false000175567200017556722025-02-052025-02-050001755672dei:OtherAddressMember2025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 5, 2025

Corteva, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38710 | | 82-4979096 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of Incorporation) | | File Number) | | Identification No.) |

9330 Zionsville Road,

Indianapolis, Indiana 46268

974 Centre Road,

Wilmington, Delaware 19805

(Address of principal executive offices)(Zip Code)

(833) 267-8382

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

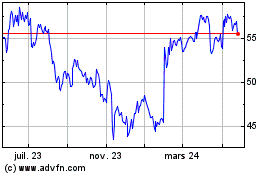

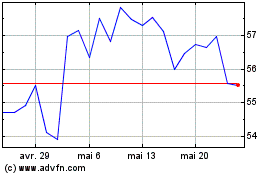

| Common Stock, par value $0.01 per share | | CTVA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On February 5, 2025, Corteva, Inc. (the "Company") announced its consolidated financial results for the quarter and full year ended December 31, 2024. A copy of the Company’s press release and financial statement schedules are furnished herewith on Form 8-K as Exhibits 99.1 and 99.2, respectively. The information contained in this report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. In addition, the information contained in this report shall not be deemed to be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Press Release dated February 5, 2025 |

| Financial Statement Schedules dated February 5, 2025 |

| |

| 104 | The cover page from the Company’s Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CORTEVA, INC. |

| | (Registrant) |

| | |

| | /s/ Brian Titus |

| | |

| | Brian Titus |

| | Vice President and Controller |

February 5, 2025

1 News Release 4Q 2024 Corteva Strong 4Q Driven by Record Crop Demand, Disciplined Execution • Full-year 2024 results in-line with expectations on technology demand and controllable levers • Strong 4Q volume gains across both businesses, notably in Brazil, reflects growing momentum • Full-year 2025 guidance3 refined for currency impact from the strengthening U.S. dollar INDIANAPOLIS, Ind., February 5, 2025 – Corteva, Inc. (NYSE: CTVA) (“Corteva” or the “Company”) today reported financial results for the fourth quarter and full-year ended December 31, 2024. 4Q 2024 Results Overview Net Sales Loss from Cont. Ops (After Tax) EPS GAAP $4.0B $(50)M $(0.08) vs. 4Q 2023 7% 78% 76% Organic1 Sales Operating EBITDA1 Operating EPS1 NON-GAAP $4.2B $525M $0.32 vs. 4Q 2023 13% 36% 113% FY 2024 Results Overview Net Sales Income from Cont. Ops (After Tax) EPS GAAP $16.9B $863M $1.22 vs. FY 2023 (2)% (8)% (6)% Organic1 Sales Operating EBITDA1 Operating EPS1 NON-GAAP $17.4B $3.4B $2.57 vs. FY 2023 1% - (4)% Full-Year 2024 Highlights • Net sales declined 2% versus prior year. Organic1 sales increased 1% in the same period with gains in North America2, Latin America and Asia Pacific offset by declines in EMEA2. • Seed net sales increased 1% and organic1 sales increased 4%. Price was up 3% led by North America2 and EMEA2 with continued execution on the Company’s price for value strategy. Volume increased 1%, primarily reflecting the expected increase in Safrinha corn planted area in Brazil and market share gains in North America2. • Crop Protection net sales decreased 5% and organic1 sales decreased 2%. Price declined 5% primarily due to the market dynamics in Latin America. Volume increased 3%, driven by growth in Latin America on demand for new products and spinosyns, partially offset by weather and destocking impacts in EMEA2, as well as just-in-time purchasing behavior in North America2. • GAAP income and earnings per share (EPS) from continuing operations were $863 million and $1.22 per share, respectively. • Operating EBITDA1 and Operating EPS1 were $3.4 billion, and $2.57 per share, respectively. • Cash provided by operating activities – continuing operations was $2.3 billion, up 27% compared to prior year. Free cash flow1 was $1.7 billion, a 40% improvement over prior year. Strong cash performance supported total cash returned to shareholders of $1.5 billion. • The Company refined full-year 2025 guidance3 and expects net sales in the range of $17.2 to $17.6 billion. Operating EBITDA1 is expected to be $3.6 to $3.8 billion. Operating EPS1 is expected to be $2.70 to $2.95 per share. • The Company expects to repurchase approximately $1 billion of shares during 2025. 1. Organic Sales, Operating EPS, Operating EBITDA, and Free Cash Flow are non-GAAP measures. See page 7 for further discussion. 2. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa. 3. The Company does not provide the most comparable GAAP measure on a forward-looking basis. See page 5 for further discussion.

News Release 4Q 2024 2 Chuck Magro Chief Executive Officer Summary of Fourth Quarter 2024 For the fourth quarter ended December 31, 2024, net sales increased 7% versus the same period last year. Organic1 sales increased 13%. Volume was up 17% versus the prior-year period on growth in both Crop Protection and Seed. Crop Protection volume increased 16% over the prior year driven primarily by Latin America on demand for new products, spinosyns, and biologicals. Seed volume increased 19% versus prior year due to the expected increase in Safrinha corn planted area in Brazil. Price declined 4% versus prior year, reflecting expected lower Seed pricing in Brazil, as well as competitive price dynamics in Crop Protection, primarily in Latin America. GAAP income from continuing operations after income taxes was a loss of $50 million in fourth quarter of 2024 compared to a loss of $231 million in fourth quarter of 2023. Operating EBITDA1 for the fourth quarter of 2024 was $525 million, up 36% compared to prior year, translating into approximately 280 basis points of Operating EBITDA1 margin improvement. 4Q 4Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change Net Sales $3,978 $3,707 7% 13% North America $1,563 $1,497 4% 5% EMEA $448 $371 21% 22% Latin America $1,622 $1,522 7% 20% Asia Pacific $345 $317 9% 10% FY FY % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change Net Sales $16,908 $17,226 (2)% 1% North America $8,660 $8,590 1% 1% EMEA $3,124 $3,367 (7)% (2)% Latin America $3,776 $3,906 (3)% 4% Asia Pacific $1,348 $1,363 (1)% 1%

News Release 4Q 2024 3 Seed Summary Seed net sales were $1.8 billion in the fourth quarter of 2024, up from $1.6 billion in the fourth quarter of 2023. The sales increase reflects a 19% increase in volume, a 3% decline in price and an 8% unfavorable impact from currency. Volume growth in the quarter reflects the expected increase in Safrinha corn planted area in Brazil, while the decline in price is due primarily to competitive pressure in Latin America. Unfavorable currency impacts were led by the Brazilian Real. Segment operating EBITDA was $93 million in the fourth quarter of 2024, down 36% from the fourth quarter of 2023. Higher commodity and other cost of sales, price declines, and continued investment in R&D more than offset volume growth and ongoing cost and productivity actions. Segment operating EBITDA margin contracted by about 360 basis points versus the prior-year period. 4Q 4Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $639 $576 11% 11% EMEA $216 $181 19% 18% Latin America $827 $790 5% 20% Asia Pacific $90 $88 2% 3% Total 4Q Seed Net Sales $1,772 $1,635 8% 16% 4Q Seed Operating EBITDA $93 $145 (36)% N/A Seed net sales were $9.5 billion for the full year of 2024, up 1% from the same period of 2023. The sales increase reflects a 3% increase in price and a 1% increase in volume, partially offset by a 2% unfavorable currency impact and a 1% unfavorable portfolio impact. The increase in Seed price was driven by strong demand for top technology offerings and operational execution globally, with both global corn and soybean prices up 2%. Pricing actions more than offset currency impacts in EMEA2. Volume growth was driven primarily by the expected increase in Safrinha corn planted area in Brazil and share gains in North America, partially offset by reduced corn planted area in Argentina and unfavorable weather and reduced planted area in EMEA2. Unfavorable currency impacts were led by the Brazilian Real and the Turkish Lira. Segment operating EBITDA was $2.2 billion for the full year of 2024, up 5% from the same period of 2023. Price execution and market share gains in North America, reduction of net royalty expense, and ongoing cost and productivity actions more than offset the investment in R&D, higher commodity costs, and the unfavorable impact of currency. Segment operating EBITDA margin improved by 90 basis points versus the prior-year period. FY FY % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $6,033 $5,768 5% 5% EMEA $1,581 $1,622 (3)% 6% Latin America $1,523 $1,637 (7)% 1% Asia Pacific $408 $445 (8)% (6)% Total FY Seed Net Sales $9,545 $9,472 1% 4% FY Seed Operating EBITDA $2,219 $2,117 5% N/A

