Bowlero Corp. (NYSE: BOWL) (“Bowlero” or the “Company”), one of

the world’s premier operators of location-based entertainment,

today provided financial results for the first quarter of the 2025

Fiscal Year, which ended on September 29, 2024.

Quarter Highlights:

- Revenue increased 14.4% to $260.2 million from $227.4 million

in the previous year

- Total Location Revenue increased 17.5% versus the prior

year

- Same Store Revenue increased 0.4% versus the prior year

- Net income of $23.1 million versus prior year income of $18.2

million

- Adjusted EBITDA of $62.9 million versus $52.1 million in the

prior year

- From July 1, 2024 through November 4, 2024, opened two new

builds and acquired one bowling location, five family entertainment

centers and one water park. Total locations in operation as of

November 4, 2024 is 3611

“Total Location Revenue grew 17.5% year over year in the quarter

as we outperformed the market driven by increased customer wallet

share through heightened food, beverage, and experiential

offerings,” said Founder, Chairman, and CEO Thomas Shannon. “Raging

Waves, the largest waterpark in Illinois, outperformed expectations

throughout the summer, in part from an expanded season pass

offering. We acquired Boomers Parks, a leading family entertainment

center brand in California and Florida. In addition, we recently

acquired Spectrum Entertainment Complex, a 52-lane bowling and

events venue near Grand Rapids, Michigan, and opened two Lucky

Strike locations in Denver. We expect to open the flagship Lucky

Strike Beverly Hills and Lucky Strike Ladera Ranch California,

shortly. The M&A market is extremely active, and we look to

continue to deploy capital at attractive returns through our

long-proven underwriting process and operational excellence.”

“Cash flow from operations in the quarter was a record for the

seasonally small first quarter as we focus on operational

efficiencies to expand margins and improve cash flow conversion.

Mobile ordering is now available in all locations. We also have

reformatted our income statement to provide investors new

visibility into revenue segments and 4-wall profitability,” added

Bobby Lavan, Chief Financial Officer.

Share Repurchase and Capital Return Program Update

From July 1, 2024 through October 30, 2024, the Company

repurchased 0.8 million shares of Class A common stock for

approximately $8 million. The company has $156 million currently

remaining under the share repurchase program.

The Board of Directors declared a quarterly cash dividend of

$0.055 per share of common stock for the second quarter of fiscal

year 2025. The dividend will be payable on December 6, 2024, to

stockholders of record on November 22, 2024.

Fiscal Year 2025 Guidance

After completing the first quarter, Bowlero is increasing the

low end of its total revenue guidance for fiscal year 2025 by $10

million. We expect total Revenue to be up mid-single digits to 10%+

year-over-year, which equates to $1.23 billion to $1.28 billion of

total Revenue. Adjusted EBITDA margin is expected to be 32% to 34%,

which equates to Adjusted EBITDA of $390 million to $430

million.

Investor Webcast Information

Listeners may access an investor webcast hosted by Bowlero. The

webcast and results presentation will be accessible at 4:30 PM ET

on November 4, 2024 in the Events & Presentations section of

the Bowlero Investor Relations website at

https://ir.bowlerocorp.com/overview/default.aspx.

About Bowlero Corp.

Bowlero Corporation is one of the world’s premier operators of

location-based entertainment. With over 360 locations across North

America, including bowling and our other location-based

entertainment offerings like Octane Raceway, Raging Waves water

park and Boomers Parks, the Company serves more than 40 million

guest visits annually through a family of brands that include Lucky

Strike, Bowlero and AMF. In 2019, Bowlero acquired the Professional

Bowlers Association, the major league of bowling and a growing

media property that boasts millions of fans around the globe. For

more information on Bowlero, please visit BowleroCorp.com.

Forward Looking Statements

Some of the statements contained in this press release are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, that involve risk,

assumptions and uncertainties, such as statements of our plans,

objectives, expectations, intentions and forecasts. These

forward-looking statements are generally identified by the use of

forward-looking terminology, including the terms "anticipate,"

"believe," “confident,” “continue,” "could," "estimate," "expect,"

"intend," “likely,” "may," "plan," “possible,” "potential,"

"predict," "project," "should," "target," "will," "would" and, in

each case, their negative or other various or comparable

terminology. These forward-looking statements reflect our views

with respect to future events as of the date of this release and

are based on our management’s current expectations, estimates,

forecasts, projections, assumptions, beliefs and information.

