0000766421false00007664212024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

January 25, 2024

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | | | | |

| 1-8957 | | 91-1292054 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 19300 International Boulevard | Seattle | Washington | | 98188 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Ticker Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | ALK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This document is also available on our website at http://investor.alaskaair.com.

ITEM 2.02. Results of Operations And Financial Condition

On January 25, 2024, Alaska Air Group, Inc. (Air Group) issued a press release reporting financial results for the fourth quarter and full year 2023. The press release is furnished herein as Exhibit 99.1. Supplemental information is furnished herein as Exhibit 99.2.

ITEM 7.01. Regulation FD Disclosure

Pursuant to 17 CFR Part 243 (Regulation FD), the Company is submitting information relating to its financial and operational outlook herein.

The Company expects full year 2024 adjusted earnings per share to be between $3.00 and $5.00. This expectation incorporates a $150 million negative impact from the grounding of the Company's Boeing 737-9 MAX fleet and assumes a gradual return to service of the 737-9 MAX fleet through early February.

Prior to the 737-9 MAX grounding, the Company expected full year 2024 capacity to grow 3% to 5% compared to 2023. Given the grounding, and the potential for future delivery delays, the Company expects capacity growth to be at or below the lower end of this range.

This update may contain forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by our forward-looking statements, assumptions or beliefs. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2022. Some of these risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed in our most recent Form 10-K and in our subsequent SEC filings. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements made today to conform them to actual results. Over time, our actual results, performance or achievements may differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, assumptions or beliefs and such differences might be significant and materially adverse.

In accordance with General Instruction B.2 of Form 8-K, the information under this item shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

ITEM 9.01 Financial Statements and Other Exhibits | | | | | | | | |

| | Fourth Quarter and Full Year 2023 Earnings Press Release dated January 25, 2024 |

| | Supplemental Earnings Materials |

| 104 | | Cover Page Interactive Data File - embedded within the Inline XBRL Document |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: January 25, 2024

/s/ EMILY HALVERSON

Emily Halverson

Vice President Finance and Controller

Exhibit 99.1

January 25, 2024 | | | | | | | | |

| Media contact: | | Investor/analyst contact: |

| Media Relations | | Ryan St. John |

| (206) 304-0008 | | VP Finance, Planning and Investor Relations |

| | ALKInvestorRelations@alaskaair.com |

Alaska Air Group reports fourth quarter and full year 2023 results

Announced agreement to acquire Hawaiian Airlines

Achieved record annual operating revenue of $10.4 billion

SEATTLE — Alaska Air Group Inc. (NYSE: ALK) today reported financial results for the fourth quarter and full year ended December 31, 2023.

“Air Group's 2023 accomplishments were significant," said CEO Ben Minicucci. “I want to thank our people for delivering a reliable operation, industry-leading cost performance, and a strong 7.5% adjusted pretax margin. As we navigate early 2024, we remain steadfast in our commitment to safety, providing a premium experience for our guests, and delivering durable financial performance. I am also grateful for how the team has rallied together to demonstrate tremendous professionalism and care in the midst of a challenging start to 2024 for them and our guests. Alaska is a resilient company with a track record of operational excellence, and we are confident in the plans we have laid out to ensure that success moving forward."

Financial Results:

•Reported net loss for the fourth quarter and net income for the full year 2023 under Generally Accepted Accounting Principles (GAAP) of $2 million, or $0.02 per share, and $235 million, or $1.83 per diluted share. These results compare to net income for the fourth quarter and full year 2022 of $22 million, or $0.17 per diluted share, and $58 million, or $0.45 per diluted share.

•Reported net income for the fourth quarter and full year 2023, excluding special items and mark-to-market fuel hedge accounting adjustments, of $38 million, or $0.30 per diluted share, and $583 million, or $4.53 per diluted share. These results compare to net income for the fourth quarter and full year 2022, excluding special items and mark-to-market fuel hedge accounting adjustments, of $118 million, or $0.92 per diluted share, and $556 million, or $4.35 per diluted share.

•Generated an adjusted pretax margin of 7.5% for the full year 2023, among the highest in the industry.

•Recorded $2.6 billion in operating revenue for the fourth quarter, and a record $10.4 billion for the full year 2023.

•Reduced CASM excluding fuel and special items by 6.6% in the fourth quarter and 2.6% in the full year compared to 2022.

•Generated $1.1 billion in operating cash flow for the full year 2023.

•Repurchased approximately 2 million shares of common stock for $75 million in the fourth quarter, bringing total repurchases to approximately 3.5 million shares for $145 million for the full year 2023.

•Recognized more than $400 million in bank card partner commissions in the fourth quarter and $1.6 billion for the full year 2023, representing a 13% year-over-year increase compared to the full year 2022.

•Air Group employees earned $200 million of incentive pay in 2023 by achieving profitability, sustainability, operational, and safety targets. The payout represents more than three weeks of pay for most employees.

•Received an investment grade credit rating of "Baa3" from Moody's Investors Service, citing the Company's "strong business profile and conservative financial policy."

Balance Sheet and Liquidity:

•Ended the year with a debt-to-capitalization ratio of 46%, within the target range of 40% to 50%.

•Repaid $40 million in debt in the fourth quarter, bringing total debt payments to $282 million for the full year 2023.

Operational Updates:

•Agreed to purchase Hawaiian Airlines for $18 per share in cash. The proposed combined airline will preserve both the Alaska and Hawaiian brands and provide guests with an expanded network across the Pacific.

•Placed our first 737-800 freighter into operating service, with a second 737-800 freighter expected to be delivered in the first quarter of 2024.