News Release 4Q 2024 4 Crop Protection Summary Crop Protection net sales were approximately $2.2 billion in the fourth quarter of 2024 compared to approximately $2.1 billion in the fourth quarter of 2023. The sales increase over the prior period reflects a 16% increase in volume, partially offset by a 5% price decline and a 5% unfavorable impact from currency. The increase in volume was driven primarily by Latin America on demand for new products, spinosyns, and biologicals. The price decline was primarily due to the competitive pricing environment in Latin America. Unfavorable currency impacts were led by the Brazilian Real. Segment operating EBITDA was $461 million in the fourth quarter of 2024, up 73% from the fourth quarter of 2023. Raw material deflation, productivity savings, and volume growth more than offset price pressure. Segment operating EBITDA margin improved by approximately 800 basis points versus the prior-year period. 4Q 4Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $924 $921 - - EMEA $232 $190 22% 25% Latin America $795 $732 9% 21% Asia Pacific $255 $229 11% 13% Total 4Q Crop Protection Net Sales $2,206 $2,072 6% 11% 4Q Crop Protection Operating EBITDA $461 $267 73% N/A Crop Protection net sales were approximately $7.4 billion for the full year of 2024 compared to approximately $7.8 billion in the same period of 2023. The sales decrease reflects a 5% decline in price and a 3% unfavorable impact from currency, partially offset by a 3% increase in volume. The price decline was primarily due to market dynamics in Latin America. Unfavorable currency impacts were led by the Brazilian Real and the Turkish Lira. The increase in volume was driven by volume growth in Latin America on demand for new products and spinosyns, partially offset by residual destocking and unfavorable weather impacts in EMEA2, as well as just-in-time purchasing behavior globally. Segment operating EBITDA was $1.3 billion for the full year of 2024, down 7% from the same period last year. Pricing pressure and the unfavorable impact of currency, more than offset productivity savings, raw material deflation, and volume growth. Segment operating EBITDA margin contracted by approximately 45 basis points versus the prior-year period. FY FY % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $2,627 $2,822 (7)% (7)% EMEA $1,543 $1,745 (12)% (9)% Latin America $2,253 $2,269 (1)% 6% Asia Pacific $940 $918 2% 5% Total FY Crop Protection Net Sales $7,363 $7,754 (5)% (2)% FY Crop Protection Operating EBITDA $1,272 $1,374 (7)% N/A

News Release 4Q 2024 5 2025 Guidance Overall agriculture fundamentals remain constructive as record global consumption of corn and soybeans coupled with strong production in 2024 supported farm sector income levels. Global grain prices are recovering, and global stocks-to-use levels of corn are the tightest they have been in over a decade. On-farm demand remains strong as farmers continue to prioritize the need for top-tier technology to maximize their yields. We are beginning to see stabilization in the Crop Protection industry, with continued volume gains in the fourth quarter, yet we expect price pressure will persist. Finally, we expect the strong USD will impact the agricultural economy throughout 2025. As a result, for full-year 2025, Corteva now expects net sales in the range of $17.2 billion to $17.6 billion, growth of 3% at the mid-point. Operating EBITDA1 is expected to be $3.6 billion to $3.8 billion, growth of 10% at the mid-point. Operating EPS1 is expected to be $2.70 to $2.95 per share, growth of 10% at the mid-point. The Company expects to repurchase approximately $1.0 billion of shares in 2025. The Company is not able to reconcile its forward-looking non-GAAP financial measures, to its most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of its control, such as Significant Items, without unreasonable effort. Fourth Quarter Conference Call The Company will host a live webcast of its fourth quarter 2024 earnings conference call with investors to discuss its results and outlook tomorrow, February 6, 2025, at 9:00 a.m. ET. The slide presentation that accompanies the conference call is posted on the Company’s Investor Events and Presentations page. A replay of the webcast will also be available on the Investor Events and Presentations page. About Corteva Corteva, Inc. (NYSE: CTVA) is a global pure-play agriculture company that combines industry-leading innovation, high-touch customer engagement and operational execution to profitably deliver solutions for the world’s most pressing agriculture challenges. Corteva generates advantaged market preference through its unique distribution strategy, together with its balanced and globally diverse mix of seed, crop protection, and digital products and services. With some of the most recognized brands in agriculture and a technology pipeline well positioned to drive growth, the company is committed to maximizing productivity for farmers, while working with stakeholders throughout the food system as it fulfills its promise to enrich the lives of those who produce and those who consume, ensuring progress for generations to come. More information can be found atwww.corteva.com.

News Release 4Q 2024 6 Cautionary Statement About Forward-Looking Statements This press release contains certain estimates and forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “estimates,” “outlook,” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva’s financial results or outlook; strategy for growth; product development; regulatory approvals; market position; capital allocation strategy; liquidity; sustainability commitments and strategies; the anticipated benefits of acquisitions, restructuring actions, or cost savings initiatives; and the outcome of contingencies, such as litigation and environmental matters, are forward-looking statements. Forward-looking statements and other estimates are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements and other estimates also involve risks and uncertainties, many of which are beyond Corteva’s control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva’s business, results of operations and financial condition. Some of the important factors that could cause Corteva’s actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to obtain or maintain the necessary regulatory approvals for some of Corteva’s products; (ii) failure to successfully develop and commercialize Corteva’s pipeline; (iii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva’s biotechnology and other agricultural products; (iv) effect of changes in agricultural and related policies of governments and international organizations; (v) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (vi) effect of climate change and unpredictable seasonal and weather factors; (vii) failure to comply with competition and antitrust laws; (viii) effect of competition in Corteva's industry; (ix) competitor’s establishment of an intermediary platform for distribution of Corteva's products; (x) risk related to geopolitical and military conflict; (xi) effect of volatility in Corteva's input costs; (xii) risks related to Corteva's global operations; (xiii) effect of industrial espionage and other disruptions to Corteva’s supply chain, information technology or network systems; (xiv) risks related to environmental litigation and the indemnification obligations of legacy EIDP liabilities in connection with the separation of Corteva; (xv) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (xvi) failure of Corteva’s customers to pay their debts to Corteva, including customer financing programs; (xvii) failure to effectively manage acquisitions, divestitures, alliances, restructurings, cost savings initiatives, and other portfolio actions; (xviii) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xix) increases in pension and other post-employment benefit plan funding obligations; (xx) risks related to pandemics or epidemics; (xxi) capital markets sentiment towards sustainability matters; (xxii) Corteva’s intellectual property rights or defense against intellectual property claims asserted by others; (xxiii) effect of counterfeit products; (xxiv) Corteva’s dependence on intellectual property cross-license agreements; and (xxv) other risks related to the Separation from DowDuPont. Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement or other estimate, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva’s management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A of this Form 10-K).

