0001517302false00015173022024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

Artisan Partners Asset Management Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35826 | 45-0969585 |

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. Employer Identification No.) |

875 E. Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices and zip code)

(414) 390-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

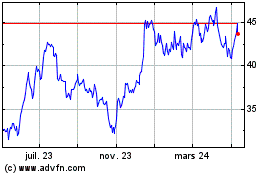

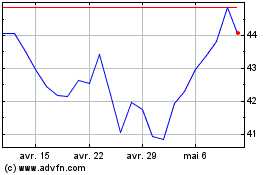

| Class A common stock, par value $0.01 per share | APAM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 30, 2024, Artisan Partners Asset Management Inc. (the “Company”) issued a press release announcing the availability of certain consolidated financial and operating results for the three months and year ended December 31, 2023. Copies of the press release and the full earnings release are attached hereto as Exhibit 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished in this Item 2.02, including the exhibits incorporated herein by reference, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 25, 2024, the compensation committee of the board of directors of the Company approved forms of two award agreements for the grant of restricted shares of Class A common stock to the Company’s named executive officers under the Company’s 2023 Omnibus Incentive Compensation Plan.

Restricted shares awarded pursuant to the Restricted Share Award Agreement will vest in annual installments, subject to the recipient’s continued employment with the Company. Restricted shares awarded pursuant to the Career Share Award Agreement (the “Career Shares”), will vest upon the satisfaction of both: (1) qualifying retirement (as defined in the agreement) and, unless certain age and service requirements have been met, (2) pro-rata annual time vesting. Under both agreements, vesting will accelerate upon the recipient’s death or disability and, under certain circumstances, after a change in control of the Company. Pursuant to the Restricted Share Award Agreement, vesting will accelerate in connection with an eligible retirement. In addition, under the Career Share Award Agreement, after the fifth anniversary of the grant date, if the Company terminates a recipient without cause (as defined in the award agreement), Career Shares will vest, provided that the recipient has met certain service requirements.

Both forms of agreement contain negative covenants prohibiting the named executive officer from competing with the Company or soliciting clients or employees of the Company, in each case for one year after termination of employment. Restricted shares awarded pursuant to the agreements will entitle the recipient to all rights of a shareholder of the Company, including voting rights and rights to dividends. The restricted shares will be subject to the Company's stockholders agreement pursuant to which a three-person stockholders committee will vote the shares. The Company intends to use these and other similar agreements for awards to certain other employees, in addition to named executive officers. The foregoing summary does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the agreement forms, which are filed as Exhibit 10.1 and Exhibit 10.2 to this Form 8-K and are incorporated by reference into this Item 5.02.

Item 9.01 Financial Statements and Exhibits | | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| 99.1 | | |

| 99.2 | | |

| 10.1 | | |

| 10.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Artisan Partners Asset Management Inc.

Date: January 30, 2024

| | | | | | | | |

| By: | | /s/ Charles J. Daley, Jr. |

| Name: | | Charles J. Daley, Jr. |

| Title: | | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 10.1

ARTISAN PARTNERS ASSET MANAGEMENT INC.

2023 OMNIBUS INCENTIVE COMPENSATION PLAN

Restricted Share Award Certificate

Artisan Partners Asset Management Inc. (“Artisan”), pursuant to the Artisan Partners Asset Management Inc. 2023 Omnibus Incentive Compensation Plan (as amended from time to time, the “Plan”), has awarded restricted shares of Artisan’s Class A common stock (“Restricted Shares”) to Grantee as set forth below in consideration of Grantee’s service as an employee of Artisan or any of its subsidiaries..

| | | | | | | | |

| Grantee: | | [ ] |

| Grant Date: | | [ ] |

| Number of Restricted Shares: | | [ ] |

| Vesting Schedule: | | 20% of the Restricted Shares will vest on February 15 of each of [ ], [ ], [ ], [ ] and [ ]. There is no proportionate or partial vesting in the period prior to a vesting date. |

| | |

This award is subject to all of the terms, conditions and restrictions set forth in Grantee’s Restricted Share Award Agreement (including any schedules and appendices thereto) dated [ ], as may be amended from time to time in accordance with the provisions of the Plan (the “Award Agreement”) and the Plan, each of which has been provided to Grantee and is incorporated herein by reference.

Grantee acknowledges receipt of copies of the Award Agreement and the Plan, has read and understands the terms and provisions thereof, has had the opportunity to consult with his or her legal, tax and financial advisors, and accepts this award subject to all of the terms and conditions of the Award Agreement and the Plan.

Artisan may, in its sole discretion, deliver this Restricted Share Award Certificate, the Award Agreement, the Plan or any other documents related to this award, by electronic means and request Grantee’s acceptance of this award and the terms of the Award Agreement by electronic means. Grantee hereby consents to receive such documents by electronic delivery, including by accessing such documents on a website, and agrees to accept this award and the terms of the Award Agreement through any on-line or electronic system utilized by Artisan for this purpose.

Grantee may take up to 30 days to accept this award.

| | | | | | | | | | | |

Artisan Partners Asset Management Inc.

| | Grantee |

| By: | [ ] | | [ ] |

| Title: | [ ] | | |

ARTISAN PARTNERS ASSET MANAGEMENT INC.

2023 OMNIBUS INCENTIVE COMPENSATION PLAN

RESTRICTED SHARE AWARD AGREEMENT

This Restricted Share Award Agreement (this “Award Agreement”) between [ ] (the “Grantee”) and Artisan Partners Asset Management Inc. (“Artisan” or “the Company”) is effective [ ].

1.The Plan. Awards of restricted shares of Class A common stock (“Restricted Shares”) are made pursuant to the Artisan Partners Asset Management Inc. 2023 Omnibus Incentive Compensation Plan (as amended, from time to time, the “Plan”). Capitalized terms used but not defined in this Award Agreement have the meanings as used or defined in the Plan.

2.Forfeiture. Subject to Section 3 and the terms of any employment, severance or similar agreement between Grantee and the Company, if Grantee’s Employment with the Company terminates for any reason prior to a vesting date, any then unvested Restricted Shares shall be automatically forfeited and the Company shall have no further obligations to Grantee or Grantee’s legal representative under this Award Agreement.

3.Acceleration.

a.Change in Control: Upon a Change in Control, any outstanding Restricted Shares will immediately vest in full, provided that if Grantee is a named executive officer of Artisan those outstanding Restricted Shares will be treated in accordance with the terms of the Plan.

b.Death or Disability: Upon termination of Grantee’s employment with the Company by reason of death or Disability, the Restricted Shares will vest in full as of the date of such termination. For purposes of this Award Agreement, “Disability” means Grantee’s inability to perform the essential functions of Grantee’s position, with or without reasonable accommodation, for a period aggregating 180 days within any continuous period of 365 days by reason of physical or mental incapacity.

c.Traditional Retirement: If at any time during Grantee’s Employment, Grantee has received any award that is a Career Vesting Award (as defined within the award agreement governing the terms of such award (a “Career Vesting Agreement”)), then if Grantee satisfies the requirements for vesting of such Career Vesting Award as described in the Career Vesting Agreement, and Grantee has also attained a combination of years of service with the Company plus age of at least 70 as of the date of retirement, then on Grantee’s retirement date, any unvested portion of the Restricted Shares awarded pursuant to this Award Agreement will vest in full.

4.Issuance and Delivery. Artisan may issue stock certificates or evidence Grantee’s interest in Restricted Shares by using a book entry account with Artisan’s transfer agent. Upon the vesting of Restricted Shares, Artisan will cause to be delivered to Grantee shares of Common Stock free from risk of forfeiture (but still bearing and/or subject to any other legends that may be required by Artisan).

5.Non-Transferability. Prior to vesting, Restricted Shares may not be sold, transferred, assigned, pledged, hedged or otherwise disposed of in any manner other than by will or by the laws of descent and distribution, and any attempt to sell, transfer, assign, pledge, hedge or otherwise dispose of the Restricted Shares in violation of this Award Agreement shall be void and of no effect.

