00015624010001716558false00015624012024-02-212024-02-210001562401amh:AmericanHomes4RentLimitedPartnershipMember2024-02-212024-02-210001562401us-gaap:CommonClassAMember2024-02-212024-02-210001562401us-gaap:SeriesGPreferredStockMember2024-02-212024-02-210001562401us-gaap:SeriesHPreferredStockMember2024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 21, 2024

AMERICAN HOMES 4 RENT

AMERICAN HOMES 4 RENT, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| American Homes 4 Rent | Maryland | 001-36013 | 46-1229660 |

| American Homes 4 Rent, L.P. | Delaware | 333-221878-02 | 80-0860173 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

280 Pilot Road

Las Vegas, Nevada 89119

(Address of principal executive offices) (Zip Code)

(805) 413-5300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbols | | Name of each exchange on which registered |

| | | | |

| Class A common shares of beneficial interest, $.01 par value | | AMH | | New York Stock Exchange |

| Series G perpetual preferred shares of beneficial interest, $.01 par value | | AMH-G | | New York Stock Exchange |

| Series H perpetual preferred shares of beneficial interest, $.01 par value | | AMH-H | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On February 22, 2024, American Homes 4 Rent (the “Company”) announced that David P. Singelyn, the Company’s Chief Executive Officer, had notified the Board of Trustees (the “Board”) of the Company of his intent to retire. Subject to the terms of a Retirement and Award Agreement (the “Retirement Agreement”) described below, Mr. Singelyn agreed to continue to serve as Chief Executive Officer until December 31, 2024. The Company also announced that the Board had appointed Bryan Smith, the Company’s Chief Operating Officer, as the new Chief Executive Officer of the Company, effective upon Mr. Singelyn’s retirement, and that Christopher C. Lau, the Company’s Chief Financial Officer, had been appointed to the elevated role of Senior Executive Vice President, effective immediately.

Mr. Smith, age 50, has served as the Company’s Chief Operating Officer since 2019, as Executive Vice President and President of Property Management from 2015-2019, and as Senior Vice President and Director of Property Management from 2012-2015.

In connection with the above promotions, the Human Capital and Compensation Committee of the Board approved the following changes in compensation: (i) Mr. Smith’s base salary was increased to $750,000, effective immediately, and his target 2024 performance-based Annual Incentive Plan award was changed to 175% of his base salary; and (ii) Mr. Lau was issued a restricted stock unit award with a grant date fair value of $5,000,000 that is subject to five year cliff vesting.

In addition, on February 21, 2024, the Company and Mr. Singelyn entered into the Retirement Agreement pursuant to which (i) Mr. Singelyn agreed to defer the effective date of his retirement to December 31, 2024, (ii) Mr. Singelyn agreed to provide transition advisory services from his retirement until June 30, 2025, (iii) the Company agreed to issue Mr. Singelyn a restricted stock unit award with a grant date fair value of $1,600,000 (the “Transition Award”), subject to vesting on June 30, 2025 upon satisfaction of certain vesting conditions, including performance of his obligations under the Retirement Agreement, (iv) the Company agreed that Mr. Singelyn’s base salary for 2024 is $825,000 and that he would be eligible to receive a 2024 performance-based Annual Incentive Plan award, (v) the Company agreed to reimburse Mr. Singelyn for the cost of continuing COBRA health coverage for up to eighteen (18) months after he is no longer eligible for Company health coverage, and (vi) Mr. Singelyn agreed to a customary general release and certain restrictive covenants.

Item 7.01 Regulation FD Disclosure

A copy of the Company’s press release announcing the succession plan is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104—Cover Page Interactive Data File (embedded within the inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

Date: February 23, 2024 | | | | | | | | | | | |

| | AMERICAN HOMES 4 RENT |

| | | |

| | By: | /s/ Sara H. Vogt-Lowell |

| | | Sara H. Vogt-Lowell |

| | | Chief Legal Officer and Secretary |

| | | | | | | | | | | |

| | AMERICAN HOMES 4 RENT, L.P. |

| | | |

| | By: | American Homes 4 Rent, its General Partner |

| | | |

| | By: | /s/ Sara H. Vogt-Lowell |

| | | Sara H. Vogt-Lowell |

| | | Chief Legal Officer and Secretary |

AMH Announces CEO Succession Plan

AMH Announces Bryan Smith to Succeed David P. Singelyn as Chief Executive Officer

LAS VEGAS, Feb. 22, 2024—AMH (NYSE: AMH) (the “Company”), a leading large-scale integrated owner, operator, and developer of single-family rental homes, today announced that David P. Singelyn, who has served as Chief Executive Officer since the Company’s inception, has announced his intent to retire effective December 31, 2024. The Company’s Board of Trustees has named Bryan Smith, the Company’s Chief Operating Officer, as the next Chief Executive Officer effective January 1, 2025. Subsequently, Mr. Singelyn will serve as an advisor through June 2025.

