Aris Water Solutions, Inc. (NYSE: ARIS) (“Aris,” “Aris Water” or

the “Company”) today announced financial and operating results for

the first quarter ended March 31, 2024.

FIRST QUARTER 2024

HIGHLIGHTS

- Increased produced water volumes 6% quarter-over-quarter and

19% versus the first quarter of 2023

- Grew recycled produced water volumes 31% versus the first

quarter of 2023

- Achieved first quarter 2024 net income of $16.8 million, a 29%

increase sequentially

- Generated Adjusted EBITDA1 of $53.1 million for the first

quarter, up 8% sequentially and up 39% versus the first quarter of

2023

- Improved Gross Margin per Barrel by 19% and Adjusted Operating

Margin2 per Barrel by 12% sequentially, new all-time highs

reflecting the continued success of electrification and cost

reduction initiatives

- Maintained a strong balance sheet with quarter-end leverage of

2.15x3 and $324 million of available liquidity under our revolving

credit facility

- Announcing a 17% increase to the quarterly dividend from $0.09

per share to $0.105 per share, reflecting consistent business

performance and confidence in the Company’s long-term outlook

“Aris had an exceptional start to 2024, continuing to build on

our momentum and strong results from last year. We grew produced

water volumes 6% sequentially and expanded our operating margins to

new highs. Our consistent performance is reflective of the hard

work of our dedicated team leveraging our critical expansive

infrastructure to support the delivery of our differentiated water

solutions,” said Amanda Brock, President and CEO of Aris.

“Aris’s long-term infrastructure contracts continue to provide

significant volume and revenue visibility. Over 80% of our revenue

is from these production-based dedication agreements in the core of

the Permian Basin from top-tier customers. We’ve steadily increased

our volumes and achieved record margins while finding ways to

better leverage our asset footprint to lower our capital spending.

Our persistent focus on efficiency is evident in our results, as

our Adjusted EBITDA grew 8% sequentially, exceeding our

expectations and guidance.

“Given our balance sheet strength, expectations for continued

growth, and confidence in our ability to increase our free cash

flow, we are pleased to announce a 17% increase to our quarterly

dividend. We expect to further reduce our capital expenditures in

the second half of 2024 and intend to evaluate additional

opportunities to increase returns to shareholders.

“While we remain focused on execution in our core environmental

infrastructure business, we are evaluating adjacent growth

opportunities and have made progress in our beneficial reuse and

mineral extraction efforts. We are successfully piloting and

developing processes to desalinate and treat produced water to

standards acceptable for aquifer replenishment, agriculture, and

industrial uses and are actively pursuing how to cost effectively

scale these technologies.

“After extensive long-term testing, Aris has identified

high-value minerals that could potentially be economically

recovered from our produced water. Aris is now assessing potential

partnership opportunities to commercialize the extraction of

certain minerals.

“Beneficial reuse and mineral extraction could expand our

markets and revenue streams, and we are excited to be taking a

leadership role in the future of the industry while executing

exceptionally well and returning cash to shareholders.”

OPERATIONS UPDATE

Three Months Ended

Three Months Ended

March 31,

December 31,

% Change

March 31,

% Change

2024

2023

2023

(thousands of barrels of water per

day)

Total Volumes

1,523

1,577

(3)

%

1,376

11

%

Produced Water Handling Volumes

1,159

1,095

6

%

971

19

%

Water Solutions Volumes

Recycled Produced Water Volumes Sold

337

401

(16)

%

258

31

%

Groundwater Volumes Sold

27

81

(67)

%

147

(82)

%

Total Water Solutions Volumes

364

482

(24)

%

405

(10)

%

Skim oil recoveries (barrels of oil per

day)

1,729

1,362

27

%

1,348

28

%

Skim oil recoveries (as a % of produced

water volumes)

0.15%

0.12%

25

%

0.14%

7

%

FINANCIAL UPDATE

Net income was $16.8 million for the first quarter of 2024

versus net income of $7.7 million in the first quarter of 2023 and

net income of $13.0 million in the fourth quarter of 2023. Adjusted

Net Income1 was $20.1 million for the first quarter of 2024 versus

$9.8 million for the first quarter of 2023 and $15.4 million in the

fourth quarter of 2023.

