Delivers Net Income of $48M and Net Income

Margin of 1.4%

Drives industry-leading 33% YoY Retail Unit

growth and industry-leading profitability among public automotive

retailers with record 10.4% Adjusted EBITDA Margin

Carvana expects a sequential increase in retail

units in Q3 and FY 2024 Adjusted EBITDA of $1.0 - 1.2 Billion1

Carvana Co. (NYSE: CVNA), the leading e-commerce platform for

buying and selling used cars, today announced financial results for

the quarter ended June 30, 2024. Carvana’s complete second quarter

2024 financial results and management commentary are available in

the company’s shareholder letter on the quarterly results page of

its Investor Relations website.

“Carvana’s second quarter results clearly demonstrate the

differentiated strength of our customer offering and business

model. We not only led the industry in retail unit growth, which

accelerated from Q1, but also delivered 1.4% Net Income margin and

a new record 10.4% Adjusted EBITDA margin, which sets an all-time

high water mark for public automotive retailers,” said Ernie

Garcia, Carvana Founder and Chief Executive Officer. “We couldn’t

be prouder of our team and remain just as ambitious looking forward

as we tackle the many opportunities to make our business and

customer offering even better as we drive toward buying and selling

millions of cars per year.”

Q2 2024 Highlights In Q2 2024, Carvana sold 101,440

retail units (+33% YoY) for total revenue of $3.41 billion (+15%

YoY) while reaching new profitability milestones, including:

- Net Income of $48 million1 and Net Income margin of 1.4%

- Record Adjusted EBITDA of $355 million

- Record Adjusted EBITDA margin of 10.4%, a new best for public

automotive retailers

- Record GAAP Operating Income of $259 million

Outlook Looking forward, Carvana expects the following as

long as the environment remains stable:

- A sequential increase in retail units in Q3 compared to Q2,

and

- Adjusted EBITDA of $1.0 to $1.2 billion for the full year 2024,

an increase from $339 million last year.1

_______________________________

1 In order to clearly demonstrate our progress and highlight the

most meaningful drivers within our business, we continue to use

forecasted Non-GAAP financial measures, including forecasted

Adjusted EBITDA. We have not provided a quantitative reconciliation

of forecasted GAAP measures to forecasted Non-GAAP measures within

this communication because we are unable, without making

unreasonable efforts, to calculate one-time or restructuring

expenses. These items could materially affect the computation of

forward-looking Net Income (loss).

2 Net income included a negative ~$22 million impact from the

decline in the fair value of our warrants to acquire Root common

stock.

Conference Call Details

Carvana will host a conference call today, July 31, 2024, at

5:30 p.m. ET (2:30 p.m. PT) to discuss financial results. To

participate in the live call, analysts and investors should dial

(833) 255-2830 or (412) 902-6715. A live audio webcast of the

conference call along with supplemental financial information will

also be accessible on the company's website at

investors.carvana.com. Following the webcast, an archived version

will also be available on the Investor Relations section of the

company’s website. A telephonic replay of the conference call will

be available until Wednesday, August 7, 2024, by dialing (877)

344-7529 or (412) 317-0088 and entering passcode 5009147#.

Forward Looking

Statements

This letter contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements reflect Carvana’s current

expectations and projections with respect to, among other things,

its financial condition, results of operations, plans, objectives,

strategy, future performance, and business. These statements may be

preceded by, followed by or include the words "aim," "anticipate,"

"believe," "estimate," "expect," "forecast," "intend," "likely,"

"outlook," "plan," "potential," "project," "projection," "seek,"

"can," "could," "may," "should," "would," "will," the negatives

thereof and other words and terms of similar meaning.

Forward-looking statements include all statements that are not

historical facts, including expectations regarding our operational

and efficiency initiatives and gains, our strategy, expected gross

profit per unit, forecasted results, including forecasted Adjusted

EBITDA, potential infrastructure capacity utilization, efficiency

gains and opportunities to improve our results, including

opportunities to increase our margins and reduce our expenses,

potential normalization of inventory, potential benefits from new

technology, and our long-term financial goals and growth

opportunities. Such forward-looking statements are subject to

various risks and uncertainties. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. Among

these factors are risks related to: our ability to utilize our

available infrastructure capacity and realize the expected benefits

therefrom, including increased margins and lower expenses; our

ability to scale up our business; the larger automotive ecosystem,

including consumer demand, global supply chain challenges, and

other macroeconomic issues; our ability to raise additional capital

and our substantial indebtedness; our history of losses and ability

to maintain profitability in the future; our ability to effectively

manage our historical rapid growth; our ability to maintain

customer service quality and reputational integrity and enhance our

brand; the seasonal and other fluctuations in our quarterly

operating results; our relationship with DriveTime and its

affiliates; the highly competitive industry in which we

participate, which among other consequences, could impact our

long-term growth opportunities; the changes in prices of new and

used vehicles; our ability to normalize our inventory or acquire

desirable inventory; our ability to sell our inventory

expeditiously; and the other risks identified under the “Risk

Factors” section in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2023.

There is no assurance that any forward-looking statements will

materialize. You are cautioned not to place undue reliance on

forward-looking statements, which reflect expectations only as of

this date. Carvana does not undertake any obligation to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments, or otherwise.

Use of Non-GAAP Financial

Measures

To supplement the consolidated financial measures, which are

prepared and presented in accordance with GAAP, we also refer to

the following non-GAAP measures in this press release: Adjusted

EBITDA; and Adjusted EBITDA Margin.

Adjusted EBITDA is defined as net income (loss) plus income tax

provision, interest expense, other expense (income), net, loss on

debt extinguishment, other operating expense, net, depreciation and

amortization expense in cost of sales and SG&A expenses,

share-based compensation expense in SG&A expenses, and

restructuring expense in cost of sales and SG&A expenses, minus

revenue related to our Root Warrants. Adjusted EBITDA margin is

Adjusted EBITDA as a percentage of total revenues.

We believe that these metrics are useful measures to us and to

our investors because they exclude certain financial, capital

structure, and non-cash items that we do not believe directly

reflect our core operations and may not be indicative of our

recurring operations, in part because they may vary widely across

time and within our industry independent of the performance of our

core operations. We believe that excluding these items enables us

to more effectively evaluate our performance period-over-period and

relative to our competitors.

For the Three Months Ended (dollars in millions, except

per unit amounts) Jun 30, 2024 Jun 30, 2023 Net

income (loss)

$

48

$

(105

)

Income tax provision

1

-

Interest expense

173

155

Other expense (income), net

35

(8

)

Loss on debt extinguishment

2

-

Operating income (loss)

$

259

$

42

Other operating expense, net

1

5

Depreciation and amortization expense in cost of sales

35

44

Depreciation and amortization expense in SG&A expenses

41

46

Share-based compensation expense in SG&A expenses

24

20

Root warrant revenue

(5

)

(5

)

Restructuring expense

-

3

Adjusted EBITDA

$

355

$

155

Total revenues

$

3,410

$

2,968

Net income (loss) margin

1.4

%

(3.5

)%

Adjusted EBITDA margin

10.4

%

5.2

%

About Carvana (NYSE: CVNA)

Carvana’s mission is to change the way people buy and sell cars.

Over the past decade, Carvana has revolutionized automotive retail

and delighted millions of customers with an offering that is fun,

fast, and fair. With Carvana, customers can choose from tens of

thousands of vehicles, get financing, trade-in, and complete a

purchase entirely online with the convenience of home delivery or

local pick up in over 300 U.S. markets. Carvana’s vertically

integrated platform is powered by its passionate team, unique

national infrastructure, and purpose-built technology. Carvana is a

Fortune 500 company and is proud to be recognized by Forbes as one

of America’s Best Employers.

For more information, please visit www.carvana.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731599122/en/

Investors: Carvana Mike McKeever investors@carvana.com

or

Media: Carvana press@carvana.com

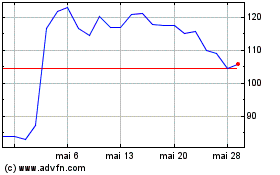

Carvana (NYSE:CVNA)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Carvana (NYSE:CVNA)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024