BlackRock Survey: Retirement Plan Advisors Demand Active and Income Strategies

17 Septembre 2024 - 12:00PM

Business Wire

Amid changing market conditions, retirement

plan advisors are focused on resilient portfolio construction to

drive better long-term results for clients.

- The majority (81%) of retirement plan advisors are discussing

retirement income with clients.

- Over half of retirement plan advisors (55%) believe active

managers can consistently outperform the market.

- Sharp increase in adoption of AI-powered tools, with 53% of

retirement plan advisors likely to use AI in the next 12 months

(versus 9% currently).

As the market regime shifts to one with higher volatility and

rate uncertainty, retirement plan advisors are looking to help plan

sponsors build more resilient portfolios. According to BlackRock’s

2024 Read on Retirement®: Advisor Outlook, retirement plan advisors

are focused on implementing active and income strategies, and

streamlining their practice management, including incorporating

AI-powered tools.

Carrie Schroen, Head of BlackRock’s U.S. Defined Contribution

Intermediary Business said, “In these uncertain market conditions,

retirement plan advisors are looking for solutions that will help

more Americans achieve better retirement outcomes. Our research

demonstrates the importance of access to affordable solutions and

education, areas that are vital to providers and participants

alike.”

Demand for Retirement Income

Amid changing market conditions and persistent concerns around

outliving savings, retirement income solutions are a focus area for

retirement plan advisors. 81% of retirement plan advisors report

discussing retirement income with DC clients. Interest in

retirement income continues to grow as 82% of retirement plan

advisors currently recommend a retirement income solution or are

likely to recommend one in the next 12 months.

Retirement plan advisors are looking to implement these

solutions as employers are increasingly concerned about their

employees’ long-term retirement preparedness. BlackRock’s 2024 Read

on Retirement® survey found that only 58% of plan sponsors believe

participants are on track with their retirement savings, versus 64%

in 2023. Despite the importance of retirement income, retirement

plan advisors report their top barriers to greater adoption are

communicating a clear benefit in terms of improved outcomes (44%)

and providing clear participant education and communications

(42%).

Rob Crothers, BlackRock’s Head of U.S. Retirement, added, “The

findings underscore that it is not enough to offer retirement

income solutions, participants also demand greater education to

help sift through the complexity. This is why BlackRock has paired

a digital experience, MyLifePath™ with LifePath Paycheck™, our

investment solution providing access to guaranteed income through a

target date fund. MyLifePath is designed to help educate

participants on how today’s contributions can translate into income

in retirement.”

Focus on Active

Over half (55%) of retirement plan advisors believe that active

managers can consistently outperform the market. They cite three

primary ways active management can add value to plans: access to

more investments (59%), protection against loss (47%) and sector

choices (44%).

When conducting due diligence on active investments, retirement

plan advisors say access to a cost-effective strategy is the most

important factor (71%). Diversification (66%) and manager expertise

(60%) are also ranked as important factors.

Enhancements to Practice Management

Retirement plan advisors view client servicing and meeting

participant education needs as areas that are important to their

growth. Over half (55%) of retirement plan advisors mention they

differentiate their practice from their peers through their

expertise in meeting participants’ needs and education, including

advice and retirement readiness. There is still opportunity,

however, for retirement plan advisors to develop education programs

for clients. Despite being an area retirement plan advisors

identify as being a differentiating factor, less than half (48%)

are currently offering financial wellness plans.

The data also shows a spike in interest around adopting AI to

streamline practice management. Retirement plan advisors see client

servicing and business development as use cases for AI in their

practice. While only 9% of retirement plan advisors are currently

using AI-powered tools, 53% report being likely to use them in the

next 12 months.

About the BlackRock Read on Retirement survey

The 2024 BlackRock Read on Retirement® survey provides insights

from a research study of over 450 large defined contribution plan

sponsors, 300 retirement plan advisors, 1,300 workplace retirement

plan savers, 1,300 independent savers and 300 retired workplace

savers in the United States. The survey is executed by Escalent, an

independent research company. All respondents were interviewed

using an online survey conducted between January 29 and March 7,

2024.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917770966/en/

Media Thomasin Bentley thomasin.bentley@blackrock.com

646-231-1769

Kristen Rivera kristen.rivera@blackrock.com 646-231-8352

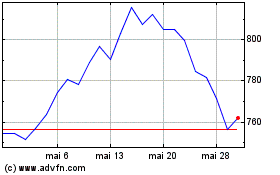

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

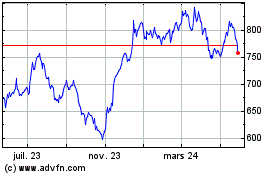

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024