energy is needed for many other things that we do in this world of atoms. So, I have been focused on ways to get energy, particularly nuclear as a path for a very long time. And that is what led me originally to Oklo. I met the founders of Oklo, back in 2013, and recruited them to Y Combinator in 2014. And then invested more and became the chairman in 2015. And they've been working closely with the company ever since. I'm excited about Oklo, for many reasons, but I'll mention a few here. And one is that the policy support for nuclear is strong and growing, as the world recognizes how critical this is going to be to the future. Two, is the design itself. I looked at many designs for efficient plants out there and thought this was by far the most exciting, it is a combination of simple and modern. But it also applies to demonstrated technology that we know will work. The business model is attractive, makes a lot of sense. We'll talk more about that later. The design, I think is lets the company get to significant scale quickly which the market really needs. The company has already secured both a site and fuel for first deployment, which the company expects in '26, or '27. And Oklo has a potential for a fuel recycling opportunity. I think it's very exciting. And then finally, and super importantly to me, Oklo's founder lead, which I always look for it has deep technical expertise combined with strong leadership across all critical facets of the business. So, I'm super excited about this opportunity. And I'll hand it over to Jake. |

| Jacob DeWitte |

Thank you, Sam. So, in Oklo our mission is to provide clean, reliable, affordable energy at scale. And we are executing on this mission through the design and deployment of next generation fast reactor technologies that include some exciting opportunities around the ability to recycle used fuel, we started Oklo to address some of the challenges that have hindered nuclear deployment by focusing on building on demonstrated advanced technologies while combining that with better business models and go to market strategies. We purpose built Oklo to solve legacy nuclear challenges, specifically by focusing on taking a demonstrated technology and combining that with a business model that delivers what we find customers want, which is clean power and clean heat. We also focus on taking a demonstrated technology and modernizing it with state-of-the-art approaches to deliver a simplified design and the associated benefits from that. Additionally, because we're fast reactor, we have some very exciting opportunities around fuel recycling, which allow us to unlock the tremendous reserves of unused energy still remaining and spent fuel. We intend a couple of these aspects and attributes to deliver value to the world by powering the increasing energy needs of artificial intelligence and advanced computational needs by accelerating the energy transition to cleaner sources of energy with enhanced reliability, while also building increased energy security and access. We believe that clean reliable and abundant energy is critical to our future as a species. The world is growing its energy consumption, while also trying to reverse climate change. We see innovation and artificial intelligence and advanced computing driving unprecedented power needs. We also see that the U.S. grid is increasingly facing reliability challenges, as populations grow as infrastructure ages, and severe weather challenges that infrastructure. Additionally, many folks anticipate that the global electric demand profile of the world is expected to triple by 2050, especially as we increasingly electrify our society, and living standards improve across the world. Finally, climate change is viewed by some as one of the biggest health threats facing humanity. Transitioning to clean energy sources is critical to addressing those challenges. Nuclear is a reliable clean energy solution that's deployable at scale today, it's had a wonderful history of deep decarbonization. In countries like Sweden and in France, and new technologies, demonstrated technologies in particular of these advanced reactor types have the potential to realize that potential on a much larger scale. Nuclear has amongst the lowest lifecycle emissions of any major generating energy source. And it's very high-capacity factor, enabling significant reliability features. And additionally, it's demonstrated its ability to deliver at scale, partly because of the tremendous energy density of its fuel, and also its low material intensity. In other words, nuclear uses amongst the fewest kilograms of all the materials that go into a power plant of all energy sources when normalized against the megawatt hours or amount of energy produced over its lifetime. Based on these attributes, recent Department of Energy reports estimate that nuclear capacity will need to increase by more than 3x for the U.S. to achieve a net zero energy grid. Accordingly, policymakers on a bipartisan basis recognize the importance of U.S. leadership and nuclear technology. This is demonstrated by a suite of recent legislation that shows significant and growing support for the deployment of new nuclear technologies. Now with that in mind, let me talk to you a bit about our base business. We started the company to realize the significant potential that these advanced technologies have. And we do that by combining a demonstrated technology with a modern design approach and an attractive business model to create very attractive value propositions while we progress not only to our first deployment, but beyond. So

