Firm adds Columbia U.S. High Yield ETF (NJNK)

and Columbia Short Duration High Yield ETF (HYSD) to its ETF range

amidst rising investor interest in active ETFs

Columbia Threadneedle Investments today announced the expansion

of its exchange-traded fund (ETF) offerings with the launch of two

actively managed, fully-transparent fixed income ETFs: the Columbia

U.S. High Yield ETF (NYSE Arca: NJNK) and the Columbia Short

Duration High Yield ETF (NYSE Arca: HYSD). Both ETFs draw on

Columbia Threadneedle’s extensive high yield capabilities and are

designed to provide investors and allocators with compelling

investment options when building portfolios. Launching these

strategies as ETFs addresses an increasing market demand for high

current income in a low-cost, tax-efficient structure.

Columbia Threadneedle’s fixed income team is made up of more

than 180 professionals managing over $210 billion in fixed income

assets.1 Under that umbrella, the high yield team has experience

managing a broad offering across the high yield spectrum, and these

two new ETFs will benefit from their expertise. NJNK is managed by

Daniel DeYoung, a high yield senior portfolio manager and David

Janssen, a multi-sector fixed income portfolio manager. HYSD is

managed by Brett Kaufman and Kris Keller, senior portfolio managers

on the high yield team.

“We believe that high yield bonds have an important role to play

in a diversified portfolio and that that investors should consider

making a long-term allocation to the asset class to capture the

high levels of income that it can offer,” says Dan DeYoung, senior

portfolio manager, High Yield Fixed Income. “With potential cuts to

the federal funds rate on the horizon, the benefits of thoughtful

exposure to high yield are compelling.”

Marc Zeitoun, Head of North America Product and Business

Intelligence, said: “Our investment teams leverage decades of

experience in fundamental research, bottom-up credit selection and

risk management to build high yield portfolios aimed at generating

strong risk-adjusted returns while intentionally avoiding some of

the riskiest segments of the high yield market. This commitment to

original, independent research is central to our investment

philosophy and how we deliver value to investors. With NJNK and

HYSD, we expect to provide clients with investment solutions that

offer greater potential for alpha relative to indexed benchmarks,

in a wrapper that emphasizes tax efficiency and low cost. These

important additions to our ETF range reflect our commitment to

offering investors greater choice in how they access our investment

strategies.”

Fund Name

Ticker

Performance Benchmark

Portfolio Managers

Columbia U.S. High Yield ETF

NJNK

Bloomberg U.S. Corporate High Yield

Index

Dan DeYoung

David Janssen

Columbia Short Duration High Yield

ETF

HYSD

ICE BofA 0-5 Year BB-B U.S. High Yield

Constrained Index

Brett Kaufman

Kris Keller

NJNK is a fully transparent, rules-based ETF with a

discretionary active overlay designed to pursue strong risk

adjusted returns through varying market environments. The Fund

seeks to produce high current income with a strategy that focuses

on reducing exposure to the lowest quality, highest risk issuers

while also avoiding higher- rated yet low-yielding securities.

HYSD is a fully transparent, actively managed ETF that focuses

on short duration high yield corporate bonds and floating rate

loans. The short duration high yield strategy aims to generate

alpha comparable to other high yield portfolios managed by the

team, powered by rigorous fundamental credit research. The process

strongly emphasizes risk management due to high yield’s

asymmetrical risk profile and is designed to limit downside risk.

The ETF will leverage the firm’s institutional Short Duration High

Yield separate account strategy that has been in place for nearly

10 years.

NJNK and HYSD are the latest additions to Columbia

Threadneedle’s actively managed ETF offerings, which also include

the Columbia U.S Equity Income ETF (NYSE Arca: EQIN), Columbia

International Equity Income ETF (NYSE Arca: INEQ) and the Columbia

Semiconductor and Technology ETF (NYSE Arca: SEMI). With the

addition of these two new actively managed, fully transparent ETFs,

Columbia Threadneedle now offers 14 ETFs across the active/indexed

spectrum.

About Columbia Threadneedle Investments

Columbia Threadneedle Investments is a leading global asset

manager that provides a broad range of investment strategies and

solutions for individual, institutional and corporate clients

around the world. With more than 2,500 people, including over 650

investment professionals based in North America, Europe and Asia,

we manage $642 billion of assets across developed and emerging

market equities, fixed income, asset allocation solutions and

alternatives.2

Columbia Threadneedle Investments is the global asset management

group of Ameriprise Financial, Inc. (NYSE: AMP). For more

information, please visit columbiathreadneedleus.com.

Columbia Threadneedle Investments (Columbia Threadneedle) is the

global brand name of the Columbia and Threadneedle group of

companies.

1, 2 As of June 30, 2024

The views expressed are as of the date given, may change as

market or other conditions change and may differ from views

expressed by other Columbia Management Investment Advisers, LLC

(CMIA) associates or affiliates. Actual investments or investment

decisions made by CMIA and its affiliates, whether for its own

account or on behalf of clients, may not necessarily reflect the

views expressed. This information is not intended to provide

investment advice and does not take into consideration individual

investor circumstances. Investment decisions should always be made

based on an investor's specific financial needs, objectives, goals,

time horizon and risk tolerance. Asset classes described may not be

appropriate for all investors. Past performance does not guarantee

future results, and no forecast should be considered a guarantee

either. Since economic and market conditions change frequently,

there can be no assurance that the trends described here will

continue or that any forecasts are accurate.

