Strong Aerospace Aftermarket Drives Top-line Growth

Comparisons are year-over-year unless noted otherwise

Third Quarter 2024:

- Sales of $388 million, up 7%; Organic Sales up 4%

- Operating Margin of 10.8%; Adjusted Operating Margin of 12.3%,

up 150 bps

- Adjusted EBITDA Margin of 19.8%, up 140 bps

- GAAP EPS of -$0.04; Adjusted EPS of $0.09, down 52%

Barnes Group Inc. (NYSE: B), a global provider of highly

engineered products, differentiated industrial technologies, and

innovative solutions, today reported financial results for the

third quarter of 2024.

“In the third quarter, despite ongoing production delays from

aircraft manufacturers, our Aerospace OEM business generated

extraordinarily strong orders in anticipation of a future industry

re-ramp. Meanwhile, our Aerospace aftermarket business continues to

deliver robust performance on strong top-line growth. With the MB

Aerospace integration and synergies progressing ahead of plan, we

are delivering on our strategy to scale Aerospace and transform

Barnes,” said Thomas J. Hook, President and Chief Executive Officer

of Barnes. “Over the last eighteen months, we have taken numerous

actions to unlock the underlying value of Barnes by growing

Aerospace, simplifying Industrial, investing in our businesses, and

streamlining costs. Collectively, these actions have helped to

position us for long-term profitable growth and led to outside

interest in Barnes. As such, we are excited about our pending

acquisition by Apollo Funds.”

Barnes to be Acquired by Apollo Funds

As announced on October 7, 2024, Barnes has entered into a

definitive agreement to be acquired by funds managed by affiliates

of Apollo Global Management, Inc. (NYSE: APO) (“Apollo”) (the

“Apollo Funds”) in an all-cash transaction that values Barnes at an

enterprise value of approximately $3.6 billion. Under the terms of

the agreement, Barnes shareholders will receive $47.50 per share in

cash. The transaction is subject to customary closing conditions,

including approval by Barnes shareholders and receipt of required

regulatory approvals. The transaction is expected to close in the

first quarter of 2025.

Third Quarter 2024 Highlights

Sales of $388 million were up 7% versus the same quarter a year

ago, with organic growth of 4%. The net beneficial impact of

acquisition and divestiture related sales was approximately 3%,

while foreign exchange increased sales by approximately 1%.

Adjusted operating income of $47.9 million increased 23% and

adjusted operating margin of 12.3% increased 150 bps. Adjusted

operating income excludes restructuring and transformation-related

charges of $3.8 million, additional costs related to the sale of

Associated Spring and Hänggi of $1.7 million, and MB Aerospace

short-term purchase accounting adjustments of $0.6 million.

Adjusted EBITDA was $76.9 million, up 16% from a year ago and

adjusted EBITDA margin was 19.8%, up 140 bps.

Interest expense was $19.6 million, down 14% from $22.8 million

a year ago due to last year’s one-time bridge financing fees of

$9.5 million that were included in interest expense, offset in part

by higher average borrowings from the purchase of MB Aerospace and

a higher average interest rate given the recapitalization of the

Company’s debt structure.

The Company's effective tax rate for the third quarter of 2024

was 110% driven by a $7.4 million tax provision related to the

Income Inclusion Rule under Pillar Two which significantly reduces

the benefit of tax holidays especially in Malaysia, a Canadian

discrete tax item of $3.0 million, and the non-deductibility of

transaction costs associated with the Company’s pending sale to

Apollo Funds impacting tax by $1.6 million.

Net loss was $2.1 million, or -$0.04 per share, compared to a

net loss of $21.7 million, or -$0.43 per share in the prior year.

On an adjusted basis, net income per share of $0.09 was down 53%

from $0.19. Adjusted net income per share excludes $0.06 of

restructuring and transformation-related charges, a $0.03

adjustment to the loss on sale of Associated Spring and Hänggi,

$0.03 of income tax effects on non-deductible merger costs, and

$0.01 of MB Aerospace short-term purchase accounting

adjustments.

Year-to-date cash provided by operating activities was $49.8

million versus $71.0 million a year ago. The decrease from the

prior year was primarily due to an increase in working capital and

divestiture related income tax payments. Capital expenditures of

$41.8 million year-to-date increased $4.4 million over the prior

year, driven by investments related to the Company’s restructuring

program and investments for growth. Year-to-date free cash flow,

adjusted for the tax payments related to the divestiture, was $20.4

million.

Segment Performance

Aerospace

Third quarter sales in the Aerospace segment were $232 million,

up 49%. Organic sales increased 9%, and acquisition related sales

added 39%. Aerospace original equipment manufacturing (“OEM”) sales

increased 38%, while aftermarket sales increased 67%. On an organic

basis, OEM sales decreased 1% and aftermarket sales increased 27%.

