Form 8-K - Current report

09 Octobre 2024 - 3:15PM

Edgar (US Regulatory)

0000010456false00000104562024-10-082024-10-080000010456exch:XCHIbax:CommonStock1.00PerValueMember2024-10-082024-10-080000010456exch:XNYSbax:CommonStock1.00PerValueMember2024-10-082024-10-080000010456exch:XNYSbax:GlobalNotes13Due2025Member2024-10-082024-10-080000010456exch:XNYSbax:GlobalNotes13Due2029Member2024-10-082024-10-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 8, 2024 | | | | | |

| Baxter International Inc. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

| (State or other jurisdiction of incorporation) |

| |

| 1-4448 | 36-0781620 |

| (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

One Baxter Parkway, Deerfield, Illinois | 60015 |

| (Address of principal executive offices) | (Zip Code) |

| |

(224)948-2000 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | BAX (NYSE) | | New York Stock Exchange |

| | | | NYSE Chicago |

| 1.3% Global Notes due 2025 | | BAX 25 | | New York Stock Exchange |

| 1.3% Global Notes due 2029 | | BAX 29 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act: ☐

Item 7.01 Regulation FD Disclosure.

On September 29, 2024, Baxter International Inc., a Delaware corporation (the “Company” or “Baxter”) issued a press release regarding the impact of Hurricane Helene, which brought unprecedented rain and extensive flooding to Western North Carolina, on the operations of its North Cove facility in Marion, N.C. Baxter’s North Cove facility was affected by flooding due to the storm and is currently closed for production while the Company undertakes related remediation efforts.

The Company is actively working with customers, regulators and other stakeholders to manage inventory and minimize disruption to patient care as it works to fully restore its North Cove manufacturing operations. This work includes implementing allocations, which limit customer orders based on historical ordering and medical necessity as well as available and projected inventory, reallocating capacity from certain other Baxter facilities and working with U.S. Food and Drug Administration to provide for the temporary importation of certain Baxter products.

On October 8, 2024, based on the current status of its remediation efforts and the Company’s expectations of its ability to reallocate capacity from certain other Baxter facilities and to initiate temporary importation on certain products, Baxter shared that its goal is to restart North Cove production in phases and to be at 90% to 100% allocation of certain intravenous solution product codes by the end of 2024.

The Company plans on providing periodic updates regarding the status of its remediation efforts and supply continuity matters on its website (www.baxter.com/baxter-newsroom/hurricane-helene-updates) and to provide other updates (including with respect to the related estimated financial impact on its operations) as part of its third quarter earnings announcement.

This Form 8-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including with respect to statements regarding the status and remediation of Baxter’s North Cove facility, including targets to restart production and related product allocation goals, the related timing and the estimated impact on its financial performance and results of operations. Use of the words “may,” “will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,” “potential,” “expects,” “plans,” “seeks,” “intends,” “evaluates,” “pursues,” “anticipates,” “continues,” “designs,” “impacts,” “affects,” “forecasts,” “target,” “outlook,” “initiative,” “objective,” “designed,” “priorities,” “goal,” or the negative of those words or other similar expressions is intended to identify forward-looking statements that represent its current judgment about possible future events. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: risks related to further disruption due to Hurricane Helene or other storm-related events (including Hurricane Milton); the Company’s ability to import and distribute product from other Baxter facilities (in connection with temporary importations, the reallocation of manufacturing capacity or otherwise); the receipt of any necessary regulatory or other approvals required to reopen all or a portion of the North Cove facility; physical, environmental or other obstacles identified during the course of the ongoing remediation (including with respect to the availability of third party contractors and any equipment, transportation or other supplies needed to support the remediation efforts); and risks identified in Baxter’s most recent filings on Form 10-K, Form 10-Q and other filings with the U.S. Securities and Exchange Commission (the “SEC”), all of which are available on Baxter’s website. Baxter does not undertake to update its forward-looking statements or any of the statements contained in this Form 8-K.

None of the information or data included on the Baxter website referenced in this Form 8-K or accessible at this link is incorporated into, and will not be deemed to be a part of, this Form 8-K or any of the Company’s other filings with the SEC.

The information contained in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of such section, nor will such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: October 9, 2024 | | | | | | | | |

| BAXTER INTERNATIONAL INC. |

| | |

| By: | /s/ Ellen K. Bradford |

| Name: | Ellen K. Bradford |

| Title: | Senior Vice President and Corporate Secretary |

| | |

v3.24.3

Document and Entity Information Document

|

Oct. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 08, 2024

|

| Entity Registrant Name |

Baxter International Inc.

|

| Entity Central Index Key |

0000010456

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-4448

|

| Entity Tax Identification Number |

36-0781620

|

| Entity Address, Address Line One |

One Baxter Parkway

|

| Entity Address, City or Town |

Deerfield

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60015

|

| City Area Code |

224

|

| Local Phone Number |

948-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock, $1.00 Per Value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

BAX (NYSE)

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.3% Global Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.3% Global Notes due 2025

|

| Trading Symbol |

BAX 25

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.3% Global Notes due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.3% Global Notes due 2029

|

| Trading Symbol |

BAX 29

|

| Security Exchange Name |

NYSE

|

| CHICAGO STOCK EXCHANGE, INC | Common Stock, $1.00 Per Value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

BAX (NYSE)

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_CommonStock1.00PerValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_GlobalNotes13Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_GlobalNotes13Due2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

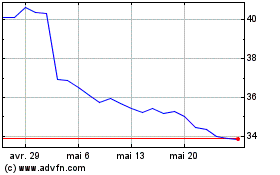

Baxter (NYSE:BAX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Baxter (NYSE:BAX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025