false

0001142750

0001142750

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

November 2, 2023

| AMN HEALTHCARE SERVICES, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

001-16753 |

06-1500476 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

2999 Olympus Boulevard, Suite 500

Dallas, Texas 75019 |

| (Address of principal executive offices) (Zip Code) |

| |

| (866) 871-8519 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common Stock, par value $0.01 per share |

|

AMN |

|

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On November 2, 2023,

AMN Healthcare Services, Inc. reported its results for the fiscal quarter ended September 30, 2023. A copy of the press release is attached

hereto as Exhibit 99.1 and incorporated by reference herein.

The information in

this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the

extent as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMN Healthcare Services, Inc. |

|

| |

|

|

|

| |

|

|

|

Date: November 2, 2023 |

By: |

/s/ Cary Grace |

|

| |

Name: |

Cary Grace |

|

| |

Title: |

Chief Executive Officer |

|

EXHIBIT

99.1

AMN HEALTHCARE ANNOUNCES THIRD QUARTER 2023 RESULTS

Quarterly revenue of $853 million;

GAAP EPS of $1.39 and adjusted EPS of $1.97

DALLAS — AMN Healthcare Services, Inc. (NYSE:

AMN), the leader and innovator in total talent solutions for healthcare organizations across the United States, today announced its third

quarter 2023 financial results. Financial highlights are as follows:

Dollars in millions, except per share amounts.

| |

Q3 2023 |

% Change Q3

2022 |

YTD

September 30,

2023 |

% Change YTD September 30,

2022 |

| Revenue |

$853.5 |

(25%) |

$2,971.0 |

(28%) |

| Gross profit |

$289.5 |

(25%) |

$988.6 |

(26%) |

| Net income |

$53.2 |

(42%) |

$198.2 |

(45%) |

| GAAP diluted EPS |

$1.39 |

(34%) |

$4.99 |

(38%) |

| Adjusted diluted EPS* |

$1.97 |

(23%) |

$6.86 |

(27%) |

| Adjusted EBITDA* |

$133.7 |

(26%) |

$475.1 |

(29%) |

* See “Non-GAAP Measures” below for a

discussion of our use of non-GAAP items and the table entitled “Non-GAAP Reconciliation Tables” for a reconciliation of non-GAAP

items.

Business Highlights

| · | AMN made significant progress in the third quarter, staying aligned with clients’ changing needs and delivering on a full slate

of technology and process milestones that are transforming our go-to-market and value proposition. |

| · | Third quarter revenue was in line with expectations with outperformance from Nurse and Allied Solutions. Earnings were better than

expected as in-line core results were augmented by several favorable factors that we expect will not recur in the fourth quarter. |

| · | Fourth quarter expectations call for tapering of the post-pandemic downtrend in the nurse and allied staffing market. |

| · | Cash flow from operations remained strong at $172 million in the quarter and $413 million year to date. |

| · | AMN net leverage ratio at quarter end remained modest at 1.4:1. |

“The AMN team did an impressive

job balancing business execution in the third quarter alongside our initiatives to sharpen our strategic plan and implement powerful advancements

in our technology platform and processes,” said Cary Grace, President and Chief Executive Officer of AMN Healthcare. “At the

same time, we made an important strategic move with the pending acquisition of MSDR, which will bolster our presence in the robust locum

tenens market.”

Ms. Grace continued, “I

am pleased to report that, through the course of 2023, we have progressed from identifying needed changes to delivering enhanced technology-enabled

solutions that help clients with their ongoing workforce objectives. These are key milestones on our path toward defining the new normal

for healthcare workforce solutions.”

Third Quarter 2023 Results

Consolidated revenue for the quarter

was $853.5 million, a 25% decrease from prior year and 14% lower than the prior quarter. Net income was $53 million (6.2% of revenue),

or $1.39 per diluted share, compared with $92 million (8.1% of revenue), or $2.10 per diluted share, in the third quarter of 2022. Adjusted

diluted EPS in the third quarter was $1.97 compared with $2.57 in the same quarter a year ago.

Revenue for the Nurse and Allied

Solutions segment was $573 million, lower by 31% year over year and down 17% from the prior quarter. Travel nurse staffing revenue dropped

by 34% year over year and 20% sequentially. Allied division revenue declined 12% year over year and 8% versus prior quarter.

The Physician and Leadership Solutions

segment reported revenue of $160 million, down 9% year over year and down 9% sequentially. Locum tenens revenue was $113 million, 6% higher

year over year and down 8% sequentially. Interim leadership revenue fell by 35% year over year and was down 15% from prior quarter. Our

physician and leadership search businesses saw revenue decline by 25% year over year and 10% quarter over quarter.

Technology and Workforce Solutions

segment revenue was $120 million, a decrease of 11% year over year and down 4% sequentially. Language services revenue was $66 million

in

the quarter, 20% higher than the prior year and up

4% sequentially. Vendor management systems revenue was $38 million, 37% lower year over year and down 18% from the prior quarter.

