1934 Act Registration No. 1-31731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated August 10, 2023

Chunghwa Telecom Co., Ltd.

(Translation of Registrant’s Name into English)

21-3 Xinyi Road Sec. 1,

Taipei, Taiwan, 100 R.O.C.

(Address of Principal Executive Office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable )

1

EXHIBIT INDEX

|

|

|

Exhibit |

Description |

|

99.1 |

Announcement on 2023/08/09 |

The Board approved the real estate exchange transaction between Chunghwa Telecom and National property administration |

99.2 |

Announcement on 2023/08/09 |

The Board Approved the construction of BinJiang Internet Data Center |

99.3 |

Announcement on 2023/08/09 |

The Company announced consolidated financial statements for the six months ended June. 30, 2023 approved by the Board of Directors |

99.4 |

Announcement on 2023/08/09 |

Board of Directors approved donation to related parties |

99.5 |

Announcement on 2023/08/09 |

New appointment of Company’s corporate governance officer |

99.6 |

Announcement on 2023/08/09 |

The Board approved the appointments of senior management |

99.7 |

Announcement on 2023/08/10 |

Chunghwa Telecom announces its operating results for July 2023 |

99.8 |

Announcement on 2023/08/10 |

July 2023 sales |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Chunghwa Telecom Co., Ltd. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Date: August 10, 2023 |

|

|

|

|

Chunghwa Telecom Co., Ltd. |

|

|

|

|

|

By: /s/Yu-Shen Chen |

|

Name: Yu-Shen Chen |

|

Title: Chief Financial Officer |

3

EXHIBIT 99.1

The Board approved the real estate exchange transaction between Chunghwa Telecom and National

Property Administration

Date of events: 2023/08/09

Contents:

1.Name and nature of the underlying asset (e.g., land located at Sublot XX, Lot XX, North District, Taichung City):

(1)Exchanged-out:The land and building located at No.17-2, Xilingding, Guishan Dist., Taoyuan City.

(2)Exchanged-in:Land and buildings located at Xindian Dist., New Taipei City, Zhuangwei Township, Yilan County, Xitun Dist., Taichung City, Rende Dist., Tainan City, Fengshan Dist., Kaohsiung City, Pingtung City, Pingtung County, Gaoshu Township, Pingtung County, and Wandan Township, Pingtung County.

2.Date of occurrence of the event: 2023/08/09

3.Transaction unit amount (e.g.XX square meters, equivalent to XX ping), unit price, and total transaction price:

(1)Exchanged-out:The land is about 939.12 square meters (equivalent to 284 pings) and about NT$15,598,783 in value. The building is about 467.58 square meters (equivalent to 141 pings) and about NT$7,892,750 in value. The total value of the premise is about NT$23,491,533.

(2)Exchanged-in:The total area of the 8 lands exchanged is about 208.80 square meters (equivalent to 63 pings), and the value is about NT$15,901,785. The total area of the 8 buildings exchanged is about 667 square meters (equivalent to 201 pings), and the value is about NT$7,589,700. The total value of the premises is about NT$23,491,485.

4.Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

National Property Administration, a related party of the Company.

5.Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6.Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7.Projected gain (or loss) through disposal (not applicable for acquisition of assets; those with deferral should provide a table explaining recognition):

4

In accordance with the accounting principles, the cost of the exchanged-in assets would be measured by the book value of the exchanged-out assets, and thus no exchange gain or loss would be generated.

8.Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

In accordance with the laws and regulations.

9.The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

Based on the appraisal results of the National Property Evaluation Committee of the National Property Administration.

10.Name of the professional appraisal firm or company and its appraisal price: N/A

11.Name of the professional appraiser: N/A

12.Practice certificate number of the professional appraiser: N/A

13.The appraisal report has a limited price, specific price, or special price: N/A

14.An appraisal report has not yet been obtained: N/A

15.Reason for an appraisal report not being obtained: N/A

16.Reason for any significant discrepancy with the appraisal reports and opinion of the CPA: N/A

17.Name of the CPA firm: N/A

19.Practice certificate number of the CPA: N/A

20.Broker and broker's fee: N/A

21.Concrete purpose or use of the acquisition or disposal:

To improve the management efficiency of real estate.

