UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| SCHEDULE 14A INFORMATION | |

| | |

| PROXY STATEMENT PURSUANT TO SECTION 14(A) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| (AMENDMENT NO. ____) |

| | |

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | | | | |

Check the appropriate box: |

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

¨ | | Definitive Proxy Statement |

| |

x | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

| | |

AMBAC FINANCIAL GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | | | | | | | |

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| | | | |

| x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

AMBAC FINANCIAL GROUP, INC.

One World Trade Center

New York, NY 10007

SUPPLEMENT TO THE 2023 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT DATED APRIL 28, 2023 FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, JUNE 22, 2023

June 16, 2023

On April 28, 2023, Ambac Financial Group, Inc. (“Ambac” or the “Company”) commenced distribution of the Notice of Annual Meeting and Proxy Statement (the “Proxy Statement”) for the Annual Meeting and notices of availability of the Proxy Statement. This Supplement provides updated information regarding the design and objectives of our executive compensation program and is provided with respect to the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Ambac to be held on June 22, 2023, and should be read in conjunction with the Proxy Statement.

More specifically, in this document Ambac provides additional information on the following topics:

•Significance of 2022 performance/achievements

•Importance of a competitive compensation program to retain key executives

•Appropriateness of 2022 incentive design

2022 Accomplishments Position Ambac for Success

2022 was a transformational year for Ambac, during which we resolved a number of the most significant strategic challenges facing the Company, and materially advanced our specialty P&C insurance business strategy. Further, we achieved strong performance relative to our financial goals, resulting in net income of $522 million for the year, an increase in our Book Value per share by 24% and an increase in our Adjusted book value per share by 50%. These results were also reflected in our total shareholder return (TSR) of 8.66% for the year, which exceeded our peer group TSR results of negative 8.84%. As a result of the successful execution of our key strategic priorities in 2022, Ambac today finds itself in the strongest financial position in well over a decade.

Competitiveness of Compensation Programs

In designing the 2022 compensation plan the Compensation Committee (the “Committee”) strove to strike the right balance between financial performance metrics and strategic performance goals. Decisions made on executive compensation for 2022 were made with the following considerations in mind:

•The inherent challenges and complexities of managing the run-off of the legacy financial guarantee business and the execution of our business strategy to scale our new specialty P&C platform

•Ambac has no business peers that are of comparable size AND complexity. Ambac’s approved peers reflect companies in the specialty P&C insurance space that are representative of Ambac’s new and growing lines of business on its developing platform

•The need to pay compensation sufficient to recruit, engage, and retain senior executive talent

•The continuing significance of a “strategic performance goals” category in the Short- Term Incentive Plan (“STIP”) to create strong alignment between the Company’s stated objectives and management’s compensation

The Committee determined that the STIP metrics were appropriately selected given the Company’s profile in 2022 and, more importantly that there was strong alignment between management’s compensation, the majority of which is performance based and a significant portion of which is paid in equity, and the execution of the Company’s strategic priorities, driving the creation of long-term value for shareholders. Further, Ambac’s CEO target total compensation, including long-term incentive compensation, is positioned within a competitive range of market median, relative to Ambac’s own peer group.

Incentive Design and Goals

In setting the compensation metrics for the STIP for 2022, the Committee focused on key strategic objectives to increase long-term shareholder value. Namely, the efficient run-off and stabilization of our legacy financial guarantee insurance business and the growth and expansion of our specialty P&C insurance platform. The Committee believes the 2022 STIP design struck an appropriate balance between financial performance metrics and strategic performance goals.

