Revenues of $2.1 billion, up 11% YoY

Net income of $120.2 million and diluted EPS

of $5.33, up 42% YoY

Adjusted net income of $133.6 million and

adjusted diluted EPS of $5.93, up 36% YoY

EBITDA of $215.9 million and EBITDA margin

of 10.5%, up 110 bps YoY

Contract awards of $3.3 billion and

book-to-bill of 1.6x

CACI International Inc (NYSE: CACI), a leading provider of

expertise and technology to government customers, announced results

today for its fiscal first quarter ended September 30, 2024.

“In the first quarter, CACI delivered exceptional financial

results across the board with revenue growth of 11%, healthy

profitability and cash flow, and strong awards and backlog. In

addition, we demonstrated our flexible and opportunistic approach

to capital deployment by announcing two strategic acquisitions,

Azure Summit Technology and Applied Insight,” said John Mengucci,

CACI President and Chief Executive Officer. “Our continued momentum

allows us to raise our fiscal year 2025 guidance. CACI is well

positioned to continue driving long-term value for our customers

and our shareholders.”

First Quarter Results

Three Months Ended

(in millions, except earnings per share

and DSO)

9/30/2024

9/30/2023

% Change

Revenues

$

2,056.9

$

1,850.1

11.2

%

Income from operations

$

179.8

$

137.3

30.9

%

Net income

$

120.2

$

86.0

39.7

%

Adjusted net income, a non-GAAP

measure1

$

133.6

$

99.7

34.0

%

Diluted earnings per share

$

5.33

$

3.76

41.8

%

Adjusted diluted earnings per share, a

non-GAAP measure1

$

5.93

$

4.36

36.0

%

Earnings before interest, taxes,

depreciation and amortization (EBITDA), a non-GAAP measure1

$

215.9

$

174.2

23.9

%

Net cash provided by operating activities

excluding MARPA1

$

60.9

$

93.3

-34.7

%

Free cash flow, a non-GAAP measure1

$

49.4

$

79.3

-37.7

%

Days sales outstanding (DSO)2

47

49

(1)

This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. For additional information regarding this

non-GAAP measure, see the related explanation and reconciliation to

the GAAP measure included below in this release.

(2)

The DSO calculations for three months

ended September 30, 2024 and 2023 exclude the impact of the

Company's Master Accounts Receivable Purchase Agreement (MARPA),

which was 6 days and 5 days, respectively.

Revenues in the first quarter of fiscal year 2025 increased 11.2

percent year-over-year, driven by 9.9 percent organic growth. The

increase in income from operations was driven by higher revenues

and gross profit. Growth in diluted earnings per share and adjusted

diluted earnings per share was driven by higher income from

operations and a lower share count, partially offset by a higher

tax provision. The decrease in cash from operations, excluding

MARPA, was driven primarily by changes in working capital partially

offset by higher earnings.

First Quarter Contract Awards

Contract awards in the first quarter totaled $3.3 billion, with

nearly 75 percent for new business to CACI. Awards exclude ceiling

values of multi-award, indefinite delivery, indefinite quantity

(IDIQ) contracts. Some notable awards during the quarter were:

- CACI was awarded a five-year task order valued at up to $805

million to provide engineering services and technology to the U.S.

Navy NavalX under the Department of Defense Information Analysis

Center’s (DoD IAC) multiple-award contract (MAC) vehicle.

- CACI was awarded a five-year task order valued at up to $314

million to provide engineering services and technology to the U.S.

Navy Naval Undersea Warfare Center (NUWC) under the Department of

Defense Information Analysis Center’s (DoD IAC) multiple-award

contract (MAC) vehicle. Through the NUWC Engineering and

Modernization Operations (NEMO) program, CACI will develop,

deliver, and train sailors in the areas of integration support,

logistics, project management, cyber capabilities, and analysis.

These activities will allow the customer to engage in new fleet

exercises and events, test new capabilities, and evaluate

vulnerabilities that will ultimately reduce the risk of cyber

intrusions.

