UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission file number: 001-39087

Youdao, Inc.

(Exact Name of Registrant as Specified in Its Charter)

No. 399, Wangshang

Road, Binjiang District

Hangzhou 310051, People’s Republic of China

+86 0571-8985-2163

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F. Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Youdao, Inc. |

| |

|

|

| |

|

|

| Date: |

February 20, 2025 |

|

By: |

/s/ Feng Zhou |

| |

|

|

|

Name: |

Feng Zhou |

| |

|

|

|

Title: |

Chief Executive Officer, Director |

Exhibit 99.1

For investor

and media inquiries, please contact:

In China:

Jeffrey Wang

Youdao, Inc.

Tel: +86-10-8255-8163

ext. 89980

E-mail: IR@rd.netease.com

Piacente Financial

Communications

Helen Wu

Tel: +86-10-6508-0677

E-mail: youdao@thepiacentegroup.com

In the United States:

Piacente Financial

Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: youdao@thepiacentegroup.com

Youdao Reports

Fourth Quarter and Fiscal Year 2024 Unaudited Financial Results

Hangzhou, China

– February 20, 2025 – Youdao, Inc. (“Youdao” or the “Company”) (NYSE: DAO), an intelligent learning

company with industry-leading technology in China, today announced its unaudited financial results for the fourth quarter and fiscal

year ended December 31, 2024.

Fourth Quarter

2024 Financial Highlights

| · | Total

net revenues were RMB1.3 billion (US$183.6 million), representing a 9.5% decrease from

the same period in 2023. |

| o | Net

revenues from learning services were RMB617.7 million (US$84.6 million), representing

a 21.2% decrease from the same period in 2023. |

| o | Net

revenues from smart devices were RMB240.4 million (US$32.9 million), representing an

8.1% increase from the same period in 2023. |

| o | Net

revenues from online marketing services were RMB481.7 million (US$66.0 million), representing

a modest increase from the same period in 2023. |

| · | Gross

margin was 47.8%, compared with 49.9% for the same period in 2023. |

| · | Income

from operations was RMB84.2 million (US$11.5 million), representing a 10.3% increase

from the same period in 2023. |

| · | Basic

and diluted net income per American depositary share (“ADS”) attributable

to ordinary shareholders was RMB0.71 (US$0.10) and RMB0.70 (US$0.10), respectively, compared

with RMB0.47 for the same period of 2023. |

Fiscal Year 2024 Financial Highlights

| · | Total

net revenues were RMB5.6 billion (US$770.7 million), representing a 4.4% increase from

2023. |

| o | Net

revenues from learning services were RMB2.7 billion (US$376.4 million), representing

a 12.7% decrease from 2023. |

| o | Net

revenues from smart devices were RMB903.7 million (US$123.8 million), remaining stable

compared to 2023. |

| o | Net

revenues from online marketing services were RMB2.0 billion (US$270.6 million), representing

a 48.3% increase from 2023. |

| · | Gross

margin was 48.9%, compared with 51.4% for 2023. |

| · | Income

from operations was RMB148.8 million (US$20.4 million), compared with loss from operations

of RMB466.3 million for 2023. |

| · | Basic

and diluted net income per ADS attributable to ordinary shareholders was RMB0.70 (US$0.10),

compared with basic and diluted net loss per ADS attributable to ordinary shareholders of

RMB4.53 for 2023. |

“We achieved

a significant milestone of first-ever full-year profitability in 2024. In terms of products and services, our AI-based and differentiated

services enhanced customer loyalty, with retention rate surpassing 70% in the fourth quarter for Youdao Lingshi. In addition, we strengthened

collaboration with NetEase in online marketing services, facilitating the long-term development of this segment. AI-driven subscription

services continued to upgrade, leading to elevated customer satisfaction and over 130% year-over-year increase in total sales,”

said Dr. Feng Zhou, Chief Executive Officer and Director of Youdao.

“Looking

ahead, we are launching our ‘AI Native’ strategy-integrating AI more comprehensively across our business lines, for example,

automating our advertising platforms and introducing AI-driven tutoring for our course customers. We are excited by the rapid maturing

of reasoning models and eager to deliver these innovative projects to our customers,” Dr. Zhou concluded.

Fourth Quarter

2024 Financial Results

Net Revenues

Net revenues for

the fourth quarter of 2024 were RMB1.3 billion (US$183.6 million), representing a 9.5% decrease from RMB1.5 billion for the same period

of 2023.