News Release 4Q 2024 7 Regulation G (Non-GAAP Financial Measures) This earnings release includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures may include organic sales, organic growth (including by segment and region), operating EBITDA, operating earnings (loss) per share, and base income tax rate. Management uses these measures internally for planning and forecasting, including allocating resources and evaluating incentive compensation. Management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year over year results. These non-GAAP measures supplement the Company’s U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations for these non-GAAP measures to U.S. GAAP are provided in the Selected Financial Information and Non-GAAP Measures starting on page A-5 of the Financial Statement Schedules. Corteva is not able to reconcile its forward-looking non-GAAP financial measures, except for Free Cash Flow, to its most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of the Company’s control, such as significant items, without unreasonable effort. For significant items reported in the periods presented, refer to page A-10 of the Financial Statement Schedules. Beginning January 1, 2020, the Company presents accelerated prepaid royalty amortization expense as a significant item. Accelerated prepaid royalty amortization represents the non-cash charge associated with the recognition of upfront payments made to Monsanto in connection with the Company’s non-exclusive license in the United States and Canada for Monsanto’s Genuity® Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits. Due to the ramp-up of Enlist E3TM, Corteva significantly reduced the volume of products with the Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits beginning in 2021, with expected minimal use of the trait platform thereafter. In 2023 and 2024, the company committed to restructuring activities to optimize the Crop Protection network of manufacturing and external partners, which are expected to be substantially complete in 2026. The company expects to record approximately $150 million to $165 million net pre-tax restructuring charges during 2025 for these activities. Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items. Operating EBITDA is defined as earnings (loss) (i.e., income (loss) from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs), foreign exchange gains (losses), and net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting, excluding the impact of significant items. Non-operating benefits (costs) consists of non-operating pension and other post- employment benefit (OPEB) credits (costs), tax indemnification adjustments, and environmental remediation and legal costs associated with legacy businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the Company as pre-tax income or expense. Operating earnings (loss) per share is defined as “earnings (loss) per common share from continuing operations - diluted” excluding the after-tax impact of significant items, the after-tax impact of non-operating benefits (costs), the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont, and the after-tax impact of net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting. Although amortization of the Company’s intangible assets is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. Net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting represents the non-cash net gain (loss) from changes in fair value of certain undesignated foreign currency derivative contracts. Upon settlement, which is within the same calendar year of execution of the contract, the realized gain (loss) from the changes in fair value of the non-qualified foreign currency derivative contracts will be reported in the relevant non-GAAP financial measures, allowing quarterly results to reflect the economic effects of the foreign currency derivative contracts without the resulting unrealized mark to fair value volatility. Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and non-operating (benefits) costs. The Company also uses Free Cash Flow as a non-GAAP measure to evaluate and discuss its liquidity position and ability to generate cash. Free Cash Flow is defined as cash provided by (used for) operating activities – continuing operations, less capital expenditures. Management believes that Free Cash Flow provides investors with meaningful information regarding the company’s ongoing ability to generate cash through core operations, and the company’s ability to service its indebtedness, pay dividends (when declared), make share repurchases, and meet its ongoing cash needs for its operations. ® TM Corteva Agriscience and its affiliated companies. 2/5/2025 Media Contact Bethany Shively +1 804-866-2377 bethany.shively@corteva. com Investor Contact Kim Booth +1 302-485-3704 kimberly.a.booth@corteva.com

A-1

Corteva, Inc.

Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 3,978 | | | $ | 3,707 | | | $ | 16,908 | | | $ | 17,226 | |

| Cost of goods sold | 2,496 | | | 2,366 | | | 9,529 | | | 9,920 | |

| Research and development expense | 365 | | | 357 | | | 1,402 | | | 1,337 | |

| Selling, general and administrative expenses | 735 | | | 735 | | | 3,196 | | | 3,176 | |

| Amortization of intangibles | 164 | | | 175 | | | 685 | | | 683 | |

| Restructuring and asset related charges - net | 89 | | | 241 | | | 288 | | | 336 | |

| | | | | | | |

| | | | | | | |

| Other income (expense) - net | 19 | | | (94) | | | (300) | | | (448) | |

| | | | | | | |

| Interest expense | 60 | | | 62 | | | 233 | | | 233 | |

| Income (loss) from continuing operations before income taxes | 88 | | | (323) | | | 1,275 | | | 1,093 | |

| Provision for (benefit from) income taxes on continuing operations | 138 | | | (92) | | | 412 | | | 152 | |

| Income (loss) from continuing operations after income taxes | (50) | | | (231) | | | 863 | | | 941 | |

| Income (loss) from discontinued operations after income taxes | 11 | | | (20) | | | 56 | | | (194) | |

| | | | | | | |

| Net income (loss) | (39) | | | (251) | | | 919 | | | 747 | |

| | | | | | | |

| Net income (loss) attributable to noncontrolling interests | 2 | | | 2 | | | 12 | | | 12 | |

| | | | | | | |

| Net income (loss) attributable to Corteva | $ | (41) | | | $ | (253) | | | $ | 907 | | | $ | 735 | |

| | | | | | | |

| Basic earnings (loss) per share of common stock: | | | | | | | |

| Basic earnings (loss) per share of common stock from continuing operations | $ | (0.08) | | | $ | (0.33) | | | $ | 1.23 | | | $ | 1.31 | |

| Basic earnings (loss) per share of common stock from discontinued operations | 0.02 | | | (0.03) | | | 0.08 | | | (0.27) | |

| Basic earnings (loss) per share of common stock | $ | (0.06) | | | $ | (0.36) | | | $ | 1.31 | | | $ | 1.04 | |

| | | | | | | |

| Diluted earnings (loss) per share of common stock: | | | | | | | |

| Diluted earnings (loss) per share of common stock from continuing operations | $ | (0.08) | | | $ | (0.33) | | | $ | 1.22 | | | $ | 1.30 | |

| Diluted earnings (loss) per share of common stock from discontinued operations | 0.02 | | | (0.03) | | | 0.08 | | | (0.27) | |

| Diluted earnings (loss) per share of common stock | $ | (0.06) | | | $ | (0.36) | | | $ | 1.30 | | | $ | 1.03 | |

| | | | | | | |

| Average number of shares outstanding used in earnings (loss) per share (EPS) calculation (in millions) | | | | | | | |

| Basic | 687.3 | | 704.0 | | 693.7 | | 709.0 |

| Diluted | 687.3 | | 704.0 | | 696.0 | | 711.9 |

A-2

Corteva, Inc.

Consolidated Balance Sheets

(Dollars in millions, except share amounts)

| | | | | | | | | | | | | | |

| | |

| | December 31,

2024 | | December 31,

2023 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 3,106 | | | $ | 2,644 | |

| Marketable securities | | 63 | | | 98 | |

| Accounts and notes receivable - net | | 5,676 | | | 5,488 | |

| Inventories | | 5,432 | | | 6,899 | |

| Other current assets | | 820 | | | 1,131 | |

| | | | |

| Total current assets | | 15,097 | | | 16,260 | |

| Investment in nonconsolidated affiliates | | 134 | | | 115 | |

| Property, plant and equipment | | 9,074 | | | 8,956 | |

| Less: Accumulated depreciation | | 4,975 | | | 4,669 | |

| Net property, plant and equipment | | 4,099 | | | 4,287 | |

| Goodwill | | 10,408 | | | 10,605 | |

| Other intangible assets | | 8,876 | | | 9,626 | |

| Deferred income taxes | | 401 | | | 584 | |

| Other assets | | 1,810 | | | 1,519 | |

| | | | |

| Total Assets | | $ | 40,825 | | | $ | 42,996 | |

| | | | |

| Liabilities and Equity | | | | |

| Current liabilities | | | | |

| Short-term borrowings and finance lease obligations | | $ | 750 | | | $ | 198 | |

| Accounts payable | | 4,039 | | | 4,280 | |

| Income taxes payable | | 207 | | | 174 | |

| Deferred revenue | | 3,287 | | | 3,406 | |

| Accrued and other current liabilities | | 2,103 | | | 2,351 | |

| | | | |

| Total current liabilities | | 10,386 | | | 10,409 | |

| Long-term debt | | 1,953 | | | 2,291 | |

| Other noncurrent liabilities | | | | |

| Deferred income tax liabilities | | 478 | | | 899 | |

| Pension and other post employment benefits | | 2,271 | | | 2,467 | |

| Other noncurrent obligations | | 1,707 | | | 1,651 | |

| | | | |

| Total noncurrent liabilities | | 6,409 | | | 7,308 | |

| | | | |

| Commitments and contingent liabilities | | | | |

| | | | |

| Stockholders' equity | | | | |

Common stock, $0.01 par value;1,666,667,000 shares authorized;

issued at December 31, 2024 - 685,595,000 and December 31, 2023 - 701,260,000 | | 7 | | | 7 | |

| Additional paid-in capital | | 27,196 | | | 27,748 | |

| Retained earnings (accumulated deficit) | | 55 | | | (41) | |

| Accumulated other comprehensive income (loss) | | (3,469) | | | (2,677) | |

| Total Corteva stockholders' equity | | 23,789 | | | 25,037 | |

| Noncontrolling interests | | 241 | | | 242 | |

| Total equity | | 24,030 | | | 25,279 | |

| Total Liabilities and Equity | | $ | 40,825 | | | $ | 42,996 | |

A-3

Corteva, Inc.

