Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today announced that its Board of

Directors (the “Board”) has appointed Richard Imperiale, President

and Chief Investment Officer of Uniplan Investment Counsel, Inc.,

and Joseph Saffire, the former Chief Executive Officer of Life

Storage, Inc. and current director of Extra Space Storage Inc., to

the Board.

“I am delighted to welcome Rick and Joe to BNL’s Board of

Directors,” said John Moragne, the Company’s Chief Executive

Officer and director. “They bring deep and impressive working

knowledge of the REIT industry and related operational matters as

well as strong foundations overseeing the growth of investment

vehicles. We believe Rick’s extensive experience managing

investments in alternative asset strategies, as well as his

previous service as a director for multiple publicly traded REITs,

will provide invaluable insight to the Board. Further, we believe

the Board will benefit greatly from the insights and experience Joe

acquired during his accomplished tenure as the Chief Executive

Officer of a publicly traded REIT. Following the substantial

completion of our recent clinical healthcare portfolio

simplification efforts, the appointments of Rick and Joe represent

the next step in the evolution of BNL’s board as we continue to

implement our differentiated investment strategy built upon our

core building blocks of growth.”

Mr. Imperiale is a founding member of Uniplan Investment

Counsel, Inc., as well as the Chairman of its Investment Policy

Committee, Chief Investment Officer, and an active member of its

Compliance Committee. He has been the portfolio manager for the

Uniplan REIT Strategy since its launch in 1988. Prior to founding

Uniplan in 1984, Rick was a Corporate Credit Analyst with B.C.

Ziegler and Company, as well as a Credit Analyst at First Wisconsin

Bank (now U.S. Bank).

Mr. Saffire joined Life Storage, Inc. as its Chief Investment

Officer in 2017 and served as the Chief Executive Officer and as a

director for Life Storage from March 2019 through July 2023, when

Life Storage was merged into Extra Space Storage Inc. Mr. Saffire

joined the board of directors of Extra Space following the merger.

Prior to joining Life Storage, Mr. Saffire served as the EVP &

Head of Commercial Banking for First Niagara Bank, and the EVP

& Head of Global Bank, EMEA for Wells Fargo Bank, as well as

serving in numerous leadership positions for HSBC Bank.

The Company also announced today that Shekar Narasimhan and

Denise Brooks-Williams have determined not to stand for re-election

to the Board at the Company’s next annual meeting of stockholders,

which the Company intends to hold in May 2025. Mr. Narasimhan has

been a member of the Board since the Company’s inception in October

2007, served as the Chair of the Real Estate Investment Committee

from 2020 until 2023, and currently serves as a member of the

Nominating & Corporate Governance Committee. Ms.

Brooks-Williams has been a member of the Board since May 2021 and

currently serves as a member of the Nominating & Corporate

Governance Committee.

“I am incredibly grateful for the contributions of Shekar and

Denise,” said Laurie Hawkes, the Chairman of the Board. “Shekar has

been a stalwart in the boardroom since BNL was formed. He has been

a consistent and reliable presence and his efforts throughout his

17 years of service helped BNL grow and evolve from a small

Rochester, New York-based company into a publicly traded REIT with

properties across the nation. He played key roles with respect to

BNL’s internalization of management in 2019, including serving on

the Special Committee of the Board, which reviewed and negotiated

the transaction, and serving as the Chair of the Real Estate

Investment Committee, which oversaw management’s investment

processes post-internalization. These efforts contributed to the

transformation of BNL and helped enable our IPO in September

2020.”

“Over the last several years, Denise helped the Board and

management navigate difficult conditions in the healthcare

industry. She was instrumental as we developed and executed upon

BNL’s healthcare portfolio simplification strategy, through which

the Company significantly reduced investments in the clinically

oriented healthcare space. With the substantial completion of our

healthcare portfolio simplification strategy and Denise’s recent

promotion to Executive Vice President and Chief Operating Officer

of Henry Ford Health, overseeing all hospital and service

operations for the 13-hospital health system comprising more than

550 sites of care, 50,000 team members and annual revenues of $12

billion, she felt the time was right for her to step down and focus

on her new role. Both Shekar and Denise have contributed to BNL in

countless ways and helped shape the Company into what BNL is today.

We all thank Shekar and Denise for their years of service to the

Company. The Board and management are focused on building upon

their past contributions as we continue to grow long-term

stockholder value.”

About Broadstone Net Lease, Inc. BNL is an

industrial-focused, diversified net lease REIT that invests in

primarily single-tenant commercial real estate properties that are

net leased on a long-term basis to a diversified group of tenants.

Utilizing an investment strategy underpinned by strong fundamental

credit analysis and prudent real estate underwriting, as of

September 30, 2024, BNL’s diversified portfolio consisted of 773

individual net leased commercial properties with 766 properties

located in 44 U.S. states and seven properties located in four

Canadian provinces across the industrial, restaurant, retail,

healthcare, and office property types.

Forward-Looking Statements This press release contains

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, regarding, among other

things, our plans, strategies, and prospects, both business and

financial. Such forward-looking statements can generally be

identified by our use of forward-looking terminology such as

“outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,”

“approximately,” “projects,” “predicts,” “expect,” “intends,”

“anticipates,” “estimates,” “plans,” “would be,” “believes,”

“continues,” or the negative version of these words or other

comparable words. Forward-looking statements, including our 2024

guidance and assumptions, involve known and unknown risks and

uncertainties, which may cause BNL’s actual future results to

differ materially from expected results, including, without

limitation, risks and uncertainties related to general economic

conditions, including but not limited to increases in the rate of

inflation and/or interest rates, local real estate conditions,

tenant financial health, property investments and acquisitions, and

the timing and uncertainty of completing these property investments

and acquisitions, and uncertainties regarding future distributions

to our stockholders. These and other risks, assumptions, and

uncertainties are described in Item 1A “Risk Factors” of the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on February 22,

2024, which you are encouraged to read, and will be available on

the SEC’s website at www.sec.gov. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements.

Accordingly, you are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

are made. The Company assumes no obligation to, and does not

currently intend to, update any forward-looking statements after

the date of this press release, whether as a result of new

information, future events, changes in assumptions, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218648788/en/

Company: Brent Maedl Director, Corporate Finance &

Investor Relations brent.maedl@broadstone.com 585.382.8507

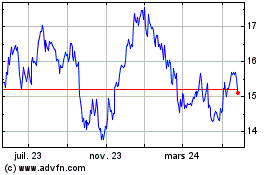

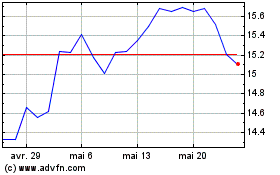

Broadstone Net Lease (NYSE:BNL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Broadstone Net Lease (NYSE:BNL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025