Segment operating profit was $35.3 million versus $3.6 million a

year ago. Adjusted operating profit of $36.3 million was up 55%,

while adjusted operating margin increased 70 bps to 15.7%. Adjusted

operating profit excludes restructuring and transformation related

charges of $0.4 million and MB Aerospace short-term purchase

accounting adjustments of $0.6 million. Adjusted operating profit

benefited from the contribution of higher organic sales volumes,

inclusive of pricing, the contribution of MB Aerospace sales, and

positive productivity, partially offset by the amortization of

long-term acquired intangibles. Aerospace adjusted EBITDA was $55.9

million, up 52%, and adjusted EBITDA margin was 24.1%, up 60 bps

from a year ago.

Aerospace OEM backlog ended the third quarter at $1.80 billion,

up 19% sequentially from June 2024 on a strong book-to-bill of 2.9

times.

Industrial

Third quarter sales in the Industrial segment were $156 million,

down 24% primarily due to the sale of the Associated Spring and

Hänggi businesses. On an organic basis, sales were up 1% from a

year ago. Operating profit was $6.5 million versus $6.4 million in

the prior year. Adjusted operating profit was $11.6 million, down

26%, and adjusted operating margin was 7.4%, down 20 bps. The lower

adjusted operating profit reflects divested profits from the sale

of the Associated Spring and Hänggi businesses and lower

productivity, partially offset by positive pricing. Adjusted

operating profit excludes restructuring and transformation-related

charges of $3.4 million and additional costs related to the sale of

Associated Spring and Hänggi of $1.7 million. Adjusted EBITDA was

$21.6 million, down 25% from a year ago, and adjusted EBITDA margin

was 13.9%, down 20 bps.

Leverage

Barnes’ “Net Debt to EBITDA” ratio, as defined in our credit

agreements, was 3.35 times on September 30, 2024, down from 3.48

times on June 30, 2024.

Canceled Third Quarter 2024 Earnings Call and Suspension of

Guidance

Given the pending acquisition of Barnes by Apollo Funds, the

Company will not be conducting a third quarter 2024 conference call

and webcast. In addition, Barnes is suspending its financial

guidance for the full year 2024.

Non-GAAP Financial Measures

The financial statements included within this press release are

prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP” or “U.S. GAAP”).

The Company provides additional information with respect to certain

non-GAAP financial measures, which include organic sales growth,

adjusted operating profit, adjusted operating margin, adjusted

EBITDA, adjusted EBITDA margin, adjusted EPS and Free Cash Flow.

While these financial measures do not constitute U.S. GAAP

measures, nor are they a substitute for U.S. GAAP measures, we

believe they provide useful information to investors in

understanding the ongoing operating performance of the Company.

Investors should consider non-GAAP measures in addition to, not as

a substitute for, or as superior to, measures of financial

performance prepared in accordance with U.S. GAAP. Tables

reconciling non-GAAP to GAAP financial measures, including forward

looking outlook information, are presented at the end of this press

release. The Company believes that these non-GAAP measures provide

useful information to investors:

- Organic sales growth represents the total reported sales

increase within the Company’s ongoing businesses less the impact of

foreign currency translation and acquisitions/divestitures

completed in the preceding twelve months. Management believes that

organic sales growth provides an indication of baseline revenue

performance and growth.

- Adjusted operating profit, adjusted operating margin and

adjusted EPS provide an indication of our baseline profit

performance. Management believes that these metrics are useful to

investors as they exclude items that do not reflect our ongoing

results.

- Adjusted EBITDA and Adjusted EBITDA margin provide adjusted

earnings before interest, income tax, depreciation and

amortization. Through acquisitions, the Company has incurred

significant amortization expense (acquired intangible assets) and

additional interest expense from debt-funded acquisitions.

Management believes these financial metrics are useful to investors

as they exclude the impact of these items.

- Free Cash Flow is defined by the Company as net cash provided

by operating activities less capital expenditures. The Company

believes that the free cash flow metric represents a measure of

cash generated by business operations that can be used to invest in

future growth, pay dividends, repurchase stock and reduce debt.

This metric can also be used to evaluate the Company's ability to

generate cash flow from business operations and the impact that

this cash flow has on the Company's liquidity.

About Barnes

Barnes Group Inc. (NYSE: B) leverages world-class manufacturing

capabilities and market-leading engineering to develop advanced

processes, automation solutions, and applied technologies for

industries ranging from aerospace and medical & personal care

to mobility and packaging. With a celebrated legacy of pioneering

excellence, Barnes delivers exceptional value to customers through

advanced manufacturing capabilities and cutting-edge industrial

technologies. Barnes Aerospace specializes in the production and

servicing of intricate fabricated and precision-machined components

for both commercial and military turbine engines, nacelles, and

airframes. Barnes Industrial excels in advancing the processing,

control, and sustainability of engineered plastics and delivering

innovative, custom-tailored solutions for industrial automation and

metal forming applications. Established in 1857 and headquartered

in Bristol, Connecticut, USA, the Company has manufacturing and

support operations around the globe. For more information, visit

please visit www.onebarnes.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements often address our expected

future operating and financial performance and financial condition,

and often contain words such as “anticipate,” “believe,” “expect,”

