FALSE000170968200017096822023-08-082023-08-080001709682us-gaap:CommonStockMember2023-08-082023-08-080001709682ctos:RedeemableWarrantsMember2023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

CUSTOM TRUCK ONE SOURCE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-38186 | | 84-2531628 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | |

7701 Independence Avenue Kansas City, Missouri | | 64125 |

| (Address of principal executive offices) | | (Zip code) |

(816) 241-4888

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Exchange on Which Registered |

| Common Stock, $0.0001 par value | | CTOS | | New York Stock Exchange |

| Redeemable warrants, exercisable for Common Stock, $0.0001 par value | | CTOS.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2023, Custom Truck One Source, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended June 30, 2023. The press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, shall be deemed "furnished" and not "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company's filings under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On August 8, 2023, the Company posted an updated investor presentation on its website at www.customtruck.com.

The information in this Item 7.01 shall be deemed "furnished" and not "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company's filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| Date: | August 8, 2023 | Custom Truck One Source, Inc. |

| | | |

| | /s/ Christopher J. Eperjesy |

| | | Christopher J. Eperjesy

Chief Financial Officer |

EXHIBIT 99.1

Custom Truck One Source, Inc. Reports Continued Strong Results for Second Quarter 2023

KANSAS CITY, Mo, August 8, 2023 – (BUSINESS WIRE) – Custom Truck One Source, Inc. (NYSE: CTOS), a leading provider of specialty equipment to the electric utility, telecom, rail and other infrastructure-related end markets, today reported financial results for its three and six months ended June 30, 2023.

CTOS Second-Quarter Highlights

•Total revenue of $456.8 million, an increase of $94.7 million or 26.2%, compared to the second quarter of 2022 as a result of continued strong demand across our end markets

•Gross profit of $110.6 million, an improvement of $27.8 million, or 33.7%, compared to $82.8 million for the second quarter of 2022

•Adjusted Gross Profit of $154.2 million, an increase of $28.2 million, or 22.3%, compared to $126.1 million for the second quarter of 2022

•Net income of $11.6 million, a decrease of $2.0 million or 14.8%, compared to net income of $13.6 million, in the second quarter of 2022

•Adjusted EBITDA of $103.2 million, an increase of $17.8 million, or 20.8% compared to $85.4 million in the second quarter of 2022

•Further reduction in Net Leverage Ratio from 3.4 at the end of the last quarter to 3.3 as of June 30, 2023

•Increasing Full Year 2023 Revenue and Adjusted EBITDA Guidance

“Our second quarter results reflect continued strong demand across our primary end markets. The tremendous efforts of our team allowed us to deliver the record levels of vehicle production required to both add to our fleet and meet the demand for new vehicle sales,” said Ryan McMonagle, Chief Executive Officer of CTOS. “All three of our business segments continued to experience strong year-over-year growth. The demand environment, the continued improvement in the supply chain and the performance of our team, together give us the confidence to improve our outlook for 2023. We continue to believe that our one-stop-shop business model and significant scale provide us with a competitive advantage that allows us to deliver unequaled service to our customers,” McMonagle added.

Summary Actual Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Rental revenue | $ | 122,169 | | | $ | 112,055 | | | $ | 240,457 | | | $ | 221,200 | | | $ | 118,288 | |

| Equipment sales | 302,117 | | | 218,506 | | | 603,407 | | | 445,692 | | | 301,290 | |

| Parts sales and services | 32,544 | | | 31,545 | | | 65,129 | | | 61,690 | | | 32,585 | |

| Total revenue | 456,830 | | | 362,106 | | | 908,993 | | | 728,582 | | | 452,163 | |

| Gross Profit | $ | 110,619 | | | $ | 82,758 | | | $ | 220,994 | | | $ | 167,251 | | | $ | 109,661 | |

Adjusted Gross Profit1 | $ | 154,235 | | | $ | 126,082 | | | $ | 304,226 | | | $ | 255,539 | | | $ | 149,991 | |

| Net Income | $ | 11,610 | | | $ | 13,623 | | | $ | 25,410 | | | $ | 10,350 | | | $ | 13,800 | |

Adjusted EBITDA1 | $ | 103,183 | | | $ | 85,383 | | | $ | 208,383 | | | $ | 176,860 | | | $ | 105,200 | |

1 - Each of Adjusted Gross Profit and Adjusted EBITDA is a non-GAAP financial measure. Further information and reconciliations for our non-GAAP measures to the most directly comparable financial measure under United States generally accepted accounting principles in the U.S. (“GAAP”) is included at the end of this press release.

Summary Actual Financial Results by Segment

Our results are reported for our three segments: Equipment Rental Solutions (“ERS”), Truck and Equipment Sales (“TES”) and Aftermarket Parts and Services (“APS”). ERS encompasses our core rental business, inclusive of sales of used rental equipment to our customers. TES encompasses our specialized truck and equipment production and new equipment sales activities. APS encompasses sales and rentals of parts, tools and other supplies to our customers, as well as our aftermarket repair service operations. Segment performance is presented below for the three and six months ended June 30, 2023 and 2022 and three months ended March 31, 2023.