Consolidated gross margin was

33.9%, 10 basis points higher year over year and improved by 60 basis points sequentially. Gross margin improved year over year and sequentially,

primarily from the release of a workers' compensation reserve in the Nurse and Allied Solutions segment. On a sequential basis, improvement

was partly offset by a drop in margin for Technology and Workforce Solutions from a change in revenue mix within the segment.

Consolidated SG&A expenses

were $163 million, or 19.1% of revenue, compared with $215 million, or 18.9% of revenue, in the same quarter last year. SG&A was $202

million, or 20.4% of revenue, in the previous quarter. The year-over-year decrease in SG&A costs was driven primarily by lower employee

compensation with the drop in revenue and a higher allowance for bad debt in the prior-year period. Several favorable items that we expect

will not recur in the fourth quarter reduced SG&A expense by $5 million in the third quarter.

Income from operations was $87

million with an operating margin of 10.2%, compared with $136 million and 12.0%, respectively, in the same quarter last year. Adjusted

EBITDA was $134 million, a year-over-year decrease of 26%. Adjusted EBITDA margin was 15.7%, 30 basis points lower than the year-ago period.

At September 30, 2023, cash

and cash equivalents totaled $29 million. Cash flow from operations was $172 million for the third quarter, and capital expenditures were

$30 million. The Company ended the quarter with total debt outstanding of $945 million and a net leverage ratio of 1.4 to 1.

MSDR Acquisition Agreement

In October 2023, AMN signed a

definitive agreement to acquire MSDR, which includes two locum tenens and advanced practices staffing companies, Medical Search International

and DRW Healthcare Staffing. The purchase price is approximately $300 million, which we expect to

fund with cash on hand and borrowings on our revolving

credit facility. Closing of the transaction is anticipated in the fourth quarter, subject to customary closing conditions and regulatory

approval.

Stock Repurchase Update

We completed the $200 million

accelerated share repurchase program in August 2023. As of September 30, 2023, $227 million remained on the repurchase program authorized

by our Board of Directors.

Fourth Quarter 2023 Outlook

| |

Metric |

|

Guidance* |

|

| |

Consolidated revenue |

|

$790 - $810 million |

|

| |

Gross margin |

|

32.3% - 32.8% |

|

| |

SG&A as percentage of revenue |

|

21.0% - 21.5% |

|

| |

Operating margin |

|

5.9% - 6.5% |

|

| |

Adjusted EBITDA margin |

|

12.5% - 13.0% |

|

*Note: Guidance percentage metrics are approximate.

For a reconciliation of adjusted EBITDA margin, see the table entitled “Reconciliation of Guidance Operating Margin to Guidance

Adjusted EBITDA Margin” below.

Revenue in the fourth quarter

of 2023 is expected to be 28-30% lower than prior year and 5-7% lower sequentially. Nurse and Allied Solutions segment revenue is expected

to be down 33-35% year over year. Physician and Leadership Solutions segment revenue is expected to be down 12-14% year over year. For

the Technology and Workforce Solutions segment, we expect revenue to be approximately 18% lower year over year. Guidance does not include

any contribution from the MSDR acquisition, which we expect to close later in the fourth quarter.

Fourth quarter estimates for certain

other financial items include depreciation of $17 million, depreciation in cost of revenue of $1.5 million, non-cash amortization expense

of $22 million, share-based compensation expense of $5 million, integration and other expenses of $7 million, interest expense of $11

million, an adjusted tax rate of 28%, and 38.2 million diluted average shares outstanding.

Conference Call on November 2, 2023

AMN Healthcare Services, Inc.

(NYSE: AMN) will host a conference call to discuss its third quarter 2023 financial results and fourth quarter 2023 outlook on Thursday,

November 2, 2023 at 5:00 p.m. Eastern Time. A live webcast of the call can be accessed through AMN Healthcare’s website at

http://ir.amnhealthcare.com. Interested parties may participate live via telephone by registering at this

link. Registrants will receive confirmation and dial-in details. Following the conclusion of the call, a replay of the webcast

will be available at the Company’s investor relations website.

About AMN Healthcare

AMN Healthcare is the leader and

innovator in total talent solutions for healthcare organizations across the nation. The Company provides access to the most comprehensive

network of quality healthcare professionals through its innovative recruitment strategies and breadth of career opportunities. With insights

and expertise, AMN Healthcare helps providers optimize their workforce to successfully reduce complexity, increase efficiency and improve

patient outcomes. AMN total talent solutions include managed services programs, clinical and interim healthcare leaders, temporary staffing,

permanent placement, executive search, vendor management systems, recruitment process outsourcing, predictive modeling, language services,

revenue cycle solutions, and other services. Clients include acute-care hospitals, community health centers and clinics, physician practice

groups, retail and urgent care centers, home health facilities, schools and many other healthcare settings. AMN Healthcare is committed

to fostering and maintaining a diverse team that reflects the communities we serve. Our commitment to the inclusion of many different

backgrounds, experiences and perspectives enables our innovation and leadership in the healthcare services industry.

The Company’s common stock

is listed on the New York Stock Exchange under the symbol “AMN.” For more information about AMN Healthcare, visit www.amnhealthcare.com,

where the Company posts news releases, investor presentations, webcasts, SEC filings and other material information. The Company also

utilizes email alerts and Really Simple Syndication (“RSS”) as routine channels to supplement distribution of this information.