6.Privileges of Share Ownership. Subject to Sections 4 and 5, effective upon the applicable Grant Date, Grantee shall have all rights of a shareholder of Artisan with respect to the Restricted Shares granted on that Grant Date, including voting rights and rights to dividends. For the avoidance of doubt, Grantee shall have no rights with respect to any forfeited shares. Notwithstanding the foregoing, the Restricted Shares are subject to the Stockholders Agreement, dated as of March 12, 2013 (the “Stockholders Agreement”), including the irrevocable voting proxy included therein. If Grantee is not already a party to the Stockholders Agreement, then, as a condition to Grantee’s receipt of Restricted Shares, Grantee shall execute a joinder to the Stockholders Agreement in form and substance satisfactory to Artisan.

7.Restrictive Covenants. Grantee’s agreement to and full compliance with the Restrictive Covenants set forth in Appendix A to this Award Agreement are a condition of Grantee’s eligibility to participate in the Plan and entitlement to any award that might otherwise vest or be payable to Grantee. For avoidance of doubt, the obligations in the Restrictive Covenants are material terms of this Award Agreement. Additionally, if the non-compete in Section 2 of Appendix A (the “Non-compete Restriction”) applies to Grantee, Grantee agrees that any award granted hereunder serves as consideration for the Non-compete Restriction. Grantee further understands and agrees that Grantee would not have received any award hereunder, without Grantee’s agreement to Appendix A.

8.Section 83(b) Election. Grantee hereby acknowledges that Grantee has been informed that, with respect to the grant of Restricted Shares, if Grantee is filing a U.S. federal income tax return for the year in which the grant of Restricted Shares occurs, Grantee may file an election (the “Election”) with the United States Internal Revenue Service, within 30 days of the grant, electing pursuant to Section 83(b) of the Code to be taxed currently on the Fair Market Value of the Restricted Shares on the Grant Date. This will result in recognition of taxable income to Grantee on the Grant Date, equal to the Fair Market Value of the Restricted Shares on such date. Absent an Election, taxable income will be measured and recognized by Grantee at the time the Restricted Shares vest. Grantee is hereby encouraged to seek the advice of Grantee’s own tax consultants in connection with the advisability of filing the Election. GRANTEE UNDERSTANDS THAT ANY TAXES PAID AS A RESULT OF THE FILING OF THE ELECTION GENERALLY WILL NOT BE RECOVERED IF THE RESTRICTED SHARES ARE FORFEITED TO ARTISAN. GRANTEE ACKNOWLEDGES THAT IT IS GRANTEE’S SOLE RESPONSIBILITY AND NOT ARTISAN’S TO TIMELY FILE THE ELECTION, EVEN IF GRANTEE REQUESTS ARTISAN OR ITS REPRESENTATIVE TO MAKE THIS FILING ON GRANTEE’S BEHALF. GRANTEE MUST NOTIFY ARTISAN WITHIN 10 BUSINESS DAYS OF FILING ANY ELECTION

9.Tax Withholding. In connection with vesting or an Election, Grantee will pay, or otherwise provide for to the satisfaction of the Company, any applicable federal, state and local tax and social security withholding obligations of the Company. At its sole discretion, in connection with vesting, Artisan may provide and/or require for payment by Grantee of withholding taxes through either (i) cash payment or (ii) remitting to Artisan shares of Common Stock with a fair market value (determined as of the date of vesting), in either case in an amount equal to the statutory minimum amount of taxes required to be withheld. In the latter case, without any further action by Grantee, Artisan will cause its transfer agent to deduct the shares of Common Stock to be remitted from the shares of Common Stock held of record by the Grantee (“Net Share Settle”). If Grantee shall fail to make such payment or otherwise satisfy such obligations, the Company shall, to the extent permitted by law, have the right (but not the obligation) to withhold delivery of vesting shares and/or deduct from any payment of any kind otherwise due to Grantee any federal, state or local tax and social security withholding obligations with respect to the Restricted Shares. Notwithstanding the foregoing, if at the time of vesting Grantee is a named executive officer of Artisan for whom the Company has withholding obligations, Grantee will be required to Net Share Settle, unless another method is specifically approved by the Compensation Committee of the Board of Directors of Artisan.

10.Compliance with Securities Laws. The issuance and delivery of Restricted Shares shall be subject to compliance by Artisan and Grantee with all applicable requirements under federal and state securities laws and with all applicable rules of the New York Stock Exchange. Restricted Shares will not be issued or delivered unless and until any then applicable requirements of federal and state laws and regulatory agencies have been fully complied with to the satisfaction of Artisan.

11.Entire Agreement. This Award Agreement, together with any restricted share award certificates, and the Plan constitute the entire agreement and understanding of the parties with respect to any award granted hereunder and supersede all prior understandings and agreements (whether written or oral) between the Company and Grantee with respect to such award.

12.Notices. Any notice required to be given to Artisan under the terms of this Award Agreement will be in writing or email and be delivered to Artisan’s Chief Legal Officer. Any notice required to be given to Grantee will be in writing or email and delivered to the address or addresses last maintained in the Company’s records.

13.Binding Effect. Any action taken or decision made in good faith by the Compensation Committee of the Board of Directors of Artisan in connection with the construction, administration or interpretation of this Award Agreement will lie within its sole and absolute discretion and will be final, conclusive and binding on Grantee and all persons claiming under or through Grantee.

14.Choice of Forum. As a condition to Grantee’s receipt of the Restricted Shares, Grantee hereby irrevocably submits to the exclusive jurisdiction of any state or federal court located in Delaware over any suit, action or proceeding arising out of or relating to the Plan or this Award Agreement, including Appendix A governing Restrictive Covenants.

15.Governing Law. This Award Agreement, including Appendix A governing Restrictive Covenants, will be governed by and construed in accordance with the laws of the State of Delaware without regard to its principles of conflict of laws.

16.Electronic Delivery and Signature. Artisan may, in its sole discretion, deliver this Award Agreement, the Plan and any other documents related to the Restricted Shares by electronic means and request Grantee’s agreement to the terms thereof by electronic means. Grantee hereby consents to receive such documents by electronic delivery, including by accessing such documents on a website, and agrees to accept the terms of the Award Agreement through any on-line or electronic system utilized by Artisan for this purpose.

| | | | | | | | | | | | | | | | | |

Artisan Partners Asset Management Inc.

| | Grantee |

| [ ] | | [ ] | |

[ ] | | | |

Appendix A: Restrictive Covenants

1.Definitions. For purposes of this Appendix A:

“Artisan Client” means each of the following:

a.Any client of the Artisan Group (i) for which Grantee provided services (such as investment management or relationship management services) on behalf of the Artisan Group during the 12 months preceding Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, in person, phone, or electronic communication) during the 12 months preceding the Grantee’s last date of Employment.

b.Any investor in a mutual fund, UCITS fund, private fund or other pooled investment vehicle advised, promoted, or sponsored by the Artisan Group (each, an “Artisan Pooled Vehicle”) (i) for which investor the Grantee provided services (such as investment management services to the relevant Artisan Pooled Vehicle or relationship management services) on behalf of the Artisan Group during the 12 months preceding Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, in person, phone, or electronic communication) during the 12 months preceding the Grantee’s last date of Employment.

c.Any employee, partner or director of a financial intermediary, financial adviser or planner, consultant or broker-dealer (each, a “Client Intermediary”) (i) to whom the Grantee provided services (such as investment management or relationship management services) on behalf of the Artisan Group during the 12 months preceding the Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, phone or email contact) during the 12 months preceding the Grantee’s last date of Employment.

“Artisan Group” means Artisan Partners Asset Management Inc. and each of its subsidiaries and affiliates (including, for the avoidance of doubt, Artisan Partners Limited Partnership).

