Form 8-K - Current report

11 Décembre 2023 - 10:18PM

Edgar (US Regulatory)

0001517302false00015173022023-12-112023-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2023

Artisan Partners Asset Management Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-35826 | 45-0969585 |

(State or other jurisdiction of

incorporation or organization) | (Commission file number) | (I.R.S. Employer

Identification No.) |

| | | | | |

875 E. Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

| | | | | | | | |

| (Address of principal executive offices and zip code) | |

(414) 390-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | | APAM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On December 11, 2023, Artisan Partners Asset Management Inc. (the “Company”) issued a press release reporting certain information about the Company’s preliminary assets under management as of November 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 8.01, including the exhibit incorporated herein by reference, shall be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, and shall be deemed incorporated by reference in the Company’s filings under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Artisan Partners Asset Management Inc.

Date: December 11, 2023

| | | | | | | | |

| By: | | /s/ Charles J. Daley, Jr. |

| Name: | | Charles J. Daley, Jr. |

| Title: | | Executive Vice President, Chief Financial Officer and Treasurer |

Artisan Partners Asset Management Inc. Reports November 2023 Assets Under Management

Milwaukee, WI - December 11, 2023 - Artisan Partners Asset Management Inc. (NYSE: APAM) today reported that its preliminary assets under management ("AUM") as of November 30, 2023 totaled $143.1 billion. Artisan Funds and Artisan Global Funds accounted for $69.4 billion of total firm AUM, while separate accounts and other AUM1 accounted for $73.7 billion. In November, certain Artisan Funds made their annual income and capital gains distributions. November month-end AUM includes the impact of approximately $350 million of Artisan Funds distributions not reinvested.

| | | | | | | | |

PRELIMINARY ASSETS UNDER MANAGEMENT BY STRATEGY2 | | |

| | |

As of November 30, 2023 - ($ Millions) | | |

| Growth Team | | |

| Global Opportunities | $ | 20,073 | | |

| Global Discovery | 1,371 | | |

| U.S. Mid-Cap Growth | 11,900 | | |

| U.S. Small-Cap Growth | 2,968 | | |

| Global Equity Team | | |

| Global Equity | 354 | | |

| Non-U.S. Growth | 12,814 | | |

| Non-U.S. Small-Mid Growth | 6,631 | | |

| China Post-Venture | 161 | | |

| U.S. Value Team | | |

| Value Equity | 4,007 | | |

| U.S. Mid-Cap Value | 2,694 | | |

| Value Income | 12 | | |

| International Value Team | | |

| International Value | 38,972 | | |

| International Explorer | 211 | | |

| Global Value Team | | |

| Global Value | 24,085 | | |

| Select Equity | 317 | | |

| Sustainable Emerging Markets Team | | |

| Sustainable Emerging Markets | 882 | | |

| Credit Team | | |

| High Income | 8,808 | | |

| Credit Opportunities | 207 | | |

| Floating Rate | 57 | | |

| Developing World Team | | |

| Developing World | 3,355 | | |

Antero Peak Group | | |

| Antero Peak | 1,947 | | |

| Antero Peak Hedge | 431 | | |

| EMsights Capital Group | | |

| Global Unconstrained | 305 | | |

| Emerging Markets Debt Opportunities | 86 | | |

| Emerging Markets Local Opportunities | 435 | | |

| | |

| Total Firm Assets Under Management ("AUM") | $ | 143,083 | | |

1 Separate account and other AUM consists of the assets we manage in or through vehicles other than Artisan Funds or Artisan Global Funds. Separate account and other AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts, and in our own private funds.

2 AUM for certain strategies include the following amounts for which Artisan Partners provides investment models to managed account sponsors (reported on a one-month lag): Artisan Sustainable Emerging Markets $75 million.

ABOUT ARTISAN PARTNERS

Artisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Artisan Partners' autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates.

Investor Relations Inquiries: 866.632.1770 or ir@artisanpartners.com

Source: Artisan Partners Asset Management Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

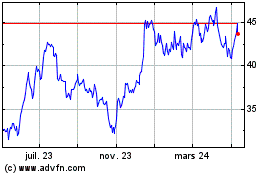

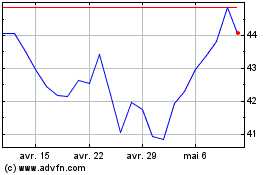

Artisan Partners Asset M... (NYSE:APAM)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Artisan Partners Asset M... (NYSE:APAM)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024