false

0000761648

0000761648

2024-09-25

2024-09-25

0000761648

CDRpB:Sec7.25SeriesBCumulativeRedeemablePreferredStock25.00LiquidationValueMember

2024-09-25

2024-09-25

0000761648

CDRpB:Sec6.50SeriesCCumulativeRedeemablePreferredStock25.00LiquidationValueMember

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2024

Cedar Realty Trust, Inc.

(Exact name of Registrant as Specified in

Its Charter)

| Maryland |

|

001-31817 |

|

42-1241468 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 2529 Virginia Beach Blvd. |

|

| Virginia Beach, Virginia |

|

23452 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 757 627-9088

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☒ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| 7.25% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

CDRpB |

|

New York Stock Exchange |

| 6.50% Series C Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

CDRpC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On September 25, 2024, Cedar Realty Trust, Inc. (the “Company”)

issued a press release announcing its intention to commence a tender offer (the “Offer”) to purchase up to an aggregate amount

paid of $9 million of shares of its 6.50% Series C Cumulative Redeemable Preferred Stock (the “Series C Preferred Stock”).

The purchase price per share of Series C Preferred Stock will be not less than $13.25 per share nor greater than $15.50 per share. The

Offer is intended to commence on September 25, 2024 and to expire on October 24, 2024, unless the Company earlier extends or terminates

it. Furnished as Exhibit 99.1 and incorporated herein by reference is a copy of the press release announcing the Offer.

The Offer has not yet commenced. The press release included as Exhibit

99.1 is for informational purposes only. The press release is not a recommendation to buy or sell the Series C Preferred Stock or any

other securities, and it is neither an offer to purchase nor a solicitation of an offer to sell the Series C Preferred Stock or any other

securities. On the commencement of the Offer, the Company will file a tender offer statement on Schedule TO, including an offer to purchase,

letter of transmittal and related materials, with the United States Securities and Exchange Commission (the “SEC”). The Offer

will be made only pursuant to the offer to purchase, letter of transmittal and related materials filed as a part of the Schedule TO. Stockholders

should read carefully the offer to purchase, letter of transmittal and related materials because they contain important information, including

the various terms of, and conditions to, the Offer. Once the Offer is commenced, stockholders will be able to obtain a free copy of the

tender offer statement on Schedule TO, the offer to purchase, letter of transmittal and other documents that the Company will be filing

with the SEC at the SEC’s website at www.sec.gov or from the information agent for the Offer.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Forward-Looking Statements

This communication contains "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of

1934, as amended, that are subject to risks, uncertainties and other factors which may cause the actual results, performance or achievements

to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking

statements, which are based on certain assumptions and describe the Company's future plans, strategies and expectations, are generally

identifiable by use of the words "may", "will", "should", "estimates", "projects", "anticipates",

"believes", "expects", "intends", "future", and words of similar import, or the negative thereof.

These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are

beyond the Company’s control, are difficult to predict and could cause actual results to differ materially from those expressed

or forecasted in the forward-looking statements.

Forward-looking statements that were true at the

time made may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements.

The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CEDAR REALTY TRUST, INC. |

| |

|

|

|

| Date: |

September 25, 2024 |

By: |

/s/ M. Andrew Franklin |

| |

|

|

M. Andrew Franklin

Chief Executive Officer and President |

Exhibit 99.1

CEDAR REALTY TRUST ANNOUNCES PLANNED TENDER OFFER

Virginia Beach, Virginia, September 25, 2024

– Cedar Realty Trust, Inc. (NYSE: CDRpB, CDRpC) (the “Company”) announced today that it plans to commence on

September 25, 2024 a “modified Dutch auction” tender offer (the “Offer”) to purchase up to an aggregate

amount paid of $9 million of shares of its outstanding 6.50% Series C Cumulative Redeemable Preferred Stock (the “Series C

Shares”), at a price per Series C Share of not less than $13.25 and not greater than $15.50. The tender offer will commence

upon the filing by the Company of a tender offer statement on Schedule TO, including an offer to purchase, letter of transmittal and

related materials, with the United States Securities and Exchange Commission (the “SEC”).

The Offer is expected to commence on September 25,

2024, and is intended to expire at 5:00 p.m., New York City time, on Thursday, October 24, 2024, unless the offer is extended. Tenders

of Series C Shares must be made prior to the expiration of the Offer and may be withdrawn at any time prior to the expiration time, in

each case, in accordance with the procedures described in the tender offer materials. The Company intends to pay for the shares repurchased

in the Offer with available cash. The closing price of the Series C Shares on the New York Stock Exchange on September 24, 2024, the last

full trading day before the planned commencement of the tender offer, was $13.98 per

Series C Share.

A “modified Dutch auction” tender offer

allows stockholders to indicate how many shares of stock and at what price within the specified offer range they wish to tender their

stock. Based on the number of Series C Shares tendered and the prices specified by the tendering stockholders, the Company will determine

the lowest price per Series C Share within the specified range that will enable it to purchase up to an aggregate amount paid of $9 million

of Series C Shares at such price, or such lesser number of Series C Shares that are tendered and not withdrawn (the “Final Purchase

Price”), subject to the terms of the Offer. All Series C Shares purchased by the Company in the Offer will be purchased at the same

price.

