Bain Capital Specialty Finance, Inc. (NYSE: BCSF, the “Company”,

“our” or “we”) today announced financial results for the third

quarter ended September 30, 2023, and that its Board of Directors

has declared a dividend of $0.42 per share for the fourth quarter

of 2023.

“We delivered another strong quarter of earnings driven by the

continued benefits of higher interest rates across our diversified

portfolio of largely floating rate loans coupled with stable credit

quality in the portfolio,” said Michael Ewald, Chief Executive

Officer of BCSF. “We believe BCSF remains well-positioned to take

advantage of attractive opportunities in the current environment as

we execute our longstanding strategy of investing in senior secured

loans to middle market companies.”

QUARTERLY HIGHLIGHTS

- Net investment income (NII) per share was $0.55, equating to an

annualized NII yield on book value of 12.6%(1);

- Net income per share was $0.52, equating to an annualized

return on book value of 12.0%(1);

- Net asset value per share as of September 30, 2023 was $17.54,

as compared to $17.44 as of June 30, 2023;

- Gross and net investment fundings were $109.5 million and $6.7

million, respectively; Ending net debt-to-equity was 1.12x, as

compared to 1.13x as of June 30, 2023(2); and

- Subsequent to quarter-end, the Company’s Board of Directors

declared a dividend of $0.42 per share for the fourth quarter of

2023 payable to stockholders of record as of December 29,

2023(3).

SELECTED FINANCIAL HIGHLIGHTS

($ in millions, unless otherwise

noted)

Q3 2023

Q2 2023

Net investment income per share

$0.55

$0.60

Net investment income

$35.6

$38.9

Earnings per share

$0.52

$0.45

Dividends per share declared and

payable

$0.42

$0.38

($ in millions, unless otherwise

noted)

As of

September 30, 2023

As of

June 30, 2023

Total fair value of investments

$2,390.2

$2,385.3

Total assets

$2,566.5

$2,675.4

Total net assets

$1,132.5

$1,125.8

Net asset value per share

$17.54

$17.44

PORTFOLIO AND INVESTMENT ACTIVITY

For the three months ended September 30, 2023, the Company

invested $109.5 million in 40 portfolio companies, including $52.1

million in two new companies and $57.4 million in 38 existing

companies. The Company had $102.8 million of principal repayments

and sales in the quarter, resulting in net investment fundings of

$6.7 million.

Investment Activity for the Quarter Ended September 30,

2023:

($ in millions)

Q3 2023

Q2 2023

Investment Fundings

$109.5

$197.5

Sales and Repayments

$102.8

$227.8

Net Investment Activity

$6.7

$(30.3)

As of September 30, 2023, the Company’s investment portfolio had

a fair value of $2,390.2 million, comprised of investments in 143

portfolio companies operating across 30 different industries.

Investment Portfolio at Fair Value as of September 30,

2023:

Investment Type

$ in Millions

% of Total

First Lien Senior Secured Loans

$1,531.3

64.0%

Second Lien Senior Secured Loans

85.3

3.6

Subordinated Debt

45.4

1.9

Structured Products

23.1

1.0

Preferred Equity

105.6

4.4

Equity Interests

229.8

9.6

Warrants

0.5

0.0

Investment Vehicles

369.2

15.5

Subordinated Note in ISLP

187.0

7.8

Equity Interest in ISLP

65.2

2.8

Subordinated Note in SLP

116.0

4.9

Preferred and Equity Interest in SLP

1.0

0.0

Total

$2,390.2

100.0%

As of September 30, 2023, the weighted average yield on the

investment portfolio at amortized cost and fair value were 12.9%

and 13.1%, respectively, as compared to 12.8% and 13.0%,

respectively, as of June 30, 2023.(4) 94.2% of the Company’s debt

investments at fair value were in floating rate securities.

As of September 30, 2023, three portfolio companies were on

non-accrual status, representing 1.5% and 1.0% of the total

investment portfolio at amortized cost and fair value,

respectively.

As of September 30, 2023, ISLP’s investment portfolio had an

aggregate fair value of $661.6 million, comprised of investments in

37 portfolio companies operating across 17 different industries.

The investment portfolio on a fair value basis was comprised of

93.7% first lien senior secured loans, 3.0% second lien senior

secured loans and 3.3% equity interests. 100% of ISLP’s debt

investments at fair value were in floating rate securities.

As of September 30, 2023, SLP’s investment portfolio had an

aggregate fair value of $826.5 million, comprised of investments in

60 portfolio companies operating across 22 different industries.(5)

The investment portfolio on a fair value basis was comprised of

97.4% first lien senior secured loans and 2.6% second lien senior

secured loans. 98.8% of SLP’s debt investments at fair value were

in floating rate securities.

RESULTS OF OPERATIONS

For the three months ended September 30, 2023 and June 30, 2023,

total investment income was $72.4 million and $75.7 million,

respectively. The decrease in investment income was primarily due

to a decrease in interest income as a result of lower interest

income and other income.

Total expenses (before taxes) for the three months ended

September 30, 2023 and June 30, 2023 were $36.1 million and $35.7

million, respectively.