“Artisan Prospective Client” means any person or entity for which the Artisan Group made a proposal to perform services in which the Grantee participated by means of substantive personal contact with the person or entity or the agents of the person or entity during the 12 months preceding the Grantee’s last date of Employment. For the avoidance of doubt, “Artisan Prospective Client” shall include a person or entity with respect to which this definition otherwise applies, including but not limited to financial intermediaries, financial advisers or planners, consultants, and broker dealers, notwithstanding that the services that were proposed to be provided would have been provided indirectly through such person’s or entity’s investment in an Artisan Pooled Vehicle.

“Competitive Enterprise” means any business enterprise that either (i) engages in any activity that competes with any then-current activity of the Artisan Group, including, without limitation, investment management services, or (ii) holds a 10% or greater equity, voting or profit participation interest in any enterprise that engages in such a competitive activity.

“Portfolio Manager" means an individual who has the authority to exercise investment discretion over one or more client accounts and is therefore identified as a portfolio manager in Artisan’s Form ADV.

“Restricted Period” means the period during which Grantee is Employed and for a period of one year immediately following termination of Grantee’s Employment for any reason.

“Restricted Person” means an individual who, at the time of the solicitation was an employee of the Artisan Group and: (i) was an executive officer, portfolio manager (including associate or co-portfolio manager), or managing director of the Artisan Group (a “top-level employee”), had special skills or knowledge important to the Artisan Group, or had skills that are difficult for the Artisan Group to replace, and (ii) with whom Grantee had a working relationship or about whom Grantee acquired or possessed specialized knowledge,

in each case, in connection with Grantee’s Employment and during the 18 months prior to the termination of Grantee’s Employment.

“Restricted Services” means any job function that Grantee was engaged in on behalf of the Artisan Group at any time during the 12 months preceding Grantee’s last date of Employment.

“Territory” means the United States and any other country where Grantee provided services or had a material impact, presence, or influence on behalf of the Artisan Group. Grantee acknowledges that, by virtue of Grantee’s position, duties, level, and access to the Artisan Group’s trade secrets and other confidential information, Grantee provides services to and has a material impact, presence, and influence in any country worldwide in which the Artisan Group has an office, has a client or otherwise does business.

All capitalized terms used but not defined in this Appendix A will have the meanings ascribed thereto in the Award Agreement.

2.Non-Competition. If during any portion of Grantee’s Employment with the Artisan Group Grantee is or was an Executive Officer, Portfolio Manager, or identified as a founding member of an Artisan investment team, then the terms and conditions of this Section 2 shall apply. Based on Grantee’s position, duties, level, and access to the Artisan Group’s trade secrets and other confidential information, as a necessary measure to protect the trade secrets and other confidential information of the Artisan Group, as well as Artisan’s goodwill with its clients, and in consideration of the award (as described in the Award Agreement), Grantee agrees that during the Restricted Period he or she will not, directly or indirectly, (i) hold an equity, voting or profit participation interest in a Competitive Enterprise (other than a 10% or less interest in a public or private entity which is only held for passive investment purposes); (ii) provide Restricted Services anywhere in the Territory to a Competitive Enterprise; or (iii) manage or supervise personnel engaged in providing Restricted Services anywhere in the Territory on behalf of a Competitive Enterprise. As it relates to the practice of law, the terms of this Section 2 and the terms of any other similar provision agreed to by the parties hereto shall be binding and effective upon Grantee only to the extent permissible under the Rules of Professional Conduct or any other professional or ethical rules governing the practice of law that Grantee may be subject to. Further, the prohibitions in this Section 2 shall not apply to Grantee’s management, without compensation, of the investments of Grantee or investments of members of Grantee’s family or investments of a trust or similar vehicle for the benefit of Grantee or members of Grantee’s family.

3.Non-Solicitation of Clients and Prospective Clients. Grantee agrees that during the Restricted Period, Grantee will not directly or indirectly induce or attempt to induce any Artisan Client or Artisan Prospective Client, (i) to use the investment management services of any person or entity, (ii) to cease using the investment management services of the Artisan Group (including any Artisan Pooled Vehicle); and/or (iii) for purposes of offering Restricted Services. The prohibitions in this Section 3 shall not apply to (x) Grantee’s management, without compensation, of the investments of the Grantee or members of the Grantee’s family or a trust or similar vehicle for the benefit of any of the foregoing, or (y) the provision of services by Grantee to a business enterprise solely because such business enterprise engages in general advertising and solicitation efforts that may or do reach an Artisan Client.

4.Non-Solicitation of Restricted Persons. Grantee agrees that during the Restricted Period, Grantee will not: (i) directly or indirectly solicit or attempt to solicit any Restricted Person to terminate employment for the purpose of engaging in, or starting a business which engages in, a Competitive Enterprise; and/or (ii) hire, employ or otherwise use the professional services of a Restricted Person.

The parties agree that, if during the Restricted Period, the Grantee and one or more persons who at any time within the period of 18 months prior to the end of the Grantee’s Employment was a Portfolio Manager (including associate or co-portfolio manager), become employed by either the same employer or an affiliate thereof, or otherwise become affiliated as partners, contractors or other professional service providers with an entity together with its affiliates, to provide Restricted Services for the benefit of a Competitive Enterprise or any affiliate of a Competitive Enterprise, it shall give rise to a conclusive presumption that it resulted from an impermissible solicitation, and therefore it shall be a deemed violation of this Section 4.

5.Exclusions in Certain States. Sections 2, 3, and 4 of this Appendix A shall not apply if and for as long as Grantee lives in California, unless Grantee moves to California to avoid such obligations. Section 2 of this Appendix A shall not apply if and for as long as Grantee primarily resides and works in Minnesota, North Dakota, and Oklahoma.

6.Included Actions. The parties agree that Grantee shall be deemed to have taken any action prohibited by this Appendix A (and therefore to be in violation of this Appendix A) if Grantee takes such action directly or indirectly, or if it is taken by any person or entity with whom Grantee is associated as an employee, independent contractor, consultant, agent, partner, member, proprietor, owner, stockholder, officer, director, or trustee, or by any entity directly or indirectly controlled by, controlling or under common control with Grantee.

7.Injunctive Relief; Enforceability of Restrictive Covenants. Grantee acknowledges that irreparable injury may result to the Artisan Group if Grantee breaches the provisions of this Appendix A and agrees that the Artisan Group will be entitled, in addition to all other legal remedies available to the Artisan Group, to an injunction or other equitable relief by any court of competent jurisdiction to prevent or restrain any breach of this Appendix A. The parties hereto acknowledge that the restrictions on Grantee imposed by this Appendix A are reasonable in duration, geographic scope, and in all other respects for the protection of the Artisan Group, and its business, goodwill, trade secrets and other confidential information, and Artisan’s other protectable rights. Grantee acknowledges that the restrictions imposed in this Appendix A will not prevent Grantee from earning a living in the event of, and after, the end of Grantee’s Employment.

8.Enforceability/Severability/Modification. The parties agree that, if any provisions of this Appendix A are determined by a court of competent jurisdiction to be unenforceable unless modified, the Court should modify such provisions to the least extent necessary to make such provisions (and this Appendix A) enforceable so as to carry out the intent of the parties as embodied herein to the maximum extent permitted by law. The parties expressly agree that this Appendix A as so modified by the court shall be binding upon and enforceable against each of them. In any event, should one or more of the provisions of this Appendix A be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Appendix A shall be construed as if such invalid, illegal or unenforceable provisions had not been set forth herein.

9.Survival of Provisions. The obligations contained in this Appendix A will survive, and will remain fully enforceable after, the vesting of any and all awards granted pursuant to this Award Agreement, any termination of this Award Agreement, and the termination of the Grantee’s Employment for any reason.

