false

0001227654

0001227654

2025-01-27

2025-01-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2025

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-31921 |

36-3972986 |

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification No.) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(Address of principal executive offices)

(913) 344-9200

(Registrant's telephone number, including area

code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, $0.01 par value |

|

CMP |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

¨

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment

and Compensation of Chief Operations Officer

On

January 27, 2025, the Board of Directors (the “Board”) of Compass Minerals International, Inc. (the

“Company”) appointed Patrick Merrin as the Company’s new Chief Operations Officer, effective as of the date he begins

employment with the Company, which is expected to be March 3, 2025.

Mr. Merrin,

age 54, has three decades of experience in the mining industry. He joins the Company from Lundin Mining Corporation, a diversified Canadian

base metals miner, where he served as executive vice president of technical services since January 2024. In April 2023, Mr. Merrin

was appointed Chief Executive Officer of Copper Mountain Mining, a copper mining company, but did not assume the role due to its acquisition

in June 2023. From March 2022 to April 2023 he worked at Newcrest Mining, first as Vice President of Planning and Development

and later as Senior Vice President of Canadian Operations. From November 2020 to March 2022 he was an independent consultant.

From January 2020 to October 2020 he was Chief Operations Officer of Mining at Washington Companies, a diversified holding company

in the transportation, mining, construction, and shipbuilding industries.

The

Company entered into a letter agreement, signed January 17, 2025, with Mr. Merrin (the “COO Offer Letter”), establishing

his compensation as Chief Operations Officer. Pursuant to the COO Offer Letter, Mr. Merrin’s

base salary will be $575,000 per year. Mr. Merrin’s targeted cash bonus under the Company’s Management Annual Incentive

Program (“MAIP”) will be calculated at 100% of his base salary, with any bonus payments dependent on the Company’s pre-established performance

goals. Mr. Merrin will be eligible to receive equity awards as part of the Company’s Long-Term Incentive Program (“LTIP”),

with a target equity award value of $1,150,000. Mr. Merrin will receive a prorated LTIP grant for fiscal 2025 and will also receive

a one-time LTIP grant on his start date, consisting of (i) a one-time grant of restricted

stock units with a value of $150,000, vesting ratably over two years, and (ii) a one-time grant of performance stock units

with a value of $150,000, cliff vesting on the three-year anniversary of the grant date. Mr. Merrin will also receive a one-time

cash payment consisting of $280,000.

Mr. Merrin

will be eligible to participate in the employee benefit plans and programs generally available to the Company’s executive officers.

Mr. Merrin will also be designated as an eligible executive under the Company’s Executive Severance Plan. The COO Offer

Letter provides that Mr. Merrin’s employment with the Company is at-will.

The

foregoing description of the COO Offer Letter is qualified in its entirety by reference to the full text of the COO Offer Letter, which

is attached as Exhibit 10.1 and incorporated by reference herein. Mr. Merrin and the Company

will also enter into the Company’s standard Change in Control Severance Agreement.

There

is no arrangement or understanding between Mr. Merrin and any other person pursuant to which Mr. Merrin was appointed as Chief

Operations Officer. Furthermore, there are no transactions between Mr. Merrin (or any member of his immediate family) and the Company

(or any of its subsidiaries) that would be required to be reported under Item 404(a) of Regulation S-K.

Departure

of Chief Financial Officer and Services Agreement

On

January 27, 2025, Jeffrey Cathey resigned as Chief Financial Officer of Compass Minerals International, Inc. (the

“Company”). Mr. Cathey’s resignation was for personal reasons and not because of any dispute or disagreement with

the Company, including with respect to any matter relating to the Company’s accounting practices or financial reporting. Effective

January 28, 2025, the Compensation Committee of the Board approved, and the Company entered into, an Independent Contractor Services

Agreement (the “Services Agreement”) with Mr. Cathey. The Services Agreement provides that Mr. Cathey will serve

as a consultant to the Company for three months at a rate of $15,500 per month and contains customary confidentiality provisions.

The

foregoing description of the Services Agreement is a summary of the material terms only and is qualified in its entirety by the full text

of the agreement, which is attached as Exhibit 10.2.

Appointment

and Compensation of Chief Financial Officer

Effective

January 28, 2025, the Company appointed Peter Fjellman as its new Chief Financial Officer.

