- Significant financial and programmatic investments in support

of critical economic priorities including housing affordability,

no-fee banking access, and small business growth

- Includes $44 billion in community development financing, $600

million in support for Community Development Financial

Institutions, $575 million in philanthropy, $200 billion in

consumer lending to low- and moderate-income (LMI) consumers or

consumers in LMI communities, $15 billion in lending to small

businesses, and $5 billion in anticipated spending with diverse

suppliers

- Plan will be more than twice as large as any community

commitment previously developed in connection with a bank

acquisition

- Innovative approach brought together a coalition of four

leading community groups to negotiate and develop the comprehensive

package of community-focused solutions

Capital One Financial Corporation (NYSE: COF) today announced a

community benefits plan that commits more than $265 billion in

lending, investment, and philanthropy over five years as part of

its proposed acquisition of Discover Financial Services (NYSE:

DFS). The plan was developed in partnership with the National

Association for Latino Community Asset Builders (NALCAB),

NeighborWorks America, the Opportunity Finance Network (OFN), and

the Woodstock Institute.

This plan is twice as large as any other community commitment

developed in connection with a bank acquisition and demonstrates

that the combination of Capital One and Discover will create an

opportunity to provide more lending, investment, and services to

underserved communities than the institutions would undertake on a

stand-alone basis.

These commitments will aim to expand economic opportunity for

underserved consumers, including those in low- and moderate-income

(LMI) neighborhoods, rural areas, and communities of color. It will

support increased access to best-in-class products and services for

unbanked or underbanked consumers as well as consumers across the

credit spectrum and expand access to capital and opportunity.

“Our commitments to financial inclusion and well-being are core

to who we are as a company,” said Richard Fairbank, Founder, CEO,

and Chairman of Capital One. “That comes to life in our product

portfolio, which serves the full spectrum of American consumers,

and in the investments we make in our communities. We have a long

history of developing innovative ways to serve these core

constituencies, and we are committed to ensuring, through this

community benefits plan, that our acquisition of Discover builds on

our history of positive impact.”

In addition to a robust negotiating process led by the four

community groups identified above, which collectively represent

more than 800 nonprofit organizations nationwide, Capital One’s

plan was informed by engagement with the company’s long-standing

Community Advisory Council, more than 100 community organizations

nationwide, and more than 100 local, state, and federal elected

officials. This engagement included listening sessions with

community organizations in key markets across Capital One’s and

Discover’s footprint.

The plan is designed to enable greater access to safe and

affordable housing; expand access to credit so small business

owners can sustain and grow their businesses; increase access to

credit for LMI consumers; build high-quality local infrastructure

to facilitate the delivery of essential services; and support the

development of schools, civic centers, and healthcare facilities

that are vital to building strong and vibrant communities.

“This plan delivers high-impact, scalable solutions for low- and

moderate-income communities, and its commitments and ambition

reflect the robust, candid dialogue that drove its development,”

said Andres Navarrete, Executive Vice President and Head of

External Affairs at Capital One. “We have long valued community and

customer feedback on our products, policies, and programs,

recognizing that our partners are often the closest to the needs of

the community, and we are deeply grateful to our negotiating

partners and the many other community members and leaders across

the country whose feedback and innovative ideas are reflected in

this plan.”

Negotiating Partner Statements

“We’re thrilled to have had the chance to include our expertise

and our members’perspectives in the development of a community

benefits plan with Capital One,” said Marla Bilonick, President and

CEO of NALCAB. “Capital One consistently and proactively seeks

constructive community feedback—then takes it a step further by

incorporating that feedback into their product and service

delivery. We appreciate the chance to help guide their continued

investment in communities, and we look forward to helping bring the

plan to life.”

"We were proud to participate with Capital One in the

development of the community benefits plan. We applaud Capital

One’s efforts to bring national and local groups together around

the table to hear and learn of the needs in communities. At

NeighborWorks, we understand the need for intentional investments

and bold partnerships driven by a commitment to transformational

impact," said Marietta Rodriguez, President and CEO of

NeighborWorks America. "Capital One has been a dependable partner

in improving the financial future of residents across the country,

and this new community benefits plan will continue to build on that

commitment by expanding support for a broader range of products and

services, particularly benefiting underserved consumers."

“OFN is committed to working with partners across the country to

ensure our communities have access to affordable, responsible

financial solutions,” said Harold Pettigrew, President and CEO of

OFN. “Throughout this process, we were encouraged by Capital One’s

ownership of areas where it has room for improvement and openness

to discussing ideas beyond its comfort zone. We look forward to

continuing to work together to deliver on the plan’s commitments

and help drive capital to the communities that need it most.”

