false

0001722438

0001722438

2023-11-07

2023-11-07

0001722438

doma:CommonStockParValue00001PerShareCustomMember

2023-11-07

2023-11-07

0001722438

doma:WarrantsToPurchaseCommonStockCustomMember

2023-11-07

2023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 7, 2023

DOMA HOLDINGS, INC.

(Exact name of Registrant, as specified in its charter)

|

Delaware

|

|

001-39754

|

|

84-1956909

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

101 Mission Street, Suite 1050

San Francisco, California 94105

(Address of principal executive offices) (Zip code)

650-419-3827

(Registrant's telephone number, including area code)

Not Applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.0001 per share

|

|

DOMA

|

|

The New York Stock Exchange

|

|

Warrants to purchase common stock

|

|

DOMAW

|

|

*

|

* The warrants are trading on the OTC Pink Marketplace under the symbol “DOMAW”.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2023, Doma Holdings, Inc. (the "Company") issued a press release announcing its financial results for the three and nine months ended September 30, 2023. The press release is furnished as Exhibit 99.1 and incorporated by reference herein.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

|

99.1*

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

*Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 7, 2023

| |

|

| |

|

|

| |

By:

|

/s/ Mike Smith

|

| |

Name:

|

Mike Smith

|

| |

Title:

|

Chief Financial Officer

|

Exhibit 99.1

Doma Reports Third Quarter 2023 Financial Results

Announces offering of groundbreaking new Upfront Title product to reduce high title costs for homeowners by up to 80%

Initial launch of Upfront Title product announced via pilot with a major mortgage software platform leader

Continues making progress towards reaching adjusted EBITDA profitability

Core Underwriting platform continues to perform well, benefitting from increased operational efficiency and significant tech upgrades

SAN FRANCISCO--(Business Wire)--November 7, 2023-- Doma Holdings, Inc. (NYSE: DOMA) (“Doma” or the “Company”), a leading force for disruptive change in the real estate industry, today reported quarterly financial results and key operating data for the three months ended September 30, 2023 (1).

Third Quarter 2023 Business Highlights (2)(3):

| |

●

|

Total revenues of $76 million, down 6% versus Q2 2023 |

| |

●

|

Retained premiums and fees of $15 million, down 7% versus Q2 2023

|

| |

●

|

Gross profit of $3 million, up 56% versus Q2 2023

|

| |

●

|

Adjusted gross profit of $6 million, up 23% versus Q2 2023

|

| |

●

|

Net loss of $22 million, compared to a net loss of $24 million in Q2 2023

|

| |

●

|

Adjusted EBITDA loss of $5 million, compared to a loss of $12 million in Q2 2023

|

“We’re pleased to announce key new details on our new strategy that will ensure our proprietary technology helps address the significant home affordability challenge facing millions of Americans today. We are launching an innovative new product, Upfront Title, which will enable Doma to move our instant underwriting decision closer to the loan underwriting decision itself, allowing lenders to significantly reduce key areas of cost and operational activity, all while providing homebuyers with more affordable title solutions,” said Max Simkoff, CEO of Doma. “We will be making our Upfront Title product available to both mortgage software platforms as well as the Government Sponsored Enterprises as soon as the end of this year. Doma’s Upfront Title will enable the lender customers of these platforms to receive near-instant title certainty at the point of deciding whether to underwrite the loan, as well as being able to provide their homeowner customers a price meaningfully below current industry standard rates for title insurance. Additionally, this configuration of our technology will help Doma shift more of our revenue toward higher-margin software licensing revenue.”

Mr. Simkoff added, “We are also excited to announce that we will be launching a pilot program with one of the largest mortgage software platforms in the country for our initial launch of Upfront Title in the mortgage software platform channel. Presently, we’re in the process of onboarding this mortgage software system partner and working towards finalizing commercial terms in advance of launching the program. Further, we’ve worked collaboratively with a major national lender on the mortgage software provider’s platform to deliver instant underwriting and title certainty, which will support the lender’s underwriting decisions in the mortgage software and enable it to offer our discounted rates to its borrowers. We believe the configuration of this new product will drive substantial growth in title insurance premium business for our underwriter as well. We anticipate being able to go live with the program by early Q1 2024, subject to agreement and documentation of final commercial terms.” (4)

“We are proud of the continued progress we’ve made towards profitability, and we were pleased to see a $2 million and $7 million sequential improvement in our net loss and adjusted EBITDA loss, respectively, this quarter,” said Mike Smith, Chief Financial Officer of Doma. “While we believe we are within striking distance of achieving our goal and expect to see continued significant improvement in our overall adjusted EBITDA in the fourth quarter, the continued degradation of the housing market means there is still risk to us achieving full quarter adjusted EBITDA profitability in Q4, and this risk will likely persist into the first quarter of 2024. Our team has worked hard to successfully execute significant cost reduction actions while still enhancing the customer service levels at our underwriter and our enterprise division, and at this point we believe our cost-cutting measures are largely behind us. Going forward we will look toward growing our revenue and expanding our margins as we seek to meet the substantial demand for lower cost title solutions.”

(1) Doma completed its business combination with Capitol Investment Corp. V ("Capitol") on July 28, 2021. The financial results and key operating data included in this third quarter release include operating results of Doma prior to completion of the business combination and operating results of the combined company subsequent to completion of the business combination.

(2) Reconciliations of retained premiums and fees, adjusted gross profit, and the other financial measures used in this press release that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) to the nearest measures prepared in accordance with GAAP have been provided in this press release in the accompanying tables. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

(3) Doma has exited the Company’s local retail operations nationwide. Local and associated operations are classified as “discontinued operations” and segregated in the Company’s financial results beginning in the third quarter ended September 30, 2023. The financial results and key operating data highlighted today reflect the continuing operations of Doma, excluding the discontinued Local and associated operations.

(4) While Doma and our initial mortgage software system partner are working towards finalizing commercial terms, there can be no assurance that the parties will be able to reach a definitive agreement in a timely manner or at all.

Non-GAAP Financial Measures

Some of the financial information and data contained in this press release, such as retained premiums and fees, adjusted gross profit and adjusted EBITDA, have not been prepared in accordance with United States generally accepted accounting principles ("GAAP"). Retained premiums and fees is defined as total revenue less premiums retained by agents. Adjusted gross profit is defined as gross profit (loss), adjusted to exclude the impact of depreciation and amortization. Adjusted EBITDA is defined as net income (loss) before interest, income taxes and depreciation and amortization, and further adjusted to exclude the impact of net loss from discontinued operations, stock-based compensation, severance and interim salary costs, goodwill impairment, long-lived asset impairment, accelerated contract expense, change in fair value of local sales deferred earnout, and the change in fair value of warrant and sponsor covered shares liabilities. Doma believes that the use of retained premiums and fees, adjusted gross profit and adjusted EBITDA provides additional tools to assess operational performance and trends in, and in comparing Doma's financial measures with, other similar companies, many of which present similar non-GAAP financial measures to investors. Doma’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial measures determined in accordance with GAAP. Because of the limitations of non-GAAP financial measures, you should consider the non-GAAP financial measures presented herein in conjunction with Doma’s financial statements and the related notes thereto. Please refer to the non-GAAP reconciliations in this press release for a reconciliation of these non-GAAP financial measures to the most comparable financial measure prepared in accordance with GAAP.

Conference Call Information

Doma will host a conference call at 5:00 PM Eastern Time today on Tuesday, November 7, to present its third quarter 2023 financial results.

Dial-in Details: To access the call by phone, please go to this link (https://edge.media-server.com/mmc/p/98xq8h9h/) and you will be provided with dial-in details. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time.

The live webcast of the call will be accessible on the Company’s website at investor.doma.com. Approximately two hours after conclusion of the live event, an archived webcast of the conference call will be accessible from the Investor Relations section of the Company’s website for twelve months.

About Doma Holdings, Inc.