In addition, the Board has promoted Christopher C. Lau, the Company’s Chief Financial Officer, to the elevated role of Senior Executive Vice President.

Matthew J. Hart, Chairperson of the Board, said “Since co-founding the Company with B. Wayne Hughes in 2012, Dave Singelyn has built AMH into a market leader with nearly 60,000 high-quality single-family properties, which over 200,000 people today call home. On behalf of the Board, I want to thank Dave for his leadership and vision and for assembling a fantastic team of executives. We believe that Bryan, with his deep knowledge of the Company and all facets of its business, is uniquely positioned to lead the Company as it executes on its strategic growth plan. Together with Chris, we have two energized, dynamic executives who will lead the Company to even greater heights in the future.”

“Bryan is a talented and experienced executive who has driven our business, our strategy, and our operations during the past 12 years,” said Mr. Singelyn. “His operational expertise, leadership skills, and commitment to our ongoing success make him an excellent choice to lead the Company into an exciting future. I will be working closely with Bryan to ensure a smooth transition.”

Mr. Singelyn added, “I am also very pleased for Chris in his elevated role. He has been instrumental to the Company’s strategy and execution during the past 11 years, and his unwavering commitment to excellence has further propelled our Company’s ability to dramatically increase shareholder value and demonstrate resilience during any economic cycle.”

“I am excited to serve as AMH’s next CEO and would like to thank Dave for his mentorship and guidance,” said Mr. Smith. “Under Dave’s strategic leadership, our highly talented management team has built a strong track record of operating performance. I look forward to continuing to benefit from Dave’s insights as CEO in the coming months.”

About AMH

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator, and developer of single-family rental homes. We’re an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing, and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

In recent years, we’ve been named one of Fortune’s 2023 Best Workplaces in Real Estate™, a 2023 Great Place to Work®, a 2023 Most Loved Workplace®, a 2023 Top U.S. Homebuilder by Builder100, and one of America’s Most Responsible Companies 2023 and America’s Most Trustworthy Companies 2023 by Newsweek and Statista Inc. As of December 31, 2023, we owned nearly 60,000 single-family properties in the Southeast, Midwest, Southwest, and Mountain West regions of the United States. Additional information about AMH is available on our website at www.amh.com.

AMH refers to one or more of American Homes 4 Rent, American Homes 4 Rent, L.P., and their subsidiaries and joint ventures. In certain states, we operate under AMH Living or American Homes 4 Rent. Please see www.amh.com/dba to learn more.

AMH Contacts

Trent Frager

Media Relations

Phone: (855) 774-4663

Email: media@amh.com

Nicholas Fromm

Investor Relations

Phone: (855) 794-2447

Email: investors@amh.com

v3.24.0.1

Document and Entity Information

|

Feb. 21, 2024 |

| Document Information |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

AMERICAN HOMES 4 RENT

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-36013

|

| Entity Tax Identification Number |

46-1229660

|

| Entity Address, Address Line One |

280 Pilot Road

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89119

|

| City Area Code |

805

|

| Local Phone Number |

413-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001562401

|

| Amendment Flag |

false

|

| Class A common shares/units |

|

| Document Information |

|

| Title of 12(b) Security |

Class A common shares of beneficial interest, $.01 par value

|

| Trading Symbol |

AMH

|

| Security Exchange Name |

NYSE

|

| Series G Perpetual Preferred Shares |

|

| Document Information |

|

| Title of 12(b) Security |

Series G perpetual preferred shares of beneficial interest, $.01 par value

|

| Trading Symbol |

AMH-G

|

| Security Exchange Name |

NYSE

|

| Series H Perpetual Preferred Shares |

|

| Document Information |

|

| Title of 12(b) Security |

Series H perpetual preferred shares of beneficial interest, $.01 par value

|

| Trading Symbol |

AMH-H

|

| Security Exchange Name |

NYSE

|

| American Homes 4 Rent, L.P. |

|

| Document Information |

|

| Entity Registrant Name |

AMERICAN HOMES 4 RENT, L.P.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-221878-02

|

| Entity Tax Identification Number |

80-0860173

|

| Entity Central Index Key |

0001716558

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=amh_AmericanHomes4RentLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

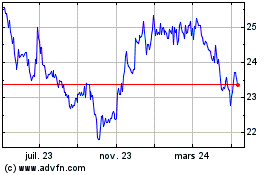

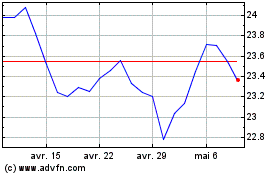

American Homes 4 Rent (NYSE:AMH-H)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

American Homes 4 Rent (NYSE:AMH-H)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024