G2 Goldfields Inc. (“

G2” or the

“

Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to

provide an update on the ongoing exploration program at the

Company’s 27,719-acre OKO-AREMU gold project. G2 recently announced

an updated Mineral Resource Estimate (“

MRE”) for

the OKO-Aremu project comprised of

922,000 ounces of

gold (“

Indicated”) and

1,099,000

ounces of gold (“

Inferred”) [press

release dated April 03, 2024].

Figure 1

G2’s OKO gold resource lies along a prominent 2.5 km long

north-south structure which is defined by the high grade OMZ

resource to the north [688,000 ounces Au @ 9.03 g/t Au (Indicated)

and 495,000 ounces Au at 6.38 g/t Au (Inferred)] and the Ghanie

open pit and underground resource to the south. G2 is currently

drilling the southern half of the structure, where results

demonstrate significant potential for the expansion of the

established resource.

An ongoing 30,000 metre drill program at the Ghanie district

continues to intercept both new near surface mineralization as well

as high-grade shoots at vertical depths between 200 and 400 metres.

The results for thirteen new drill holes are included in this

release (a full table is available here).

Highlights include:

|

Hole ID |

From |

To |

Int (m) |

Au g/t |

|

| GDD-96 |

403.0 |

417.5 |

14.5 |

3.5 |

|

| Incl. |

413.5 |

416.0 |

2.5 |

8.2 |

|

| |

|

|

|

|

|

| GDD-98 |

428.5 |

429.0 |

0.5 |

17.5 |

|

| GDD-98 |

501.5 |

512.0 |

10.5 |

4.6 |

|

| incl. |

509.0 |

510.5 |

1.5 |

14.2 |

|

| |

|

|

|

|

|

| GDD-101 |

321.5 |

340.0 |

18.5 |

2.2 |

|

| Incl. |

337.2 |

340.0 |

2.8 |

9.7 |

|

| |

|

|

|

|

|

| GDD-105 |

451.0 |

453.0 |

2.0 |

20.9 |

|

| GDD-105 |

497.5 |

500.4 |

2.9 |

19.8 |

|

| GDD-105 |

544.5 |

553.9 |

9.4 |

5.5 |

|

| Incl. |

546.0 |

549.0 |

3.0 |

11.7 |

|

| |

|

|

|

|

|

| GDD-109 |

36.5 |

41.8 |

5.3 |

9.2 |

|

| Incl. |

40.9 |

41.8 |

0.9 |

45.0 |

|

| GDD-109 |

200.7 |

224.5 |

23.8 |

1.9 |

|

| Incl. |

215.5 |

223.0 |

7.5 |

4.2 |

|

| |

|

|

|

|

|

| GDD-110 |

198.0 |

216.0 |

18.0 |

6.7 |

|

| Incl. |

201.0 |

204.0 |

3.0 |

15.9 |

|

| Incl. |

211.5 |

214.5 |

3.0 |

21.5 |

|

The intercepts reported are down-hole widths.

True widths are estimated between 75% and _85% of reported

down-hole widths. Gold grades are uncapped.

Drilling was successful in demonstrating the down plunge

continuity of gold mineralization in Ghanie north, central, and

south and also in discovering new near surface mineralization

(GDD-109).

Figure 2

Figure 3

Discussion

Ghanie North

|

GDD-109 |

|

9.2 g/t Au |

over |

5.3 m |

(36.5 m to 41.8 m) |

|

|

|

and |

4.2 g/t Au |

over |

7.5 m |

(215.5 m to 223.0 m) |

|

|

|

|

|

|

|

|

|

|

GDD-110 |

|

6.7 g/t Au |

over |

18.0 m |

(198.0 m to 216.0 m) |

|

|

|

inc. |

15.9 g/t Au |

over |

3.0 m |

(201.0 m to 204.0 m) |

|

| |

inc. |

21.5 g/t Au |

over |

3.0 m |

(211.5 m to 214.5 m) |

|

| |

|

|

|

|

|

|

Hole GDD-110 intercepted an emerging high-grade shoot in the

Ghanie north area with two significant +15 g/t Au intercepts in a

previously unexplored area approximately 150 metres below

surface.