Net revenues

from learning services were RMB617.7 million (US$84.6 million) for the fourth quarter of 2024, representing a 21.2% decrease from

RMB784.0 million for the same period of 2023. The year-over-year decrease was due to our continued strategic focus on a more

selective customer acquisition approach, prioritizing higher ROI (return on investment) engagements. We believe despite the

short-term revenue decline, this strategy has enhanced the overall resilience and operational efficiency of our business.

Net revenues from

smart devices were RMB240.4 million (US$32.9 million) for the fourth quarter of 2024, representing an 8.1% increase from RMB222.4 million

for the same period of 2023, primarily driven by the continued increase in sales of Youdao

Dictionary Pen in 2024.

Net revenues from

online marketing services were RMB481.7 million (US$66.0 million) for the fourth quarter of 2024, representing a modest increase from

RMB474.1 million for the same period of 2023.

Gross Profit

and Gross Margin

Gross profit for

the fourth quarter of 2024 was RMB640.8 million (US$87.8 million), representing a 13.3% decrease from RMB738.8 million for the same period

of 2023. Gross margin was 47.8% for the fourth quarter of 2024, compared with 49.9% for the same period of 2023.

Gross margin for

learning services was 60.0% for the fourth quarter of 2024, compared with 63.6% for the same period of 2023. The decrease was mainly

due to the decline in economies of scale as a result of the decreased revenues from learning services.

Gross margin for

smart devices increased to 43.9% for the fourth quarter of 2024 from 38.3% for the same period of 2023. The

improvement was mainly attributable to the higher gross margin arising from the newly launched Youdao Dictionary Pen in 2024.

Gross margin for

online marketing services was 34.2% for the fourth quarter of 2024, compared with 32.7% for the same period of 2023. The increase was

mainly attributable to improved gross margin profile of performance-based advertisements through third parties’ internet properties

compared with the same period of last year.

Operating Expenses

Total operating

expenses for the fourth quarter of 2024 were RMB556.6 million (US$76.3 million), compared with RMB662.5 million for the same period of

last year.

Sales and marketing

expenses for the fourth quarter of 2024 were RMB381.8 million (US$52.3 million), representing a decrease of 13.5% from RMB441.4 million

for the same period of 2023. This decrease was attributable to the reduced marketing expenditures, as well as declined outsourcing labor

service fees and payroll related expenses in learning services.

Research and development

expenses for the fourth quarter of 2024 were RMB120.7 million (US$16.5 million), representing a decrease of 28.2% from RMB168.1 million

for the same period of 2023. The decrease was primarily due to the decreased headcount for research and development employees, leading

to payroll savings in the fourth quarter of 2024.

General and administrative

expenses for the fourth quarter of 2024 were RMB54.1 million (US$7.4 million), largely flat compared with RMB53.0 million for the

same period of 2023.

Income from

Operations

As a result of

the foregoing, income from operations for the fourth quarter of 2024 was RMB84.2 million (US$11.5 million), representing a 10.3% increase

from RMB76.3 million for the same period in 2023. The margin of income from operations was 6.3%, compared with 5.2% for the same period

of last year.

Net Income Attributable

to Youdao’s Ordinary Shareholders

Net income attributable

to Youdao’s ordinary shareholders for the fourth quarter of 2024 was RMB83.0 million (US$11.4 million), representing a 47.0% increase

from RMB56.5 million for the same period of last year. Non-GAAP net income attributable to Youdao’s ordinary shareholders for the

fourth quarter of 2024 was RMB91.8 million (US$12.6 million), representing a 32.5% increase from RMB69.3 million for the same period

of last year.

Basic and diluted

net income per ADS attributable to ordinary shareholders for the fourth quarter of 2024 was RMB0.71 (US$0.10) and RMB0.70 (US$0.10),

respectively, compared with RMB0.47 for the same period of 2023. Non-GAAP basic and diluted net income per ADS attributable to ordinary

shareholders was RMB0.78 (US$0.11) and RMB0.77 (US$0.11), respectively, compared with RMB0.58 for the same period of 2023.