Investors should carefully consider the investment

objectives, risks, charges and expenses of the Funds before

investing. To obtain a prospectus containing this and other

important information, please visit

https://www.columbiathreadneedleus.com/etf to view or

download a prospectus. Read the prospectus carefully before

investing.

Columbia Management Investment Advisers, LLC serves as the

investment manager to the ETFs. The ETFs are distributed by ALPS

Distributors, Inc., which is not affiliated with Columbia

Management Investment Advisers, LLC, Columbia Management Investment

Distributors, Inc. or its parent company Ameriprise Financial,

Inc.

General ETF Risks

There are risks involved with investing in ETFs, including the

loss of the principal amount that you invest.

ETF shares are bought and sold throughout the trading day at

their market price, not their NAV, on the exchange on which they

are listed. ETF shares may trade in the market at a premium or

discount to their NAV. A financial intermediary (such as a broker)

may charge a commission to execute a transaction in ETF shares, and

an investor also may incur the cost of the spread between the price

at which a dealer will buy ETF shares and the somewhat higher price

at which a dealer will sell ETF shares.

ETF shares are not individually redeemable from an ETF. Only

market makers or Authorized Participants may trade directly with an

ETF, typically in large blocks of shares, as disclosed in each

Fund’s prospectus.

Fund Investment Risks

Due to its active management, the Fund could underperform

its benchmark index and/or other funds with similar investment

objectives and/or strategies.

Fixed income securities Involve interest rate, credit,

inflation, illiquidity, and reinvestment risks.

Interest rate risk is the risk that fixed income

securities will decline in value because of changes in interest

rates. Generally, the value of debt securities falls as interest

rates rise. Fixed income securities differ in their sensitivities

to changes in interest rates. Fixed income securities with longer

effective durations tend to be more sensitive to changes in

interest rates, usually making them more volatile than securities

with shorter effective durations. Effective duration is determined

by a number of factors including coupon rate, whether the coupon is

fixed or floating, time to maturity, call or put features, and

various repayment features.

Credit risk is the risk that the value of debt

instruments may decline if the borrower or the issuer thereof

defaults or otherwise becomes unable or unwilling, or is perceived

to be unable or unwilling, to honor its financial obligations, such

as making payments to the Fund when due. Credit rating agencies

assign credit ratings to certain debt instruments to indicate their

credit risk. A rating downgrade by such agencies can negatively

impact the value of such instruments. Lower-rated or unrated

instruments held by the Fund may present increased credit risk as

compared to higher-rated instruments. Non-investment grade debt

instruments may be subject to greater price fluctuations and are

more likely to experience a default than investment grade debt

instruments and therefore may expose the Fund to increased credit

risk.

Below investment-grade securities, or “junk bonds,” are

more likely to pose a credit risk, as the issuers of these

securities are more likely to have problems making interest and

principal payments than issuers of higher-rated securities.

Lower-rated securities may be more susceptible to real or perceived

adverse economic and competitive industry conditions than

higher-grade securities, and prices of these securities may be more

sensitive to adverse economic downturns or individual corporate

developments. If the issuer of the securities defaults, the ETF may

incur additional expenses to seek recovery.

Floating rate loans typically present greater risk than

other fixed-income investments as they are generally subject to

legal or contractual resale restrictions, may trade less frequently

and experience value impairments during liquidation.

Foreign investments subject the fund to risks, including

political, economic, market, social and others within a particular

country, as well as to currency instabilities and less stringent

financial and accounting standards generally applicable to U.S.

issuers.

As a non-diversified fund, holding fewer investments

increases the risk that a change in the value of any one investment

could affect the overall value of the Fund more than it would

affect that of a diversified fund holding a greater number of

investments.

Although the Fund’s shares are listed on an exchange,

there can be no assurance that an active, liquid or otherwise

orderly trading market for shares will be established or

maintained. The Fund may have portfolio turnover, which may cause

an adverse cost impact.

Investing involves risks, including the risk of loss of

principal.

Market risk may affect a single issuer, sector of the

economy, industry, or the market as a whole.

Although the Fund’s shares are listed on an exchange,

there can be no assurance that an active, liquid or otherwise

orderly trading market for shares will be established or

maintained. The Fund may have portfolio turnover, which may

cause an adverse cost impact.

This fund is new and has limited operating history.

AdTrax: CTNA7001132.1-RUSH ALPS: CET002183

© 2024 Columbia Management Investment Advisers, LLC. All rights

reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912370996/en/

Meghan Shields Meghan.Shields@columbiathreadneedle.com

617.451.0739

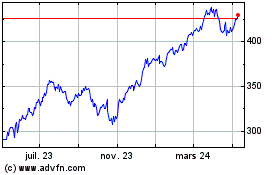

Ameriprise Financial (NYSE:AMP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

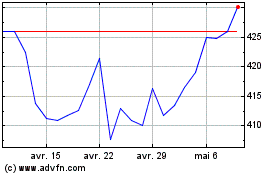

Ameriprise Financial (NYSE:AMP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025