Mr. Fjellman,

age 56, has more than 30 years of finance experience. Most recently, from August 2021 to October 2024, he was the senior vice

president of finance, Americas and Asia Pacific for GXO Logistics, a publicly-traded logistics company spun off from XPO Logistics. Prior

to the spinoff, he was the senior vice president of finance, Americas and Asia Pacific for XPO Logistics from October 2018 to August 2021.

Prior to XPO Logistics, Mr. Fjellman’s roles included Chief Financial Officer, Americas for ABB, a global power and automation

products manufacturer; vice president, finance, North America at Danaher Corporation, a global life sciences and diagnostics company;

and positions of increasing responsibility at Newell Rubbermaid Corporation, a global consumer goods manufacturer.

The

Company entered into a letter agreement, signed January 17, 2025, with Mr. Fjellman

(the “CFO Offer Letter”), establishing his compensation as Chief Financial Officer. Pursuant to the CFO Offer Letter, Mr. Fjellman’s

base salary will be $525,000 per year. Mr. Fjellman’s targeted cash bonus under

the MAIP will be calculated at 70% of his base salary, with any bonus payments dependent on the Company’s pre-established performance

goals. Mr. Fjellman will be eligible to receive equity awards as part of the LTIP, with

a target equity award value of $892,500. Mr. Fjellman will receive a prorated LTIP grant

for fiscal 2025 on his start date. Mr. Fjellman will also receive an inducement cash

award consisting of $100,000.

Mr. Fjellman

will be eligible to participate in the employee benefit plans and programs generally available to the Company’s executive officers.

Mr. Fjellman will also be designated as an eligible executive under the Company’s Executive Severance Plan. The CFO

Offer Letter provides that Mr. Fjellman’s employment with the Company is at-will.

The

foregoing description of the CFO Offer Letter is qualified in its entirety by reference to the full text of the CFO Offer Letter, which

is attached as Exhibit 10.3 and incorporated by reference herein. Mr. Fjellman and the

Company will also enter into the Company’s standard Change in Control Severance Agreement.

There

is no arrangement or understanding between Mr. Fjellman and any other person pursuant

to which Mr. Fjellman was appointed as Chief Financial Officer. Furthermore, there are

no transactions between Mr. Fjellman (or any member of his immediate family) and the

Company (or any of its subsidiaries) that would be required to be reported under Item 404(a) of Regulation S-K.

The

Company issued a press release announcing Mr. Merrin’s and Mr. Fjellman’s appointment on January 28, 2025.

A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

| Exhibit No. |

|

Exhibit Description |

| |

|

| 10.1 |

|

Offer Letter, signed January 17, 2025, between Compass Minerals International, Inc. and Patrick Merrin. |

| 10.2 |

|

Services Agreement, effective January 28, 2025, between Compass Minerals International, Inc. and Jeffrey Cathey. |

| 10.3 |

|

Offer Letter, signed January 17, 2025, between Compass Minerals International, Inc. and Peter Fjellman. |

| 99.1 |

|

Press Release issued by Compass Minerals International, Inc. on January 28, 2025. |

| 104 |

|

Cover Page Interactive Data File (embedded within the XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

COMPASS

MINERALS INTERNATIONAL, INC. |

| |

|

|

| Date: January 28,

2025 |

By: |

/s/

Mary L. Frontczak |

| |

|

Name:

Mary L. Frontczak |

| |

|

Title:

Chief Legal and Administrative Officer and Corporate Secretary |

Exhibit 10.1

|

9900

W. 109TH ST. SUITE 100

OVERLAND PARK,

KS 66210

913.344.9200

COMPASSMINERALS.COM |

|

January 16, 2025

Patrick Merrin

Dear Pat,

I am pleased to confirm that Compass Minerals

(CMP) wishes to invite you to join our leadership team by making you this offer of employment. If you accept this offer, your title will

be Chief Operations Officer. Your start date will be March 17, 2025, or otherwise agreed upon by you and the company. The position

will be located at our corporate office in Overland Park, Kansas and you will be reporting directly to me.

The Chief Operations Officer position is a full-time

exempt position. Your annual gross starting salary will be $575,000.00.

In addition to your base salary, you will be eligible

to participate in CMP’s performance-based Management Annual Incentive Program (MAIP) starting with the fiscal 2025 performance year,

with a target bonus equal to 100% of your base salary ($575,000.00), prorated from your start date for the fiscal 2025 performance year.

You will also be eligible to participate in CMP’s

Long Term Incentive Program (LTIP). For your position, the LTIP target is $1,150,000.00, prorated from your start date for fiscal year

2025. You will receive the full value of your LTIP award beginning with the fiscal 2026 annual LTIP grant, in October 2025, where

such awards will be granted in accordance with the plan in place at the time of grant.