“plan,” “estimate,” “project,” “continue,” “will,” “should,” “may,”

and similar terms. These forward-looking statements do not

constitute guarantees of future performance and are subject to a

variety of risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. These risks and uncertainties include, among others:

the occurrence of any event, change or other circumstances that

could give rise to the termination of the Agreement and Plan of

Merger (the “Merger Agreement”) pursuant to which the Company has

agreed to be acquired by funds managed by affiliates of Apollo

Global Management, Inc. (the “Merger”) or extend the anticipated

timetable for completion of the Merger; the failure to obtain

approval of the proposed Merger from the Company’s shareholders or

certain required regulatory approvals or the failure to satisfy any

of the other closing conditions to the completion of the Merger

within the expected timeframes or at all; risks related to

disruption of management’s attention from the Company’s ongoing

business operations due to the Merger; the risk of any unexpected

costs or expenses resulting from the Merger; the risk of any

litigation relating to the Merger; the effect of the announcement

of the Merger on the ability of the Company to retain and hire key

personnel and maintain relationships with its customers, suppliers

and others with whom it does business, or on its operating results

and business generally; the Company’s ability to manage economic,

business and geopolitical conditions, including rising interest

rates, global price inflation and shortages impacting the

availability of materials; the duration and severity of unforeseen

events such as an epidemic or a pandemic, including their impacts

across our business on demand, supply chains, operations and

liquidity; failure to successfully negotiate collective bargaining

agreements or potential strikes, work stoppages or other similar

events; changes in market demand for our products and services;

rapid technological and market change; the ability to protect and

avoid infringing upon intellectual property rights; challenges

associated with the introduction or development of new products or

transfer of work; higher risks in global operations and markets;

the impact of intense competition; the physical and operational

risks from natural disasters, severe weather events, and climate

change which may limit accessibility to sufficient water resources,

outbreaks of contagious diseases and other adverse public health

developments; acts of war, terrorism and other international

conflicts; the failure to achieve anticipated cost savings and

benefits associated with workforce reductions and restructuring

actions; currency fluctuations and foreign currency exposure;

impacts from goodwill impairment and related charges; our

dependence upon revenues and earnings from a small number of

significant customers; a major loss of customers; inability to

realize expected sales or profits from existing backlog due to a

range of factors, including changes in customer sourcing decisions,

material changes, production schedules and volumes of specific

programs; the impact of government budget and funding decisions;

our ability to successfully integrate and achieve anticipated

synergies associated with recently announced and future

acquisitions, including the acquisition of MB Aerospace;

government-imposed sanctions, tariffs, trade agreements and trade

policies; changes or uncertainties in laws, regulations, rates,

policies or interpretations that impact the Company’s business

operations or tax status, including those that address climate

change, environmental, health and safety matters, and the materials

processed by our products or their end markets; fluctuations in the

pricing or availability of raw materials, freight, transportation,

energy, utilities and other items required by our operations; labor

shortages or other business interruptions at transportation

centers, shipping ports, our suppliers’ facilities or our

facilities; disruptions in information technology systems,

including as a result of cybersecurity attacks or data security

breaches; the ability to hire and retain senior management and

qualified personnel; the continuing impact of prior acquisitions

and divestitures, and any ongoing and future strategic actions, and

our ability to achieve the financial and operational targets set in

connection with any such actions; the ability to achieve social and

environmental performance goals; the outcome of pending and future

litigation and governmental proceedings; the impact of actual,

potential or alleged defects or failures of our products or

third-party products within which our products are integrated,

including product liabilities, product recall costs and uninsured

claims; future repurchases of common stock; future levels of

indebtedness; the impact of shareholder activism; and other risks

and uncertainties described in documents filed with or furnished to

the Securities and Exchange Commission (“SEC”) by the Company,

including, among others, those in the Management's Discussion and

Analysis of Financial Condition and Results of Operations and Risk

Factors sections of the Company's filings. The Company assumes no

obligation to update its forward-looking statements.

