AUTONATION, INC.0000350698PRE 14Afalse00003506982023-01-012023-12-310000350698an:MichaelManleyMember2023-01-012023-12-31iso4217:USD0000350698an:MichaelManleyMember2022-01-012022-12-310000350698an:MichaelManleyMember2021-01-012021-12-31iso4217:USDxbrli:shares00003506982022-01-012022-12-310000350698an:MichaelJacksonMember2021-01-012021-12-3100003506982021-01-012021-12-310000350698an:MichaelJacksonMember2020-01-012020-12-310000350698an:CherylMillerMember2020-01-012020-12-3100003506982020-01-012020-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2023-01-012023-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:MichaelManleyMember2023-01-012023-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:MichaelManleyMember2023-01-012023-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:MichaelManleyMember2023-01-012023-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2023-01-012023-12-310000350698ecd:PeoMemberan:MichaelManleyMember2023-01-012023-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2022-01-012022-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:MichaelManleyMember2022-01-012022-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:MichaelManleyMember2022-01-012022-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:MichaelManleyMember2022-01-012022-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2022-01-012022-12-310000350698ecd:PeoMemberan:MichaelManleyMember2022-01-012022-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2021-01-012021-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:MichaelManleyMember2021-01-012021-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:MichaelManleyMember2021-01-012021-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:MichaelManleyMember2021-01-012021-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:MichaelManleyMember2021-01-012021-12-310000350698ecd:PeoMemberan:MichaelManleyMember2021-01-012021-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:MichaelJacksonMember2021-01-012021-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:MichaelJacksonMember2021-01-012021-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:MichaelJacksonMember2021-01-012021-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:MichaelJacksonMember2021-01-012021-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:MichaelJacksonMember2021-01-012021-12-310000350698ecd:PeoMemberan:MichaelJacksonMember2021-01-012021-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:MichaelJacksonMember2020-01-012020-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:MichaelJacksonMember2020-01-012020-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:MichaelJacksonMember2020-01-012020-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:MichaelJacksonMember2020-01-012020-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:MichaelJacksonMember2020-01-012020-12-310000350698ecd:PeoMemberan:MichaelJacksonMember2020-01-012020-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:PeoMemberan:CherylMillerMember2020-01-012020-12-310000350698ecd:PeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMemberan:CherylMillerMember2020-01-012020-12-310000350698ecd:PeoMemberan:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberan:CherylMillerMember2020-01-012020-12-310000350698ecd:PeoMemberan:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberan:CherylMillerMember2020-01-012020-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:PeoMemberan:CherylMillerMember2020-01-012020-12-310000350698ecd:PeoMemberan:CherylMillerMember2020-01-012020-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000350698ecd:NonPeoNeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMember2023-01-012023-12-310000350698an:FairValueAtVestingDateOfEquityAwardsThatGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000350698an:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2023-01-012023-12-310000350698an:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000350698ecd:NonPeoNeoMember2023-01-012023-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000350698ecd:NonPeoNeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMember2022-01-012022-12-310000350698an:FairValueAtVestingDateOfEquityAwardsThatGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000350698an:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310000350698an:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000350698ecd:NonPeoNeoMember2022-01-012022-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000350698ecd:NonPeoNeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMember2021-01-012021-12-310000350698an:FairValueAtVestingDateOfEquityAwardsThatGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000350698an:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310000350698an:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000350698ecd:NonPeoNeoMember2021-01-012021-12-310000350698an:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000350698ecd:NonPeoNeoMemberan:FairValueAtYearEndOfEquityAwardsGrantedDuringTheYearMember2020-01-012020-12-310000350698an:FairValueAtVestingDateOfEquityAwardsThatGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000350698an:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310000350698an:ChangeInFairValueAsOfVestingDateOfAwardsGrantedInPriorYearsAndVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000350698an:FairValueAsOfTheEndOfPriorYearOfAwardsCancelledDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000350698ecd:NonPeoNeoMember2020-01-012020-12-31000035069812023-01-012023-12-31000035069822023-01-012023-12-31000035069832023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

þ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under § 240.14a-12

AutoNation, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

DATED MARCH 4, 2024

NOTICE OF THE 2024 ANNUAL MEETING OF STOCKHOLDERS

To Stockholders of AutoNation, Inc.:

The 2024 Annual Meeting of Stockholders of AutoNation, Inc. will be held in a virtual format only, on Wednesday, April 24, 2024, at 8:00 a.m. Eastern Time for the following purposes as more fully described in the proxy statement:

(1) To elect the eight director nominees named in the proxy statement, each for a term expiring at the next Annual Meeting of Stockholders or until their successors are duly elected and qualified;

(2) To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2024;

(3) To hold an advisory vote to approve named executive officer compensation;

(4) To approve and adopt an Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation;

(5) To approve the AutoNation, Inc. 2024 Non-Employee Director Equity Plan;

(6) To consider a stockholder proposal, if properly presented at the Annual Meeting; and

(7) To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

Only stockholders of record as of the close of business on March 4, 2024, the record date, are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We cordially invite you to attend the virtual Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to vote your shares in advance using one of the methods described in this proxy statement to ensure that your vote will be represented at the Annual Meeting. To attend, vote, and submit questions at the 2024 Annual Meeting, please log in to www.virtualshareholdermeeting.com/AN2024 using the control number on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. You may revoke your proxy and reclaim your right to vote at any time prior to its use at the Annual Meeting. The proxy statement includes information on what you will need to attend the virtual Annual Meeting.

By Order of the Board of Directors,

C. Coleman Edmunds

Executive Vice President, General Counsel

and Corporate Secretary

March [•], 2024

TABLE OF CONTENTS

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials, including this proxy statement and our annual report, to our stockholders primarily via the Internet. On March [•], 2024, we began mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) that contains instructions on how to access our proxy materials on the Internet. The Notice also contains instructions on how to vote via the Internet or by telephone. Other stockholders, in accordance with their prior requests, received an email with instructions on how to access our proxy materials and vote via the Internet, or have been mailed paper copies of our proxy materials and a proxy card or voting form. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on April 24, 2024

Our 2023 Annual Report and this Proxy Statement are available at http://www.proxyvote.com.

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of AutoNation, Inc. (“AutoNation” or the “Company”) for use at our 2024 Annual Meeting of Stockholders (the “Annual Meeting”) or any adjournment or postponement thereof. Our Annual Meeting will be held in a virtual format only, on Wednesday, April 24, 2024, at 8:00 a.m. Eastern Time. To attend, vote, and submit questions at the 2024 Annual Meeting, please log in to www.virtualshareholdermeeting.com/AN2024 using the control number on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials.

Only stockholders of record as of the close of business on March 4, 2024 (the “record date”) are entitled to receive notice of the Annual Meeting and to vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the record date, there were [•] shares of AutoNation common stock issued and outstanding and entitled to vote at the Annual Meeting. We made copies of this proxy statement available to our stockholders beginning on or about March [•], 2024.