Consolidated Statements of Cash Flows

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2024 | | 2023 |

| Operating activities | | | |

| Net income (loss) | $ | 919 | | | $ | 747 | |

| (Income) loss from discontinued operations after income taxes | (56) | | | 194 |

| Adjustments to reconcile net income (loss) to cash provided by (used for) operating activities | | | |

| Depreciation and amortization | 1,227 | | | 1,211 | |

| Provision for (benefit from) deferred income tax | (365) | | | (438) | |

| Net periodic pension and OPEB (benefit) cost, net | 160 | | | 138 | |

| Pension and OPEB contributions | (151) | | | (149) | |

| Net (gain) loss on sales of property, businesses, consolidated companies, and investments | (17) | | | (22) | |

| Restructuring and asset related charges - net | 288 | | | 336 | |

| | | |

| Other net loss | 383 | | | 578 | |

| Changes in assets and liabilities, net | | | |

| Accounts and notes receivable | (705) | | | 358 | |

| Inventories | 1,110 | | | 57 | |

| Accounts payable | (115) | | | (663) | |

| Deferred revenue | (86) | | | (11) | |

| Other assets and liabilities | (296) | | | (527) | |

| Cash provided by (used for) operating activities - continuing operations | $ | 2,296 | | | $ | 1,809 | |

| Cash provided by (used for) operating activities - discontinued operations | (151) | | | (40) | |

| Cash provided by (used for) operating activities | $ | 2,145 | | | $ | 1,769 | |

| Investing activities | | | |

| Capital expenditures | $ | (597) | | | $ | (595) | |

| Proceeds from sales of property, businesses, and consolidated companies - net of cash divested | 5 | | | 57 | |

| Acquisitions of businesses - net of cash acquired | — | | | (1,456) | |

| | | |

| Investments in and loans to nonconsolidated affiliates | (7) | | | (32) | |

| Purchases of investments | (144) | | | (148) | |

| Proceeds from sales and maturities of investments | 130 | | | 147 | |

| Proceeds from settlement of net investment hedge | 63 | | | 42 | |

| Other investing activities, net | (39) | | | (2) | |

| Cash provided by (used for) investing activities | $ | (589) | | | $ | (1,987) | |

| Financing activities | | | |

| Net change in borrowings (less than 90 days) | $ | 53 | | | $ | (6) | |

| Proceeds from debt | 3,072 | | | 3,429 | |

| Payments on debt | (2,885) | | | (2,309) | |

| Repurchase of common stock | (1,009) | | | (756) | |

| Proceeds from exercise of stock options | 60 | | | 31 | |

| Dividends paid to stockholders | (458) | | | (439) | |

| | | |

| | | |

| | | |

| | | |

| Other financing activities, net | (32) | | | (49) | |

| Cash provided by (used for) financing activities | $ | (1,199) | | | $ | (99) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash equivalents | (93) | | | (143) | |

| Increase (decrease) in cash, cash equivalents and restricted cash equivalents | $ | 264 | | | $ | (460) | |

| Cash, cash equivalents and restricted cash equivalents at beginning of period | 3,158 | | | 3,618 | |

| Cash, cash equivalents and restricted cash equivalents at end of period | $ | 3,422 | | | $ | 3,158 | |

A-4

Corteva, Inc.

Consolidated Segment Information

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| SEGMENT NET SALES - SEED | | 2024 | | 2023 | | 2024 | | 2023 |

| Corn | | $ | 1,411 | | | $ | 1,308 | | | $ | 6,496 | | | $ | 6,447 | |

| Soybean | | 154 | | | 145 | | | 1,927 | | | 1,858 | |

| Other oilseeds | | 87 | | | 71 | | | 653 | | | 708 | |

| Other | | 120 | | | 111 | | | 469 | | | 459 | |

| Seed | | $ | 1,772 | | | $ | 1,635 | | | $ | 9,545 | | | $ | 9,472 | |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| SEGMENT NET SALES - CROP PROTECTION | | 2024 | | 2023 | | 2024 | | 2023 |

| Herbicides | | $ | 1,031 | | | $ | 991 | | | $ | 3,599 | | | $ | 4,034 | |

| Insecticides | | 490 | | | 442 | | | 1,715 | | | 1,598 | |

| Fungicides | | 320 | | | 275 | | | 1,081 | | | 1,112 | |

| Biologicals | | 169 | | | 155 | | | 476 | | | 491 | |

| Other | | 196 | | | 209 | | | 492 | | | 519 | |

| Crop Protection | | $ | 2,206 | | | $ | 2,072 | | | $ | 7,363 | | | $ | 7,754 | |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| GEOGRAPHIC NET SALES - SEED | | 2024 | | 2023 | | 2024 | | 2023 |

North America 1 | | $ | 639 | | | $ | 576 | | | $ | 6,033 | | | $ | 5,768 | |

EMEA 2 | | 216 | | | 181 | | | 1,581 | | | 1,622 | |

| Latin America | | 827 | | | 790 | | | 1,523 | | | 1,637 | |

| Asia Pacific | | 90 | | | 88 | | | 408 | | | 445 | |

Rest of World 3 | | 1,133 | | | 1,059 | | | 3,512 | | | 3,704 | |

| Net Sales | | $ | 1,772 | | | $ | 1,635 | | | $ | 9,545 | | | $ | 9,472 | |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| GEOGRAPHIC NET SALES - CROP PROTECTION | | 2024 | | 2023 | | 2024 | | 2023 |

North America 1 | | $ | 924 | | | $ | 921 | | | $ | 2,627 | | | $ | 2,822 | |

EMEA 2 | | 232 | | | 190 | | | 1,543 | | | 1,745 | |

| Latin America | | 795 | | | 732 | | | 2,253 | | | 2,269 | |

| Asia Pacific | | 255 | | | 229 | | | 940 | | | 918 | |

Rest of World 3 | | 1,282 | | | 1,151 | | | 4,736 | | | 4,932 | |

| Net Sales | | $ | 2,206 | | | $ | 2,072 | | | $ | 7,363 | | | $ | 7,754 | |

| | | | | | | | |

|

1. Reflects U.S. & Canada | | | | | | | | |

2. Reflects Europe, Middle East, and Africa | | | | | | | | |

3. Reflects EMEA, Latin America, and Asia Pacific | | | | | | | | |

A-5

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2024 | | 2024 |

| Net Sales (GAAP) | | $ | 3,978 | | | $ | 16,908 | |

| Add: Impacts from Currency and Portfolio / Other | | 216 | | | 490 | |

| Organic Sales (Non-GAAP) | | $ | 4,194 | | | $ | 17,398 | |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| OPERATING EBITDA | | 2024 | | 2023 | | 2024 | | 2023 |