Other Information

As of December

31, 2024, Youdao’s cash, cash equivalents, current and non-current restricted cash, time deposits and short-term investments totaled RMB662.6

million (US$90.8 million), compared with RMB527.1 million as of December

31, 2023. For the fourth quarter of 2024, net cash provided by operating activities was RMB158.2 million (US$21.7 million). Youdao’s

ability to continue as a going concern is dependent on management’s ability to implement an effective business plan amid a changing

regulatory environment, generate operating cash flows, and secure external financing for future development. To support Youdao’s

future business, NetEase Group has agreed to provide financial support for ongoing operations in the next thirty-six months starting

from May 2024. As of December 31, 2024, Youdao has received various forms of financial support from the NetEase Group, including, among

others, RMB878.0 million in short-term loan, and US$126.1 million in long-term loans maturing on March 31, 2027 drawn from the US$300.0

million revolving loan facility.

As of December

31, 2024, the Company’s contract liabilities, which mainly consisted of deferred revenues generated from Youdao’s learning

services, were RMB961.0 million (US$131.7 million), compared with RMB1.1 billion as of December 31, 2023.

Fiscal Year

2024 Financial Results

Net Revenues

Net revenues for

2024 were RMB5.6 billion (US$770.7 million), representing a 4.4% increase from RMB5.4 billion for 2023.

Net revenues from

learning services were RMB2.7 billion (US$376.4 million) for 2024, representing a 12.7% decrease from RMB3.1 billion for 2023. The decrease

reflects our commitment to a more selective customer acquisition approach, prioritizing higher ROI engagements. This strategy has contributed

to the overall resilience and efficiency of our business.

Net revenues from

smart devices were RMB903.7 million (US$123.8 million) for 2024, remaining stable compared to 2023.

Net revenues from

online marketing services were RMB2.0 billion (US$270.6 million) for 2024, representing a 48.3% increase from RMB1.3 billion for 2023.

The increase was mainly attributable to the increased demand for performance-based advertisements through third parties’ internet

properties, which was driven by our continued investments in cutting-edge AI technology.

Gross Profit and Gross Margin

Gross profit for

2024 was RMB2.7 billion (US$376.5 million), remaining stable compared to 2023. Gross margin for 2024 was 48.9%, compared with 51.4% for

2023.

Gross margin for

learning services was 61.4% for 2024, compared with 63.2% for 2023. The decrease was mainly due to the decline in economies of scale

as a result of the decreased revenues from learning services.

Gross margin for

smart devices was 38.7% for 2024, remaining stable compared to 2023.

Gross margin for

online marketing services increased to 36.0 % for 2024 from 31.7% for 2023. The increase was mainly attributable to improved gross margin

profile of performance-based advertisements through third parties’ internet properties compared with last year.

Operating Expenses

Total operating

expenses for 2024 were RMB2.6 billion (US$356.2 million), representing a decrease of 19.6%, compared with RMB3.2 billion for 2023.

Sales and marketing

expenses for 2024 were RMB1.9 billion (US$256.5 million), representing a decrease of 17.5%, compared with RMB2.3 billion for 2023. This

decrease was primarily attributable to the reduced marketing expenditures, as well as declined outsourcing labor service fees and payroll

related expenses in learning services.

Research and development

expenses for 2024 were RMB540.0 million (US$74.0 million), representing a decrease of 27.4%, compared with RMB743.4 million for 2023.

The decrease was primarily due to the decreased headcount for research and development employees, leading to payroll savings in 2024.

General and administrative

expenses for 2024 were RMB187.1 million (US$25.6 million), representing a decrease of 15.7%, compared with RMB222.0 million for 2023.

The decrease was primarily due to the decreased headcount for general and administrative employees, leading to payroll savings in 2024.

Income/(Loss)

from Operations

Income from operations

for 2024 was RMB148.8 million (US$20.4 million), compared with loss from operations of RMB466.3 million for 2023. The margin of income

from operations was 2.6%, compared with margin of loss from operations of 8.7% for 2023.

Net Income/(Loss)

Attributable to Youdao’s Ordinary Shareholders

Net income attributable

to Youdao’s ordinary shareholders for 2024 was RMB82.2 million (US$11.3 million), compared with net loss attributable to Youdao’s

ordinary shareholders of RMB549.9 million for 2023. Non-GAAP net income attributable to Youdao’s ordinary shareholders for 2024

was RMB104.8 million (US$14.4 million), compared with non-GAAP net loss attributable to Youdao’s ordinary shareholders of RMB475.4

million for 2023.