If, based on the Final Purchase Price, more than an

aggregate amount paid of $9 million of Series C Shares (or such greater number of Series C Shares as the Company may choose to purchase

in accordance with applicable rules) are properly tendered and not properly withdrawn, the Company will purchase shares tendered at or

below the Final Purchase Price on a pro rata basis, subject to certain conditional tender provisions. Stockholders whose Series C Shares

are purchased in the Offer will be paid the determined purchase price in cash, less any applicable withholding taxes and without interest,

after the expiration of the Offer.

The Offer will not be contingent upon the receipt

of financing or any minimum number of Series C Shares being tendered. However, the Offer is subject to a number of other terms and conditions,

which will be described in detail in the offer to purchase for the Offer. Specific instructions and a complete explanation of the terms

and conditions of the Offer will be contained in the offer to purchase, the related letter of transmittal and other related materials,

which will be mailed to stockholders of record promptly after commencement of the Offer.

While the Company’s Board of Directors

has authorized the Company to make the Offer, none of the Company, its Board of Directors, the Company’s officers, the information

agent, or the depositary makes any recommendation as to whether to tender or refrain from tendering Series C Shares or as to the price

at which to tender them. The Company has not authorized any person to make any such recommendation. Stockholders must make their own decision

as to whether to tender their Series C Shares and, if so, how many Series C Shares to tender and the purchase price or purchase prices

at which they will tender them. In doing so, stockholders should consult their own financial and tax advisors and read carefully and evaluate

the information in the Offer documents, when available.

Georgeson LLC is serving as information agent for

the tender offer and Computershare Inc. is serving as the depositary for the tender offer. Alston & Bird LLP is serving as counsel

to the Company for the tender offer. Once commenced, for all questions relating to the tender offer, please call the information agent,

Georgeson LLC toll-free at (866) 735-3807; banks and brokers may call the depositary, Computershare Inc., at (800) 736-3001.

Additional Information Regarding the Tender Offer

This communication is for informational purposes only

and is not a recommendation to buy or sell the Company’s Series C Shares or any other securities, and it is neither an offer to

purchase nor a solicitation of an offer to sell the Company’s Series C Shares or any other securities. On the commencement of the

Offer, the Company will file a tender offer statement on Schedule TO, including an offer to purchase, letter of transmittal and related

materials, with the SEC. The Offer will only be made pursuant to the offer to purchase, letter of transmittal and related materials filed

as a part of the Schedule TO. Stockholders should read carefully the offer to purchase, letter of transmittal and related materials because

they contain important information, including the various terms of, and conditions to, the Offer. Once the Offer is commenced, stockholders

will be able to obtain a free copy of the tender offer statement on Schedule TO, the offer to purchase, letter of transmittal and other

documents that the Company will be filing with the SEC at the SEC’s website at www.sec.gov or from the information agent for the

tender offer.

About Cedar Realty Trust

Cedar

Realty Trust, Inc., a wholly-owned subsidiary of Wheeler Real Estate Investment Trust, Inc., is a Maryland corporation (taxed as a real

estate investment trust ("REIT")) that focuses on owning and operating income producing retail properties with a primary focus

on grocery-anchored shopping centers in the Northeast. Cedar's portfolio comprises 17 properties, with approximately 2.6 million square

feet of gross leasable area.

For

additional financial and descriptive information on the Company, its operations and its portfolio, please refer to the Company's website

at www.whlr.us.

Contact

Information:

Cedar Realty Trust, Inc.

(757) 627-9088

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking

statements” that are subject to risks, uncertainties and other factors which may cause the actual results, performance or achievements

to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking

statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally

identifiable by use of the words “may”, “will”, “should”, “estimates”, “projects”,

“anticipates”, “believes”, “expects”, “intends”, “future”, and words of similar

import, or the negative thereof. These statements are not guarantees of future performance and are subject to risks, uncertainties and

other factors, some of which are beyond the Company’s control, are difficult to predict and could cause actual results to differ

materially from those expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time

made may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated

events or changes to future operating results.

v3.24.3

Cover

|

Sep. 25, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2024

|

| Entity File Number |

001-31817

|

| Entity Registrant Name |

Cedar Realty Trust, Inc.

|

| Entity Central Index Key |

0000761648

|

| Entity Tax Identification Number |

42-1241468

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd.

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

true

|

| Entity Emerging Growth Company |

false

|

| 7.25% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

| Title of 12(b) Security |

7.25% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value

|

| Trading Symbol |

CDRpB

|

| Security Exchange Name |

NYSE

|

| 6.50% Series C Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

| Title of 12(b) Security |

6.50% Series C Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value

|

| Trading Symbol |

CDRpC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CDRpB_Sec7.25SeriesBCumulativeRedeemablePreferredStock25.00LiquidationValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CDRpB_Sec6.50SeriesCCumulativeRedeemablePreferredStock25.00LiquidationValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

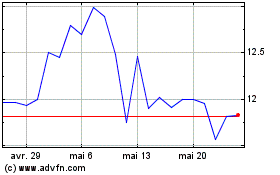

Cedar Realty (NYSE:CDR-C)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Cedar Realty (NYSE:CDR-C)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025