- CACI was awarded a five-year task order valued at up to $273

million to continue providing intelligence expertise to the U.S.

Central Command (USCENTCOM). Awarded through the U.S. Army

Intelligence and Security Command (INSCOM), CACI’s leading

intelligence analysts will assist in safeguarding U.S. forces from

foreign adversarial threats and will continue to provide USCENTCOM

with intelligence, security operations, all-source and identity

intelligence, biometric-related analysis, and production supporting

tasks ensuring decision makers have essential intelligence,

surveillance, and reconnaissance (ISR) resources and actionable

analysis.

- CACI was awarded a five-year task order valued at up to $226

million to provide expertise to the U.S. military.

Total backlog as of September 30, 2024 was $32.4 billion

compared with $26.7 billion a year ago, an increase of 21.3

percent. Funded backlog as of September 30, 2024 was $4.3 billion

compared with $4.2 billion a year ago, an increase of 2.4

percent.

Additional Highlights

- CACI won two Nunn-Perry Awards for excellence as part of the

DoD Mentor Protégé Program. These recognitions mark the sixth and

seventh consecutive Nunn-Perry awards the company has received

since 2014. This prestigious honor recognizes CACI’s collaboration

with EXPANSIA, a service-disabled, veteran-owned small business,

and Mayvin, a woman-owned small business management consulting firm

that provides a wide range of professional and technical

services.

Subsequent to quarter end:

- CACI completed the acquisition of Applied Insight, a Northern

Virginia-based portfolio company of Acacia Group, in an all-cash

transaction. In alignment with CACI’s mission to deliver

distinctive expertise and differentiated technology to meet its

customers’ greatest national security challenges, Applied Insight

delivers proven cloud migration, adoption, and transformation

capabilities, coupled with intimate customer relationships across

the Department of Defense (DoD) and Intelligence Communities

(IC).

- Scott C. Morrison was elected by CACI shareholders to its Board

of Directors, effective immediately. Morrison will serve as an

independent director on the Board. Morrison joins CACI’s Board of

Directors from his most recent role as executive vice president and

chief financial officer of Ball Corporation, sustainable packaging

solutions for beverage, food, and household products

customers.

- Charles L. Szews was elected by CACI shareholders to its Board

of Directors, effective immediately. Szews will serve as an

independent director on the board. From 2012 to 2015, Szews served

as chief executive officer (CEO) of Oshkosh Corporation, a

designer, manufacturer, and marketer of specialty vehicles and

vehicle bodies.

Fiscal Year 2025 Guidance

The table below summarizes our fiscal year 2025 guidance and

represents our views as of October 23, 2024. Our guidance reflects

increased organic growth and the inclusion of the Applied Insight

acquisition, but does not include the pending Azure Summit

Technology acquisition.

(in millions, except earnings per

share)

Fiscal Year 2025

Current Guidance

Prior Guidance

Revenues

$8,100 - $8,300

$7,900 - $8,100

Adjusted net income, a non-GAAP

measure1

$515 - $535

$505 - $525

Adjusted diluted earnings per share, a

non-GAAP measure1

$22.89 - $23.78

$22.44 - $23.33

Diluted weighted average shares

22.5

22.5

Free cash flow, a non-GAAP measure2

at least $435

at least $425

(1)

Adjusted net income and adjusted diluted

earnings per share are defined as GAAP net income and GAAP diluted

EPS, respectively, excluding intangible amortization expense and

the related tax impact. This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. For additional information regarding this

non-GAAP measure, see the related explanation and reconciliation to

the GAAP measure included below in this release.

(2)

Free cash flow is defined as net cash

provided by operating activities excluding MARPA, less payments for

capital expenditures (capex). This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. Fiscal year 2025 free cash flow guidance

assumes approximately $55 million in tax payments related to

Section 174 of the Tax Cuts and Jobs Act of 2017 and an

approximately $40 million cash tax refund related to our method

change enacted in fiscal year 2021. For additional information

regarding this non-GAAP measure, see the related explanation and

reconciliation to the GAAP measure included below in this

release.