10.Counsel/Notice. Grantee understands that this Appendix A may affect Grantee’s legal rights, and Grantee agrees that Grantee has had the opportunity to review it. Grantee further understands that Grantee has the right to consult with counsel and tax advisors of Grantee’s choosing prior to signing this Appendix A and agrees that Grantee has had the opportunity to do so.

11.Effective Date; Binding Effect. Following Grantee’s execution of this Appendix A, this Appendix A shall be effective on the later of Grantee’s execution or eleven business days from when Grantee received a copy of it, and it shall be binding upon the parties and their heirs, successors, and assigns. If for any reason this Appendix A or any portion of it is determined by a court to be illegal, invalid, or unenforceable in a way that cannot be modified in accordance with Section 7 above, Grantee agrees that Grantee remains bound by any prior agreements and restrictive covenants that this Appendix A or such illegal, invalidated, or unenforceable portion was intended to replace.

12.Entire Agreement. This Appendix A is the sole and entire agreement of the parties with respect to the matters addressed in this Appendix A. Except under the conditions stated in Section 11 above, this Appendix A supersedes all prior agreements and understandings with respect to the matters addressed in this Appendix A. This Appendix A may be amended only by a written agreement between the Artisan Group and Grantee.

By signing below, Grantee acknowledges and agrees that (i) Grantee has been provided at least 11 business days to review and consider this Appendix A, even if Grantee has voluntarily waived the period and continues work subject to this Appendix A in fewer than 11 business days; (ii) Grantee understands this Appendix A and Grantee’s obligations under this Appendix A and agrees to be bound by them; (iii) Grantee has received adequate, fair, and reasonable consideration for this Appendix A and (iv) if Grantee signs this Agreement electronically, Grantee’s signature is deemed signed and received in Delaware.

| | | | | | | | | | | |

| Artisan Partners Limited Partnership | | Grantee |

| | | |

| By: | [ ] | | [ ] |

| Title: | [ ] | | |

Exhibit 10.2

ARTISAN PARTNERS ASSET MANAGEMENT INC.

2023 OMNIBUS INCENTIVE COMPENSATION PLAN

Career Share Award Certificate (Non-Investment Team Members)

Artisan Partners Asset Management Inc. (“Artisan”), pursuant to the Artisan Partners Asset Management Inc. 2023 Omnibus Incentive Compensation Plan (as amended, from time to time, the “Plan”), has awarded restricted shares of Artisan’s Class A common stock (“Career Shares”) to Grantee as set forth below in consideration of Grantee’s service as an employee of Artisan or any of its subsidiaries.

| | | | | | | | | | | |

| Grantee: | [ ] | | |

| Grant Date: | [ ] | | |

| Number of Career Shares: | [ ] | | |

| Vesting Eligibility Schedule: | The Career Shares become eligible to vest over the five years following the year of grant, as follows: |

| Date | Amount Becoming Eligible to Vest on Indicated Date | Cumulative Amount Eligible to Vest as of the Indicated Date |

| February 15, [ ] | 20% | 20% |

| February 15, [ ] | 20% | 40% |

| February 15, [ ] | 20% | 60% |

| February 15, [ ] | 20% | 80% |

| February 15, [ ] | 20% | 100% |

| As provided in the Award Agreement, with certain exceptions, Career Shares will vest only after they have become eligible to vest in accordance with the schedule above and the Grantee has had a Qualifying Retirement. There is no proportionate or partial vesting in the period prior to a vesting date. |

This award is subject to all of the terms, conditions and restrictions set forth in Grantee’s Career Share Award Agreement (including any schedules and appendices thereto) dated [ ], as may be amended from time to time in accordance with the provisions of the Plan (the “Award Agreement”) and the Plan, each of which has been provided to Grantee and are incorporated herein by reference.

Grantee acknowledges receipt of copies of the Award Agreement and the Plan, has read and understands the terms and provisions thereof, has had the opportunity to consult with his or her legal, tax and financial advisors, and accepts this award subject to all of the terms and conditions of the Award Agreement and the Plan.

Artisan may, in its sole discretion, deliver this Career Share Award Certificate, the Award Agreement, the Plan or any other documents related to this award, by electronic means and request Grantee’s acceptance of this award and the terms of the Award Agreement by electronic means. Grantee hereby consents to receive such documents by electronic delivery, including by accessing such documents on a website, and agrees to accept this award and the terms of the Award Agreement through any on-line or electronic system utilized by Artisan for this purpose.

Grantee may take up to 30 days to accept this award.

| | | | | | | | | | | |

Artisan Partners Asset Management Inc.

| | Grantee |

| By: | [ ] | | [ ] |

| Title: | [ ] | | |

ARTISAN PARTNERS ASSET MANAGEMENT INC.

2023 OMNIBUS INCENTIVE COMPENSATION PLAN

CAREER SHARE AWARD AGREEMENT

This Career Share Award Agreement (this “Award Agreement”) between [ ] (the “Grantee”) and Artisan Partners Asset Management Inc. (“Artisan”) is effective [ ].

1.The Plan. Awards of restricted shares of Class A common stock (“Career Shares”) are made pursuant to the Artisan Partners Asset Management Inc. 2023 Omnibus Incentive Compensation Plan (as amended, from time to time, the “Plan”). Capitalized terms used but not defined in this Award Agreement have the meanings as used or defined in the Plan.

2.Nature of Career Share Award. Any award granted pursuant to the terms of this Award Agreement is subject to career vesting, as described in Section 4 below (any such award, a “Career Vesting Award”).

3.Forfeiture. Subject to Sections 4 and 5 and the terms of any employment, severance or similar agreement between Grantee and the Company, if Grantee’s Employment with the Company terminates for any reason prior to vesting, any then unvested Career Shares shall be automatically forfeited and the Company shall have no further obligations to Grantee or Grantee’s legal representative under this Award Agreement.

4.Vesting upon Qualifying Retirement. Provided that Grantee (i) has given the Company at least one-year advance written notice of intention to retire and (ii) has attained at least ten years of service with the Company as of the retirement date (requirements (i) and (ii) together, a “Qualifying Retirement”), the Career Shares eligible to vest under any applicable Vesting Eligibility Schedule (as set forth in any career share award certificates) will vest on Grantee’s retirement date. If during any portion of Grantee’s Employment with the Company, Grantee is or was an Executive Officer of Artisan or a decision-making portfolio manager (meaning he or she has or had investment discretion) with respect to any client accounts, then the advance written notice required under clause (i) of this Section 4 shall be 18-month advance written notice of intention to retire. Any shares not eligible to vest under the applicable

Vesting Eligibility Schedule as of the retirement date shall be automatically forfeited on the retirement date.If Grantee would have attained at least ten years of service with the Company as of the retirement date but for the Company reducing the notice period and causing the retirement date to occur prior to the date on which Grantee will have attained ten years of service with the Company, then the ten-year service requirement will be deemed to be satisfied as of the retirement date.

5.Traditional Retirement. If Grantee satisfies the requirements for vesting under Section 4, and Grantee has also attained a combination of years of service with the Company plus age of at least 70 as of the date of retirement, any Career Shares granted pursuant to this Award Agreement will be eligible to vest (without regard to its eligibility to vest under the applicable Vesting Eligibility Schedule) as otherwise set forth in Section 4 above.

6.Acceleration.

a.Change in Control: Upon a Change in Control, any outstanding Career Shares will immediately vest in full, provided that if Grantee is a named executive officer of Artisan those outstanding Career Shares will be treated in accordance with the terms of the Plan.

b.Death or Disability: Notwithstanding any other provision in this Agreement, upon termination of Grantee’s employment with the Company by reason of death or Disability, the Career Shares will vest in full as of the date of such termination. For purposes of this Award Agreement, “Disability” means Grantee’s inability to perform the essential functions of Grantee’s position, with or without reasonable accommodation, for a period aggregating 180 days within any continuous period of 365 days by reason of physical or mental incapacity.

c.Termination without Cause: If, on or after the fifth anniversary of a Grant Date (as set forth in any career share award certificates), (i) the Company terminates the Employment of Grantee without Cause and (ii) Grantee has attained at least ten years of service with the Company as of the date of termination of Employment, those Career Shares granted five or more years earlier will vest in full as of the date of such termination. In any dispute over whether the Company terminated the Employment of Grantee without Cause, the burden shall be on the Grantee to prove that the Company’s purpose in terminating the Employment of Grantee was without Cause.

