Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: August 31, 2023

On Tuesday, July 11, 2023, AltC Acquisition Corp. (“AltC”)

entered into an agreement for a business combination (the “business combination”) with Oklo Inc. (“Oklo”).

On August 31, 2023, in connection therewith, Oklo made the following communications available on LinkedIn, X and Facebook:

LinkedIn:

X:

Facebook:

IMPORTANT LEGAL INFORMATION

Additional Information About the Proposed Transaction and Where

to Find It

The proposed transaction will be submitted to shareholders of AltC

for their consideration. AltC intends to file a registration statement on Form S-4 (the “Registration Statement”) with

the U.S. Securities and Exchange Commission (“SEC”), which will include preliminary and definitive proxy statements

to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s shareholders

in connection with the proposed transaction and other matters to be described in the Registration Statement, as well as the prospectus

relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of the proposed transaction.

After the Registration Statement has been filed and declared effective, AltC will mail a definitive proxy statement/prospectus/consent

solicitation statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transaction.

AltC’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus/consent

solicitation statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation

statement, in connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among

other things, the proposed transaction, as well as other documents filed with the SEC by AltC in connection with the proposed transaction,

as these documents will contain important information about AltC, Oklo and the proposed transaction. Shareholders may obtain a copy of

the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed

by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition

Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors, executive officers

and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s

shareholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants

in the solicitation of AltC’s shareholders in connection with the proposed transaction will be set forth in AltC’s proxy statement/prospectus/consent

solicitation statement when it is filed with the SEC. You can find more information about AltC’s directors and executive officers

in AltC’s final prospectus filed with the SEC on July 7, 2021 and in the Annual Reports filed by AltC with the SEC on Form 10-K.

Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will

be included in the proxy statement/prospectus/consent solicitation statement when it becomes available. Shareholders, potential investors

and other interested persons should read the proxy statement/prospectus/consent solicitation statement carefully when it becomes available

before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public

offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. INVESTMENT

IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON

OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are

not statements of historical matters. We have based these forward-looking statements on our current expectations and projections about

future events. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial

and operational metrics; estimates and projections regarding future manufacturing capacity and plant performance; estimates and projections

of market opportunity and market share; estimates and projections of adjacent energy sector opportunities; Oklo’s projected commercialization

timeline; Oklo’s ability to demonstrate scientific and engineering feasibility of its technologies; Oklo’s ability to attract,

retain, and expand its future customer base; Oklo’s ability to timely and effectively meet construction timelines and scale its

production and manufacturing processes; Oklo’s ability to develop products and services and bring them to market in a timely manner;

Oklo’s ability to achieve a competitive levelized cost of electricity; Oklo’s ability to compete successfully with fission

energy products and solutions offered by other companies, including fusion, as well as with other sources of energy, including renewables;

Oklo’s expectations concerning relationships with strategic partners, suppliers, governments, regulatory bodies and other third

parties; Oklo’s ability to maintain, protect, and enhance its intellectual property; future acquisitions, ventures or investments

in companies or products, services, or technologies; Oklo’s ability to attract and retain qualified employees; development of regulations

and government incentives affecting the markets in which Oklo operates; Oklo’s expectations regarding regulatory framework development

and its regulatory strategy; the potential for and timing of receipt of a license for designing, constructing and operating nuclear facilities

from the U.S. Nuclear Regulatory Commission; and the success of proposed projects for which Oklo’s powerhouses would provide power,

which is outside of Oklo’s control and the potential success of Oklo’s go-to-market strategy. These statements are based on

various assumptions, whether or not identified in this communication, and on the current expectations of Oklo’s and AltC’s

management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only

and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions.

Many actual events and circumstances are beyond the control of Oklo and AltC. These forward-looking statements are subject to known and

unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include changes in domestic and foreign business, market, financial, political and legal conditions;

Oklo’s pursuit of an emerging market, with no commercial project operating; the fact that Oklo has entered into any definitive agreements

with customers for the sale of power or recycling of nuclear fuel; the occurrence of any event, change or other circumstances that could

delay the proposed transaction; changes to the proposed structure of the business combination that may be required or appropriate as a

result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed transaction; Oklo’s

potential need for financing to grow its business and/or to construct its powerhouses or other facilities; the inability of the parties

to successfully or timely consummate the proposed transaction, including the risk that any required regulatory approvals are not obtained,

are delayed or are subject to unanticipated conditions that could adversely affect the new public entity following the business combination