INFORMATION ABOUT THE ANNUAL MEETING

Annual Meeting Proposals

| | | | | | | | |

| Proposal | Matter | Board Vote Recommendation |

| 1 | Election of Directors | FOR EACH NOMINEE |

| 2 | Ratification of the Selection of KPMG LLP as Our Independent Auditor for 2024 | FOR |

| 3 | Advisory Vote to Approve Named Executive Officer Compensation | FOR |

| 4 | Approval and Adoption of an Amended and Restated Certificate of Incorporation to Reflect New Delaware Law Provisions Regarding Officer Exculpation | FOR |

| 5 | Approval of the AutoNation, Inc. 2024 Non-Employee Director Equity Plan | FOR |

| 6 | Stockholder Proposal Regarding Political Contributions | AGAINST |

Voting Matters

Quorum. The holders of at least [•] shares (a majority of shares outstanding on the record date) must be present at the Annual Meeting or represented by proxy to conduct business at the Annual Meeting. Both abstentions and broker non-votes will be counted for the purpose of determining the presence of a quorum.

Voting by Stockholders of Record. If you are a stockholder of record (your shares are registered directly in your name with our transfer agent), you may vote by proxy via the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials. If you receive printed copies of the proxy materials by mail, you may also vote by proxy via the Internet, by telephone, or by mail by following the instructions provided on the proxy card. Stockholders of record who virtually attend the Annual Meeting may vote during the Annual Meeting by visiting www.virtualshareholdermeeting.com/AN2024, entering the applicable control number, and following the instructions on the Annual Meeting website.

Voting by Beneficial Owners. If you are a beneficial owner of shares (your shares are held in the name of a brokerage firm, bank, or other nominee), you may vote by proxy by following the instructions provided in the Notice of Internet Availability of Proxy Materials, voting instruction form, or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. If you do not provide specific voting instructions to the nominee that holds your shares, such nominee will have the authority to vote your shares only with respect to the ratification of the selection of KPMG LLP as our independent registered public accounting firm (such proposal is considered a “routine” matter under NYSE rules), and your shares will not be voted and will be considered “broker non-votes” with respect to the other proposals (such proposals are considered “non-routine” matters under NYSE rules). To vote during the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank, or other nominee that holds your shares.

Changing Your Vote. You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the meeting will be counted), by signing and returning a new proxy card with a later date, or by attending and voting during the Annual Meeting. Your virtual attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again during the Annual Meeting or specifically request in writing that your prior proxy be revoked.

Votes Required to Adopt Proposals. Each share of our common stock outstanding on the record date is entitled to one vote on each of the eight director nominees and one vote on each other matter. To be elected, each director nominee must receive a majority of the votes cast (the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee). Approval of Proposals 2, 3, 5, and 6 each requires the affirmative vote of a majority of the shares of common stock present at the Annual Meeting or represented by proxy and entitled to vote on the proposal. Approval of Proposal 4 requires the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote on the proposal at the Annual Meeting. Although the advisory vote on Proposal 3 is non-binding, the Board and its Compensation Committee will review and carefully consider the voting results when making future decisions regarding our executive compensation program.

Effect of Abstentions and Broker Non-Votes. For the election of directors, broker non-votes (shares held by brokers that do not have discretionary authority to vote on a proposal and have not received voting instructions from their clients) and abstentions will not be counted as having been voted. For Proposals 2, 3, 5, and 6, abstentions will be counted as present and entitled to vote and will have the same effect as negative votes. For Proposals 3, 5, and 6, broker non-votes will not be counted as present and entitled to vote and therefore will not impact the voting results of such proposals. Brokers will have discretionary authority to vote on Proposal 2, since it is considered a routine matter under NYSE rules. For Proposal 4, abstentions and broker non-votes will have the same effect as negative votes.

Voting Instructions. If you complete and submit a proxy with voting instructions, the persons named as proxy holders will follow your instructions. If you are a stockholder of record and submit a proxy without voting instructions, or if your instructions are unclear, the persons named as proxy holders will vote as the Board recommends on each proposal. With respect to any other matters properly presented at the Annual Meeting, the persons named as proxy holders will vote as recommended by our Board, or if no recommendation is given, in their own discretion.

Proxy Solicitation

We will pay for the cost of soliciting proxies, and we have retained Innisfree M&A Incorporated to assist with the solicitation of proxies for an estimated fee of $17,500 plus reimbursement for expenses. Our directors, officers, and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, email, or otherwise. As is customary, we will reimburse brokerage firms, banks, and other nominees for forwarding our proxy materials to each beneficial owner of common stock held of record by them.

Attending the Annual Meeting

We are pleased to welcome stockholders to our Annual Meeting, which will be held in a virtual format only. We have designed the format of the Annual Meeting to ensure that stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting.

To attend and vote at the Annual Meeting, please visit www.virtualshareholdermeeting.com/AN2024 and follow the instructions included in our Notice of Internet Availability of Proxy Materials, on your proxy card, or in the email you received regarding our proxy materials. Online access to the Annual Meeting will begin approximately 15 minutes prior to the start of the Annual Meeting. Please see “Attending the 2024 Annual Meeting of Stockholders of AutoNation, Inc.” below for additional information.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Directors

The Board has nominated the eight persons listed below to stand for election for a term expiring at the 2025 Annual Meeting of Stockholders or until their successors are duly elected and qualified. See “Items To Be Voted On - Proposal 1: Election of Directors.” All of our director nominees were elected by our stockholders at our 2023 Annual Meeting of Stockholders.

Our Board nominees consist of a diverse group of leaders. Two of our Board nominees are women, and one is from an underrepresented racial/ethnic group. Many of our Board nominees have experience serving as executive officers and/or on boards and board committees of major companies. Many of them also have extensive corporate finance and investment banking experience as well as a broad understanding of capital markets.

We have set forth below information regarding each person nominated to stand for election, including the specific experience, qualifications, attributes, or skills that led the Board to conclude that such person should serve as a director. Our Corporate Governance and Nominating Committee and the Board believe that the experience, qualifications, attributes, and skills of our Board nominees provide the Company with the ability to address the evolving needs of the Company and represent the best interests of our stockholders. All of our directors are elected annually.

Rick L. Burdick, age 72, has served as our Chairman of the Board since February 2021 and as one of our directors since May 1991. Mr. Burdick previously served as our Lead Independent Director from December 2018 until January 2021. Mr. Burdick also serves as Chairman of the Board of Directors of CBIZ, Inc., a provider of integrated business services and products. From 1988 through 2019, Mr. Burdick was a partner with Akin, Gump, Strauss, Hauer & Feld, L.L.P., a global full service law firm. Mr. Burdick’s experience as a senior partner at an international law firm advising large companies on a broad range of corporate transactions and on securities law and corporate governance matters led the Board to conclude that he should serve as one of our directors.