For purposes of this Section 6(c), “Cause” means the occurrence of any of the following: (i) such Grantee’s material violation of any material obligation in any written policy or any material written contract or agreement between Grantee and Artisan; (ii) such Grantee’s commission or attempted commission of any felony or any crime involving fraud or dishonesty under the laws of the United States or any state thereof or under the laws of any other jurisdiction; (iii) such Grantee’s attempted commission of, or participation in, a fraud or act of dishonesty against Artisan or any client of Artisan; or (iv) such Grantee’s willful, material violation of the applicable rules or regulations of any governmental or self-regulatory authority that causes material harm to Artisan, such Grantee’s disqualification or bar by any governmental or self-regulatory authority from serving in the capacity required by his or her job description or such Grantee’s loss of any governmental or self-regulatory license that is reasonably necessary for such Grantee to perform his or her duties or responsibilities as an employee of Artisan.

7.Issuance and Delivery. Artisan may issue stock certificates or evidence Grantee’s interest in Career Shares by using a book entry account with Artisan’s transfer agent. Upon the vesting of Career Shares, Artisan will cause to be delivered to Grantee shares of Common Stock free from risk of forfeiture (but still bearing and/or subject to any other legends that may be required by Artisan).

8.Non-Transferability. Prior to vesting, Career Shares may not be sold, transferred, assigned, pledged, hedged or otherwise disposed of in any manner other than by will or by the laws of descent and distribution, and any attempt to sell, transfer, assign, pledge, hedge or otherwise dispose of the Career Shares in violation of this Award Agreement shall be void and of no effect.

9.Privileges of Share Ownership. Subject to sections 7 and 8, effective upon the applicable Grant Date, Grantee shall have all rights of a shareholder of Artisan with respect to the Career Shares granted on that Grant Date, including voting rights and rights to dividends. For the avoidance of doubt, Grantee shall have no rights with respect to any forfeited shares, including shares (if any) forfeited as of Grantee’s retirement date because such shares were not eligible to vest under the applicable Vesting Eligibility Schedule. Notwithstanding the foregoing, the Career Shares are subject to the Stockholders Agreement, dated as of March 12, 2013 (the “Stockholders Agreement”), including the irrevocable voting proxy included therein.

10.Section 83(b) Election. Grantee hereby acknowledges that Grantee has been informed that, with respect to the grant of Career Shares, if Grantee is filing a U.S. federal income tax return for the year in which the grant of Career Shares occurs, Grantee may file an election (the “Election”) with the United States Internal Revenue Service, within 30 days of the grant, electing pursuant to Section 83(b) of the Code to be taxed currently on the Fair Market Value of the Career Shares on the Grant Date. This will result in recognition of taxable income to Grantee on the Grant Date, equal to the Fair Market Value of the Career Shares on such date. Absent an Election, taxable income will be measured and recognized by Grantee at the time the Career Shares vest. Grantee is hereby encouraged to seek the advice of Grantee’s own tax consultants in connection with the advisability of filing the Election. GRANTEE UNDERSTANDS THAT ANY TAXES PAID AS A RESULT OF THE FILING OF THE ELECTION GENERALLY WILL NOT BE RECOVERED IF THE CAREER SHARES ARE FORFEITED TO ARTISAN. GRANTEE ACKNOWLEDGES THAT IT IS GRANTEE’S SOLE RESPONSIBILITY AND NOT ARTISAN’S TO TIMELY FILE THE ELECTION, EVEN IF GRANTEE REQUESTS ARTISAN OR ITS REPRESENTATIVE TO MAKE THIS FILING ON GRANTEE’S BEHALF. GRANTEE MUST NOTIFY ARTISAN WITHIN 10 BUSINESS DAYS OF FILING ANY ELECTION.

11.Tax Withholding. In connection with vesting or an Election, Grantee will pay, or otherwise provide for to the satisfaction of the Company, any applicable federal, state and local tax and social security withholding

obligations of the Company. At its sole discretion, in connection with a vesting, Artisan may provide and/or require for payment by Grantee of withholding taxes through either (i) cash payment or (ii) remitting to Artisan shares of Common Stock with a fair market value (determined as of the date of vesting), in either case in an amount equal to the statutory minimum amount of taxes required to be withheld. In the latter case, without any further action by Grantee, Artisan will cause its transfer agent to deduct the shares of Common Stock to be remitted from the shares of Common Stock held of record by the Grantee (“Net Share Settle”). If Grantee shall fail to make such payment or otherwise satisfy such obligations, the Company shall, to the extent permitted by law, have the right (but not the obligation) to withhold delivery of vesting shares and/or deduct from any payment of any kind otherwise due to Grantee any federal, state or local tax and social security withholding obligations with respect to the Career Shares. Notwithstanding the foregoing, if at the time of vesting Grantee is a named executive officer of Artisan for whom the Company has withholding obligations, Grantee will be required to Net Share Settle, unless another method is specifically approved by the Compensation Committee of the Board of Directors of Artisan.

12.Compliance with Securities Laws. The issuance and delivery of Career Shares shall be subject to compliance by Artisan and Grantee with all applicable requirements under federal and state securities laws and with all applicable rules of the New York Stock Exchange. Career Shares will not be issued or delivered unless and until any then applicable requirements of federal and state laws and regulatory agencies have been fully complied with to the satisfaction of Artisan.

13.Entire Agreement. This Award Agreement, together with any career share award certificates, and the Plan constitute the entire agreement and understanding of the parties with respect to any award granted hereunder and supersede all prior understandings and agreements (whether written or oral) between the Company and Grantee with respect to any such award.

14.Notices. Any notice required to be given to Artisan under the terms of this Award Agreement will be in writing or email and be delivered to Artisan’s Chief Legal Officer. Any notice required to be given to Grantee will be in writing or email and delivered to the address or addresses last maintained in the Company’s records.

15.Binding Effect. Any action taken or decision made in good faith by the Compensation Committee of the Board of Directors of Artisan in connection with the construction, administration or interpretation of this Award Agreement will lie within its sole and absolute discretion and will be final, conclusive and binding on Grantee and all persons claiming under or through Grantee.

16.Choice of Forum. As a condition to Grantee’s receipt of the Career Shares, Grantee hereby irrevocably submits to the exclusive jurisdiction of any state or federal court located in Delaware over any suit, action or proceeding arising out of or relating to the Plan or this Award Agreement.

17.Governing Law. This Award Agreement will be governed by and construed in accordance with the laws of the State of Delaware without regard to its principles of conflict of laws.

18.Electronic Delivery and Signature. Artisan may, in its sole discretion, deliver this Award Agreement, the Plan or any other documents related to the Career Shares by electronic means and request Grantee’s agreement to the terms thereof by electronic means. Grantee hereby consents to receive such documents by electronic delivery, including by accessing such documents on a website, and agrees to accept the terms of the Award Agreement through any on-line or electronic system utilized by Artisan for this purpose.

| | | | | | | | | | | |

| Artisan Partners Asset Management Inc. | | Grantee |

| By: | [ ] | | [ ] |

| Title: | [ ] | | |

Appendix A: Restrictive Covenants

1.Definitions. For purposes of this Appendix A:

“Artisan Client” means each of the following:

a.Any client of the Artisan Group (i) for which Grantee provided services (such as investment management or relationship management services) on behalf of the Artisan Group during the 12 months preceding Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, in person, phone, or electronic communication) during the 12 months preceding the Grantee’s last date of Employment.

b.Any investor in a mutual fund, UCITS fund, private fund or other pooled investment vehicle advised, promoted, or sponsored by the Artisan Group (each, an “Artisan Pooled Vehicle”) (i) for which investor the Grantee provided services (such as investment management services to the relevant Artisan Pooled Vehicle or relationship management services) on behalf of the Artisan Group during the 12 months preceding Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, in person, phone, or electronic communication) during the 12 months preceding the Grantee’s last date of Employment.

c.Any employee, partner or director of a financial intermediary, financial adviser or planner, consultant or broker-dealer (each, a “Client Intermediary”) (i) to whom the Grantee provided services (such as investment management or relationship management services) on behalf of the Artisan Group during the 12 months preceding the Grantee’s last date of Employment and (ii) with whom the Grantee had substantive personal contact (including, without limitation, phone or email contact) during the 12 months preceding the Grantee’s last date of Employment.