Category: Earnings

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF (LOSS)

INCOME (Dollars in thousands, except per share data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

% Change

2024

2023

% Change

Net sales

$

387,794

$

360,988

7.4

$

1,200,664

$

1,035,329

16.0

Cost of sales

259,402

253,490

2.3

817,686

704,358

16.1

Selling and administrative expenses

84,920

97,508

(12.9

)

255,314

271,688

(6.0

)

Goodwill impairment charge

-

-

-

53,694

-

100.0

Costs (gain) related to the sale of businesses

1,651

-

100.0

(5,420

)

-

NM

345,973

350,998

(1.4

)

1,121,274

976,046

14.9

Operating income

41,821

9,990

318.6

79,390

59,283

33.9

Operating margin

10.8

%

2.8

%

6.6

%

5.7

%

Interest expense

19,573

22,792

(14.1

)

65,216

34,612

88.4

Other expense (income), net

517

(874

)

NM

1,367

(2,427

)

NM

Income (loss) before income taxes

21,731

(11,928

)

NM

12,807

27,098

(52.7

)

Income taxes

23,875

9,802

143.6

59,824

18,318

226.6

Net (loss) income

$

(2,144

)

$

(21,730

)

(90.1

)

$

(47,017

)

$

8,780

(635.5

)

Common dividends

$

8,132

$

8,107

0.3

$

24,361

$

24,302

0.2

Per common share: Net (loss) income: Basic

$

(0.04

)

$

(0.43

)

(90.7

)

$

(0.92

)

$

0.17

(641.2

)

Diluted

(0.04

)

(0.43

)

(90.7

)

(0.92

)

0.17

(641.2

)

Dividends

0.16

0.16

-

0.48

0.48

-

Weighted average common shares outstanding: Basic

51,302,818

51,057,979

0.5

51,276,280

51,033,181

0.5

Diluted

51,302,818

51,057,979

0.5

51,276,280

51,223,978

0.1

NM - Not meaningful

BARNES GROUP INC.

OPERATIONS BY REPORTABLE BUSINESS SEGMENT (Dollars in

thousands) (Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

% Change

2024

2023

% Change

Net sales Aerospace

$

231,934

$

156,090

48.6

$

671,262

$

395,362

69.8

Industrial

155,864

204,898

(23.9

)

529,406

639,977

(17.3

)

Intersegment sales

(4

)

-

(4

)

(10

)

Total net sales

$

387,794

$

360,988

7.4

$

1,200,664

$

1,035,329

16.0

Operating profit (loss) Aerospace

$

35,319

$

3,622

875.1

$

95,749

$

38,953

145.8

Industrial

6,502

6,368

2.1

(16,359

)

20,330

(180.5

)

Total operating profit (loss)

$

41,821

$

9,990

318.6

$

79,390

$

59,283

33.9

Operating margin

Change Change

Aerospace

15.2

%

2.3

%

1,290

bps.

14.3

%

9.9

%

440

bps. Industrial

4.2

%

3.1

%

110

bps.

-3.1

%

3.2

%

(630

)

bps. Total operating margin

10.8

%

2.8

%

800

bps.

6.6

%

5.7

%

90

bps.

BARNES GROUP INC. CONSOLIDATED BALANCE

SHEETS (Dollars in thousands) (Unaudited)

September 30,2024 December 31,2023

Assets Current assets Cash and cash equivalents

$

80,675

$

89,827

Accounts receivable

327,063

353,923

Inventories

353,230

365,221

Prepaid expenses and other current assets

105,763

97,749

Total current assets

866,731

906,720

Deferred income taxes

8,289

10,295

Property, plant and equipment, net

351,735

402,697

Goodwill

1,081,960

1,183,624

Other intangible assets, net

655,927

706,471

Other assets

110,390

98,207

Total assets

$

3,075,032

$

3,308,014

Liabilities and Stockholders' Equity Current

liabilities Notes and overdrafts payable

$

506

$

16

Accounts payable

142,571

164,264

Accrued liabilities

226,637

221,462

Long-term debt - current

9,765

10,868

Total current liabilities

379,479

396,610

Long-term debt

1,135,162

1,279,962

Accrued retirement benefits

36,540

45,992

Deferred income taxes

117,010

120,608

Long-term tax liability

7,400

21,714

Other liabilities

94,955

80,865

Total stockholders' equity

1,304,486

1,362,263

Total liabilities and stockholders' equity

$

3,075,032

$

3,308,014

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (Dollars in thousands) (Unaudited)

Nine months ended September 30,

2024

2023

Operating activities: Net (loss) income

$

(47,017

)

$

8,780

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: Depreciation and amortization

89,837

79,196

Gain on disposition of property, plant and equipment

(9

)

(202

)

Stock compensation expense

10,530

8,121

Non-cash goodwill impairment charge

53,694

-

Gain on sale of businesses

(3,894

)

-

Changes in assets and liabilities, net of the effects of

acquisition and divestiture: Accounts receivable

(4,587

)

(5,273

)

Inventories

(21,481

)

(8,699

)

Prepaid expenses and other current assets

(11,629

)

5,367

Accounts payable

(4,641

)

(11,629

)

Accrued liabilities

5,510

22,437

Deferred income taxes

683

(3,541

)

Long-term retirement benefits

(12,364

)

(13,096

)

Long-term tax liability

(9,972

)

(13,029

)

Other

5,090

2,541

Net cash provided by operating activities

49,750

70,973

Investing activities: Proceeds from disposition of

property, plant and equipment

223

6,990

Proceeds from the sale of businesses

160,869

-

Capital expenditures

(41,822

)