| Seed | | $ | 93 | | | $ | 145 | | | $ | 2,219 | | | $ | 2,117 | |

| Crop Protection | | 461 | | | 267 | | | 1,272 | | | 1,374 | |

| Corporate Expenses | | (29) | | | (26) | | | (115) | | | (110) | |

| Operating EBITDA (Non-GAAP) | | $ | 525 | | | $ | 386 | | | $ | 3,376 | | | $ | 3,381 | |

| | | | | | | | |

| RECONCILIATION OF INCOME (LOSS) FROM CONTINUING OPERATIONS AFTER INCOME TAXES TO OPERATING EBITDA | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income (loss) from continuing operations after income taxes (GAAP) | | $ | (50) | | | $ | (231) | | | $ | 863 | | | $ | 941 | |

| Provision for (benefit from) income taxes on continuing operations | | 138 | | | (92) | | | 412 | | | 152 | |

| Income (loss) from continuing operations before income taxes (GAAP) | | 88 | | | (323) | | | 1,275 | | | 1,093 | |

| Depreciation and amortization | | 302 | | | 312 | | | 1,227 | | | 1,211 | |

| Interest income | | (39) | | | (130) | | | (132) | | | (283) | |

| Interest expense | | 60 | | | 62 | | | 233 | | | 233 | |

Exchange (gains) losses1 | | 50 | | | 155 | | | 284 | | | 397 | |

Non-operating (benefits) costs2 | | 42 | | | 36 | | | 174 | | | 151 | |

| | | | | | | | |

| Mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | | 4 | | | (34) | | | — | | | — | |

Significant items (benefit) charge3 | | 18 | | | 308 | | | 315 | | | 579 | |

| Operating EBITDA (Non-GAAP) | | $ | 525 | | | $ | 386 | | | $ | 3,376 | | | $ | 3,381 | |

1.Refer to page A-15 for pre-tax and after tax impacts of exchange (gains) losses.

2.Non-operating (benefits) costs consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments and environmental remediation and legal costs associated with legacy businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense.

3.Refer to page A-10 for pre-tax and after tax impacts of significant items.

A-6

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PRICE - VOLUME - CURRENCY ANALYSIS |

| REGION | | |

| Q4 2024 vs. Q4 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 66 | | 4 | % | $ | 68 | | 5 | % | 3 | % | 2 | % | (1) | % | — | % |

| EMEA | 77 | | 21 | % | 80 | | 22 | % | 2 | % | 20 | % | (1) | % | — | % |

| Latin America | 100 | | 7 | % | 306 | | 20 | % | (14) | % | 34 | % | (13) | % | — | % |

| Asia Pacific | 28 | | 9 | % | 33 | | 10 | % | 4 | % | 6 | % | — | % | (1) | % |

| Rest of World | 205 | | 9 | % | 419 | | 19 | % | (8) | % | 27 | % | (10) | % | — | % |

| Total | $ | 271 | | 7 | % | $ | 487 | | 13 | % | (4) | % | 17 | % | (6) | % | — | % |

| | | | | | | | |

| SEED | | | | | | | | |

| Q4 2024 vs. Q4 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 63 | | 11 | % | $ | 64 | | 11 | % | 6 | % | 5 | % | — | % | — | % |

| EMEA | 35 | | 19 | % | 32 | | 18 | % | 4 | % | 14 | % | 1 | % | — | % |

| Latin America | 37 | | 5 | % | 155 | | 20 | % | (13) | % | 33 | % | (15) | % | — | % |

| Asia Pacific | 2 | | 2 | % | 3 | | 3 | % | 10 | % | (7) | % | (1) | % | — | % |

| Rest of World | 74 | | 7 | % | 190 | | 18 | % | (8) | % | 26 | % | (11) | % | — | % |

| Total | $ | 137 | | 8 | % | $ | 254 | | 16 | % | (3) | % | 19 | % | (8) | % | — | % |

| | | | | | | | |

| CROP PROTECTION | | | | | | | |

| Q4 2024 vs. Q4 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 3 | | — | % | $ | 4 | | — | % | — | % | — | % | — | % | — | % |

EMEA | 42 | | 22 | % | 48 | | 25 | % | (1) | % | 26 | % | (3) | % | — | % |

| Latin America | 63 | | 9 | % | 151 | | 21 | % | (13) | % | 34 | % | (12) | % | — | % |

| Asia Pacific | 26 | | 11 | % | 30 | | 13 | % | 2 | % | 11 | % | — | % | (2) | % |

| Rest of World | 131 | | 11 | % | 229 | | 20 | % | (8) | % | 28 | % | (8) | % | (1) | % |

| Total | $ | 134 | | 6 | % | $ | 233 | | 11 | % | (5) | % | 16 | % | (5) | % | — | % |

A-7

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEED PRODUCT LINE | | | | | | | |

| Q4 2024 vs. Q4 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| Corn | $ | 103 | | 8 | % | $ | 212 | | 16 | % | (8) | % | 24 | % | (8) | % | — | % |

| Soybeans | 9 | | 6 | % | 10 | | 7 | % | 10 | % | (3) | % | (1) | % | — | % |

| Other oilseeds | 16 | | 23 | % | 17 | | 24 | % | 18 | % | 6 | % | (1) | % | — | % |

| Other | 9 | | 8 | % | 15 | | 14 | % | 17 | % | (3) | % | (6) | % | — | % |

| Total | $ | 137 | | 8 | % | $ | 254 | | 16 | % | (3) | % | 19 | % | (8) | % | — | % |

| | | | | | | | |

| CROP PROTECTION PRODUCT LINE | | | | | | |

| Q4 2024 vs. Q4 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| Herbicides | $ | 40 | | 4 | % | $ | 64 | | 6 | % | (3) | % | 9 | % | (2) | % | — | % |

| Insecticides | 48 | | 11 | % | 73 | | 17 | % | (4) | % | 21 | % | (6) | % | — | % |

| Fungicides | 45 | | 16 | % | 74 | | 27 | % | (12) | % | 39 | % | (10) | % | (1) | % |

| Biologicals | 14 | | 9 | % | 30 | | 19 | % | (14) | % | 33 | % | (10) | % | — | % |

| Other | (13) | | (6) | % | (8) | | (4) | % | 3 | % | (7) | % | (2) | % | — | % |

| Total | $ | 134 | | 6 | % | $ | 233 | | 11 | % | (5) | % | 16 | % | (5) | % | — | % |

1.Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items.

A-8

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PRICE - VOLUME - CURRENCY ANALYSIS |

| REGION | | |

| Twelve Months 2024 vs. Twelve Months 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 70 | | 1 | % | $ | 70 | | 1 | % | 1 | % | — | % | — | % | — | % |

EMEA2 | (243) | | (7) | % | (59) | | (2) | % | 5 | % | (7) | % | (3) | % | (2) | % |

| Latin America | (130) | | (3) | % | 144 | | 4 | % | (12) | % | 16 | % | (8) | % | 1 | % |

| Asia Pacific | (15) | | (1) | % | 17 | | 1 | % | 2 | % | (1) | % | (2) | % | — | % |

| Rest of World | (388) | | (4) | % | 102 | | 1 | % | (3) | % | 4 | % | (5) | % | — | % |

| Total | $ | (318) | | (2) | % | $ | 172 | | 1 | % | (1) | % | 2 | % | (3) | % | — | % |

| | | | | | | | |

| SEED | | | | | | | | |

| Twelve Months 2024 vs. Twelve Months 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 265 | | 5 | % | $ | 266 | | 5 | % | 4 | % | 1 | % | — | % | — | % |

EMEA2 | (41) | | (3) | % | 104 | | 6 | % | 9 | % | (3) | % | (5) | % | (4) | % |

| Latin America | (114) | | (7) | % | 12 | | 1 | % | (7) | % | 8 | % | (8) | % | — | % |

| Asia Pacific | (37) | | (8) | % | (26) | | (6) | % | 9 | % | (15) | % | (2) | % | — | % |

| Rest of World | (192) | | (5) | % | 90 | | 2 | % | 1 | % | 1 | % | (5) | % | (2) | % |

| Total | $ | 73 | | 1 | % | $ | 356 | | 4 | % | 3 | % | 1 | % | (2) | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION | | | | | | | |

| Twelve Months 2024 vs. Twelve Months 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | (195) | | (7) | % | $ | (196) | | (7) | % | (3) | % | (4) | % | — | % | — | % |

EMEA | (202) | | (12) | % | (163) | | (9) | % | 1 | % | (10) | % | (3) | % | — | % |

| Latin America | (16) | | (1) | % | 132 | | 6 | % | (15) | % | 21 | % | (8) | % | 1 | % |

| Asia Pacific | 22 | | 2 | % | 43 | | 5 | % | (1) | % | 6 | % | (3) | % | — | % |

| Rest of World | (196) | | (4) | % | 12 | | — | % | (7) | % | 7 | % | (5) | % | 1 | % |

| Total | $ | (391) | | (5) | % | $ | (184) | | (2) | % | (5) | % | 3 | % | (3) | % | — | % |

A-9

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEED PRODUCT LINE | | | | | | | |

| Twelve Months 2024 vs. Twelve Months 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

Corn2 | $ | 49 | | 1 | % | $ | 250 | | 4 | % | 2 | % | 2 | % | (3) | % | — | % |

| Soybeans | 69 | | 4 | % | 83 | | 4 | % | 2 | % | 2 | % | — | % | — | % |

Other oilseeds2 | (55) | | (8) | % | 7 | | 1 | % | 8 | % | (7) | % | (4) | % | (5) | % |

| Other | 10 | | 2 | % | 16 | | 3 | % | 8 | % | (5) | % | (1) | % | — | % |

| Total | $ | 73 | | 1 | % | $ | 356 | | 4 | % | 3 | % | 1 | % | (2) | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION PRODUCT LINE | | | | | | |

| Twelve Months 2024 vs. Twelve Months 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| Herbicides | $ | (435) | | (11) | % | $ | (372) | | (9) | % | (5) | % | (4) | % | (2) | % | — | % |

| Insecticides | 117 | | 7 | % | 190 | | 12 | % | (5) | % | 17 | % | (5) | % | — | % |

| Fungicides | (31) | | (3) | % | 28 | | 3 | % | (9) | % | 12 | % | (6) | % | — | % |

| Biologicals | (15) | | (3) | % | (12) | | (2) | % | (8) | % | 6 | % | (7) | % | 6 | % |

| Other | (27) | | (5) | % | (18) | | (3) | % | — | % | (3) | % | (2) | % | — | % |

| Total | $ | (391) | | (5) | % | $ | (184) | | (2) | % | (5) | % | 3 | % | (3) | % | — | % |

1.Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items.

2.Other during the twelve months ended December 31, 2023 includes the revenue recognized relating to seed sales associated with the Russia Exit. Refer to schedule A-10 for further detail on significant items.

A-10

Corteva, Inc.

Significant Items

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| SIGNIFICANT ITEMS BY SEGMENT (PRE-TAX) | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Seed | $ | 1 | | | $ | (22) | | | $ | (49) | | | $ | (81) | |

| Crop Protection | 12 | | | (274) | | | (175) | | | (476) | |

| Corporate | (31) | | | (12) | | | (91) | | | (22) | |

| Total significant items before income taxes | $ | (18) | | | $ | (308) | | | $ | (315) | | | $ | (579) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SIGNIFICANT ITEMS - PRE-TAX, AFTER TAX, AND EPS IMPACTS | | | | | | | | |

| | | | | | | | | | |

| | Pre-tax | | After tax11 | | ($ Per Share) |

| | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| 1st Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net 1 | $ | (75) | | | $ | (33) | | | $ | (56) | | | $ | (25) | | | $ | (0.08) | | | $ | (0.03) | |

Estimated settlement expense 2 | (54) | | | (49) | | | (41) | | | (37) | | | (0.06) | | | (0.05) | |

Inventory write-offs 3 | — | | | (4) | | | — | | | (4) | | | — | | | (0.01) | |

Gain (loss) on sale of assets and equity investments 3 | 4 | | | 3 | | | 3 | | | 1 | | | 0.01 | | | — | |

Seed sale associated with Russia Exit 3 | — | | | 19 | | | — | | | 14 | | | — | | | 0.02 | |

Acquisition-related costs 5 | (2) | | | (19) | | | (1) | | | (17) | | | — | | | (0.02) | |

1st Quarter – Total | $ | (127) | | | $ | (83) | | | $ | (95) | | | $ | (68) | | | $ | (0.13) | | | $ | (0.09) | |

| | | | | | | | | | | | |

| 2nd Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net 1 | $ | (92) | | | $ | (60) | | | $ | (69) | | | $ | (45) | | | $ | (0.10) | | | $ | (0.06) | |

Estimated settlement expense 2 | (47) | | | (41) | | | (36) | | | (31) | | | (0.05) | | | (0.04) | |

Inventory write-offs 3 | 2 | | | (3) | | | 2 | | | (3) | | | — | | | — | |

Gain (loss) on sale of assets and equity investments 3 | 3 | | | — | | | 2 | | | — | | | — | | | — | |

Seed sale associated with Russia Exit 3 | — | | | (1) | | | — | | | (1) | | | — | | | (0.01) | |

Acquisition-related costs 5 | (3) | | | (15) | | | (2) | | | (12) | | | — | | | (0.02) | |

Employee Retention Credit 6 | — | | | 3 | | | — | | | 2 | | | — | | | — | |

Income tax items 7 | | — | | | — | | | — | | | 29 | | | — | | | 0.04 | |

2nd Quarter – Total | $ | (137) | | | $ | (117) | | | $ | (103) | | | $ | (61) | | | $ | (0.15) | | | $ | (0.09) | |

| | | | | | | | | | | | |

| 3rd Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net 1 | $ | (32) | | | $ | (2) | | | $ | (24) | | | $ | (4) | | | $ | (0.03) | | | $ | (0.01) | |

Estimated settlement expense 2 | — | | | (66) | | | — | | | (50) | | | — | | | (0.07) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Gain (loss) on sale of business, assets and equity investments 3 | — | | | 4 | | | — | | | 3 | | | — | | | 0.01 | |

Acquisition-related costs 5 | (1) | | | (7) | | | (1) | | | (6) | | | — | | | (0.01) | |

| | | | | | | | | | | |

Income tax items 7 | — | | | — | | | 4 | | | — | | | — | | | — | |

3rd Quarter – Total | $ | (33) | | | $ | (71) | | | $ | (21) | | | $ | (57) | | | $ | (0.03) | | | $ | (0.08) | |

| | | | | | | | | | | | |

| 4th Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net 1 | $ | (89) | | | $ | (241) | | | $ | (66) | | | $ | (183) | | | $ | (0.10) | | | $ | (0.26) | |

Estimated settlement expense 2 | — | | | (48) | | | — | | | (36) | | | — | | | (0.05) | |

Spare parts write-off 4 | — | | | (12) | | | — | | | (9) | | | — | | | (0.01) | |

AltEn facility remediation charge 8 | — | | | (10) | | | — | | | (7) | | | — | | | (0.01) | |

Gain (loss) on sale of assets 3 | — | | | 7 | | | — | | | 5 | | | — | | | — | |

Acquisition-related costs 5 | — | | | (4) | | | — | | | (3) | | | — | | | — | |

Insurance proceeds 9 | 71 | | | — | | | 54 | | | — | | | 0.08 | | | — | |

Income tax items 7 | — | | | — | | | (120) | | | 16 | | | (0.17) | | | 0.02 | |

4th Quarter – Total | $ | (18) | | | $ | (308) | | | $ | (132) | | | $ | (217) | | | $ | (0.19) | | | $ | (0.31) | |

| | | | | | | | | | | |

Annual Total 10 | $ | (315) | | | $ | (579) | | | $ | (351) | | | $ | (403) | | | $ | (0.50) | | | $ | (0.57) | |

1.Fourth, third, second and first quarter 2024 includes restructuring and asset related benefits (charges) of $(89), $(32), $(92) and $(75), respectively. The charges primarily relate to the Crop Protection Operations Strategy Restructuring Program of $(89), $(29), $(57) and

A-11

Corteva, Inc.