Net investment income for the three months ended September 30,

2023 and June 30, 2023 was $35.6 million or $0.55 per share and

$38.9 million or $0.60 per share, respectively.

During the three months ended September 30, 2023, the Company

had net realized and unrealized gains (losses) of $(1.8)

million.

Net increase in net assets resulting from operations for the

three months ended September 30, 2023 was $33.9 million, or $0.52

per share.

CAPITAL AND LIQUIDITY

As of September 30, 2023, the Company had total principal debt

outstanding of $1,378.5 million, including $426.0 million

outstanding in the Company’s Sumitomo Credit Facility, $352.5

million outstanding of the debt issued through BCC Middle Market

CLO 2019-1 LLC, $300.0 million outstanding in the Company’s senior

unsecured notes due March 2026 and $300.0 million outstanding in

the Company’s senior unsecured notes due October 2026.

For the three months ended September 30, 2023, the weighted

average interest rate on debt outstanding was 5.4%, as compared to

5.2% for the three months ended June 30, 2023.

As of September 30, 2023, the Company had cash and cash

equivalents (including foreign cash) of $79.5 million, restricted

cash and cash equivalents of $25.9 million, $(0.4) million of

unsettled trades, net of receivables and payables of investments,

and $224.2 million of capacity under its Sumitomo Credit Facility.

As of September 30, 2023, the Company had $283.8 million of undrawn

investment commitments.

As of September 30, 2023, the Company’s debt-to-equity and net

debt-to-equity ratios were 1.22x and 1.12x, respectively, as

compared to 1.33x and 1.13x, respectively, as of June 30,

2023(2).

Endnotes

(1)

Net investment income yields and

net income returns are calculated on average net assets, or book

value, for the respective periods shown.

(2)

Net debt-to-equity represents

principal debt outstanding less cash and cash equivalents and

unsettled trades, net of receivables and payables of

investments.

(3)

The fourth quarter dividend is

payable on January 31, 2024 to holders of record as of December 29,

2023.

(4)

The weighted average yield is

computed as (a) the annual stated interest rate or yield earned on

the relevant accruing debt and other income producing securities

plus amortization of fees and discounts on the performing debt and

other income producing investments, divided by (b) the total

relevant investments at amortized cost or fair value. The weighted

average yield does not represent the total return to our

stockholders.

(5)

SLP acquired 70% of the member

equity interests of the Company’s 2018-1 portfolio (“2018-1”). The

Company retained 30% of the 2018-1 membership interests as a

non-controlling equity interest.

CONFERENCE CALL INFORMATION

A conference call to discuss the Company’s financial results

will be held live at 8:30 a.m. Eastern Time on November 7, 2023.

Please visit BCSF’s webcast link located on the Events &

Presentations page of the Investor Resources section of BCSF’s

website at http://www.baincapitalspecialtyfinance.com for a slide

presentation that complements the Earnings Conference Call.

Participants are also invited to access the conference call by

dialing one of the following numbers:

- Domestic: 1-844-825-9789

- International: 1-412-317-5180

- Conference ID: 10183669

All participants will need to reference “Bain Capital Specialty

Finance - Third Quarter Ended September 30, 2023 Earnings

Conference Call” once connected with the operator. All participants

are asked to dial in 10-15 minutes prior to the call.

Replay Information:

An archived replay will be available approximately three hours

after the conference call concludes through November 14, 2023 via a

webcast link located on the Investor Resources section of BCSF’s

website, and via the dial-in numbers listed below:

- Domestic: 1-844-512-2921

- International: 1-412-317-6671

- Conference ID: 10183669

Bain Capital Specialty

Finance, Inc.

Consolidated Statements of

Assets and Liabilities

(in thousands, except share

and per share data)

As of

As of

September 30, 2023

December 31, 2022

(Unaudited)

Assets

Investments at fair value:

Non-controlled/non-affiliate investments

(amortized cost of $1,701,847 and $1,846,172, respectively)

$

1,666,594

$

1,774,947

Non-controlled/affiliate investment

(amortized cost of $150,031 and $133,808, respectively)

191,583

173,400

Controlled affiliate investment (amortized

cost of $525,528 and $439,958, respectively)

532,021

438,630

Cash and cash equivalents

65,212

30,205

Foreign cash (cost of $15,089 and $34,528,

respectively)

14,286

29,575

Restricted cash and cash equivalents

25,908

65,950

Collateral on forward currency exchange

contracts

12,056

9,612

Deferred financing costs

3,040

3,742

Interest receivable on investments

33,398

34,270

Receivable for sales and paydowns of

investments

2,824

18,166

Prepaid Insurance

408

194

Unrealized appreciation on forward

currency exchange contracts

5,854

62

Dividend receivable

13,291

13,681

Total Assets

$

2,566,475

$

2,592,434

Liabilities

Debt (net of unamortized debt issuance

costs of $8,230 and $10,197, respectively)