Although management believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

All such forward-looking statements are subject to risks and

uncertainties, many of which are outside of our control, and could

cause future events or results to be materially different from

those stated or implied in this document. It is not possible to

predict or identify all such risks. These risks include, but are

not limited to: our ability to design and execute our business

strategy; changes in consumer preferences and buying patterns; our

ability to compete in our markets; the occurrence of unfavorable

publicity; risks associated with long-term non-cancellable leases

for our locations; our ability to retain key managers; risks

associated with our substantial indebtedness and limitations on

future sources of liquidity; our ability to carry out our expansion

plans; our ability to successfully defend litigation brought

against us; our ability to adequately obtain, maintain, protect and

enforce our intellectual property and proprietary rights and claims

of intellectual property and proprietary right infringement,

misappropriation or other violation by competitors and third

parties; failure to hire and retain qualified employees and

personnel; the cost and availability of commodities and other

products we need to operate our business; cybersecurity breaches,

cyber-attacks and other interruptions to our and our third-party

service providers’ technological and physical infrastructures;

catastrophic events, including war, terrorism and other conflicts;

public health emergencies and pandemics, such as the COVID-19

pandemic, or natural catastrophes and accidents; changes in the

regulatory atmosphere and related private sector initiatives;

fluctuations in our operating results; economic conditions,

including the impact of increasing interest rates, inflation and

recession; and other factors described under the section titled

“Risk Factors” in the Company's Annual Report on Form 10-K filed

with the U.S. Securities and Exchange Commission (the “SEC”) by the

Company on September 5, 2024, as well as other filings that the

Company will make, or has made, with the SEC, such as Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this press release and in other filings. We expressly disclaim

any obligation to publicly update or review any forward-looking

statements, whether as a result of new information, future

developments or otherwise, except as required by applicable

law.

Non-GAAP Financial Measures

To provide investors with information in addition to our results

as determined under Generally Accepted Accounting Principles

(“GAAP”), we disclose Revenue Excluding Service Fee Revenue, Total

Location Revenue, Same Store Revenue and Adjusted EBITDA as

“non-GAAP measures”, which management believes provide useful

information to investors because each measure assists both

investors and management in analyzing and benchmarking the

performance and value of our business. Accordingly, management

believes that these measurements are useful for comparing general

operating performance from period to period, and management relies

on these measures for planning and forecasting of future periods.

Additionally, these measures allow management to compare our

results with those of other companies that have different financing

and capital structures. These measures are not financial measures

calculated in accordance with GAAP and should not be considered as

a substitute for revenue, net income, or any other operating

performance or liquidity measure calculated in accordance with

GAAP, and may not be comparable to a similarly titled measure

reported by other companies. Our fiscal year 2025 guidance measures

(other than revenue) are provided on a non-GAAP basis without a

reconciliation to the most directly comparable GAAP measure because

the Company is unable to predict with a reasonable degree of

certainty certain items contained in the GAAP measures without

unreasonable efforts. For the same reasons, the Company is unable

to address the probable significance of the unavailable

information. Such items include, but are not limited to,

acquisition related expenses, share-based compensation and other

items not reflective of the company's ongoing operations.

Revenue Excluding Service Fee Revenue represents total Revenue

less Service Fee Revenue. Total Location Revenue represents total

Revenue less Non-Location Related Revenue, Revenue from Closed

Locations, and Service Fee Revenue, if applicable. Same Store

Revenue represents total Revenue less Non-Location Related Revenue,

Revenue from Closed Locations, Service Fee Revenue, if applicable,

and Acquired Revenue. Adjusted EBITDA represents Net Income (Loss)

before Interest Expense, Income Taxes, Depreciation and

Amortization, Impairment and Other Charges, Share-based

Compensation, EBITDA from Closed Locations, Foreign Currency

Exchange Loss (Gain), Asset Disposition Loss (Gain), Transactional

and other advisory costs, changes in the value of earnouts, and

other.

The Company considers Revenue Excluding Service Fee Revenue as

an important financial measure because it provides a financial

measure of revenue directly associated with consumer discretionary

spending and Total Location Revenue as an important financial

measure because it provides a financial measure of revenue directly

associated with location operations. The Company also considers

Same Store Revenue as an important financial measure because it

provides comparable revenue for locations open for the entire

duration of both the current and comparable measurement

periods.

The Company considers Adjusted EBITDA as an important financial

measure because it provides a financial measure of the quality of

the Company’s earnings. Other companies may calculate Adjusted

EBITDA differently than we do, which might limit its usefulness as

a comparative measure. Adjusted EBITDA is used by management in

addition to and in conjunction with the results presented in

accordance with GAAP. We have presented Adjusted EBITDA solely as a

supplemental disclosure because we believe it allows for a more

complete analysis of results of operations and assists investors

and analysts in comparing our operating performance across

reporting periods on a consistent basis by excluding items that we

do not believe are indicative of our core operating performance.

