0000723188

false

COMMUNITY BANK SYSTEM, INC.

false

0000723188

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 31, 2023

(Exact name of registrant as specified in

its charter)

| Delaware |

001-13695 |

16-1213679 |

| (State or other

jurisdiction of |

(Commission File Number) |

(IRS Employer Identification No.) |

| incorporation) |

|

|

| 5790 Widewaters Parkway, DeWitt, New York |

13214 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (315)

445-2282

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

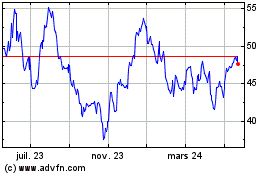

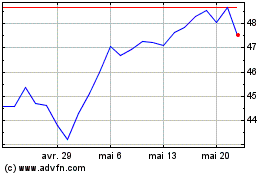

| Common Stock, $1.00 par value per share |

CBU |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 2.02 | Results of Operations and Financial Condition. |

On July 31, 2023, Community Bank System, Inc.

announced its results of operations for the quarter ended June 30, 2023. The public announcement was made by means of a news release,

the text of which is furnished as Exhibit 99.1.

The information in this Form 8-K, including

Exhibit 99.1 attached hereto, is being furnished under Item 2.02 and shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is being furnished pursuant

to Item 2.02 above.

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Community Bank

System, Inc. |

| |

|

| |

By: |

/s/ Joseph E. Sutaris |

| |

Name: |

Joseph E. Sutaris |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Dated: July 31, 2023

Exhibit Index

Exhibit 99.1

|

|

News

Release

For further

information, please contact: |

| 5790

Widewaters Parkway, DeWitt, N.Y. 13214 |

|

Joseph

E. Sutaris, EVP & Chief Financial Officer

Office:

(315) 445-7396 |

Community

Bank System, Inc. Reports Second Quarter 2023 Results

SYRACUSE,

N.Y. — July 31, 2023 — Community Bank System, Inc. (the “Company”) (NYSE: CBU) reported second quarter

2023 results that are included in the attached supplement. This earnings release, including supporting financial tables, is also available

within the press releases section of the Company's investor relations website at: https://ir.communitybanksystem.com/news-presentations/press-releases/.

An archived webcast of the earnings call will be available on this site for one full year.

Second

Quarter 2023 Performance Highlights Summary

| · | Second

Quarter 2023 Net Income of $48.3 million, or $0.89 per fully-diluted share, was up $8.5 million,

or $0.16 per fully-diluted share, from the prior year’s second quarter |

| · | Operating

Net Income, a non-GAAP measure, of $49.1 million, or $0.91 per fully-diluted share, was up

$2.8 million, or $0.06 per fully-diluted share, from the prior year’s second quarter |

| · | Total

Loans of $9.17 billion, was up $188.4 million, or 2.1%, from the end of the prior quarter |

| · | Total

Financial Services (Employee Benefit Services, Insurance Services and Wealth Management

Services) Revenues of $48.3 million, was up $1.4 million, or 3.1%, from the prior year’s

second quarter |

| · | Annualized

Loan Net Charge-Offs of 0.03% was down 0.04 percentage points from the end of the prior quarter |

| · | Tier

1 Leverage Ratio of 9.35% was up 0.29 percentage points from the end of the prior quarter |

Company

management will conduct an investor call at 11:00 a.m. (ET) today, July 31, 2023, to discuss the second quarter 2023 results.

The conference call can be accessed at 1-833-630-0464 (1-412-317-1809 if outside the United States and Canada). Investors may also listen

live via the Internet at: https://app.webinar.net/4bGKa4M5koZ.

About

Community Bank System, Inc.

Community

Bank System, Inc. is a diversified financial services company focused on four main business lines – banking, benefits administration,

insurance services and wealth management with total assets of $15.1 billion. Its banking subsidiary, Community Bank, N.A., is among the

country’s 100 largest banking institutions and operates more than 200 customer facilities across Upstate New York, Northeastern

Pennsylvania, Vermont, and Western Massachusetts. In addition to a full range of retail, business, and municipal banking services, the

Company offers comprehensive financial planning, trust administration and wealth management services through its Community Bank Wealth

Management operating unit. The Company’s Benefit Plans Administrative Services, Inc. subsidiary is a leading provider of employee

benefits administration, trust services, collective investment fund administration, and actuarial consulting services to customers on

a national scale. The Company’s OneGroup NY, Inc. subsidiary is a top 100 U.S. insurance agency. Community Bank System, Inc.

is listed on the New York Stock Exchange and the Company’s stock trades under the symbol CBU. For more information about Community

Bank visit www.cbna.com or https://ir.communitybanksystem.com.

|

|

News Release

For further information, please contact: |

| 5790

Widewaters Parkway, DeWitt, N.Y. 13214 |

|

Joseph

E. Sutaris, EVP & Chief Financial Officer

Office: (315)

445-7396 |

Community

Bank System, Inc. Reports Second Quarter 2023 Results

SYRACUSE, N.Y. — July 31, 2023

| Community

Bank System, Inc. (the “Company”) (NYSE: CBU) reported second quarter 2023 net income of $48.3 million, or $0.89 per fully-diluted

share and operating net income, a non-GAAP measure, of $49.1 million, or $0.91 per fully-diluted share. |

| |

|

"We are pleased with

the performance of our Company in the second quarter," commented Mark E. Tryniski, President and CEO. "Earnings per share of $0.89 for

the quarter were $0.16 higher than the second quarter of 2022 and $0.78 higher than the linked first quarter of 2023. Operating earnings

per share of $0.91 for the quarter were $0.06 higher than the prior year's second quarter and $0.05 higher than the first quarter of

2023. Operating revenues across all lines of business remained strong in the quarter, with noninterest revenues contributing 37.6% of

the revenue. Total banking segment revenues were up $6.6 million, or 5.5%, over the prior year's second quarter, while financial services

business revenues were up $1.4 million, or 3.1%, over the same period. Net interest margin was stable and the Company's cycle-to-date

deposit beta remained low at just 10%. The Company's employee benefit services, insurance services and wealth management services businesses

contributed $48.3 million in revenues in the second quarter, which represents 73.2% of total noninterest revenues of $66.0 million and

27.5% of total revenues of $175.3 million. Asset quality remained strong as annualized net charge-offs were only three basis points in

the quarter. Total operating expenses, which excludes acquisition-related expenses, were up $6.0 million, or 5.6%, from the second quarter

of 2022, but were $2.0 million, or 1.7%, lower than the linked first quarter. Total loans outstanding were up $188.4 million, or 2.1%,

during the quarter, marking the eighth consecutive quarter of loan growth. Although higher interest rates, decreasing money supply and

more acute competition from banks and non-depository institutions are expected to continue to be a challenge over the next few quarters,

we believe the Company is well positioned to continue to outperform the banking industry as a whole. The Company's deposits are well

diversified across customer segments and approximately 72% of total deposits were in checking and savings accounts at the end of the

second quarter. We believe the Company's strong core deposit base, in combination with its strong liquidity profile, capital, asset quality

and diversified revenue profile provide a solid foundation for future opportunities and growth."