•Announced Alaska's 30th global airline partner, Porter Airlines, opening new opportunities for guests to travel to Canada from the West Coast.

•Announced new routes beginning in 2024, including: Seattle-Toronto, Anchorage-New York JFK, Anchorage-San Diego, and Portland-Nashville.

•Enhanced partnership with Condor Airlines with a bilateral codeshare agreement that enables Alaska and Condor to sell each other's flights.

•Completed sale of ten Airbus A321neos to American Airlines, with eight transactions occurring in the fourth quarter and two in January.

•Introduced inflight contactless payment Tap to Pay, an industry first, providing customers with an easier option to make purchases while flying.

737-9 MAX Grounding:

•Preparing to complete the final inspections on all of our 737-9 MAX aircraft. Each aircraft will be returned to service after the inspection has been completed and any findings resolved.

•Completed requested inspections of all 737-900ER aircraft with only one minor finding which was immediately corrected.

•Initiated a thorough review of Boeing's production quality and control systems, including Boeing's production vendor oversight to enhance quality control on new aircraft.

•Began enhanced quality oversight program at the Boeing production facility, expanding our team to validate work and quality of our aircraft as they progress through the manufacturing process.

Environmental, Social, and Governance Updates:

•Partnered with climate-tech company CHOOOSE to offer guests the ability to purchase sustainable aviation fuel credits or support nature-based climate projects upon check-out.

•Through Alaska's Care Miles program, Mileage Plan members donated over 100 million miles to 22 different charities in 2023.

Awards and Recognition:

•Named Worldwide Airline of the Year by the Centre for Aviation at the World Aviation Summit in Abu Dhabi.

•Achieved a score of 100 on the Human Rights Foundation's 2023-2024 Corporate Equity Index in recognition of Alaska's policies and practices supporting LGBTQ+ workplace equality.

The following table reconciles the company's reported GAAP net income (loss) per share (EPS) for the three and twelve months ended December 31, 2023 and 2022 to adjusted amounts. | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | 2022 |

| (in millions, except per share amounts) | Dollars | | Diluted EPS | | Dollars | | Diluted EPS |

| GAAP net income (loss) per share | $ | (2) | | | $ | (0.02) | | | $ | 22 | | | $ | 0.17 | |

| Mark-to-market fuel hedge adjustments | 12 | | | 0.09 | | | 12 | | | 0.09 | |

Special items - fleet transition and other(a) | 37 | | | 0.29 | | | 120 | | | 0.93 | |

Special items - labor and related(b) | — | | | — | | | (6) | | | (0.04) | |

Special items - net non-operating(c) | 4 | | | 0.03 | | | — | | | — | |

| | | | | | | |

| Income tax effect of reconciling items above | (13) | | | (0.09) | | | (30) | | | (0.23) | |

| Non-GAAP adjusted net income per share | $ | 38 | | | $ | 0.30 | | | $ | 118 | | | $ | 0.92 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | 2022 |

| (in millions, except per share amounts) | Dollars | | Diluted EPS | | Dollars | | Diluted EPS |

| GAAP net income per share | $ | 235 | | | $ | 1.83 | | | $ | 58 | | | $ | 0.45 | |

| | | | | | | |

| Mark-to-market fuel hedge adjustments | (2) | | | (0.02) | | | 76 | | | 0.60 | |

Special items - fleet transition and other(a) | 392 | | | 3.05 | | | 496 | | | 3.88 | |

Special items - labor and related(b) | 51 | | | 0.40 | | | 84 | | | 0.66 | |

Special items - net non-operating(c) | 18 | | | 0.14 | | | — | | | — | |

| | | | | | | |

| Income tax effect of reconciling items above | (111) | | | (0.87) | | | (158) | | | (1.24) | |

| Non-GAAP adjusted net income per share | $ | 583 | | | $ | 4.53 | | | $ | 556 | | | $ | 4.35 | |

(a) Special items - fleet transition and other in the three and twelve months ended December 31, 2023 and 2022 is primarily for impairment charges and accelerated costs associated with the retirement of Airbus and Q400 aircraft.

(b) Special items - labor and related is primarily for changes to Alaska pilots' sick leave benefits resulting from an agreement signed in the first quarter of 2023, and for a one-time payment to Alaska pilots following ratification of a new collective bargaining agreement in the third quarter of 2022.

(c) Special items - net non-operating in the three and twelve months ended December 31, 2023 is for interest expense associated with certain A321neo lease agreements which were modified as part of Alaska's fleet transition.

Statistical data, as well as a reconciliation of the reported non-GAAP financial measures, can be found in the accompanying tables. A glossary of financial terms can be found on the last page of this release.

A conference call regarding the fourth quarter and full year results will be streamed online at 8:30 a.m. PST on January 25, 2024. It can be accessed at www.alaskaair.com/investors. For those unable to listen to the live broadcast, a replay will be available after the conclusion of the call.

References in this update to “Air Group,” “Company,” “we,” “us,” and “our” refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified.

This news release may contain forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by our forward-looking statements, assumptions or beliefs. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2022. Some of these risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business. All of the forward-looking statements are qualified in their entirety by

reference to the risk factors discussed in our most recent Form 10-K and in our subsequent SEC filings. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements made today to conform them to actual results. Over time, our actual results, performance or achievements may differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, assumptions or beliefs and such differences might be significant and materially adverse.