(37,405

)

Business acquisitions, net of cash acquired

159

(718,782

)

Other

-

(921

)

Net cash provided (used) by investing activities

119,429

(750,118

)

Financing activities: Net change in other borrowings

242

(167

)

Payments on long-term debt

(321,318

)

(268,580

)

Proceeds from the issuance of long-term debt

170,000

1,006,333

Payments of debt issuance costs

-

(11,341

)

Proceeds from the issuance of common stock

176

277

Dividends paid

(24,361

)

(24,302

)

Withholding taxes paid on stock issuances

(1,391

)

(857

)

Cash settlement of foreign currency hedges related to intercompany

financing

(1,070

)

(6,346

)

Other

(232

)

(2,625

)

Net cash (used) provided by financing activities

(177,954

)

692,392

Effect of exchange rate changes on cash flows

(2,590

)

(2,190

)

(Decrease) increase in cash, cash equivalents and restricted

cash

(11,365

)

11,057

Cash, cash equivalents and restricted cash at beginning of

the period

92,040

81,128

Cash, cash equivalents and restricted cash at end of

period

80,675

92,185

Less: Restricted cash, included in Prepaid expenses and

other current assets

-

(2,145

)

Cash and cash equivalents at end of period

$

80,675

$

90,040

BARNES GROUP INC. RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW (Dollars

in thousands) (Unaudited)

Nine months ended September

30,

2024

2023

Free cash flow: Net cash provided by operating activities

$

49,750

$

70,973

Capital expenditures

(41,822

)

(37,405

)

Free cash flow(1)

$

7,928

$

33,568

Free cash flow (as adjusted): Free cash flow (from

above)

$

7,928

$

33,568

Income tax payments related to the sale of the businesses

12,472

-

Free cash flow (as adjusted) (1)

$

20,400

$

33,568

Notes: (1) The

Company defines free cash flow as net cash provided by operating

activities less capital expenditures. In 2024, net cash provided by

operating activities was negatively impacted by $12.5 million of

estimated income tax payments related to the pre-tax gain related

to the sale of the Associated Spring™ and Hänggi™ businesses (the

"Businesses"). The proceeds from the sale are reflected in

investing activities. The Company believes that the free cash flow

metric is useful to investors and management as a measure of cash

generated by business operations that can be used to invest in

future growth, pay dividends, repurchase stock and reduce debt.

This metric can also be used to evaluate the Company's ability to

generate cash flow from business operations and the impact that

this cash flow has on the Company's liquidity.

BARNES

GROUP INC. NON-GAAP FINANCIAL MEASURE RECONCILIATION

ADJUSTED OPERATING PROFIT AND ADJUSTED DILUTED EARNINGS PER

SHARE (Dollars in thousands, except per share data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

% Change

2024

2023

% Change

SEGMENT RESULTS

Operating Profit - Aerospace Segment (GAAP)

$

35,319

$

3,622

875.1

$

95,749

$

38,953

145.8

Restructuring/reduction in force and transformation

related charges

355

3,922

2,993

6,263

Shareholder advisory costs

-

-

1,078

-

Acquisition related costs

-

7,817

-

11,376

MB Short-term purchase accounting adjustments

643

8,019

3,469

8,019

Operating Profit - Aerospace Segment as adjusted

(Non-GAAP) (1)

$

36,317

$

23,380

55.3

$

103,289

$

64,611

59.9

Operating Margin - Aerospace Segment (GAAP)

15.2

%

2.3

%

1,290

bps.

14.3

%

9.9

%

440

bps.

Operating Margin - Aerospace Segment as adjusted (Non-GAAP)

(1)

15.7

%

15.0

%

70

bps.

15.4

%

16.3

%

(90

)

bps.

Operating Profit (Loss) - Industrial Segment

(GAAP)

$

6,502

$

6,368

2.1

$

(16,359

)

$

20,330

(180.5

)

Restructuring/reduction in force and transformation

related charges

3,398

9,277

10,286

34,711

Shareholder advisory costs

-

-

1,022

-

Costs (gain) related to the sale of businesses

1,651

-

(5,420

)

-

Goodwill impairment charge

-

-

53,694

-

Operating Profit - Industrial Segment as adjusted

(Non-GAAP) (1)

$

11,551

$

15,645

(26.2

)

$

43,223

$

55,041

(21.5

)

Operating Margin - Industrial Segment (GAAP)

4.2

%

3.1

%

110

bps.

-3.1

%

3.2

%

(630

)

bps.

Operating Margin - Industrial Segment as adjusted

(Non-GAAP) (1)

7.4

%

7.6

%

(20

)

bps.

8.2

%

8.6

%

(40

)

bps.