Our financial performance metrics, weighted 60%, focused on the following:

•Reducing Net Par Outstanding (“NPO”) in the legacy financial guarantee business

•Reducing Gross Operating Run Rate Expense (“GORRE”)

•Increasing gross written premiums at Everspan

In setting the 2022 targets the Committee took into consideration the significant amount of de- risking activity previously executed in our legacy financial guarantee portfolios, which in turn made further reductions in NPO much more challenging and complex. The amount of derisking required to meet the target and maximum metrics, relative to the starting NPO, was increased in 2022 compared to 2021 from 13% to 14% and from 15% to 17%, respectively. The ongoing challenge of de-risking exposures became even more challenging in 2022, which saw sharply higher interest rates, inflationary pressures, decreased municipal issuance, and diminished market liquidity that made refinancing transactions, restructurings, and commutations more difficult. Despite these challenges, as a result of management’s focused efforts, Ambac exceeded the maximum performance goal with year-end NPO reduced to $22.9 billion. Management achieved this result by (among other means) restructuring all of Ambac’s remaining exposure to Puerto

Rico, which was a notable and hard-won accomplishment following years of intense efforts. In addition, management significantly pared NPO to a number of large, long-dated exposures through commutations and negotiated refinancings. Notably, management reduced international NPO by $1.2 billion, which had the added benefit of improving Ambac UK’s Solvency II capital position.

GORRE measures our effective management of operating expenses at our legacy financial guarantee business. The 2022 targets recognized the challenges the Company faces to retain and incentivize qualified management and to manage expenses for a heavily regulated run-off insurance enterprise during an inflationary period. Specifically, inflation-driven increases in healthcare, insurance, audit, and other costs collectively outweighed meaningful 2022 budgeted cost reductions. In face of these challenges, management took decisive action to reduce headcount, including as a result of aggressive de-risking of the insured portfolio, resulting in the actual GORRE metric ($16.3 million) being lower than (i.e., better than) the maximum target metric ($16.5 million) for 2022.

While performance for NPO and GORRE earned above-target payouts, we note that management did not meet the targeted metric related to increasing gross written premium at Everspan. Everspan’s 2022 gross written premium of $146.4 million exceeded the threshold performance level, but was below the target performance goal set for that metric.

Our strategic performance goals, weighted at forty percent (40%), a majority of which were based on objective, quantifiable or financial outcomes, included the following

•Active de-risking and rationalization of our capital and liability structure

•Effective litigation management

•Resolution of Puerto Rico

•Further growth and scale of our specialty P&C insurance platform via M&A at Cirrata (our insurance distribution division) and expansion of Everspan’s program partners

Management successfully executed on all of these goals delivering significant value to Ambac and its shareholders as a result of the following successes:

•The resolution, through negotiated settlements, of all of our remaining legacy RMBS representation and warranty litigations resulting in recoveries of nearly $2 billion

•The completion of the restructuring of our largest and most distressed financial guarantee exposures in Puerto Rico

•Reduction of our outstanding debt by $1.8 billion

•Material advancement of our specialty P&C business platform, including the acquisition by Cirrata of two new companies, All Trans and Capacity Marine, adding additional specialty underwriting as well as wholesale and retail brokerage capabilities to Cirrata’s platform and a 116% increase in premium production to over $280 million

In light of the material success achieved by the Company in 2022, the Board of Directors recommends a vote FOR the approval of executive compensation.

THIS SUPPLEMENTAL PROXY MATERIAL SHOULD BE READ IN CONJUNCTION WITH AMBAC’S 2023 PROXY STATEMENT.

If you have already returned your proxy card or voting instruction form, you do not need to take any action unless you wish to change your vote. If you have not yet returned your proxy card or voting instruction form, please complete the proxy card or voting instruction form. Information on how to vote your shares, or change or revoke your prior vote or voting instruction, is available in the Proxy Statement.

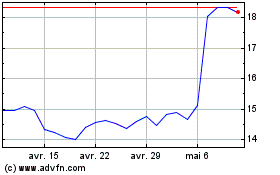

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

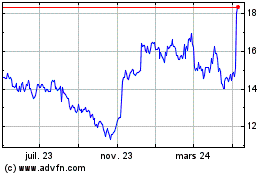

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024