Adjusted EBITDA1 was $53.1 million for the first quarter of

2024, up approximately 39% from $38.1 million in the first quarter

of 2023, and up approximately 8% from $49.3 million in the fourth

quarter of 2023.

Gross Margin per Barrel for the first quarter of 2024 was $0.32

per barrel versus $0.24 per barrel in the first quarter of

2023.

Adjusted Operating Margin per Barrel2 for the first quarter of

2024 was $0.46 per barrel versus $0.39 per barrel in the first

quarter of 2023.

First quarter 2024 Capital Expenditures4 totaled approximately

$38 million versus $48 million in the first quarter of 2023.

STRONG BALANCE SHEET AND

LIQUIDITY

As of March 31, 2024, the Company had approximately $21 million

in cash and $324 million available under its revolving credit

facility for total available liquidity of $345 million. The

Company’s leverage ratio at the end of the first quarter of 2024

was 2.15X3, below the low end of its target leverage range of

2.5X-3.5X.

SECOND QUARTER 2024 DIVIDEND

INCREASE

On April 30, 2024, Aris’s Board of Directors approved a 17%

increase to Aris’s quarterly dividend to $0.105 per share. In

conjunction with the dividend payment, a distribution of $0.105 per

unit will be paid to unit holders of Solaris Midstream Holdings,

LLC. The dividend will be paid on June 20, 2024, to holders of

record of the Company’s Class A common stock as of the close of

business on June 6, 2024. The distribution to unit holders of

Solaris Midstream Holdings, LLC will be subject to the same payment

and record dates.

SECOND QUARTER 2024 FINANCIAL

OUTLOOK

“2024 is off to a strong start and we are encouraged by our

outlook for the rest of the year. The first quarter of 2024

benefited from new well connections being delivered earlier than

expected, which pulled forward produced water volumes from the

second quarter into the first. Additionally, certain flowback

volumes resulted in higher skim oil recoveries than we normally see

and certain well maintenance costs were delayed until later this

year. We estimate the EBITDA benefit to the quarter from these

items was approximately $4.0 million.

As we update our outlook for the balance of the year and

consider first quarter results, we are increasing the low-end of

our 2024 Adjusted EBITDA guidance, establishing a new range of

between $185 and $200 million,” said Amanda Brock.

For the second quarter of 2024, the Company expects:

- Produced Water Handling volumes between 1,015 and 1,045

thousand barrels of water per day

- Water Solutions volumes between 400 and 430 thousand barrels of

water per day

- Adjusted Operating Margin per Barrel2 between $0.42 and

$0.44

- Skim oil recoveries of approximately 1,200 barrels per day

- Adjusted EBITDA1 between $44 and $48 million

- Capital Expenditures4 between $38 and $43 million, consistent

with Aris’s first-half weighted capital plan; no change to Aris’s

full year capital expenditure outlook of $85 to $105 million

CONFERENCE CALL

Aris will host a conference call to discuss its first quarter

2024 results on Wednesday, May 8, 2024, at 8:00 a.m. Central Time

(9:00 a.m. Eastern Time).

Participants should call (877) 407-5792 and refer to Aris Water

Solutions, Inc. when dialing in. Participants are encouraged to log

in to the webcast or dial in to the conference call approximately

ten minutes prior to the start time. To listen via live webcast,

please visit the Investor Relations section of the Company’s

website, www.ariswater.com.

An audio replay of the conference call will be available shortly

after the conclusion of the call and will remain available for

approximately fourteen days. It can be accessed by dialing (877)

660-6853 within the United States or (201) 612-7415 outside of the

United States. The conference call replay access code is

13745332.

About Aris Water Solutions,

Inc.