|

Second Quarter 2023 Performance Highlights

Operating

Performance |

· GAAP

EPS

o $0.89

per share, up from $0.73 per share for the second quarter of 2022

· Operating

EPS (non-GAAP)

o $0.91

per share, up $0.06 per share from the second quarter of 2022

· Adjusted

Pre-Tax, Pre-Provision Net Revenue Per Share (non-GAAP)

o $1.17

per share, up $0.04 per share from the second quarter of 2022 |

| |

|

| Return

Metrics |

· Return

on Assets / Return on Assets – Operating (non-GAAP)

o 1.28%

/ 1.30%

· Return

on Equity / Return on Equity – Operating (non-GAAP)

o 11.86%

/ 12.06% |

| |

|

| Revenues |

· Total

Revenues

o $175.3

million, up $8.0 million, or 4.8%, from the second quarter of 2022

· Noninterest

Revenues

o $66.0

million, up $1.9 million, or 2.9%, from the second quarter of 2022

· Noninterest

Revenues/Operating Revenues (FTE)

o 37.6% |

| |

|

Net

Interest

Income and Net

Interest Margin |

· Net

Interest Income

o $109.3

million, up $6.1 million, or 6.0%, from the second quarter of 2022 and down $1.7 million, or 1.6%, from the first quarter of 2023

· Net

Interest Margin (Fully Tax-Equivalent) (non-GAAP)

o 3.18%,

down two basis points from 3.20% for the first quarter of 2023 and up 29 basis points from 2.89% for the second quarter of 2022 |

Balance

Sheet

and Funding |

· Total

Loans

o Up

$188.4 million, or 2.1%, from March 31, 2023 and up $1.03 billion, or 12.6%, from one year ago

· Total

Deposits

o Down

$238.9 million, or 1.8%, from March 31, 2023

· Total

Deposit Funding Costs / Total Cost of Funds

o 0.59%

/ 0.67% |

| |

|

| Risk

Metrics |

· Annualized

Loan Net Charge-Offs

o 0.03%

· Tier

1 Leverage Ratio

o 9.35%

· Loan-to-deposit

ratio

o 71.2%

· Non-owner

occupied commercial real estate / total bank-level capital

o 180% |

Second Quarter 2023 Business Segment Highlights

| Banking |

· Total Revenues of $127.0 million, up $6.6 million, or 5.5%, from the second quarter of 2022, primarily due to higher net interest income, and up $51.6 million, or 68.5%, from the first quarter of 2023, primarily due to the impact of $52.3 million of investment security losses realized in connection with the Company’s balance sheet repositioning during the prior quarter. |

| |

|

Employee

Benefit

Services |

· Total Revenues of $28.6 million, down $0.4 million, or 1.2%, from the second quarter of 2022 and down $0.8 million, or 2.8%, from the first quarter of 2023. |

| |

|

Insurance

Services |

· Total Revenues of $11.9 million, up $2.1 million, or 21.3%, from the second quarter of 2022 and up $0.3 million, or 2.9%, from the first quarter of 2023. |

| |

|

Wealth

Management

Services |

· Total Revenues of $7.9 million, down $0.3 million, or 3.5%, from the second quarter of 2022 and down $0.4 million, or 4.7%, from the first quarter of 2023. |

Results of Operations

The Company reported second quarter 2023 net income of $48.3 million,

or $0.89 per fully-diluted share. This compares to $39.8 million of net income, or $0.73 per fully-diluted share for the second quarter

of 2022. The $0.16 increase in earnings per share was reflective of increases in net interest income and noninterest revenues and decreases

in the provision for credit losses and fully-diluted shares outstanding, partially offset by increases in operating expenses and income

taxes. Comparatively, the Company recorded $0.11 in fully-diluted earnings per share for the linked first quarter of 2023, which was negatively

impacted by $0.75 per share of realized losses on investment security sales made as part of a strategic balance sheet repositioning.

Net Interest Income and Net Interest Margin

The Company’s eighth consecutive quarter of loan growth and a rising

rate environment supported year-over-year growth in net interest income and net interest margin expansion that more than offset higher

funding costs.

| · | Net interest income in the second quarter of 2023 was $109.3 million, up $6.1

million, or 6.0%, compared to the second quarter of 2022, but was down $1.7 million, or 1.6%, from the first quarter of 2023. |

| · | Second quarter tax-equivalent net interest margin, a non-GAAP measure, of

3.18% increased by 29 basis points from the second quarter of 2022 primarily as a result of higher yields on interest-earning assets,

partially offset by higher rates paid on interest-bearing liabilities. |

| · | The yield on interest-earning assets increased 85 basis points to 3.82% in

the second quarter of 2023 from the prior year’s second quarter primarily as a result of higher loan yields due to market-related

increases in interest rates on new loans, a significant increase in variable and adjustable rate loan yields driven by rising market interest

rates, including the prime rate, and a high level of new loan originations. |

| · | The cost of interest-bearing liabilities increased 81 basis points to 0.94%

in the second quarter of 2023 from the second quarter of 2022 driven by higher deposit and borrowing rates. |

| · | On a linked quarter basis, tax-equivalent net interest margin, a non-GAAP

measure, decreased by two basis points as the cost of funds increased 23 basis points, including a 32 basis point increase in the cost

of interest-bearing liabilities, while the yield on interest-earning assets increased 19 basis points. |

Noninterest Revenues

The Company’s banking and financial services (employee benefit

services, insurance services and wealth management services) noninterest revenue streams reduce dependence on net interest income, continue

to be strong, diverse and provide a solid foundation for future opportunities and growth.

| · | Banking noninterest revenues increased $0.4 million, or 2.6%, from $17.3 million

in the second quarter of 2022 to $17.7 million in the second quarter of 2023. |

| · | Employee benefit services revenues for the second quarter of 2023 were $28.6

million, down $0.4 million, or 1.2%, in comparison to the second quarter of 2022 driven primarily by a decline in asset-based fees reflecting

the impact of lower financial market valuations. |

| · | Insurance services revenues for the second quarter of 2023

were $11.9 million, which represents a $2.1 million, or 21.3%, increase versus the prior year’s second quarter, reflective primarily

of a strong premium market and organic growth. |

| · | Wealth management services revenues for the second quarter of 2023 were $7.9

million, down from $8.1 million in the second quarter of 2022, primarily driven by more challenging investment market conditions. |

Noninterest Expenses and Income Taxes

The Company continues to maintain a focus on expense management. For

the remaining two quarters of 2023, management anticipates that total operating expenses, excluding any future acquisition activities,

will remain generally in line with first and second quarter levels.

| · | The Company recorded $113.0 million in total operating expenses in the second

quarter of 2023, compared to $110.4 million of total operating expenses in the prior year’s second quarter, mainly driven by higher

salaries and employee benefits, data processing and communications expenses, business development and marketing and other expenses, partially

offset by lower acquisition expenses. |

| · | The $2.6 million, or 4.0%, increase in salaries and benefits expense was primarily

driven by merit and market-related increases in employee wages and acquisition-related and other additions to staffing. |

| · | The $0.7 million, or 5.0%, increase in data processing and communications

expenses is reflective of the Company’s continued investment in customer-facing and back-office digital technologies. |

| · | Business development and marketing expenses increased $1.0 million, or 26.3%,

due to the Company’s investment in digital marketing automation technologies and higher levels of targeted advertisements intended

to generate deposits. |

| · | Other expenses were up $2.1 million, or 36.5%, due to increases in insurance

and travel-related expenses along with incremental expenses associated with operating an expanded franchise subsequent to the Elmira acquisition

in May of 2022. |

| · | The effective tax rate for the second quarter of 2023 was 21.4%, down slightly

from 21.6% in the second quarter of 2022. |

Financial Position and Liquidity

The Company’s financial position and liquidity profile remains

strong.