As an inducement to accept this offer of employment,

you will receive additional one-time awards to help offset compensation you may be forfeiting upon termination of employment with your

current employer.

Specifically, you will receive a one-time cash

bonus payment of $280,000.00, less applicable taxes, payable within 30 days of your start date.

You will receive a one-time grant of restricted

stock units (RSUs) valued at $150,000.00 on your start date, which will vest ratably over two years. In addition, you will receive a one-time

grant of performance stock units (PSUs) valued at $150,000.00 on your start date. The PSUs will cliff vest on the three-year anniversary

of your start date and are subject to performance metrics established by the Compensation Committee of CMP’s Board of Directors.

Enclosed is a benefit packet to familiarize you

with benefits that are available to you once you join CMP. In addition, you will be entitled to an annual physical paid for by CMP.

You will also be eligible to participate in the Executive Disability Plan.

Offer Letter

Page 2 of 3

In addition, Compass Minerals will provide you

with a monthly stipend to cover the Canadian healthcare costs for your family.

To facilitate your relocation to the Overland

Park, Kansas area, you are eligible for our Executive Relocation benefit for U.S. domestic relocation, with up to six (6) months

of temporary housing. Please note that this benefit does not include any buy-out option of a current primary residence or home equity

loss guarantee. A copy of the relocation plan will be provided to you.

Effective on your hire, you will be eligible for

4 weeks (20 days) of paid vacation annually, which, for calendar year 2025, will be prorated from your start date.

If you accept this offer of employment, you will

be required to sign a Change in Control Severance Agreement and a Restrictive Covenant Agreement, along with other standard employment

documents applicable to other CMP employees.

We have enclosed the Change in Control Severance

Agreement, Restrictive Covenant Agreement and a CMP Executive Severance Plan for your review.

This offer of employment is conditional upon Compensation

Committee approval, attainment of proper US work authorization1,

verification of a satisfactory background investigation and reference checks, satisfactorily passing a drug screen, and the execution

of the Restrictive Covenant Agreement.

Please sign this letter on the following page,

acknowledging your acceptance and anticipated employment date. We look forward to you joining Compass Minerals.

Sincerely,

/s/ Ed Dowling

Ed Dowling

President and CEO

1

The Immigration and Control Act of 1986 requires employers to verify that every new hire is either a U.S. citizen or eligible

to be employed in this country. We are required to examine and will copy any one of the following: US passport, certification of U.S.

citizenship or naturalization, a valid foreign passport authorizing U.S. employment, a resident alien card containing employment, a resident

alien card containing employment authorization, or other document designated by the Immigration and Naturalization Service.

Alternatively, verification can be accomplished

by providing two forms of documentation one which established identity and one which establishes employment eligibility. Examples of documents

which show employment eligibility are a Social Security card or birth certificate; and examples of documents which show proof of identity

are a driver’s license or other state-issued card, which contain a photograph or other identifying information. The above documentation

must be presented prior to commencing employment. Please bring the appropriate items on your start date.

Offer Letter

Page 3 of 3

By signing below, you understand and agree that

your employment with the company is at-will. That is, your employment is not for any specified duration and you or the company may terminate

it, at any time, with or without cause and without notice. You are also representing and warranting to CMP that you have disclosed to

CMP in writing any and all agreements to which you are currently subject that in any way restrict your right to (a) solicit employees

or customers of your former employer(s) or (b) compete in any manner with your former employer(s) (e.g. a non-solicitation,

non-compete or restrictive covenant agreement). Please indicate your understanding and acceptance of the terms and conditions outlined

in this letter and your acceptance of this employment offer by signing and dating this page where indicated below.

| /s/ Patrick Merrin |

January 17, 2025 |

|

Employment date:

March 17, 2025 or otherwise agreed upon date |

Exhibit 10.2

INDEPENDENT CONTRACTOR SERVICES AGREEMENT

This INDEPENDENT CONTRACTOR

SERVICES AGREEMENT (this “Agreement”) is made effective this January 28, 2025 (the “Effective Date”)

by and between Compass Minerals America Inc., a Delaware limited liability company

(“Company”) and JEFFREY CATHEY, an individual (the “Contractor”). Compass and Contractor

may be referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, Company desires that

Contractor provide certain services to the Company and Company’s Affiliates (as hereinafter defined) and Contractor desires to provide

such services, in accordance with the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration

of the mutual promises and conditions contained herein, Company and Contractor agree as follows:

| (a) | From time to time hereunder, as requested by Company, Contractor agrees to provide the services described

in, and in accordance with, Exhibit A attached hereto and incorporated in by this reference (the “Services”)

for the Company and Company’s Affiliates (Company and Company’s Affiliates, hereinafter collectively, the “Company Group”).