Conference Call Information

We have scheduled a conference call for 8:00 a.m. Eastern time

Thursday, October 24, 2024 during which members of our senior

management will be making a brief presentation focusing on first

quarter results and operating trends, followed by a

question-and-answer session. You can listen to the webcast and view

the accompanying exhibits on CACI’s investor relations website at

http://investor.caci.com/events/default.aspx at the scheduled time.

A replay of the call will also be available on CACI’s investor

relations website at http://investor.caci.com/.

About CACI

At CACI International Inc (NYSE: CACI), our 24,000 talented and

dynamic employees are ever vigilant in delivering distinctive

expertise and technology to meet our customers’ greatest challenges

in national security. We are a company of good character,

relentless innovation, and long-standing excellence. Our culture

drives our success and earns us recognition as a Fortune World's

Most Admired Company. CACI is a member of the Fortune 1000 Largest

Companies, the Russell 1000 Index, and the S&P MidCap 400

Index. For more information, visit us at www.caci.com.

There are statements made herein that do not address historical

facts and, therefore, could be interpreted to be forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. Such statements are subject to risk

factors that could cause actual results to be materially different

from anticipated results. These risk factors include, but are not

limited to, the following: our reliance on U.S. government

contracts, which includes general risk around the government

contract procurement process (such as bid protest, small business

set asides, loss of work due to organizational conflicts of

interest, etc.) and termination risks; significant delays or

reductions in appropriations for our programs and broader changes

in U.S. government funding and spending patterns; legislation that

amends or changes discretionary spending levels or budget

priorities, such as for homeland security or to address global

pandemics like COVID-19; legal, regulatory, and political change

from successive presidential administrations that could result in

economic uncertainty; changes in U.S. federal agencies, current

agreements with other nations, foreign events, or any other events

which may affect the global economy, including the impact of global

pandemics like COVID-19; the results of government audits and

reviews conducted by the Defense Contract Audit Agency, the Defense

Contract Management Agency, or other governmental entities with

cognizant oversight; competitive factors such as pricing pressures

and/or competition to hire and retain employees (particularly those

with security clearances); failure to achieve contract awards in

connection with re-competes for present business and/or competition

for new business; regional and national economic conditions in the

United States and globally, including but not limited to: terrorist

activities or war, changes in interest rates, currency

fluctuations, significant fluctuations in the equity markets, and

market speculation regarding our continued independence; our

ability to meet contractual performance obligations, including

technologically complex obligations dependent on factors not wholly

within our control; limited access to certain facilities required

for us to perform our work, including during a global pandemic like

COVID-19; changes in tax law, the interpretation of associated

rules and regulations, or any other events impacting our effective

tax rate; changes in technology; the potential impact of the

announcement or consummation of a proposed transaction and our

ability to successfully integrate the operations of our recent and

any future acquisitions; our ability to achieve the objectives of

near term or long-term business plans; the effects of health

epidemics, pandemics and similar outbreaks may have material

adverse effects on our business, financial position, results of

operations and/or cash flows; and other risks described in our

Securities and Exchange Commission filings.

CACI International Inc

Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share

data)

Three Months Ended

9/30/2024

9/30/2023

% Change

Revenues

$

2,056,889

$

1,850,147

11.2

%

Costs of revenues:

Direct costs

1,414,424

1,272,918

11.1

%

Indirect costs and selling expenses

427,946

404,633

5.8

%

Depreciation and amortization

34,678

35,247

-1.6

%

Total costs of revenues

1,877,048

1,712,798

9.6

%

Income from operations

179,841

137,349

30.9

%

Interest expense and other, net

23,970

25,571

-6.3

%

Income before income taxes

155,871

111,778

39.4

%

Income taxes

35,694

25,731

38.7

%

Net income

$

120,177

$

86,047

39.7

%

Basic earnings per share

$

5.39

$

3.80

41.8

%

Diluted earnings per share

$

5.33

$

3.76

41.8

%

Weighted average shares used in per share

computations:

Weighted-average basic shares

outstanding

22,304

22,647

-1.5

%

Weighted-average diluted shares

outstanding

22,539

22,894

-1.6

%

CACI International Inc

Consolidated Balance Sheets

(Unaudited)

(in thousands)

9/30/2024

6/30/2024

ASSETS

Current assets:

Cash and cash equivalents

$

440,706

$

133,961

Accounts receivable, net

1,069,611

1,031,311

Prepaid expenses and other current

assets

236,781

209,257

Total current assets

1,747,098

1,374,529

Goodwill

4,166,015

4,154,844

Intangible assets, net

457,087

474,354

Property, plant and equipment, net

191,379

195,443

Operating lease right-of-use assets

339,748

305,637

Supplemental retirement savings plan

assets

101,909

99,339

Accounts receivable, long-term

14,130

13,311

Other long-term assets

165,697

178,644

Total assets

$

7,183,063

$

6,796,101

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

61,250

$

61,250

Accounts payable

263,535

287,142

Accrued compensation and benefits

242,059

316,514

Other accrued expenses and current

liabilities

434,254

413,354

Total current liabilities

1,001,098

1,078,260

Long-term debt, net of current portion

1,761,623

1,481,387

Supplemental retirement savings plan

obligations, net of current portion

119,906

111,208

Deferred income taxes

156,933

169,808

Operating lease liabilities,

noncurrent

380,480

325,046

Other long-term liabilities

111,417

112,185

Total liabilities

3,531,457

3,277,894

Total shareholders’ equity

3,651,606

3,518,207

Total liabilities and shareholders’

equity

$

7,183,063

$

6,796,101

CACI International Inc

Consolidated Statements of

Cash Flows (Unaudited)

(in thousands)

Three Months Ended

9/30/2024

9/30/2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

120,177

$

86,047

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

34,678

35,247

Amortization of deferred financing

costs

549

547

Stock-based compensation expense

15,391

10,024

Deferred income taxes

(7,086

)

(7,812

)

Changes in operating assets and

liabilities, net of effect of business acquisitions:

Accounts receivable, net

(35,770

)

(111,159

)

Prepaid expenses and other assets

(40,308

)

(37,343

)

Accounts payable and other accrued

expenses

(10,561

)

154,469

Accrued compensation and benefits

(75,614

)

(90,511

)

Income taxes payable and receivable

30,609

23,803

Operating lease liabilities and assets,

net

(1,054

)

(868

)

Long-term liabilities

3,650

7,644

Net cash provided by operating

activities

34,661

70,088

CASH FLOWS FROM INVESTING

ACTIVITIES

Capital expenditures

(11,476

)

(13,991

)

Acquisitions of businesses

(251

)

(347

)

Other

—

1,974

Net cash used in investing activities

(11,727

)

(12,364

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from borrowings under bank credit

facilities

1,289,000

732,500

Principal payments made under bank credit

facilities

(1,009,313

)

(640,156

)

Proceeds from employee stock purchase

plans

3,098

3,156

Repurchases of common stock

(3,242

)

(140,364

)

Payment of taxes for equity

transactions

(187

)

(697

)

Net cash provided by (used in) financing

activities

279,356

(45,561

)

Effect of exchange rate changes on cash

and cash equivalents

4,455

(2,393

)

Net change in cash and cash

equivalents

306,745

9,770

Cash and cash equivalents, beginning of

period

133,961

115,776

Cash and cash equivalents, end of

period

$

440,706

$

125,546

Revenues by Customer Group

(Unaudited)

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

$ Change

% Change

Department of Defense

$

1,534,533

74.6

%

$

1,352,306

73.1

%

$

182,227

13.5

%

Federal Civilian agencies

439,371

21.4

%

407,344

22.0

%

32,027

7.9

%

Commercial and other

82,985

4.0

%

90,497

4.9

%

(7,512

)