| · | The Company’s total assets were $15.11 billion at June 30, 2023,

representing a $379.8 million, or 2.5%, decrease from one year prior and a $147.9 million, or 1.0%, decrease from the end of the first

quarter of 2023. The decrease in the Company’s total assets during the prior twelve-month period was primarily driven by the sales

and maturities of certain available-for-sale investment securities, partially offset by organic loan growth. |

| · | At June 30, 2023, the Company’s readily available sources of liquidity

totaled $4.27 billion, including cash and cash equivalents balances, net of float, of $120.4 million, investment securities unpledged

as collateral totaling $1.08 billion, unused borrowing capacity at the Federal Home Loan Bank of New York of $1.65 billion and $1.42 billion

of funding availability at the Federal Reserve Bank’s discount window. |

| · | The available sources of immediately available liquidity represent over 200%

of the Company’s estimated uninsured deposits, net of collateralized and intercompany deposits. |

| · | Estimated insured deposits, net of collateralized and intercompany deposits,

represent greater than 80% of second quarter ending total deposits. |

Deposits and Funding

The Company maintains a solid core deposit base with low funding costs.

| · | Ending deposits at June 30, 2023 of $12.87 billion were $238.9 million,

or 1.8%, lower than the first quarter of 2023 and $486.0 million, or 3.6%, lower than one year prior. |

| · | Ending borrowings of $484.8 million at June 30, 2023 increased $104.5

million, or 27.5%, from March 31, 2023 and increased $172.3 million, or 55.1%, from a year prior due, in part, to the funding of

strong loan growth. |

| · | The Company’s average cost of funds was up 58 basis points, from 0.09%

in the second quarter of 2022 to 0.67% in the second quarter of 2023, while the average cost of total deposits remained relatively low

at 0.59% for the quarter. |

| · | Through the end of the second quarter, the Company’s cycle-to-date deposit

beta was 10% and the cycle-to-date total funding beta was 12%. The target Federal Funds rate has increased 500 basis points since December 31,

2021, while the Company’s total deposit costs and total funding costs increased 51 basis points and 58 basis points, respectively,

over the same period. |

| · | The Company’s deposit base is well diversified across customer segments,

comprised of approximately 63% consumer, 26% business and 11% municipal at the end of the current quarter, and broadly dispersed with

an average deposit account balance of under $20,000. |

| · | 72% of the Company’s total deposits were in checking and savings accounts

at the end of the second quarter and the Company does not currently utilize brokered or wholesale deposits. 10% of the Company’s

total deposits were in time deposit accounts at the end of the second quarter, up two percentage points from the end of the prior year’s

second quarter and the end of the first quarter of 2023 primarily due to the movement of individual’s deposits from non-time to

time accounts. |

Loans and Credit Quality

The Company’s in-footprint based loan portfolio is growing and

diversified with a core focus on credit quality.

| · | Ending loans at June 30, 2023 of $9.17 billion were $188.4 million, or

2.1%, higher than March 31, 2023 and $1.03 billion, or 12.6%, higher than one year prior with the year-over-year growth driven by

increases in all loan categories due to net organic growth. |

| · | At June 30, 2023, the Company’s allowance for credit losses totaled

$63.3 million, or 0.69% of total loans outstanding compared to $63.2 million, or 0.70% of total loans outstanding, at the end of the first

quarter of 2023 and $55.5 million, or 0.68% of total loans outstanding, at June 30, 2022. |

| · | Reflective of an increase in loans outstanding and a stable economic forecast,

the Company recorded a $0.8 million provision for credit losses during the second quarter of 2023. While certain macroeconomic concerns

are emerging related to non-owner occupied commercial real estate, the Company’s exposure to this portfolio remains relatively low

at 180% of total bank-level capital. |

| · | The Company recorded net charge-offs of $0.7 million, or an annualized 0.03%

of average loans, in the second quarter of 2023 compared to net charge-offs of $0.4 million, or an annualized 0.02% of average loans,

in the second quarter of 2022 and net charge-offs of $1.5 million, or an annualized 0.07% of average loans, in the first quarter of 2023. |

| · | Total delinquent loans, which includes nonperforming loans and loans 30 or

more days delinquent, to total loans outstanding was 0.83% at the end of the second quarter of 2023. This compares to 0.75% at the end

of the second quarter of 2022 and 0.73% at the end of the first quarter of 2023. |

| · | At June 30, 2023, nonperforming (90 or more days past due and non-accruing)

loans decreased to $33.3 million, or 0.36%, of total loans outstanding compared to $33.8 million, or 0.38%, of total loans outstanding

at the end of the first quarter of 2023 and $37.1 million, or 0.46%, of total loans outstanding one year earlier. |

| · | Loans 30 to 89 days delinquent (categorized by the Company as delinquent but

performing), which tend to exhibit seasonal characteristics, were 0.47% of total loans outstanding at June 30, 2023, up from 0.35%

at the end of the first quarter of 2023 and 0.29% one year earlier. |

Shareholders’ Equity and Regulatory Capital

The Company’s capital planning and management activities, coupled

with its historically strong earnings performance, diversified streams of revenue and prudent dividend practices, have allowed it to build

and maintain a strong capital position. At June 30, 2023, all of the Company’s and the Bank’s regulatory capital ratios

significantly exceeded well-capitalized standards.

| · | Shareholders’ equity of $1.62 billion at June 30, 2023 was $44.3

million, or 2.7%, lower than one year ago despite strong earnings retention primarily because of a $76.1 million decline in accumulated

other comprehensive income related to the Company’s investment securities portfolio due to higher market interest rates. Shareholders’

equity was down $16.6 million, or 1.0%, from March 31, 2023, primarily driven by a $33.3 million decrease in accumulated other comprehensive

income related to the Company’s investment securities portfolio. |

| · | The Company’s tier 1 leverage ratio was 9.35% at June 30, 2023,

which substantially exceeds the regulatory well-capitalized standard of 5.0%. |

| · | The Company’s shareholders’ equity to assets ratio (GAAP) was

10.71% at June 30, 2023, down slightly from 10.73% at June 30, 2022, but consistent with 10.71% at March 31, 2023. |

| · | The Company’s net tangible equity to net tangible assets ratio (non-GAAP)

was 5.34% at June 30, 2023, down slightly from 5.40% a year earlier and 5.41% at the end of the first quarter of 2023. The decrease

in the net tangible equity to net tangible assets ratio (non-GAAP) from one year prior was primarily driven by a $28.5 million, or 3.6%,

decrease in tangible equity due to the aforementioned decline in accumulated other comprehensive income related to the Company’s

investment securities portfolio, partially offset by a $363.9 million, or 2.5%, decrease in tangible assets due primarily to the aforementioned

sales and maturities of certain available-for-sale investment securities. |

Dividend Increase and Stock Repurchase Program

The payment of a meaningful and growing dividend is an important component

of our commitment to provide consistent and favorable long term returns to our shareholders, and it reflects the continued strength of

our current operating results and capital position, and our confidence in the future performance of the Company. The $0.01 increase in

the quarterly dividend declared in the third quarter of 2023 marked the 31st consecutive year of dividend increases for the

Company.

