iShares® iBonds® ETFs Near Final Distribution Dates

17 Octobre 2024 - 11:12PM

Business Wire

BlackRock announced today the planned termination of three 2024

iShares iBonds ETFs which possess the following timelines for

trading, net-asset value (NAV) calculation and expected

liquidation:

Ticker

Fund name

Exchange

Last day of trading

Final NAV calculation

date

Liquidation date

IBTE

iShares® iBonds® Dec 2024 Term Treasury

ETF

NASDAQ

12/16/2024

12/16/2024

12/19/2024

IBDP

iShares® iBonds® Dec 2024 Term Corporate

ETF

NYSE Arca

12/16/2024

12/16/2024

12/19/2024

IBHD

iShares® iBonds® Dec 2024 Term High Yield

and Income ETF

CBOE

12/16/2024

12/16/2024

12/19/2024

iBonds ETFs are designed to cease trading and mature during a

specific maturity window like an individual bond. Leading up to the

ETF’s final distribution date, the bonds held by the iBonds ETF

matures, and the ETF transitions into short-term instruments and

cash. Shareholders will receive their proceeds from the liquidation

on or around the listed liquidation date, based on their

brokerage’s processes.

iBonds ETFs across treasuries, municipal bonds and both

investment-grade and high-yield corporate credit remain available

to investors. iShares iBonds ETFs can help market participants

build bond ladders and manage interest rate risk in rising rate

environments.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding

decline in the value of debt securities. Credit risk refers to the

possibility that the debt issuer will not be able to make principal

and interest payments. Non-investment-grade debt securities

(high-yield/junk bonds) may be subject to greater market

fluctuations, risk of default or loss of income and principal than

higher-rated securities. There may be less information on the

financial condition of municipal issuers than for public

corporations. The market for municipal bonds may be less liquid

than for taxable bonds. Some investors may be subject to federal or

state income taxes or the Alternative Minimum Tax (AMT). Capital

gains distributions, if any, are taxable. An investment in the Fund

is not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency and its return and yield

will fluctuate with market conditions.

The iShares® iBonds® ETFs (“Funds”) will terminate in October or

December of the year in each Fund’s name. An investment in the

Fund(s) is not guaranteed, and an investor may experience losses,

including near or at the termination date. Unlike a direct

investment in a bond that has a level coupon payment and a fixed

payment at maturity, the Fund(s) will make distributions of income

that vary over time. In the final months of each Fund’s operation,

as the bonds it holds mature, its portfolio will transition to cash

and cash-like instruments. As a result, its yield will tend to move

toward prevailing money market rates, and may be lower than the

yields of the bonds previously held by the Fund and lower than

prevailing yields in the bond market. As the Fund approaches its

termination date, its holdings of money market or similar funds may

increase, causing the Fund to incur the fees and expenses of these

funds.

Following the Fund’s termination date, the Fund will distribute

substantially all of its net assets, after deduction of any

liabilities, to then-current investors without further notice and

will no longer be listed or traded. The Funds’ distributions and

liquidation proceeds are not predictable at the time of investment

and the Funds do not seek to return any predetermined amount.

The rate of Fund distribution payments may adversely affect the

tax characterization of an investor’s returns from an investment in

the Fund relative to a direct investment in bonds. If the amount an

investor receives as liquidation proceeds upon the Fund’s

termination is higher or lower than the investor’s cost basis, the

investor may experience a gain or loss for tax purposes.

The Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change.

©2024 BlackRock, Inc or its affiliates. All rights reserved.

iSHARES, iBONDS and BLACKROCK are trademarks

of BlackRock, Inc. or its affiliates. All other trademarks are

those of their respective owners

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017791950/en/

MEDIA CONTACTS:

Paige Hofman Paige.hofman@blackrock.com

212-810-3368

Jenna Merchant Jenna.merchant@blackrock.com

914-329-5684

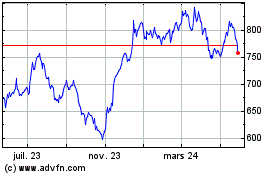

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

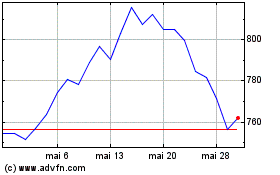

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024