(the “Post-Closing Company”) or the expected benefits of the proposed transaction or that the approval of AltC stockholders

or Oklo stockholders is not obtained; the outcome of any legal proceedings that may be instituted against Oklo or AltC following announcement

of the business combination; failure to realize the anticipated benefits of the proposed transaction; the risk that shareholders of AltC

could elect to have their shares redeemed by AltC, thus leaving the Post-Closing Company insufficient cash to grow its business; risks

relating to the uncertainty of the projected financial information with respect to Oklo, including conversion of reservations into binding

orders; risks related to the timing of expected business milestones and commercial launch; risks related to future market adoption of

Oklo’s offerings; the effects of competition; changes in regulatory requirements, governmental incentives and fuel and energy prices;

changes to applicable government policies, regulations, mandates and funding levels relating to Oklo’s business with government

entities; the impact to Oklo and its potential customers from changes in interest rates or inflation and rising costs, including commodity

and labor costs; Oklo’s ability to rapidly innovate; Oklo’s ability to maintain, protect and enhance its intellectual property;

Oklo’s ability to attract, retain and expand its future customer base; future changes to vehicle specifications which may impact

performance, pricing and other expectations; Oklo’s ability to effectively manage its growth and recruit and retain key employees,

including its chief executive officer and executive team; Oklo’s ability to establish its brand and capture additional market share,

and the risks associated with negative press or reputational harm; Oklo’s ability to achieve a competitive levelized cost of electricity;

Oklo’s ability to manage expenses; Oklo’s projected commercialization costs and timeline; Oklo’s ability to timely and

effectively meet construction timelines and scale its production and manufacturing process; changes in the policies, priorities, regulations,

mandates and funding levels of the governmental entities to which Oklo is subject; illustrative unit economics are based on assumptions

and expectations, including with respect to costs, revenue, and resources of revenue, gross margins, that prove to be incorrect for any

reason; the risk that the proposed business combination disrupts current plans and operations of Oklo; the amount of redemption requests

made by AltC public stockholders; the ability of AltC or the Post-Closing Company to issue equity or equity-linked securities in connection

with the proposed transaction or in the future; the ability to raise sufficient capital to fund the Post-Closing Company’s and Oklo’s

business plan, including limitations on the amount of capital raised in the proposed transaction as a result of redemptions or otherwise;

the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things,

competition, and the ability of the Post-Closing Company and Oklo to grow and manage growth profitability; the impact and potential extended

duration of the current supply/demand imbalance in the market for high-essay low-enriched uranium; whether government funding for high-assay

low-enriched uranium for government or commercial uses will result in adequate supply on anticipated timelines to support Oklo’s

business; the Post-Closing Company’s, Oklo’s and their commercial partners’ ability to obtain regulatory approvals necessary

to deploy small modular reactors in the U.S. and abroad in a timely way, or at all; risks relating to the negative public or political

perception of Oklo or the nuclear energy industry in general; the outcome of any potential litigation, government and regulatory proceedings,

investigations and inquiries; the impact of the COVID-19 pandemic on Oklo’s, AltC’s, and the Post-Closing Company’s

projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; other factors disclosed

in this communication; and those factors discussed in AltC’s Quarterly Reports filed by AltC with the SEC on Form 10-Q and the Annual

Reports filed by AltC with the SEC on Form 10-K, in each case, under the heading “Risk Factors,” as well as the factors summarized

in this communication under “Risk Factors” and other documents filed, or to be filed, with the SEC by AltC. If any of these

risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that neither Oklo nor AltC presently know or that Oklo and AltC currently believe are immaterial

that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements

reflect Oklo’s and AltC’s expectations, plans or forecasts of future events and views as of the date of this communication.

Oklo and AltC anticipate that subsequent events and developments will cause Oklo’s and AltC’s assessments to change. However,

while Oklo and AltC may elect to update these forward- looking statements at some point in the future, Oklo and AltC specifically disclaim

any obligation to do so. These forward-looking statements should not be relied upon as representing Oklo’s and AltC’s assessments

as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking

statements. An investment in AltC is not an investment in any of our founders' or sponsors' past investments or companies or any funds

affiliated with any of the foregoing. The historical results of these investments are not indicative of future performance of AltC, which

may differ materially from the performance of the founders or sponsors past investments, companies or affiliated funds.

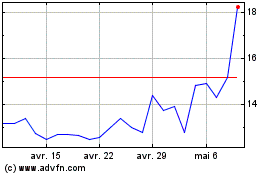

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

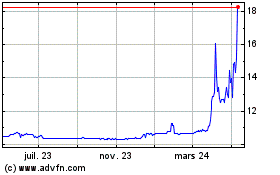

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024