Civitas Resources, Inc. (the “Company”) (NYSE: CIVI) today

announced that it has priced a private placement (the “Offering”)

to eligible purchasers under Rule 144A and Regulation S of the

Securities Act of 1933, as amended (the “Securities Act”) of $1,350

million in aggregate principal amount of new 8.375% senior notes

due 2028 (the “2028 Notes”) and $1,350 million in aggregate

principal amount of new 8.750% senior notes due 2031 (the “2031

Notes” and, together with the 2028 Notes, the “Notes”) at par. The

Offering is expected to close on June 29, 2023, subject to the

satisfaction of customary closing conditions.

The Company expects to use the net proceeds from the Offering,

together with cash on hand and borrowings under the Company’s

existing credit facility, to fund a portion of the consideration

for the Acquisitions (as defined below). The Notes will be subject

to a full or partial “special mandatory redemption” in the event

that the transactions contemplated by the Acquisition Agreements

(as defined below) are not consummated on or before October 31,

2023, or if the Company notifies the trustee of the Notes that it

will not pursue the consummation of either or both of the

Acquisitions.

The Notes to be offered will not be registered under the

Securities Act or under any state or other securities laws, and the

Notes will be issued pursuant to an exemption therefrom, and may

not be offered or sold within the United States, or to or for the

account or benefit of any U.S. Person, absent registration or an

applicable exemption from registration requirements.

The Notes are being offered only to persons who are either

reasonably believed to be “qualified institutional buyers” under

Rule 144A or who are non-“U.S. persons” outside the United States

under Regulation S as defined under applicable securities laws.

This press release does not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Civitas Resources, Inc.

Civitas Resources, Inc. is Colorado’s first carbon neutral oil

and gas producer and is focused on developing and producing crude

oil, natural gas, and natural gas liquids in Colorado’s

Denver-Julesburg Basin. The Company is committed to pursuing

compelling economic returns and cash flow while delivering

best-in-class cost leadership and capital efficiency. The Company

is dedicated to safety, environmental responsibility, and

implementing industry leading practices to create a positive local

impact. The Company’s common stock is listed for trading on the New

York Stock Exchange under the symbol: “CIVI.”

Cautionary Statement Regarding Forward-Looking

Information

Certain statements in the foregoing, including those that

express belief, expectation or intention, are “forward-looking”

statements based on assumptions currently believed to be valid.

Forward-looking statements are all statements other than statements

of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,” “could,”

“should,” “would,” “potential,” “may,” “might,” “anticipate,”

“likely” “plan,” “positioned,” “strategy,” and similar expressions

or other words of similar meaning, and the negatives thereof, are

intended to identify forward-looking statements. Specific

forward-looking statements include statements regarding the

Company’s plans and expectations with respect to the Offering, the

anticipated use of the proceeds from the Offering and the

transactions contemplated by (a) the Membership Interest Purchase

Agreement, dated as of June 19, 2023, by and among the Company,

Hibernia Energy III Holdings, LLC and Hibernia Energy III-B

Holdings, LLC (the “Hibernia Acquisition Agreement”), pursuant to

which the Company agreed to purchase all of the issued and

outstanding equity ownership interests of Hibernia Energy III, LLC

(“HE 3”) and Hibernia Energy III-B, LLC (“HE 3-B” and, together

with HE 3, the “Hibernia Targets”) (the “Hibernia Acquisition”) and

(b) the Membership Interest Purchase Agreement, dated as of June

19, 2023, by and among the Company, Tap Rock Resources Legacy, LLC

(“Tap Rock I Legacy”), Tap Rock Resources Intermediate, LLC (“Tap

Rock I Intermediate” and, together with Tap Rock I Legacy, the “Tap

Rock I Sellers”), Tap Rock Resources II Legacy, LLC, Tap Rock

Resources II Intermediate, LLC, Tap Rock NM10 Legacy Holdings, LLC

and Tap Rock NM10 Holdings Intermediate, LLC, solely in its

capacity as the sellers’ representative, Tap Rock I Legacy, and

solely for the limited purposes set forth therein, Tap Rock

Resources, LLC (the “Tap Rock Acquisition Agreement” and, together

with the Hibernia Acquisition Agreement, the “Acquisition

Agreements”), pursuant to which the Company agreed to purchase all

of the issued and outstanding equity interests of a Delaware

limited liability company to be formed by the Tap Rock I Sellers

(“Tap Rock AcquisitionCo”), Tap Rock Resources II, LLC (“Tap Rock

II”) and Tap Rock NM10 Holdings, LLC (“NM10” and, together with Tap

Rock AcquisitionCo and Tap Rock II, the “Tap Rock Targets”) (the

“Tap Rock Acquisition” and, together with the Hibernia Acquisition,

the “Acquisitions”). The forward-looking statements are intended to

be subject to the safe harbor provided by Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of

1995.

The Company cautions investors that any forward-looking

statements are subject to known and unknown risks and

uncertainties, many of which are outside the Company’s control, and

which may cause actual results and future trends to differ

materially from those matters expressed in, or implied or projected

by, such forward-looking statements, which speak only as of the

date they are made. Investors are cautioned not to place undue

reliance on these forward-looking statements. Risks and

uncertainties that could cause actual results to differ from those

described in forward-looking statements include, without

limitation, the following:

- the Acquisition Agreements may be terminated in accordance with

their terms and the Acquisitions may not be completed;

- the parties may not be able to satisfy the conditions to the

completion of the Acquisitions in a timely manner or at all;

- the Acquisitions may not be accretive, and may be dilutive, to

the Company’s earnings per share, which may negatively affect the

market price of the Company’s common stock;

- the Company may incur significant transaction and other costs

in connection with the Acquisitions in excess of those anticipated

by the Company;

- the Company may fail to realize anticipated benefits expected

from the Acquisitions in the timeframe expected or at all;

- the Company may face unforeseen difficulties in operating in

new geographic areas;

- the ultimate timing, outcome, and results of integrating the

operations of the Hibernia Targets and the Tap Rock Targets into

the Company’s business;

- the Acquisitions and their announcement and/or completion could

have an adverse effect on business or employee relationships;

- the risk related to disruption of management time from ongoing

business operations due to the Acquisitions;

- the effects of the Acquisitions, including the Company’s future

financial condition, results of operations, strategy, and

plans;

- changes in capital markets and the ability of the Company to

finance operations in the manner expected;

- any litigation relating to the Acquisitions; and

- disruptions to our business due to acquisitions and other

significant transactions, including the Acquisitions.

Additional information concerning other factors that could cause

results to differ materially from those described above can be

found under Item 1A. “Risk Factors” and “Management’s Discussion

and Analysis” sections elsewhere in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022, subsequently filed

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

other filings made with the Securities and Exchange Commission

(“SEC”), each of which is on file with the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at the time they

were made. The Company assumes no obligation to any update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by federal securities laws. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230622605278/en/

Investor Relations: John Wren, ir@civiresources.com Media: Rich

Coolidge, info@civiresources.com

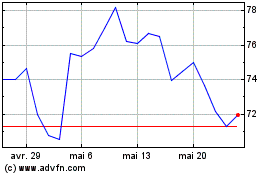

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025