Adjusted EBITDA has limitations as an analytical tool, and you

should not consider it in isolation or as a substitute for analysis

of our results as reported under GAAP. Some of these limitations

are that Adjusted EBITDA:

- do not reflect every expenditure, future requirements for

capital expenditures or contractual commitments;

- do not reflect changes in our working capital needs;

- do not reflect the interest expense, or the amounts necessary

to service interest or principal payments, on our outstanding

debt;

- do not reflect income tax (benefit) expense, and because the

payment of taxes is part of our operations, tax expense is a

necessary element of our costs and ability to operate;

- do not reflect non-cash equity compensation, which will remain

a key element of our overall equity based compensation package;

and

- do not reflect the impact of earnings or charges resulting from

matters we consider not to be indicative of our ongoing

operations.

1 Two properties from a recent acquisition are excluded from the

count

GAAP Financial Information

Bowlero Corp.

Condensed Consolidated Balance

Sheets

(Amounts in thousands, except

share and per share amounts)

(Unaudited)

September 29, 2024

June 30, 2024

Assets

Current assets:

Cash and cash equivalents

$

38,448

$

66,972

Accounts and notes receivable, net

5,666

6,757

Inventories, net

13,650

13,171

Prepaid expenses and other current

assets

30,365

25,316

Assets held-for-sale

20

1,746

Total current assets

88,149

113,962

Property and equipment, net

892,782

887,738

Operating lease right of use assets

554,474

559,168

Finance lease right of use assets, net

520,218

524,392

Intangible assets, net

45,111

47,051

Goodwill

833,961

833,888

Deferred income tax asset

122,847

112,106

Other assets

34,884

35,730

Total assets

$

3,092,426

$

3,114,035

Liabilities, Temporary Equity and

Stockholders’ Deficit

Current liabilities:

Accounts payable and accrued expenses

$

146,022

$

135,784

Current maturities of long-term debt

9,106

9,163

Current obligations of operating lease

liabilities

28,811

28,460

Other current liabilities

8,381

9,399

Total current liabilities

192,320

182,806

Long-term debt, net

1,130,141

1,129,523

Long-term obligations of operating lease

liabilities

567,209

561,916

Long-term obligations of finance lease

liabilities

681,222

680,213

Long-term financing obligations

442,980

440,875

Earnout liability

88,741

137,636

Other long-term liabilities

26,093

26,471

Deferred income tax liabilities

4,129

4,447

Total liabilities

3,132,835

3,163,887

Commitments and Contingencies

September 29, 2024

June 30, 2024

Temporary Equity

Series A preferred stock

$

123,918

$

127,410

Stockholders’ Deficit

Class A common stock

11

11

Class B common stock

6

6

Additional paid-in capital

509,929

510,675

Treasury stock, at cost

(392,735

)

(385,015

)

Accumulated deficit

(280,064

)

(303,159

)

Accumulated other comprehensive (loss)

income

(1,474

)

220

Total stockholders’ deficit

(164,327

)

(177,262

)

Total liabilities, temporary equity and

stockholders’ deficit

$

3,092,426

$

3,114,035

Bowlero Corp.

Condensed Consolidated Statements

of Operations

(Amounts in thousands)

(Unaudited)

Three Months Ended

September 29,

2024

October 1, 2023

Revenues

Bowling

$

122,203

$

116,430

Food & beverage

88,039

74,913

Amusement & other

49,953

36,062

Total revenues

260,195

227,405

Costs and expenses

Location operating costs, excluding

depreciation and amortization

86,228

73,373

Location payroll and benefit costs

67,436

63,054

Location food and beverage costs

20,530

16,685

Selling, general and administrative

expenses, excluding depreciation and amortization

34,811

38,124

Depreciation and amortization

36,983

31,352

Loss (gain) on impairment and disposal of

fixed assets, net

1,472

(1

)

Other operating income, net

(211

)

(538

)

Total costs and expenses

247,249

222,049

Operating income

12,946

5,356

Other (income) expenses

Interest expense, net

48,670

37,449

Change in fair value of earnout

liability

(48,921

)

(40,682

)

Other expense

—

53

Total other income

(251

)

(3,180

)

Income before income tax

benefit

13,197

8,536

Income tax benefit

(9,898

)

(9,683

)

Net income

$

23,095

$

18,219

Bowlero Corp.

Condensed Consolidated Statements

of Cash Flows

(Amounts in thousands)

(Unaudited)

Three Months Ended

September 29,

2024

October 1, 2023

Net cash provided by operating

activities

$

29,413

$

16,083

Net cash used in investing activities

(39,924

)

(176,576

)

Net cash (used in) provided by financing

activities

(17,806

)

5,091

Effect of exchange rate changes on

cash

(207

)

(143

)

Net decrease in cash and cash

equivalents

(28,524

)

(155,545

)

Cash and cash equivalents at beginning of

period

66,972

195,633

Cash and cash equivalents at end of

period

$

38,448

$

40,088

Balance Sheet and Liquidity

As of September 29, 2024 and June 30, 2024, our calculation of

net debt was as follows:

(in thousands)

September 29, 2024

June 30, 2024

Cash and cash equivalents

$

38,448

$

66,972

Bank debt and loans

1,151,951

1,152,200

Net debt

$

1,113,503

$

1,085,228

As of September 29, 2024 and June 30, 2024, our cash on hand and

revolving borrowing capacity was as follows:

(in thousands)

September 29, 2024

June 30, 2024

Cash and cash equivalents

$

38,448

$

66,972

Revolver Capacity

335,000

285,000

Revolver capacity committed to letters of

credit

(18,584

)

(15,834

)

Total cash on hand and revolving borrowing

capacity

$

354,864

$

336,138

GAAP to non-GAAP Reconciliations

Same Store Revenue

Three Months Ended

(in thousands)

October 1, 2023

September 29, 2024

Total Revenue - Reported

$

227,405

$

260,195

less: Service Fee Revenue

(1,621

)

(650

)

Revenue Excluding Service Fee Revenue

$

225,784

$

259,545

less: Non-Location Related (including

Closed Centers)

(7,985

)

(3,597

)

Total Location Revenue

$

217,799

$

255,948

less: Acquired Revenue

(1,211

)

(38,425

)

Same Store Revenue

$

216,588

$

217,523

% Year-over-Year

Change

Total Revenue – Reported

14.4

%

Total Revenue excluding Service Fee

Revenue

15.0

%

Total Location Revenue

17.5

%

Same Store Revenue

0.4

%

Adjusted EBITDA

Reconciliation

Three Months Ended

(in thousands)

September 29, 2024

October 1, 2023

Consolidated

Revenue

$

260,195

$

227,405

Net income - GAAP

23,095

18,219

Net income margin

8.9

%

8.0

%

Adjustments:

Interest expense

48,670

39,032

Income tax benefit

(9,898

)

(9,683

)

Depreciation and amortization

37,437

32,000

Loss (gain) on impairment, disposals, and

other charges, net

1,472

(1

)

Share-based compensation

4,503

1,911

Closed location EBITDA (1)

2,205

2,462

Transactional and other advisory costs

(2)

3,259

8,398

Changes in the value of earnouts (3)

(48,921

)

(40,682

)

Other, net (4)

1,121

478

Adjusted EBITDA

$

62,943

$

52,134

Adjusted EBITDA Margin

24.2

%

22.9

%

[1]

The closed location adjustment is to remove EBITDA for closed

locations. Closed locations are those locations that are closed for

a variety of reasons, including permanent closure, newly acquired

or built locations prior to opening, locations closed for

renovation or rebranding and conversion. If a location is not open

on the last day of the reporting period, it will be considered

closed for that reporting period. If the location is closed on the

first day of the reporting period for permanent closure, the

location will be considered closed for that reporting period.

[2]

The adjustment for transaction costs and other advisory costs is

to remove charges incurred in connection with any transaction,

including mergers, acquisitions, refinancing, amendment or

modification to indebtedness, dispositions and costs in connection

with an initial public offering, in each case, regardless of

whether consummated.

[3]

The adjustment for changes in the

value of earnouts is to remove of the impact of the revaluation of

the earnouts. Changes in the fair value of the earnout liability is

recognized in the statement of operations. Decreases in the

liability will have a favorable impact on the statement of

operations and increases in the liability will have an unfavorable

impact.

[4]

Other includes the following related to transactions that do not

represent ongoing or frequently recurring activities as part of the

Company’s operations: (i) non-routine expenses, net of recoveries

for matters outside the normal course of business, (ii) costs

incurred that have been expensed associated with obtaining an

equity method investment in a subsidiary of VICI, (iii) severance

expense, and (iv) other individually de minimis expenses. Certain

prior year amounts have been reclassified to conform to current

year presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104846708/en/

Bowlero Corp. Investor Relations IR@BowleroCorp.com

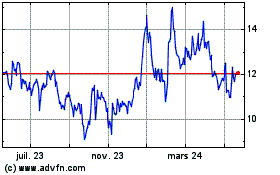

Bowlero (NYSE:BOWL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

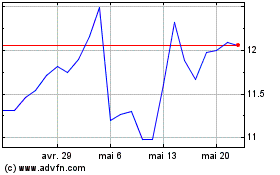

Bowlero (NYSE:BOWL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025