BrightView Announces Pricing of Secondary Offering Anchored by T. Rowe Price Investment Management

20 Mai 2024 - 10:30PM

Business Wire

BrightView Holdings, Inc. (NYSE: BV) (“BrightView”) today

announced the pricing of an underwritten secondary offering by a

selling stockholder affiliated with KKR & Co. Inc. (the

“Selling Stockholder”) of 17,500,000 shares of common stock of

BrightView pursuant to a registration statement filed by BrightView

with the U.S. Securities and Exchange Commission (the “SEC”). No

shares are being sold by BrightView. The Selling Stockholder will

receive all of the proceeds from this offering. The offering is

expected to close on May 23, 2024, subject to customary closing

conditions.

KKR, Craig-Hallum, CJS Securities, Morgan Stanley, and Loop

Capital Markets are acting as the active joint book-running

managers for the offering. The underwriters intend to distribute

the shares sold in the offering to a group of institutional

investors led by T. Rowe Price Investment Management Inc.

A registration statement relating to these securities has been

filed with the SEC and has become effective. This press release

shall not constitute an offer to sell or a solicitation of an offer

to buy these securities, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

The offering of these securities will be made only by means of a

prospectus supplement and accompanying prospectus. Copies of the

preliminary prospectus and accompanying prospectus for the offering

may be obtained from; KKR Capital Markets LLC, by telephone at

(212) 750-8300 or by email to ECMCapitalMarkets@kkr.com;

Craig-Hallum, 222 South Ninth Street, Suite 350, Minneapolis,

Minnesota 55402, Attn: Equity Capital Markets, by telephone at

(612) 334-6300 or by e-mail at prospectus@chlm.com; CJS Securities,

Attention: Prospectus Department, 50 Main Street, #325, White

Plains, New York 10606, or by email at info@cjs-securities.com;

Morgan Stanley, Attention: Prospectus Department, 180 Varick

Street, 2nd Floor, New York, New York 10014; or Loop Capital

Markets, 435 South Financial Place, Suite 2700, Chicago, Illinois

60607, or by email at Compliance@loopcapital.com. You may also

obtain these and the other documents referred to above for free by

visiting the SEC’s website at www.sec.gov.

About BrightView BrightView, the nation’s largest

commercial landscaper, proudly designs, creates, and maintains the

best landscapes on Earth and provides the most efficient and

comprehensive snow and ice removal services. With a dependable

service commitment, BrightView brings brilliant landscapes to life

at premier properties across the United States, including business

parks and corporate offices, homeowners' associations, healthcare

facilities, educational institutions, retail centers, resorts and

theme parks, municipalities, golf courses, and sports venues.

BrightView also serves as the Official Field Consultant to Major

League Baseball. Through industry-leading best practices and

sustainable solutions, BrightView is invested in taking care of our

team members, engaging our clients, inspiring our communities, and

preserving our planet.

Forward Looking Statements This press release includes

certain disclosures which contain “forward-looking statements.” You

can identify forward-looking statements because they contain words

such as “believes,” “expects,” “may,” “will,” “should,” “seeks,”

“intends,” “plans,” “estimates,” or “anticipates,” and variations

of such words or similar expressions. Forward-looking statements

are based on BrightView’s current expectations and assumptions.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements, which are neither statements of

historical fact nor guarantees or assurances of future performance.

Important factors that could cause actual results to differ

materially from those in the forward-looking statements can be

found under the caption “Risk Factors” in BrightView’s annual

report on Form 10-K for the year ended September 30, 2023, as filed

with the SEC, as such risk factors may be updated from time to time

in its periodic filings with the SEC, which are accessible on the

SEC’s website on www.sec.gov. Any forward-looking statement in this

release speaks only as of the date of this release. BrightView

undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by any

applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520155122/en/

Investors Chris Stoczko, Vice President of Finance

IR@brightview.com

News Media David Freireich, Vice President of

Communications & Public Affairs

David.Freireich@brightview.com

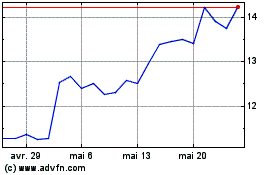

BrightView (NYSE:BV)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

BrightView (NYSE:BV)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024