1-for-25 Reverse Stock Split for Common

Stock

Expected to Begin Trading on Reverse

Split-Adjusted Basis on April 29, 2024

Bakkt Holdings, Inc. (NYSE: BKKT) today announced that,

following approval by the Company's stockholders and its Board of

Directors, the Company will effect a reverse stock split (the

“Reverse Stock Split”) of Bakkt’s Class A common stock, par value

$0.0001 per share (“Class A Common Stock”), and Class V common

stock, par value $0.0001 per share (“Class V Common Stock” and

collectively with the Class A Common Stock, the “Common Stock”), at

a ratio of 1-for-25 (the “Reverse Stock Split Ratio”), effective as

of the close of the trading day on The New York Stock Exchange (the

“NYSE”) on April 26, 2024 (the “Effective Time”).

The Company’s Class A Common Stock is expected to begin trading

on a reverse-split adjusted basis on NYSE as of the open of trading

on April 29, 2024. After the Effective Time, Bakkt will continue to

be subject to periodic reporting and other requirements under the

Exchange Act and the Class A Common Stock and Public Warrants will

continue to be listed on the NYSE under the symbol “BKKT” and “BKKT

WS,” respectively.

Following the Reverse Stock Split, the Company’s Class A Common

Stock will have a new CUSIP number (05759B 305). The CUSIP number

for the Company’s Public Warrants will not change.

As previously disclosed, the Company believes the Reverse Stock

Split will increase the price per share of the Company's Class A

Common Stock and thus enable it to regain compliance with the price

criteria of Section 802.01C of the NYSE Listed Company Manual (the

“Listing Rule”). The Company, however, cannot assure that the price

of its Class A Common Stock after the Reverse Stock Split will

reflect the Reverse Split Ratio, that the price per share following

the Effective Time will be maintained for any period of time, or

that the price will remain above the pre-split trading price.

In connection with the Reverse Stock Split, the Company will

effect a corresponding and proportional adjustment to its

authorized shares of Common Stock, such that the 1,000,000,000

authorized shares of Common Stock, consisting of 750,000,000 shares

of Class A Common Stock and 250,000,000 shares of Class V Common

Stock will be reduced proportionately pursuant to 40,000,000

authorized shares of Common Stock, consisting of 30,000,000 shares

of Class A Common Stock and 10,000,000 shares of Class V Common

Stock. The par value per share of Common Stock and number of

authorized shares of preferred stock will not change.

The Company will not issue fractional shares in connection with

the Reverse Stock Split. Stockholders who would otherwise hold

fractional shares because the number of shares of Class A Common

Stock they hold before the Reverse Stock Split is not evenly

divisible by the Reverse Stock Split Ratio will be entitled to

receive cash (without interest, and subject to any required tax

withholding applicable to a holder) in lieu of such fractional

shares. To maintain parity with the Class A Common Stock, holders

of paired interests (each of which is a combination of one share of

Class V Common Stock and one common unit of Bakkt Opco Holdings,

LLC and is exchangeable into a share of Class A Common Stock on a

one-for-one basis) will also be correspondingly adjusted for the

Reverse Stock Split and be paid out in cash, applying the same

per-share price, for any resulting fractional interests. The

Company does not anticipate that the aggregate cash amount it will

pay in respect of fractional interests will be material.

Immediately after the Reverse Stock Split, each stockholder’s

percentage ownership interest in the Company and proportional

voting power will remain unchanged, except for minor changes that

will result from the treatment of fractional shares.

All of the Company’s outstanding warrants to purchase Class A

Common Stock will be proportionately adjusted as a result of the

Reverse Stock Split in accordance with the terms of the warrants.

Proportionate adjustments will also be made to the Company's

outstanding equity awards, as well as to the number of shares

issuable under the Company's 2021 Omnibus Incentive Plan, as

amended (the “2021 Omnibus Incentive Plan”).

Furthermore, as discussed in the Company’s definitive proxy

statement filed with the U.S. Securities and Exchange Commission

(the “SEC”) on April 19, 2024 in respect of the Company’s 2024

annual meeting of stockholders, the proposal described therein

relating to the approval of an amendment to the 2021 Omnibus

Incentive Plan to increase the number of shares of Class A Common

Stock issuable thereunder will be automatically adjusted to give

effect to the Reverse Stock Split such that the proposed increase

will be for 938,626 shares, rather 75,873,051 shares.

Equiniti Trust Company, LLC will serve as the exchange agent for

the Reverse Stock Split. Registered stockholders holding

pre-reverse split shares of the Company’s Common Stock

electronically in book-entry form are not required to take any

action to receive post-reverse-split shares. Those stockholders who

hold their shares in brokerage accounts or in “street name” will

have their positions automatically adjusted to reflect the Reverse

Stock Split, subject to each brokers’ particular processes, and

will not be required to take any action in connection with the

Reverse Stock Split.

Additional information about the Reverse Stock Split can be

found in Bakkt’s definitive proxy statement filed with the SEC on

April 4, 2024, which is available free of charge at the SEC’s

website, www.sec.gov, and on Bakkt’s Investor Relations website at

https://investors.bakkt.com/home/.

About Bakkt

Founded in 2018, Bakkt builds solutions that enable our clients

to grow with the crypto economy. Through institutional-grade

custody, trading, and onramp capabilities, our clients leverage

technology that’s built for sustainable, long-term involvement in

crypto.

Bakkt is headquartered in Alpharetta, GA. For more information,

visit: https://www.bakkt.com/ | X (Formerly Twitter) @Bakkt |

LinkedIn https://www.linkedin.com/company/bakkt/.

Bakkt-C

Note on Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include, but are not limited to, the

future effective date and intended effects of the Reverse Stock

Split, the Company’s ability to maintain the listing of its Class A

Common Stock on the NYSE, whether or not the Reverse Stock Split

will cure any deficiency under, and allow the Company to regain

compliance with, the Listing Rule and the Company’s expected cash

payout for fractional interests, among others. Forward-looking

statements can be identified by words such as “will,” “likely,”

“expect,” “continue,” “anticipate,” “estimate,” “believe,”

“intend,” “plan,” “projection,” “outlook,” “grow,” “progress,”

“potential” or words of similar meaning. Such forward-looking

statements are based upon the current beliefs and expectations of

Bakkt’s management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are difficult to predict and beyond Bakkt’s control.

Actual results and the timing of events may differ materially from

the results anticipated in such forward-looking statements as a

result of the following factors, among others: the Company’s

ability to continue as a going concern; the Company’s ability to

grow and manage growth profitably; changes in the Company’s

business strategy; the Company’s ability to integrate its

acquisitions and achieve desired synergies; the Company’s future

capital requirements and sources and uses of cash, including funds

to satisfy its liquidity needs; the Company’s inability to maintain

the listing of its securities on the New York Stock Exchange;

changes in the market in which the Company competes, including with

respect to its competitive landscape, technology evolution or

changes in applicable laws or regulations; changes in the markets

that the Company targets; disruptions in the crypto market that

subject the Company to additional risks, including the risk that

banks may not provide banking services to the Company; the

possibility that the Company may be adversely affected by other

economic, business, and/or competitive factors; the inability to

launch new services and products or to profitably expand into new

markets and services; the inability to execute the Company’s growth

strategies, including identifying and executing acquisitions and

the Company’s initiatives to add new clients; the Company’s failure

to comply with extensive government regulation, oversight,

licensure and appraisals; uncertain regulatory regime governing

blockchain technologies and crypto; the inability to develop and

maintain effective internal controls and procedures; the exposure

to any liability, protracted and costly litigation or reputational

damage relating to the Company’s data security; the impact of any

goodwill or other intangible assets impairments on the Company’s

operating results; and other risks and uncertainties indicated in

the Company’s filings with the SEC. You are cautioned not to place

undue reliance on such forward-looking statements. Such

forward-looking statements relate only to events as of the date on

which such statements are made and are based on information

available to us as of the date of this press release. Unless

otherwise required by law, we undertake no obligation to update any

forward-looking statements made in this press release to reflect

events or circumstances after the date of this press release or to

reflect new information or the occurrence of unanticipated

events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423525987/en/

Investor Relations IR@bakkt.com Media

press@bakkt.com

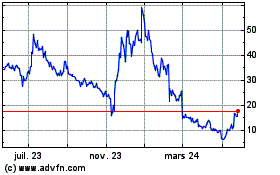

Bakkt (NYSE:BKKT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

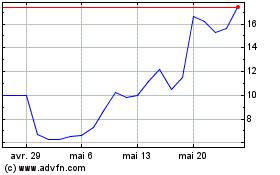

Bakkt (NYSE:BKKT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025