Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

09 Décembre 2024 - 2:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-36206

BIT Mining Limited

|

428 South Seiberling Street

Akron, Ohio 44306

United States of America

+1 (346) 204-8537 |

| |

|

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

EXPLANATORY NOTE

This report on Form 6-K is hereby incorporated by reference into the

Company’s Registration Statement on Form F-3, as amended, initially filed with the U.S. Securities and Exchange Commission on July

30, 2021 (Registration No. 333-258329), and shall be a part thereof from the date on which this current report is furnished, to the extent

not superseded by documents or reports subsequently filed or furnished.

TABLE OF CONTENT

Exhibit 99.1 BIT Mining Completed the First Phase of Acquisition in Ethiopia

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BIT MINING LIMITED |

| |

|

| |

By: |

/s/ Xianfeng Yang

|

| |

Name: |

Xianfeng Yang |

| |

Title: |

Chief Executive Officer |

| |

|

|

Date: December 9, 2024

Exhibit 99.1

BIT Mining Completed the First Phase of Acquisition

in Ethiopia

AKRON,

Ohio, December 9, 2024 /PRNewswire/ – BIT Mining Limited (NYSE: BTCM) (“BIT Mining” or the “Company”),

a leading technology-driven cryptocurrency mining company, today announced that it has completed the first phase of previously-announced

acquisition of crypto mining data centers and Bitcoin (“BTC”) mining machines in Ethiopia. To complete the first phase of

the acquisition, the Company has made a cash payment of US$2.265 million and issued an aggregate number of 369,031,800 Class A ordinary

shares to the sellers in exchange for a 35-megawatt operational and electrified crypto mining data center and 17,869 BTC mining machines.

The second phase of the acquisition, which involves transfer of the remaining data centers to the Company, will close upon completion

of construction of the remaining data centers, which is expected to occur in March or April 2025. Upon closing of the second

phase, the Company will issue an additional 45,278,600 Class A ordinary shares as consideration.

About BIT Mining

BIT Mining (NYSE: BTCM) is a leading technology-driven cryptocurrency

mining company with operations in cryptocurrency mining, data center operation and mining machine manufacturing. The Company is strategically

creating long-term value across the industry with its cryptocurrency ecosystem. Anchored by its cost-efficient data centers that strengthen

its profitability with steady cash flow, the Company also conducts self-mining operations that enhance its marketplace resilience by leveraging

self-developed and purchased mining machines to seamlessly adapt to dynamic cryptocurrency pricing. The Company also owns 7-nanometer

BTC chips and has strong capabilities in the development of LTC/DOGE miners and ETC miners.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “target,”

“going forward,” “outlook” and similar statements. Forward looking statements in this press release include, but

are not limited to, statements on the closing of the second phase of the proposed acquisition. Such statements are based upon management’s

current expectations and current market and operating conditions and relate to events that involve known or unknown risks, uncertainties

and other factors, all of which are difficult to predict and many of which are beyond the Company’s control, which may cause the

Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements. Important

factors that could cause BIT Mining’s actual results to differ materially from those indicated in the forward-looking statements

include, but are not limited to, any adverse change in the business and financial performance of the Company or the landscape of the cryptocurrency

mining industry, the inability of the Company or the counterparty to satisfy the closing conditions of the proposed acquisition, and the

occurrence of any event, change or other circumstance that could give rise to the termination of the agreement for the proposed acquisition.

Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S.

Securities and Exchange Commission. The Company does not undertake any obligation to update any forward-looking statement as a result

of new information, future events or otherwise, except as required under law.

For more information:

BIT Mining Limited

ir@btcm.group

Ir.btcm.group

www.btcm.group

Piacente Financial Communications

Brandi Piacente

Tel: +1 (212) 481-2050

Email: BITMining@thepiacentegroup.com

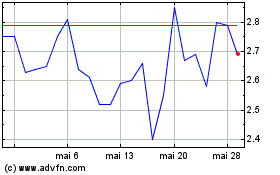

Bit Mining (NYSE:BTCM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Bit Mining (NYSE:BTCM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025