David B. Edelson, age 64, has served as one of our directors since July 2008 and is Chair of the Board’s Audit Committee. Mr. Edelson has served as a Managing Director in the North American Private Equity business of Bain Capital, LP, one of the world’s leading private investment firms, since October 2022. Mr. Edelson previously served as the Chief Financial Officer of the Loews Corporation, a diversified company with businesses in the insurance, energy, hospitality, and packaging industries, from May 2014 until May 2022; and, thereafter, as a Senior Advisor from July 2022 until October 2022. Prior to joining Loews, Mr. Edelson was Executive Vice President & Corporate Treasurer of JPMorgan Chase & Co. He was named Corporate Treasurer in April 2001 and promoted to Executive Vice President in February 2003. Mr. Edelson spent the first 15 years of his career as an investment banker, first with Goldman Sachs & Co. and subsequently with JPMorgan Chase & Co. Mr. Edelson’s experience as a senior executive officer of a large holding company owning a wide range of businesses, as well as his experience as an investment banker and corporate treasurer, led the Board to conclude that he should serve as one of our directors.

Robert R. Grusky, age 66, has served as one of our directors since June 2006. In 2000, Mr. Grusky founded Hope Capital Management, LLC, an investment management firm for which he serves as Managing Member. He co-founded New Mountain Capital, LLC, a private and public equity investment management firm, in 2000 and was a Principal, Managing Director and Member of New Mountain Capital from 2000 to 2005 and was a Senior Advisor through 2019, and a member of the Executive Leadership Council since then. From 1998 to 2000, Mr. Grusky served as President of RSL Investments Corporation, the primary investment vehicle for the Hon. Ronald S. Lauder. Prior thereto, Mr. Grusky served in a variety of capacities at Goldman Sachs & Co. in its Mergers & Acquisitions Department and Principal Investment Area. Mr. Grusky is a director of Strategic Education, Inc., an education services company. Mr. Grusky’s board experience and experience in investment management, private equity, and investment banking led the Board to conclude that he should serve as one of our directors.

Norman K. Jenkins, age 61, has served as one of our directors since December 2020. Mr. Jenkins is President and Chief Executive Officer of Capstone Development, a privately held firm he founded in 2009. Capstone develops and acquires commercial and multi-family real estate, with significant expertise in public-private partnerships and developing hospitality real estate that is generally affiliated with international lodging brands. Prior to launching Capstone, Mr. Jenkins was a senior executive and corporate officer of Marriott International Inc. During his 16 year tenure with Marriott, he served in a variety of leadership roles including, Senior Vice President - North American Lodging

Development, Vice President and Chief Financial Officer - Ramada International, Vice President - Owner & Franchise Services and Acquisition Executive. Prior to joining Marriott, Mr. Jenkins spent 5 years with McDonald’s Corporation where he held positions in finance and operations. Mr. Jenkins currently serves as Lead Trustee of Urban Edge Properties and as a director of RE/MAX Holdings, Inc. He previously served on the board of Duke Realty from 2017 until it was acquired by Prologis, Inc. in 2022 and on the board of New Senior Investment Group from 2020 until it was acquired by Ventas, Inc. in 2021. He is a member of the Washington DC Developer Roundtable and is a former member of the Suburban Hospital Board of Trustees and the Howard University Board of Trustees. Mr. Jenkins’s executive and real estate experience led the Board to conclude that he should serve as one of our directors.

Lisa Lutoff-Perlo, age 66, has served as one of our directors since February 2020. Since May 2023, she has served as Vice Chair, External Affairs for the Royal Caribbean Group. Ms. Lutoff-Perlo previously served as President and Chief Executive Officer of Celebrity Cruises, a multi-billion dollar cruise line and wholly-owned subsidiary of Royal Caribbean Cruises Ltd., from December 2014 until May 2023. Previously, Ms. Lutoff-Perlo was the Executive Vice President, Operations of Royal Caribbean International from 2012 to 2014; Senior Vice President, Hotel Operations of Celebrity Cruises from 2007 to 2012; and the Vice President, Onboard Revenue of Celebrity Cruises from 2005 to 2007. Ms. Lutoff-Perlo held various senior positions with Royal Caribbean International from 1985 to 2005. Ms. Lutoff-Perlo’s business operations and senior executive management experience led the Board to conclude that she should serve as one of our directors.

Michael Manley, age 60, has served as our Chief Executive Officer and as a member of our Board since November 1, 2021. Prior to joining AutoNation, Mr. Manley served as Head of Americas and as a member of the Group Executive Council for Stellantis N.V., one of the largest automotive original equipment manufacturers in the world, from January 2021 until October 2021. From July 2018 until January 2021, he served as Chief Executive Officer of Fiat Chrysler Automobiles N.V. (“FCA”), a predecessor to Stellantis N.V. Mr. Manley joined DaimlerChrysler (a predecessor to FCA) in 2000 and, prior to becoming FCA’s Chief Executive Officer, served in a number of management-level roles with increasing responsibility overseeing various aspects of FCA’s operations, including as Executive Vice President - International Sales & Marketing, Business Development and Global Product Planning Operations, Chief Executive Officer of Jeep, Chief Executive Officer of Ram, Chief Operating Officer for the Asia Pacific region, and FCA Global Executive Council member. Mr. Manley currently serves on the Board of Directors of Dover Corporation, a diversified global manufacturer and solutions provider delivering innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions and support services. Mr. Manley’s automotive experience, his broad knowledge of the automotive industry, and his position as our Chief Executive Officer led the Board to conclude that he should serve as one of our directors.

G. Mike Mikan, age 52, has served as one of our directors since March 2013 and is Chair of the Board’s Compensation Committee. Since January 2019, Mr. Mikan has served as Vice Chairman and President of NeueHealth, Inc. (formerly known as Bright Health Group, Inc.), a consumer-focused health insurance and services business, and in April 2020, Mr. Mikan became its Chief Executive Officer. Mr. Mikan served as Chairman and Chief Executive Officer of Shot-Rock Capital, LLC, a private investment capital group, from January 2015 until December 2018. From January 2013 until December 2014, he served as President of ESL Investments, Inc. Mr. Mikan served as the Interim Chief Executive Officer of Best Buy Co., Inc. from April 2012 until September 2012. From November 1998 through February 2012, he served in various executive positions at UnitedHealth Group Incorporated, including as Executive Vice President and Chief Financial Officer and as Chief Executive Officer of UnitedHealth’s Optum subsidiary. Mr. Mikan previously served as a director of Princeton Everest Fund (formerly known as Princeton Private Investments Access Fund) from 2014 until February 2023 and as a Trustee of Ellington Income Opportunities Fund from 2018 until February 2023. Mr. Mikan’s operational and public company leadership experience and his broad understanding of capital investment and allocation led the Board to conclude that he should serve as one of our directors.

Jacqueline A. Travisano, Ed.D., age 54, has served as one of our directors since April 2018 and is Chair of the Board’s Corporate Governance and Nominating Committee. Dr. Travisano has served as Executive Vice President and Chief Financial Officer of Wake Forest University since July 2023. She previously served as the Executive Vice President for Business and Finance and Chief Operating Officer of the University of Miami, a private research university, from June 2017 until June 2023. From 2011 to May 2017, Dr. Travisano served as Executive Vice President and Chief Operating Officer of Nova Southeastern University. She began her career in public accounting at Coopers & Lybrand and is a NACD Governance Fellow. Dr. Travisano’s senior executive and financial, accounting, and operational experience led the Board to conclude that she should serve as one of our directors.