For purposes of this Agreement, “Affiliate” means, as to Company, any other entity who directly, or indirectly through

one or more intermediaries, controls, is controlled by or is under common control with Company, where the term “control,”

including the correlative terms “controlling,” “controlled by” and “under common control with,” means

possession, directly or indirectly, of the power to direct or cause the direction of management or policies (whether through ownership

of securities or any partnership or other ownership interest, by contract or otherwise) of an entity. |

| (b) | Contractor will comply with all applicable laws, regulations, ordinances in the performance of the Services. |

| (c) | Contractor will perform the Services in a timely, ethical and professional manner and to devote such time,

attention and skill to Contractor’s duties under this Agreement as may reasonably be necessary to ensure the performance of the

Services to Company’ reasonable satisfaction. |

| (d) | Contractor’s execution, delivery and performance of this Agreement will not violate or cause a breach

of any existing employment, Contractor or any other agreement, covenant, promise or any other duties by which Contractor is bound, including

confidentiality obligations or covenants not to compete including any present or previous employer. |

| (a) | For the Services to be performed by Contractor hereunder, Company shall pay to Contractor the fees set

forth in Exhibit A (the “Fees”). Company shall reimburse Contractor for any out-of-pocket expenses reasonably

incurred or paid by Contractor in connection with Contractor’s performance of the Service and as approved in advance in writing

by Company. |

| (b) | The fee for the Services shall be paid within thirty (30) days following the last day of each calendar month during

the Consulting Period. Subject to the Company’s reimbursement rules and procedures, as in effect from time to time, Executive

shall be entitled to reimbursement for reasonable business expenses properly incurred by Executive in connection with the performance

of the Services. |

| (c) | The Fees shall cover and include all sales and use taxes, duties, and charges of any kind imposed by any

federal, state, or local governmental authority on amounts payable by Company under this Agreement, and in no event shall Company be required

to pay any additional amount to Contractor in connection with such taxes, duties, and charges, or any taxes imposed on, or regarding,

Contractor’s income, revenues, gross receipts, personnel, or real or personal property or other assets. |

| 3. | Independent Contractor Status |

| (a) | Contractor will perform the Services as an independent contractor and not as an employee of Company. The

manner of and means by which Contractor executes and performs Contractor’s obligations hereunder are to be determined by Contractor

in Contractor’s discretion provided that Compass Minerals may set guidelines or specification as to achieve Company’s desired

outcomes for the Services. Contractor agrees that Contractor will not describe or hold itself out as an employee of Company. |

| (b) | Nothing in this Agreement creates any agency, joint venture, partnership or other form of joint enterprise,

or fiduciary relationship between the Parties. |

| (c) | As an independent contractor, the Contractor acknowledges and agrees that it is Contractor’s responsibility

to pay and remit to the relevant government authorities such taxes as may be due or imposed on the Contractor’s compensation received

hereunder. |

| 4. | Indemnification; Limitation of Liability; Insurance |

| (a) | Contractor will indemnify and hold Company Group and their officers, directors, employees, agents and

business advisors) free and harmless, to the full extent permitted by law or in equity, for and from any and all third-party claims and

all related losses, liabilities, damages, costs, expenses (including reasonable attorneys’ fees) to the extent arising out of or

due to Contractor’s violation of law, negligence, fraud or willful misconduct. |

| (b) | Except as arising from (i) a Party’s fraud, gross negligence or willful misconduct or (ii) with

respect to Contractor’s indemnification obligations hereunder, neither Party will be liable for any indirect, special, incidental,

consequential, exemplary or punitive damages in relation to this Agreement. |

| 5. | Contractor Work Product |

| (a) | To the extent Contractor creates any work product or other deliverables for Company as part of the Services

hereunder (“Work Product”), Company will have all right, title and interest in and to all such Work Product including

all patent, copyright, trademark, trade secret, know how, computer code and other intellectual property and proprietary rights. All such

Work Product will be deemed to be “works made for hire.” To the extent any Work Product is not deemed “works made for

hire” by operation of law, Contractor, upon full and final payment under the terms of this Agreement, hereby irrevocably assigns,

transfers and conveys to Company, without further consideration, all of its right, title and interest in and to the copyright in such