-8.3

%

Total

$

2,056,889

100.0

%

$

1,850,147

100.0

%

$

206,742

11.2

%

Revenues by Contract Type

(Unaudited)

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

$ Change

% Change

Cost-plus-fee

$

1,280,010

62.2

%

$

1,134,435

61.4

%

$

145,575

12.8

%

Fixed-price

475,256

23.1

%

502,077

27.1

%

(26,821

)

-5.3

%

Time-and-materials

301,623

14.7

%

213,635

11.5

%

87,988

41.2

%

Total

$

2,056,889

100.0

%

$

1,850,147

100.0

%

$

206,742

11.2

%

Revenues by Prime or

Subcontractor (Unaudited)

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

$ Change

% Change

Prime contractor

$

1,880,419

91.4

%

$

1,649,362

89.1

%

$

231,057

14.0

%

Subcontractor

176,470

8.6

%

200,785

10.9

%

(24,315

)

-12.1

%

Total

$

2,056,889

100.0

%

$

1,850,147

100.0

%

$

206,742

11.2

%

Revenues by Expertise or

Technology (Unaudited)

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

$ Change

% Change

Expertise

$

988,265

48.0

%

$

878,094

47.5

%

$

110,171

12.5

%

Technology

1,068,624

52.0

%

972,053

52.5

%

96,571

9.9

%

Total

$

2,056,889

100.0

%

$

1,850,147

100.0

%

$

206,742

11.2

%

Contract Awards

(Unaudited)

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

$ Change

% Change

Contract Awards

$

3,339,635

$

3,069,243

$

270,392

8.8

%

Reconciliation of Net Income to Adjusted Net

Income and Diluted EPS to Adjusted Diluted EPS (Unaudited)

Adjusted net income and Adjusted diluted EPS are non-GAAP

performance measures. We define Adjusted net income and Adjusted

diluted EPS as GAAP net income and GAAP diluted EPS, respectively,

excluding intangible amortization expense and the related tax

impact as we do not consider intangible amortization expense to be

indicative of our operating performance. We believe that these

performance measures provide management and investors with useful

information in assessing trends in our ongoing operating

performance, provide greater visibility in understanding the

long-term financial performance of the Company, and allow investors

to more easily compare our results to results of our peers. These

non-GAAP measures should not be considered in isolation or as a

substitute for performance measures prepared in accordance with

GAAP.

(in thousands, except per share data)

Three Months Ended

9/30/2024

9/30/2023

% Change

Net income, as reported

$

120,177

$

86,047

39.7

%

Intangible amortization expense

18,007

18,366

-2.0

%

Tax effect of intangible amortization1

(4,550

)

(4,684

)

-2.9

%

Adjusted net income

$

133,634

$

99,729

34.0

%

Three Months Ended

9/30/2024

9/30/2023

% Change

Diluted EPS, as reported

$

5.33

$

3.76

41.8

%

Intangible amortization expense

0.80

0.80

0.0

%

Tax effect of intangible amortization1

(0.20

)

(0.20

)

0.0

%

Adjusted diluted EPS

$

5.93

$

4.36

36.0

%

FY25 Guidance Range

(in millions, except per share data)

Low End

High End

Net income, as reported

$

452

---

$

472

Intangible amortization expense

84

---

84

Tax effect of intangible amortization1

(21

)

---

(21

)

Adjusted net income

$

515

---

$

535

FY25 Guidance Range

Low End

High End

Diluted EPS, as reported

$

20.09

---

$

20.98

Intangible amortization expense

3.73

---

3.73

Tax effect of intangible amortization1

(0.93

)

---

(0.93

)

Adjusted diluted EPS

$

22.89

---

$

23.78

(1)

Calculation uses an assumed full year

statutory tax rate of 25.3% and 25.5% on non-GAAP tax deductible

adjustments for September 30, 2024 and 2023, respectively.

Note: Numbers may not sum due to

rounding.