Equipment Rental Solutions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Rental revenue | $ | 117,832 | | | $ | 108,109 | | | $ | 231,616 | | | $ | 213,670 | | | $ | 113,784 | |

| Equipment sales | 50,694 | | | 37,200 | | | 142,830 | | | 96,553 | | | 92,136 | |

| Total revenue | 168,526 | | | 145,309 | | | 374,446 | | | 310,223 | | | 205,920 | |

| Cost of rental revenue | 31,341 | | | 27,851 | | | 60,401 | | | 52,642 | | | 29,060 | |

| Cost of equipment sales | 39,802 | | | 30,418 | | | 110,883 | | | 73,648 | | | 71,081 | |

| Depreciation of rental equipment | 42,805 | | | 42,384 | | | 82,317 | | | 86,350 | | | 39,512 | |

| Total cost of revenue | 113,948 | | | 100,653 | | | 253,601 | | | 212,640 | | | 139,653 | |

| Gross profit | $ | 54,578 | | | $ | 44,656 | | | $ | 120,845 | | | $ | 97,583 | | | $ | 66,267 | |

Truck and Equipment Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Equipment sales | $ | 251,423 | | | $ | 181,306 | | | $ | 460,577 | | | $ | 349,139 | | | $ | 209,154 | |

| | | | | | | | | |

| | | | | | | | | |

| Cost of equipment sales | 205,464 | | | 154,177 | | | 380,508 | | | 298,225 | | | 175,044 | |

| | | | | | | | | |

| Gross profit | $ | 45,959 | | | $ | 27,129 | | | $ | 80,069 | | | $ | 50,914 | | | $ | 34,110 | |

Aftermarket Parts and Services

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Rental revenue | $ | 4,337 | | | $ | 3,946 | | | $ | 8,841 | | | $ | 7,530 | | | $ | 4,504 | |

| Parts and services revenue | 32,544 | | | 31,545 | | | 65,129 | | | 61,690 | | | 32,585 | |

| Total revenue | 36,881 | | | 35,491 | | | 73,970 | | | 69,220 | | | 37,089 | |

| | | | | | | | | |

| Cost of revenue | 25,988 | | | 23,578 | | | 52,975 | | | 48,528 | | | 26,987 | |

| Depreciation of rental equipment | 811 | | | 940 | | | 1,629 | | | 1,938 | | | 818 | |

| Total cost of revenue | 26,799 | | | 24,518 | | | 54,604 | | | 50,466 | | | 27,805 | |

| Gross profit | $ | 10,082 | | | $ | 10,973 | | | $ | 19,366 | | | $ | 18,754 | | | $ | 9,284 | |

Summary Combined Operating Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

Ending OEC(a) (as of period end) | $ | 1,467,779 | | | $ | 1,399,500 | | | $ | 1,467,779 | | | $ | 1,399,500 | | | $ | 1,457,870 | |

Average OEC on rent(b) | $ | 1,203,855 | | | $ | 1,150,400 | | | $ | 1,209,111 | | | $ | 1,150,800 | | | $ | 1,214,300 | |

Fleet utilization(c) | 81.7 | % | | 82.8 | % | | 82.6 | % | | 82.6 | % | | 83.6 | % |

OEC on rent yield(d) | 40.1 | % | | 39.2 | % | | 39.8 | % | | 39.1 | % | | 39.6 | % |

Sales order backlog(e) (as of period end) | $ | 863,757 | | | $ | 663,619 | | | $ | 863,757 | | | $ | 663,619 | | | $ | 855,049 | |

(a) Ending OEC — original equipment cost (“OEC”) is the original equipment cost of units at the end of the measurement period.

(b) Average OEC on rent — Average OEC on rent is calculated as the weighted-average OEC on rent during the stated period.

(c) Fleet utilization — total number of days the rental equipment was rented during a specified period of time divided by the total number of days available during the same period and weighted based on OEC.

(d) OEC on rent yield (“ORY”) — a measure of return realized by our rental fleet during a 12-month period. ORY is calculated as rental revenue (excluding freight recovery and ancillary fees) during the stated period divided by the Average OEC on rent for the same period. For period less than 12 months, the ORY is adjusted to an annualized basis.

(e) Sales order backlog — purchase orders received for customized and stock equipment. Sales order backlog should not be considered an accurate measure of future net sales.

Management Commentary

Total revenue in the second quarter of 2023 was characterized by continued strong customer demand for both rental and new equipment across our end markets. Second quarter 2023 rental revenue increased 9.0% to $122.2 million, compared to $112.1 million in the second quarter of 2022, reflecting the continued expansion of our rental fleet, stable utilization, and pricing gains. Equipment sales increased 38.3% in the second quarter of 2023 to $302.1 million, compared to $218.5 million in the second quarter of 2022, reflecting continuing improvements in the supply chain and our ability to replenish inventory. Parts sales and service revenue increased 3.2% to $32.5 million, compared to $31.5 million in the second quarter of 2022. On a sequential quarter basis, total second quarter of 2023 revenue increased $4.7 million, or 1.0%, primarily due to the expansion of rental fleet.

In our ERS segment, rental revenue in the second quarter of 2023 was $117.8 million compared to $108.1 million in the second quarter of 2022, a 9.0% increase. Fleet utilization continued to be strong at 81.7% compared to 82.8% in the second quarter of 2022, and average OEC on rent increased 4.6% year-over-year. Total segment gross profit in the second quarter of 2023 was $54.6 million, an increase of 22.2% compared to $44.7 million in the second quarter of 2022. Adjusted Gross Profit in the segment, was $97.4 million in the second quarter of 2023, compared to $87.0 million in the second quarter of 2022, representing 11.9% year-over-year growth. Rental Gross Profit improved to $86.5 million in the second quarter of 2023 compared to $80.3 million in the second quarter of 2022, a 7.8% increase. On a sequential quarter basis, total segment second quarter of 2023 revenue decreased $37.4 million, or 18.2%, driven by a 45.0% decrease in rental equipment sales from the first quarter’s record levels. Despite the decline, we experienced favorable pricing, with OEC on-rent yield increasing to a record 40.1% in the second quarter of 2023, up from 39.6% in the first quarter of 2023.