close inspired by the Experimental Breeder Reactor II, the fast reactor that ran in Idaho for 30 years between 1964 and 1994. It was a plant that produced about 20 megawatts of electric power, and sold that power commercially to the grid. It also demonstrated some amazing characteristics that provide the platform from which we built our approaches and our design. It showed the ability and flexibility to run on recycled fuel as well as fresh fuel. It also demonstrated inherent safety characteristics that support design simplification, which in turn lead to significant plant cost savings as well as operating and maintenance savings. This is a significant benefit from not just taking a demonstrated technology and building on it, but also having the experiential databases and cases in hand to support plant simplification afforded by the experiences with this plant. Similarly, the plant also demonstrated competitive operating and maintenance characteristics compared to operating commercial plants at the time. So close taken this demonstrated technology base and simplified it and modernize it to enable streamlined deployment. This is manifests with our Aurora Powerhouse, a liquid metal fast reactor that produces heat and electricity. Significant benefits are afforded by building not just on a demonstrated technology but by starting small, we're able to reduce complexity of the plant, while also enabling lower total capital needs to get to market. This plant shares fundamental similarities to plants that can be built and designed at larger scales. So, we anticipate taking these experiences and scaling them up to larger power plants as we grow. One of the benefits additionally, of having a modern design, coupled with being small, is allows us to reduce the number of parts and also tap into existing supply chains for other industries. We combine those technology benefits with a business model that we find delivers what customers want, which is heat and power. Our owner operator model is enabled by our plant size or plant complexity. In other words, the reduced complexity and the associated cost reductions. This means we can be design, build and own our powerhouses, and sell power accordingly from them through things like power purchase agreements. This leads to an attractive business model that's expected to generate compelling recurring revenue. We're pursuing a widely used earnings model in the global power markets with the sale of electricity under long term contracts. As illustrated below, the Aurora Powerhouse is expected to have attractive unit economics, driven by our simplified low-cost design that delivers power and heat reliably and efficiently for four decades or more. The inherent safety characteristics of our plant help keep costs low by removing the need for redundant safety features are specialized and hard to find componentry and raw materials. The powerhouse's size and reliability are attractive to an array of customers who have multi decade clean power needs, resulting in them having a strong interest in signing up for long term power purchase agreements or PPAs that helped to underpin the attractive unit economics of our plant. Our design also allows us to front load fuel expenditures for at least a decade, resulting in less downtime, and the associated costs of that downtime, while also delivering greater reliability for our customers. In other words, instead of refueling frequently on the order of every day or so, to every couple of years, we only have to refuel once every decade or so. The powerhouse possesses the ability to also run-on recycled fuel, which over time, we see as a significant upside to economics as recycled fuel becomes increasingly available. Oklo offers a winning value proposition for its customers. It's intended to accelerate customer adoption. We found strong customer interest based on our business model and our technology. We found that customers are more interested in buying what they really use, what they really need, which is power and heat, not so much buying, owning and operating power

plants themselves. This is important because this enables us to access and open up new markets for nuclear, including datacenter space, the defense space powering factories, industrial facilities, off grid and rural generation cases as well as utilities. Combining a proven technology with this business model opens up what we find customers are most interested in, which is the ability to adopt a reliable power production platform without having to own and operate it. Instead, we do we get the benefits accordingly of that, while also being able to scale forward from those experiences and reduce costs as we go forward. Now to talk a little bit more about our near-term projects that are on the table, I'll hand it off to my co-founder, Caroline Cochran. |

| Caroline Cochran |

Thank you Jake. Oklo has seen significant customer

interest and has now announced three sites. These include a site in Idaho and two sites in Ohio. And a goal of the first deployment

in the 2026-2027 timeline. Oklo has worked with the Department of Energy or the DOE in various capacities for a number of years now.

This is including many collaborative research projects over about seven years perform with three different national labs. And

importantly, in 2017, Oklo and DOE signed a Memorandum of Understanding related to working together for both citing and fuel for the

deployment of an Oklo powerhouse. Oklo was awarded a site use permit for the Idaho National Laboratory

site in 2019. And in 2020, they award of use fuel material to Oklo was announced. We're actively working with the lab on

establishment of our fuel fabrication capacity and on-site preparation. This year, Oklo announced two sites in Southeast Ohio

partnering with a community reuse organization called Southern Ohio Diversification Initiative. We're excited about the benefits of

the site related to its strategic location, proximity to nuclear technical resources, business climate, and strong local talent

pool. We're also looking forward toward announcements of future sites and deployments. And because our vision is clean, reliable

energy at scale, repeatable licensing is vital. We knew repeatable licensing would be most effective with a plant using technology

with inherent safety. Though the plants safety is separated from site specific constraints as possible. We also knew using a

technology with proven inherent safety would be key to change how nuclear power historically necessitated high costs for ensuring

plant safety, mostly through regulatorily induced costs. Our focus on repeatable licensing is why starting early our engagement with the Nuclear Regulatory Commission or NRC, we focused on an all-in-one combined license application. This is a regulatory pathway that already existed but had not been exercised. We approach the regulatory process both deliberately and in a novel way. We started formal engagement with the NRC in 2016 as the only advanced vision that is non-water-cooled design, formally engaged with the NRC at the time. |

| |

|

| |

|

| |

Because the combined license for advanced vision is

entirely new, we work with the NRC to pilot the new application structure in 2018, then submitted our application in 2020. Based on

the experience in the pilot application, the application submitted in 2020 was based on the expectation of a more efficient in

person audit review process. The pandemic made this exceptionally challenging, and the application was denied without prejudice in