Alaska Airlines and our regional partners serve more than 120 destinations across the United States, the Bahamas, Belize, Canada, Costa Rica, Guatemala and Mexico. We offer our guests a premium flying experience with award-winning customer service and an industry-leading loyalty program, Mileage Plan. With our fellow oneworld Alliance members and additional global partners, our guests have more choices than ever to purchase, earn or redeem on alaskaair.com across 30 airlines and more than 1,000 worldwide destinations. Learn more about Alaska at news.alaskaair.com and follow @alaskaairnews for news and stories. Alaska Airlines and Horizon Air are subsidiaries of Alaska Air Group.

###

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

| Alaska Air Group, Inc. | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in millions, except per-share amounts) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Operating Revenue | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Passenger revenue | $ | 2,326 | | | $ | 2,264 | | | 3 | % | | $ | 9,526 | | | $ | 8,808 | | | 8 | % |

| Mileage Plan other revenue | 165 | | | 157 | | | 5 | % | | 648 | | | 590 | | | 10 | % |

| Cargo and other revenue | 62 | | | 58 | | | 7 | % | | 252 | | | 248 | | | 2 | % |

| Total Operating Revenue | 2,553 | | | 2,479 | | | 3 | % | | 10,426 | | | 9,646 | | | 8 | % |

| | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | |

| Wages and benefits | 782 | | | 709 | | | 10 | % | | 3,041 | | | 2,640 | | | 15 | % |

| Variable incentive pay | 51 | | | 117 | | | (56) | % | | 200 | | | 257 | | | (22) | % |

| | | | | | | | | | | |

| Aircraft fuel, including hedging gains and losses | 709 | | | 668 | | | 6 | % | | 2,641 | | | 2,668 | | | (1) | % |

| Aircraft maintenance | 121 | | | 93 | | | 30 | % | | 488 | | | 424 | | | 15 | % |

| Aircraft rent | 47 | | | 69 | | | (32) | % | | 208 | | | 291 | | | (29) | % |

| Landing fees and other rentals | 178 | | | 146 | | | 22 | % | | 680 | | | 581 | | | 17 | % |

| Contracted services | 99 | | | 86 | | | 15 | % | | 389 | | | 329 | | | 18 | % |

| Selling expenses | 72 | | | 77 | | | (6) | % | | 303 | | | 295 | | | 3 | % |

| Depreciation and amortization | 121 | | | 105 | | | 15 | % | | 451 | | | 415 | | | 9 | % |

| Food and beverage service | 65 | | | 54 | | | 20 | % | | 241 | | | 197 | | | 22 | % |

| Third-party regional carrier expense | 54 | | | 37 | | | 46 | % | | 218 | | | 182 | | | 20 | % |

| Other | 185 | | | 181 | | | 2 | % | | 729 | | | 717 | | | 2 | % |

| Special items - fleet transition and other | 37 | | | 120 | | | (69) | % | | 392 | | | 496 | | | (21) | % |

| Special items - labor and related | — | | | (6) | | | (100) | % | | 51 | | | 84 | | | (39) | % |

| | | | | | | | | | | |

| Total Operating Expenses | 2,521 | | | 2,456 | | | 3 | % | | 10,032 | | | 9,576 | | | 5 | % |

| Operating Income | 32 | | | 23 | | | 39 | % | | 394 | | | 70 | | | NM |

| Non-operating Income (Expense) | | | | | | | | | | | |

| Interest income | 18 | | | 18 | | | — | | | 80 | | | 53 | | | 51 | % |

| Interest expense | (31) | | | (24) | | | 29 | % | | (121) | | | (108) | | | 12 | % |

| Interest capitalized | 6 | | | 6 | | | — | | | 27 | | | 14 | | | 93 | % |

| Special items - net non-operating | (4) | | | — | | | NM | | (18) | | | — | | | NM |

| Other - net | (17) | | | 12 | | | NM | | (39) | | | 50 | | | (178) | % |

| Total Non-operating Income (Expense) | (28) | | | 12 | | | NM | | (71) | | | 9 | | | NM |

| Income Before Income Tax | 4 | | | 35 | | | | | 323 | | | 79 | | | |

| Income tax expense | 6 | | | 13 | | | | | 88 | | | 21 | | | |

| Net Income (Loss) | $ | (2) | | | $ | 22 | | | | | $ | 235 | | | $ | 58 | | | |

| | | | | | | | | | | | |

| Basic Earnings (Loss) Per Share | $ | (0.02) | | | $ | 0.17 | | | | | $ | 1.84 | | | $ | 0.46 | | | |

| Diluted Earnings (Loss) Per Share | $ | (0.02) | | | $ | 0.17 | | | | | $ | 1.83 | | | $ | 0.45 | | | |

| | | | | | | | | | | |

| Shares used for computation: | | | | | | | | | | | |

| Basic | 127.376 | | | 127.303 | | | | | 127.375 | | | 126.657 | | | |

| Diluted | 127.376 | | | 128.470 | | | | | 128.708 | | | 127.899 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) | | | |

| Alaska Air Group, Inc. | | | |

As of December 31 (in millions) | 2023 | | 2022 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 281 | | | $ | 338 | |

| Marketable securities | 1,510 | | | 2,079 | |

| Total cash and marketable securities | 1,791 | | | 2,417 | |

| Receivables - net | 383 | | | 296 | |

| Inventories and supplies - net | 116 | | | 104 | |

| Prepaid expenses | 176 | | | 163 | |

| Other current assets | 239 | | | 60 | |

| Total Current Assets | 2,705 | | | 3,040 | |

| | | |

| Property and Equipment | | | |

| Aircraft and other flight equipment | 10,425 | | | 9,053 | |

| Other property and equipment | 1,814 | | | 1,661 | |

| Deposits for future flight equipment | 491 | | | 670 | |

| 12,730 | | | 11,384 | |

| Less accumulated depreciation and amortization | 4,342 | | | 4,127 | |

| Total Property and Equipment - Net | 8,388 | | | 7,257 | |

| | | |

| Other Assets | | | |

| Operating lease assets | 1,195 | | | 1,471 | |

| Goodwill and intangible assets | 2,033 | | | 2,038 | |

| Other noncurrent assets | 292 | | | 380 | |

| Total Other Assets | 3,520 | | | 3,889 | |

| | | |

| Total Assets | $ | 14,613 | | | $ | 14,186 | |

| | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) | | | |

| Alaska Air Group, Inc. | | | |

As of December 31 (in millions except share amounts) | 2023 | | 2022 |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 207 | | | $ | 221 | |