| · | During the second quarter of 2023, the Company declared a quarterly cash dividend

of $0.44 per share on its common stock, up 2.3% from the $0.43 dividend declared in the second quarter of 2022. |

| · | On July 19, 2023, the Company announced an additional one cent, or 2.3%,

increase in the quarterly dividend to $0.45 per share on its common stock, payable on October 10, 2023 to shareholders of record

as of September 15, 2023, representing an annualized yield of 3.4% based upon the $52.59 closing price of the Company’s stock

on July 28, 2023. This increase marked the 31st consecutive year of dividend increases for the Company. |

| · | As previously announced, in December 2022 the Company’s Board of

Directors (the “Board”) approved a stock repurchase program authorizing the repurchase of up to 2.70 million shares of the

Company’s common stock during a twelve-month period starting January 1, 2023. Such repurchases may be made at the discretion

of the Company’s senior management based on market conditions and other relevant factors and will be acquired through open market

or privately negotiated transactions as permitted under Rule 10b-18 of the Securities Exchange Act of 1934 and other applicable regulatory

and legal requirements. There were 400,000 shares repurchased pursuant to the 2023 stock repurchase program in the first six months of

2023, including 200,000 shares in the second quarter of 2023. |

Non-GAAP Measures

The Company also provides supplemental reporting of its results on an

“operating,” “adjusted” and “tangible” basis, from which it excludes the after-tax effect of amortization

of core deposit and other intangible assets (and the related goodwill, core deposit intangible and other intangible asset balances, net

of applicable deferred tax amounts), accretion on non-purchased credit deteriorated (“PCD”) loans, expenses associated with

acquisitions, acquisition-related provision for credit losses, acquisition-related contingent consideration adjustments, gain on debt

extinguishment, loss on sales of investment securities and unrealized loss on equity securities. In addition, the Company provides supplemental

reporting for “adjusted pre-tax, pre-provision net revenues,” which subtracts the provision for credit losses, acquisition

expenses, acquisition-related contingent consideration adjustments, gain on debt extinguishment, loss on sales of investment securities

and unrealized loss on equity securities from income before income taxes. Although these items are non-GAAP measures, the Company’s

management believes this information helps investors and analysts measure underlying core performance and provides better comparability

to other organizations that have not engaged in acquisitions. The Company also provides supplemental reporting of its net interest margin

on a “fully tax-equivalent” basis, which includes an adjustment to net interest income that represents taxes that would have

been paid had nontaxable investment securities and loans been taxable. Although fully tax-equivalent net interest margin is a non-GAAP

measure, the Company’s management believes this information helps enhance comparability of the performance of assets that have different

tax liabilities. The amounts for such items are presented in the tables that accompany this release. Diluted adjusted net earnings per

share, a non-GAAP measure, were $0.95 in the second quarter of 2023, compared to $0.89 in the second quarter of 2022 and $0.90 in the

first quarter of 2023. Adjusted pre-tax, pre-provision net revenue per share, a non-GAAP measure, was $1.17 in the second quarter of 2023,

compared to $1.13 in the second quarter of 2022 and $1.16 in the first quarter of 2023.

Conference Call Scheduled

Company management will conduct an investor call at 11:00 a.m. (ET)

today, July 31, 2023, to discuss the second quarter 2023 results. The conference call can be accessed at 1-833-630-0464 (1-412-317-1809

if outside the United States and Canada). Investors may also listen live via the Internet at: https://app.webinar.net/4bGKa4M5koZ.

This earnings release, including supporting financial tables, is also

available within the press releases section of the Company's investor relations website at: https://ir.communitybanksystem.com/news-presentations/press-releases/.

An archived webcast of the earnings call will be available on this site for one full year.

About Community Bank System, Inc.

Community Bank System, Inc. is a diversified financial services

company focused on four main business lines – banking, benefits administration, insurance services and wealth management with total

assets of $15.1 billion. Its banking subsidiary, Community Bank, N.A., is among the country’s 100 largest banking institutions

and operates more than 200 customer facilities across Upstate New York, Northeastern Pennsylvania, Vermont and Western Massachusetts.

In addition to a full range of retail, business, and municipal banking services, the Company offers comprehensive financial planning,

trust administration and wealth management services through its Community Bank Wealth Management operating unit. The Company’s

Benefit Plans Administrative Services, Inc. subsidiary is a leading provider of employee benefits administration, trust services,

collective investment fund administration, and actuarial consulting services to customers on a national scale. The Company’s OneGroup

NY, Inc. subsidiary is a top 100 U.S. insurance agency. Community Bank System, Inc. is listed on the New York Stock Exchange

and the Company’s stock trades under the symbol CBU. For more information about Community Bank visit www.cbna.com

or https://ir.communitybanksystem.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of CBU’s

management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking

statements. The following factors, among others, could cause the actual results of CBU’s operations to differ materially from its

expectations: the macroeconomic and other challenges and uncertainties related to or resulting from recent bank failures; current and

future economic and market conditions, including the effects on housing prices, unemployment rates, high inflation, U.S. fiscal debt,

budget and tax matters, geopolitical matters, and global economic growth; fiscal and monetary policies of the Federal Reserve Board;

the potential adverse effects of unusual and infrequently occurring events; management’s estimates and projections of interest

rates and interest rate policies; the effect of changes in the level of checking, savings, or money market account deposit balances and

other factors that affect net interest margin; future provisions for credit losses on loans and debt securities; changes in nonperforming

assets; containing costs and expenses; the effect on financial market valuations on CBU’s fee income businesses, including its

employee benefit services, wealth management, and insurance businesses; the successful integration of operations of its acquisitions;

competition; changes in legislation or regulatory requirements, including capital requirements; and the timing for receiving regulatory

approvals and completing pending merger and acquisition transactions. For more information about factors that could cause actual results

to differ materially from CBU’s expectations, refer to its annual, periodic and other reports filed with the Securities and Exchange

Commission (“SEC”), including the discussion under the “Risk Factors” section of such reports filed with the

SEC and available on CBU’s website at https://ir.communitybanksystem.com and on the SEC’s

website at www.sec.gov. Further, any forward-looking statement speaks only as of the date on

which it is made, and CBU undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the

date on which the statement is made or to reflect the occurrence of unanticipated events.