Work Product and any other intellectual property associated therewith. In relation to the Work Product, Contractor acknowledges that Company

has the right to obtain and to hold in its own name, copyright registrations, trademarks, patents or such other protection as may be appropriate

to the subject matter, and any extensions and renewals thereof. Contractor will execute any documents or take any other actions as may

be reasonably necessary, or as Company may reasonably request, to assist Company to perfect the ownership rights defined in this Section. |

| 6. | Confidential Information |

| (a) | Contractor acknowledges that in connection with Contractor’s performance of the Services Contractor

has any may receive confidential and proprietary information of the Company, Group and that Contractor may also create such information

in the course of performing the Services (“Company Group Confidential Information”). Such information (in whatever form, medium

or manner of storage) includes but is not limited to any and all: (i) trade secrets, know-how, inventions, research or proprietary

business information of any sort; (ii) business, technical, marketing, production, financial, sales, pricing, or engineering data;

(iii) information relating to environmental matters, remediation efforts or Company Group’s strategy for or status of regulatory

approvals or negotiations; or (iv) information regarding customers, suppliers, vendors, contracts, personnel or staffing, research

or any other past, present or future business or manufacturing processes, plans or strategies of the Company Group. |

| (b) | Subject to the terms and conditions of this Agreement, Contractor hereby agrees that Contractor will not

publicly divulge, disseminate, publish or otherwise disclose any Company Group Confidential Information without Company’s prior

written consent; and Contractor will not use any such Company Group Confidential Information for any purposes other than performing the

Services hereunder. Notwithstanding the above, Company and Contractor acknowledge and agree that the obligations set out in this Section 6

will not apply to any portion of Company Group Confidential Information which: |

| (i) | was at the time of disclosure to Contractor part of the public domain by publication or otherwise; |

| (ii) | became part of the public domain after disclosure to Contractor by publication or otherwise, except by

breach of this Agreement; |

| (iii) | was already properly and lawfully in Contractor’s possession at the time it was received from Company; |

| (iv) | was or is lawfully received by Contractor from a third party who was under no obligation of confidentiality

with respect thereto; or |

| (v) | is required to be disclosed by law, regulation or judicial or administrative process, provided that all

available legal remedies have been exhausted and written advance notice of such action was timely given to Company. |

| (c) | Contractor acknowledges and expressly agrees that any disclosure of Confidential Information or other

breach of Contractor’s obligations set forth in this Section 6 may cause irreparable harm to the Company Group for which monetary

damages may not alone provide adequate relief. Therefore, in accordance with applicable law and in addition to any other rights and remedies

provided herein, Company will be entitled to seek equitable relief by way of an injunction or otherwise. |

| (d) | Upon termination of this Agreement, or any other cessation of Contractor’s providing the Services,

Contractor will (i) return to Company, any and all property belonging to Company, including without limitation, all files, correspondence,

records and electronic data relating to Company’s business, and any and all information, documents or materials which may contain

Company Group Confidential Information, and (ii) not make any further use of Company Group Confidential Information. |

| (e) | Contractor’s obligations under this Section 6 will survive the termination or expiration of

this Agreement for a period of three (3) years, provided that with respect to any Company Group Confidential Information that constitutes

a trade secret, Contractor’s obligations shall continue until such information no longer so constitutes (other than due to an act

or omission of Contractor). |

| (a) | Unless sooner terminated as hereinafter provided, this Agreement shall be effective as of the Effective

Date and continue for a period of three (3) months (and thereafter will automatically terminate unless the Parties agree in writing

to a renewal. |

| (b) | This Agreement may be terminated by either Party (i) for such Party’s convenience upon thirty

(30) days prior written notice to the other Party or (ii) effective immediately upon written notice if the other Party is in material

breach of this Agreement. Additionally, this Agreement will terminate automatically upon the death or physical or mental incapacity of

Contractor. |

| (c) | Upon termination of this Agreement, Contractor will be entitled to receive such compensation and reimbursement,

if any, accrued hereunder but unpaid as of the termination date. |

Any notice or other communications hereunder

must be in writing and either personally delivered, sent by a reputable overnight carrier, or transmitted by email (provided the recipient

confirms receipt thereof), addressed as follows:

If to Contractor:

Jeffrey Cathey

If to Company:

Compass Minerals

America Inc.