| Accrued wages, vacation and payroll taxes | 584 | | | 619 | |

| Air traffic liability | 1,136 | | | 1,180 | |

| Other accrued liabilities | 800 | | | 846 | |

| Deferred revenue | 1,221 | | | 1,123 | |

| Current portion of operating lease liabilities | 158 | | | 228 | |

| Current portion of long-term debt and finance leases | 353 | | | 276 | |

| Total Current Liabilities | 4,459 | | | 4,493 | |

| | | |

| Long-Term Debt, Net of Current Portion | 2,182 | | | 1,883 | |

| | | |

| Noncurrent Liabilities | | | |

| Long-term operating lease liabilities, net of current portion | 1,125 | | | 1,393 | |

| Deferred income taxes | 695 | | | 574 | |

| Deferred revenue | 1,382 | | | 1,374 | |

| Obligation for pension and post-retirement medical benefits | 362 | | | 348 | |

| Other liabilities | 295 | | | 305 | |

| Total Noncurrent Liabilities | 3,859 | | | 3,994 | |

| | | |

| Commitments and Contingencies | | | |

| | | |

| Shareholders' Equity | | | |

Preferred stock, $0.01 par value, Authorized: 5,000,000 shares, none issued or outstanding | — | | | — | |

Common stock, $0.01 par value, Authorized: 400,000,000 shares, Issued: 2023 - 138,960,830 shares; 2022 - 136,883,042 shares, Outstanding: 2023 - 126,090,353 shares; 2022 - 127,533,916 shares | 1 | | | 1 | |

| Capital in excess of par value | 695 | | | 577 | |

Treasury stock (common), at cost: 2023 - 12,870,477 shares; 2022 - 9,349,944 shares | (819) | | | (674) | |

| Accumulated other comprehensive loss | (299) | | | (388) | |

| Retained earnings | 4,535 | | | 4,300 | |

| | 4,113 | | | 3,816 | |

| Total Liabilities and Shareholders' Equity | $ | 14,613 | | | $ | 14,186 | |

| | | | | | | | | | | | | | | | | |

| SUMMARY CASH FLOW (unaudited) | | | | | |

| Alaska Air Group, Inc. | | | | | |

| (in millions) | Year Ended December 31, 2023 | | Nine Months Ended September 30, 2023(a) | | Three Months Ended December 31, 2023(b) |

| Cash Flows from Operating Activities: | | | | | |

| Net income (loss) | $ | 235 | | | $ | 237 | | | $ | (2) | |

| Non-cash reconciling items | 958 | | | 798 | | | 160 | |

| Changes in working capital | (143) | | | 68 | | | (211) | |

| Net cash provided by (used in) operating activities | 1,050 | | | 1,103 | | | (53) | |

| | | | | |

| Cash Flows from Investing Activities: | | | | | |

| Property and equipment additions | (1,494) | | | (991) | | | (503) | |

| Other investing activities | 531 | | | 181 | | | 350 | |

| Net cash used in investing activities | (963) | | | (810) | | | (153) | |

| | | | | |

| Cash Flows from Financing Activities | (148) | | | 12 | | | (160) | |

| | | | | |

| Net increase (decrease) in cash and cash equivalents | (61) | | | 305 | | | (366) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 369 | | | 369 | | | 674 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 308 | | | $ | 674 | | | $ | 308 | |

(a) As reported in Form 10-Q for the third quarter of 2023.

(b) Cash flows for the three months ended December 31, 2023 can be calculated by subtracting cash flows for the nine months ended

September 30, 2023, as reported in Form 10-Q for the third quarter 2023, from the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OPERATING STATISTICS SUMMARY (unaudited) | | | | | | | | |

| Alaska Air Group, Inc. | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Consolidated Operating Statistics:(a) | | | | | | | | | | | |

| Revenue passengers (000) | 10,903 | | 10,331 | | 6% | | 44,557 | | 41,468 | | 7% |

| RPMs (000,000) "traffic" | 14,153 | | 12,855 | | 10% | | 57,362 | | 51,330 | | 12% |

| ASMs (000,000) "capacity" | 17,077 | | 15,030 | | 14% | | 68,524 | | 60,773 | | 13% |

| Load factor | 82.9% | | 85.5% | | (2.6) pts | | 83.7% | | 84.5% | | (0.8) pts |

| Yield | 16.43¢ | | 17.61¢ | | (7)% | | 16.61¢ | | 17.16¢ | | (3)% |

| RASM | 14.95¢ | | 16.49¢ | | (9)% | | 15.21¢ | | 15.87¢ | | (4)% |

CASMex(b) | 10.40¢ | | 11.14¢ | | (7)% | | 10.14¢ | | 10.41¢ | | (3)% |

Economic fuel cost per gallon(b) | $3.42 | | $3.55 | | (4)% | | $3.21 | | $3.42 | | (6)% |