Aris Water Solutions, Inc. is a leading, growth-oriented

environmental infrastructure and solutions company that directly

helps its customers reduce their water and carbon footprints. Aris

Water delivers full-cycle water handling and recycling solutions

that increase the sustainability of energy company operations. Its

integrated pipelines and related infrastructure create long-term

value by delivering high-capacity, comprehensive produced water

management, recycling and supply solutions to operators in the core

areas of the Permian Basin.

1 Adjusted Net Income, Adjusted EBITDA,

and Diluted Adjusted Net Income per Share are non-GAAP financial

measures. See the supplementary schedules in this press release for

a discussion of how we define and calculate Adjusted Net Income,

Adjusted EBITDA, and Diluted Adjusted Net Income per Share and a

reconciliation thereof to net income, the most directly comparable

GAAP measure.

2 Adjusted Operating Margin per Barrel is

a non-GAAP financial measure. See the supplementary schedules in

this press release for a discussion of how we define and calculate

Adjusted Operating Margin per Barrel and a reconciliation thereof

to gross margin, the most directly comparable GAAP measure.

3 Represents a non-GAAP financial measure.

Defined as net debt as of March 31, 2024, divided by trailing

twelve months Adjusted EBITDA. Net debt is calculated as total debt

less cash and cash equivalents. See the supplementary schedules in

this press release for a reconciliation to the most directly

comparable GAAP measure.

4 Capital Expenditures is a non-GAAP

financial measure. See the supplementary schedules in this press

release for a discussion of how we define and calculate Capital

Expenditures and a reconciliation thereof to cash paid for

property, plant, and equipment, the most directly comparable GAAP

measure.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Examples of forward-looking statements include, but are

not limited to, statements, information, opinions or beliefs

regarding our business strategy, our industry, our future

profitability, business and financial performance, including our

guidance for 2024, current and potential future long-term

contracts, legal and regulatory developments, our ability to

identify strategic acquisitions and realize expected benefits

therefrom, the development of technologies for the beneficial reuse

of produced water and related strategies, plans, objectives and

strategic pursuits and other statements that are not historical

facts. In some cases, you can identify forward-looking statements

by terminology such as “anticipate,” “guidance,” “preliminary,”

“project,” “estimate,” “expect,” “anticipate,” “continue,”

“sustain,” “will,” “intend,” “strive,” “plan,” “goal,” “target,”

“believe,” “forecast,” “outlook,” “future,” “potential,”

“opportunity,” “predict,” “may,” “visibility,” “possible,”

“should,” “could” and variations of such words or similar

expressions. Forward-looking statements are based on our current

expectations and assumptions regarding our business, the economy

and other future conditions. Because forward-looking statements

relate to the future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, our actual results may differ

materially from those contemplated or implied by the

forward-looking statements including our guidance for 2024. Factors

that could cause our actual results to differ materially from the

results contemplated by such forward-looking statements include,

but are not limited to, energy prices, the Russia-Ukraine and

Middle Eastern conflicts, macroeconomic conditions (such as

inflation) and market uncertainty related thereto, legislative and

regulatory developments, customer plans and preferences, adverse

results from litigation and the use of financial resources for

litigation defense, technological innovations and developments, and

other events discussed or referenced in our filings made from time

to time with the Securities and Exchange Commission (“SEC”),

including such factors discussed under “Risk Factors” in our most

recent Annual Report on Form 10-K, and if applicable, our

subsequent SEC filings, which are available on our Investor

Relations website at https://ir.ariswater.com/sec-filings or on the

SEC’s website at www.sec.gov/edgar. Readers are cautioned not to

place undue reliance on forward-looking statements, which speak

only as of the date hereof. All forward-looking statements,

expressed or implied, included in this presentation and any oral

statements made in connection with this presentation are expressly

qualified in their entirety by the foregoing cautionary statements.