9900 W. 109th Street,

Suite 100

Overland Park, KS

66210

| (a) | ENTIRE AGREEMENT. This Agreement constitutes the entire agreement of the Parties and there are no other

promises or conditions in any other agreement whether oral or written related to Contractor’s performance of services to Company. |

| (b) | AMENDMENT. This Agreement may be modified or amended if the amendment is made in writing and is signed

by authorized representatives of both Parties. |

| (c) | SEVERABILITY. If any provision of this Agreement is held to be invalid or unenforceable for any reason,

the remaining provisions will continue to be valid and enforceable. If a court finds that any provision of this Agreement is invalid or

unenforceable, but that by limiting such provision it would become valid and enforceable, then such provision will be deemed to be written,

construed, and enforced as so limited. |

| (d) | WAIVER. The failure of either Party to enforce any provision of this Agreement is not to be construed

as a waiver or limitation of that Party’s right to subsequently enforce and compel strict compliance with every provision of this

Agreement. |

| (e) | GOVERNING LAW; JURISDICTION. This Agreement is governed by the laws of the state of Kansas, without regard

to principles of conflicts of laws. Contractor agrees that the state and federal courts located in Johnson County, Kansas shall have exclusive

jurisdiction to hear, settle and/or determine any dispute, controversy or claim (including any non-contractual dispute, controversy or

claim) raised by Contractor arising out of or in connection with this Agreement and hereby irrevocably submits to the jurisdiction of

such courts. Nothing in this Section p(e) shall limit Company’s right to bring proceedings in any jurisdiction permitted

by applicable law. |

| (f) | ASSIGNMENT. Neither Party may assign, delegate or transfer to third parties this Agreement, or any or

all of such Party’s rights or obligations hereunder. |

| (g) | COUNTERPARTS. This Agreement may be signed in counterparts and delivered to the other Party either physically

or by electronic means. Each counterpart constitutes an original and all such counterparts together will constitute one and the same instrument. |

IN WITNESS WHEREOF, the Parties

have executed this Agreement effective as of the date first set forth above.

| /s/ Jeffrey Cathey |

|

COMPASS MINERAls America inc. |

| JEFFREY CATHEY |

|

|

| |

|

By: |

/s/ Chuck Otec |

| |

|

Name: |

Chuck Otec |

| |

|

Title: |

VP Human Resources |

EXHIBIT A

Services & Fees

| · | Contractor will provide Company with up to 80 hours per month of professional services including: |

| · | consulting and transition services relating to the company’s finance and accounting functions, including and without limitation,

assisting with the onboarding of the incoming Chief Financial Officer and providing guidance on key initiatives and projects. |

The Company will pay Contractor a retainer of $15,500 per month with

the expectation that Contractor will be available with reasonable notice by the Company and work no more than 80 hours per month.

In the event the contractor works more than 80 hours in a month, Contractor

will invoice Company and be paid $200 per hour for each hour over 80 hours in a month. All hours worked more than in a month shall be

pre-approved by the Company.

Exhibit 10.3

|

9900

W. 109TH ST. SUITE 100 OVERLAND PARK, KS 66210 913.344.9200 COMPASSMINERALS.COM |

|

January 17, 2025

Peter Fjellman

Dear Peter,

I am pleased to confirm that Compass Minerals

(CMP) wishes to invite you to join our leadership team by making you this offer of employment. If you accept this offer, your title will

be Chief Financial Officer. Your start date will be January 27, 2025, or otherwise agreed upon by you and the company. The position

will be located at our corporate office in Overland Park, Kansas and you will be reporting directly to me.

The Chief Financial Officer position is a full-time

exempt position. Your annual gross starting salary will be $525,000.00.

In addition to your base salary, you will be eligible

to participate in CMP’s performance-based Management Annual Incentive Program (MAIP) starting with the fiscal 2025 performance year,

with a target bonus equal to 70% of your base salary ($367,500.00), prorated from your start date for the fiscal 2025 performance year.

You will also be eligible to participate in CMP’s

Long Term Incentive Program (LTIP). For your position, the LTIP target is $892,500.00, prorated from your start date for fiscal year 2025.

You will receive the full value of your LTIP award beginning with the fiscal 2026 annual LTIP grant, in October 2025, where such

awards will be granted in accordance with the plan in place at the time of grant.