| Fuel gallons (000,000) | 204 | | 185 | | 10% | | 824 | | 758 | | 9% |

| ASMs per gallon | 83.7 | | 81.2 | | 3% | | 83.2 | | 80.2 | | 4% |

| Departures (000) | 103 | | 95 | | 8% | | 414 | | 404 | | 2% |

| Average full-time equivalent employees (FTEs) | 23,117 | | 23,195 | | — | | 23,319 | | 22,564 | | 3% |

| Mainline Operating Statistics: | | | | | | | | | | | |

| Revenue passengers (000) | 8,572 | | 8,237 | | 4% | | 35,307 | | 31,795 | | 11% |

| RPMs (000,000) "traffic" | 13,008 | | 11,994 | | 8% | | 52,975 | | 46,812 | | 13% |

| ASMs (000,000) "capacity" | 15,708 | | 14,004 | | 12% | | 63,292 | | 55,224 | | 15% |

| Load factor | 82.8% | | 85.6% | | (2.8) pts | | 83.7% | | 84.8% | | (1.1) pts |

| Yield | 15.03¢ | | 16.39¢ | | (8)% | | 15.28¢ | | 15.92¢ | | (4)% |

| RASM | 13.79¢ | | 15.49¢ | | (11)% | | 14.12¢ | | 14.91¢ | | (5)% |

CASMex(b) | 9.54¢ | | 10.05¢ | | (5)% | | 9.23¢ | | 9.45¢ | | (2)% |

Economic fuel cost per gallon(b) | $3.38 | | $3.52 | | (4)% | | $3.18 | | $3.40 | | (6)% |

| Fuel gallons (000,000) | 175 | | 163 | | 7% | | 713 | | 646 | | 10% |

| ASMs per gallon | 89.8 | | 85.9 | | 5% | | 88.8 | | 85.5 | | 4% |

| Departures (000) | 66 | | 62 | | 6% | | 268 | | 244 | | 10% |

| Average full-time equivalent employees (FTEs) | 17,966 | | 17,792 | | 1% | | 18,129 | | 17,224 | | 5% |

| Aircraft utilization | 11.2 | | 9.9 | | 13% | | 11.4 | | 9.9 | | 15% |

| Average aircraft stage length | 1,409 | | 1,341 | | 5% | | 1,387 | | 1,347 | | 3% |

Operating fleet(d) | 231 | | 225 | | 6 a/c | | 231 | | 225 | | 6 a/c |

Regional Operating Statistics:(c) | | | | | | | | | | | |

| Revenue passengers (000) | 2,331 | | 2,094 | | 11% | | 9,250 | | 9,673 | | (4)% |

| RPMs (000,000) "traffic" | 1,145 | | 861 | | 33% | | 4,387 | | 4,518 | | (3)% |

| ASMs (000,000) "capacity" | 1,369 | | 1,027 | | 33% | | 5,232 | | 5,549 | | (6)% |

| Load factor | 83.6% | | 83.9% | | (0.3) pts | | 83.8% | | 81.4% | | 2.4 pts |

| Yield | 32.41¢ | | 34.66¢ | | (6)% | | 32.57¢ | | 29.97¢ | | 9% |

| RASM | 28.08¢ | | 30.08¢ | | (7)% | | 28.26¢ | | 25.34¢ | | 12% |

| Departures (000) | 37 | | 33 | | 12% | | 146 | | 160 | | (9)% |

Operating fleet(d) | 83 | | 86 | | (3) a/c | | 83 | | 86 | | (3) a/c |

(a)Except for FTEs, data includes information related to third-party regional capacity purchase flying arrangements.

(b)See a reconciliation of this non-GAAP measure and Note A for a discussion of potential importance of this measure to investors in the accompanying pages.

(c)Data presented includes information related to flights operated by Horizon and third-party carriers.

(d)Excludes all aircraft removed from operating service.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OPERATING SEGMENTS (unaudited) | | | | | | |

| Alaska Air Group, Inc. | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| (in millions) | Mainline | | Regional | | Horizon | | Consolidating & Other(a) | | Air Group Adjusted(b) | | Special Items(c) | | Consolidated |

| Operating Revenue | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Passenger revenue | $ | 1,954 | | | $ | 372 | | | $ | — | | | $ | — | | | $ | 2,326 | | | $ | — | | | $ | 2,326 | |

| CPA revenue | — | | | — | | | 100 | | | (100) | | | — | | | — | | | — | |

| Mileage Plan other revenue | 152 | | | 13 | | | — | | | — | | | 165 | | | — | | | 165 | |

| Cargo and other revenue | 60 | | | — | | | — | | | 2 | | | 62 | | | — | | | 62 | |

| Total Operating Revenue | 2,166 | | | 385 | | | 100 | | | (98) | | | 2,553 | | | — | | | 2,553 | |

| Operating Expenses | | | | | | | | | | | | | |

| Operating expenses, excluding fuel | 1,499 | | | 289 | | | 84 | | | (97) | | | 1,775 | | | 37 | | | 1,812 | |

| Fuel expense | 592 | | | 105 | | | — | | | — | | | 697 | | | 12 | | | 709 | |

| Total Operating Expenses | 2,091 | | | 394 | | | 84 | | | (97) | | | 2,472 | | | 49 | | | 2,521 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-operating Income (Expense) | (12) | | | — | | | (12) | | | — | | | (24) | | | (4) | | | (28) | |

| Income (Loss) Before Income Tax | $ | 63 | | | $ | (9) | | | $ | 4 | | | $ | (1) | | | $ | 57 | | | $ | (53) | | | $ | 4 | |