To register for email alerts and RSS, visit http://ir.amnhealthcare.com.

Non-GAAP Measures

This earnings release and

the non-GAAP reconciliation tables included with the earnings release contain certain non-GAAP financial information, which the

Company provides as additional information, and not as an alternative, to the Company’s condensed consolidated financial

statements presented in accordance with GAAP. These non-GAAP financial measures include (1) adjusted EBITDA, (2) adjusted EBITDA

margin, (3) adjusted net income, and (4) adjusted diluted EPS. The Company provides such non-GAAP financial measures because

management believes that they are useful to both management and investors as a supplement, and not as a substitute, when evaluating

the Company’s operating performance. Additionally, management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted

net income and adjusted diluted EPS serve as industry-wide financial measures. The Company uses adjusted EBITDA for making financial

decisions, allocating resources and for determining certain incentive compensation objectives. The non-GAAP measures in this release

are not in accordance with, or an alternative to, GAAP measures and may be different from non-GAAP measures, or may be calculated

differently than other similarly titled non-GAAP measures, reported by other companies. They should not be used in isolation to

evaluate the Company’s performance. A reconciliation of non-GAAP measures identified in this release, along with further

detail about the use and limitations of certain of these non-GAAP measures, may be found below in the table entitled “Non-GAAP

Reconciliation Tables” under the caption entitled “Reconciliation of Non-GAAP Items” and the footnotes thereto or

on the Company’s website at https://ir.amnhealthcare.com/financials/quarterly-results. Additionally, from time to time,

additional information regarding non-GAAP financial measures, including pro forma measures, may be made available on the

Company’s website.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements include, among others, statements concerning the labor market conditions, future demand

for staffing and other services, wage and bill rates, our ability to meet the needs of our markets or align with our clients, our competitive

position in technology-enabled solutions, our ability to implement our strategic plan and advancement in our technology platform and processes

to transform our services and improve our value proposition, our ability to deliver enhanced technology-enabled solutions, our long-term

growth opportunities and sales pipeline, that we will have sufficient capital to invest in growth through capital expenditures and potential

acquisitions or make future repurchases under our stock repurchase program, fourth quarter 2023 financial projections for consolidated

and segment revenue, consolidated gross margin, operating margin, SG&A as a percent of revenue, adjusted EBITDA

margin, depreciation expense, non-cash amortization

expense, share-based compensation expense, integration and other expenses, interest expense, adjusted tax rate, and number of diluted

shares outstanding. The Company bases these forward-looking statements on its current expectations, estimates and projections about future

events and the industry in which it operates using information currently available to it. Actual results could differ materially from

those discussed in, or implied by, these forward-looking statements. Forward-looking statements are also identified by words such as “believe,”

"project," “anticipate,” “expect,” “intend,” “plan,” “will,” “may,”

“estimates,” variations of such words and other similar expressions. In addition, any statements that refer to expectations,

projections or other characterizations of future events or circumstances are forward-looking statements.

The targets and expectations noted

in this release depend upon, among other factors, (i) the magnitude and duration of the effects of the post-COVID-19 pandemic environment

or any future pandemic or health crisis on demand and supply trends, our business, its financial condition and our results of operations,

(ii) our ability to effectively address client demand by attracting and placing nurses and other clinicians, (iii) our ability to recruit

and retain sufficient quality healthcare professionals at reasonable costs, (iv) our ability to anticipate and quickly respond to changing

marketplace conditions, such as alternative modes of healthcare delivery, reimbursement, or client needs and requirements, including implementing

changes that will make our services more tech-enabled and integrated, (v) our ability to manage the pricing impact that the labor market

or consolidation of healthcare delivery organizations may have on our business, (vi) the duration and extent to which hospitals and other

healthcare entities adjust their utilization of temporary nurses and allied healthcare professionals, physicians, healthcare leaders and

other healthcare professionals and workforce technology applications as a result of the labor market, economic conditions or COVID-19

or other pandemic or health crisis, (vii) the effects of economic downturns, inflation or slow recoveries, which could result in less

demand for our services, increased client initiatives designed to contain costs, including reevaluating their approach as it pertains

to contingent labor and managed services programs, other solutions and providers, pricing pressures and negatively impact payments terms

and collectability of accounts receivable, (viii) our ability to develop and evolve our current technology offerings and capabilities

and implement new infrastructure and technology systems to optimize our operating results and manage our business effectively, (ix) our

ability and the expense to comply with extensive and complex federal and state laws and regulations related to the conduct of our operations,

costs and payment for services and payment for referrals as well as laws regarding employment practices, (x) our ability to consummate

and effectively incorporate acquisitions into our business, (xi) the negative effects that intermediary organizations may have on our

ability to secure new and profitable contracts, (xii) the ability of our clients to increase the efficiency and effectiveness of their

staffing management and recruiting efforts, through

predictive analytics, online recruiting, internal

travel agencies and float pools, telemedicine or otherwise and successfully hire and retain permanent staff, (xiii) the extent to which

the Great Resignation or a future spike in the COVID-19 pandemic or other pandemic or health crisis may disrupt our operations due to

the unavailability of our employees or healthcare professionals due to burnout, illness, risk of illness, quarantines, travel restrictions,

mandatory vaccination requirements, or other factors that limit our existing or potential workforce and pool of candidates, (xiv) security

breaches and cybersecurity incidents, including ransomware, that could compromise our information and systems, which could adversely affect

our business operations and reputation and could subject us to substantial liabilities and (xv) the severity and duration of the impact

the labor market, economic downturn or COVID-19 pandemic has on the financial condition and cash flow of many hospitals and healthcare

systems such that it impairs their ability to make payments to us, timely or otherwise, for services rendered.