2022, with the NRC requesting more information. With the learnings from this process and the expansion

of our regulatory team, Oklo has since been actively engaging and addressing outstanding questions by the regulator, and engaging

with them in order to progress towards our next application. The NRC has approved Oklo's quality assurance program description and

Oklo has another regulatory engagement ongoing. That is for our work on recycling technologies, which was announced in late 2022. I'll pass it back to Jake to speak more to our work, progress and outlook for the benefits of these recycling technologies, both to make use of recycling our own fuel, as well as to recycle what is now nuclear waste into a cost-effective domestic fuel supply chain. |

| |

|

| Jacob DeWitte |

Thank you, Caroline. One of the other opportunities we're really excited about in Oklo is around fuel recycling. Several countries around the world currently do fuel recycling. But we're particularly excited about bringing forward domestically developed advanced recycling technologies coupled with our fast reactor design that can unlock the tremendous energy reserves in today's use fuel inventories. Today's reactors use about 5% of the energy content available in the fuel when it's loaded into the reactor. After it's discharged from the reactor, more than 90% of that energy content remains accessible through advanced recycling and fast reactors like ours. This means there's a tremendous amount of fuel available through recycling, and it's something that fast reactors are uniquely suited to be able to do. And today's U.S. nuclear power plants are heavily reliant on imported nuclear fuel and nuclear fuel services to fabricate and deliver that fuel. And fuel recycling could provide potential future margin uplift and new revenue streams for us at Oklo. One benefit of spent fuel recycling is a pathway to significant cost savings, while also enhancing fuel availability and reducing fuel waste footprints. Fuel recycling solves a long-standing issue in the market that also creates a significant competitive advantage unique to fast reactors like ours. In January of 2023, Oklo submitted a commercial scale fuel recycling facility licensing project plan to the Nuclear Regulatory Commission outlining our anticipated pathway to licensing our first recycling facility. Since our founding, we've envisioned the potential that recycling can have coupled with advanced fast reactor designs. We've embarked on several significant projects to bring that vision to reality through partnerships with the Department of Energy and associated national laboratories. We currently have four major competitively awarded projects in the recycling space ongoing, that are focused on advancing the technology for commercial readiness. Oklo is a founder led organization, my co-founder and I have deep technical expertise. And we've been able to build a highly experienced team that taps into leading companies from other industries, while also building on deep nuclear experience, including nuclear regulatory experience. We've been building Oklo for over a decade. And we have the right technology, we have the right market opportunities, and we're finding significant early customer traction and engagement. When we combine that, with having secured our first site and fuel for our first plant, as well as the significant regulatory traction we've had to date, all operating on a high level of capital efficiency positions us at a time we're partnering with AltC and raising the capital through this transaction enables us to scale and deliver on the mission we're working to, which is to provide clean, reliable, affordable energy at a global scale. Thank you so much for joining us today. Thank you for listening to us and I look forward to meeting many of you soon. |

| |

|

| Bonita Chester |

This concludes today's webcast. We appreciate your participation and you may now disconnect. |

IMPORTANT LEGAL INFORMATION

Additional Information About the Proposed Transaction and Where

to Find It

The proposed transaction will be submitted to shareholders of AltC

for their consideration. AltC intends to file a registration statement on Form S-4 (the “Registration Statement”) with

the U.S. Securities and Exchange Comission (“SEC”), which will include preliminary and definitive proxy statements

to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s shareholders

in connection with the proposed transaction and other matters to be described in the Registration Statement, as well as the prospectus

relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of the proposed transaction.

After the Registration Statement has been filed and declared effective, AltC will mail a definitive proxy statement/prospectus/consent

solicitation statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transaction.

AltC’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus/consent

solicitation statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation

statement, in connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among

other things, the proposed transaction, as well as other documents filed with the SEC by AltC in connection with the proposed transaction,

as these documents will contain important information about AltC, Oklo and the proposed transaction. Shareholders may obtain a copy of

the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed

by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition

Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors, executive officers

and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s

shareholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants

in the solicitation of AltC’s shareholders in connection with the proposed transaction will be set forth in AltC’s proxy statement/prospectus/consent

solicitation statement when it is filed with the SEC. You can find more information about AltC’s directors and executive officers

in AltC’s final prospectus filed with the SEC on July 7, 2021 and in the Annual Reports filed by AltC with the SEC on Form 10-K.

Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will

be included in the proxy statement/prospectus/consent solicitation statement when it becomes available. Shareholders, potential investors

and other interested persons should read the proxy statement/prospectus/consent solicitation statement carefully when it becomes available

before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public

offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. INVESTMENT

IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON

OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are

not statements of historical matters. We have based these forward-looking statements on our current expectations and projections about

future events. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial

and operational metrics; estimates and projections regarding future manufacturing capacity and plant performance; estimates and projections

of market opportunity and market share; estimates and projections of adjacent energy sector opportunities; Oklo’s projected commercialization

timeline; Oklo’s ability to demonstrate scientific and engineering feasibility of its technologies; Oklo’s ability to attract,

retain, and expand its future customer base; Oklo’s ability to timely and effectively meet construction timelines and scale its

production and manufacturing processes; Oklo’s ability to develop products and services and bring them to market in a timely manner;

Oklo’s ability to achieve a competitive levelized cost of electricity; Oklo’s ability to compete successfully with fission

energy products and solutions offered by other companies, including fusion, as well as with other sources of clean energy; Oklo’s

expectations concerning relationships with strategic partners, suppliers, governments, regulatory bodies and other third parties; Oklo’s

ability to maintain, protect, and enhance its intellectual property; future acquisitions, ventures or investments in companies or products,

services, or technologies; Oklo’s ability to attract and retain qualified employees; development of favorable regulations and government

incentives affecting the markets in which Oklo operates; Oklo’s expectations regarding regulatory framework development; the potential

for and timing of receipt of a license to operate nuclear facilities from the U.S. Nuclear Regulatory Commission; the ability to achieve

the results illustrated in the unit economics and the potential benefits of the proposed transaction and expectations related to the terms

and timing of the proposed transaction. These statements are based on various assumptions, whether or not identified in this communication,

and on the current expectations of Oklo’s and AltC’s management and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Oklo and AltC.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual

results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include changes in domestic and

foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate

the proposed transaction, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect the combined company or the expected benefits of the proposed transaction or that the approval

of the shareholders of AltC or Oklo is not obtained; the outcome of any legal proceedings that may be instituted against Oklo or AltC

following announcement of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction; risks relating

to the uncertainty of the projected financial information with respect to Oklo; the effects of competition; changes in applicable laws

or regulations; the ability of Oklo to manage expenses and recruit and retain key employees; the ability of AltC or the combined company

to issue equity or equity-linked securities in connection with the proposed transaction or in the future; the outcome of any potential

litigation, government and regulatory proceedings, investigations and inquiries; and the impact of the global COVID-19 pandemic on Oklo,

AltC, the combined company’s projected results of operations, financial performance or other financial metrics, or on any of the

foregoing risks; those factors discussed in AltC’s Quarterly Reports filed by AltC with the SEC on Form 10-Q and the Annual Reports

filed by AltC with the SEC on Form 10-K, in each case, under the heading “Risk Factors,” as well as the factors summarized

in this communication under “Risk Factors” and other documents filed, or to be filed, with the SEC by AltC. If any of these

risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that neither Oklo nor AltC presently know or that Oklo and AltC currently believe are immaterial

that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements

reflect Oklo’s and AltC’s expectations, plans or forecasts of future events and views as of the date of this communication.

Oklo and AltC anticipate that subsequent events and developments will cause Oklo’s and AltC’s assessments to change. However,

while Oklo and AltC may elect to update these forward- looking statements at some point in the future, Oklo and AltC specifically disclaim

any obligation to do so. These forward-looking statements should not be relied upon as representing Oklo’s and AltC’s assessments

as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking

statements. An investment in AltC is not an investment in any of our founders' or sponsors' past investments or companies or any funds

affiliated with any of the foregoing. The historical results of these investments are not indicative of future performance of AltC, which

may differ materially from the performance of the founders or sponsors past investments, companies or affiliated funds.

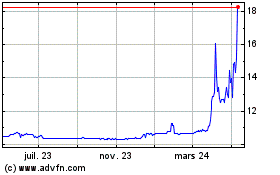

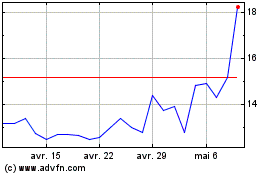

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024