Basic and diluted

net income per ADS attributable to ordinary shareholders for 2024 was RMB0.70 (US$0.10), compared with basic and diluted net loss per

ADS attributable to ordinary shareholders of RMB4.53 for 2023. Non-GAAP basic and diluted net income per ADS attributable to ordinary

shareholders was RMB0.89 (US$0.12), compared with non-GAAP basic and diluted net loss per ADS attributable to ordinary shareholders of

RMB3.92 for 2023.

Operating Cash Flow

For 2024, net cash

used in operating activities was RMB67.9 million (US$9.3 million), compared with RMB438.1 million for 2023.

Share Repurchase

Program

On November 17,

2022, the Company announced that its board of directors had authorized the Company to adopt a share repurchase program in accordance

with applicable laws and regulations for up to US$20.0 million of its Class A ordinary shares (including in the form of ADSs) during

a period of up to 36 months. This amount was subsequently increased to US$40.0 million in August 2023. As of December 31, 2024, the Company

had repurchased a total of approximately 7.5 million ADSs for a total consideration of approximately US$33.8 million in the open market

under the share repurchase program.

Conference Call

Youdao’s

management team will host a teleconference call with simultaneous webcast at 5:00 a.m. Eastern Time on Thursday, February 20, 2025 (Beijing/Hong

Kong Time: 6:00 p.m., Thursday, February 20, 2025). Youdao’s management will be on the call to discuss the financial results and

answer questions.

Dial-in details

for the earnings conference call are as follows:

| United States (toll free): |

+1-888-346-8982 |

| International: |

+1-412-902-4272 |

| Mainland China (toll free): |

400-120-1203 |

| Hong Kong (toll free): |

800-905-945 |

| Hong Kong: |

+852-3018-4992 |

| Conference ID: |

6589745 |

A live and archived

webcast of the conference call will be available on the Company’s investor relations website at http://ir.youdao.com.

A replay of the

conference call will be accessible by phone one hour after the conclusion of the live call at the following numbers, until February 27,

2025:

| United States: |

+1-877-344-7529 |

| International: |

+1-412-317-0088 |

| Replay Access Code: |

6589745 |

About Youdao,

Inc.

Youdao, Inc. (NYSE:

DAO) is an intelligent learning company with industry-leading technology in China dedicated to developing and using technologies to provide

learning content, applications and solutions to users of all ages. Building on the popularity of its online knowledge tools such as Youdao

Dictionary and Youdao Translation, Youdao now offers smart devices, STEAM courses, adult and vocational courses, and education digitalization

solutions. In addition, Youdao has developed a variety of interactive learning apps. Youdao was founded in 2006 as part of NetEase, Inc.

(NASDAQ: NTES; HKEX: 9999), a leading internet technology company in China.

For

more information, please visit: http://ir.youdao.com.

Non-GAAP Measures

Youdao considers

and uses non-GAAP financial measures, such as non-GAAP net income/(loss) attributable to the Company’s ordinary shareholders and

non-GAAP basic and diluted net income/(loss) per ADS, as supplemental metrics in reviewing and assessing its operating performance and

formulating its business plan. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in accordance with accounting principles generally accepted in the United

States of America (“U.S. GAAP”).

Youdao defines

non-GAAP net income/(loss) attributable to the Company’s ordinary shareholders as net income/(loss) attributable to the Company’s

ordinary shareholders excluding share-based compensation expenses and impairment of long-term investments. Non-GAAP net income/(loss)

attributable to the Company’s ordinary shareholders enables Youdao’s management to assess its operating results without considering

the impact of these items, which are non-cash charges in nature. Youdao believes that these non-GAAP financial measures provide useful

information to investors in understanding and evaluating the Company’s current operating performance and prospects in the same

manner as management does, if they so choose.

Non-GAAP financial

measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations

as analytical tools, which possibly do not reflect all items of expense that affect our operations. In addition, the non-GAAP financial

measures Youdao uses may differ from the non-GAAP measures uses by other companies, including peer companies, and therefore their comparability

may be limited.

For more information

on these non-GAAP financial measures, please see the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results”

set forth at the end of this release.

The accompanying

table has more details on the reconciliation between our GAAP financial measures that are mostly directly comparable to non-GAAP financial

measures. Youdao encourages you to review its financial information in its entirety and not rely on a single financial measure.