“Artisan Group” means Artisan Partners Asset Management Inc. and each of its subsidiaries and affiliates (including, for the avoidance of doubt, Artisan Partners Limited Partnership).

“Artisan Prospective Client” means any person or entity for which the Artisan Group made a proposal to perform services in which the Grantee participated by means of substantive personal contact with the person or entity or the agents of the person or entity during the 12 months preceding the Grantee’s last date of Employment. For the avoidance of doubt, “Artisan Prospective Client” shall include a person or entity with respect to which this definition otherwise applies, including but not limited to financial intermediaries, financial advisers or planners, consultants, and broker dealers, notwithstanding that the services that were proposed to be provided would have been provided indirectly through such person’s or entity’s investment in an Artisan Pooled Vehicle.

“Competitive Enterprise” means any business enterprise that either (i) engages in any activity that competes with any then-current activity of the Artisan Group, including, without limitation, investment management services, or (ii) holds a 10% or greater equity, voting or profit participation interest in any enterprise that engages in such a competitive activity.

“Portfolio Manager" means an individual who has the authority to exercise investment discretion over one or more client accounts and is therefore identified as a portfolio manager in Artisan’s Form ADV.

“Restricted Period” means the period during which Grantee is Employed and for a period of one year immediately following termination of Grantee’s Employment for any reason.

“Restricted Person” means an individual who, at the time of the solicitation was an employee of the Artisan Group and: (i) was an executive officer, portfolio manager (including associate or co-portfolio manager), or managing director of the Artisan Group (a “top-level employee”), had special skills or knowledge important to the Artisan Group, or had skills that are difficult for the Artisan Group to replace, and (ii) with whom Grantee had a working relationship or about whom Grantee acquired or possessed specialized knowledge,

in each case, in connection with Grantee’s Employment and during the 18 months prior to the termination of Grantee’s Employment.

“Restricted Services” means any job function that Grantee was engaged in on behalf of the Artisan Group at any time during the 12 months preceding Grantee’s last date of Employment.

“Territory” means the United States and any other country where Grantee provided services or had a material impact, presence, or influence on behalf of the Artisan Group. Grantee acknowledges that, by virtue of Grantee’s position, duties, level, and access to the Artisan Group’s trade secrets and other confidential information, Grantee provides services to and has a material impact, presence, and influence in any country worldwide in which the Artisan Group has an office, has a client or otherwise does business.

All capitalized terms used but not defined in this Appendix A will have the meanings ascribed thereto in the Award Agreement.

2.Non-Competition. If during any portion of Grantee’s Employment with the Artisan Group Grantee is or was an Executive Officer, Portfolio Manager, or identified as a founding member of an Artisan investment team, then the terms and conditions of this Section 2 shall apply. Based on Grantee’s position, duties, level, and access to the Artisan Group’s trade secrets and other confidential information, as a necessary measure to protect the trade secrets and other confidential information of the Artisan Group, as well as Artisan’s goodwill with its clients, and in consideration of the award (as described in the Award Agreement), Grantee agrees that during the Restricted Period he or she will not, directly or indirectly, (i) hold an equity, voting or profit participation interest in a Competitive Enterprise (other than a 10% or less interest in a public or private entity which is only held for passive investment purposes); (ii) provide Restricted Services anywhere in the Territory to a Competitive Enterprise; or (iii) manage or supervise personnel engaged in providing Restricted Services anywhere in the Territory on behalf of a Competitive Enterprise. As it relates to the practice of law, the terms of this Section 2 and the terms of any other similar provision agreed to by the parties hereto shall be binding and effective upon Grantee only to the extent permissible under the Rules of Professional Conduct or any other professional or ethical rules governing the practice of law that Grantee may be subject to. Further, the prohibitions in this Section 2 shall not apply to Grantee’s management, without compensation, of the investments of Grantee or investments of members of Grantee’s family or investments of a trust or similar vehicle for the benefit of Grantee or members of Grantee’s family.

3.Non-Solicitation of Clients and Prospective Clients. Grantee agrees that during the Restricted Period, Grantee will not directly or indirectly induce or attempt to induce any Artisan Client or Artisan Prospective Client, (i) to use the investment management services of any person or entity, (ii) to cease using the investment management services of the Artisan Group (including any Artisan Pooled Vehicle); and/or (iii) for purposes of offering Restricted Services. The prohibitions in this Section 3 shall not apply to (x) Grantee’s management, without compensation, of the investments of the Grantee or members of the Grantee’s family or a trust or similar vehicle for the benefit of any of the foregoing, or (y) the provision of services by Grantee to a business enterprise solely because such business enterprise engages in general advertising and solicitation efforts that may or do reach an Artisan Client.

4.Non-Solicitation of Restricted Persons. Grantee agrees that during the Restricted Period, Grantee will not: (i) directly or indirectly solicit or attempt to solicit any Restricted Person to terminate employment for the purpose of engaging in, or starting a business which engages in, a Competitive Enterprise; and/or (ii) hire, employ or otherwise use the professional services of a Restricted Person.

The parties agree that, if during the Restricted Period, the Grantee and one or more persons who at any time within the period of 18 months prior to the end of the Grantee’s Employment was a Portfolio Manager (including associate or co-portfolio manager), become employed by either the same employer or an affiliate thereof, or otherwise become affiliated as partners, contractors or other professional service providers with an entity together with its affiliates, to provide Restricted Services for the benefit of a Competitive Enterprise or any affiliate of a Competitive Enterprise, it shall give rise to a conclusive presumption that it resulted from an impermissible solicitation, and therefore it shall be a deemed violation of this Section 4.

5.Exclusions in Certain States. Sections 2, 3, and 4 of this Appendix A shall not apply if and for as long as Grantee lives in California, unless Grantee moves to California to avoid such obligations. Section 2 of this Appendix A shall not apply if and for as long as Grantee primarily resides and works in Minnesota, North Dakota, and Oklahoma.

6.Included Actions. The parties agree that Grantee shall be deemed to have taken any action prohibited by this Appendix A (and therefore to be in violation of this Appendix A) if Grantee takes such action directly or indirectly, or if it is taken by any person or entity with whom Grantee is associated as an employee, independent contractor, consultant, agent, partner, member, proprietor, owner, stockholder, officer, director, or trustee, or by any entity directly or indirectly controlled by, controlling or under common control with Grantee.

7.Injunctive Relief; Enforceability of Restrictive Covenants. Grantee acknowledges that irreparable injury may result to the Artisan Group if Grantee breaches the provisions of this Appendix A and agrees that the Artisan Group will be entitled, in addition to all other legal remedies available to the Artisan Group, to an injunction or other equitable relief by any court of competent jurisdiction to prevent or restrain any breach of this Appendix A. The parties hereto acknowledge that the restrictions on Grantee imposed by this Appendix A are reasonable in duration, geographic scope, and in all other respects for the protection of the Artisan Group, and its business, goodwill, trade secrets and other confidential information, and Artisan’s other protectable rights. Grantee acknowledges that the restrictions imposed in this Appendix A will not prevent Grantee from earning a living in the event of, and after, the end of Grantee’s Employment.