“We do not need another empty promise, a splashy marketing

campaign, or re-packaging existing activity as something new,” said

Horacio Mendez, President and CEO of Woodstock Institute.

“Woodstock Institute came to the table to challenge Capital One to

develop a community benefits plan that moves the industry forward

and sets an ambitious standard for others to follow. While nobody

got everything they asked for, everyone involved in this process

recognizes that substantive change and progress have been made on

important issues. Specific to Woodstock's mission, Capital One’s

commitment to fair and responsible lending, and to collaborate on

advocacy issues and policies that reflect our common interests,

creates a new and powerful alliance that can effectively advance

systemic solutions for those most in need.”

A Comprehensive Community Benefits Plan

The five-year plan includes significant financial and

programmatic commitments across community development, Community

Development Financial Institutions (CDFIs), philanthropy and pro

bono, consumer card and auto lending, small business and supplier

diversity, and bank access. The following sections highlight key

elements of Capital One’s commitments in each area.

Community Development

Capital One has ranked first or second among all banks in

Community Reinvestment Act (CRA) -qualified community development

lending by total dollar amount over the past six reported years and

will expand on this record through $44 billion in capital for

affordable housing, economic development, public infrastructure,

and alternative energy. This community development commitment

includes:

- Over $35 billion supporting affordable housing for LMI

communities and individuals, including Low-Income Housing Tax

Credit (LIHTC) investments, representing a nearly 30% increase over

previously planned activities.

- Over $5 billion supporting solutions to challenges LMI

communities face, including employment, food accessibility,

healthcare, education, renewable energy and public infrastructure,

via New Markets Tax Credits, alternative energy financing, and

municipal lending.

- Continuing Discover’s partnership with the Delaware State

Housing Authority (DSHA) to enable homeownership through bond

purchases and investments in mortgage-backed securities. The

commitment provides certainty of liquidity and funding to support

DSHA homeownership programs offering interest rates at or below

market, down payment or closing costs assistance to low to moderate

income households who are first time homebuyers or seeking to

refinance existing mortgages. The premium pricing in the

predetermined forward commitment is passed through to borrowers in

the rates or assistance offered.

Community Development Financial Institutions (CDFIs)

Capital One recognizes CDFIs as proven, highly effective

organizations for delivering capital to underserved communities and

connecting consumers to financial products and services. The

commitment includes:

- $600 million in capital to nonprofit CDFIs focused on

affordable housing, small business, and consumer lending, 6X

Capital One’s and Discover’s planned activities.

Philanthropy and Pro Bono

Building on Capital One’s existing five-year, $200 million

Impact Initiative, Capital One will significantly increase

philanthropic giving and capacity-building efforts. This plan

commits to a total of $575 million in philanthropy over its

duration, representing a nearly 30% increase over previously

planned activities. Included in this total is a $35 million

commitment to philanthropic support for nonprofits in Delaware,

including Discover’s CRA assessment area, and $20 million for

Chicago-based organizations, a portion of which is incremental to

Capital One and Discover’s historical support. New philanthropic

investments include:

- $50 million increase in new grants to CDFIs over the duration

of this community benefits plan, more than 3X planned CDFI

grantmaking. These grants, in addition to the expanded CDFI loans

and investments referenced above, will further enable CDFIs’

lending activities to small businesses and affordable housing, as

well as small dollar consumer lending, and assist Capital One’s

partners in building capacity and bolstering operations to deliver

their services more effectively.

- $25 million increase in new grants and pro bono initiatives to

support programs that enable homeownership, including down payment

assistance, funding repairs, and pre-purchase and foreclosure

prevention counseling.

- $25 million increase in new grants to support pre-development

activities, resident services, and rent reporting initiatives in

Capital One’s LIHTC-financed properties.

- $15 million increase in new grants to fund research related to

artificial intelligence (AI), focusing on the integration of AI in

the banking sector while emphasizing responsible

implementation.

Capital One is committed to helping nonprofit organizations

continue their critical work through an expanded pro bono program

and a range of capacity-building services, including:

- 10X expansion of current pro bono associate volunteering

program for nonprofits and small businesses.

- 5X expansion of current pro bono associate volunteering

programs for CDFIs, with a focus on data and technology management

and change management.