Exchange Rate

Information

This announcement

contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the

reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2993 to US$1.00, the exchange rate on

December 31, 2024 set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the

RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor

Statement

This press release

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause

actual results to differ materially from those contained in any forward-looking statement. In some cases, forward-looking statements

can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“target,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,”

“continue,” “is/are likely to” or other similar expressions. The Company may also make written or oral forward-looking

statements in its reports filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Further

information regarding such risks, uncertainties or factors is included in the Company’s filings with the SEC. The announced results

of the fourth quarter and full year of 2024 are preliminary and subject to adjustments. All information provided in this press release

is as of the date of this press release, and the Company does not undertake any duty to update such information, except as required under

applicable law.

YOUDAO, INC.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(RMB and

USD in thousands)

| |

|

As of December 31, |

|

As of December 31, |

|

As of December 31, |

| |

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

USD (1) |

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

454,536 |

|

592,721 |

|

81,202 |

| Time deposits |

|

277 |

|

- |

|

- |

| Restricted cash |

|

395 |

|

3,567 |

|

489 |

| Short-term investments |

|

71,848 |

|

63,064 |

|

8,640 |

| Accounts receivable, net |

|

354,006 |

|

418,644 |

|

57,354 |

| Inventories |

|

217,067 |

|

174,741 |

|

23,939 |

| Amounts due from NetEase Group |

|

26,117 |

|

79,700 |

|

10,919 |

| Prepayment and other current assets |

|

175,705 |

|

154,331 |

|

21,143 |

| Total current assets |

|

1,299,951 |

|

1,486,768 |

|

203,686 |

| |

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

| Property, equipment and software, net |

|

70,906 |

|

46,725 |

|

6,401 |

| Operating lease right-of-use assets, net |

|

89,022 |

|

68,494 |

|

9,384 |

| Long-term investments |

|

51,396 |

|

72,380 |

|

9,916 |

| Goodwill |

|

109,944 |

|

109,944 |

|

15,062 |

| Other assets, net |

|

44,976 |

|

30,084 |

|

4,122 |

| Total non-current assets |

|

366,244 |

|

327,627 |

|

44,885 |

| |

|

|

|

|

|

|

| Total assets |

|

1,666,195 |

|

1,814,395 |

|

248,571 |

| |

|

|

|

|

|

|

| Liabilities, Mezzanine Equity and Shareholders' Deficit |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payables |

|

159,005 |

|

145,148 |

|

19,885 |

| Payroll payable |

|

282,679 |

|

264,520 |

|

36,239 |

| Amounts due to NetEase Group |

|

82,430 |

|

21,997 |

|

3,014 |

| Contract liabilities |

|

1,052,622 |

|

961,024 |

|

131,660 |

| Taxes payable |

|

52,781 |

|

37,603 |

|

5,152 |

| Accrued liabilities and other payables |

|

591,770 |

|

638,660 |

|

87,495 |

| Short-term loans from NetEase Group |

|

878,000 |

|

878,000 |

|

120,286 |

| Total current liabilities |

|

3,099,287 |

|

2,946,952 |

|

403,731 |

| |

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

| Long-term lease liabilities |

|

49,337 |

|

25,566 |

|

3,503 |

| Long-term loans from NetEase Group |

|

630,360 |

|

913,000 |

|

125,080 |

| Other non-current liabilities |

|

16,314 |

|

18,189 |

|

2,492 |

| Total non-current liabilities |

|

696,011 |

|

956,755 |

|

131,075 |

| |

|

|

|

|

|

|

| Total liabilities |

|

3,795,298 |

|

3,903,707 |

|

534,806 |

| |

|

|

|

|

|

|

| Mezzanine equity |

|

37,961 |

|

- |

|

- |

| |

|

|

|

|

|

|

| Shareholders' deficit: |

|

|

|

|

|

|

| Youdao's shareholders' deficit |

|

(2,186,736) |

|

(2,139,958) |

|

(293,173) |

| Noncontrolling interests |

|

19,672 |

|

50,646 |

|

6,938 |

| Total shareholders' deficit |

|

(2,167,064) |

|

(2,089,312) |

|

(286,235) |

| |

|

|

|

|

|

|

| Total liabilities, mezzanine equity and shareholders’ deficit |

|

1,666,195 |

|

1,814,395 |

|

248,571 |

Note

1:

The conversion

of Renminbi (RMB) into United States dollars (USD) is based on the noon buying rate of USD1.00=RMB7.2993 on the last trading day

of December (December 31, 2024) as set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

YOUDAO, INC.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(RMB and

USD in thousands, except share and per ADS data)

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

RMB |

|

USD (1) |

|

RMB |

|

RMB |

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Learning services |

|

784,012 |

|

767,859 |

|

617,673 |

|

84,621 |

|

3,148,114 |

|

2,747,290 |

| Smart devices |

|

222,407 |

|

315,305 |

|

240,444 |

|

32,941 |

|

909,192 |

|

903,669 |

| Online marketing services |

|

474,102 |

|

489,377 |

|

481,681 |

|

65,990 |

|

1,331,902 |

|

1,974,960 |

| Total net revenues |

|

1,480,521 |

|

1,572,541 |

|

1,339,798 |

|

183,552 |

|

5,389,208 |

|

5,625,919 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues (2) |

|

(741,720) |

|

(783,085) |

|

(699,045) |

|

(95,769) |

|

(2,621,746) |

|

(2,877,428) |

| Gross profit |

|

738,801 |

|

789,456 |

|

640,753 |

|

87,783 |

|

2,767,462 |

|

2,748,491 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing expenses (2) |

|

(441,399) |

|

(519,620) |

|

(381,815) |

|

(52,308) |

|

(2,268,428) |

|

(1,872,586) |

| Research and development expenses (2) |

|

(168,130) |

|

(119,594) |

|

(120,694) |

|

(16,535) |

|

(743,364) |

|

(539,998) |

| General and administrative expenses (2) |

|

(52,989) |

|

(42,968) |

|

(54,068) |

|

(7,408) |

|

(221,996) |

|

(187,086) |

| Total operating expenses |

|

(662,518) |

|

(682,182) |

|

(556,577) |

|

(76,251) |

|

(3,233,788) |

|

(2,599,670) |

| Income/(Loss) from operations |

|

76,283 |

|

107,274 |

|

84,176 |

|

11,532 |

|

(466,326) |

|

148,821 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

1,733 |

|

1,057 |

|

970 |

|

133 |

|

8,348 |

|

3,919 |

| Interest expense |

|

(18,869) |

|

(15,112) |

|

(16,828) |

|

(2,305) |

|

(69,472) |

|

(73,090) |

| Others, net |

|

(2,589) |

|

(1,992) |

|

1,594 |

|

218 |

|

(11,578) |

|

1,585 |

| Income/(Loss) before tax |

|

56,558 |

|

91,227 |

|

69,912 |

|

9,578 |

|

(539,028) |

|

81,235 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (expenses)/benefits |

|

(441) |

|

(2,370) |

|

2,386 |

|

327 |

|

(11,089) |

|

(6,009) |

| Net income/(loss) |

|

56,117 |

|

88,857 |

|

72,298 |

|

9,905 |

|

(550,117) |

|

75,226 |

| Net loss/(income) attributable to noncontrolling interests |

|

365 |

|

(2,604) |

|

10,705 |

|

1,466 |

|

182 |

|

6,987 |

| Net income/(loss) attributable to ordinary shareholders of the Company |

|

56,482 |

|

86,253 |

|

83,003 |

|

11,371 |

|

(549,935) |

|

82,213 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income/(loss) per ADS |

|

0.47 |

|

0.74 |

|

0.71 |

|

0.10 |

|

(4.53) |

|

0.70 |

| Diluted net income/(loss) per ADS |

|

0.47 |

|

0.74 |

|

0.70 |

|

0.10 |

|

(4.53) |

|

0.70 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing basic net income/(loss) per ADS |

|

119,764,891 |

|

116,965,181 |

|

117,259,091 |

|

117,259,091 |

|

121,381,857 |

|

117,426,938 |

| Shares used in computing diluted net income/(loss) per ADS |

|

120,426,624 |

|

117,343,848 |

|

118,705,233 |

|

118,705,233 |

|

121,381,857 |

|

118,173,469 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 1:

The conversion of Renminbi (RMB) into United States dollars

(USD) is based on the noon buying rate of USD1.00=RMB7.2993 on the last trading day of December (December 31, 2024) as set forth

in the H.10 statistical release of the U.S. Federal Reserve Board. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Note 2: |

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation in each category: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

(2,975) |

|

(171) |

|

1,025 |

|

140 |

|

1,645 |

|

2,359 |

| Sales and marketing expenses |

|

865 |

|

(1,359) |

|

1,069 |

|

146 |

|

6,071 |

|

1,183 |

| Research and development expenses |

|

(312) |

|

1,868 |

|

2,402 |

|

329 |

|

8,020 |

|

8,712 |

| General and administrative expenses |

|

5,224 |

|

2,072 |

|

4,285 |

|

588 |

|

15,061 |

|

10,342 |

YOUDAO, INC.

UNAUDITED

ADDITIONAL INFORMATION

(RMB and

USD in thousands)

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

RMB |

|

USD |

|

RMB |

|

RMB |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Learning services |

|

784,012 |

|

767,859 |

|

617,673 |

|

84,621 |

|

3,148,114 |

|

2,747,290 |

| Smart devices |

|

222,407 |

|

315,305 |

|

240,444 |

|

32,941 |

|

909,192 |

|

903,669 |

| Online marketing services |

|

474,102 |

|

489,377 |

|

481,681 |

|

65,990 |

|

1,331,902 |

|

1,974,960 |

| Total net revenues |

|

1,480,521 |

|

1,572,541 |

|

1,339,798 |

|

183,552 |

|

5,389,208 |

|

5,625,919 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Learning services |

|

285,383 |

|

290,877 |

|

247,059 |

|

33,847 |

|

1,159,357 |

|

1,060,177 |

| Smart devices |

|

137,150 |

|

180,390 |

|

134,896 |

|

18,481 |

|

552,810 |

|

553,620 |

| Online marketing services |

|

319,187 |

|

311,818 |

|

317,090 |

|

43,441 |

|

909,579 |

|

1,263,631 |

| Total cost of revenues |

|

741,720 |

|

783,085 |

|

699,045 |

|

95,769 |

|

2,621,746 |

|

2,877,428 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

|

|

|

|

|

|

|

|

| Learning services |

|

63.6% |

|

62.1% |

|

60.0% |

|

60.0% |

|

63.2% |

|

61.4% |

| Smart devices |

|

38.3% |

|

42.8% |

|

43.9% |

|

43.9% |

|

39.2% |

|

38.7% |

| Online marketing services |

|

32.7% |

|

36.3% |

|

34.2% |

|

34.2% |

|

31.7% |

|

36.0% |

| Total gross margin |

|

49.9% |

|

50.2% |

|

47.8% |

|

47.8% |

|

51.4% |

|

48.9% |

YOUDAO, INC.

UNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS

(RMB and

USD in thousands, except share and per ADS data)

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

RMB |

|

USD |

|

RMB |

|

RMB |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income/(loss) attributable to ordinary shareholders of the Company |

|

56,482 |

|

86,253 |

|

83,003 |

|

11,371 |

|

(549,935) |

|

82,213 |

| Add: share-based compensation |

|

2,802 |

|

2,410 |

|

8,781 |

|

1,203 |

|

30,797 |

|

22,596 |

| impairment of long-term investments |

|

10,000 |

|

- |

|

- |

|

- |

|

43,740 |

|

- |

| Non-GAAP net income/(loss) attributable to ordinary shareholders of the Company |

|

69,284 |

|

88,663 |

|

91,784 |

|

12,574 |

|

(475,398) |

|

104,809 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP basic net income/(loss) per ADS |

|

0.58 |

|

0.76 |

|

0.78 |

|

0.11 |

|

(3.92) |

|

0.89 |

| Non-GAAP diluted net income/(loss) per ADS |

|

0.58 |

|

0.76 |

|

0.77 |

|

0.11 |

|

(3.92) |

|

0.89 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP shares used in computing basic net income/(loss) per ADS |

|

119,764,891 |

|

116,965,181 |

|

117,259,091 |

|

117,259,091 |

|

121,381,857 |

|

117,426,938 |

| Non-GAAP shares used in computing diluted net income/(loss) per ADS |

|

120,426,624 |

|

117,343,848 |

|

118,705,233 |

|

118,705,233 |

|

121,381,857 |

|

118,173,469 |

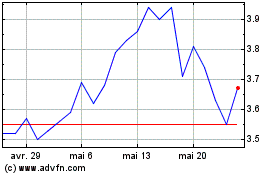

Youdao (NYSE:DAO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Youdao (NYSE:DAO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025