Revenue in our TES segment increased 38.7% to $251.4 million in the second quarter of 2023, from $181.3 million in the second quarter of 2022, primarily as a result of continued supply chain improvements, greater order fulfillments as a result of record production levels, and sustained strong customer demand. Gross profit improved by 69.4% to $46.0 million in the second quarter of 2023 compared to $27.1 million in the second quarter of 2022. Gross profit margin for the quarter was 18.3%, up from 15.0% in the second quarter of 2022 and 16.3% to the first quarter of 2023. On a sequential quarter basis, total revenue in the second quarter of 2023 increased $42.3 million, or 20.2%.

APS segment revenue increased 3.9% in the second quarter of 2023 to $36.9 million, compared to $35.5 million in the second quarter of 2022. Growth in demand for parts, tools and accessories sales was augmented by increased tools and accessories rentals in the Parts, Tools and Accessories (“PTA”) division. Gross profit margin in the segment slightly declined to 27.3% in the second quarter of 2023 from 30.9% in the second quarter of 2022. On a sequential quarter basis, total segment gross profit margin in the second quarter of 2023 increased 230 bps from 25.0%.

Net income was $11.6 million in the second quarter of 2023, compared to net income of $13.6 million for the second quarter of 2022. The $2.0 million or 14.8% decrease in net income is primarily the result of higher interest expense on variable-rate debt and variable-rate floor plan liabilities, the change in fair value of the private warrants liability from a gain to a loss, and higher operating expenses, largely offset by gross profit expansion. On a sequential quarter basis, total second quarter of 2023 net income declined $2.2 million for the reasons mentioned above.

Adjusted EBITDA for the second quarter of 2023 was $103.2 million, an increase of 20.8%, compared to $85.4 million for the second quarter of 2022. The increase in Adjusted EBITDA was largely driven by growth in rental revenue and new and used equipment sales, all of which contributed to margin expansion. On a sequential quarter basis, Adjusted EBITDA declined by $2.0 million.

As of June 30, 2023, cash and cash equivalents was $42.2 million, Total Debt outstanding was $1,453.8 million, Net Debt was $1,414.9 million and Net Leverage Ratio was 3.3x. Availability under the senior secured credit facility was $254.5 million as of June 30, 2023, and $296.0 million of suppressed availability based on the borrowing base calculation, with the ability to upsize the facility. For the three months ended June 30, 2023, Ending OEC increased by $68.3 million as our fleet additions were only partially offset by our continued focus on selling older equipment from our rental fleet at current advantageous residual values. During the three months ended June 30, 2023, CTOS purchased $3.2 million of its common stock under the previously announced stock repurchase program.

OUTLOOK

We are updating our full-year revenue and Adjusted EBITDA guidance for 2023 at this time. We believe our ERS segment will continue to benefit from strong demand from our rental customers, higher average OEC on rent and for purchases of rental fleet units, particularly older equipment, in 2023. As we noted in our initial 2023 guidance, we also expect to grow our rental fleet (based on Ending OEC) by mid- to high-single digits this year. Regarding our TES segment, supply chain improvements, improved inventory levels, record production and backlog levels continue to improve our ability to produce and deliver an even greater number of units in 2023.

| | | | | | | | | | | |

| 2023 Consolidated Outlook | | | |

| Revenue | $1,725 | million | — | $1,830 million |

Adjusted EBITDA1 | $425 | million | — | $445 million |

| | | |

| 2023 Revenue Outlook by Segment | | | |

| ERS | $700 | million | — | $735 million |

| TES | $880 | million | — | $940 million |

| APS | $145 | million | — | $155 million |

1 - CTOS is not able to present a quantitative reconciliation of its forward-looking Adjusted EBITDA for the year ending December 31, 2023 to its most directly comparable GAAP financial measure, net income, because management cannot reliably present a quantitative reconciliation of its forward-looking Adjusted EBITDA for the year ending December 31, 2023 to its most directly comparable GAAP financial measure, net income, because management cannot reliably forecast net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, customer buyout requests on rentals with rental purchase options, income tax expense and changes in fair value of derivative financial instruments. Adjusted EBITDA should not be used to predict net income as the difference between the two measures is variable.

RECENT EVENT

Effective July 31, 2023, the Company’s Board of Directors appointed Paul Jolas to serve as Executive Vice President, General Counsel. Mr. Jolas reports to Custom Truck CEO, Ryan McMonagle, and directly oversees all legal affairs for the Company, as well as its Environment, Health & Safety and Risk Management functions. Mr. Jolas has almost 20 years of experience serving as general counsel for publicly traded companies, most recently for U.S. Concrete, Inc., where he advised on a wide range of complex legal matters, including 35 mergers and acquisitions. He received his Bachelor of Arts degree in Economics from Northwestern University and his Juris Doctor degree from Duke University School of Law. Mr. Jolas succeeds Adam Haubenreich, who left the Company in July to pursue another opportunity.