Corporate Governance Guidelines and Codes of Ethics

Our Board is committed to sound corporate governance principles and practices. Our Board’s core principles of corporate governance are set forth in the AutoNation, Inc. Corporate Governance Guidelines (the “Guidelines”), which were adopted by the Board in March 2003 and most recently amended as of October 16, 2023. The Guidelines serve as a framework within which our Board conducts its operations. The Corporate Governance and Nominating Committee of our Board is charged with reviewing annually, or more frequently as appropriate, the Guidelines and recommending to our Board appropriate changes in light of applicable laws and regulations, the governance standards identified by leading governance authorities, and our Company’s evolving needs.

In order to clearly set forth our commitment to conduct our operations in accordance with our high standards of business ethics and applicable laws and regulations, we have a company-wide Business Ethics Program, which includes a Code of Business Ethics applicable to all of our employees. We also maintain a 24-hour Alert-Line for employees to report any Company policy violations under our Business Ethics Program. In addition, our Board has adopted the Code of Ethics for Senior Officers and the Code of Business Ethics for the Board of Directors. These codes comply with applicable NYSE listing standards and SEC rules.

A copy of the Guidelines and the codes referenced above are available on our corporate website at investors.autonation.com. You also may obtain a printed copy of the Guidelines and the codes referenced above by sending a written request to: Investor Relations, AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301.

Corporate Governance Highlights

•Independent Chairman. Rick L. Burdick, one of our independent directors, currently serves as our Chairman of the Board. In addition, our Guidelines provide for the selection of a Lead Independent Director whenever the Chairman of the Board is not an independent director.

•Proxy Access. Our by-laws permit a stockholder, or a group of up to 20 stockholders, who has owned 3% or more of our common stock for at least three years to nominate and include in our proxy materials director candidates representing up to the greater of two individuals or 20% of the Board, provided the stockholder(s) and the nominee(s) satisfy the requirements and conditions specified in our by-laws. See “Stockholder Proposals and Nominations for the 2025 Annual Meeting” below.

•Majority Voting with Resignation Policy for Uncontested Director Elections. Our Guidelines provide that an incumbent director who fails to receive a majority vote in an uncontested election shall tender his or her written resignation to the Chairman of the Board for consideration by the Corporate Governance and Nominating Committee.

•Special Meetings. Our amended and restated by-laws enable stockholders of record holding at least 25% of our common stock to call special meetings of stockholders.

•Prohibition on Hedging and Short Sales. We prohibit our directors and our employees from purchasing any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities. In addition, we prohibit our directors and employees from engaging in short sales of our securities.

Role of the Board and Board Structure

Our business and affairs are managed under the direction of our Board, which is the Company’s ultimate decision-making body, except with respect to those matters reserved to our stockholders. Our Board’s mission is to maximize long-term stockholder value. Our Board establishes our overall corporate policies, selects and evaluates our senior management team, who is charged with the conduct of our business, and acts as an advisor and counselor to senior management. Our Board also oversees our business strategy and planning, our ongoing and long-term plans for capital allocation, as well as the performance of management in executing our business strategy, assessing and managing risks, and managing our day-to-day operations. Our Board reviews and approves the Company’s long-term strategic plan developed by management.

Our Board’s oversight of our business strategy and planning and management of our day-to-day operations includes an ongoing review of risks that could impact our goals, objectives, and financial condition. In addition, our Audit, Compensation, and Corporate Governance and Nominating committees assist the Board in overseeing our management of risk. Our Audit Committee reviews with management significant risks related to financial reporting, internal controls, and cybersecurity, as well as our comprehensive enterprise risk management process (annually, with quarterly updates, as appropriate) designed to assess, manage and identify risks in order to align Board discussion topics with identified risks. Our Compensation Committee reviews and approves our executive compensation program and also reviews the general compensation structure for our corporate and key field employees. Our Corporate Governance and Nominating Committee oversees our company-wide Business Ethics Program, which includes a Code of Business Ethics applicable to all of our employees and policies and practices relating to environmental, social, and governance issues.

Rick L. Burdick, one of our independent directors, currently serves as our Chairman of the Board. In addition, our Guidelines provide for the selection of a Lead Independent Director if the Chairman of the Board is not an independent director.

The Board believes that having an independent Chairman of the Board is in the best interests of the Company at this time because it allows Mr. Manley, our Chief Executive Officer, to devote his time and attention to the day-to-day operations of the Company, while allowing Mr. Burdick to focus on leading the Board and supporting the initiatives of the Company and management. The Board also believes that our current leadership structure, with the separation of the Chairman of the Board and Chief Executive Officer positions, together with independent leadership at the committee level, enhances the Board’s effectiveness in risk oversight.

Our Board held five meetings and took four actions by unanimous written consent during 2023. In 2023, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he or she served (held during the period for which such person has been a director). Our independent directors held four executive sessions without management present during 2023.

Our directors are expected to attend our Annual Meeting of Stockholders. Any director who is unable to attend our Annual Meeting is expected to notify the Chairman of the Board in advance of the Annual Meeting. Each of our directors attended the 2023 Annual Meeting of Stockholders.

Board Committees

Our Board has three separately designated standing committees to assist the Board in discharging its responsibilities: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. The charters for each of our Board committees are in compliance with applicable SEC rules and NYSE listing standards. These charters are available at investors.autonation.com. You may obtain a printed copy of any of these charters by sending a request to: Investor Relations, AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301.

The following table sets forth the current membership of each of our Board’s committees:

| | | | | | | | | | | |

| Name | Audit Committee | Compensation Committee | Corporate

Governance and

Nominating

Committee |

| Rick L. Burdick | | ü | |

| David B. Edelson | Chair | | |

| Robert R. Grusky | | | ü |

| Norman K. Jenkins | ü | | |

| Lisa Lutoff-Perlo | ü | | ü |

| G. Mike Mikan | | Chair | |

| Jacqueline A. Travisano | | | Chair |

Audit Committee

The Audit Committee primarily assists our Board in fulfilling its oversight responsibilities by reviewing our financial reporting and audit processes and our systems of internal control over financial reporting and disclosure controls. Among the Committee’s core responsibilities are the following: (i) overseeing the integrity of our consolidated financial statements, for which management is responsible, and reviewing and approving the scope of the annual audit; (ii) selecting, retaining, compensating, overseeing, and evaluating our independent registered public accounting firm; (iii) reviewing the Company’s critical accounting policies; (iv) reviewing the Company’s quarterly and annual financial statements prior to the filing of such statements with the SEC; (v) preparing the Audit Committee report for inclusion in our proxy statement; and (vi) reviewing with management significant financial and cybersecurity risks or exposures and assessing the steps management has taken to minimize, monitor, and control such risks or exposures. For a complete description of our Audit Committee’s responsibilities, please refer to the Audit Committee’s charter.

Our Board has determined that each Audit Committee member has the requisite independence and other qualifications for audit committee membership under SEC rules, NYSE listing standards, the Audit Committee’s charter, and the independence standards set forth in the Guidelines (as discussed below under “Director Independence”). Our Board has also determined that each of Messrs. Edelson and Jenkins is an “audit committee financial expert” within the meaning of Item 407(d)(5) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See “Directors” above for a description of the business experience of each of our Audit Committee members.

