0001847064

false

0001847064

2023-07-19

2023-07-19

0001847064

dei:FormerAddressMember

2023-07-19

2023-07-19

0001847064

CLBR:ClassACommonStockParValueMember

2023-07-19

2023-07-19

0001847064

CLBR:RedeemableWarrantsEachWholeWarrantExercisableMember

2023-07-19

2023-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July

19, 2023

PSQ Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40457 |

|

86-2062844 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

222 Lakeview Avenue, Suite 800

West Palm Beach, Florida |

|

33401 |

| (Address of principal executive offices) |

|

(Zip Code) |

(561) 805-3588

(Registrant’s telephone number, including

area code)

Colombier Acquisition Corp.

214 Brazilian Avenue, Suite 200-J

Palm Beach, Florida, 33480

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2 below):

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

|

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

PSQH |

|

New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

PSQH WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On July 19, 2023, Colombier

Acquisition Corp. (“Colombier”) issued a press release announcing that at the special meeting of stockholders of Colombier

held that day, Colombier’s stockholders voted in favor of the Business Combination (as defined below) and the related proposals.

A copy of such press release is attached as Exhibit 99.1 hereto and is incorporated by reference into this Item 7.01.

Additionally on July 19, 2023,

PSQ Holdings, Inc., now known as PublicSq. Inc. (“PublicSq.”), issued a press release announcing that it consummated the previously

announced business combination (the “Business Combination”) with Colombier, pursuant to the Agreement and Plan of Merger,

dated as of February 27, 2023, by and among Colombier, PublicSq. and the other parties thereto. In connection with the closing of the

Business Combination, the registrant changed its name from Colombier Acquisition Corp. to PSQ Holdings, Inc. (the “Combined Company”).

The Combined Company will continue the existing business operations of PublicSq. as a publicly traded company. The Class A common stock

and warrants of the Combined Company are expected to begin trading on the New York Stock Exchange under the symbols “PSQH”

and “PSQH WS,” respectively, on July 20, 2023. A copy of such press release is attached as Exhibit 99.2 hereto and is incorporated

by reference into this Item 7.01.

The information set forth in this Item 7.01, including Exhibit 99.1,

is being furnished under Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. In addition,

this information shall not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended,

or any filing under the Exchange Act, regardless of any general incorporation language in any such filing.

Item 9.01 Financial

Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

PSQ HOLDINGS, INC. |

| |

|

|

| Dated: July 19, 2023 |

By: |

/s/ Michael Seifert |

| |

|

Name: |

Michael Seifert |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

Colombier Acquisition Corp. Announces Stockholder

Approval of the Proposed Business Combination with Patriotic Marketplace PublicSq.

PALM BEACH, Fla. -- Colombier Acquisition Corp.

(NYSE: CLBR) (“Colombier”), a publicly traded special purpose acquisition company, announced that at the special meeting of

Colombier stockholders (the “Special Meeting”) held today, Colombier’s stockholders voted in favor of the proposed business

combination (the “Business Combination”) and the related proposals with PSQ Holdings, Inc. (“PublicSq.”), a leading

marketplace of patriotic businesses and consumers.

The period for holders of Colombier public shares

to request redemptions is closed; further, Colombier is not accepting any requests to “reverse” or withdraw previously tendered

redemption requests, effective immediately.

The completion of the Business Combination is

expected to occur as soon as practicable, subject to the satisfaction or waiver of remaining customary closing conditions. Following the

closing of the Business Combination, the combined company will be renamed “PSQ Holdings, Inc.” and its common stock and warrants

will trade on the New York Stock Exchange under the symbols “PSQH” and “PSQH WS,” respectively.

About PublicSq.

PublicSq. is an app and website that connect freedom-loving

Americans to high-quality businesses that share their values, both online and in their local communities. The primary mission of the platform

is to help consumers "shop their values" and put purpose behind their purchases. In less than ten months since its nationwide

launch, PublicSq. has seen tremendous growth and proven to the nation that the parallel, "patriotic" economy can be a major

force in commerce. The platform has over 55,000 businesses from a variety of different industries and over 1.1 million consumer members.

It is free to join for both consumers and business owners alike. To learn more, download the app on the App Store or Google Play, or visit

PublicSq.com.