8.Enforceability/Severability/Modification. The parties agree that, if any provisions of this Appendix A are determined by a court of competent jurisdiction to be unenforceable unless modified, the Court should modify such provisions to the least extent necessary to make such provisions (and this Appendix A) enforceable so as to carry out the intent of the parties as embodied herein to the maximum extent permitted by law. The parties expressly agree that this Appendix A as so modified by the court shall be binding upon and enforceable against each of them. In any event, should one or more of the provisions of this Appendix A be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Appendix A shall be construed as if such invalid, illegal or unenforceable provisions had not been set forth herein.

9.Survival of Provisions. The obligations contained in this Appendix A will survive, and will remain fully enforceable after, the vesting of any and all awards granted pursuant to this Award Agreement, any termination of this Award Agreement, and the termination of the Grantee’s Employment for any reason.

10.Counsel/Notice. Grantee understands that this Appendix A may affect Grantee’s legal rights, and Grantee agrees that Grantee has had the opportunity to review it. Grantee further understands that Grantee has the right to consult with counsel and tax advisors of Grantee’s choosing prior to signing this Appendix A and agrees that Grantee has had the opportunity to do so.

11.Effective Date; Binding Effect. Following Grantee’s execution of this Appendix A, this Appendix A shall be effective on the later of Grantee’s execution or eleven business days from when Grantee received a copy of it, and it shall be binding upon the parties and their heirs, successors, and assigns. If for any reason this Appendix A or any portion of it is determined by a court to be illegal, invalid, or unenforceable in a way that cannot be modified in accordance with Section 7 above, Grantee agrees that Grantee remains bound by any prior agreements and restrictive covenants that this Appendix A or such illegal, invalidated, or unenforceable portion was intended to replace.

12.Entire Agreement. This Appendix A is the sole and entire agreement of the parties with respect to the matters addressed in this Appendix A. Except under the conditions stated in Section 11 above, this Appendix A supersedes all prior agreements and understandings with respect to the matters addressed in this Appendix A. This Appendix A may be amended only by a written agreement between the Artisan Group and Grantee.

By signing below, Grantee acknowledges and agrees that (i) Grantee has been provided at least 11 business days to review and consider this Appendix A, even if Grantee has voluntarily waived the period and continues work subject to this Appendix A in fewer than 11 business days; (ii) Grantee understands this Appendix A and Grantee’s obligations under this Appendix A and agrees to be bound by them; (iii) Grantee has received adequate, fair, and reasonable consideration for this Appendix A and (iv) if Grantee signs this Agreement electronically, Grantee’s signature is deemed signed and received in Delaware.

| | | | | | | | | | | |

| Artisan Partners Limited Partnership | | Grantee |

| | | |

| By: | [ ] | | [ ] |

| Title: | [ ] | | |

Artisan Partners Asset Management Inc. Reports 4Q23 and Year Ended December 31, 2023 Results and Quarterly and Special Annual Dividend

Milwaukee, WI – January 30, 2024 – Artisan Partners Asset Management Inc. (NYSE: APAM) (the “Company” or “Artisan Partners”) today reported its results for the quarter and year ended December 31, 2023, and declared a quarterly and special annual dividend. The full December 2023 quarter earnings release and investor presentation can be viewed at www.apam.com.

Conference Call

The Company will host a conference call on January 31, 2024 at 1:00 p.m. (Eastern Time) to discuss these results. Hosting the call will be Eric Colson, Chief Executive Officer, Jason Gottlieb, President, and C.J. Daley, Chief Financial Officer. Supplemental materials that will be reviewed during the call are available on the Company’s website at www.apam.com. The call will be webcast and can be accessed via the Company’s website. Listeners may also access the call by dialing 877.328.5507 or 412.317.5423 for international callers; the conference ID is 10185029. A replay of the call will be available until February 7, 2024 at 9:00 a.m. (Eastern Time), by dialing 877.344.7529 or 412.317.0088 for international callers; the replay conference ID is 1696871. An audio recording will also be available on the Company’s website.

About Artisan Partners

Artisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Artisan Partners’ autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates.

Source: Artisan Partners Asset Management Inc.

Investor Relations Inquiries

866.632.1770

ir@artisanpartners.com

Artisan Partners Asset Management Inc. Reports 4Q23 and Year Ended December 31, 2023 Results and Quarterly and Special Annual Dividend

Milwaukee, WI – January 30, 2024 – Artisan Partners Asset Management Inc. (NYSE: APAM) (the “Company” or “Artisan Partners”) today reported its results for the quarter and year ended December 31, 2023, and declared a quarterly and special annual dividend.

Chief Executive Officer Eric Colson said: “Those who follow Artisan Partners closely know that quarterly and annual periods are not the time horizons we are trying to solve for. We seek to generate and compound wealth for clients over much longer periods and through market cycles. To do this, we strive to be the ideal home for differentiated and entrepreneurial investment leaders. We constantly reinvest in our talent and in our investment platform. We add degrees of freedom necessary to generate high value-added investment outcomes for clients. And we remain patient, prioritizing long-term outcomes over short-term results.

“We have broadened our high value-added strategies beyond equities into fixed income and alternatives with increasing investment degrees of freedom. Consistent with this approach, we have retained fee rates commensurate with the net-of-fees alpha we generate. Our talent-driven model is proven over time, geographical locations, asset classes, and strategies. We have executed capital efficient, long duration build outs of investment franchises rather than acquiring and merging for scale and synergy through capital intensive, higher risk M&A transactions.

“We have spent decades building our equity businesses. Today, we have eight equity investment teams and 16 strategies accounting for $137 billion in AUM and approximately $900 million of annual revenue. The incremental growth of these businesses over short periods depends on a multitude of factors, but we believe all of our equity teams have long-term growth potential, and several of the teams are well-positioned for nearer-term flows.

“We have been building equity franchises for nearly 30 years. We are ten years in with fixed income and are beginning to see the long-term outcomes. Our first fixed income strategy, Artisan High Income, is nearing its ten-year mark and since inception has generated an average annual return of 6.18%, after fees, compared to an average annual return of 4.31% for the index. Over that time period, the Artisan High Income Fund is ranked #1 out of 324 funds in its Lipper category. As a result of that long-term performance, the High Income strategy generated $1.5 billion in net inflows in 2023, contributing to our nearly $2 billion of net inflows into fixed income strategies in 2023, an organic growth rate of 28%.

“In the same way that we methodically built out our equity and fixed income businesses, we continue to methodically build out alternative capabilities. Investment talent needs degrees of freedom to generate differentiated returns. And greater differentiation is increasingly required to align with asset owner budgets for active management. Fixed income provides a natural avenue for us to continue expanding in this direction. Our Credit Opportunities strategy now has a six-year track record and has generated average annual returns of 9.84% since inception, net of fees. The more recently launched Artisan Global Unconstrained strategy has generated average annual returns of 8.92% since inception, net of fees, with low correlations to both equity and fixed income indexes. And during the fourth quarter, we closed on $130 million in commitments for our first closed-end fund designed to capture opportunities in dislocated credit markets. All recent outcomes of long-term investments.

“Another long-term investment we are making is in our distribution model. We continue to re-align our distribution structure, resources, and operations to be more effective at distributing and servicing 25 investment strategies across multiple asset classes, including alternatives, and at identifying and accessing asset owners, intermediaries, consultants, and advisors who understand and align with our value proposition and time horizon.

“Time is an asset that we manage to maximize long duration outcomes, avoiding short-term thinking that can often impede long-term success. The relationship between investing and returns is non-linear, and discipline and patience are required to maximize returns. We are highly confident that if we continue to methodically invest in differentiated investment talent and degrees of freedom for high value-added allocations, we will generate highly attractive long-term outcomes for our clients, our talent, and our shareholders.”

