MFS Announces Closed End Fund Portfolio Management Appointment

15 Février 2018 - 3:10PM

Business Wire

MFS Investment Management (MFS) is announcing portfolio

management appointments to MFS Multimarket Income Trust (NYSE:

MMT), MFS Charter Income Trust (NYSE: MCR), MFS Intermediate High

Income Fund (NYSE: CIF), and MFS Special Value Trust (NYSE: MFV),

four closed end funds.

Effective March 1, 2018, Michael Skatrud will join the portfolio

management team of MFS Multimarket Income Trust, MFS Charter Income

Trust, MFS Intermediate Income Trust, and MFS Special Value Trust

MFS. He will be focused on managing below investment grade

securities in each fund, working with current portfolio manager

David Cole. William Adams, a current portfolio manager on each

fund, will relinquish his portfolio management responsibilities on

the funds, effective on September 1, 2018. Adams will remain with

MFS and continue in his role as the firm's chief investment officer

for Global Fixed Income.

Skatrud joined MFS in 2013 as a research analyst, covering high

yield securities. His prior experience includes four years as a

senior high yield analyst at Columbia Management as well as two

years as a senior credit analyst with Oppenheimer Funds, Inc. He

also worked as a corporate bond analyst at Putnam Investments

previously. He earned a bachelor of science degree with distinction

from the University of Wisconsin and holds a Master of Business

Administration from The Wharton School at The University of

Pennsylvania.

There are no other changes to the portfolio management teams of

the funds. The funds' investment objectives and investment

strategies will not change as a result of this appointment.

About MFS Investment ManagementEstablished in 1924, MFS

is an active, global investment manager with investment offices in

Boston, Hong Kong, London, Mexico City, São Paulo, Singapore,

Sydney, Tokyo and Toronto. We employ a uniquely collaborative

approach to build better insights for our clients. Our investment

approach has three core elements: integrated research, global

collaboration and active risk management. As of January 31, 2018,

MFS manages US$510.5 billion in assets on behalf of individual and

institutional investors worldwide.

Statements made in this release that look forward in time

involve risks and uncertainties and are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such risks and uncertainties include, without limitation,

the adverse effect from a decline in the securities markets or a

decline in a Fund’s performance, a general downturn in the economy,

competition from other closed-end investment companies, changes in

government policy or regulation, inability of a Fund’s investment

adviser to attract or retain key employees, inability of a Fund to

implement its investment strategy, inability of a Fund to manage

rapid expansion and unforeseen costs and other effects related to

legal proceedings or investigations of governmental and

self-regulatory organizations.

Each fund is a closed end investment product advised by MFS

Investment Management. Common shares of the funds are only

available for purchase/sale on the NYSE at the current market

price. Shares may trade at a discount to NAV. Shares of the funds

are not FDIC-insured and are not deposits or other obligations of,

or guaranteed by, any bank. Shares of the funds involve investment

risk, including possible loss of principal.

39733.1

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180215005676/en/

MFS Shareholders or Advisors (investment product

information):Jeffrey Schwarz, 800-343-2829, ext.

55872orMedia Only:James Aber, 617-954-6154, or Dan Flaherty,

617-954-4256

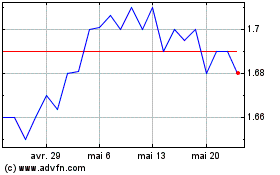

MFS Intermediate High In... (NYSE:CIF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

MFS Intermediate High In... (NYSE:CIF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025