As an inducement to accept this offer of employment,

you will receive a one-time cash bonus payment of $100,000.00, less applicable withholdings and deductions, payable within 30 days of

your start date. The sign-on bonus is subject to repayment in all instances, except a job elimination, if you do not remain employed with

Compass Minerals for twenty-four months from your first day of employment with Compass Minerals. If you leave the Company in

the first 12 months after your start date, you will be required to repay the entire sign-on bonus. After twelve months employment,

the repayment amount will be prorated based on the number of months worked. For example, if your employment ends after fifteen months,

the amount of repayment would be 9/24th of the sign-on bonus.

Enclosed is a benefit packet to familiarize you

with benefits that are available to you once you join CMP. In addition, you will be entitled to an annual physical paid for by CMP.

You will also be eligible to participate in the Executive Disability Plan.

Offer Letter

Page 2 of 3

To facilitate your relocation to the Overland

Park, Kansas area, you are eligible for our Executive Relocation benefit for U.S. domestic relocation, with up to six (6) months

of temporary housing. Please note that this benefit does not include any buy-out option of a current primary residence or home equity

loss guarantee. A copy of the relocation plan will be provided to you.

Effective on your hire, you will be eligible for

5 weeks (25 days) of paid vacation annually, which, for calendar year 2025, will be prorated from your start date.

If you accept this offer of employment, you will

be required to sign a Change in Control Severance Agreement and a Restrictive Covenant Agreement, along with other standard employment

documents applicable to other CMP employees.

We have enclosed the Change in Control Severance

Agreement, Restrictive Covenant Agreement and a CMP Executive Severance Plan for your review.

This offer of employment is conditional upon Compensation

Committee approval, verification of a satisfactory background investigation and reference checks, satisfactorily passing a drug screen,

and the execution of the Restrictive Covenant Agreement.

The Immigration and Control Act of 1986 requires

employers to verify that every new hire is either a U.S. citizen or eligible to be employed in this country. We are required to examine

and will copy any one of the following: US passport, certification of U.S. citizenship or naturalization, a valid foreign passport authorizing

U.S. employment, a resident alien card containing employment, a resident alien card containing employment authorization, or other document

designated by the Immigration and Naturalization Service.

Alternatively, verification can be accomplished

by providing two forms of documentation one which established identity and one which establishes employment eligibility. Examples of documents

which show employment eligibility are a Social Security card or birth certificate; and examples of documents which show proof of identity

are a driver’s license or other state-issued card, which contain a photograph or other identifying information. The above documentation

must be presented prior to commencing employment. Please bring the appropriate items on your start date.

Please sign this letter on the following page,

acknowledging your acceptance and anticipated employment date. We look forward to you joining Compass Minerals.

Sincerely,

/s/ Ed Dowling

Ed Dowling

President and CEO

Offer Letter

Page 3 of 3

By signing below, you understand and agree that

your employment with the company is at-will. That is, your employment is not for any specified duration and you or the company may terminate

it, at any time, with or without cause and without notice. You are also representing and warranting to CMP that you have disclosed to

CMP in writing any and all agreements to which you are currently subject that in any way restrict your right to (a) solicit employees

or customers of your former employer(s) or (b) compete in any manner with your former employer(s) (e.g. a non-solicitation,

non-compete or restrictive covenant agreement). Please indicate your understanding and acceptance of the terms and conditions outlined

in this letter and your acceptance of this employment offer by signing and dating this page where indicated below.

| /s/

Peter Fjellman |

January 17,

2025 |

|

Employment date:

January 27, 2025 or otherwise agreed upon date |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Compass Minerals

Announces Senior Leadership Team Appointments

Patrick Merrin

named Chief Operations Officer and Peter Fjellman named Chief Financial Officer

OVERLAND PARK, Kan. (Jan. 28, 2025)

– Compass Minerals (NYSE: CMP), a leading global provider of essential minerals, today announced the appointment of Patrick Merrin,

a seasoned operating executive in the mining industry, as the company’s new chief operations officer (COO) and Peter Fjellman,

who has decades of experience in senior finance roles, as its new chief financial officer (CFO). Merrin’s appointment is effective

March 3 and fills the COO position which has been open since June 2024. Fjellman, whose appointment is effective immediately,

succeeds Jeff Cathey who has decided to depart Compass Minerals due to personal reasons. Cathey has agreed to serve the company in a

consulting capacity for a period of three months to help ensure a smooth transition.

As COO, Merrin will be responsible for

the primary operational management of the company’s 12 production and packaging facilities across the U.S., Canada and the U.K.

He joins Compass Minerals from Lundin Mining Corporation (LUN.TO), a diversified Canadian base metals miner, where he served as executive

vice president of technical services.