For a discussion of additional

risk factors and a more complete discussion of some of the cautionary statements noted above that could cause actual results to differ

from those implied by the forward-looking statements contained in this press release, please refer to our most recent Annual Report on

Form 10-K for the year ended December 31, 2022. Be advised that developments subsequent to this press release are likely to cause these

statements to become outdated and the Company is under no obligation (and expressly disclaims any such obligation) to update or revise

any forward-looking statements whether as a result of new information, future events, or otherwise.

Contact:

Randle Reece

Senior Director, Investor

Relations

AMN Healthcare Services, Inc.

Condensed Consolidated Statements of Comprehensive

Income

(in thousands, except per share amounts)

(unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

June 30, | |

September 30, |

| | |

2023 | |

2022 | |

2023 | |

2023 | |

2022 |

| Revenue | |

$ | 853,463 | | |

$ | 1,138,586 | | |

$ | 991,299 | | |

$ | 2,970,985 | | |

$ | 4,117,731 | |

| Cost of revenue | |

| 563,957 | | |

| 753,560 | | |

| 661,018 | | |

| 1,982,352 | | |

| 2,776,300 | |

| Gross profit | |

| 289,506 | | |

| 385,026 | | |

| 330,281 | | |

| 988,633 | | |

| 1,341,431 | |

| Gross margin | |

| 33.9 | % | |

| 33.8 | % | |

| 33.3 | % | |

| 33.3 | % | |

| 32.6 | % |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative (SG&A) | |

| 163,405 | | |

| 215,419 | | |

| 201,771 | | |

| 570,775 | | |

| 717,428 | |

| SG&A as a % of revenue | |

| 19.1 | % | |

| 18.9 | % | |

| 20.4 | % | |

| 19.2 | % | |

| 17.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization (exclusive of depreciation included in cost of revenue) | |

| 39,175 | | |

| 33,239 | | |

| 36,847 | | |

| 113,599 | | |

| 96,169 | |

| Total operating expenses | |

| 202,580 | | |

| 248,658 | | |

| 238,618 | | |

| 684,374 | | |

| 813,597 | |

| Income from operations | |

| 86,926 | | |

| 136,368 | | |

| 91,663 | | |

| 304,259 | | |

| 527,834 | |

| Operating margin (1) | |

| 10.2 | % | |

| 12.0 | % | |

| 9.2 | % | |

| 10.2 | % | |

| 12.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net, and other | |

| 11,541 | | |

| 8,961 | | |

| 12,175 | | |

| 33,975 | | |

| 28,630 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 75,385 | | |

| 127,407 | | |

| 79,488 | | |

| 270,284 | | |

| 499,204 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 22,211 | | |

| 34,962 | | |

| 18,582 | | |

| 72,094 | | |

| 136,951 | |

| Net income | |

$ | 53,174 | | |

$ | 92,445 | | |

$ | 60,906 | | |

$ | 198,190 | | |

$ | 362,253 | |

| Net income as a % of revenue | |

| 6.2 | % | |

| 8.1 | % | |

| 6.1 | % | |

| 6.7 | % | |

| 8.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized gains (losses) on available-for-sale securities, net, and other | |

| 133 | | |

| (219 | ) | |

| 50 | | |

| 329 | | |

| (794 | ) |

| Other comprehensive income (loss) | |

| 133 | | |

| (219 | ) | |

| 50 | | |

| 329 | | |

| (794 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Comprehensive income | |

$ | 53,307 | | |

$ | 92,226 | | |

$ | 60,956 | | |

$ | 198,519 | | |

$ | 361,459 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 1.39 | | |

$ | 2.11 | | |

$ | 1.56 | | |

$ | 5.01 | | |

$ | 8.04 | |

| Diluted | |

$ | 1.39 | | |

$ | 2.10 | | |

$ | 1.55 | | |

$ | 4.99 | | |

$ | 7.99 | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 38,147 | | |

| 43,785 | | |

| 39,151 | | |

| 39,547 | | |

| 45,056 | |

| Diluted | |

| 38,325 | | |

| 44,039 | | |

| 39,341 | | |

| 39,734 | | |

| 45,332 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

AMN Healthcare Services, Inc.

Condensed Consolidated Balance Sheets

(dollars in thousands)

(unaudited)

| | |

September 30, 2023 | |

December 31, 2022 | |

September 30, 2022 |

| Assets | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 29,377 | | |

$ | 64,524 | | |

$ | 155,723 | |

| Accounts receivable, net | |

| 565,724 | | |

| 675,650 | | |

| 724,966 | |

| Accounts receivable, subcontractor | |

| 175,976 | | |

| 268,726 | | |

| 253,954 | |

| Prepaid and other current assets | |

| 60,043 | | |

| 84,745 | | |

| 71,523 | |

| Total current assets | |

| 831,120 | | |

| 1,093,645 | | |

| 1,206,166 | |

| Restricted cash, cash equivalents and investments | |

| 69,995 | | |

| 61,218 | | |

| 64,883 | |

| Fixed assets, net | |

| 187,557 | | |

| 149,276 | | |

| 140,995 | |

| Other assets | |

| 220,512 | | |

| 172,016 | | |

| 171,475 | |

| Goodwill | |

| 935,779 | | |

| 935,364 | | |

| 935,675 | |

| Intangible assets, net | |

| 409,803 | | |

| 476,832 | | |

| 499,067 | |

| Total assets | |

$ | 2,654,766 | | |

$ | 2,888,351 | | |

$ | 3,018,261 | |

| | |

| | | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 362,907 | | |

$ | 476,452 | | |

$ | 459,237 | |

| Accrued compensation and benefits | |

| 263,697 | | |

| 333,244 | | |

| 338,833 | |

| Other current liabilities | |

| 80,522 | | |

| 48,237 | | |

| 93,176 | |

| Total current liabilities | |

| 707,126 | | |

| 857,933 | | |

| 891,246 | |

| Revolving credit facility | |

| 95,000 | | |

| — | | |

| — | |

| Notes payable, net | |

| 844,393 | | |

| 843,505 | | |

| 843,210 | |

| Deferred income taxes, net | |

| 31,296 | | |

| 22,713 | | |

| 42,159 | |

| Other long-term liabilities | |

| 159,782 | | |

| 120,566 | | |

| 109,013 | |

| Total liabilities | |

| 1,837,597 | | |

| 1,844,717 | | |

| 1,885,628 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity: | |

| 817,169 | | |

| 1,043,634 | | |

| 1,132,633 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 2,654,766 | | |

$ | 2,888,351 | | |

$ | 3,018,261 | |

| | |

| | | |

| | | |

| | |

AMN Healthcare Services, Inc.

Summary Condensed Consolidated Statements of Cash

Flows

(dollars in thousands)

(unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

June 30, | |

September 30, |

| | |

2023 | |

2022 | |

2023 | |

2023 | |

2022 |

| | |

| |

| |

| |

| |

|

| Net cash provided by operating activities | |

$ | 172,194 | | |

$ | 113,728 | | |

$ | 197,667 | | |

$ | 413,295 | | |

$ | 538,405 | |

| Net cash used in investing activities | |

| (33,903 | ) | |

| (32,305 | ) | |

| (22,428 | ) | |

| (88,762 | ) | |

| (148,067 | ) |

| Net cash used in financing activities | |

| (105,022 | ) | |

| (3,835 | ) | |

| (203,287 | ) | |

| (352,766 | ) | |

| (415,523 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 33,269 | | |

| 77,588 | | |

| (28,048 | ) | |

| (28,233 | ) | |

| (25,185 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 76,370 | | |

| 143,941 | | |

| 104,418 | | |

| 137,872 | | |

| 246,714 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 109,639 | | |

$ | 221,529 | | |

$ | 76,370 | | |

$ | 109,639 | | |

$ | 221,529 | |

AMN Healthcare Services, Inc.

Non-GAAP Reconciliation Tables

(dollars in thousands, except per share data)

(unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

June 30, | |

September 30, |

| | |

2023 | |

2022 | |

2023 | |

2023 | |

2022 |

| Reconciliation of Non-GAAP Items: | |

| |

| |

| |

| |

|

| | |

| |

| |

| |

| |

|

| Net income | |

$ | 53,174 | | |

$ | 92,445 | | |

$ | 60,906 | | |

$ | 198,190 | | |

$ | 362,253 | |

| Income tax expense | |

| 22,211 | | |

| 34,962 | | |

| 18,582 | | |

| 72,094 | | |

| 136,951 | |

| Income before income taxes | |

| 75,385 | | |

| 127,407 | | |

| 79,488 | | |

| 270,284 | | |

| 499,204 | |

| Interest expense, net, and other | |

| 11,541 | | |

| 8,961 | | |

| 12,175 | | |

| 33,975 | | |

| 28,630 | |

| Income from operations | |

| 86,926 | | |

| 136,368 | | |

| 91,663 | | |

| 304,259 | | |

| 527,834 | |

| Depreciation and amortization | |

| 39,175 | | |

| 33,239 | | |

| 36,847 | | |

| 113,599 | | |

| 96,169 | |

| Depreciation (included in cost of revenue) (2) | |

| 1,552 | | |

| 1,091 | | |

| 1,387 | | |

| 4,196 | | |

| 2,918 | |

| Share-based compensation | |

| 306 | | |

| 4,898 | | |

| 4,818 | | |

| 15,442 | | |

| 24,670 | |

| Acquisition, integration, and other costs (3) | |

| 5,771 | | |

| 6,237 | | |

| 6,103 | | |

| 16,616 | | |

| 20,532 | |

| Legal settlement accrual changes (4) | |

| — | | |

| — | | |

| 21,000 | | |

| 21,000 | | |

| — | |

| Adjusted EBITDA (5) | |

$ | 133,730 | | |

$ | 181,833 | | |

$ | 161,818 | | |

$ | 475,112 | | |

$ | 672,123 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA margin (6) | |

| 15.7 | % | |

| 16.0 | % | |

| 16.3 | % | |

| 16.0 | % | |

| 16.3 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 53,174 | | |

$ | 92,445 | | |

$ | 60,906 | | |

$ | 198,190 | | |

$ | 362,253 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 22,563 | | |

| 20,884 | | |

| 22,120 | | |

| 66,340 | | |

| 60,843 | |

| Acquisition, integration, and other costs (3) | |

| 5,771 | | |

| 6,237 | | |

| 6,103 | | |

| 16,616 | | |

| 20,532 | |

| Legal settlement accrual changes (4) | |

| — | | |

| — | | |

| 21,000 | | |

| 21,000 | | |

| — | |

| Cumulative effect of change in accounting principle (7) | |

| — | | |

| — | | |

| — | | |

| 2,974 | | |

| — | |

| Tax effect on above adjustments | |

| (7,367 | ) | |

| (7,051 | ) | |

| (12,798 | ) | |

| (27,802 | ) | |

| (21,157 | ) |

| Tax effect of COLI fair value changes (8) | |

| 1,227 | | |

| 1,507 | | |

| (1,744 | ) | |

| (2,324 | ) | |

| 6,488 | |

| Excess tax deficiencies (benefits) related to equity awards (9) | |

| 134 | | |

| (727 | ) | |

| (1,798 | ) | |

| (2,346 | ) | |

| (2,832 | ) |

| Adjusted net income (10) | |

$ | 75,502 | | |

$ | 113,295 | | |

$ | 93,789 | | |

$ | 272,648 | | |

$ | 426,127 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP diluted net income per share (EPS) | |

$ | 1.39 | | |

$ | 2.10 | | |

$ | 1.55 | | |

$ | 4.99 | | |

$ | 7.99 | |

| Adjustments | |

| 0.58 | | |

| 0.47 | | |

| 0.83 | | |

| 1.87 | | |

| 1.41 | |

| Adjusted diluted EPS (11) | |

$ | 1.97 | | |

$ | 2.57 | | |

$ | 2.38 | | |

$ | 6.86 | | |

$ | 9.40 | |

AMN Healthcare Services, Inc.

Supplemental Segment Financial and Operating Data

(dollars in thousands, except operating data)

(unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

June 30, | |

September 30, |

| | |

2023 | |

2022 | |

2023 | |

2023 | |

2022 |

| Revenue | |

| |

| |

| |

| |

|

| Nurse and allied solutions | |

$ | 573,426 | | |

$ | 828,317 | | |

$ | 689,015 | | |

$ | 2,086,921 | | |

$ | 3,157,834 | |

| Physician and leadership solutions | |

| 159,554 | | |

| 175,152 | | |

| 176,229 | | |

| 501,540 | | |

| 530,355 | |

| Technology and workforce solutions | |

| 120,483 | | |

| 135,117 | | |

| 126,055 | | |

| 382,524 | | |

| 429,542 | |

| | |

$ | 853,463 | | |

$ | 1,138,586 | | |

$ | 991,299 | | |

$ | 2,970,985 | | |

$ | 4,117,731 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment operating income (12) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nurse and allied solutions | |

$ | 82,882 | | |

$ | 115,182 | | |

$ | 102,993 | | |

$ | 299,320 | | |

$ | 471,141 | |

| Physician and leadership solutions | |

| 21,609 | | |

| 23,904 | | |

| 26,456 | | |

| 73,165 | | |

| 64,280 | |

| Technology and workforce solutions | |

| 50,664 | | |

| 71,145 | | |

| 55,623 | | |

| 173,297 | | |

| 232,526 | |

| | |

| 155,155 | | |

| 210,231 | | |

| 185,072 | | |

| 545,782 | | |

| 767,947 | |

| Unallocated corporate overhead (13) | |

| 21,425 | | |

| 28,398 | | |

| 23,254 | | |

| 70,670 | | |

| 95,824 | |

| Adjusted EBITDA (5) | |

$ | 133,730 | | |

$ | 181,833 | | |

$ | 161,818 | | |

$ | 475,112 | | |

$ | 672,123 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Margin | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nurse and allied solutions | |

| 27.5 | % | |

| 27.0 | % | |

| 26.7 | % | |

| 26.6 | % | |

| 26.2 | % |

| Physician and leadership solutions | |

| 33.4 | % | |

| 34.0 | % | |

| 35.1 | % | |

| 34.6 | % | |

| 34.4 | % |

| Technology and workforce solutions | |

| 65.0 | % | |

| 75.6 | % | |

| 66.7 | % | |

| 67.9 | % | |

| 76.9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating Data: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nurse and allied solutions | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average travelers on assignment (14) | |

| 11,990 | | |

| 14,722 | | |

| 13,597 | | |

| 13,570 | | |

| 16,085 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Physician and leadership solutions | |

| | | |

| | | |

| | | |

| | | |

| | |

| Days filled (15) | |

| 45,981 | | |

| 49,694 | | |

| 49,976 | | |

| 142,857 | | |

| 150,550 | |

| Revenue per day filled (16) | |

$ | 2,447 | | |

$ | 2,134 | | |

$ | 2,439 | | |

$ | 2,388 | | |

$ | 2,157 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

As of September 30, | |

As of December 31, |

| | |

2023 | |

2022 | |

2022 |

| Leverage ratio (17) | |

| 1.4 | | |

| 0.8 | | |

| 1.0 | |

| | |

| | | |

| | | |

| | |

AMN Healthcare Services, Inc.

Additional Supplemental Non-GAAP Disclosure

Reconciliation of Guidance Operating Margin to Guidance

Adjusted EBITDA Margin

(unaudited)

| | |

Three Months Ended |

| | |

December 31, 2023 |

| | |

| Low(18) | | |

| High(18) | |

| | |

| | | |

| | |

| Operating margin | |

| 5.9 | % | |

| 6.5 | % |

| Depreciation and amortization (total) | |

| 5.1 | % | |

| 5.0 | % |

| EBITDA margin | |

| 11.0 | % | |

| 11.5 | % |

| Share-based compensation | |

| 0.6 | % | |

| 0.6 | % |

| Acquisition, integration, and other costs | |

| 0.9 | % | |

| 0.9 | % |

| Adjusted EBITDA margin | |

| 12.5 | % | |

| 13.0 | % |

| (1) | Operating margin represents income from operations divided by revenue. |

| (2) | A portion of depreciation expense for AMN Language Services is included in cost of revenue. We exclude

the impact of depreciation included in cost of revenue from the calculation of adjusted EBITDA. |

| (3) | Acquisition, integration, and other costs include acquisition and integration costs, net changes in the

fair value of contingent consideration liabilities for recently acquired companies, certain legal expenses, restructuring expenses, and

certain nonrecurring expenses, which we exclude from the calculation of adjusted EBITDA, adjusted net income, and adjusted diluted EPS

because we believe that these expenses are not indicative of the Company’s operating performance. For the three and nine months

ended September 30, 2023, acquisition and integration costs were approximately $1.3 million and $3.3 million, respectively, expenses

related to the closures of certain office leases were approximately $1.7 million and $3.7 million, respectively, increases in contingent

consideration liabilities for recently acquired companies were approximately $2.4 million, certain legal expenses of approximately

$1.2 million and $2.2 million, respectively, restructuring expenses were approximately $0.2 million and $1.8 million,

respectively, and other nonrecurring expenses were approximately $1.4 million and $3.2 million, respectively. For the three

and nine months ended September 30, 2022, acquisition and integration costs were approximately $1.1 million and $3.1 million,

respectively, expenses related to the closures of certain office leases were approximately $1.7 million and $12.6 million, respectively,

certain legal expenses were approximately $4.8 million, and other nonrecurring expenses were approximately $0.4 million and

$1.2 million, respectively. Additionally, the aforementioned costs for the three and nine months ended September 30, 2022 were partially

offset by net decreases in contingent consideration liabilities for recently acquired companies of approximately $1.8 million and

$1.2 million, respectively. |

| (4) | During the three months ended June 30, 2023, the Company recorded an increase to its legal accrual for

a wage and hour claim in connection with reaching an agreement to settle the matter in its entirety. Since the settlement is largely unrelated

to the Company’s operating performance, we excluded its impact in the calculations of adjusted EBITDA, adjusted net income, and

adjusted diluted EPS. |

| (5) | Adjusted EBITDA represents net income plus interest expense (net of interest income) and other, income

tax expense (benefit), depreciation and amortization, depreciation (included in cost of revenue), acquisition, integration, and other

costs, restructuring expenses, certain legal expenses, and share-based compensation. Management believes that adjusted EBITDA provides

an effective measure of the Company’s results, as it excludes certain items that management believes are not indicative of the Company’s

operating performance. Adjusted EBITDA is not intended to represent cash flows for the period, nor has it been presented as an alternative

to income from operations or net income as an indicator of operating performance. Although management believes that some of the items

excluded from adjusted EBITDA are not indicative of the Company’s operating performance, these items do impact the statement of

comprehensive income, and management therefore utilizes adjusted EBITDA as an operating performance measure in conjunction with GAAP measures

such as net income. |

| (6) | Adjusted EBITDA margin represents adjusted EBITDA divided by revenue. |

| (7) | As a result of a change in accounting principle on January 1, 2023 related to forfeitures of share-based

awards, the Company recognized the cumulative effect of the change in share-based compensation expense during the three months ended March

31, 2023. The cumulative effect of the change in accounting principle is immaterial to prior periods and, therefore, was recognized in

the current period. Since the cumulative effect is unrelated to the Company’s operating performance for the nine months ended September

30, 2023, we excluded its impact in the calculation of adjusted net income and adjusted diluted EPS. |

| (8) | The Company records net tax expense (benefit) related to the income tax treatment of the fair value changes

in the cash surrender value of its company owned life insurance. Since this change in fair value is unrelated to the Company’s operating

performance, we excluded the impact on adjusted net income and adjusted diluted EPS. |

| (9) | The consolidated effective tax rate is affected by the recording of excess tax benefits and tax deficiencies

relating to equity awards vested during the period. As a result of the adoption of a new accounting pronouncement on January 1, 2017,

the Company no longer records excess tax benefits and tax deficiencies to additional paid-in capital, but such excess tax benefits and

tax deficiencies are now recognized in income tax expense. The magnitude of the impact of excess tax benefits and tax deficiencies generated

in the future, which may be favorable or unfavorable, is dependent upon the Company’s future grants of share-based compensation

and the Company’s future stock price on the date awards vest in relation to the fair value of the awards on the grant date. Since

these excess tax benefits and tax deficiencies are largely unrelated to our income before taxes and are unrepresentative of our normal

effective tax rate, we excluded their impact in the calculation of adjusted net income and adjusted diluted EPS. |

| | |

| (10) | Adjusted net income represents GAAP net income excluding the impact of the (A) amortization of intangible

assets, (B) acquisition, integration, and other costs, (C) certain legal expenses, (D) changes in fair value of equity investments and

instruments, (E) deferred financing related costs, (F) cumulative effect of change in accounting principle, (G) tax effect, if any, of

the foregoing adjustments, (H) excess tax benefits and tax deficiencies relating to equity awards vested and exercised since January 1,

2017, and (I) net tax expense (benefit) related to the income tax treatment of fair value changes in the cash surrender value of its company

owned life insurance, and (J) restructuring tax benefits. Management included this non-GAAP measure to provide investors and prospective

investors with an alternative method for assessing the Company’s operating results in a manner that is focused on its operating

performance and to provide a more consistent basis for comparison between periods. However, investors and prospective investors should

note that this non-GAAP measure involves judgment by management (in particular, judgment as to what is classified as a special item to

be excluded in the calculation of adjusted net income). Although management believes the items in the calculation of adjusted net income

are not indicative of the Company’s operating performance, these items do impact the statement of comprehensive income, and management

therefore utilizes adjusted net income as an operating performance measure in conjunction with GAAP measures such as GAAP net income. |

| (11) | Adjusted diluted EPS represents adjusted net income divided by diluted weighted average common shares

outstanding. Management included this non-GAAP measure to provide investors and prospective investors with an alternative method for assessing

the Company’s operating results in a manner that is focused on its operating performance and to provide a more consistent basis

for comparison between periods. However, investors and prospective investors should note that this non-GAAP measure involves judgment

by management (in particular, judgment as to what is classified as a special item to be excluded in the calculation of adjusted net income).

Although management believes the items in the calculation of adjusted net income are not indicative of the Company’s operating performance,

these items do impact the statement of comprehensive income, and management therefore utilizes adjusted diluted EPS as an operating performance

measure in conjunction with GAAP measures such as GAAP diluted EPS. |

| (12) | Segment operating income represents net income plus interest expense (net of interest income) and other,

income tax expense (benefit), depreciation and amortization, depreciation (included in cost of revenue), unallocated corporate overhead,

acquisition, integration, and other costs, legal settlement accrual changes, and share-based compensation. |

| (13) | Unallocated corporate overhead (as presented in the tables above) consists of unallocated corporate overhead

(as reflected in our quarterly and annual financial statements filed with the SEC) less acquisition, integration, and other costs and

legal settlement accrual changes. |

| (14) | Average travelers on assignment represents the average number of nurse and allied healthcare professionals

on assignment during the period presented. |

| (15) | Days filled is calculated by dividing the locum tenens hours filled during the period by eight hours. |

| (16) | Revenue per day filled represents revenue of the Company’s locum tenens business divided by days

filled for the period presented. |

| (17) | Leverage ratio represents the ratio of the Company’s debt outstanding (including the outstanding

letters of credit collateralized by the senior credit facility) minus cash and cash equivalents at the end of the subject period to adjusted

EBITDA for the twelve-month period ended at the end of the subject period. |

| (18) | Guidance percentage metrics are approximate. |

| | |

v3.23.3

Cover

|

Nov. 02, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity File Number |

001-16753

|

| Entity Registrant Name |

AMN HEALTHCARE SERVICES, INC.

|

| Entity Central Index Key |

0001142750

|

| Entity Tax Identification Number |

06-1500476

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2999 Olympus Boulevard

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75019

|

| City Area Code |

866

|

| Local Phone Number |

871-8519

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AMN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

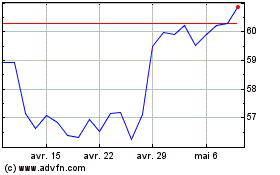

AMN Healthcare Services (NYSE:AMN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

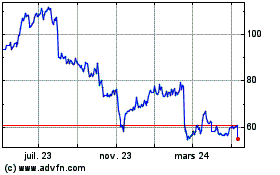

AMN Healthcare Services (NYSE:AMN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024