The Audit Committee held four meetings during 2023. The Audit Committee Report for 2023, which contains a description of the Audit Committee’s responsibilities and its recommendation with respect to our audited consolidated financial statements for the year ended December 31, 2023, is set forth below under “Audit Committee Report.”

Compensation Committee

The Compensation Committee primarily assists our Board in fulfilling its compensation oversight responsibilities by, among other things: (i) reviewing our director compensation program and suggesting changes in director compensation to the Board, if appropriate; (ii) reviewing and approving the compensation of our CEO and other senior executive officers and setting annual and long-term performance goals for these individuals; (iii) reviewing and approving the compensation of all of our corporate officers; (iv) reviewing the Company’s program for management development and succession planning; (v) reviewing and approving performance-based compensation of executive officers, including incentive awards and stock-based awards; and (vi) administering our equity compensation plans.

Pursuant to its charter, the Compensation Committee may form subcommittees and may delegate to such subcommittees any or all power and authority of the Compensation Committee as the Compensation Committee deems appropriate, provided that no subcommittee may consist of fewer than two members, and provided further that the Compensation Committee may not delegate to a subcommittee any power or authority required by any applicable laws, regulations, or listing standards to be exercised by the Compensation Committee as a whole.

The Compensation Committee reviews executive compensation at its meetings throughout the year and sets executive compensation. The Compensation Committee also reviews director compensation annually and recommends to the full Board the compensation for non-employee directors. Our CEO reviews the performance of other named executive officers and makes recommendations, if any, to the Compensation Committee with respect to compensation adjustments for such officers. However, the Compensation Committee determines in its sole discretion whether to make any adjustments to the compensation paid to such executive officers.

Since October 2019, the Compensation Committee has engaged compensation consultant, Meridian Compensation Partners, LLC (“Meridian”). The Compensation Committee sought input from Meridian on executive and director compensation matters for 2023, including the design and competitive positioning of our executive and director compensation programs, our peer group, appropriate compensation levels, and evolving compensation trends. While the Compensation Committee considered input from Meridian, the Committee’s decisions reflect many factors and considerations.

Meridian did not provide any other services to the Company or its subsidiaries. The Compensation Committee assessed the independence of Meridian pursuant to SEC and NYSE rules and concluded that no conflict of interest exists that would prevent Meridian from serving as an independent consultant to the Compensation Committee. The Compensation Committee reviews the appointment of its independent compensation consulting firm annually. As part of

the review process, the Compensation Committee considers the independence of the firm in accordance with applicable SEC rules and NYSE listing standards.

For more information on the responsibilities and activities of the Compensation Committee, including the Committee’s processes for determining executive compensation, see “Executive Compensation” below, as well as the Compensation Committee’s charter.

Our Board has determined that each Compensation Committee member has the requisite independence for Compensation Committee membership under NYSE listing standards and the independence standards set forth in the Guidelines. Our Board has also determined that each Compensation Committee member qualifies as a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act and as an “outside director” under Section 162(m) of the Internal Revenue Code. The Compensation Committee held four meetings during 2023.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee assists our Board in fulfilling its oversight responsibilities by performing the following duties: (i) reviewing annually, or more frequently as appropriate, the corporate governance principles and practices set forth in the Guidelines, in comparison to the governance standards identified by leading governance authorities and our evolving needs, and making recommendations to the Board with respect to any appropriate amendment to the Guidelines; (ii) considering and advising the Board with respect to other corporate governance issues; (iii) periodically reviewing our codes of ethics and conduct for directors, officers, and employees; (iv) leading annual evaluations of Board and Board committee performance; (v) assessing periodically our Board’s needs in terms of skills and qualifications and recommending to our Board candidates for nomination and election to our Board; (vi) reviewing Board candidates recommended by our stockholders; (vii) recommending to our Board assignments to committees; and (viii) reviewing and evaluating the Company’s programs, policies, and practices relating to social and environmental issues.

Our Board has determined that each Corporate Governance and Nominating Committee member is independent under NYSE listing standards and the independence standards set forth in the Guidelines. The Corporate Governance and Nominating Committee held four meetings during 2023.

The Corporate Governance and Nominating Committee has a policy with regard to the consideration of director candidates recommended by stockholders. For information regarding this policy, refer to “Stockholder Communications - Stockholder Director Recommendations” below.

Director Independence

Under our Guidelines, our Board must consist of a substantial majority of directors who qualify as independent directors under the listing standards of the NYSE. To be considered independent:

•our Board must affirmatively determine that a director has no material relationship with the Company (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company); and

•a director must not have a disqualifying relationship, as set forth in the NYSE listing standards.

To assist the Board in determining whether a director is independent, our Board has established director independence standards, which are part of our Guidelines available at investors.autonation.com. Under our director independence standards, none of our non-employee directors has a material relationship with the Company that impairs his or her independence, and our Board has affirmatively determined that each person who served as one of our directors since the beginning of the last fiscal year, other than Mr. Manley, was “independent” under our director independence standards and the listing standards of the NYSE.

In addition to our independence standards, the directors who serve on our Audit Committee each satisfy standards established by the SEC providing that to qualify as “independent” for the purposes of membership on that committee, members of audit committees may not:

•accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any of its subsidiaries other than their director compensation, or

•be an affiliated person of the Company or any of its subsidiaries.

In accordance with the listing standards of the NYSE, in affirmatively determining the independence of each director who serves on our Compensation Committee, our Board also considered all factors specifically relevant to determining whether each such director has a relationship to the Company which is material to his or her ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to:

•the source of compensation of each such director, including any consulting, advisory, or other compensatory fee paid by the Company to him or her, and

•whether he or she is affiliated with the Company, a subsidiary of the Company, or an affiliate of a subsidiary of the Company.

Director Selection Process

The Corporate Governance and Nominating Committee is responsible for identifying, evaluating, and recommending candidates to the Board for nomination and election to the Board. The Committee is also responsible for assessing the appropriate balance of skills and characteristics required of our Board members. The Committee considers candidates suggested by its members and other Board members, as well as management and stockholders.

In accordance with the Guidelines, candidates, including candidates recommended by stockholders, are selected on the basis of, among other things, broad experience, financial expertise, wisdom, integrity, ability to make independent analytical inquiries, understanding of our business environment, the candidate’s ownership interest in the Company, and willingness and ability to devote adequate time to Board duties, all in the context of assessing the needs of our Board at that point in time and with the objective of ensuring diversity in the background, experience, and viewpoints of our Board members. The Guidelines provide that the number of directors should permit diversity of experience without hindering effective discussion, diminishing individual accountability, or exceeding a number that can function efficiently as a body.

The Board periodically reviews the size of the Board to determine the size that will be most effective for the Company. In addition, the Board completes an annual self-evaluation, which includes a self-assessment questionnaire for each Board member. The self-assessment questionnaire addresses topics such as the structure of the Board, the skills and backgrounds of the current directors, the size of the Board, and the Board’s committee structure. Each of the Audit, Compensation, and Corporate Governance and Nominating committees also completes an annual self-evaluation, which includes a self-assessment questionnaire tailored specifically for each committee.