Reconciliation of Net Income to Earnings

Before Interest, Taxes, Depreciation and Amortization (EBITDA)

(Unaudited)

The Company views EBITDA and EBITDA margin, both of which are

defined as non-GAAP measures, as important indicators of

performance, consistent with the manner in which management

measures and forecasts the Company’s performance. EBITDA is a

commonly used non-GAAP measure when comparing our results with

those of other companies. We define EBITDA as GAAP net income plus

net interest expense, income taxes, and depreciation and

amortization expense (including depreciation within direct costs).

We consider EBITDA to be a useful metric for management and

investors to evaluate and compare the ongoing operating performance

of our business on a consistent basis across reporting periods, as

it eliminates the effect of non-cash items such as depreciation of

tangible assets, amortization of intangible assets primarily

recognized in business combinations, which we do not believe are

indicative of our operating performance. EBITDA margin is EBITDA

divided by revenue. These non-GAAP measures should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with GAAP.

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

% Change

Net income

$

120,177

$

86,047

39.7

%

Plus:

Income taxes

35,694

25,731

38.7

%

Interest income and expense, net

23,970

25,571

(6.3

)%

Depreciation and amortization expense,

including amounts within direct costs

36,050

36,889

(2.3

)%

EBITDA

$

215,891

$

174,238

23.9

%

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

% Change

Revenues, as reported

$

2,056,889

$

1,850,147

11.2

%

EBITDA

215,891

174,238

23.9

%

EBITDA margin

10.5%

9.4%

Reconciliation of Net Cash Provided by

Operating Activities to Net Cash Provided by Operating Activities

Excluding MARPA and to Free Cash Flow (Unaudited)

The Company defines Net cash provided by operating activities

excluding MARPA, a non-GAAP measure, as net cash provided by

operating activities calculated in accordance with GAAP, adjusted

to exclude cash flows from CACI’s Master Accounts Receivable

Purchase Agreement (MARPA) for the sale of certain designated

eligible U.S. government receivables up to a maximum amount of

$250.0 million. Free cash flow is a non-GAAP liquidity measure and

may not be comparable to similarly titled measures used by other

companies. The Company defines Free cash flow as Net cash provided

by operating activities excluding MARPA, less payments for capital

expenditures. The Company uses these non-GAAP measures to assess

our ability to generate cash from our business operations and plan

for future operating and capital actions. We believe these measures

allow investors to more easily compare current period results to

prior period results and to results of our peers. Free cash flow

does not represent residual cash flows available for discretionary

purposes and should not be used as a substitute for cash flow

measures prepared in accordance with GAAP.

Three Months Ended

(in thousands)

9/30/2024

9/30/2023

Net cash provided by operating

activities

$

34,661

$

70,088

Cash used in (provided by) MARPA

26,210

23,167

Net cash provided by operating activities

excluding MARPA

60,871

93,255

Capital expenditures

(11,476

)

(13,991

)

Free cash flow

$

49,395

$

79,264

(in millions)

FY25 Guidance

Current

Prior

Net cash provided by operating

activities

$

515

$

505

Cash used in (provided by) MARPA

—

—

Net cash provided by operating activities

excluding MARPA

515

505

Capital expenditures

(80

)

(80

)

Free cash flow

$

435

$

425

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023060981/en/

Corporate Communications and Media: Lorraine Corcoran, Executive

Vice President, Corporate Communications (703) 434-4165,

lorraine.corcoran@caci.com

Investor Relations: George Price, Senior Vice President,

Investor Relations (703) 841-7818, george.price@caci.com

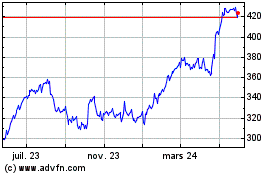

CACI (NYSE:CACI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

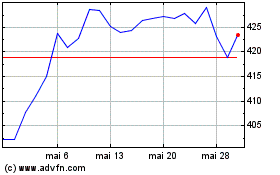

CACI (NYSE:CACI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025