About Colombier

Colombier Acquisition Corp. was formed for the

purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination

with one or more businesses.

Forward-Looking Statements

This communication may contain forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended,

and for purposes of the “safe harbor” provisions under the United States Private Securities Litigation Reform Act of 1995.

Any statements other than statements of historical fact contained herein are forward-looking statements. Such forward-looking statements

include, but are not limited to, expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding

PublicSq. and the future held by PublicSq.’s management team and the products and markets, future financial condition, expected

future performance and market opportunities of PublicSq. These forward-looking statements generally are identified by the words “anticipate,”

“believe,” “could,” “expect,” “estimate,” “future,” “intend,”

“may,” “might,” “strategy,” “opportunity,” “plan,” “project,”

“possible,” “potential,” “project,” “predict,” “scales,” “representative

of,” “valuation,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions, but the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future

events to differ materially from the forward-looking statements in this communication, including, without limitation: (i) the outcome

of any legal proceedings that may be instituted against PublicSq. related to the business combination with Colombier, (ii) the ability

to maintain the listing of PublicSq.’s securities on the New York Stock Exchange or another national securities exchange, (iii)

changes in the competitive industries and markets in which PublicSq. operates; variations in performance across competitors, changes in

laws and regulations affecting PublicSq.’s business and changes in the combined capital structure, (iv) the ability to implement

business plans, growth, marketplace and other expectations, and identify and realize additional opportunities, (v) risks related to PublicSq.’s

limited operating history, the rollout and/or expansion of its business and the timing of expected business milestones (vi) risks related

to PublicSq.’s potential inability to achieve or maintain profitability and generate significant revenue, (vii) expectations with

respect to future operating and financial performance and growth, including when PublicSq. will generate positive cash flow from operations,

(viii) the ability to raise funding on reasonable terms as necessary to develop its products in the timeframe contemplated by PublicSq.’s

business plan, (ix) the ability to execute PublicSq.’s anticipated business plans and strategy, (x) the ability of PublicSq. to

enforce its current or future intellectual property, including patents and trademarks, along with potential claims of infringement by

PublicSq. of the intellectual property rights of others, (xi) risk of loss of key influencers, media outlets and promoters of PublicSq.’s

business or a loss of reputation of PublicSq. or reduced interest in the mission and values of PublicSq. and the segment of the consumer

marketplace it intends to serve and (xii) the risk of economic downturn, increased competition, a changing regulatory landscape and related

impacts that could occur in the highly competitive consumer marketplace, both online and through “bricks and mortar” operations.

The foregoing list of factors is not exhaustive. Recipients should carefully consider such factors and the other risks and uncertainties

described and to be described in the “Risk Factors” section of the Registration Statement on Form S-4, as amended, filed by

Colombier, including the definitive proxy/prospectus declared effective by the United States Securities and Exchange Commission (“SEC”)

on June 30, 2023 and other documents filed or to be filed by PublicSq. from time to time with the SEC. These filings identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Recipients are cautioned not to put undue reliance on

forward-looking statements, and PublicSq. does not assume any obligation to, nor intends to, update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise, except as required by law. PublicSq. gives no assurance that PublicSq.

will achieve its expectations.

Contacts

For Investors:

Longacre Square Partners

IRCLBR@longacresquare.com

For Media:

JCONNELLY

psq@jconnelly.com

Exhibit 99.2

Patriotic Marketplace PSQ Holdings, Inc. and

Colombier Acquisition Corp. Announce Closing of Business Combination

Follows Colombier Stockholders’ Approval

of the Business Combination and Related Proposals with PSQ Holdings, Inc. at Special Meeting

Colombier Acquisition Corp. to Become “PSQ

Holdings, Inc.”

Shares and Warrants to Trade on the NYSE Under

the Symbols “PSQH” and “PSQH WS”

WEST PALM BEACH, Fla. – PSQ Holdings, Inc.,

a leading marketplace of patriotic businesses and consumers, and Colombier Acquisition Corp. (NYSE: CLBR) (“Colombier”), a

publicly traded special purpose acquisition company, today announced the completion of their previously announced business combination.