Candidates recommended by our stockholders are considered on the same basis as if such candidates were recommended by one of our Board members or other persons. See “Stockholder Communications - Stockholder Director Recommendations” below.

Certain Relationships and Related Party Transactions

Our Board has adopted a written policy which requires that transactions with related parties must be entered into in good faith on fair and reasonable terms that are no less favorable to us than those that would be available in a comparable transaction in arm’s-length dealings with an unrelated third party. Our Board, by a vote of the disinterested directors, must approve all related party transactions valued over $500,000, while our Audit Committee must approve related party transactions valued between $100,000 and $500,000 and review with management all other related party transactions. Under SEC rules, a related party is defined as any director, executive officer, nominee for director, or greater than 5% stockholder of the Company, and their immediate family members. Since the beginning of 2023, the Company has not participated in any related party transaction in which any related party had or will have a direct or indirect material interest.

Board Compensation

Our non-employee director compensation program is designed to ensure alignment with long-term stockholder interests, to ensure we can attract and retain outstanding directors who meet the criteria outlined under “Director Selection Process” above, and to recognize the time commitments necessary to oversee the Company.

For 2023, our non-employee director compensation program remained the same as it was for 2021 and 2022, and it consisted of the following:

•annual Board retainer of $50,000 for each non-employee director;

•annual retainer of $200,000 for the independent Chairman;

•annual committee retainers of $25,000 for the Chair of the Audit Committee and $15,000 for the Chair of each of the Compensation and Corporate Governance and Nominating Committees;

•annual award of restricted stock units based on a fixed dollar value of $250,000 as described further below; and

•expense reimbursement in connection with Board and committee meeting attendance.

On January 3, 2023, each of our non-employee directors received a grant of 2,331 (calculated by dividing $250,000 by the closing price of our common stock on the grant date and rounding down to the nearest whole number) vested restricted stock units (“RSUs”) under the AutoNation, Inc. 2014 Non-Employee Director Equity Plan (as amended, the “2014 Director Plan”), which was approved by our stockholders at our 2014 Annual Meeting of Stockholders. The RSUs will settle in shares of the Company’s common stock on the first trading day of February in the third year following the date of grant, except to the extent a recipient elected to defer settlement of the RSUs beyond such date in accordance with the terms of the award and the 2014 Director Plan. Settlement of the RSUs will be accelerated in certain circumstances as provided in the terms of the award and the 2014 Director Plan, including in the event the recipient ceases to serve as a non-employee director of the Company. If the Company pays a dividend with respect to its common stock, each RSU award will be credited with a number of additional RSUs equal to (i) the aggregate amount or value of the dividends paid with respect to the number of shares subject to the award on the dividend record date divided by (ii) the fair market value per share on the payment date for such dividend. Any such additional RSUs will be subject to the same terms and conditions that apply to the award, including vesting conditions, and the shares subject to such additional RSUs will be distributed only upon the settlement of the underlying shares with respect to which the dividend equivalents were granted.

Our non-employee directors are eligible to defer all or a portion of their annual and committee retainers under the AutoNation, Inc. Deferred Compensation Plan (the “DCP”). We do not provide matching contributions to non-employee directors that participate in the DCP.

Director Compensation

The following table sets forth the compensation earned during 2023 by each non-employee director who served in 2023.

| | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash

($) | Stock Awards

($)(1) | Total

($) |

| Rick L. Burdick | 250,000 | | 249,930 | | 499,930 | |

| David B. Edelson | 75,000 | | 249,930 | | 324,930 | |

| Robert R. Grusky | 50,000 | | 249,930 | | 299,930 | |

| Norman K. Jenkins | 50,000 | | 249,930 | | 299,930 | |

| Lisa Lutoff-Perlo | 50,000 | | 249,930 | | 299,930 | |

| G. Mike Mikan | 65,000 | | 249,930 | | 314,930 | |

| Jacqueline A. Travisano | 65,000 | | 249,930 | | 314,930 | |

(1) The amounts reported in this column reflect the grant date fair value of awards computed in accordance with FASB ASC Topic 718. On January 3, 2023, each person then serving as one of our non-employee directors received a grant of 2,331 vested RSUs under the 2014 Director Plan. The grant date fair value of each RSU granted on January 3, 2023 was $107.22, the closing price per share of our common stock on such date.

Outstanding Equity Awards

The following table sets forth information regarding the number of RSUs and the number of options held, as of December 31, 2023, by each non-employee director who served in 2023:

| | | | | | | | |

| Name | Aggregate Number of RSUs Held as of 12/31/2023 | Aggregate Number of Options Held as of 12/31/2023 |

|

| Rick L. Burdick | 18,068 | | — | |

| David B. Edelson | 9,471 | | — | |

| Robert R. Grusky | 8,194 | | — | |

| Norman K. Jenkins | 8,194 | | — | |

| Lisa Lutoff-Perlo | 8,194 | | — | |

| G. Mike Mikan | 13,304 | | — | |

| Jacqueline A. Travisano | 8,194 | | — | |

AutoNation, Inc. 2024 Non-Employee Director Equity Plan

In the first quarter of 2024, our Board, upon the recommendation of the Compensation Committee, unanimously:

•approved the AutoNation, Inc. 2024 Non-Employee Director Equity Plan (the “2024 Director Plan”), subject to stockholder approval at the Annual Meeting, in order to replace the 2014 Director Plan, which was scheduled to terminate on May 6, 2024, and

•discontinued the 2014 Director Plan, subject to stockholder approval of the 2024 Director Plan at the Annual Meeting, and confirmed that, if the new plan is approved by stockholders at the Annual Meeting, no new awards shall be issued under the 2014 Plan.

The 2024 Director Plan is intended to benefit the Company and its stockholders by enhancing the Company’s ability to attract, retain, and motivate highly qualified non-employee directors and to further align the interests of such directors with those of our stockholders See “Items To Be Voted On - Proposal 5: Approval of AutoNation, Inc. 2024 Non-Employee Director Equity Plan” for more information regarding the 2024 Director Plan.

Director Stock Ownership Guidelines

Under our director stock ownership guidelines, each of our non-employee directors is expected to hold shares of the Company’s common stock having a fair market value of not less than $750,000 by the fifth anniversary of the date of his or her initial appointment to the Board. The following table sets forth information regarding the number of shares (including vested RSUs) held as of February 27, 2024 by our non-employee directors.

| | | | | | | | | | | | |

| Name | Number of

Shares Held | Fair Market Value of Shares Held

($)(1) | Progress Towards

Stock Ownership

Guidelines | |

| Rick L. Burdick | 64,219 | | 9,278,361 | | Achieved | |

| David B. Edelson | 58,793 | | 8,494,413 | | Achieved | |

| Robert R. Grusky | 45,945 | | 6,638,134 | | Achieved | |

| Norman K. Jenkins | 9,853 | | 1,423,561 | | Achieved | |

| Lisa Lutoff-Perlo | 9,853 | | 1,423,561 | | Achieved | |

| G. Mike Mikan | 33,722 | | 4,872,155 | | Achieved | |

| Jacqueline A. Travisano | 6,182 | | 893,175 | | Achieved | |

(1) The fair market value of the shares is based on the closing price of our common stock on February 27, 2024 ($144.48).

Stockholder Communications

Communications with the Company and the Board

Stockholders and interested parties may communicate with the Company through its Investor Relations Department by writing to Investor Relations, AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301. Stockholders and interested parties interested in communicating with our Board, any Board committee, any individual director, or any group of directors (such as our independent directors) should send written correspondence to Board of Directors c/o Corporate Secretary, AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301. Additional information is available on our corporate website at investors.autonation.com.

Stockholder Director Recommendations

The Corporate Governance and Nominating Committee has established a policy pursuant to which it considers director candidates recommended by our stockholders. All director candidates recommended by our stockholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other persons. To recommend a director candidate for consideration by our Corporate Governance and Nominating Committee, a stockholder must submit the recommendation in writing to our Corporate Secretary not later than 120 calendar days prior to the anniversary date of our proxy statement distributed to our stockholders in connection with our previous year’s annual meeting of stockholders, and the recommendation must provide the following information: (i) the name of the stockholder making the recommendation; (ii) the name of the candidate; (iii) the candidate’s resume or a listing of his or her qualifications to be a director; (iv) the proposed candidate’s written consent to being named as a nominee and to serving as one of our directors if elected; and (v) a description of all relationships, arrangements, or understandings, if any, between the proposed candidate and the recommending stockholder and between the proposed candidate and us so that the candidate’s independence may be assessed. The stockholder or the director candidate also must provide any additional information requested by our Corporate Governance and Nominating Committee to assist the Committee in appropriately evaluating the candidate.

Stockholder Proposals and Nominations for the 2025 Annual Meeting

Proposals for Inclusion in our Proxy Materials

Under SEC rules, if a stockholder wishes to submit a proposal for inclusion in our Proxy Statement for the 2025 Annual Meeting of Stockholders, the proposal must be received by our Corporate Secretary not later than November [•], 2024. All proposals must comply with Rule 14a-8 under the Exchange Act.

Nominations for Inclusion in our Proxy Materials (Proxy Access)

Under our proxy access bylaw, a stockholder (or a group of up to 20 stockholders) owning three percent or more of our common stock continuously for at least three years may nominate and include in our proxy statement candidates for up to 20% of our Board (rounded down, but not less than two). Nominations must comply with the requirements and conditions of our proxy access bylaw, including delivering proper notice to us not earlier than October [•], 2024 nor later than November [•], 2024. Detailed information for submitting proxy access nominations will be provided upon written request to the Corporate Secretary of AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301.

Other Proposals and Nominations

Any stockholder who wishes to make a nomination or introduce an item of business, other than as described above, must comply with the procedures set forth in our by-laws, including delivering proper notice to us not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s Annual Meeting, which means not earlier than December [•], 2024 nor later than January [•], 2025.

A person who intends to solicit proxies in support of director nominees other than the Company’s nominees must satisfy the requirements under our by-laws, including by providing the notice to the Company that sets forth the information required by Rule 14a-19(b) under the Exchange Act.

Detailed information for submitting stockholder proposals or nominations, other than for inclusion in our proxy statement, will be provided upon written request to the Corporate Secretary of AutoNation, Inc., 200 SW 1st Ave, Fort Lauderdale, Florida 33301.

STOCK OWNERSHIP

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information as of February 27, 2024 regarding beneficial owners of more than five percent of the outstanding shares of our common stock.

| | | | | | | | |

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of

Class(1) |

William H. Gates III One Microsoft Way, Redmond, WA 98052 | 9,871,303 | (2) | 23.7 | % |

ESL Investments, Inc. and related entities(3) 1170 Kane Concourse, Suite 200, Bay Harbor, FL 33154 | 4,434,270 | (4) | 10.6 | % |

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | 3,585,551 | (5) | 8.6 | % |

| | |

BlackRock, Inc. 50 Hudson Yards, New York, NY 10001 | 2,931,619 | (6) | 7.0 | % |

| | |

(1) Based on 41,684,578 shares outstanding at February 27, 2024.

(2) Based on a Schedule 13D/A filed with the SEC on February 13, 2024, all shares held by Cascade Investment, L.L.C. (“Cascade”) may be deemed to be beneficially owned by William H. Gates III as the sole member of Cascade. Cascade and Mr. Gates have sole voting and dispositive power with respect to 9,871,303 shares. The address of Cascade is 2365 Carillon Point, Kirkland, WA 98033.

(3) Includes ESL Partners, L.P. (“ESL”), RBS Partners, L.P. (“RBS”), ESL Investments, Inc. (“Investments”), The Lampert Foundation (the “Foundation”), and Edward S. Lampert. ESL, RBS, Investments, the Foundation, and Mr. Lampert are collectively referred to as the “ESL Entities.” RBS is the general partner of, and may be deemed to indirectly beneficially own securities owned by, ESL. Investments is the general partner of, and may be deemed to indirectly beneficially own securities owned by, RBS. Mr. Lampert is the Chairman, Chief Executive Officer and Director of, and may be deemed to indirectly beneficially own securities owned by, Investments. Mr. Lampert and his wife Kinga Keh Lampert are co-trustees of, and may be deemed to indirectly beneficially own securities owned by, the Foundation.

(4) Based on a Schedule 13D/A filed with the SEC on January 12, 2024 and a Form 4 filed on February 12, 2024, the total number of AutoNation shares beneficially owned by the ESL Entities consists of 4,408 shares held or controlled by ESL, 162,002 shares held by the Foundation, 4,264,562 shares held by Mr. Lampert, 1,649 shares held by The Nicholas Floyd Lampert 2015 Trust, and 1,649 shares held by The Nina Rose Lampert 2015 Trust. Each of ESL, RBS, and Investments has sole voting and dispositive power with respect to 4,408 shares; the Foundation has sole voting and dispositive power with respect to 162,002 shares; and Mr. Lampert has sole voting and dispositive power with respect to 4,434,270 shares.

(5) Based on a Schedule 13G/A filed with the SEC on February 13, 2024, The Vanguard Group has sole voting power with respect to zero shares, shared voting power with respect to 10,460 shares, sole dispositive power with respect to 3,545,332 shares, and shared dispositive power with respect to 40,219 shares.

(6) Based on a Schedule 13G/A filed with the SEC on January 26, 2024, BlackRock, Inc. has sole voting power with respect to 2,738,493 shares and sole dispositive power with respect to 2,931,619 shares.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information as of February 27, 2024 regarding the amount of our common stock beneficially owned by (1) each of our directors, (2) each of our 2023 named executive officers, and (3) our directors and executive officers as a group. Beneficial ownership includes (1) shares that may be acquired within 60 days of February 27, 2024 through the exercise of outstanding stock options and (2) vested restricted stock units held by our non-employee directors. Unless otherwise indicated and subject to applicable community property laws, each person listed in the table has sole voting and investment power with respect to the securities listed.

| | | | | | | | | | | | | | |

| Name of Beneficial Owner | Number of Shares of Common

Stock Owned | Number of Shares

Acquirable

Within 60 days | Shares of Common Stock

Beneficially Owned |

| Number | Percent(1) |

| Rick L. Burdick | 44,492 | | 19,727 | (2) | 64,219 | | * |

| David B. Edelson | 51,334 | | 7,459 | (2) | 58,793 | | * |

| Robert R. Grusky | 36,092 | | 9,853 | (2) | 45,945 | | * |

| Norman K. Jenkins | — | | 9,853 | (2) | 9,853 | | * |

| Lisa Lutoff-Perlo | 3,671 | | 6,182 | (2) | 9,853 | | * |

| G. Mike Mikan | 23,869 | (3) | 9,853 | (2) | 33,722 | | * |

| Jacqueline A. Travisano | — | | 6,182 | (2) | 6,182 | | * |

| Michael Manley | 33,255 | | — | | 33,255 | | * |

| Thomas A. Szlosek | 1,421 | | — | | 1,421 | | * |

| Gianluca Camplone | 4,610 | | — | | 4,610 | | * |

| C. Coleman Edmunds | 17,021 | | — | | 17,021 | | * |

| Dave Koehler | 5,545 | | — | | 5,545 | | * |

| Marc Cannon | — | | — | | — | | * |

| Joseph T. Lower | — | | — | | — | | * |

| | | | |

| | | | |

| All current directors and executive officers as a group (14 persons) | 221,310 | | 69,109 | | 290,419 | | * |

* Less than 1%.

(1) Based on 41,684,578 shares outstanding at February 27, 2024.

(2) Represents vested restricted stock units.

(3) Includes 14,259 shares held by a trust for the benefit of Mr. Mikan’s family, of which Mr. Mikan is the trustee.

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT

The following statement made by our Compensation Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate such statement by reference.

The Compensation Committee of the Company has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and, based on such review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Compensation Committee:

G. Mike Mikan, Chair

Rick L. Burdick

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis provides a detailed description of our executive compensation philosophy and programs, the compensation decisions the Compensation Committee (referred to as the “Committee” in this section) of the Board has made under those programs with respect to the “named executive officers” listed below, and the factors considered in making those decisions.

Executive Officer Transitions. On August 7, 2023, Thomas Szlosek joined the Company as Executive Vice President and Chief Financial Officer, and Joseph T. Lower, our former Chief Financial Officer, transitioned to a new role overseeing business transformation initiatives for the Company. Marc Cannon, our former Executive Vice President and Chief Customer Experience Officer, retired from the Company on December 31, 2023, and he was not serving as an executive officer as of such date.

Named Executive Officers. Our “named executive officers” for 2023 are as follows:

| | | | | | | | |

| Michael Manley | Chief Executive Officer and Director | | | |

| Thomas A. Szlosek | Executive Vice President and Chief Financial Officer | | | |

| Gianluca Camplone | Chief Operating Officer, Precision Parts Business, and Executive Vice President, Head of Mobility, Business Strategy, and Development | | | |

| C. Coleman Edmunds | Executive Vice President, General Counsel and Corporate Secretary | | | |

| Dave Koehler | Chief Operating Officer, Non-Franchised Business | | | |

| Marc Cannon | Former Executive Vice President and Chief Customer Experience Officer | | | |

| Joseph T. Lower | Former Executive Vice President and Chief Financial Officer | | | |

| | | | |

| | | | |

| | | | |

2023 Financial Highlights

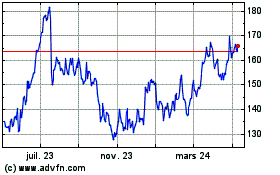

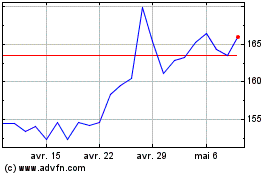

In 2023, our total stockholder return was 40.0%, compared to 24.2% for the S&P 500. Our revenue was relatively flat, and our adjusted earnings per share decreased 6%, in 2023 as compared to 2022, driven primarily by moderation in new vehicle margins resulting from increasing supply and availability of new vehicle inventory, as well as an increase in SG&A expenses, due to acquisitions and investments in technology and strategic initiatives, and an increase in borrowing costs, due to higher interest rates and higher inventory levels. Our results of operations in 2023 benefited from a significant increase in same store parts and service gross profit, resulting from double-digit year-over-year increases in gross profit from customer-pay service, the preparation of vehicles for sale, and warranty service. Please refer to our Annual Report on Form 10-K for the year ended December 31, 2023, for additional information regarding our financial results and see Annex A for a reconciliation of non-GAAP financial measures to our results as reported under GAAP.

Compensation Philosophy and Objectives

Our executive compensation programs are administered by the Committee. The Committee’s fundamental philosophy is to closely link executive compensation with the achievement of performance goals tied to key metrics and to create an owner-oriented culture through our executive compensation programs. The objectives of our executive compensation program are to ensure that we are able to attract and retain highly skilled executives and to provide a compensation program that incentivizes management to optimize business performance, deploy capital productively, and increase long-term stockholder value.

The Committee believes that total compensation for each of our executive officers should be fair for the services rendered and competitive with market practice. In addition, the Committee designs our executive compensation program to be transparent and easily understood and administered, which is why the key components of executive compensation are limited to a base salary, an annual cash incentive award based on the achievement of a predetermined performance goal, and long-term incentive awards in the form of time-based and performance-based equity awards. The Committee strives to ensure executive compensation aligns management with the Company’s annual and long-term plans, business strategy, and stockholder interests.

Setting Compensation Levels of Executive Officers

The Committee reviews executive compensation at its meetings throughout the year and sets executive compensation based primarily on our financial and operating performance and on executive management’s performance in executing the Company’s business strategy, optimizing the Company’s business performance and productivity of its business operations, deploying capital productively, and increasing long-term stockholder value. The Committee also considers the scope of each executive’s experience, duties and responsibilities, individual performance, and total compensation, as well as compensation market data derived from our peer group. Our Chief Executive Officer reviews the performance of other named executive officers and makes recommendations, if any, to the Committee with respect to compensation adjustments for such officers. However, the Committee determines in its sole discretion whether to make any adjustments to the compensation paid to such executive officers.

For 2023, as in prior years, a significant portion of the total compensation for each named executive officer was allocated to compensation in the form of an annual performance-based cash incentive award and performance-based equity awards in order to provide incentives to enhance long-term stockholder value.

The Role of the Compensation Consultant. Since 2019, the Committee has engaged a compensation consultant, Meridian Compensation Partners, LLC, an independent compensation consulting firm, to provide research and analysis and to make recommendations as to the form and level of executive compensation. The Committee sought input from Meridian on executive compensation matters for 2023, including the design and competitive positioning of our executive compensation program, our peer group, appropriate compensation levels, and evolving compensation trends. See “Board of Directors and Corporate Governance - Board Committees - Compensation Committee” above for more information regarding the Committee’s engagement of Meridian.