Current Report Filing (8-k)

13 Juin 2023 - 10:54PM

Edgar (US Regulatory)

0001840572

false

0001840572

2023-06-13

2023-06-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of

Report (date of earliest event reported): June 13, 2023

BOWLERO CORP.

(Exact name

of registrant as specified in its charter)

| Delaware |

001-40142 |

98-1632024 |

| |

|

|

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

7313 Bell Creek Road

Mechanicsville, Virginia 23111

(Address of principal executive

offices and zip code)

(804) 417-2000

(Registrant's telephone

number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Class A common stock, par value $0.0001 |

BOWL |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On June 13, 2023, Bowlero Corp. (the “Company”)

entered into a Ninth Amendment (the “Ninth Amendment”) to the First Lien Credit Agreement, dated as of July 3, 2017,

by and among the Company, Kingpin Intermediate Holdings LLC, a direct subsidiary of the Company, as borrower, the other guarantors party

thereto, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders from time to time party thereto (as amended, restated, amended

and restated, supplemented or otherwise modified and in effect prior to the date hereof, the “Existing Credit Agreement”;

the Existing Credit Agreement, as amended by the Ninth Amendment, the “Amended Credit Agreement”). Capitalized terms

not defined herein are as defined in the Amended Credit Agreement.

The Ninth Amendment provides for (i) $250 million of incremental term

loans (the “Incremental Term Loans”) and (ii) a $35 million increase of the total revolving commitments under the Existing

Credit Agreement to an aggregate amount of $235 million. The Incremental Term Loans have the same terms as the existing terms loans under

the Existing Credit Agreement, including amortization rate, interest rate and maturity date. Proceeds of the Incremental Term Loans will

be used for general corporate purposes (which may include acquisitions).

The description above is a summary and is qualified in its entirety

by the full text of the Ninth Amendment and the Amended Credit Agreement, which are filed as Exhibit 10.1 to this Current Report on Form

8-K and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

|

Exhibit

No. |

Description |

| 10.1 |

Ninth Amendment, dated June 13, 2023, to the First Lien Credit Agreement, dated as of July 3, 2017, by and among Bowlero Corp., Kingpin Intermediate Holdings LLC, as borrower, the other guarantors party thereto, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders from time to time party thereto. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

BOWLERO CORP. |

| Date: June 13, 2023 |

|

By: |

/s/ Robert M. Lavan |

| |

|

Name: |

Robert M. Lavan |

| |

|

Title: |

Chief Financial Officer |

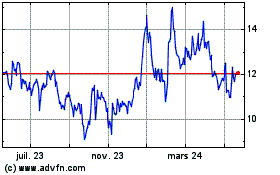

Bowlero (NYSE:BOWL)

Graphique Historique de l'Action

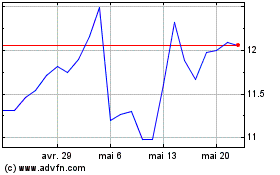

De Mai 2024 à Juin 2024

Bowlero (NYSE:BOWL)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024