| Pretax Margin | | | | | | | | | 2.2 | % | | | | 0.2 | % |

| | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| (in millions) | Mainline | | Regional | | Horizon | | Consolidating & Other(a) | | Air Group Adjusted(b) | | Special Items(c) | | Consolidated |

| Operating Revenue | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Passenger revenue | $ | 1,966 | | | $ | 298 | | | $ | — | | | $ | — | | | $ | 2,264 | | | $ | — | | | $ | 2,264 | |

| CPA revenue | — | | | — | | | 71 | | | (71) | | | — | | | — | | | — | |

| Mileage Plan other revenue | 146 | | | 11 | | | — | | | — | | | 157 | | | — | | | 157 | |

| Cargo and other revenue | 58 | | | — | | | — | | | — | | | 58 | | | — | | | 58 | |

| Total Operating Revenue | 2,170 | | | 309 | | | 71 | | | (71) | | | 2,479 | | | — | | | 2,479 | |

| Operating Expenses | | | | | | | | | | | | | |

| Operating expenses, excluding fuel | 1,408 | | | 243 | | | 92 | | | (69) | | | 1,674 | | | 114 | | | 1,788 | |

| Fuel expense | 572 | | | 84 | | | — | | | — | | | 656 | | | 12 | | | 668 | |

| Total Operating Expenses | 1,980 | | | 327 | | | 92 | | | (69) | | | 2,330 | | | 126 | | | 2,456 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-operating Income (Expense) | 18 | | | — | | | (7) | | | 1 | | | 12 | | | — | | | 12 | |

| Income (Loss) Before Income Tax | $ | 208 | | | $ | (18) | | | $ | (28) | | | $ | (1) | | | $ | 161 | | | $ | (126) | | | $ | 35 | |

| Pretax Margin | | | | | | | | | 6.5 | % | | | | 1.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OPERATING SEGMENTS (unaudited) | | | | | | |

| Alaska Air Group, Inc. | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 |

| (in millions) | Mainline | | Regional | | Horizon | | Consolidating & Other(a) | | Air Group Adjusted(b) | | Special Items(c) | | Consolidated |

| Operating Revenue | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Passenger revenue | $ | 8,097 | | | $ | 1,429 | | | $ | — | | | $ | — | | | $ | 9,526 | | | $ | — | | | $ | 9,526 | |

| CPA revenue | — | | | — | | | 374 | | | (374) | | | — | | | — | | | — | |

| Mileage Plan other revenue | 599 | | | 49 | | | — | | | — | | | 648 | | | — | | | 648 | |

| Cargo and other revenue | 244 | | | — | | | — | | | 8 | | | 252 | | | — | | | 252 | |

| Total Operating Revenue | 8,940 | | | 1,478 | | | 374 | | | (366) | | | 10,426 | | | — | | | 10,426 | |

| Operating Expenses | | | | | | | | | | | | | |

| Operating expenses, excluding fuel | 5,841 | | | 1,121 | | | 344 | | | (358) | | | 6,948 | | | 443 | | | 7,391 | |

| Fuel expense | 2,264 | | | 379 | | | — | | | — | | | 2,643 | | | (2) | | | 2,641 | |

| Total Operating Expenses | 8,105 | | | 1,500 | | | 344 | | | (358) | | | 9,591 | | | 441 | | | 10,032 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-operating Income (Expense) | (15) | | | — | | | (41) | | | 3 | | | (53) | | | (18) | | | (71) | |

| Income (Loss) Before Income Tax | $ | 820 | | | $ | (22) | | | $ | (11) | | | $ | (5) | | | $ | 782 | | | $ | (459) | | | $ | 323 | |

| Pretax Margin | | | | | | | | | 7.5 | % | | | | 3.1 | % |

| | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2022 |

| (in millions) | Mainline | | Regional | | Horizon | | Consolidating & Other(a) | | Air Group Adjusted(b) | | Special Items(c) | | Consolidated |

| Operating Revenue | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Passenger revenue | $ | 7,454 | | | $ | 1,354 | | | $ | — | | | $ | — | | | $ | 8,808 | | | $ | — | | | $ | 8,808 | |

| CPA revenue | — | | | — | | | 359 | | | (359) | | | — | | | — | | | — | |

| Mileage Plan other revenue | 538 | | | 52 | | | — | | | — | | | 590 | | | — | | | 590 | |

| Cargo and other revenue | 244 | | | — | | | — | | | 4 | | | 248 | | | — | | | 248 | |

| Total Operating Revenue | 8,236 | | | 1,406 | | | 359 | | | (355) | | | 9,646 | | | — | | | 9,646 | |

| Operating Expenses | | | | | | | | | | | | | |

| Operating expenses, excluding fuel | 5,216 | | | 1,085 | | | 383 | | | (356) | | | 6,328 | | | 580 | | | 6,908 | |

| Fuel expense | 2,195 | | | 397 | | | — | | | — | | | 2,592 | | | 76 | | | 2,668 | |

| Total Operating Expenses | 7,411 | | | 1,482 | | | 383 | | | (356) | | | 8,920 | | | 656 | | | 9,576 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-operating Income (Expense) | 30 | | | — | | | (22) | | | 1 | | | 9 | | | — | | | 9 | |

| Income (Loss) Before Income Tax | $ | 855 | | | $ | (76) | | | $ | (46) | | | $ | 2 | | | $ | 735 | | | $ | (656) | | | $ | 79 | |

| Pretax Margin | | | | | | | | | 7.6 | % | | | | 0.8 | % |

(a)Includes consolidating entries, Air Group parent company, McGee Air Services, and other immaterial business units.

(b)The Air Group Adjusted column represents the financial information that is reviewed by management to assess performance of operations and determine capital allocation and excludes certain charges. See Note A in the accompanying pages for further information.

(c)Includes special items and mark-to-market fuel hedge accounting adjustments.

GAAP TO NON-GAAP RECONCILIATIONS (unaudited)

Alaska Air Group, Inc. | | | | | | | | | | | | | | | | | | | | | | | |

| CASM Excluding Fuel and Special Items Reconciliation |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in cents) | 2023 | | 2022 | | 2023 | | 2022 |

| Consolidated: | | | | | | | |

| CASM | 14.76 | ¢ | | 16.34 | ¢ | | 14.64 | ¢ | | 15.76 | ¢ |

| Less the following components: | | | | | | | |

| | | | | | | |

| Aircraft fuel, including hedging gains and losses | 4.15 | | | 4.44 | | | 3.85 | | | 4.39 | |

Special items - fleet transition and other(a) | 0.21 | | | 0.80 | | | 0.57 | | | 0.82 | |

Special items - labor and related(b) | — | | | (0.04) | | | 0.08 | | | 0.14 | |

| | | | | | | |

| CASM excluding fuel and special items | 10.40 | ¢ | | 11.14 | ¢ | | 10.14 | ¢ | | 10.41 | ¢ |

| | | | | | | |

| Mainline: | | | | | | | |

| CASM | 13.63 | ¢ | | 14.95 | ¢ | | 13.51 | ¢ | | 14.42 | ¢ |

| Less the following components: | | | | | | | |

| | | | | | | |

| Aircraft fuel, including hedging gains and losses | 3.85 | | | 4.17 | | | 3.57 | | | 4.11 | |

Special items - fleet transition and other(a) | 0.24 | | | 0.77 | | | 0.63 | | | 0.71 | |

Special items - labor and related(b) | — | | | (0.04) | | | 0.08 | | | 0.15 | |

| | | | | | | |

| CASM excluding fuel and special items | 9.54 | ¢ | | 10.05 | ¢ | | 9.23 | ¢ | | 9.45 | ¢ |

(a) Special items - fleet transition and other in the three and twelve months ended December 31, 2023 and 2022 is primarily for impairment charges and accelerated costs associated with the retirement of Airbus and Q400 aircraft.

(b) Special items - labor and related is primarily for changes to Alaska pilots' sick leave benefits resulting from an agreement signed in the first quarter of 2023 and for a one-time payment to Alaska pilots following ratification of a new collective bargaining agreement in the third quarter of 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fuel Reconciliation | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| (in millions, except for per gallon amounts) | Dollars | | Cost/Gal | | Dollars | | Cost/Gal |

| Raw or "into-plane" fuel cost | $ | 679 | | | $ | 3.33 | | | $ | 657 | | | $ | 3.55 | |

| Losses (gains) on settled hedges | 18 | | | 0.09 | | | (1) | | | — | |

| Consolidated economic fuel expense | $ | 697 | | | $ | 3.42 | | | $ | 656 | | | $ | 3.55 | |

| Mark-to-market fuel hedge adjustment | 12 | | | 0.06 | | | 12 | | | 0.06 | |

| GAAP fuel expense | $ | 709 | | | $ | 3.48 | | | $ | 668 | | | $ | 3.61 | |

| Fuel gallons | | | 204 | | | | | 185 | |

| | | | | | | | |

| Twelve Months Ended December 31, |

| 2023 | | 2022 |

| (in millions, except for per gallon amounts) | Dollars | | Cost/Gal | | Dollars | | Cost/Gal |

| Raw or "into-plane" fuel cost | $ | 2,579 | | | $ | 3.13 | | | $ | 2,761 | | | $ | 3.64 | |

| Losses (gains) on settled hedges | 64 | | | 0.08 | | | (169) | | | (0.22) | |

| Consolidated economic fuel expense | $ | 2,643 | | | $ | 3.21 | | | $ | 2,592 | | | $ | 3.42 | |

| Mark-to-market fuel hedge adjustment | (2) | | | — | | | 76 | | | 0.10 | |

| GAAP fuel expense | $ | 2,641 | | | $ | 3.21 | | | $ | 2,668 | | | $ | 3.52 | |

| Fuel gallons | | | 824 | | | | | 758 | |

| | | | | | | | | | | |

| Debt-to-capitalization, including operating and financing leases |

| (in millions) | December 31, 2023 | | December 31, 2022 |

| Long-term debt, net of current portion | $ | 2,182 | | | $ | 1,883 | |

| Capitalized operating leases | 1,283 | | | 1,621 | |

Capitalized finance leases(a) | 64 | | | — | |

| Adjusted debt, net of current portion of long-term debt | $ | 3,529 | | | $ | 3,504 | |

| Shareholders' equity | 4,113 | | | 3,816 | |

| Total Invested Capital | $ | 7,642 | | | $ | 7,320 | |

| | | |

| Debt-to-capitalization ratio, including operating and finance leases | 46% | | 48% |

(a) To best reflect our leverage at December 31, 2023, we included our capitalized finance lease balances, which are recognized within the Current portion of long-term debt and finance leases line in the condensed consolidated balance sheets.