We undertake no obligation to update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

Table 1

Aris Water Solutions,

Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

(in thousands, except for share and

Three Months Ended

per share amounts)

March 31,

2024

2023

Revenue

Produced Water Handling

$

59,106

$

46,100

Produced Water Handling — Affiliate

26,827

23,140

Water Solutions

11,702

13,882

Water Solutions — Affiliate

5,242

7,984

Other Revenue

529

465

Total Revenue

103,406

91,571

Cost of Revenue

Direct Operating Costs

39,646

43,845

Depreciation, Amortization and

Accretion

19,421

18,606

Total Cost of Revenue

59,067

62,451

Operating Costs and Expenses

Abandoned Well Costs

335

—

General and Administrative

14,501

11,799

Research and Development Expense

1,065

408

Other Operating Expense, Net

580

217

Total Operating Expenses

16,481

12,424

Operating Income

27,858

16,696

Other Expense

Interest Expense, Net

8,438

7,661

Other

1

—

Total Other Expense

8,439

7,661

Income Before Income Taxes

19,419

9,035

Income Tax Expense

2,589

1,327

Net Income

16,830

7,708

Net Income Attributable to Noncontrolling

Interest

9,207

4,330

Net Income Attributable to Aris Water

Solutions, Inc.

$

7,623

$

3,378

Net Income Per Share of Class A Common

Stock

Basic

$

0.23

$

0.11

Diluted

$

0.23

$

0.11

Weighted Average Shares of Class A Common

Stock Outstanding

Basic

30,354,014

29,935,145

Diluted

30,354,014

29,935,145

Table 2

Aris Water Solutions,

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except for share and per

share amounts)

March 31,

December 31,

2024

2023

Assets

Cash

$

20,654

$

5,063

Accounts Receivable, Net

55,426

59,393

Accounts Receivable from Affiliate

25,669

22,963

Other Receivables

11,084

12,767

Prepaids and Deposits

6,350

8,364

Total Current Assets

119,183

108,550

Fixed Assets

Property, Plant and Equipment

1,079,012

1,041,703

Accumulated Depreciation

(131,121

)

(121,989

)

Total Property, Plant and Equipment,

Net

947,891

919,714

Intangible Assets, Net

223,013

232,277

Goodwill

34,585

34,585

Deferred Income Tax Assets, Net

20,729

22,634

Right-of-Use Assets

16,454

16,726

Other Assets

5,740

5,995

Total Assets

$

1,367,595

$

1,340,481

Liabilities and Stockholders'

Equity

Accounts Payable

$

37,814

$

25,925

Payables to Affiliate

695

894

Insurance Premium Financing Liability

3,676

5,463

Accrued and Other Current Liabilities

66,903

64,416

Total Current Liabilities

109,088

96,698

Long-Term Debt, Net of Debt Issuance

Costs

422,259

421,792

Asset Retirement Obligations

20,149

19,030

Tax Receivable Agreement Liability

98,274

98,274

Other Long-Term Liabilities

16,423

16,794

Total Liabilities

666,193

652,588

Stockholders' Equity

Preferred Stock $0.01 par value,

50,000,000 authorized. None issued or outstanding as of March 31,

2024 and December 31, 2023

—

—

Class A Common Stock $0.01 par value,

600,000,000 authorized, 31,097,976 issued and 30,547,736

outstanding as of March 31, 2024; 30,669,932 issued and 30,251,613

outstanding as of December 31, 2023

310

306

Class B Common Stock $0.01 par value,

180,000,000 authorized, 27,543,565 issued and outstanding as of

March 31, 2024 and December 31, 2023

275

275

Treasury Stock (at Cost), 550,240 shares

as of March 31, 2024; 418,319 shares as of December 31, 2023

(6,714

)

(5,133

)

Additional Paid-in-Capital

333,252

328,543

Retained Earnings (Accumulated

Deficit)

4,652

(87

)

Total Stockholders' Equity Attributable to

Aris Water Solutions, Inc.

331,775

323,904

Noncontrolling Interest

369,627

363,989

Total Stockholders' Equity

701,402

687,893

Total Liabilities and Stockholders'

Equity

$

1,367,595

$

1,340,481

Table 3

Aris Water Solutions,

Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Three Months Ended

(in thousands)

March 31,

2024

2023

Cash Flow from Operating

Activities

Net Income

$

16,830

$

7,708

Adjustments to Reconcile Net Income to Net

Cash Provided by Operating Activities

Deferred Income Tax Expense

2,129

1,300

Depreciation, Amortization and

Accretion

19,421

18,606

Stock-Based Compensation

3,521

2,468

Abandoned Well Costs

335

—

Gain on Disposal of Assets, Net

(54

)

(13

)

Abandoned Projects

729

—

Amortization of Debt Issuance Costs,

Net

716

508

Other

323

180

Changes in Operating Assets and

Liabilities:

Accounts Receivable

3,371

7,951

Accounts Receivable from Affiliate

(2,706

)

18,790

Other Receivables

1,683

(332

)

Prepaids and Deposits

2,014

1,262

Accounts Payable

3,382

1,298

Payables to Affiliate

(199

)

(410

)

Accrued Liabilities and Other

(7,686

)

357

Net Cash Provided by Operating

Activities

43,809

59,673

Cash Flow from Investing

Activities

Property, Plant and Equipment

Expenditures

(19,582

)

(35,315

)

Proceeds from the Sale of Property, Plant

and Equipment

1

—

Net Cash Used in Investing

Activities

(19,581

)

(35,315

)

Cash Flow from Financing

Activities

Dividends and Distributions Paid

(5,449

)

(5,373

)

Repurchase of Shares

(1,310

)

(599

)

Repayment of Credit Facility

(15,000

)

(9,000

)

Proceeds from Credit Facility

15,000

15,000

Payment of Insurance Premium Financing

(1,878

)

—

Net Cash (Used in) Provided by

Financing Activities

(8,637

)

28

Net Increase in Cash

15,591

24,386

Cash, Beginning of Period

5,063

1,122

Cash, End of Period

$

20,654

$

25,508

Use of Non-GAAP Financial

Information

The Company uses financial measures that are not calculated in

accordance with U.S. generally accepted accounting principles

(“GAAP”), including Adjusted EBITDA, Adjusted Operating Margin,

Adjusted Operating Margin per Barrel, Adjusted Net Income, net debt

and leverage ratio, and Capital Expenditures. Although these

Non-GAAP financial measures are important factors in assessing the

Company’s operating results and cash flows, they should not be

considered in isolation or as a substitute for net income or gross

margin or any other measures prepared under GAAP.

The Company calculates Adjusted EBITDA as net income (loss)

plus: interest expense; income taxes; depreciation, amortization

and accretion expense; abandoned well costs, asset impairment and

abandoned project charges; losses on the sale of assets;

transaction costs; research and development expense; change in

payables related to the Tax Receivable Agreement liability as a

result of state tax rate changes; loss on debt modification;

stock-based compensation expense; and other non-recurring or

unusual expenses or charges (such as temporary power costs,

litigation expenses and severance costs), less any gains on the

sale of assets.

The Company calculates Adjusted Operating Margin as Gross Margin

plus depreciation, amortization and accretion and temporary power

costs. The Company defines Adjusted Operating Margin per Barrel as

Adjusted Operating Margin divided by total volumes handled, sold or

transferred.

The Company calculates Adjusted Net Income as Net Income (Loss)

plus the after-tax impacts of stock-based compensation and plus or

minus the after-tax impacts of certain items affecting

comparability, which are typically noncash and/or nonrecurring

items. The Company calculated Diluted Adjusted Net Income Per Share

as (i) Net Income (Loss) plus the after-tax impacts of stock-based

compensation and plus or minus the after-tax impacts of certain

items affecting comparability, which are typically noncash and/or

nonrecurring items, divided by (ii) the diluted weighted-average

shares of Class A common stock outstanding, assuming the full

exchange of all outstanding LLC interests, adjusted for the

dilutive effect of outstanding equity-based awards.

For the quarter ended March 31, 2024, the Company calculates its

leverage ratio as net debt as of March 31, 2024, divided by

Adjusted EBITDA for the trailing twelve months. Net debt is

calculated as the principal amount of total debt outstanding as of

March 31, 2024, less cash and cash equivalents as of March 31,

2024.

The Company calculates Capital Expenditures as cash capital

expenditures for property, plant, and equipment additions less

changes in accrued capital costs.

The Company believes these presentations are used by investors

and professional research analysts for the valuation, comparison,

rating, and investment recommendations of companies within its

industry. Similarly, the Company’s management uses this information

for comparative purposes as well. Adjusted EBITDA, Adjusted

Operating Margin, Adjusted Operating Margin per Barrel, Adjusted

Net Income, and Capital Expenditures are not measures of financial

performance under GAAP and should not be considered as measures of

liquidity or as alternatives to net income (loss), gross margin, or

cash paid for property, plant and equipment. Additionally, these

presentations as defined by the Company may not be comparable to

similarly titled measures used by other companies and should be

considered in conjunction with net income (loss) and other measures

prepared in accordance with GAAP, such as gross margin, operating

income, net income, cash paid for property, plant, and equipment or

cash flows from operating activities.

Although we provide forecasts for the non-GAAP measures Adjusted

EBITDA, Adjusted Operating Margin per Barrel, and Capital

Expenditures, we are not able to forecast their most directly

comparable measures (net income, gross margin, and cash paid for

property, plant, and equipment) calculated and presented in

accordance with GAAP without unreasonable effort. Certain elements

of the composition of forward-looking non-GAAP metrics are not

predictable, making it impractical for us to forecast. Such

elements include but are not limited to non-recurring gains or

losses, unusual or non-recurring items, income tax benefit or

expense, or one-time transaction costs and cost of revenue, which

could have a significant impact on the GAAP measures. The

variability of the excluded items may have a significant, and

potentially unpredictable, impact on our future GAAP results. As a

result, no reconciliation of forecasted non-GAAP measures is

provided.

Table 4

Aris Water Solutions,

Inc.

Operating Metrics

(Unaudited)

Three Months Ended

March 31,

December 31,

2024

2023

2023

(thousands of barrels of water per

day)

Produced Water Handling Volumes

1,159

971

1,095

Water Solutions Volumes

Recycled Produced Water Volumes Sold

337

258

401

Groundwater Volumes Sold

27

147

81

Total Water Solutions Volumes

364

405

482

Total Volumes

1,523

1,376

1,577

Per Barrel Operating Metrics (1)

Produced Water Handling Revenue/Barrel

$

0.81

$

0.79

$

0.79

Water Solutions Revenue/Barrel

$

0.51

$

0.60

$

0.54

Revenue/Barrel of Total Volumes (2)

$

0.74

$

0.74

$

0.71

Direct Operating Costs/Barrel

$

0.29

$

0.35

$

0.31

Gross Margin/Barrel

$

0.32

$

0.24

$

0.27

Adjusted Operating Margin/Barrel

$

0.46

$

0.39

$

0.41

(1) Per Barrel operating metrics are

calculated independently. Therefore, the sum of individual amounts

may not equal the total presented.

(2) Does not include Other Revenue.

Table 5

Aris Water Solutions,

Inc.

Reconciliation of Net Income

to Non-GAAP Adjusted EBITDA

(Unaudited)

Three Months Ended

(in thousands)

March 31,

2024

2023

Net Income

$

16,830

$

7,708

Interest Expense, Net

8,438

7,661

Income Tax Expense

2,589

1,327

Depreciation, Amortization and

Accretion

19,421

18,606

Abandoned Well Costs

335

—

Stock-Based Compensation

3,521

2,468

Abandoned Projects

729

—

Gain on Disposal of Assets, Net

(54

)

(13

)

Transaction Costs

7

45

Research and Development Expense

1,065

408

Other

227

(104

)

Adjusted EBITDA

$

53,108

$

38,106

Table 6

Aris Water Solutions,

Inc.

Reconciliation of Gross Margin

to Adjusted Operating Margin and

Adjusted Operating Margin per

Barrel

(Unaudited)

Three Months Ended

(in thousands)

March 31,

2024

2023

Total Revenue

$

103,406

$

91,571

Cost of Revenue

(59,067

)

(62,451

)

Gross Margin

44,339

29,120

Depreciation, Amortization and

Accretion

19,421

18,606

Adjusted Operating Margin

$

63,760

$

47,726

Total Volumes (thousands of barrels)

138,603

123,815

Adjusted Operating Margin/BBL

$

0.46

$

0.39

Table 7

Aris Water Solutions,

Inc.

Reconciliation of Net Income

to Non-GAAP Adjusted Net Income

(Unaudited)

Three Months Ended

(in thousands)

March 31,

2024

2023

Net Income

$

16,830

$

7,708

Adjusted items:

Abandoned Well Costs

335

—

Gain on Disposal of Assets, Net

(54

)

(13

)

Stock-Based Compensation

3,521

2,468

Tax Effect of Adjusting Items (1)

(507

)

(326

)

Adjusted Net Income

$

20,125

$

9,837

(1) Estimated tax effect of adjusted items

allocated to Aris based on statutory rates.

Table 8

Aris Water Solutions,

Inc.

Reconciliation of Diluted Net

Income Per Share to Non-GAAP Diluted Adjusted Net Income Per

Share

(Unaudited)

Three Months Ended

March 31,

2024

2023

Diluted Net Income Per Share of Class A

Common Stock

$

0.23

$

0.11

Adjusted items:

Reallocation of Net Income Attributable to

Noncontrolling Interests From the Assumed Exchange of LLC

Interests

0.05

0.03

Abandoned Well Costs

0.01

—

Gain on Disposal of Assets, Net

—

—

Stock-Based Compensation

0.06

0.04

Tax Effect of Adjusting Items (1)

(0.01

)

(0.01

)

Diluted Adjusted Net Income Per Share

$

0.34

$

0.17

(1) Estimated tax effect of adjusted items

allocated to Aris based on statutory rates.

Diluted Weighted Average Shares of Class A

Common Stock Outstanding

30,354,014

29,935,145

Adjusted Items:

Assumed Redemption of LLC Interests

27,543,565

27,568,302

Dilutive Performance-Based Stock Units

(2)

—

—

Diluted Adjusted Fully Weighted Average

Shares of Class A Common Stock Outstanding

57,897,579

57,503,447

(2) Dilutive impact of Performance-Based

Stock Units already included for the three months ended March 31,

2024 and 2023.

Table 9

Aris Water Solutions,

Inc.

Computation of Leverage

Ratio

(Unaudited)

As of

(in thousands)

March 31, 2024

Principal Amount of Debt at March 31,

2024

$

429,676

Less: Cash at March 31, 2024

(20,654

)

Net Debt

$

409,022

Net Debt

$

409,022

÷ Trailing Twelve Months Adjusted

EBITDA

189,974

Leverage Ratio

2.15

Table 10

Aris Water Solutions,

Inc.

Reconciliation of Capital

Expenditures

(Unaudited)

Three Months Ended

March 31,

(in thousands)

2024

2023

Cash Paid for Property, Plant and

Equipment

$

19,582

$

35,315

Change in Capital Related Accruals

18,134

12,659

Capital Expenditures

$

37,716

$

47,974

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507674748/en/

David Tuerff Senior Vice President, Finance and Investor

Relations (281) 501-3070 IR@ariswater.com

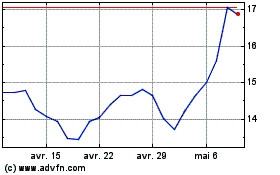

Aris Water Solutions (NYSE:ARIS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Aris Water Solutions (NYSE:ARIS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024