Significant Items

(Dollars in millions, except per share amounts)

$(55) for the fourth, third, second and first quarter, respectively, and to non-cash accelerated prepaid royalty amortization expense related related to Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits of $—, $—, $(35) and $(20) for the fourth, third, second and first quarter, respectively.

Fourth, third, second and first quarter 2023 includes restructuring and asset related benefits (charges) of $(241), $(2), $(60) and $(33), respectively. The charges primarily relate to a $(217) charge for the fourth quarter related to the Crop Protection Operations Strategy Restructuring Program, a $(6), $2, $(52) and $(16) benefit (charge) for the fourth, third, second and first quarter, respectively, related to non-cash accelerated prepaid royalty amortization expense related to Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits and a $(23), $(1), $(7) and $(11) charge for the fourth, third, second and first quarter, respectively, associated with the 2022 Restructuring Actions.

2.Fourth, third, second and first quarter 2024 included estimated Lorsban® related charges of $—, $—, $(47) and $(54), respectively.

Fourth, third, second and first quarter 2023 included estimated Lorsban® related charges of $(48), $(66), $(41) and $(49), respectively.

3.Fourth, third, second and first quarter 2024 includes a benefit of $—, $—, $3 and $4, respectively, related to the 2022 Restructuring Actions consisting of gain on the sale of assets. Second quarter of 2024 also includes a $2 benefit associated with sales of inventory previously reserved for in association with the 2022 Restructuring Actions.

Fourth, third and first quarter 2023 includes benefits (charges) of $7, $4, and $(11), respectively, related to the 2022 Restructuring Actions consisting of gains (losses) on the sale of businesses, assets and the Company’s interest in an equity investment. Second and first quarter 2023 includes a benefit (charge) of $(1) and $19, respectively, relating to the sale of seeds already under production in Russia when the decision to exit the country was made and that the Company was contractually required to purchase, which consisted of $30 and $41 of net sales and $31 and $22 of cost of goods sold, respectively. Second and first quarter 2023 also includes a charge of $(3) and $(4) associated with activities related to the 2022 Restructuring Actions consisting of inventory write offs.

4.Fourth quarter 2023 includes a charge associated with activities related to the Crop Protection Operations Strategy Restructuring Program.

5.Fourth, third, second and first quarter 2024 includes acquisition-related costs relating to third-party integration costs associated with the completed acquisitions of Stoller and Symborg.

Fourth, third, second and first quarter 2023 includes acquisition-related costs relating to transaction and third-party integration costs associated with the completed acquisitions of Stoller and Symborg and the recognition of the inventory fair value step-up.

6.Second quarter 2023 includes a benefit of $3 relating to an adjustment due to a change in estimate related to the Employee Retention Credit that the Company earned pursuant to the Coronavirus Aid, Relief, and Economic Security ("CARES") Act as enhanced by the Consolidated Appropriations Act ("CAA") and American Rescue Plan Act ("ARPA").

7.The fourth quarter 2024 includes a tax charge of $(120) related to the establishment of a valuation allowance against the net deferred tax asset position of a legal entity in Brazil (Seed business). Third quarter 2024 includes a tax benefit of $4 related to intellectual property realignment.

Fourth quarter 2023 includes a tax benefit related to the impact of changes to deferred taxes for legal entities within Switzerland of $62 and adjustments due to intellectual property realignment of $(46). Second quarter 2023 includes a tax benefit related to the impact of a tax currency change for a legal entity within Switzerland of $24 and an adjustment due to a change in estimate related to a worthless stock deduction in the U.S.

8.Fourth quarter 2023 included a charge relating to the increase in the remediation accrual at the AltEn facility relating to Corteva's estimated voluntary contribution to the solid waste and wastewater remedial action plans.

9.Includes proceeds received related to prior significant items.

10.Earnings per share for the year may not equal the sum of quarterly earnings per share due to the changes in average share calculations.

11.Unless specifically addressed in notes above, the income tax effect on significant items was calculated based upon the enacted tax laws and statutory income tax rates applicable in the tax jurisdiction(s) of the underlying non-GAAP adjustment.

A-12

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Earnings (Loss) Per Share (Non-GAAP) | | | | | | | | |

Operating earnings (loss) per share is defined as earnings (loss) per share from continuing operations – diluted, excluding the after-tax impact of significant items, the after-tax impact of non-operating benefits (costs), the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont, and the after-tax impact of net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting. |

| | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | $ | | $ | | EPS (diluted) | | EPS (diluted) |

| Income (loss) from continuing operations attributable to Corteva common stockholders (GAAP) | | $ | (52) | | | $ | (233) | | | $ | (0.08) | | | $ | (0.33) | |

Less: Non-operating benefits (costs), after tax1 | | (29) | | | (27) | | | (0.04) | | | (0.04) | |

| Less: Amortization of intangibles (existing as of Separation), after tax | | (109) | | | (117) | | | (0.16) | | | (0.17) | |

| | | | | | | | |

| Less: Mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, after tax | | (3) | | | 25 | | | (0.01) | | | 0.04 | |

| Less: Significant items benefit (charge), after tax | | (132) | | | (217) | | | (0.19) | | | (0.31) | |

Operating Earnings (Loss) (Non-GAAP) 2 | | $ | 221 | | | $ | 103 | | | $ | 0.32 | | | $ | 0.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | $ | | $ | | EPS (diluted) | | EPS (diluted) |

| Income (loss) from continuing operations attributable to Corteva common stockholders (GAAP) | | $ | 851 | | | $ | 929 | | | $ | 1.22 | | | $ | 1.30 | |

Less: Non-operating benefits (costs), after tax1 | | (127) | | | (111) | | | (0.18) | | | (0.16) | |

| Less: Amortization of intangibles (existing as of Separation), after tax | | (459) | | | (471) | | | (0.67) | | | (0.66) | |

| | | | | | | | |

| Less: Mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, after tax | | — | | | — | | | — | | | — | |

| Less: Significant items benefit (charge), after tax | | (351) | | | (403) | | | (0.50) | | | (0.57) | |

Operating Earnings (Loss) (Non-GAAP) 2 | | $ | 1,788 | | | $ | 1,914 | | | $ | 2.57 | | | $ | 2.69 | |

1.Non-operating benefits (costs) consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments and environmental remediation and legal costs associated with legacy businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense.

2.Refer to page A-13 for the Non-GAAP reconciliation of operating EBITDA to operating earnings (loss) per share.

A-13

Corteva, Inc.