Colombier stockholders approved the business combination with PSQ Holdings, Inc., and the related proposals, at a Special Meeting of Colombier

stockholders (the “Special Meeting”) on July 19, 2023. In connection with the closing of the business combination, a wholly-owned

subsidiary of Colombier merged with and into PSQ Holdings, Inc., with PSQ Holdings, Inc. continuing as a wholly-owned subsidiary of Colombier,

and was renamed “PublicSq. Inc.,” and Colombier was renamed “PSQ Holdings, Inc.” (“PublicSq.”). PublicSq.’s

shares of Class A common stock and warrants will trade on the New York Stock Exchange (“NYSE”) under the symbols “PSQH”

and “PSQH WS,” respectively, beginning July 20, 2023.

The transaction provides PublicSq. with approximately

$34.9 million, after giving effect to Colombier stockholder redemptions and before payment of transaction expenses. The foregoing amount

does not include $22.5 million in additional gross proceeds previously raised by PublicSq. in its private financing completed

in June 2023 and prior to completion of the business combination with Colombier. After payment of transaction expenses, the funds released

to PublicSq. from Colombier’s trust account will be used to support PublicSq.’s direct-to-consumer (“D2C”), and

business-to-business operating expenses, to fund an increase in PublicSq.’s payroll in areas of engineering and product for the

further development of PublicSq.’s platform functionality, including the enhancement of e-commerce capabilities, consumer rewards

programs, and platform scalability, to launch targeted marketing initiatives, including brand awareness campaigns, direct-response advertising,

promotional events, and the expansion of PublicSq.’s outreach program, to fund PublicSq.’s D2C inventory and supply chain

requirements and for other general corporate purposes including, but not limited to, working capital for operations and potential future

acquisitions.

Michael Seifert, the Founder and Chief Executive

Officer of PublicSq., commented: “Today, PublicSq. has reached a true milestone, and the best part is we are just getting started.

We could not be prouder to pave the way for the quickly growing parallel, patriot economy – which includes over a million and counting

freedom-loving Americans who are registered on our platform as members, as well as over 55,000 business vendors on the platform. We are

ready to begin our next phase of growth as a public company, and I want to congratulate the entire PublicSq. team on this achievement.”

Following the closing of the merger, Michael Seifert

has a majority of the voting power in PublicSq. and will continue to drive PublicSq.’s mission of becoming the nation’s leading

values-aligned marketplace.

Omeed Malik, Chairman and CEO of Colombier, and

a member of the PublicSq. board of directors, said: “We chose to partner with PublicSq. because we believe patriotic Americans who

feel alienated by the woke agendas of the mainstream economy represent the most massive underserved market in the world. I look forward

to continuing to provide my expertise and guidance as a member of the board as PublicSq. continues on its growth trajectory as a publicly

listed company.”

Advisors

Cantor Fitzgerald & Co. served as a capital

markets advisor on the Business Combination.

Ellenoff Grossman & Schole LLP and Eversheds

Sutherland LLP served as legal advisors to Colombier.

Wilmer Cutler Pickering Hale and Dorr LLP served

as legal advisor to PublicSq.

About PublicSq.

PublicSq. is an app and website that connect freedom-loving

Americans to high-quality businesses that share their values, both online and in their local communities. The primary mission of the platform

is to help consumers "shop their values" and put purpose behind their purchases. In less than ten months since its nationwide

launch, PublicSq. has seen tremendous growth and proven to the nation that the parallel, "patriotic" economy can be a major

force in commerce. The platform has over 55,000 businesses from a variety of different industries and over 1.1 million consumer members.

It is free to join for both consumers and business owners alike. To learn more, download the app on the App Store or Google Play, or visit

PublicSq.com.

About Colombier

Colombier Acquisition Corp. was formed for the

purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination

with one or more businesses.

Forward-Looking Statements

This communication may contain forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended,

and for purposes of the “safe harbor” provisions under the United States Private Securities Litigation Reform Act of 1995.

Any statements other than statements of historical fact contained herein are forward-looking statements. Such forward-looking statements

include, but are not limited to, expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding

PublicSq. and the future held by PublicSq.’s management team and the products and markets, future financial condition, expected

future performance and market opportunities of PublicSq. These forward-looking statements generally are identified by the words “anticipate,”

“believe,” “could,” “expect,” “estimate,” “future,” “intend,”

“may,” “might,” “strategy,” “opportunity,” “plan,” “project,”

“possible,” “potential,” “project,” “predict,” “scales,” “representative

of,” “valuation,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions, but the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future

events to differ materially from the forward-looking statements in this communication, including, without limitation: (i) the outcome

of any legal proceedings that may be instituted against PublicSq. related to the business combination with Colombier, (ii) the ability

to maintain the listing of PublicSq.’s securities on the New York Stock Exchange or another national securities exchange, (iii)

changes in the competitive industries and markets in which PublicSq. operates; variations in performance across competitors, changes in

laws and regulations affecting PublicSq.’s business and changes in the combined capital structure, (iv) the ability to implement

business plans, growth, marketplace and other expectations, and identify and realize additional opportunities, (v) risks related to PublicSq.’s

limited operating history, the rollout and/or expansion of its business and the timing of expected business milestones (vi) risks related

to PublicSq.’s potential inability to achieve or maintain profitability and generate significant revenue, (vii) expectations with

respect to future operating and financial performance and growth, including when PublicSq. will generate positive cash flow from operations,

(viii) the ability to raise funding on reasonable terms as necessary to develop its products in the timeframe contemplated by PublicSq.’s

business plan, (ix) the ability to execute PublicSq.’s anticipated business plans and strategy, (x) the ability of PublicSq. to

enforce its current or future intellectual property, including patents and trademarks, along with potential claims of infringement by

PublicSq. of the intellectual property rights of others, (xi) risk of loss of key influencers, media outlets and promoters of PublicSq.’s

business or a loss of reputation of PublicSq. or reduced interest in the mission and values of PublicSq. and the segment of the consumer

marketplace it intends to serve and (xii) the risk of economic downturn, increased competition, a changing regulatory landscape and related

impacts that could occur in the highly competitive consumer marketplace, both online and through “bricks and mortar” operations.

The foregoing list of factors is not exhaustive. Recipients should carefully consider such factors and the other risks and uncertainties

described and to be described in the “Risk Factors” section of the Registration Statement on Form S-4, as amended, filed by

Colombier, including the definitive proxy/prospectus declared effective by the United States Securities and Exchange Commission (“SEC”)

on June 30, 2023 and other documents filed or to be filed by PublicSq. from time to time with the SEC. These filings identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Recipients are cautioned not to put undue reliance on

forward-looking statements, and PublicSq. does not assume any obligation to, nor intends to, update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise, except as required by law. PublicSq. gives no assurance that PublicSq.

will achieve its expectations.

Contacts

For Investors:

Longacre Square Partners

IRCLBR@longacresquare.com

For Media:

JCONNELLY

psq@jconnelly.com

v3.23.2

Cover

|

Jul. 19, 2023 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 19, 2023

|

| Entity File Number |

001-40457

|

| Entity Registrant Name |

PSQ Holdings, Inc.

|

| Entity Central Index Key |

0001847064

|

| Entity Tax Identification Number |

86-2062844

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

222 Lakeview Avenue

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

West Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33401

|

| City Area Code |

(561)

|

| Local Phone Number |

805-3588

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Common Stock Par Value [Member] |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

PSQH

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants Each Whole Warrant Exercisable [Member] |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

PSQH WS

|

| Security Exchange Name |

NYSE

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

Colombier Acquisition Corp.

|

| Entity Address, Address Line Two |

214 Brazilian Avenue

|

| Entity Address, Address Line Three |

Suite 200-J

|

| Entity Address, City or Town |

Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33480

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CLBR_ClassACommonStockParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CLBR_RedeemableWarrantsEachWholeWarrantExercisableMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

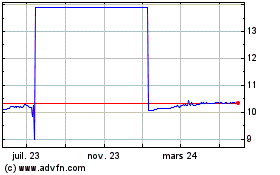

Colombier Acquisition (NYSE:CLBR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

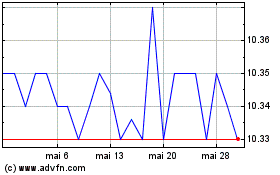

Colombier Acquisition (NYSE:CLBR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024