- Investing in long-term, interdisciplinary capacity-building

engagements with community partners in data, cyber, infrastructure,

machine learning, and AI, focused on strengthening the collective

capacity and impact of the CDFI industry and fostering growth,

innovation, and sustainability across the sector.

- Establishing a formal pro bono program to build the lobbying

and advocacy capacity of nonprofit partners.

- 30% growth for the Capital One Insights Center and

partnership-based research approaches to increase the number of

research projects conducted and commissioned each year.

- Partnering with community groups to develop a shared agenda on

key advocacy issues and policies that reflect Capital One’s and

these organizations’ shared interests.

Consumer Card and Auto Lending

Capital One is deepening its long-standing commitment to serving

and empowering consumers from across the credit spectrum with

best-in-class consumer credit products. Since its founding, Capital

One has enabled 42 million customers with subprime or no FICO

scores when they opened an account with the bank to achieve prime

or better FICO scores. Capital One is committed to supporting its

customers’ financial well-being through tools and programs driving

tangible and positive customer outcomes.

These programs include simple and flexible auto-pay options,

automatic enrollment in credit card payment alerts, and one-click

payments that have prevented over 25 million late payments and past

due fees in the past year alone. Capital One has invested in:

- Free digital tools like CreditWise, which currently serves

nearly 60 million customers and non-customers alike.

- A financial literacy partnership with Khan Academy, which has

reached over 850,000 learners who have spent over 21 million

minutes engaged with the content since its launch in July

2023.

- The Auto Navigator tool, which provides transparency and

education to auto loan customers and non-customers alike.

- The Keep Customers in their Cars program, which has leveraged

innovative loan adjustments and modifications to enable over one

million customers, who at another lender may have experienced

repossession, to stay in their cars. This program is specifically

designed to ensure customers maintain ongoing access to mobility, a

critical resource in accessing and maintaining jobs, affordable

housing, healthcare and healthy food, and other essential

services.

Capital One will build on this legacy by expanding access to its

products and delivering transparency, education, and hands-on

support throughout its customers’ financial lives, notably through

the following commitments:

- $125 billion in credit card lending to LMI consumers and

consumers who reside in LMI communities nationwide.

- $75 billion in automobile finance lending to LMI consumers and

consumers who reside in LMI communities nationwide.

- Expanding the Secured Card unsecuring program (returning

customers' deposits) with the goal of unsecuring 90%+ of customers

in good standing with Capital One and other bureau accounts once

they have been a customer for two years. This represents a 15-20%

expansion of this program and builds upon Capital One’s practice of

auto-reviewing accounts for unsecuring eligibility to proactively

support customers' ability to improve their credit standing.

- Launching a “Second Look” auto loan program to refer consumers

declined through Capital One’s Auto Navigator to CDFIs and provide

pro bono and technical assistance to CDFI partners to enable

greater scale and success in this effort.

In addition, Capital One will continue to empower customers to

have greater control over their financial decisions. This support

will include building on currently available resources that equip

customers with accessible financial education, providing simple

tools for customers to manage their finances, and supporting

customers through financial setbacks. These initiatives

include:

- Providing a streamlined ability to opt out of proposed credit

line increases through a simple and easy-to-use digital interface,

ensuring that customers can more easily control decisions regarding

their available credit.

- $15 million in additional grant funding to credit counseling

agencies (CCAs) over the duration of the community benefits plan,

including more proactive referrals of customers to reputable and

effective CCAs.

- Bringing an additional 600,000 borrowers into Capital One’s

Keep Customers in their Cars program, helping these individuals at

moments of need stay in their vehicles.

Small Businesses, Diverse Suppliers, and Diverse &

Culturally Relevant Marketers

Capital One continues to invest in helping small business owners

access the capital and tools they need to sustain and grow their

businesses and expanding opportunities for diverse suppliers by

committing to:

- Over $15 billion to small businesses and businesses in LMI

communities to improve access to credit and capital.

- Launching Ventures Lending, a mission-based credit card focused

on closing gaps in equity and opportunity targeted to traditionally

underserved small businesses. This new product will provide

below-market rate pricing, and Capital One will partner with CDFIs

to originate lending and deliver wrap-around services designed to

enhance the long-term viability of these businesses.

- Expanding opportunities for diverse suppliers to engage in

Capital One’s supplier process, with $5 billion in anticipated

spending with diverse suppliers, representing an over 70% increase

to historic levels over the duration of this plan.

- 30% increase to historic levels in Capital One’s diverse and

culturally relevant marketing spend over the duration of this

plan.

- Delivering tools for small businesses as they build and grow,

including Cash Flow Insights, a free digital dashboard to help

small businesses track and project expected income and expenses,

designed to help improve business financial health and stability

with relevant insights.

Bank Access

Capital One’s retail business has been a leader in delivering

innovative, market-leading products. Capital One is a national

bank, serving a broad and diverse customer base through a unique

blend of best-in-class digital and physical delivery channels.

Capital One and Discover customers will be able to access branches

in the company’s traditional bank footprint in the Washington, DC

and New York metro areas and the Gulf Coast; Cafés in 21 of the top

25 MSAs; over 16,000 cash deposit locations; and more than 70,000

fee-free ATMs nationwide.

Capital One was the first large bank to completely eliminate

overdraft fees, and remains the only large bank to offer overdraft

protection free of charge on a checking account without fees or

minimum balance requirements. Since eliminating overdraft fees in

2021, Capital One customers have saved over $500 million in

potential fees. All of Capital One’s retail bank products come with

no account maintenance fees, no minimum balance requirements, and

no overdraft fees. Capital One’s flagship 360 checking product is

fully Bank On certified, and the company has ranked #1 in US

National Banking Overall Satisfaction for four years running,

according to J.D. Power.

Capital One will build on this industry-leading position by

further committing to support financial inclusion through enhanced

products, services, and physical presence:

- Growing Capital One’s flagship Bank On certified checking

accounts by at least 50% over the company's current Bank On

certified checking accounts.

- Enabling access to ~100,000 consumers with Individual Tax

Identification Numbers (ITINs) through enhanced digital acceptance

programs.

- Maintaining 30% of Capital One’s retail locations (branches and

Cafés) in LMI neighborhoods to complement the company’s digital

delivery channels and support continued neighborhood economic

stabilization and investment.

- Opening new Capital One Cafés in LMI and underserved areas,

providing significant community and consumer benefits, financial

education programming, and free convening space for community

groups and civic organizations.

- Ensuring that consumers are able to meet short-term liquidity

challenges through a suite of new services and features, including

developing new Savings Builder features that can be used with

Capital One’s flagship savings product. These digital tools will

include savings goals and auto-saving tools and be integrated into

financial counseling workshops with nonprofit partners.

- Committing to working with CDFIs and credit unions to research

and deliver viable and sustainable small-dollar loan products to

consumers.

- Increasing Café community programming and resources to expand

the reach of financial health support, including expanding the Café

student ambassadors program, Money & Life mentoring, and

workshops through community sponsorships.

Discover’s Customers, Employees and Communities

Recognizing Discover’s long history of customer service and

long-standing partnerships, Capital One is also committing to:

- Following conversion of Discover deposits and credit card

accounts to Capital One’s systems, ensuring Discover customers gain

access to a broader set of financial products and services,

including a unique mix of best-in-class digital tools, Capital

One’s nationwide network of branches and Cafés, as well as tens of

thousands of cash-load partner locations and fee-free ATMs.

- Committing to no layoffs of front line associates in connection

with the proposed transaction.

- Growing Discover’s Customer Care Center in Chatham on the South

Side of Chicago to meet Discover’s original goal of employing more

than 1,000 individuals.

- Retaining Discover’s Customer Care Center in Whitehall,

Ohio.

- Retaining Discover’s sole physical branch and CRA assessment

area located in Greenwood, Delaware. This branch will convert to a

Capital One physical branch following conversion of Discover

deposit accounts to Capital One systems.

Capital One’s commitment to transparency and inclusivity will

continue once the plan is finalized. Capital One will report on its

progress to the Federal Reserve Board and the Office of the

Comptroller of the Currency on an annual basis, update the firm’s

Community Advisory Council during regularly scheduled meetings, and

post a report on its website.

“Capital One and Discover have long been leaders in investing in

our communities to help people live, work, and build wealth on

their own terms,” said Kerone Vatel, Head of Community Impact and

Investment at Capital One and Chair of the Capital One Foundation

Board. “This plan affords everyday consumers across America the

opportunity to navigate their finances with resilience. We will

continue to forge collaborative partnerships that build on Capital

One and Discover’s combined legacy of deep community investment

centered on the needs of the people who live there.”

Capital One’s Acquisition of Discover

In February 2024, Capital One and Discover announced that they

entered into a definitive agreement under which Capital One will

acquire Discover in a landmark deal. The transaction is expected to

close in late 2024 or early 2025, subject to satisfaction of

customary closing conditions, including regulatory approvals and

approval by the shareholders of each company. The Community

Benefits Plan is subject to the closing of the Discover

transaction.

Annual results of this commitment could fluctuate from year to

year based on market conditions and macroeconomic factors. If

market conditions and macroeconomic factors worsen, safety and

soundness will remain the company’s primary priority. Capital One

will discuss proposed material changes to this community benefits

plan with its negotiating partners.

More information on Capital One’s agreement to acquire Discover

Financial Services can be found at www.capitalonediscover.com.

About Capital One

Capital One Financial Corporation (www.capitalone.com) is a

financial holding company which, along with its subsidiaries, had

$351.0 billion in deposits and $481.7 billion in total assets as of

March 31, 2024. Headquartered in McLean, Virginia, Capital One

offers a broad spectrum of financial products and services to

consumers, small businesses and commercial clients through a

variety of channels. Capital One, N.A. has branches and Cafes

located primarily in New York, Louisiana, Texas, Maryland, Virginia

and the District of Columbia. A Fortune 500 company, Capital One

trades on the New York Stock Exchange under the symbol “COF” and is

included in the S&P 100 index.

Additional information about Capital One can be found at Capital

One About at www.capitalone.com/about.

Forward Looking Statements

Information in this communication, other than statements of

historical facts, may constitute forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to, statements

about the benefits of the proposed transaction between Capital One

Financial Corporation (“Capital One”) and Discover Financial

Services (“Discover”), the combined company’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts. Forward-looking statements may be identified by

terminology such as “may,” “will,” “should,” “targets,”

“scheduled,” “plans,” “intends,” “goal,” “anticipates,” “expects,”

“believes,” “forecasts,” “outlook,” “estimates,” “potential,” or

“continue” or negatives of such terms or other comparable

terminology.

All forward-looking statements are subject to risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Capital One or Discover to differ

materially from any results expressed or implied by such

forward-looking statements. Such factors include, among others, (1)

the risk that the cost savings and any revenue synergies and other

anticipated benefits from the transaction may not be fully realized

or may take longer than anticipated to be realized, the risk that

revenues following the transaction may be lower than expected

and/or the risk that certain expenses, such as the provision for

credit losses, of Discover, or Capital One following the

transaction, may be greater than expected, (2) disruption to the

parties’ businesses as a result of the announcement and pendency of

the transaction, (3) the risk that the integration of Discover’s

business and operations into Capital One, including the integration

into Capital One’s compliance management program, will be

materially delayed or will be more costly or difficult than

expected, or that Capital One is otherwise unable to successfully

integrate Discover’s businesses into its own, including as a result

of unexpected factors or events, (4) the possibility that the

requisite regulatory, stockholder or other approvals are not

received or other conditions to the closing are not satisfied on a

timely basis or at all, or are obtained subject to conditions that

are not anticipated (and the risk that requisite regulatory

approvals may result in the imposition of conditions that could

adversely affect Capital One or the expected benefits of the

transaction following the closing of the transaction), (5)

reputational risk and the reaction of each company’s customers,

suppliers, employees or other business partners to the transaction,

(6) the failure of the closing conditions in the merger agreement

to be satisfied, or any unexpected delay in completing the

transaction or the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement, (7) the dilution caused by the issuance of additional

shares of Capital One’s common stock in connection with the

transaction, (8) the possibility that the transaction may be more

expensive to complete than anticipated, including as a result of

unexpected factors or events, (9) risks related to management and

oversight of the expanded business and operations of Capital One

following the transaction due to the increased size and complexity

of its business, (10) the possibility of increased scrutiny by,

and/or additional regulatory requirements of, governmental

authorities as a result of the transaction or the size, scope and

complexity of Capital One’s business operations following the

transaction, (11) the outcome of any legal or regulatory

proceedings that may be currently pending or later instituted

against Capital One before or after the transaction, or against

Discover, (12) the risk that expectations regarding the timing,

completion and accounting and tax treatments of the transaction are

not met, (13) the risk that any announcements relating to the

transaction could have adverse effects on the market price of

Capital One’s common stock, (14) certain restrictions during the

pendency of the transaction, (15) the diversion of management’s

attention from ongoing business operations and opportunities, (16)