Hole GDD-109 was designed to target the down plunge

mineralization discovered in GDD-93 (5.5 g/t Au over 24.5m) and, as

well as meeting its primary objective, also intercepted a parallel

zone of mineralization from only 32.5 metres downhole which

returned 9.2 g/t Au over 5.3 metres.

Ghanie Central

The central zone was further defined and extended by drill holes

GDD-98, 101, and 105. The most significant intercept was in hole

105 which hit three high grade zones within a 100-meter core

interval and opened up the central zone both to the north and to

depth.

|

GDD-105 |

|

20.9 g/t Au |

over |

2.0 m |

(451.0 m to 453.0 m) |

|

| |

and |

19.8 g/t Au |

over |

2.9 m |

(497.5 m to 500.4 m) |

|

| |

and |

5.5 g/t Au |

over |

9.4 m |

(544.5 m to 553.9 m) |

|

| |

|

|

|

|

|

|

Ghanie South

Drilling at Ghanie South targeted the down plunge extension of

the high grade mineralisation reported in hole GDD 68A (11m @ 37.9

g/t Au) [press release dated October 10, 2023], intersecting lower

grade mineralisation hosted in sandstones and andesites (holes

GDD-97, 99b, and 102). Drilling targeting further down plunge is

expected to intersect mineralisation hosted within the Magnetite

rich meta-basalts, which host the higher-grade mineralisation in

the Ghanie Central and North zones.

Dan Noone, G2 CEO, stated, “These results continue to

demonstrate that G2 remains very much a growth story, albeit one

with an established high grade resource. Multiple gold bearing

structures remain open along the +1 km Ghanie trend and in the

coming months we look forward to continuing to expand our gold

resources in the OKO district.”

QA/QC

Drill core is logged and sampled in a secure core storage

facility located on the OKO project site, Guyana. Core samples from

the program are cut in half, using a diamond cutting saw, and are

sent to MSALABS Guyana, in Georgetown, Guyana, which is an

accredited mineral analysis laboratory, for analysis. Samples from

sections of core with obvious gold mineralisation are analysed for

total gold using an industry-standard 500g metallic screen fire

assay (MSALABS method MSC 550). All other samples are analysed for

gold using standard Fire Assay-AA with atomic absorption finish

(MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are

analysed utilizing standard fire assay gravimetric methods (MSALABS

method; FAS-425). Certified gold reference standards, blanks, and

field duplicates are routinely inserted into the sample stream, as

part of G2 Goldfield’s quality control/quality assurance program

(QAQC). No QA/QC issues were noted with the results reported

herein.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have

been directly responsible for the discovery of millions of ounces

of gold in Guyana as well as the financing and development of the

Aurora Gold Mine, Guyana’s largest gold mine [RPA, 43-101,

Technical Report on the Aurora Gold Mine, March 31, 2020].

Anglo Gold Ashanti (“AGA”), the fourth largest

gold producer in the world, recently made a substantial investment

in the Company. At the close of the Subscription, AGA (NYSE: AU)

owned approximately 11.7% of G2’s issued and outstanding Shares

[see press release dated January 19, 2024].

In April 2024, G2 announced an Updated Mineral Resource Estimate

(“MRE”) for the Oko property in Guyana [see press

release dated April 03, 2024]. Highlights of the Updated MRE

include:

Total combined open pit and underground Resource for the Oko

Main Zone (OMZ):

- 495,000 oz. Au –

Inferred contained within 2,413,000 tonnes @ 6.38 g/t Au

- 686,000 oz. Au –

Indicated contained within 2,368,000 tonnes @ 9.03 g/t Au

Total combined open pit and underground Resource for

the Ghanie Zone:

- 604,000 oz. Au –

Inferred contained within 12,216,000 tonnes @ 1.54 g/t Au

- 236,000 oz. Au –

Indicated contained within 3,344,000 tonnes @ 2.20 g/t Au

The MRE was prepared by Micon International Limited with an

effective date of March 27, 2024. Significantly, the updated

mineral resources lie within 500 meters of surface. The Oko

district has been a prolific alluvial goldfield since its initial

discovery in the 1870’s, and modern exploration techniques continue

to reveal the considerable potential of the district.

All scientific and technical information in this news release

has been reviewed and approved by Dan Noone (CEO of G2 Goldfields

Inc.), a “qualified person” within the meaning of National

Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of

the Australian Institute of Geoscientists.

Additional information about the Company is available on

SEDAR (www.sedar.com) and the

Company's website

(www.g2goldfields.com).

For further information, please

contact:

Dan Noone CEO +1 416.628.5904news@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking information

and statements within the meaning of applicable securities laws.

The use of any of the words “expect”, “anticipate”, “continue”,

“estimate”, “may”, “might”, “will”, “project”, “should”, “believe”,

“plans”, “intends” and similar expressions are intended to identify

forward-looking information and/or statements. Forward-looking

statements and/or information are based on a number of material

factors, expectations and/or assumptions of G2 Goldfields which

have been used to develop such statements and/or information, but

which may prove to be incorrect. Although G2 Goldfields believes

that the expectations reflected in such forward-looking statements

and/or information are reasonable, undue reliance should not be

placed on forward-looking statements as G2 Goldfields can give no

assurance that such expectations will prove to be correct. In

addition to other factors and assumptions which may be identified

herein assumptions have been made regarding, among other things:

results from planned exploration and drilling activities; future

plans for operational expenditures; the accuracy of the

interpretations of exploration and drilling activity results;

availability of financing to fund current and future plans and

expenditures; the impact of increasing competition; the general

stability of the economic and political environment in which G2

Goldfields has property interests; the general continuance of

current industry conditions; the timely receipt of any required

regulatory approvals; the ability of G2 Goldfields to obtain

qualified staff, equipment and/or services in a timely and cost

efficient manner; the ability of the operator of each project in

which G2 Goldfields has property interests to operate in a safe,

efficient and/or effective manner and to fulfill its respective

obligations and current plans; future commodity prices; currency,

exchange and/or interest rates; and the regulatory framework

regarding royalties, taxes and/or environmental matters in the

jurisdictions in which G2 Goldfields has property interests. The

forward-looking information and statements included in this news

release are not guarantees of future performance and should not be

unduly relied upon. Such information and/or statements, including

the assumptions made in respect thereof, involve known and unknown

risks, uncertainties and other factors that may cause actual

results and/or events to differ materially from those anticipated

in such forward-looking information and/or statements including,

without limitation: risks associated with the uncertainty of

exploration results and estimates, currency fluctuations, the

uncertainty of conducting operations under a foreign regime,

exploration risk, the uncertainty of obtaining all applicable

regulatory approvals, the availability of labour and/or equipment,

the fluctuating prices of commodities, the availability of

financing and dependence on the management personnel of the

Corporation, other participants in the property areas and/or

certain other risks detailed from time-to-time in G2 Goldfields

public disclosure documents (including, without limitation, those

risks identified in this news release and G2 Goldfields current

management’s discussion and analysis). Furthermore, the

forward-looking statements contained in this news release are made

as at the date of this news release and the Corporation does not

undertake any obligations to publicly update and/or revise any of

the included forward-looking statements, whether as a result of

additional information, future events and/or otherwise, except as

may be required by applicable securities laws.

Neither the TSX nor its Regulation Services Provider (as that

term is defined in the policies of the TSX) accepts responsibility

for the adequacy and / or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3252833f-e6cd-4cba-b765-b320cddbe8f8

https://www.globenewswire.com/NewsRoom/AttachmentNg/62cfe8bd-ec0a-413d-9520-6a1611457654

https://www.globenewswire.com/NewsRoom/AttachmentNg/799713e7-26b6-4d6d-aff5-13012ca3ac06

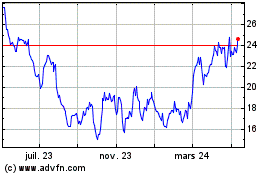

AngloGold Ashanti (NYSE:AU)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

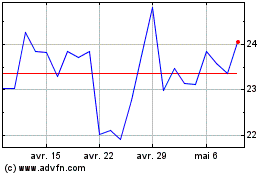

AngloGold Ashanti (NYSE:AU)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025