| Summary of Financial Data (unaudited) |

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

| |

Quarter Ended |

Year-to-Date |

| |

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

| Earnings |

|

|

|

|

| Loan income |

$107,275 |

$77,959 |

$207,637 |

$150,473 |

| Investment income |

24,349 |

28,216 |

49,869 |

53,398 |

| Total interest income |

131,624 |

106,175 |

257,506 |

203,871 |

| Interest expense |

22,345 |

3,034 |

37,197 |

5,858 |

| Net interest income |

109,279 |

103,141 |

220,309 |

198,013 |

| Acquisition-related provision for credit losses |

0 |

3,927 |

0 |

3,927 |

| Provision for credit losses |

752 |

2,111 |

4,252 |

3,017 |

| Net interest income after provision for credit losses |

108,527 |

97,103 |

216,057 |

191,069 |

| Deposit service and other banking fees |

17,740 |

17,008 |

33,896 |

33,902 |

| Mortgage banking |

11 |

269 |

286 |

424 |

| Employee benefit services |

28,565 |

28,921 |

57,949 |

58,501 |

| Insurance services |

11,860 |

9,780 |

23,382 |

20,189 |

| Wealth management services |

7,858 |

8,141 |

16,103 |

16,774 |

| Loss on sales of investment securities |

0 |

0 |

(52,329) |

0 |

| Gain on debt extinguishment |

0 |

0 |

242 |

0 |

| Unrealized loss on equity securities |

(50) |

(22) |

(50) |

(20) |

| Total noninterest revenues |

65,984 |

64,097 |

79,479 |

129,770 |

| Salaries and employee benefits |

68,034 |

65,398 |

139,521 |

127,046 |

| Data processing and communications |

14,291 |

13,611 |

27,420 |

26,270 |

| Occupancy and equipment |

10,453 |

10,424 |

21,477 |

21,376 |

| Amortization of intangible assets |

3,705 |

3,851 |

7,372 |

7,583 |

| Legal and professional fees |

3,102 |

3,385 |

8,303 |

7,002 |

| Business development and marketing |

4,567 |

3,616 |

7,468 |

6,359 |

| Acquisition-related contingent consideration adjustment |

1,000 |

400 |

1,000 |

400 |

| Acquisition expenses |

(1) |

3,960 |

56 |

4,259 |

| Other |

7,887 |

5,779 |

14,473 |

9,936 |

| Total operating expenses |

113,038 |

110,424 |

227,090 |

210,231 |

| Income before income taxes |

61,473 |

50,776 |

68,446 |

110,608 |

| Income taxes |

13,182 |

10,971 |

14,357 |

23,748 |

| Net income |

$48,291 |

$39,805 |

$54,089 |

$86,860 |

| Basic earnings per share |

$0.90 |

$0.74 |

$1.00 |

$1.61 |

| Diluted earnings per share |

$0.89 |

$0.73 |

$1.00 |

$1.60 |

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Earnings |

|

|

|

|

|

| Loan income |

$107,275 |

$100,362 |

$96,168 |

$88,434 |

$77,959 |

| Investment income |

24,349 |

25,520 |

27,815 |

27,441 |

28,216 |

| Total interest income |

131,624 |

125,882 |

123,983 |

115,875 |

106,175 |

| Interest expense |

22,345 |

14,852 |

11,760 |

5,481 |

3,034 |

| Net interest income |

109,279 |

111,030 |

112,223 |

110,394 |

103,141 |

| Acquisition-related provision for credit losses |

0 |

0 |

0 |

0 |

3,927 |

| Provision for credit losses |

752 |

3,500 |

2,768 |

5,061 |

2,111 |

| Net interest income after provision for credit losses |

108,527 |

107,530 |

109,455 |

105,333 |

97,103 |

| Deposit service and other banking fees |

17,740 |

16,156 |

19,228 |

18,364 |

17,008 |

| Mortgage banking |

11 |

275 |

(205) |

171 |

269 |

| Employee benefit services |

28,565 |

29,384 |

29,023 |

27,884 |

28,921 |

| Insurance services |

11,860 |

11,522 |

8,290 |

11,332 |

9,780 |

| Wealth management services |

7,858 |

8,245 |

7,390 |

7,502 |

8,141 |

| Loss on sales of investment securities |

0 |

(52,329) |

0 |

0 |

0 |

| Gain on debt extinguishment |

0 |

242 |

0 |

0 |

0 |

| Unrealized loss on equity securities |

(50) |

0 |

(20) |

(4) |

(22) |

| Total noninterest revenues |

65,984 |

13,495 |

63,706 |

65,249 |

64,097 |

| Salaries and employee benefits |

68,034 |

71,487 |

64,103 |

66,190 |

65,398 |

| Data processing and communications |

14,291 |

13,129 |

13,645 |

14,184 |

13,611 |

| Occupancy and equipment |

10,453 |

11,024 |

10,673 |

10,364 |

10,424 |

| Amortization of intangible assets |

3,705 |

3,667 |

3,794 |

3,837 |

3,851 |

| Legal and professional fees |

3,102 |

5,201 |

3,822 |

3,194 |

3,385 |

| Business development and marketing |

4,567 |

2,901 |

3,120 |

3,616 |

3,616 |

| Acquisition-related contingent consideration adjustment |

1,000 |

0 |

(700) |

0 |

400 |

| Acquisition expenses |

(1) |

57 |

353 |

409 |

3,960 |

| Other |

7,887 |

6,586 |

7,042 |

6,391 |

5,779 |

| Total operating expenses |

113,038 |

114,052 |

105,852 |

108,185 |

110,424 |

| Income before income taxes |

61,473 |

6,973 |

67,309 |

62,397 |

50,776 |

| Income taxes |

13,182 |

1,175 |

14,779 |

13,706 |

10,971 |

| Net income |

$48,291 |

$5,798 |

$52,530 |

$48,691 |

$39,805 |

| Basic earnings per share |

$0.90 |

$0.11 |

$0.97 |

$0.90 |

$0.74 |

| Diluted earnings per share |

$0.89 |

$0.11 |

$0.97 |

$0.90 |

$0.73 |

| Profitability |

|

|

|

|

|

| Return on assets |

1.28% |

0.15% |

1.33% |

1.24% |

1.03% |

| Return on equity |

11.86% |

1.49% |

14.12% |

11.49% |

9.16% |

| Return on tangible equity(2) (non-GAAP) |

24.89% |

3.26% |

33.73% |

23.76% |

17.61% |

| Noninterest revenues/total revenues (GAAP) |

37.6% |

10.8% |

36.2% |

37.1% |

38.3% |

| Noninterest revenues/operating revenues (FTE)(1) (non-GAAP) |

37.6% |

37.1% |

36.2% |

37.2% |

38.3% |

| Efficiency ratio (GAAP) |

64.5% |

91.6% |

60.2% |

61.6% |

66.0% |

| Operating efficiency ratio (non-GAAP) |

61.7% |

62.5% |

58.2% |

59.3% |

61.1% |

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Components of Net Interest Margin (FTE) |

|

|

|

|

|

| Loan yield |

4.75% |

4.59% |

4.39% |

4.22% |

4.05% |

| Cash equivalents yield |

4.27% |

3.49% |

2.83% |

1.76% |

0.65% |

| Investment yield |

2.07% |

2.01% |

1.85% |

1.80% |

1.81% |

| Earning asset yield |

3.82% |

3.63% |

3.34% |

3.18% |

2.97% |

| Interest-bearing deposit rate |

0.84% |

0.45% |

0.26% |

0.17% |

0.12% |

| Borrowing rate |

2.60% |

2.78% |

2.63% |

1.34% |

0.44% |

| Cost of all interest-bearing funds |

0.94% |

0.62% |

0.47% |

0.23% |

0.13% |

| Cost of funds (includes DDA) |

0.67% |

0.44% |

0.33% |

0.16% |

0.09% |

| Net interest margin |

3.14% |

3.17% |

2.99% |

3.00% |

2.86% |

| Net interest margin (FTE) (non-GAAP) |

3.18% |

3.20% |

3.02% |

3.03% |

2.89% |

| Fully tax-equivalent adjustment |

$1,080 |

$1,091 |

$1,118 |

$1,118 |

$1,008 |

| Average Balances |

|

|

|

|

|

| Loans |

$9,072,956 |

$8,884,164 |

$8,704,051 |

$8,333,148 |

$7,725,107 |

| Cash equivalents |

28,491 |

27,775 |

26,501 |

25,730 |

472,671 |

| Taxable investment securities |

4,313,875 |

4,760,089 |

5,590,538 |

5,701,691 |

5,760,399 |

| Nontaxable investment securities |

525,314 |

532,604 |

545,679 |

551,610 |

513,506 |

| Total interest-earning assets |

13,940,636 |

14,204,632 |

14,866,769 |

14,612,179 |

14,471,683 |

| Total assets |

15,150,001 |

15,366,863 |

15,665,726 |

15,553,296 |

15,452,712 |

| Interest-bearing deposits |

9,053,199 |

8,925,555 |

8,982,442 |

9,142,333 |

9,268,859 |

| Borrowings |

523,585 |

717,788 |

879,194 |

481,657 |

310,674 |

| Total interest-bearing liabilities |

9,576,784 |

9,643,343 |

9,861,636 |

9,623,990 |

9,579,533 |

| Noninterest-bearing deposits |

3,836,341 |

4,043,494 |

4,198,086 |

4,192,615 |

4,061,738 |

| Shareholders' equity |

1,632,992 |

1,576,717 |

1,476,093 |

1,680,525 |

1,743,410 |

| Balance Sheet Data |

|

|

|

|

|

| Cash and cash equivalents |

$222,779 |

$189,298 |

$209,896 |

$247,391 |

$197,628 |

| Investment securities |

4,231,899 |

4,630,741 |

5,314,888 |

5,227,292 |

5,643,022 |

| Loans: |

|

|

|

|

|

| Business lending |

3,833,697 |

3,747,942 |

3,645,665 |

3,494,425 |

3,331,998 |

| Consumer mortgage |

3,072,090 |

3,019,718 |

3,012,475 |

2,975,521 |

2,903,822 |

| Consumer indirect |

1,644,811 |

1,605,659 |

1,539,653 |

1,461,235 |

1,309,753 |

| Home equity |

439,186 |

432,027 |

433,996 |

433,027 |

425,437 |

| Consumer direct |

180,985 |

176,989 |

177,605 |

179,399 |

173,686 |

| Total loans |

9,170,769 |

8,982,335 |

8,809,394 |

8,543,607 |

8,144,696 |

| Allowance for credit losses |

63,284 |

63,170 |

61,059 |

60,363 |

55,542 |

| Goodwill and intangible assets, net |

901,709 |

900,914 |

902,837 |

909,224 |

917,891 |

| Other assets |

644,178 |

615,835 |

659,695 |

727,396 |

640,138 |

| Total assets |

15,108,050 |

15,255,953 |

15,835,651 |

15,594,547 |

15,487,833 |

| Deposits: |

|

|

|

|

|

| Noninterest-bearing |

3,855,085 |

3,949,801 |

4,140,617 |

4,281,859 |

4,092,073 |

| Non-maturity interest-bearing |

7,740,818 |

8,106,734 |

7,964,983 |

8,296,993 |

8,268,649 |

| Time |

1,275,883 |

1,054,137 |

906,708 |

907,469 |

997,050 |

| Total deposits |

12,871,786 |

13,110,672 |

13,012,308 |

13,486,321 |

13,357,772 |

| Customer repurchase agreements |

233,469 |

304,607 |

346,652 |

352,772 |

223,755 |

| Other borrowings |

251,284 |

75,684 |

791,123 |

142,528 |

88,734 |

| Accrued interest and other liabilities |

134,105 |

130,977 |

133,863 |

151,763 |

155,876 |

| Total liabilities |

13,490,644 |

13,621,940 |

14,283,946 |

14,133,384 |

13,826,137 |

| Shareholders' equity |

1,617,406 |

1,634,013 |

1,551,705 |

1,461,163 |

1,661,696 |

| Total liabilities and shareholders' equity |

15,108,050 |

15,255,953 |

15,835,651 |

15,594,547 |

15,487,833 |

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Capital and Other |

|

|

|

|

|

| Tier 1 leverage ratio |

9.35% |

9.06% |

8.79% |

8.78% |

8.65% |

| Tangible equity/net tangible assets(2) |

5.34% |

5.41% |

4.64% |

4.08% |

5.40% |

| Loan-to-deposit ratio |

71.2% |

68.5% |

67.7% |

63.4% |

61.0% |

| Diluted weighted average common shares O/S |

54,008 |

54,207 |

54,253 |

54,290 |

54,393 |

| Period end common shares outstanding |

53,528 |

53,725 |

53,737 |

53,736 |

53,734 |

| Cash dividends declared per common share |

$0.44 |

$0.44 |

$0.44 |

$0.44 |

$0.43 |

| Book value |

$30.22 |

$30.41 |

$28.88 |

$27.19 |

$30.92 |

| Tangible book value(2) |

$14.21 |

$14.49 |

$12.93 |

$11.18 |

$14.69 |

| Common stock price (end of period) |

$46.88 |

$52.49 |

$62.95 |

$60.08 |

$63.28 |

| Asset Quality |

|

|

|

|

|

| Nonaccrual loans |

$29,923 |

$29,745 |

$29,245 |

$28,076 |

$31,686 |

| Accruing loans 90+ days delinquent |

3,395 |

4,027 |

4,119 |

4,416 |

5,439 |

| Total nonperforming loans |

33,318 |

33,772 |

33,364 |

32,492 |

37,125 |

| Other real estate owned (OREO) |

623 |

508 |

503 |

527 |

619 |

| Total nonperforming assets |

33,941 |

34,280 |

33,867 |

33,019 |

37,744 |

| Net charge-offs |

706 |

1,511 |

2,054 |

358 |

383 |

| Allowance for credit losses/loans outstanding |

0.69% |

0.70% |

0.69% |

0.71% |

0.68% |

| Nonperforming loans/loans outstanding |

0.36% |

0.38% |

0.38% |

0.38% |

0.46% |

| Allowance for credit losses/nonperforming loans |

190% |

187% |

183% |

186% |

150% |

| Net charge-offs/average loans |

0.03% |

0.07% |

0.09% |

0.02% |

0.02% |

| Delinquent loans/ending loans |

0.83% |

0.73% |

0.89% |

0.71% |

0.75% |

| Provision for credit losses/net charge-offs |

106% |

232% |

135% |

1,415% |

1,577% |

| Nonperforming assets/total assets |

0.22% |

0.22% |

0.21% |

0.21% |

0.24% |

| Quarterly GAAP to Non-GAAP Reconciliations |

|

|

|

|

|

| Income statement data |

|

|

|

|

|

| Pre-tax, pre-provision net revenue |

|

|

|

|

|

| Net income (GAAP) |

$48,291 |

$5,798 |

$52,530 |

$48,691 |

$39,805 |

| Income taxes |

13,182 |

1,175 |

14,779 |

13,706 |

10,971 |

| Income before income taxes |

61,473 |

6,973 |

67,309 |

62,397 |