Capital One’s and Discover’s success in executing their respective

business plans and strategies and managing the risks involved in

the foregoing, (17) effects of the announcement, pendency or

completion of the transaction on Capital One’s or Discover’s

ability to retain customers and retain and hire key personnel and

maintain relationships with Capital One’s and Discover’s suppliers

and other business partners, and on Capital One’s and Discover’s

operating results and businesses generally, (18) general

competitive, economic, political and market conditions and other

factors that may affect future results of Capital One and Discover,

including changes in asset quality and credit risk; the inability

to sustain revenue and earnings growth; changes in interest rates

and capital markets; inflation; customer borrowing, repayment,

investment and deposit practices; the impact, extent and timing of

technological changes; capital management activities and (19) any

other factors that may affect Capital One’s future results or the

future results of Discover; and other actions of the Federal

Reserve Board and legislative and regulatory actions and reforms.

Additional factors which could affect future results of Capital One

and Discover can be found in Capital One’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form

8-K, and Discover’s Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q, and Current Reports on Form 8-K, in each case filed

with the SEC and available on the SEC’s website at

http://www.sec.gov. Capital One and Discover disclaim any

obligation and do not intend to update or revise any

forward-looking statements contained in this communication, which

speak only as of the date hereof, whether as a result of new

information, future events or otherwise, except as required by

federal securities laws.

Important Information About the Transaction and Where to Find

It

Capital One filed a registration statement on Form S-4 (No.

333-278812) with the SEC on April 18, 2024, as amended on June 14,

2024, to register the shares of Capital One’s common stock that

will be issued to Discover stockholders in connection with the

proposed transaction. The registration statement, which is not yet

effective, includes a preliminary joint proxy statement of Capital

One and Discover that also constitutes a preliminary prospectus of

Capital One. If and when the registration statement becomes

effective and the joint proxy statement/prospectus is in definitive

form, such joint proxy statement/prospectus will be sent to the

stockholders of each of Capital One and Discover in connection with

the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED

JOINT PROXY STATEMENT/PROSPECTUS (AND ANY OTHER AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR

INCORPORATED BY REFERENCE INTO THE JOINT PROXY

STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION

AND RELATED MATTERS. Investors and security holders may obtain free

copies of these documents and other documents filed with the SEC by

Capital One or Discover through the website maintained by the SEC

at http://www.sec.gov or by contacting the investor relations

department of Capital One or Discover at:

Capital One

Financial Corporation

Discover Financial

Services

1680 Capital One Drive

2500 Lake Cook Road

McLean, VA 22102

Riverwoods, IL 60015

Attention: Investor Relations

Attention: Investor Relations

investorrelations@capitalone.com

investorrelations@discover.com

(703) 720-1000

(224) 405-4555

Before making any voting or investment decision, investors

and security holders of Capital One and Discover are urged to read

carefully the entire registration statement and preliminary joint

proxy statement/prospectus, including any amendments thereto when

they become available, because they contain or will contain

important information about the proposed transaction. Free copies

of these documents may be obtained as described above.

Participants in Solicitation

Capital One, Discover and certain of their directors and

executive officers may be deemed participants in the solicitation

of proxies from the stockholders of each of Capital One and

Discover in connection with the proposed transaction. Information

regarding the directors and executive officers of Capital One and

Discover and other persons who may be deemed participants in the

solicitation of the stockholders of Capital One or of Discover in

connection with the proposed transaction will be included in the

joint proxy statement/prospectus related to the proposed

transaction, which will be filed by Capital One with the SEC.

Information about the directors and executive officers of Capital

One and their ownership of Capital One common stock can also be

found in Capital One’s definitive proxy statement in connection

with its 2024 annual meeting of stockholders, as filed with the SEC

on March 20, 2024, and other documents subsequently filed by

Capital One with the SEC. Information about the directors and

executive officers of Discover and their ownership of Discover

common stock can also be found in Discover’s definitive proxy

statement in connection with its 2024 annual meeting of

stockholders, as filed with the SEC on March 15, 2024, and other

documents subsequently filed by Discover with the SEC. Additional

information regarding the interests of such participants is

included in the preliminary joint proxy statement/prospectus and

other relevant documents regarding the proposed transaction filed

with the SEC when they become available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240716113749/en/

Sie Soheili Sie.Soheili@capitalone.com

Carlisle Campbell Carlisle.Campbell@capitalone.com

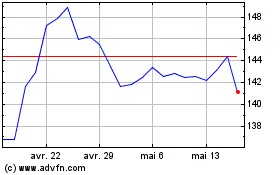

Capital One Financial (NYSE:COF)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Capital One Financial (NYSE:COF)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025