CONFERENCE CALL INFORMATION

The Company has scheduled a conference call at 5:00 P.M. Eastern Time on August 8, 2023, to discuss its second quarter 2023 financial results. A webcast and a presentation of financial information will be publicly available at: investors.customtruck.com. To listen by phone, please dial 1-855-327-6837 or 1-631-891-4304. A replay of the call will be available until midnight ET, Tuesday, August 15, 2023, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 10022174.

ABOUT CTOS

CTOS is one of the largest providers of specialty equipment, parts, tools, accessories and services to the electric utility transmission and distribution, telecommunications and rail markets in North America, with a differentiated “one-stop-shop” business model. CTOS offers its specialized equipment to a diverse customer base for the maintenance, repair, upgrade and installation of critical infrastructure assets, including electric lines, telecommunications networks and rail systems. The Company's coast-to-coast rental fleet of more than 10,200 units includes aerial devices, boom trucks, cranes, digger derricks, pressure drills, stringing gear, Hi-rail equipment, repair parts, tools and accessories. For more information, please visit customtruck.com.

FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, as amended, and within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company's management’s control, that could cause actual results or outcomes to differ materially from those discussed in this press release. This press release is based on certain assumptions that the Company's management has made in light of its experience in the industry, as well as the Company’s perceptions of historical trends, current conditions, expected future developments and other factors the Company believes are appropriate in these circumstances. As you read and consider this

press release, you should understand that these statements are not guarantees of performance or results. Many factors could affect the Company’s actual performance and results and could cause actual results to differ materially from those expressed in this press release. Important factors, among others, that may affect actual results or outcomes include: increases in labor costs, our inability to obtain raw materials, component parts and/or finished goods in a timely and cost-effective manner, and our inability to manage our rental equipment in an effective manner; our sales order backlog may not be indicative of the level of our future revenues; increases in unionization rate in our workforce; our inability to recruit and retain the experienced personnel, including skilled technicians, we need to compete in our industries; our inability to attract and retain highly skilled personnel and our inability to retain our senior management; material disruptions to our operation and manufacturing locations as a result of public health concerns, equipment failures, natural disasters, work stoppages, power outages or other reasons; potential impairment charges; any further increase in the cost of new equipment that we purchase for use in our rental fleet or for sale as inventory; aging or obsolescence of our existing equipment, and the fluctuations of market value thereof; disruptions in our supply chain; our business may be impacted by government spending; we may experience losses in excess of our recorded reserves for receivables; unfavorable conditions in the capital and credit markets and our inability to obtain additional capital as required; increases in price of fuel or freight; regulatory technological advancement, or other changes in our core end-markets may affect our customers’ spending; difficulty in integrating acquired businesses and fully realizing the anticipated benefits and cost savings of the acquired businesses, as well as additional transaction and transition costs that we will continue to incur following acquisitions; material weakness in our internal control over financial reporting which, if not remediated, could result in material misstatements in our financial statements; the interest of our majority stockholder, which may not be consistent with the other stockholders; our significant indebtedness, which may adversely affect our financial position, limit our available cash and our access to additional capital, prevent us from growing our business and increase our risk of default; our inability to generate cash, which could lead to a default; significant operating and financial restrictions imposed by our debt agreements; changes in interest rates, which could increase our debt service obligations on the variable rate indebtedness and decrease our net income and cash flows; disruptions in our information technology systems or a compromise of our system security, limiting our ability to effectively monitor and control our operations, adjust to changing market conditions, and implement strategic initiatives; we are subject to complex laws and regulations, including environmental and safety regulations that can adversely affect cost, manner or feasibility of doing business; we are subject to a series of risks related to climate change; and increased attention to, and evolving expectations for, sustainability and environmental, social and governance initiatives. For a more complete description of these and other possible risks and uncertainties, please refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2022, and its subsequent reports filed with the Securities and Exchange Commission. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements.

INVESTOR CONTACT

Brian Perman, Vice President, Investor Relations

(844) 403-6138

investors@customtruck.com

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s except per share data) | 2023 | | 2022 | | 2023 | | 2022 | |

| Revenue | | | | | | | | | |

| Rental revenue | $ | 122,169 | | | $ | 112,055 | | | $ | 240,457 | | | $ | 221,200 | | | $ | 118,288 | |

| Equipment sales | 302,117 | | | 218,506 | | | 603,407 | | | 445,692 | | | 301,290 | |

| Parts sales and services | 32,544 | | | 31,545 | | | 65,129 | | | 61,690 | | | 32,585 | |

| Total revenue | 456,830 | | | 362,106 | | | 908,993 | | | 728,582 | | | 452,163 | |

| Cost of Revenue | | | | | | | | | |

| Cost of rental revenue | 31,981 | | | 28,791 | | | 61,880 | | | 54,584 | | | 29,899 | |

| Depreciation of rental equipment | 43,616 | | | 43,324 | | | 83,946 | | | 88,288 | | | 40,330 | |

| Cost of equipment sales | 245,266 | | | 184,595 | | | 491,391 | | | 371,873 | | | 246,125 | |

| Cost of parts sales and services | 25,348 | | | 22,638 | | | 51,496 | | | 46,586 | | | 26,148 | |

| Total cost of revenue | 346,211 | | | 279,348 | | | 688,713 | | | 561,331 | | | 342,502 | |

| Gross Profit | 110,619 | | | 82,758 | | | 220,280 | | | 167,251 | | | 109,661 | |

| Operating Expenses | | | | | | | | | |

| Selling, general and administrative expenses | 58,028 | | | 48,779 | | | 115,019 | | | 102,434 | | | 56,991 | |

| Amortization | 6,606 | | | 6,871 | | | 13,278 | | | 20,206 | | | 6,672 | |

| Non-rental depreciation | 2,721 | | | 2,317 | | | 5,371 | | | 5,364 | | | 2,650 | |

| Transaction expenses and other | 3,689 | | | 6,046 | | | 7,149 | | | 10,694 | | | 3,460 | |

| | | | | | | | | |

| Total operating expenses | 71,044 | | | 64,013 | | | 140,817 | | | 138,698 | | | 69,773 | |

| Operating Income | 39,575 | | | 18,745 | | | 79,463 | | | 28,553 | | | 39,888 | |

| Other Expense | | | | | | | | | |

| | | | | | | | | |

| Interest expense, net | 31,625 | | | 20,281 | | | 60,801 | | | 39,437 | | | 29,176 | |

| Financing and other income | (5,048) | | | (15,078) | | | (8,999) | | | (24,158) | | | (3,951) | |

| Total other expense | 26,577 | | | 5,203 | | | 51,802 | | | 15,279 | | | 25,225 | |

| Income Before Income Taxes | 12,998 | | | 13,542 | | | 27,661 | | | 13,274 | | | 14,663 | |

| Income Tax Expense (Benefit) | 1,388 | | | (81) | | | 2,251 | | | 2,924 | | | 863 | |

| Net Income | $ | 11,610 | | | $ | 13,623 | | | $ | 25,410 | | | $ | 10,350 | | | $ | 13,800 | |

| | | | | | | | | |

| Net Income Per Share | | | | | | | | | |

| Basic | $ | 0.05 | | | $ | 0.05 | | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.06 | |

| Diluted | $ | 0.05 | | | $ | 0.05 | | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.06 | |

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| (in $000s) | June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 42,229 | | | $ | 14,360 | |

| Accounts receivable, net | 151,953 | | | 193,106 | |

| Financing receivables, net | 41,957 | | | 38,271 | |

| Inventory | 765,424 | | | 596,724 | |

| Prepaid expenses and other | 27,587 | | | 25,784 | |

| Total current assets | 1,029,150 | | | 868,245 | |

| Property and equipment, net | 134,358 | | | 121,956 | |

| Rental equipment, net | 920,676 | | | 883,674 | |

| Goodwill | 704,012 | | | 703,827 | |

| Intangible assets, net | 291,053 | | | 304,132 | |

| Operating lease assets | 33,495 | | | 29,434 | |

| Other assets | 25,900 | | | 26,944 | |

| Total Assets | $ | 3,138,644 | | | $ | 2,938,212 | |

| Liabilities and Stockholders' Equity | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 117,104 | | | $ | 87,255 | |

| Accrued expenses | 67,043 | | | 68,784 | |

| Deferred revenue and customer deposits | 30,088 | | | 34,671 | |

| Floor plan payables - trade | 139,723 | | | 136,634 | |

| Floor plan payables - non-trade | 366,092 | | | 293,536 | |

| Operating lease liabilities - current | 5,442 | | | 5,262 | |

| Current maturities of long-term debt | 3,550 | | | 6,940 | |

| Current portion of finance lease obligations | 247 | | | 1,796 | |

| Total current liabilities | 729,289 | | | 634,878 | |

| Long-term debt, net | 1,425,117 | | | 1,354,766 | |

| Finance leases | 3,077 | | | 3,206 | |

| Operating lease liabilities - noncurrent | 28,725 | | | 24,818 | |

| Deferred income taxes | 31,078 | | | 29,086 | |

| Derivative, warrants and other liabilities | 1,886 | | | 3,015 | |

| Total long-term liabilities | 1,489,883 | | | 1,414,891 | |

| | | |

| Stockholders' Equity | | | |

| Common stock | 25 | | | 25 | |

| Treasury stock, at cost | (21,438) | | | (15,537) | |

| Additional paid-in capital | 1,530,443 | | | 1,521,487 | |

| Accumulated other comprehensive loss | (6,383) | | | (8,947) | |

| Accumulated deficit | (583,175) | | | (608,585) | |

| Total stockholders' equity | 919,472 | | | 888,443 | |

| Total Liabilities and Stockholders' Equity | $ | 3,138,644 | | | $ | 2,938,212 | |

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| (in $000s) | 2023 | | 2022 |

| Operating Activities | | | |

| Net income | $ | 25,410 | | | $ | 10,350 | |

| Adjustments to reconcile net income to net cash flow from operating activities: | | | |

| Depreciation and amortization | 107,532 | | | 117,120 | |

| Amortization of debt issuance costs | 3,027 | | | 2,158 | |

| | | |

| Provision for losses on accounts receivable | 3,112 | | | 4,545 | |

| Share-based compensation | 7,469 | | | 5,148 | |

| Gain on sales and disposals of rental equipment | (32,643) | | | (22,905) | |

| | | |

| | | |

| Change in fair value of derivative and warrants | (1,129) | | | (18,822) | |

| | | |

| Deferred tax expense | 1,849 | | | 2,575 | |

| | | |

| Changes in assets and liabilities: | | | |

| Accounts and financing receivables | 27,344 | | | (10,744) | |

| Inventories | (166,612) | | | (125,021) | |

| Prepaids, operating leases and other | (2,747) | | | (1,736) | |

| | | |

| Accounts payable | 29,325 | | | 32,480 | |

| Accrued expenses and other liabilities | (1,545) | | | (8,099) | |

| Floor plan payables - trade, net | 3,089 | | | (1,441) | |

| Customer deposits and deferred revenue | (4,586) | | | (6,972) | |

| Net cash flow from operating activities | (1,105) | | | (21,364) | |

| Investing Activities | | | |

| Acquisition of business, net of cash acquired | — | | | (49,832) | |

| Purchases of rental equipment | (210,360) | | | (127,237) | |

| Proceeds from sales and disposals of rental equipment | 130,246 | | | 96,143 | |