50,776 |

| Provision for credit losses |

752 |

3,500 |

2,768 |

5,061 |

6,038 |

| Pre-tax, pre-provision net revenue (non-GAAP) |

62,225 |

10,473 |

70,077 |

67,458 |

56,814 |

| Acquisition expenses |

(1) |

57 |

353 |

409 |

3,960 |

| Acquisition-related contingent consideration adjustment |

1,000 |

0 |

(700) |

0 |

400 |

| Loss on sales of investment securities |

0 |

52,329 |

0 |

0 |

0 |

| Gain on debt extinguishment |

0 |

(242) |

0 |

0 |

0 |

| Unrealized loss on equity securities |

50 |

0 |

20 |

4 |

22 |

| Adjusted pre-tax, pre-provision net revenue (non-GAAP) |

$63,274 |

$62,617 |

$69,750 |

$67,871 |

$61,196 |

| |

|

|

|

|

|

| Pre-tax, pre-provision net revenue per share |

|

|

|

|

|

| Diluted earnings per share (GAAP) |

$0.89 |

$0.11 |

$0.97 |

$0.90 |

$0.73 |

| Income taxes |

0.25 |

0.02 |

0.27 |

0.25 |

0.20 |

| Income before income taxes |

1.14 |

0.13 |

1.24 |

1.15 |

0.93 |

| Provision for credit losses |

0.01 |

0.07 |

0.06 |

0.10 |

0.12 |

| Pre-tax, pre-provision net revenue per share (non-GAAP) |

1.15 |

0.20 |

1.30 |

1.25 |

1.05 |

| Acquisition expenses |

0.00 |

0.00 |

0.00 |

0.00 |

0.07 |

| Acquisition-related contingent consideration adjustment |

0.02 |

0.00 |

(0.01) |

0.00 |

0.01 |

| Loss on sales of investment securities |

0.00 |

0.96 |

0.00 |

0.00 |

0.00 |

| Gain on debt extinguishment |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Unrealized loss on equity securities |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Adjusted pre-tax, pre-provision net revenue per share (non-GAAP) |

$1.17 |

$1.16 |

$1.29 |

$1.25 |

$1.13 |

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Quarterly GAAP to Non-GAAP Reconciliations |

|

|

|

|

|

| Income statement data |

|

|

|

|

|

| Net income |

|

|

|

|

|

| Net income (GAAP) |

$48,291 |

$5,798 |

$52,530 |

$48,691 |

$39,805 |

| Acquisition expenses |

(1) |

57 |

353 |

409 |

3,960 |

| Tax effect of acquisition expenses |

0 |

(12) |

(78) |

(90) |

(856) |

| Subtotal (non-GAAP) |

48,290 |

5,843 |

52,805 |

49,010 |

42,909 |

| Acquisition-related contingent consideration adjustment |

1,000 |

0 |

(700) |

0 |

400 |

| Tax effect of acquisition-related contingent consideration adjustment |

(214) |

0 |

154 |

0 |

(86) |

| Subtotal (non-GAAP) |

49,076 |

5,843 |

52,259 |

49,010 |

43,223 |

| Acquisition-related provision for credit losses |

0 |

0 |

0 |

0 |

3,927 |

| Tax effect of acquisition-related provision for credit losses |

0 |

0 |

0 |

0 |

(848) |

| Subtotal (non-GAAP) |

49,076 |

5,843 |

52,259 |

49,010 |

46,302 |

| Loss on sales of investment securities |

0 |

52,329 |

0 |

0 |

0 |

| Tax effect of loss on sales of investment securities |

0 |

(11,171) |

0 |

0 |

0 |

| Subtotal (non-GAAP) |

49,076 |

47,001 |

52,259 |

49,010 |

46,302 |

| Gain on debt extinguishment |

0 |

(242) |

0 |

0 |

0 |

| Tax effect of gain on debt extinguishment |

0 |

52 |

0 |

0 |

0 |

| Subtotal (non-GAAP) |

49,076 |

46,811 |

52,259 |

49,010 |

46,302 |

| Unrealized loss on equity securities |

50 |

0 |

20 |

4 |

22 |

| Tax effect of unrealized loss on equity securities |

(11) |

0 |

(4) |

(1) |

(5) |

| Operating net income (non-GAAP) |

49,115 |

46,811 |

52,275 |

49,013 |

46,319 |

| Amortization of intangibles |

3,705 |

3,667 |

3,794 |

3,837 |

3,851 |

| Tax effect of amortization of intangibles |

(793) |

(783) |

(833) |

(843) |

(832) |

| Subtotal (non-GAAP) |

52,027 |

49,695 |

55,236 |

52,007 |

49,338 |

| Acquired non-PCD loan accretion |

(886) |

(1,079) |

(1,138) |

(1,397) |

(1,023) |

| Tax effect of acquired non-PCD loan accretion |

190 |

230 |

250 |

307 |

221 |

| Adjusted net income (non-GAAP) |

$51,331 |

$48,846 |

$54,348 |

$50,917 |

$48,536 |

| |

|

|

|

|

|

| Return on average assets |

|

|

|

|

|

| Adjusted net income (non-GAAP) |

$51,331 |

$48,846 |

$54,348 |

$50,917 |

$48,536 |

| Average total assets |

15,150,001 |

15,366,863 |

15,665,726 |

15,553,296 |

15,452,712 |

| Adjusted return on average assets (non-GAAP) |

1.36% |

1.29% |

1.38% |

1.30% |

1.26% |

| |

|

|

|

|

|

| Return on average equity |

|

|

|

|

|

| Adjusted net income (non-GAAP) |

$51,331 |

$48,846 |

$54,348 |

$50,917 |

$48,536 |

| Average total equity |

1,632,992 |

1,576,717 |

1,476,093 |

1,680,525 |

1,743,410 |

| Adjusted return on average equity (non-GAAP) |

12.61% |

12.56% |

14.61% |

12.02% |

11.17% |

| |

|

|

|

|

|

| Net interest margin |

|

|

|

|

|

| Net interest income |

$109,279 |

$111,030 |

$112,223 |

$110,394 |

$103,141 |

| Total average interest-earnings assets |

13,940,636 |

14,204,632 |

14,866,769 |

14,612,179 |

14,471,683 |

| Net interest margin |

3.14% |

3.17% |

2.99% |

3.00% |

2.86% |

| |

|

|

|

|

|

| Net interest margin (FTE) |

|

|

|

|

|

| Net interest income |

$109,279 |

$111,030 |

$112,223 |

$110,394 |

$103,141 |

| Fully tax-equivalent adjustment |

1,080 |

1,091 |

1,118 |

1,118 |

1,008 |

| Fully tax-equivalent net interest income |

110,359 |

112,121 |

113,341 |

111,512 |

104,149 |

| Total average interest-earnings assets |

13,940,636 |

14,204,632 |

14,866,769 |

14,612,179 |

14,471,683 |

| Net interest margin (FTE) (non-GAAP) |

3.18% |

3.20% |

3.02% |

3.03% |

2.89% |

| |

|

|

|

|

|

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Quarterly GAAP to Non-GAAP Reconciliations |

|

|

|

|

|

| Income statement data |

|

|

|

|

|

| Earnings per common share |

|

|

|

|

|

| Diluted earnings per share (GAAP) |

$0.89 |

$0.11 |

$0.97 |

$0.90 |

$0.73 |

| Acquisition expenses |

0.00 |

0.00 |

0.00 |

0.00 |

0.07 |

| Tax effect of acquisition expenses |

0.00 |

0.00 |

0.00 |

0.00 |

(0.02) |

| Subtotal (non-GAAP) |

0.89 |

0.11 |

0.97 |

0.90 |

0.78 |

| Acquisition-related contingent consideration adjustment |

0.02 |

0.00 |

(0.01) |

0.00 |

0.01 |

| Tax effect of acquisition-related contingent consideration adjustment |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Subtotal (non-GAAP) |

0.91 |

0.11 |

0.96 |

0.90 |

0.79 |

| Acquisition-related provision for credit losses |

0.00 |

0.00 |

0.00 |

0.00 |

0.07 |

| Tax effect of acquisition-related for provision credit losses |

0.00 |

0.00 |

0.00 |

0.00 |

(0.01) |

| Subtotal (non-GAAP) |

0.91 |

0.11 |

0.96 |

0.90 |

0.85 |

| Loss on sales of investment securities |

0.00 |

0.96 |

0.00 |

0.00 |

0.00 |

| Tax effect of loss on sales of investment securities |

0.00 |

(0.21) |

0.00 |

0.00 |

0.00 |

| Subtotal (non-GAAP) |

0.91 |

0.86 |

0.96 |

0.90 |

0.85 |

| Gain on debt extinguishment |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Tax effect of gain on debt extinguishment |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Subtotal (non-GAAP) |

0.91 |

0.86 |

0.96 |

0.90 |

0.85 |

| Unrealized loss on equity securities |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Tax effect of unrealized loss on equity securities |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

| Operating diluted earnings per share (non-GAAP) |

0.91 |

0.86 |

0.96 |

0.90 |

0.85 |

| Amortization of intangibles |

0.07 |

0.07 |

0.07 |

0.07 |

0.07 |

| Tax effect of amortization of intangibles |

(0.01) |

(0.01) |

(0.02) |

(0.02) |

(0.02) |

| Subtotal (non-GAAP) |

0.97 |

0.92 |

1.01 |

0.95 |

0.90 |

| Acquired non-PCD loan accretion |

(0.02) |

(0.02) |

(0.02) |

(0.02) |

(0.02) |

| Tax effect of acquired non-PCD loan accretion |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

| Diluted adjusted net earnings per share (non-GAAP) |

$0.95 |

$0.90 |

$1.00 |

$0.94 |

$0.89 |

| |

|

|

|

|

|

| Noninterest operating expenses |

|

|

|

|

|

| Noninterest expenses (GAAP) |

$113,038 |

$114,052 |

$105,852 |

$108,185 |

$110,424 |

| Amortization of intangibles |

(3,705) |

(3,667) |

(3,794) |

(3,837) |

(3,851) |

| Acquisition expenses |

1 |

(57) |

(353) |

(409) |

(3,960) |

| Acquisition-related contingent consideration adjustment |

(1,000) |

0 |

700 |

0 |

(400) |

| Total adjusted noninterest expenses (non-GAAP) |

$108,334 |

$110,328 |

$102,405 |

$103,939 |

$102,213 |

| |

|

|

|

|

|

| Efficiency ratio (GAAP) |

|

|

|

|

|

| Noninterest expenses (GAAP) – numerator |

$113,038 |

$114,052 |

$105,852 |

$108,185 |

$110,424 |

| Net interest income (GAAP) |

109,279 |

111,030 |

112,223 |

110,394 |

103,141 |

| Noninterest revenues (GAAP) |

65,984 |

13,495 |

63,706 |

65,249 |

64,097 |

| Total revenues (GAAP) – denominator |

175,263 |

124,525 |

175,929 |

175,643 |

167,238 |

| Efficiency ratio (GAAP) |

64.5% |

91.6% |

60.2% |

61.6% |

66.0% |

| |

|

|

|

|

|

| Summary of Financial Data (unaudited) |

|

|

|

|

|

| (Dollars in thousands, except per share data) |

|

|

|

|

|

| |

2023 |

2022 |

| |

2nd Qtr |

1st Qtr |

4th Qtr |

3rd Qtr |

2nd Qtr |

| Quarterly GAAP to Non-GAAP Reconciliations |

|

|

|

|

|

| Income statement data (continued) |

|

|

|

|

|

| Operating efficiency ratio (non-GAAP) |

|

|

|

|

|

| Adjusted noninterest expenses (non-GAAP) - numerator |

$108,334 |

$110,328 |

$102,405 |

$103,939 |

$102,213 |

| Fully tax-equivalent net interest income |

110,359 |

112,121 |

113,341 |

111,512 |

104,149 |

| Noninterest revenues |

65,984 |

13,495 |

63,706 |

65,249 |

64,097 |

| Acquired non-PCD loan accretion |

(886) |

(1,079) |

(1,138) |

(1,397) |

(1,023) |

| Unrealized loss on equity securities |

50 |

0 |

20 |

4 |

22 |

| Loss on sales of investment securities |

0 |

52,329 |

0 |

0 |

0 |

| Gain on debt extinguishment |

0 |

(242) |

0 |

0 |

0 |

| Operating revenues (non-GAAP) - denominator |

175,507 |

176,624 |

175,929 |

175,368 |

167,245 |

| Operating efficiency ratio (non-GAAP) |

61.7% |

62.5% |

58.2% |

59.3% |

61.1% |

| |

|

|

|

|

|

| Balance sheet data |

|

|

|

|

|

| Total assets |

|

|

|

|

|

| Total assets (GAAP) |

$15,108,050 |

$15,255,953 |

$15,835,651 |

$15,594,547 |

$15,487,833 |

| Intangible assets |

(901,709) |

(900,914) |

(902,837) |

(909,224) |

(917,891) |

| Deferred taxes on intangible assets |

45,003 |

45,369 |

46,130 |

48,893 |

45,349 |

| Total tangible assets (non-GAAP) |

$14,251,344 |

$14,400,408 |

$14,978,944 |

$14,734,216 |

$14,615,291 |

| |

|

|

|

|

|

| Total common equity |

|

|

|

|

|

| Shareholders' equity (GAAP) |

$1,617,406 |

$1,634,013 |

$1,551,705 |

$1,461,163 |

$1,661,696 |

| Intangible assets |

(901,709) |

(900,914) |

(902,837) |

(909,224) |

(917,891) |

| Deferred taxes on intangible assets |

45,003 |

45,369 |

46,130 |

48,893 |

45,349 |

| Total tangible common equity (non-GAAP) |

$760,700 |

$778,468 |

$694,998 |

$600,832 |

$789,154 |

| |

|

|

|

|

|

| Shareholders’ equity-to-assets ratio at quarter end |

|

|

|

|

|

| Total shareholders’ equity (GAAP) - numerator |

$1,617,406 |

$1,634,013 |

$1,551,705 |

$1,461,163 |

$1,661,696 |

| Total assets (GAAP) - denominator |

15,108,050 |

15,255,953 |

15,835,651 |

15,594,547 |

15,487,833 |

| Net shareholders’ equity-to-assets ratio at quarter end (GAAP) |

10.71% |

10.71% |

9.80% |

9.37% |

10.73% |

| |

|

|

|

|

|

| Net tangible equity-to-assets ratio at quarter end |

|

|

|

|

|

| Total tangible common equity (non-GAAP) - numerator |

$760,700 |

$778,468 |

$694,998 |

$600,832 |

$789,154 |

| Total tangible assets (non-GAAP) - denominator |

14,251,344 |

14,400,408 |

14,978,944 |

14,734,216 |

14,615,291 |

| Net tangible equity-to-assets ratio at quarter end (non-GAAP) |

5.34% |

5.41% |

4.64% |

4.08% |

5.40% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| (1) Excludes loss on sales of investment securities, gain on debt extinguishment and unrealized loss on equity securities. |

| (2) Includes deferred tax liabilities related to certain intangible assets. |

# # #

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |