Highly accretive acquisitions to balance

portfolio, create immediate scale, and enhance capital allocation

flexibility

Civitas Resources (NYSE: CIVI) (“CIVI” or the “Company”) today

announced the signing of two definitive agreements to acquire oil

producing assets in the Midland and Delaware Basins of west Texas

and New Mexico. The agreements were signed with affiliates of

Hibernia Energy III, LLC (“Hibernia”) and Tap Rock Resources, LLC

(“Tap Rock”), which are respective portfolio companies of funds

managed by NGP Energy Capital Management, L.L.C. (“NGP”), for total

consideration of approximately $4.7 billion, subject to customary

purchase price adjustments. The transactions will fundamentally

transform Civitas into a stronger, more balanced, and sustainable

enterprise with a deep inventory of high-return drilling

opportunities in the heart of the Permian and DJ basins. Both

transactions are subject to customary terms and conditions and are

expected to close in the third quarter of 2023 with effective dates

of July 1, 2023.

Civitas plans to hold a conference call to discuss the

transactions at 6:30 a.m. MDT (8:30 a.m. EDT) on June 20, 2023.

Participation details are included within this release. Slides

accompanying today’s release are available at

www.civitasresources.com.

Transaction Highlights

- Permian Basin entry with immediate scale: The combined

transactions will add approximately 68,000 net acres (90%

held-by-production) in the Midland and Delaware basins and will add

combined proved reserves of approximately 335 MMBoe, as of year-end

2022. The transactions will increase Civitas’ existing production

by 60%, adding approximately 100 MBoe/d (54% oil) of current

production with the acquired assets expected to average

approximately 105 Mboe/d from close through year-end 2023.

- Adds premium, low breakeven oil inventory, enhances

oil-weighting and margins: Combined, the acquisitions will add

about 800 gross locations with approximately two-thirds having an

estimated IRR of more than 40% at $70/Bbl WTI and $3.50/MMBtu Henry

Hub NYMEX pricing. The Company’s pro forma oil-weighting is

expected to increase to nearly 50%.

- Attractively priced, immediately accretive to key financial

metrics: The acquisitions are attractively priced at 3.0x 2024

estimated Adjusted EBITDAX(1) (after taking into account the

consummation of the transactions), in-line with recent Permian

transactions. The transactions are expected to deliver an estimated

35% uplift to 2024 Free Cash Flow per share. Civitas expects to

generate approximately $1.1 billion of pro forma Free Cash Flow in

2024 at $70/Bbl WTI and $3.50/MMBtu Henry Hub NYMEX pricing

- Increases peer-leading dividend and remains committed to

long-term balance sheet strength: Under its existing dividend

framework, Civitas expects that its total pro forma dividend will

increase by about 20% in 2024. As of the third quarter of 2023,

Civitas expects leverage to be approximately 1.1x with a reduction

target of less than 1x by year-end 2024. To accelerate debt

reduction, the Company amended its share buyback authorization to

$500 million through year-end 2024 (previously $1 billion through

year-end 2024). In addition, the Company plans to sell

approximately $300 million in non-core assets by mid-2024.

- Balanced portfolio maximizes capital allocation

flexibility: Post close, Civitas will have a more balanced

asset portfolio with basin and commodity diversity. The

transactions will provide flexibility in future capital allocation

and optimize returns.

(1)

Non-GAAP financial measure; see “Non-GAAP

Measures” at the end of this release for more information.

“These accretive and transformative transactions will

immediately create a stronger, more balanced and sustainable

Civitas,” said Chris Doyle, Civitas President & CEO. “By

acquiring attractively priced, scaled assets in the heart of the

Permian Basin, we advance our strategic pillars through increased

free cash flow and enhanced shareholder returns. We will soon have

nearly a decade of price-resilient, high-return drilling inventory.

Our strong capital structure allowed us to capture these

transformational assets, and, importantly, behind the strength of

the pro forma business, we have a clear path to reduce leverage and

maintain long-term balance sheet strength.”

Delaware Basin Entry

Civitas has agreed to purchase a portion of Tap Rock’s Delaware

Basin assets for $2.45 billion, which includes $1.5 billion in cash

and approximately 13.5 million shares of Civitas common stock

valued at approximately $950 million, subject to customary

anti-dilution and purchase price adjustments. Tap Rock will retain

its ownership of the Olympus development area.

The assets include approximately 30,000 net acres, primarily

located in Eddy and Lea counties, New Mexico, an area widely

considered to be the core of the Delaware Basin. First quarter 2023

average production was approximately 59 MBoe/d, of which 52% was

oil. The Company will have an inventory of approximately 350

high-quality locations in the Delaware Basin.

Midland Basin Entry

Civitas has also agreed to purchase Hibernia’s Midland Basin

assets for $2.25 billion in cash, subject to customary purchase

price adjustments. The assets include approximately 38,000 net

acres in Upton and Reagan counties, Texas – an active and well

delineated area in the Midland Basin. First quarter 2023 average

production was approximately 41 MBoe/d, of which 56% was oil. The

Company will have an inventory of approximately 450 high-quality

locations on a contiguous acreage position in the Midland

Basin.

Financing

Total consideration for the two transactions is approximately

$4.7 billion. Civitas plans to fund the two transactions through

the incurrence of approximately $2.7 billion of unsecured senior

debt, approximately 13.5 million shares of Civitas common stock

valued at $950 million, approximately $600 million in borrowings

under the Company’s undrawn credit facility and approximately $400

million of cash-on-hand. Bank of America and JP Morgan are also

providing Civitas with $3.5 billion of committed financing for the

transaction.

Outlook

With two producing basins, Civitas will have the ability to flex

capital investments and activity levels between assets to maximize

returns, ensure desired outcomes, and mitigate potential

operational and timing risks. Guidance on Civitas and the impact of

the transactions is shown below. Civitas expects to provide

additional guidance details upon closing.

CIVI 2023 Guidance

Permian

Aug-Dec 2023

CIVI Pro Forma 2023

Combined(2)

CIVI Pro Forma 2024

Combined(2)

Total Production (Mboe/d)

160 − 170

100 − 110

200 – 220

270 − 290

Oil Production (Mboe/d)

72 − 77

53 − 58

95 – 105

130 − 140

% Liquids

68 − 70%

74 − 76%

70 − 73%

71 − 74%

Capital Expenditures ($MM)

$800 − $910

$375 − $475

$1,175 − $1,385

$1,600 − $1,800

(2) Assumes an estimated close date of

August 1, 2023.

Advisors

BofA Securities and Guggenheim Securities, LLC are serving as

financial advisors, Kirkland & Ellis is serving as legal

advisor, and DrivePath Advisors is serving as communication advisor

for Civitas. Goldman Sachs also provided strategic advice to the

Company.

JP Morgan and Baker Botts L.L.P. advised Hibernia, and Jefferies

and Vinson & Elkins LLP advised Tap Rock.

Conference Call Information

The Company plans to host a conference call to discuss these

transactions at 6:30 a.m. MDT (8:30 a.m. EDT) on June 20, 2023. To

participate in the call, please dial toll free (888) 660-6128 or

(929) 203-0879 and use Conference ID 4021134. A live webcast will

be available on the Investor Relations section of the Company’s

website at www.civitasresources.com.

About Civitas Resources, Inc.

Civitas Resources, Inc. is Colorado’s first carbon neutral oil

and gas producer and is focused on developing and producing crude

oil, natural gas, and natural gas liquids in Colorado’s

Denver-Julesburg Basin. The Company is committed to pursuing

compelling economic returns and cash flow while delivering

best-in-class cost leadership and capital efficiency. Civitas is

dedicated to safety, environmental responsibility, and implementing

industry leading practices to create a positive local impact. For

more information about Civitas, please visit

www.civitasresources.com.

About NGP

NGP is a premier private equity firm that believes energy is

essential to progress. Founded in 1988, NGP is moving energy

forward by investing in innovation and empowering energy

entrepreneurs in natural resources and energy transition. With over

$20 billion of cumulative equity commitments, NGP backs portfolio

companies focused on responsibly solving and securing the energy

needs of today and leading the way to a cleaner, more reliable and

more affordable energy future. For more information, visit

www.ngpenergy.com.

Forward-Looking Statements and Cautionary Statements

Certain statements in this release concerning future

opportunities for Civitas, future financial performance and

condition, guidance and any other statements regarding Civitas’

future expectations, beliefs, plans, objectives, financial

conditions, returns to shareholders assumptions or future events or

performance that are not historical facts are “forward-looking”

statements based on assumptions currently believed to be valid.

Forward-looking statements are all statements other than statements

of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,” “could,”

“should,” “would,” “potential,” “may,” “might,” “anticipate,”

“likely” “plan,” “positioned,” “strategy,” and similar expressions

or other words of similar meaning, and the negatives thereof, are

intended to identify forward-looking statements. Specific

forward-looking statements include statements regarding Civitas’

plans and expectations with respect to the transactions

contemplated by the definitive agreements related to the

acquisitions of Hibernia and Tap Rock (collectively, the

"Acquisitions") and the anticipated impact of the Acquisitions on

Civitas’ results of operations, financial position, growth

opportunities, reserve estimates and competitive position. The

forward-looking statements are intended to be subject to the safe

harbor provided by Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended (the “Securities Act”), and the Private Securities

Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from those anticipated, including, but not limited to, Civitas’

future financial condition, results of operations, strategy and

plans; the ability of Civitas to realize anticipated synergies

related to the Acquisitions in the timeframe expected or at all;

changes in capital markets and the ability of Civitas to finance

operations in the manner expected; the effects of commodity prices;

and the risks of oil and gas activities. Additionally, risks and

uncertainties that could cause actual results to differ materially

from those anticipated also include: declines or volatility in the

prices we receive for our oil, natural gas, and natural gas

liquids; general economic conditions, whether internationally,

nationally or in the regional and local market areas in which we do

business, including any future economic downturn, the impact of

continued or further inflation, disruption in the financial markets

and the availability of credit on acceptable terms; the effects of

disruption of our operations or excess supply of oil and natural

gas due to world health events and the actions by certain oil and

natural gas producing countries including Russia; the continuing

effects of the COVID-19 pandemic, including any recurrence or the

worsening thereof; the ability of our customers to meet their

obligations to us; our access to capital on acceptable terms; our

ability to generate sufficient cash flow from operations,

borrowings, or other sources to enable us to fully develop our

undeveloped acreage positions; our ability to continue to pay

dividends at their current level or at all; the presence or

recoverability of estimated oil and natural gas reserves and the

actual future sales volume rates and associated costs;

uncertainties associated with estimates of proved oil and gas

reserves; the possibility that the industry may be subject to

future local, state, and federal regulatory or legislative actions

(including additional taxes and changes in environmental, health

and safety regulation and regulations addressing climate change);

environmental, health and safety risks; seasonal weather

conditions, as well as severe weather and other natural events

caused by climate change; lease stipulations; drilling and

operating risks, including the risks associated with the employment

of horizontal drilling and completion techniques; our ability to

acquire adequate supplies of water for drilling and completion

operations; availability of oilfield equipment, services, and

personnel; exploration and development risks; operational

interruption of centralized oil and natural gas processing

facilities; competition in the oil and natural gas industry;

management’s ability to execute our plans to meet our goals;

unforeseen difficulties encountered in operating in new geographic

areas; our ability to attract and retain key members of our senior

management and key technical employees; our ability to maintain

effective internal controls; access to adequate gathering systems

and pipeline take-away capacity; our ability to secure adequate

processing capacity for natural gas we produce, to secure adequate

transportation for oil, natural gas, and natural gas liquids we

produce, and to sell the oil, natural gas, and natural gas liquids

at market prices; costs and other risks associated with perfecting

title for mineral rights in some of our properties; political

conditions in or affecting other producing countries, including

conflicts in or relating to the Middle East, South America and

Russia (including the current events involving Russia and Ukraine),

and other sustained military campaigns or acts of terrorism or

sabotage; and other economic, competitive, governmental,

legislative, regulatory, geopolitical, and technological factors

that may negatively impact our businesses, operations, or pricing.

Expectations regarding business outlook, including changes in

revenue, pricing, capital expenditures, cash flow generation,

strategies for our operations, oil and natural gas market

conditions, legal, economic and regulatory conditions, and

environmental matters are only forecasts regarding these

matters.

Additional information concerning other risk factors is also

contained in Civitas’ most recently filed Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and other Securities and Exchange Commission (“SEC”) filings. All

forward-looking statements speak only as of the date they are made

and are based on information available at that time. Civitas does

not assume any obligation to update forward-looking statements to

reflect circumstances or events that occur after the date the

forward-looking statements were made or to reflect the occurrence

of unanticipated events except as required by federal securities

laws. As forward-looking statements involve significant risks and

uncertainties, caution should be exercised against placing undue

reliance on such statements.

Disclaimer

The common stock repurchase authorization permits Civitas to

make repurchases on a discretionary basis as determined by

management, subject to market conditions, applicable legal

requirements, available liquidity, compliance with the company's

debt agreements and other appropriate factors. Acquisitions under

this repurchase authorization are to be made through open market or

privately negotiated transactions and may be made pursuant to plans

entered into in accordance with Rule 10b5-1 and/or Rule 10b-18 of

the Securities Exchange Act of 1934. This repurchase authorization

does not obligate Civitas to acquire any particular amount of

common stock or warrants, and may be modified, extended, suspended

or discontinued at any time without prior notice. No assurance can

be given that any particular amount of common stock or warrants

will be repurchased.

Non-GAAP Measures

To provide investors with additional information in connection

with our results as determined in accordance with generally

accepted accounting principles in the United States (“GAAP”), we

disclose certain non-GAAP financial measures. The non-GAAP

financial measures include Adjusted EBITDAX, free cash flow and

related calculations. We believe the non-GAAP financial measures

provide users of our financial information with additional

meaningful comparisons between the current results and results of

prior periods, as well as comparisons with peer companies. These

non-GAAP financial measures are not measures of financial

performance in accordance with GAAP and may exclude items that are

significant in understanding and assessing our financial results.

Therefore, these measures should not be considered in isolation or

as an alternative or superior to GAAP measures. You should be aware

that our presentation of these measures may not be comparable to

similarly-titled measures used by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230620182966/en/

For further information, please contact:

Investor Relations: John Wren, ir@civiresources.com

Media: Rich Coolidge, info@civiresources.com

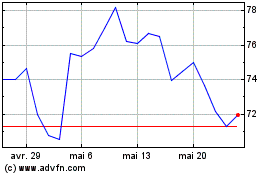

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025