$

1,370,270

$

1,385,303

Interest payable

15,016

12,130

Payable for investments purchased

3,173

34,292

Base management fee payable

9,140

8,906

Incentive fee payable

3,011

9,216

Accounts payable and accrued expenses

6,230

2,954

Distributions payable

27,116

23,242

Total Liabilities

1,433,956

1,476,043

Commitments and Contingencies (See Note

10)

Net Assets

Common stock, par value $0.001 per share,

100,000,000,000 and 100,000,000,000 shares authorized, 64,562,265

and 64,562,265 shares issued and outstanding as of September 30,

2023 and December 31, 2022, respectively

65

65

Paid in capital in excess of par value

1,168,384

1,168,384

Total distributable loss

(35,930)

(52,058)

Total Net Assets

1,132,519

1,116,391

Total Liabilities and Total Net

Assets

$

2,566,475

$

2,592,434

Net asset value per share

$

17.54

$

17.29

See Notes to Consolidated

Financial Statements

Bain Capital Specialty

Finance, Inc.

Consolidated Statements of

Operations

(in thousands, except share

and per share data)

(Unaudited)

For the Three

Months Ended

September 30

For the Three

Months Ended

September 30

2023

2022

Income

Investment income from

non-controlled/non-affiliate investments:

Interest from investments

$

45,418

$

36,239

Dividend income

—

526

PIK income

4,926

4,276

Other income

1,008

4,329

Total investment income from

non-controlled/non-affiliate investments

51,352

45,370

Investment income from

non-controlled/affiliate investments:

Interest from investments

2,412

2,141

Dividend income

950

1,067

PIK income

655

48

Total investment income from

non-controlled/affiliate investments

4,017

3,256

Investment income from controlled

affiliate investments:

Interest from investments

9,403

5,437

Dividend income

7,618

4,746

Total investment income from controlled

affiliate investments

17,021

10,183

Total investment income

72,390

58,809

Expenses

Interest and debt financing expenses

20,775

14,381

Base management fee

9,140

8,853

Incentive fee

3,011

2,976

Professional fees

760

968

Directors fees

182

177

Other general and administrative

expenses

2,234

1,357

Total expenses, net of fee

waivers

36,102

28,712

Net investment income before

taxes

36,288

30,097

Income tax expense, including excise

tax

640

—

Net investment income

35,648

30,097

Net realized and unrealized gains

(losses)

Net realized loss on

non-controlled/non-affiliate investments

(50,873)

(1,174)

Net realized gain (loss) on foreign

currency transactions

(673)

2,254

Net realized gain (loss) on forward

currency exchange contracts

(221)

17,633

Net realized loss on extinguishment of

debt

—

(745)

Net change in unrealized appreciation on

foreign currency translation

(279)

(4,820)

Net change in unrealized appreciation on

forward currency exchange contracts

7,107

(2,210)

Net change in unrealized appreciation on

non-controlled/non-affiliate investments

41,509

(24,937)

Net change in unrealized appreciation on

non-controlled/affiliate investments

(1,067)

(4,640)

Net change in unrealized appreciation on

controlled affiliate investments

2,705

(407)

Total net losses

(1,792)

(19,046)

Net increase in net assets resulting from

operations

$

33,856

$

11,051

Basic and diluted net investment income

per common share

$

0.55

$

0.47

Basic and diluted increase in net assets

resulting from operations per common share

$

0.52

$

0.17

Basic and diluted weighted average common

shares outstanding

64,562,265

64,562,265

About Bain Capital Specialty Finance, Inc.

Bain Capital Specialty Finance, Inc. is an externally managed

specialty finance company focused on lending to middle market

companies. BCSF is managed by BCSF Advisors, LP, an SEC-registered

investment adviser and a subsidiary of Bain Capital Credit, LP.

Since commencing investment operations on October 13, 2016, and

through September 30, 2023, BCSF has invested approximately $6.9

billion in aggregate principal amount of debt and equity

investments prior to any subsequent exits or repayments. BCSF’s

investment objective is to generate current income and, to a lesser

extent, capital appreciation through direct originations of secured

debt, including first lien, first lien/last out, unitranche and

second lien debt, investments in strategic joint ventures, equity

investments and, to a lesser extent, corporate bonds. BCSF has

elected to be regulated as a business development company under the

Investment Company Act of 1940, as amended.

Forward-Looking Statements

This letter may contain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Statements other than statements of historical facts included in

this letter may constitute forward-looking statements and are not

guarantees of future performance or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including those described from time to time in filings

with the U.S. Securities and Exchange Commission. The Company

undertakes no duty to update any forward-looking statement made

herein. All forward-looking statements speak only as of the date of

this letter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106763571/en/

Investor Contact: Katherine Schneider Tel. (212) 803-9613

investors@baincapitalbdc.com

Media Contact: Charlyn Lusk Tel. (646) 502-3549

clusk@stantonprm.com

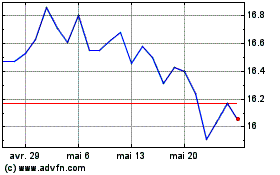

Bain Capital Specialty F... (NYSE:BCSF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Bain Capital Specialty F... (NYSE:BCSF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024