22.Any dissenting opinions of directors to the present transaction: No

23.Whether the counterparty of the current transaction is a related party: Yes

24.Date of the board of directors resolution: 2023/08/09

25.Date of ratification by supervisors or approval by the audit committee: 2023/08/07

26.The transaction is to acquire a real property or right-of-use asset from a related party: Yes

27.The price assessed in accordance with the Article 16 of the Regulations Governing the Acquisition and Disposal of Assets by Public Companies: N/A

28.Where the above assessed price is lower than the transaction price, the price assessed in accordance with the Article 17 of the same regulations: N/A

29.Any other matters that need to be specified: None

5

EXHIBIT 99.2

The board approved the construction of BinJiang Internet Data Center

Date of events: 2023/08/09

Contents:

1.Type of contract: construction contract

2.Date of occurrence of the event: 2023/08/09

3.Counterparty to the contract and relationship with the Company: N/A

4.Major content of the contract (including total contract amount, anticipated monetary amount of participation in the investment, and start and end dates of the contract), restrictive covenants, and other important terms and conditions:

Located at Taipei City, the new Data Center will be a building with two basements and seven floors above ground and the floor area is approximately 16,401 square meters in total.

5.Name of the professional appraisal firm or company and its appraisal opinion: N/A

6.Name of the real property appraiser: N/A

7.Practice certificate number of the real property appraiser: N/A

8.Concrete purpose of the acquisition:

To expand Data Center for business use.

9.Any dissenting opinions of directors to the present transaction: None

10.Whether the counterparty of the current transaction is a related party: No

11.Date of the board of directors resolution: NA

12.Date of ratification by supervisors or approval by the audit committee: NA

13.The appraisal report has a limited price, specific price, or special price: N/A

14.An appraisal report has not yet been obtained: N/A

15.Reason for an appraisal report not being obtained: N/A

16.Reason for any significant discrepancy with the appraisal reports and opinion of the CPA: N/A

17.Name of the CPA firm: N/A

19.Practice certificate number of the CPA: N/A

20.Any other matters that need to be specified: None

6

EXHIBIT 99.3

The Company announced consolidated financial statements for the six months ended June 30, 2023 approved by the Board of Directors

Date of events: 2023/08/09

Contents:

1.Date of submission to the board of directors or approval by the board of directors: 2023/08/09

2.Date of approval by the audit committee: 2023/08/07

3.Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX):

2023/01/01~2023/06/30

4.Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 107,674,556

5.Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 40,968,467

6.Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 24,434,402

7.Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 24,919,653

8.Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 20,079,735

9.Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 19,564,529

10.Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 2.52

11.Total assets end of the period (thousand NTD): 533,027,459

12.Total liabilities end of the period (thousand NTD): 156,265,200

13.Equity attributable to owners of parent end of the period (thousand NTD): 364,720,409

14.Any other matters that need to be specified: None

7

EXHIBIT 99.4

Board of Directors approved donation to related parties

Date of events: 2023/08/09

Contents:

1.Date of occurrence of the event: 2023/08/09

2.Reason for the donation: Academic rewards

3.Total amount of the donation:

4.Donating the public academic institution NT$0.72 million.

5.Counterparty to the donation: National Chengchi University

6.Relationship with the Company: Government-related entity

7.Name and resume of independent director(s) that expressed an objection or qualified opinion: None

8.Objection or qualified opinion by the aforementioned independent director(s): None

9.Any other matters that need to be specified: None

8

EXHIBIT 99.5

New appointment of Company’s corporate governance officer

Date of events: 2023/08/09

Contents:

1.Type of personnel changed (please enter: spokesperson, acting spokesperson, important personnel (CEO, COO, CMO, CSO, etc.) ,financial officer, accounting officer, corporate governance officer, chief information security officer, research and development officer, chief internal auditor, or designated and non-designated representatives):

Corporate governance officer

2.Date of occurrence of the change: 2023/08/09

3.Name, title, and resume of the previous position holder:

Ya-Chian Shiue, Assistant Vice President of Legal Affairs Department

4.Name, title, and resume of the new position holder:

An-An Hsia, Senior Director of Legal Affairs Department

5.Type of the change (please enter: ”resignation”, ”position adjustment”, ”dismissal”, ”retirement”, ”death” or ”new replacement”): new replacement

6.Reason for the change: In response to the developing trend and blueprint of corporate governance, corporate governance officer has been converted from a concurrent position to a non-concurrent position and reassigned.

7.Effective date: 2023/08/09

8.Any other matters that need to be specified: None

9

EXHIBIT 99.6

The Board approved the appointments of senior management

Date of events: 2023/08/09

Contents:

1.Date of occurrence of the event: 2023/08/09

2.Company name: Chunghwa Telecom Co., Ltd.

3.Relationship to the Company (please enter ”head office” or ”subsidiaries”): Head office

4.Reciprocal shareholding ratios: N/A

The 7th meeting of the 10th Board of Directors approved the appointment of the management as follows:

Mr. Jung-Kuei Chen, president of Information Technology Group, will be discharged on August 15, 2023, and the successor will be Ms. Huei-Chi Yang, vice president of Telecommunication Laboratories.

7.Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): None

10

EXHIBIT 99.7

Chunghwa Telecom announces its operating results for July 2023

Date of events: 2023/08/10

Contents:

1.Date of occurrence of the event: 2023/08/10

2.Company name: Chunghwa Telecom Co., Ltd.

3.Relationship to the Company (please enter "head office" or "subsidiaries"): Head office

4.Reciprocal shareholding ratios: N/A

Chunghwa Telecom announced its unaudited operating results on a consolidated basis for July 2023:

The Company’s revenue was approximately NT$17.52 billion, income from operation was approximately NT$4.01 billion, net income attributable to stockholders of the parent was approximately NT$3.15 billion, EBITDA was approximately NT$7.30 billion and earnings per share was NT$0.41 for July 2023.

The Company’s revenue was approximately NT$125.19 billion, income from operation was approximately NT$28.45 billion, net income attributable to stockholders of the parent was approximately NT$22.71 billion, EBITDA was approximately NT$51.55 billion and earnings per share was NT$2.93 for the seven months ended July 31, 2023.

7.Any other matters that need to be specified: None

11

EXHIBIT 99.8

Chunghwa Telecom

August 10, 2023

This is to report the changes or status of 1) Sales volume 2) Funds lent to other parties 3) Endorsements and guarantees 4) Financial derivative transactions for the period of January 2023.

1) Sales volume (NT$ Thousand)

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Items |

|

2023 |

|

2022 |

|

Changes |

|

% |

|

July |

|

Net sales |

|

17,520,419 |

|

17,184,646 |

|

(+) 335,773 |

|

(+)1.95% |

|

Jan.-Jul. |

|

Net sales |

|

125,194,976 |

|

120,915,094 |

|

(+)4,279,882 |

|

(+)3.54% |

|

2) Funds lent to other parties (NT$ thousand)

|

|

|

|

Lending Company |

Current Month |

Last Month |

Specified Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

0 |

0 |

3) Endorsements and guarantees (NT$ thousand)

|

|

|

|

Guarantor |

Increase (Decrease) |

Accumulated |

Limited Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

500,000 |

3,054,027 |

4) Financial derivative transactions accumulated from January to the reporting month (NT$ thousand)

a-1 Non-trading purpose (that does not meet the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

427,210 |

Fair Value |

9,431 |

The amount of unrealized gain(loss) recognized this year |

5,918 |

|

|

|

Settled Position |

Total amount of contract |

293,138 |

The amount of realized gain(loss) recognized this year |

9,807 |

|

|

|

12

a-2 Non-trading purpose (that meets the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

525,672 |

Fair Value |

22,898 |

The amount of unrealized gain(loss) recognized this year |

10,007 |

|

|

|

Settled Position |

Total amount of contract |

775,007 |

The amount of realized gain(loss) recognized this year |

17,011 |

|

|

|

b Trading purpose : None

13

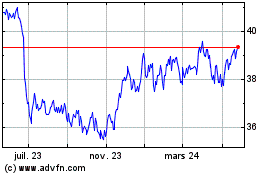

Chunghwa Telecom (NYSE:CHT)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

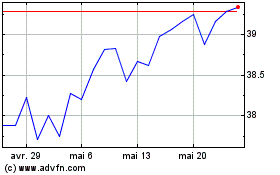

Chunghwa Telecom (NYSE:CHT)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025