Operating EBITDA to Operating Earnings (Loss) Per Share

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating EBITDA to Operating Earnings (Loss) Per Share |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Operating EBITDA (Non-GAAP)1 | | $ | 525 | | | $ | 386 | | | $ | 3,376 | | | $ | 3,381 | |

| Depreciation | | (138) | | | (137) | | | (542) | | | (528) | |

| Amortization of intangibles (post Separation) | | (20) | | | (20) | | | (82) | | | (65) | |

| Interest income | | 39 | | | 130 | | | 132 | | | 283 | |

| Interest expense | | (60) | | | (62) | | | (233) | | | (233) | |

(Provision for) benefit from income taxes on continuing operations before significant items, non-operating benefits (costs), amortization of intangibles (existing as of Separation), mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP)1 | | (80) | | | (60) | | | (604) | | | (577) | |

Base income tax rate from continuing operations (Non-GAAP)1 | | 23.1 | % | | 20.2 | % | | 22.8 | % | | 20.3 | % |

Exchange gains (losses), after tax2 | | (43) | | | (132) | | | (247) | | | (335) | |

| Net (income) loss attributable to non-controlling interests | | (2) | | | (2) | | | (12) | | | (12) | |

Operating Earnings (Loss) (Non-GAAP)1 | | $ | 221 | | | $ | 103 | | | $ | 1,788 | | | $ | 1,914 | |

| Diluted Shares (in millions) | | 687.3 | | | 704.0 | | | 696.0 | | | 711.9 | |

Operating Earnings (Loss) Per Share (Non-GAAP)1 | | $ | 0.32 | | | $ | 0.15 | | | $ | 2.57 | | | $ | 2.69 | |

1. Refer to pages A-5 through A-9, and A-12 and A-14 for Non-GAAP reconciliations.

2. Refer to page A-15 for pre-tax and after tax impacts of exchange gains (losses).

A-14

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Base Income Tax Rate to Effective Income Tax Rate |

| Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and non-operating (benefits) costs. |

| | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Income (loss) from continuing operations before income taxes (GAAP) | $ | 88 | | | $ | (323) | | | $ | 1,275 | | | $ | 1,093 | |

Add: Significant items (benefit) charge 1 | 18 | | | 308 | | | 315 | | | 579 | |

| | | | | | | |

| Non-operating (benefits) costs | 42 | | | 36 | | | 174 | | | 151 | |

| Amortization of intangibles (existing as of Separation) | 144 | | | 155 | | | 603 | | | 618 | |

| Mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | 4 | | | (34) | | | — | | | — | |

Less: Exchange gains (losses)2 | (50) | | | (155) | | | (284) | | | (397) | |

Income (loss) from continuing operations before income taxes, significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP) | $ | 346 | | | $ | 297 | | | $ | 2,651 | | | $ | 2,838 | |

| | | | | | | |

Provision for (benefit from) income taxes on continuing operations (GAAP) | $ | 138 | | | $ | (92) | | | $ | 412 | | | $ | 152 | |

Add: Tax (expenses) benefits on significant items (benefit) charge1 | (114) | | | 91 | | | (36) | | | 176 | |

| | | | | | | |

| Tax benefits on non-operating (benefits) costs | 13 | | | 9 | | | 47 | | | 40 | |

| Tax benefits on amortization of intangibles (existing as of Separation) | 35 | | | 38 | | | 144 | | | 147 | |

| Tax (expenses) benefits on mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | 1 | | | (9) | | | — | | | — | |

Tax benefits on exchange gains (losses)2 | 7 | | | 23 | | | 37 | | | 62 | |

Provision for (benefit from) income taxes on continuing operations before significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP) | $ | 80 | | | $ | 60 | | | $ | 604 | | | $ | 577 | |

| | | | | | | |

Effective income tax rate (GAAP) | 156.8 | % | | 28.5 | % | | 32.3 | % | | 13.9 | % |

| Significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), and mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges effect | (132.1) | % | | (2.2) | % | | (8.3) | % | | 7.2 | % |

| Tax rate from continuing operations before significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), and mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | 24.7 | % | | 26.2 | % | | 24.0 | % | | 21.1 | % |

Exchange gains (losses), net effect2 | (1.6) | % | | 6.0 | % | | (1.2) | % | | (0.8) | % |

Base income tax rate from continuing operations (Non-GAAP) | 23.1 | % | | 20.2 | % | | 22.8 | % | | 20.3 | % |

| | | | | | | |

| 1. See page A-10 for further detail on the significant items table. |

| 2. See page A-15 for further details of exchange gains (losses). |

A-15

Corteva, Inc.

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange Gains/Losses | | | | | | | | |

| The Company routinely uses foreign currency exchange contracts to offset its net exposures, by currency, related to the foreign currency-denominated monetary assets and liabilities. The objective of this program is to maintain an approximately balanced position in foreign currencies in order to minimize, on an after-tax basis, the effects of exchange rate changes on net monetary asset positions. The hedging program gains (losses) are largely taxable (tax deductible) in the United States (U.S.), whereas the offsetting exchange gains (losses) on the remeasurement of the net monetary asset positions are often not taxable (tax deductible) in their local jurisdictions. The net pre-tax exchange gains (losses) are recorded in other income (expense) - net and the related tax impact is recorded in provision for (benefit from) income taxes on continuing operations in the Consolidated Statements of Operations. |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Subsidiary Monetary Position Gain (Loss) | | | | | | | | |

| Pre-tax exchange gains (losses) | | $ | 47 | | | $ | (189) | | | $ | (152) | | | $ | (371) | |

| Local tax (expenses) benefits | | (12) | | | 28 | | | 11 | | | 55 | |

| Net after tax impact from subsidiary exchange gains (losses) | | $ | 35 | | | $ | (161) | | | $ | (141) | | | $ | (316) | |

| | | | | | | | |

| Hedging Program Gain (Loss) | | | | | | | | |

| Pre-tax exchange (losses) gains | | $ | (97) | | | $ | 34 | | | $ | (132) | | | $ | (26) | |

| Tax (expenses) benefits | | 19 | | | (5) | | | 26 | | | 7 | |

| Net after tax impact from hedging program exchange (losses) gains | | $ | (78) | | | $ | 29 | | | $ | (106) | | | $ | (19) | |

| | | | | | | | |

| Total Exchange Gain (Loss) | | | | | | | | |

| Pre-tax exchange gains (losses) | | $ | (50) | | | $ | (155) | | | $ | (284) | | | $ | (397) | |

| Tax (expenses) benefits | | 7 | | | 23 | | | 37 | | | 62 | |

| Net after tax exchange gains (losses) | | $ | (43) | | | $ | (132) | | | $ | (247) | | | $ | (335) | |

| | | | | | | | |

| Noncontrolling interest adjustment | | — | | | — | | | 1 | | | — | |

| | | | | | | | |

| Net after-tax exchange gain (loss) attributable to Corteva | | $ | (43) | | | $ | (132) | | | $ | (246) | | | $ | (335) | |

| | | | | | | | |

| As shown above, the "Total Exchange Gain (Loss)" is the sum of the "Subsidiary Monetary Position Gain (Loss)" and the "Hedging Program (Loss) Gain." |

A-16

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions)

| | | | | | | | | | | | | | | | | |

| Free Cash Flow (Non-GAAP) | | | | |

| Free Cash Flow is defined as cash provided by (used for) operating activities – continuing operations, less capital expenditures. |

| | | | | |

| | | Twelve Months Ended

December 31, |

| | | 2024 | | 2023 |

| Cash provided by (used for) operating activities - continuing operations (GAAP) | $ | 2,296 | | | $ | 1,809 | |

| Less: Capital expenditures | (597) | | | (595) | |

| Free Cash Flow (Non-GAAP) | $ | 1,699 | | | $ | 1,214 | |

| | | | | |

v3.25.0.1

Cover Document

|

Feb. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity Registrant Name |

Corteva, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38710

|

| Entity Tax Identification Number |

82-4979096

|

| Entity Address, Address Line One |

9330 Zionsville Road

|

| Entity Address, City or Town |

Indianapolis

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46268

|

| City Area Code |

833

|

| Local Phone Number |

267-8382

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

CTVA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001755672

|

| Document Information [Line Items] |

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity Address, Address Line One |

9330 Zionsville Road

|

| Entity Address, City or Town |

Indianapolis

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46268

|

| Entity Registrant Name |

Corteva, Inc.

|

| Other Address |

|

| Cover [Abstract] |

|

| Entity Address, Address Line One |

974 Centre Road

|

| Entity Address, City or Town |

Wilmington

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19805

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

974 Centre Road

|

| Entity Address, City or Town |

Wilmington

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19805

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |