BlackRock Survey: Overwhelming Majority of Insurers Plan to Increase Allocations to Private Investments

15 Octobre 2024 - 5:00AM

Business Wire

- 91% of respondents intend to increase investments in private

assets over the next two years

- 60% of insurers targeting clean energy infrastructure

investments for low-carbon transition objectives

- Respondents see value in technology for key challenges of

private asset modeling (53%) and regulatory capital integration

(51%)

Global insurers are focused on increased allocations to private

markets, clean energy infrastructure and utilizing innovative

technology in 2024, according to BlackRock’s 13th annual Global

Insurance Report. For the third year running, BlackRock’s annual

report shows a majority of insurers are planning increased

investments in private markets, with 91% of all respondents saying

they will do so within the next two years. This figure increases to

96% for APAC and 96% for North American insurers. The report tracks

insights from 410 insurance investors surveyed across 32 markets,

representing nearly $27 trillion USD in assets under

management.

Mark Erickson, Global Head of BlackRock’s Financial

Institutions Group, said, “We’ve seen rapidly accelerated demand

for private markets among insurers in recent years, given these

investments’ dual benefits of diversification and increased income

generation.”

Navigating risk: finding the right investment partner

With 2024 projected to be the biggest election year in history,

insurers see political uncertainty impacting macro risks, citing

regulatory developments (68%) and rising geopolitical tension and

fragmentation (61%) as their top concerns. Additionally, interest

rate risk (69%) and liquidity risk (52%) were highlighted as the

most serious market risks for insurers. Despite this outlook, 74%

of insurers have no plans to change their current risk profiles.

Notably, many insurers reported they benefit from partnerships to

augment their internal expertise for risk evaluation as well as

portfolio construction. According to 40% of survey respondents, an

investment partner who understands both their insurance business

and its operating model is fundamental to the success of insurers’

strategic priorities.

Asset allocation: a balanced approach across public and

private assets

Within public markets, 42% of those surveyed planned to increase

allocations to government and agency bonds. Inflation-linked bonds

are also a priority, with 33% planning to increase exposure, given

nearly half of insurers (46%) identify inflation as a major macro

risk. Additionally, 44% of respondents are looking to increase

their allocations to cash and short-term instruments for

liquidity.

In private markets, insurers report they are looking to increase

allocations to private debt across multiple categories, including

opportunistic private debt (41%), private placements (40%), direct

lending (39%), and infrastructure debt (34%). As the scope of

private debt has expanded to encompass a wider array of lending

opportunities, BlackRock’s report indicates this asset class can

support insurance investment objectives for those needing long-term

assets to support long-term liabilities, as well as increasing

investment income through illiquidity rather than other investment

characteristics. In addition, over half of insurers (52%) reported

they will increase allocations to multi-alternative investments for

greater flexibility and customization.

Olivier Van Eyseren, Head of the Financial Institutions

Group, EMEA for BlackRock said, “Insurers face unique challenges

when evaluating strategic asset allocation to alternative

investments, including regulatory issues, liquidity needs, and

higher capital charges. An important part of our work with

insurance clients is helping them navigate these short-term

complexities while working toward the best possible long-term

portfolio outcomes.”

Seizing the moment for clean energy infrastructure

Nearly all (99%) of insurers surveyed have set a low-carbon

transition objective within their investment portfolio, with 57% of

respondents citing management and/or mitigation of climate risks as

a top motivation for doing so. Additional drivers for setting

low-carbon transition objectives include responding to stakeholder

and beneficiary interest and fulfilling regulatory requirements. To

support their low-carbon transition strategy, clean energy

infrastructure such as wind and solar (60%) and technologies such

as batteries and energy storage (60%) were identified as the top

two thematic areas that insurers plan to target. In addition, 66%

of respondents stated that they have more conviction now towards

investing in the low-carbon transition than they did one year

ago.

Leveraging innovative technology

In an increasingly volatile and complex macroeconomic and

regulatory environment, insurers recognize the importance of

investing in technology. Integrated asset allocation (63%) and

asset liability management (61%) were named as strategic priorities

for their technology platforms. Regulatory capital integration

(51%) was also cited as an area where technology could add value.

As insurers look to continue their deployment into private markets,

53% of respondents view private asset modeling as an additional

area to leverage technology.

About the BlackRock Global Insurance Survey

The BlackRock Global Insurance Survey, now in its thirteenth

year, provides industry-leading insight into the thinking and plans

of the insurance industry through independently conducted

interviews of senior insurance executives across the globe. This

year’s survey conducted in July – September 2024 encapsulates the

views of 410 senior industry executives in 32 markets with the

following regional distribution: 42% from EMEA, 29% from

Asia-Pacific, 19% from North America, and 10% from Latin America.

Taken together these companies represent investable assets of

approximately US$ 27 trillion. The associated interactive report

complements the global findings with regional results, comments

from industry peers and insights from BlackRock experts.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information, please

visit www.blackrock.com/corporate

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014296740/en/

Press Contacts EMEA Emma Philips

emma.phillips@blackrock.com (+44) 20 7743 2922 US Thomasin

Bentley thomasin.bentley@blackrock.com (+1) 646 231 1769

APAC Cecilia Ho cecilia.ho@blackrock.com (+852) 39032595

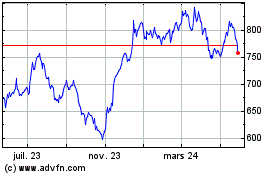

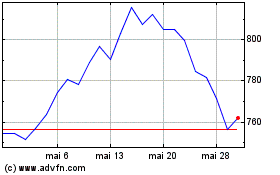

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024