| | | | | | | | | | | |

| Adjusted net debt to earnings before interest, taxes, depreciation, amortization, rent, and special items |

| (in millions) | December 31, 2023 | | December 31, 2022 |

| Current portion of long-term debt and finance leases | $ | 353 | | | $ | 276 | |

| Current portion of operating lease liabilities | 158 | | | 228 | |

| Long-term debt | 2,182 | | | 1,883 | |

| Long-term operating lease liabilities, net of current portion | 1,125 | | | 1,393 | |

| Total adjusted debt | 3,818 | | | 3,780 | |

| Less: Total cash and marketable securities | (1,791) | | | (2,417) | |

| Adjusted net debt | $ | 2,027 | | | $ | 1,363 | |

| | | |

| (in millions) | Year Ended December 31, 2023 | | Year Ended December 31, 2022 |

| GAAP Operating Income | $ | 394 | | | $ | 70 | |

| Adjusted for: | | | |

| Special items | 443 | | | 580 | |

| Mark-to-market fuel hedge adjustments | (2) | | | 76 | |

| Depreciation and amortization | 451 | | 415 |

| Aircraft rent | 208 | | 291 |

| EBITDAR | $ | 1,494 | | | $ | 1,432 | |

| Adjusted net debt to EBITDAR | 1.4x | | 1.0x |

Note A: Pursuant to Regulation G, we are providing reconciliations of reported non-GAAP financial measures to their most directly comparable financial measures reported on a GAAP basis. We believe that consideration of these non-GAAP financial measures may be important to investors for the following reasons:

•By excluding fuel expense and special items from our unit metrics, we believe that we have better visibility into the results of operations. Our industry is highly competitive and is characterized by high fixed costs, so even a small reduction in non-fuel operating costs can result in a significant improvement in operating results. In addition, we believe that all domestic carriers are similarly impacted by changes in jet fuel costs over the long run, so it is important for management (and thus investors) to understand the impact of (and trends in) company-specific cost drivers such as labor rates and productivity, airport costs, maintenance costs, etc., which are more controllable by management.

•Cost per ASM (CASM) excluding fuel and special items, is one of the most important measures used by management and by the Air Group Board of Directors in assessing quarterly and annual cost performance.

•Adjusted income before income tax (and other items as specified in our plan documents) is an important metric for the employee incentive plan, which covers the majority of Air Group employees.

•CASM excluding fuel and special items is a measure commonly used by industry analysts, and we believe it is the basis by which they have historically compared our airline to others in the industry. The measure is also the subject of frequent questions from investors.

•Disclosure of the individual impact of certain noted items provides investors the ability to measure and monitor performance both with and without these special items. We believe that disclosing the impact of these items as noted above. Industry analysts and investors consistently measure our performance without these items for better comparability between periods and among other airlines.

•Although we disclose our unit revenue, we do not, nor are we able to, evaluate unit revenue excluding the impact that changes in fuel costs have had on ticket prices. Fuel expense represents a large percentage of our total operating expenses. Fluctuations in fuel prices often drive changes in unit revenue in the mid-to-long term. Although we believe it is useful to evaluate non-fuel unit costs for the reasons noted above, we would caution readers of these financial statements not to place undue reliance on unit costs excluding fuel as a measure or predictor of future profitability because of the significant impact of fuel costs on our business.

GLOSSARY OF TERMS

Adjusted net debt - long-term debt, including current portion, plus capitalized operating leases, less cash and marketable securities

Adjusted net debt to EBITDAR - represents net adjusted debt divided by EBITDAR (trailing twelve months earnings before interest, taxes, depreciation, amortization, special items and rent)

Aircraft Utilization - block hours per day; this represents the average number of hours per day our aircraft are in transit

Aircraft Stage Length - represents the average miles flown per aircraft departure

ASMs - available seat miles, or “capacity”; represents total seats available across the fleet multiplied by the number of miles flown

CASM - operating costs per ASM; represents all operating expenses including fuel and special items

CASMex - operating costs excluding fuel and special items per ASM, or "unit cost"; this metric is used to help track progress toward reduction of non-fuel operating costs since fuel is largely out of our control

Debt-to-capitalization ratio - represents adjusted debt (long-term debt plus capitalized operating lease liabilities) divided by total equity plus adjusted debt

Diluted Earnings per Share - represents earnings per share (EPS) using fully diluted shares outstanding

Diluted Shares - represents the total number of shares that would be outstanding if all possible sources of conversion, such as stock options, were exercised

Economic Fuel - best estimate of the cash cost of fuel, net of the impact of our fuel-hedging program

Load Factor - RPMs as a percentage of ASMs; represents the number of available seats that were filled with paying passengers

Mainline - represents flying Boeing 737, Airbus 320 and Airbus 321neo family jets and all associated revenue and costs

Productivity - number of revenue passengers per full-time equivalent employee

RASM - operating revenue per ASMs, or "unit revenue"; operating revenue includes all passenger revenue, freight & mail, Mileage Plan and other ancillary revenue; represents the average total revenue for flying one seat one mile

Regional - represents capacity purchased by Alaska from Horizon and SkyWest. In this segment, Regional records actual on-board passenger revenue, less costs such as fuel, distribution costs, and payments made to Horizon and SkyWest under the respective capacity purchased arrangement (CPAs). Additionally, Regional includes an allocation of corporate overhead such as IT, finance, other administrative costs incurred by Alaska and on behalf of Horizon.

RPMs - revenue passenger miles, or "traffic"; represents the number of seats that were filled with paying passengers; one passenger traveling one mile is one RPM

Yield - passenger revenue per RPM; represents the average revenue for flying one passenger one mile

Safe Harbor Non-GAAP Financial Information

Earnings Update

Capacity & Unit Revenue Unit Revenue Capacity

Unit Cost As Guided As Guided As Guided As Guided ALK Actuals Industry As Guided

Fuel Cost

Balance Sheet

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

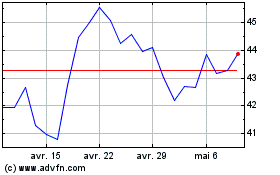

Alaska Air (NYSE:ALK)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Alaska Air (NYSE:ALK)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024