CONSOLIDATED RESULTS Operating Income

(GAAP)

$

41,821

$

9,990

318.6

$

79,390

$

59,283

33.9

Restructuring/reduction in force and transformation

related charges

3,753

13,199

13,279

40,974

Shareholder advisory costs

-

-

2,100

-

Costs (gain) related to the sale of businesses

1,651

-

(5,420

)

-

Acquisition related costs

-

7,817

-

11,376

MB Short-term purchase accounting adjustments

643

8,019

3,469

8,019

Goodwill impairment charge

-

-

53,694

-

Operating Income as adjusted (Non-GAAP) (1)

$

47,868

$

39,025

22.7

$

146,512

$

119,652

22.4

Operating Margin (GAAP)

10.8

%

2.8

%

800

bps.

6.6

%

5.7

%

90

bps.

Operating Margin as adjusted (Non-GAAP) (1)

12.3

%

10.8

%

150

bps.

12.2

%

11.6

%

60

bps.

Diluted Net (Loss) Income per Share

(GAAP)

$

(0.04

)

$

(0.43

)

(90.7

)

$

(0.92

)

$

0.17

(641.2

)

Restructuring/reduction in force and transformation

related charges

0.06

0.19

0.20

0.58

Shareholder advisory costs

-

-

0.03

-

Loss related to sale of businesses, net of tax

0.03

-

0.38

-

MB Short-term purchase accounting adjustments

0.01

0.12

0.05

0.12

Acquisition related costs

-

0.31

0.02

0.36

Income tax effects of non-deductible merger costs

0.03

-

0.03

-

Goodwill impairment charge

-

-

1.05

-

Diluted Net Income per Share as adjusted

(Non-GAAP) (1)

$

0.09

$

0.19

(52.6

)

$

0.84

$

1.23

(31.7

)

Full-Year 2023 Operating

Margin (GAAP)

6.1

%

Restructuring/reduction in force and transformation related

charges

3.2

%

Divestiture transaction costs

0.1

%

MB Short-term purchase accounting adjustments

1.3

%

Acquisition related costs

0.8

%

Operating Margin as adjusted (Non-GAAP) (1)

11.5

%

Diluted Net Income (Loss) per Share (GAAP)

$

0.31

Restructuring/reduction in force and transformation

related charges

0.66

Divestiture transaction costs

0.02

MB Short-term purchase accounting adjustments

0.29

Acquisition related costs

0.37

Diluted Net Income per Share as adjusted

(Non-GAAP) (1)

$

1.65

Notes: (1) The Company has

excluded the following from its "as adjusted" financial

measurements for 2024: 1) charges related to

restructuring/reduction in force actions at certain businesses and

transformation related costs (consulting/professional fees related

to business and portfolio transformation initiatives), 2) a pre-tax

gain related to the divestiture of the Businesses, including $5.4M

reflected within operating profit ($1.7 million of costs related to

the divestiture in the third quarter), $1.5M reflected within other

expense, net ($0.0 million in the third quarter) and a $23.7M

charge reflected within income taxes ($0.0 million in the third

quarter), 3) shareholder advisory costs, 4) short-term purchase

accounting adjustments related to its MB Aerospace acquisition, 5)

acquisition costs related to the acquisition of MB Aerospace,

including $1.6M reflected within interest expense ($0.0 million in

the third quarter), 6) goodwill impairment charge recorded in the

second quarter of 2024 related to the Automation reporting unit,

and 7) income tax effects of non-deductible merger costs. The

Company has excluded the following from its "as adjusted" financial

measurements for 2023: 1) charges related to

restructuring/reduction in force actions at certain businesses and

business transformation costs (consulting fees related to

transformation initiatives), including $41.0M reflected within

operating profit ($13.2 million in the third quarter) and ($1.1M)

reflected within other expense (income), net ($0.0 million in the

third quarter), 2) acquisition transaction costs related to the

acquisition of MB Aerospace, including $11.4M reflected within

operating profit ($7.8 million in the third quarter) and $9.6M

reflected within interest expense, and 3) short-term purchase

accounting adjustments related to its MB Aerospace acquisitions,

including $8.0M all reflected within operating profit in the third

quarter. The tax effects of the restructuring related actions,

acquisition related actions, and shareholder advisory costs were

calculated based on the respective tax jurisdictions and ranged

from approximately 15% to approximately 30%. The goodwill

impairment charge did not have a tax effect as it is not deductible

for book purposes. Management believes that these adjustments

provide the Company and its investors with an indication of our

baseline performance excluding items that are not considered to be

reflective of our ongoing results. Management does not intend

results excluding the adjustments to represent results as defined

by GAAP, and the reader should not consider it as an alternative

measurement calculated in accordance with GAAP, or as an indicator

of the Company's performance. Accordingly, the measurements have

limitations depending on their use.

BARNES GROUP INC.

NON-GAAP FINANCIAL MEASURE RECONCILIATION EBITDA, EBITDA

MARGIN, ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN (Dollars

in thousands) (Unaudited)

Three months ended September

30,

2024

2023

Aerospace Industrial Other (1) Total

Aerospace Industrial Other (1) Total

Net Sales

$

231,934

155,864

(4

)

$

387,794

$

156,090

204,898

-

$

360,988

Net Loss

$

(2,144

)

$

(21,730

)

Interest expense

19,573

22,792

Other expense (income), net

517

(874

)

Income taxes

23,875

9,802

Operating Profit (GAAP)

$

35,319

$

6,502

$

-

$

41,821

$

3,622

$

6,368

$

-

$

9,990

Operating Margin (GAAP)

15.2

%

4.2

%

10.8

%

2.3

%

3.1

%

2.8

%

Other expense (income), net

-

-

(517

)

(517

)

-

-

874

874

Depreciation (2)

9,317

4,222

-

13,539

5,863

7,560

-

13,423

Amortization (3)

10,864

5,871

-

16,735

12,460

6,400

-

18,860

EBITDA (Non-GAAP) (4)

$

55,500

$

16,595

$

(517

)

$

71,578

$

21,945

$

20,328

$

874

$

43,147

EBITDA Margin (Non-GAAP) (4)

23.9

%

10.6

%

18.5

%

14.1

%

9.9

%

12.0

%

Restructuring/reduction in force and transformation

related charges

355

3,351

-

3,706

3,922

8,481

-

12,403

Shareholder advisory costs

-

-

-

-

-

-

-

-

Acquisition transaction costs

-

-

-

-

7,817

-

-

7,817

MB Short-term purchase accounting adjustments

-

-

-

-

3,019

-

-

3,019

Costs (gain) related to the sale of businesses

-

1,651

-

1,651

-

-

-

-

Adjusted EBITDA (Non-GAAP) (4)

$

55,855

$

21,597

$

(517

)

$

76,935

$

36,703

$

28,809

$

874

$

66,386

Adjusted EBITDA Margin (Non-GAAP) (4)

24.1

%

13.9

%

19.8

%

23.5

%

14.1

%

18.4

%

Nine months ended September

30,

2024

2023

Aerospace Industrial Other (1) Total

Aerospace Industrial Other (1) Total

Net Sales

$

671,262

529,406

(4

)

$

1,200,664

$

395,362

639,977

(10

)

$

1,035,329

Net (Loss) Income

$

(47,017

)

$

8,780

Interest expense

65,216

34,612

Other expense (income), net

1,367

(2,427

)

Income taxes

59,824

18,318

Operating Profit (Loss) (GAAP)

$

95,749

$

(16,359

)

$

-

$

79,390

$

38,953

$

20,330

$

-

$

59,283

Operating Margin (GAAP)

14.3

%

-3.1

%

6.6

%

9.9

%

3.2

%

5.7

%

Other expense (income), net

-

-

(1,367

)

(1,367

)

-

-

2,427

2,427

Depreciation (2)

24,636

13,803

-

38,439

15,683

21,429

-

37,112

Amortization (3)

33,714

17,684

-

51,398

22,757

19,327

-

42,084

EBITDA (Non-GAAP) (4)

$

154,099

$

15,128

$

(1,367

)

$

167,860

$

77,393

$

61,086

$

2,427

$

140,906

EBITDA Margin (Non-GAAP) (4)

23.0

%

2.9

%

14.0

%

19.6

%

9.5

%

13.6

%

Restructuring/reduction in force and transformation

related charges

2,993

9,515

-

12,508

6,263

31,526

-

37,789

Shareholder advisory costs

1,078

1,022

-

2,100

-

-

-

-

Acquisition transaction costs

-

-

-

-

11,376

-

-

11,376

MB Short-term purchase accounting adjustments

1,540

-

-

1,540

3,019

-

-

3,019

Gain related to the sale of businesses

-

(5,420

)

-

(5,420

)

-

-

-

-

Pension related loss (gain)

-

-

1,526

1,526

-

-

(1,144

)

(1,144

)

Goodwill impairment charge

-

53,694

-

53,694

-

-

-

-

Adjusted EBITDA (Non-GAAP) (4)

$

159,710

$

73,939

$

159

$

233,808

$

98,051

$

92,612

$

1,283

$

191,946

Adjusted EBITDA Margin (Non-GAAP) (4)

23.8

%

14.0

%

19.5

%

24.8

%

14.5

%

18.5

%

Notes: (1)

"Other" includes intersegment sales and items that are included

within Other expense (income), net that are not allocated to the

Company's reportable business segments.(2) Depreciation expense in

2024 includes $0.7 million of accelerated depreciation charges

related to restructuring actions ($0.0 million related to the third

quarter). Depreciation in 2023 includes $3.2 million ($0.8 million

related to the third quarter) of similar accelerated depreciation

charges.(3) Amortization expense in 2024 includes $1.9 million

($0.6 million related to the third quarter) of short-term purchase

accounting adjustments related to backlog amortization, attributed

to the acquisition of MB Aerospace. Amortization expense in 2023

includes $5.0 million ($5.0 million related to the third quarter)

of short-term purchase accounting adjustments related to backlog

amortization, attributed to the acquisition of MB Aerospace.(4) The

Company defines EBITDA as net income plus interest expense, income

taxes, and depreciation and amortization which the Company incurs

in the normal course of business; in addition to these adjustments,

the Company also excludes the impact of its "as adjusted items"

above ("Adjusted EBITDA"). The Company does not intend EBITDA nor

Adjusted EBITDA to represent cash flows from operations as defined

by GAAP, and the reader should not consider it as an alternative to

net income, net cash provided by operating activities or any other

items calculated in accordance with GAAP, or as an indicator of the

Company's operating performance. Accordingly, the measurements have

limitations depending on their use.

BARNES GROUP

INC. NON-GAAP FINANCIAL MEASURE RECONCILIATION

Organic Sales and Organic Sales Growth (Decrease) (1)

(Dollars in millions) (Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

Organic Sales Growth

(Decrease)

2024

2023

Organic Sales Growth

(Decrease)

Aerospace Net sales (GAAP)

$

231.9

$

156.1

48.6

%

$

671.3

$

395.4

69.8

%

Acquisition sales (2)

(61.1

)

-

(39.1

%)

(229.4

)

-

(58.0

%)

Foreign currency translation

(0.6

)

-

(0.4

%)

(0.6

)

-

(0.2

%)

Organic sales (Non-GAAP)

$

170.2

$

156.1

$

14.1

9.0

%

$

441.3

$

395.4

$

45.9

11.6

%

OEM Net sales (GAAP)

$

137.8

$

99.9

37.9

%

$

405.0

$

248.0

63.3

%

Acquisition sales (2)

(38.2

)

-

(38.2

%)

(144.8

)

-

(58.4

%)

Foreign currency translation

(0.6

)

-

(0.6

%)

(0.6

)

-

(0.2

%)

Organic sales (Non-GAAP)

$

99.0

$

99.9

$

(0.9

)

(0.9

%)

$

259.6

$

248.0

$

11.6

4.7

%

Aftermarket Net sales (GAAP)

$

94.1

$

56.2

67.4

%

$

266.2

$

147.4

80.6

%

Acquisition sales (2)

(22.9

)

-

(40.7

%)

(84.6

)

-

(57.4

%)

Foreign currency translation

-

-

0.0

%

-

-

0.0

%

Organic sales (Non-GAAP)

$

71.2

$

56.2

$

15.0

26.7

%

$

181.6

$

147.4

$

34.2

23.2

%

Industrial Net sales (GAAP)

$

155.9

$

204.9

(23.9

%)

$

529.4

$

640.0

(17.3

%)

Divestiture sales (3)

-

(51.8

)

25.3

%

-

(109.4

)

17.1

%

Foreign currency translation

(1.5

)

-

(0.7

%)

0.2

-

0.0

%

Organic sales (Non-GAAP)

$

154.4

$

153.1

$

1.3

0.6

%

$

529.6

$

530.6

$

(1.0

)

(0.2

%)

Total Company Net sales (GAAP)

387.8

361.0

7.4

%

$

1,200.7

$

1,035.4

16.0

%

Acquisition sales (2)

(61.1

)

-

(16.9

%)

(229.4

)

-

(22.2

%)

Divestiture sales (3)

-

(51.8

)

14.3

%

-

(109.4

)

10.6

%

Foreign currency translation

(2.1

)

-

(0.6

%)

(0.4

)

-

(0.0

%)

Organic sales (Non-GAAP)

$

324.6

$

309.2

$

15.4

4.3

%

$

970.9

$

926.0

$

44.9

4.3

%

Notes: (1) Organic sales

and Organic sales growth (decrease) represent the total reported

net sales and total reported net sales increase (decrease),

respectively, within the Company’s ongoing businesses, less the

impacts of foreign currency translation and the sales related to

any acquisitions or divestitures that were completed within the

preceding twelve months.(2) "Acquisition sales" includes the net

sales contributed by MB Aerospace from July 1, 2024 through August

31, 2024 and from January 1, 2024 through August 31, 2024, during

the three and nine month periods ended September 30, 2024,

respectively. The acquisition of MB Aerospace was completed on

August 31, 2023.(3) "Divestiture sales" includes the net sales

contributed by the divested businesses from July 1, 2023 through

September 30, 2023 and from April 4, 2023 through September 30,

2023, during the three and nine month periods ended September 30,

2023, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025629370/en/

Investors: Barnes Group Inc. William Pitts Vice

President, Investor Relations ir@onebarnes.com 860.583.7070

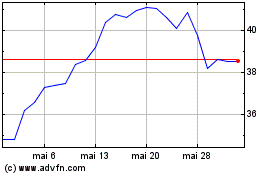

Barnes (NYSE:B)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Barnes (NYSE:B)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024