| | | |

| Purchase of non-rental property and cloud computing arrangements | (22,783) | | | (11,763) | |

| | | |

| Net cash flow from investing activities | (102,897) | | | (92,689) | |

| Financing Activities | | | |

| Proceeds from debt | 13,537 | | | — | |

| | | |

| | | |

| | | |

| Share-based payments | (86) | | | (1,247) | |

| Borrowings under revolving credit facilities | 95,082 | | | 75,000 | |

| Repayments under revolving credit facilities | (40,402) | | | (34,945) | |

| Repayments of notes payable | (4,061) | | | (3,791) | |

| Finance lease payments | (472) | | | (2,639) | |

| Repurchase of common stock | (4,532) | | | — | |

| Acquisition of inventory through floor plan payables - non-trade | 398,447 | | | 293,241 | |

| Repayment of floor plan payables - non-trade | (325,891) | | | (218,965) | |

| | | |

| Net cash flow from financing activities | 131,622 | | | 106,654 | |

| Effect of exchange rate changes on cash and cash equivalents | 249 | | | 21 | |

| Net Change in Cash and Cash Equivalents | 27,869 | | | (7,378) | |

| Cash and Cash Equivalents at Beginning of Period | 14,360 | | | 35,902 | |

| Cash and Cash Equivalents at End of Period | $ | 42,229 | | | $ | 28,524 | |

| | | | | | | | | | | |

| Six Months Ended June 30, |

| (in $000s) | 2023 | | 2022 |

| Supplemental Cash Flow Information | | | |

| Interest paid | $ | 56,164 | | | $ | 38,417 | |

| Income taxes paid | 1,450 | | | — | |

| Non-Cash Investing and Financing Activities | | | |

| Rental equipment and property and equipment purchases in accounts payable | 575 | | | — | |

| Rental equipment sales in accounts receivable | 2,294 | | | 1,145 | |

CUSTOM TRUCK ONE SOURCE, INC.

NON-GAAP FINANCIAL AND PERFORMANCE MEASURES

In our press release and schedules, and on the related conference call, we report certain financial measures that are not required by, or presented in accordance with, United States generally accepted accounting principles (“GAAP”). We utilize these financial measures to manage our business on a day-to-day basis and some of these measures are commonly used in our industry to evaluate performance. We believe these non-GAAP measures provide investors expanded insight to assess performance, in addition to the standard GAAP-based financial measures. The press release schedules reconcile the most directly comparable GAAP measure to each non-GAAP measure that we refer to. Although management evaluates and presents these non-GAAP measures for the reasons described herein, please be aware that these non-GAAP measures have limitations and should not be considered in isolation or as a substitute for revenue, operating income/loss, net income/loss, earnings/loss per share or any other comparable operating measure prescribed by GAAP. In addition, we may calculate and/or present these non-GAAP financial measures differently than measures with the same or similar names that other companies report, and as a result, the non-GAAP measures we report may not be comparable to those reported by others.

Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial performance measure that we use to monitor our results of operations, to measure performance against debt covenants and performance relative to competitors. We believe Adjusted EBITDA is a useful performance measure because it allows for an effective evaluation of operating performance, without regard to financing methods or capital structures. We exclude the items identified in the reconciliations of net income (loss) to Adjusted EBITDA because these amounts are either non-recurring or can vary substantially within the industry depending upon accounting methods and book values of assets, including the method by which the assets were acquired, and capital structures. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income (loss) determined in accordance with GAAP. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historical costs of depreciable assets, none of which are reflected in Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as an indication that results will be unaffected by the items excluded from Adjusted EBITDA. Our computation of Adjusted EBITDA may not be identical to other similarly titled measures of other companies.

We define Adjusted EBITDA as net income or loss before interest expense, income taxes, depreciation and amortization, share-based compensation, and other items that we do not view as indicative of ongoing performance. Our Adjusted EBITDA includes an adjustment to exclude the effects of purchase accounting adjustments when calculating the cost of inventory and used equipment sold. When inventory or equipment is purchased in connection with a business combination, the assets are revalued to their current fair values for accounting purposes. The consideration transferred (i.e., the purchase price) in a business combination is allocated to the fair values of the assets as of the acquisition date, with amortization or depreciation recorded thereafter following applicable accounting policies; however, this may not be indicative of the actual cost to acquire inventory or new equipment that is added to product inventory or the rental fleets apart from a business acquisition. Additionally, the pricing of rental contracts and equipment sales prices for equipment is based on OEC, and we measure a rate of return from rentals and sales using OEC. We also include an adjustment to remove the impact of accounting for certain of our rental contracts with customers containing a rental purchase option that are accounted for under GAAP as a sales-type lease. We include this adjustment because we believe continuing to reflect the transactions as an operating lease better reflects the economics of the transactions given our large portfolio of rental contracts. These, and other, adjustments to GAAP net income or loss that are applied to derive Adjusted EBITDA are specified by our senior secured credit agreements.

Adjusted Gross Profit. We present total gross profit excluding rental equipment depreciation (“Adjusted Gross Profit”) as a non-GAAP financial performance measure. This measure differs from the GAAP definition of gross profit, as we do not include the impact of depreciation expense, which represents non-cash expense. We use these measures to evaluate operating margins and the effectiveness of the cost of our rental fleet.

Net Debt. We present the non-GAAP financial measure “Net Debt,” which is total debt (the most comparable GAAP measure, calculated as current and long-term debt, excluding deferred financing fees, plus current and long-term finance lease obligations) minus cash and cash equivalents. We believe this non-GAAP measure is useful to investors to evaluate our financial position.

Net Leverage Ratio. Net Leverage Ratio is a non-GAAP financial performance measure used by management and we believe it provides useful information to investors because it is an important liquidity measure that reflects our ability to service debt. We define net leverage ratio as net debt divided by Adjusted EBITDA.

CUSTOM TRUCK ONE SOURCE, INC.

ADJUSTED EBITDA RECONCILIATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Net income | $ | 11,610 | | | $ | 13,623 | | | $ | 25,410 | | | $ | 10,350 | | | $ | 13,800 | |

| Interest expense | 23,575 | | | 18,050 | | | 45,938 | | | 35,495 | | | 22,363 | |

| Income tax expense (benefit) | 1,388 | | | (81) | | | 2,251 | | | 2,924 | | | 863 | |

| Depreciation and amortization | 55,441 | | | 54,620 | | | 107,531 | | | 117,120 | | | 52,090 | |

| EBITDA | 92,014 | | | 86,212 | | | 181,130 | | | 165,889 | | | 89,116 | |

| Adjustments: | | | | | | | | | |

| Non-cash purchase accounting impact (1) | 469 | | | 2,367 | | | 7,668 | | | 11,393 | | | 7,199 | |

| Transaction and integration costs (2) | 3,689 | | | 6,043 | | | 7,149 | | | 10,691 | | | 3,460 | |

| | | | | | | | | |

| | | | | | | | | |

| Sales-type lease adjustment (3) | 3,293 | | | 2,032 | | | 6,096 | | | 2,561 | | | 2,803 | |

| Share-based payments (4) | 4,322 | | | 1,784 | | | 7,469 | | | 5,148 | | | 3,147 | |

| Change in fair value of derivative and warrants (5) | (604) | | | (13,055) | | | (1,129) | | | (18,822) | | | (525) | |

| Adjusted EBITDA | $ | 103,183 | | | $ | 85,383 | | | $ | 208,383 | | | $ | 176,860 | | | $ | 105,200 | |

Adjusted EBITDA is defined as net income plus interest expense, provision for income taxes, depreciation and amortization, and further adjusted for non-cash purchase accounting impact, transaction and process improvement costs, including business integration expenses, share-based payments, the change in fair value of derivative instruments, sales-type lease adjustment, and other special charges that are not expected to recur. This non-GAAP measure is subject to certain limitations.

(1) Represents the non-cash impact of purchase accounting, net of accumulated depreciation, on the cost of equipment and inventory sold. The equipment and inventory acquired received a purchase accounting step-up in basis, which is a non-cash adjustment to the equipment cost pursuant to our credit agreement.

(2) Represents transaction and process improvement costs related to acquisitions of businesses, including post-acquisition integration costs, which are recognized within operating expenses in our Condensed Consolidated Statements of Income and Comprehensive Income. These expenses are comprised of professional consultancy, legal, tax and accounting fees. Also included are expenses associated with the integration of acquired businesses. These expenses are presented as adjustments to net income pursuant to our ABL Credit Agreement.

(3) Represents the adjustment for the impact of sales-type lease accounting for certain leases containing rental purchase options (or “RPOs”), as the application of sales-type lease accounting is not deemed to be representative of the ongoing cash flows of the underlying rental contracts. This adjustment is made pursuant to our credit agreement.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Equipment sales | $ | (19,603) | | | $ | (7,671) | | | $ | (43,775) | | | $ | (19,908) | | | $ | (24,172) | |

| Cost of equipment sales | 19,415 | | | 6,765 | | | 42,640 | | | 17,135 | | | 23,225 | |

| Gross profit | (188) | | | (906) | | | (1,135) | | | (2,773) | | | (947) | |

| Interest income | (4,406) | | | (2,220) | | | (7,834) | | | (5,108) | | | (3,428) | |

| Rentals invoiced | 7,887 | | | 5,158 | | | 15,065 | | | 10,442 | | | 7,178 | |

| Sales-type lease adjustment | $ | 3,293 | | | $ | 2,032 | | | $ | 6,096 | | | $ | 2,561 | | | $ | 2,803 | |

(4) Represents non-cash share-based compensation expense associated with the issuance of stock options and restricted stock units.

(5) Represents the credit to earnings for the change in fair value of the liability for private warrants.

Reconciliation of Adjusted Gross Profit

(unaudited)

The following table presents the reconciliation of Adjusted Gross Profit:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Revenue | | | | | | | | | |

| Rental revenue | $ | 122,169 | | | $ | 112,055 | | | $ | 240,457 | | | $ | 221,200 | | | $ | 118,288 | |

| Equipment sales | 302,117 | | | 218,506 | | | 603,407 | | | 445,692 | | | 301,290 | |

| Parts sales and services | 32,544 | | | 31,545 | | | 65,129 | | | 61,690 | | | 32,585 | |

| Total revenue | 456,830 | | | 362,106 | | | 908,993 | | | 728,582 | | | 452,163 | |

| Cost of Revenue | | | | | | | | | |

| Cost of rental revenue | 31,981 | | | 28,791 | | | 61,880 | | | 54,584 | | | 29,899 | |

| Depreciation of rental equipment | 43,616 | | | 43,324 | | | 83,946 | | | 88,288 | | | 40,330 | |

| Cost of equipment sales | 245,266 | | | 184,595 | | | 491,391 | | | 371,873 | | | 246,125 | |

| Cost of parts sales and services | 25,348 | | | 22,638 | | | 51,496 | | | 46,586 | | | 26,148 | |

| Total cost of revenue | 346,211 | | | 279,348 | | | 688,713 | | | 561,331 | | | 342,502 | |

| Gross Profit | 110,619 | | | 82,758 | | | 220,280 | | | 167,251 | | | 109,661 | |

| Add: depreciation of rental equipment | 43,616 | | | 43,324 | | | 83,946 | | | 88,288 | | | 40,330 | |

| Adjusted Gross Profit | $ | 154,235 | | | $ | 126,082 | | | $ | 304,226 | | | $ | 255,539 | | | $ | 149,991 | |

Reconciliation of ERS Segment Adjusted Gross Profit and Rental Gross Profit

(unaudited)

The following table presents the reconciliation of ERS segment Adjusted Gross Profit:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Revenue | | | | | | | | | |

| Rental revenue | $ | 117,832 | | | $ | 108,109 | | | $ | 231,616 | | | $ | 213,670 | | | $ | 113,784 | |

| Equipment sales | 50,694 | | | 37,200 | | | 142,830 | | | 96,553 | | | 92,136 | |

| Total revenue | 168,526 | | | 145,309 | | | 374,446 | | | 310,223 | | | 205,920 | |

| Cost of Revenue | | | | | | | | | |

| Cost of rental revenue | 31,341 | | | 27,851 | | | 60,401 | | | 52,642 | | | 29,060 | |

| Cost of equipment sales | 39,802 | | | 30,418 | | | 110,883 | | | 73,648 | | | 71,081 | |

| Depreciation of rental equipment | 42,805 | | | 42,384 | | | 82,317 | | | 86,350 | | | 39,512 | |

| Total cost of revenue | 113,948 | | | 100,653 | | | 253,601 | | | 212,640 | | | 139,653 | |

| Gross profit | 54,578 | | | 44,656 | | | 120,845 | | | 97,583 | | | 66,267 | |

| Add: depreciation of rental equipment | 42,805 | | | 42,384 | | | 82,317 | | | 86,350 | | | 39,512 | |

| Adjusted Gross Profit | $ | 97,383 | | | $ | 87,040 | | | $ | 203,162 | | | $ | 183,933 | | | $ | 105,779 | |

The following table presents the reconciliation of ERS Rental Gross Profit:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended March 31, 2023 |

| (in $000s) | 2023 | | 2022 | | 2023 | | 2022 | |

| Rental revenue | $ | 117,832 | | | $ | 108,109 | | | $ | 231,616 | | | $ | 213,670 | | | $ | 113,784 | |

| Cost of rental revenue | 31,341 | | | 27,851 | | | 60,401 | | | 52,642 | | | 29,060 | |

| Rental Gross Profit | $ | 86,491 | | | $ | 80,258 | | | $ | 171,215 | | | $ | 161,028 | | | $ | 84,724 | |

Reconciliation of Net Debt

(unaudited)

The following table presents the reconciliation of Net Debt:

| | | | | |

| (in $000s) | June 30, 2023 |

| Current maturities of long-term debt | $ | 3,550 | |

| Current portion of finance lease obligations | 247 | |

| Long-term debt, net | 1,425,117 | |

| Finance leases | 3,077 | |

| Deferred financing fees | 25,144 | |

| Less: cash and cash equivalents | (42,229) | |

| Net Debt | $ | 1,414,906 | |

Reconciliation of Net Leverage Ratio

(unaudited)

The following table presents the reconciliation of the Net Leverage Ratio:

| | | | | | | | | | | |

| Twelve Months Ended |

| (in $000s) | June 30, 2023 | | March 31, 2023 |

| Net Debt (as of period end) | $ | 1,414,906 | | | $ | 1,397,617 | |

| Divided by: Adjusted EBITDA | $ | 424,501 | | | $ | 406,701 | |

| Net Leverage Ratio | 3.33 | | | 3.44 | |

v3.23.2

Cover Page

|

Aug. 08, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

CUSTOM TRUCK ONE SOURCE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38186

|

| Entity Tax Identification Number |

84-2531628

|

| Entity Address, Address Line One |

7701 Independence Avenue

|

| Entity Address, City or Town |

Kansas City

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

64125

|

| City Area Code |

816

|

| Local Phone Number |

241-4888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001709682

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CTOS

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for Common Stock, $0.0001 par value

|

| Trading Symbol |

CTOS.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ctos_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

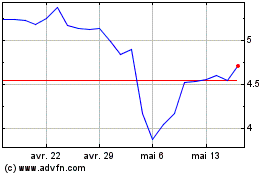

Custom Truck One Source (NYSE:CTOS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Custom Truck One Source (NYSE:CTOS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024