The table below presents AUM and a comparison of certain GAAP and non-GAAP (“adjusted”) financial measures. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Years Ended |

| December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited, in millions except per share amounts or as otherwise noted) |

| Assets Under Management (amounts in billions) |

| Ending | $ | 150.2 | | | $ | 136.5 | | | $ | 127.9 | | | $ | 150.2 | | | $ | 127.9 | |

| Average | 140.3 | | | 142.2 | | | 127.4 | | | 139.3 | | | 141.5 | |

| | | | | | | | | |

| Consolidated Financial Results (GAAP) |

| Revenues | $ | 249.0 | | | $ | 248.7 | | | $ | 226.0 | | | $ | 975.1 | | | $ | 993.3 | |

| Operating income | 76.4 | | | 82.2 | | | 70.0 | | | 303.6 | | | 344.1 | |

| Operating margin | 30.7 | % | | 33.0 | % | | 31.0 | % | | 31.1 | % | | 34.6 | % |

| Net income attributable to Artisan Partners Asset Management Inc. | $ | 64.8 | | | $ | 53.1 | | | $ | 52.9 | | | $ | 222.3 | | | $ | 206.8 | |

| Basic earnings per share | 0.92 | | | 0.76 | | | 0.76 | | | 3.19 | | | 2.94 | |

| Diluted earnings per share | 0.92 | | | 0.76 | | | 0.76 | | | 3.19 | | | 2.94 | |

| | | | | | | | | |

Adjusted1 Financial Results |

| Adjusted operating income | $ | 80.0 | | | $ | 80.9 | | | $ | 70.6 | | | $ | 308.4 | | | $ | 340.3 | |

| Adjusted operating margin | 32.1 | % | | 32.5 | % | | 31.2 | % | | 31.6 | % | | 34.3 | % |

Adjusted EBITDA2 | $ | 87.9 | | | $ | 85.5 | | | $ | 73.3 | | | $ | 327.5 | | | $ | 349.2 | |

| Adjusted net income | 62.8 | | | 60.8 | | | 52.0 | | | 233.1 | | | 249.6 | |

| Adjusted net income per adjusted share | 0.78 | | | 0.75 | | | 0.65 | | | 2.89 | | | 3.11 | |

______________________________________

1 Adjusted measures are non-GAAP measures and are explained and reconciled to the comparable GAAP measures in Exhibit 2.

2 Adjusted EBITDA represents adjusted net income before interest expense, income taxes, depreciation and amortization expense.

2

December 2023 Quarter Compared to September 2023 Quarter

AUM increased to $150.2 billion at December 31, 2023, an increase of 10%, compared to $136.5 billion at September 30, 2023, primarily due to investment returns of $14.6 billion, partially offset by $0.5 billion of Artisan Funds’ distributions not reinvested and net client cash outflows of $0.4 billion. For the quarter, average AUM decreased 1% to $140.3 billion from $142.2 billion in the September 2023 quarter.

Revenues of $249.0 million in the December 2023 quarter increased $0.3 million from $248.7 million in the September 2023 quarter.

Operating expenses of $172.6 million in the December 2023 quarter increased $6.1 million, or 4%, from $166.5 million in the September 2023 quarter, due to an increase in long-term incentive compensation costs resulting from the market valuation impact on compensation plans and higher incentive compensation expense.

GAAP operating margin was 30.7% in the December 2023 quarter compared to 33.0% in the September 2023 quarter. Adjusted operating margin was 32.1% in the December 2023 quarter compared to 32.5% in the September 2023 quarter.

Within non-operating income (expense), investment gains (losses) are comprised of net investment gains (losses) of consolidated and nonconsolidated investment products, including investments held to economically hedge compensation plans (collectively referred to as “investments in sponsored products”). Total investment gains, which include gains attributable to third party shareholders of consolidated investment products, were $36.2 million in the December 2023 quarter, compared to gains of $5.5 million in the September 2023 quarter. Artisan Partners’ portion of the gains from investments in sponsored products was $19.2 million in the December 2023 quarter, compared to losses of $3.6 million in the September 2023 quarter.

GAAP net income was $64.8 million, or $0.92 per basic and diluted share, in the December 2023 quarter, compared to GAAP net income of $53.1 million, or $0.76 per basic and diluted share, in the September 2023 quarter. Adjusted net income was $62.8 million, or $0.78 per adjusted share, in the December 2023 quarter, compared to adjusted net income of $60.8 million, or $0.75 per adjusted share, in the September 2023 quarter.

December 2023 Quarter Compared to December 2022 Quarter

AUM at December 31, 2023 was $150.2 billion, up 17% from $127.9 billion at December 31, 2022. The change in AUM from the prior year quarter was primarily due to investment returns of $27.1 billion, partially offset by $4.1 billion of net client cash outflows and $0.7 billion of Artisan Funds’ distributions that were not reinvested. Average AUM for the December 2023 quarter was $140.3 billion, 10% higher than average AUM for the December 2022 quarter.

Revenues of $249.0 million in the December 2023 quarter increased $23.0 million, or 10%, from $226.0 million in the December 2022 quarter, primarily due to higher average AUM and a $3.9 million increase in performance fee revenue.

Operating expenses of $172.6 million in the December 2023 quarter increased $16.6 million, or 11%, from $156.0 million in the December 2022 quarter, primarily due to an increase in compensation and benefits, specifically an increase in incentive compensation expense as a result of higher revenues and an increase in long-term incentive compensation costs resulting from the market valuation impact on compensation plans, offset by higher occupancy expense in 2022 due to an office lease abandonment charge.

GAAP operating margin was 30.7% for the December 2023 quarter, compared to 31.0% for the December 2022 quarter. Adjusted operating margin was 32.1% in the December 2023 quarter, compared to 31.2% in the December 2022 quarter.

Total investment gains, which include gains attributable to third party shareholders of consolidated investment products, were $36.2 million in the December 2023 quarter, compared to gains of $14.9 million in the December 2022 quarter. Artisan Partners’ portion of the gains from investments in sponsored products was $19.2 million in the December 2023 quarter, compared to gains of $13.1 million in the December 2022 quarter.

GAAP net income was $64.8 million, or $0.92 per basic and diluted share, in the December 2023 quarter, compared to GAAP net income of $52.9 million, or $0.76 per basic and diluted share, in the December 2022 quarter. Adjusted net income was $62.8 million, or $0.78 per adjusted share, in the December 2023 quarter, compared to adjusted net income of $52.0 million, or $0.65 per adjusted share, in the December 2022 quarter.

Year Ended December 31, 2023 Compared to Year Ended December 31, 2022

Average AUM for the year ended December 31, 2023 was $139.3 billion, 2% lower than average AUM of $141.5 billion for the year ended December 31, 2022.

Revenues of $975.1 million for the year ended December 31, 2023 decreased $18.2 million, or 2%, from $993.3 million for the year ended December 31, 2022, primarily due to lower average AUM, partially offset by an increase in performance fee revenue.

Operating expenses of $671.5 million for the year ended December 31, 2023 increased $22.3 million, or 3%, from $649.2 million for the year ended December 31, 2022, due to higher fixed compensation and benefits costs, reflecting an increase in the number of full time associates as well as annual merit increases, an increase in long-term incentive compensation costs resulting from the market valuation impact on compensation plans, and higher travel expenses.

GAAP operating margin was 31.1% for the year ended December 31, 2023, compared to 34.6% for the year ended December 31, 2022. Adjusted operating margin was 31.6% for the year ended December 31, 2023, compared to 34.3% for the year ended December 31, 2022.

Total investment gains, which included gains attributable to third party shareholders of consolidated investment products, were $81.9 million for the year ended December 31, 2023, compared to losses of $23.7 million for the year ended December 31, 2022. Artisan Partners’ portion of investment in sponsored products gain was $38.4 million for the year ended December 31, 2023, compared to losses of $16.9 million for the year ended December 31, 2022.