Fjellman has spent more than 30 years

leading finance teams across diverse industrial, manufacturing and logistics sectors, most recently serving as senior vice president

of finance, Americas and Asia Pacific for GXO Logistics (NYSE: GXO), a spinoff of XPO Logistics (NYSE: XPO). As CFO of Compass Minerals,

Fjellman will be responsible for all aspects of financial management for the company, including accounting, reporting, tax, internal

audit, treasury, financial planning and analysis, and investor relations.

“Pat and Peter bring more than

six decades of collective leadership experience with multi-national, private and publicly traded companies across the mining and industrial

manufacturing industries, respectively,” said Edward C. Dowling Jr., president and CEO. “Operating safely and efficiently,

while aggressively managing our balance sheet to maximize the value of our advantaged assets, are foundational in how we strive to run

our company. I look forward to the additive contributions that Pat and Peter will bring to Compass Minerals as we continue our focused

efforts on consistent performance and continuous improvement across our business.”

“I also want to thank Jeff for

his many contributions first as chief accounting officer and ultimately CFO of Compass Minerals. I’m deeply grateful for his expertise

and leadership through recent changes to our business and strategy,” added Dowling.

About Patrick Merrin

Patrick Merrin’s extensive operating

experience in the mining industry spans three decades. Prior to Lundin, he was appointed chief executive officer at Copper Mountain Mining

Corporation (CMMC.TO), a copper mining company. Previous roles include COO of mining at Washington Companies, a diversified holding company

in the transportation, mining, construction, and shipbuilding industries; and senior vice president of Canadian operations at Newcrest

Mining (NCM.TO) and Goldcorp (G.TO), both gold mining companies acquired by Newmont Corporation. Merrin earned a Bachelor of Engineering

in chemical engineering from McGill University and a Master of Business Administration from University of Toronto.

About Peter Fjellman

Fjellman has spent more than 30 years

leading finance teams across diverse industrial, manufacturing and logistics sectors. Prior to GXO Logistics, Fjellman’s roles

included CFO, Americas for ABB (SWX: ABBN), a global power and automation products manufacturer; vice president, finance, North America

at Danaher Corporation (NYSE: DHR), a global life sciences and diagnostics company; and positions of increasing responsibility at Newell

Rubbermaid Corporation (NAS: NWL), a global consumer goods manufacturer. Fjellman began his career on the audit team at KPMG after earning

a Bachelor of Science in accounting from Southwest Baptist University.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading

global provider of essential minerals focused on safely delivering where and when it matters to help solve nature’s challenges

for customers and communities. The company’s salt products help keep roadways safe during winter weather and are used in numerous

other consumer, industrial, chemical and agricultural applications. Its plant nutrition products help improve the quality and yield of

crops while supporting sustainable agriculture. Additionally, it is working to develop a long-term fire-retardant business. Compass Minerals

operates 12 production and packaging facilities with approximately 1,900 employees throughout the U.S., Canada and the U.K. Visit compassminerals.com

for more information about the company and its products.

Forward-Looking Statements

This press release may contain forward-looking

statements, including, without limitation, statements regarding performance and improvement. These statements are based on the company’s

current expectations and involve risks and uncertainties that could cause the company’s actual results to differ materially. The

differences could be caused by a number of factors including those factors identified in the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” sections of the company’s Annual and Quarterly

Reports on Forms 10-K and 10-Q, including any amendments, as well as the company’s other SEC filings. The company undertakes no

obligation to update any forward-looking statements made in this press release to reflect future events or developments, except as required

by law.

| Media

Contact |

Investor

Contact |

| Rick

Axthelm |

Brent

Collins |

| Chief

Public Affairs and Sustainability Officer |

Vice

President, Treasurer and Investor Relations |

| +1.913.344.9198 |

+1.913.344.9111 |

| MediaRelations@compassminerals.com |

InvestorRelations@compassminerals.com |

v3.24.4

Cover

|

Jan. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 27, 2025

|

| Entity File Number |

001-31921

|

| Entity Registrant Name |

Compass Minerals International, Inc.

|

| Entity Central Index Key |

0001227654

|

| Entity Tax Identification Number |

36-3972986

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9900 West 109th Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Overland Park

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66210

|

| City Area Code |

913

|

| Local Phone Number |

344-9200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

CMP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

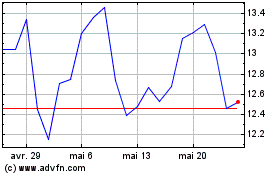

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025