Doma is a real estate technology company that is disrupting a century-old industry by building an instant and frictionless home closing experience for buyers and sellers. Doma uses proprietary machine intelligence technology and deep human expertise to create a vastly more simple and affordable experience for everyone involved in a residential real estate transaction, including current and prospective homeowners, mortgage lenders, title agents, and real estate professionals. With Doma, what used to take days can now be done in minutes, replacing an arcane and cumbersome process with a digital experience designed for today’s world. To learn more visit doma.com.

Forward-Looking Statements Legend

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "estimate," "plan," "project," "forecast," "intend," "will," "expect," "anticipate," "believe," "seek," "target" or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. The absence of these words does not mean that a statement is not forward-looking. Such statements are based on the beliefs of, as well as assumptions made by information currently available to Doma management. These forward-looking statements include, but are not limited to, statements regarding our ability to offer our technology through, and enter into commercial relationships with, mortgage software providers (including any specific partner mentioned), primary and/or secondary mortgage market participants and/or their customers, estimates and forecasts of financial and performance metrics, projections of market opportunity, total addressable market ("TAM"), market share and competition and the fact that while Doma and any specific partner mentioned are working towards finalizing commercial terms, there can be no assurance that the parties will be able to reach a definitive agreement in a timely manner or at all. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectation of Doma’s management and are not predictions of actual performance. These forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment. These statements are not guarantees of future performance and undue reliance should not be placed on them. Actual events and circumstances are difficult or impossible to predict, will differ from assumptions and are beyond the control of Doma.

These forward-looking statements are subject to a number of risks and uncertainties, including changes in business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information with respect to Doma; future global, regional or local economic, political, market and social conditions, including due to the COVID-19 pandemic; the development, effects and enforcement of laws and regulations, including with respect to the title insurance industry; Doma’s ability to manage its future growth or to develop or acquire enhancements to its platform; the effects of competition on Doma’s future business; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and those other factors described in Part I, Item 1A - “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent reports filed by Doma from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

If any of these risks materialize or Doma’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Doma does not presently know or that Doma currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Doma’s expectations, plans or forecasts of future events and views as of the date of this press release. Doma anticipates that subsequent events and developments will cause Doma’s assessments to change. However, while Doma may elect to update these forward-looking statements at some point in the future, Doma specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Doma’s assessment as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Key Operating and Financial Indicators from Continuing Operations

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited - in thousands)

|

|

|

GAAP financial data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (1)

|

|

$ |

76,240 |

|

|

$ |

97,915 |

|

|

$ |

226,331 |

|

|

$ |

311,103 |

|

|

Gross profit (2)

|

|

$ |

3,079 |

|

|

$ |

2,329 |

|

|

$ |

7,152 |

|

|

$ |

2,703 |

|

|

Net loss (3)

|

|

$ |

(22,239 |

) |

|

$ |

(38,904 |

) |

|

$ |

(77,725 |

) |

|

$ |

(121,016 |

) |

|

Non-GAAP financial data (4):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained premiums and fees

|

|

$ |

15,425 |

|

|

$ |

22,041 |

|

|

$ |

46,209 |

|

|

$ |

72,807 |

|

|

Adjusted gross profit

|

|

$ |

6,021 |

|

|

$ |

6,335 |

|

|

$ |

15,865 |

|

|

$ |

13,267 |

|

|

Ratio of adjusted gross profit to retained premiums and fees

|

|

|

39 |

% |

|

|

29 |

% |

|

|

34 |

% |

|

|

18 |

% |

|

Adjusted EBITDA

|

|

$ |

(5,277 |

) |

|

$ |

(22,435 |

) |

|

$ |

(30,203 |

) |

|

$ |

(89,192 |

) |

_________________

|

(1)

|

Revenue is comprised of (i) net premiums written, (ii) escrow, other title-related fees and other, and (iii) investment, dividend and other income.

|

|

(2)

|

Gross profit, calculated in accordance with GAAP, is calculated as total revenue, minus premiums retained by agents, direct labor expense (including mainly personnel expense for certain employees involved in the direct fulfillment of policies) and direct non-labor expense (including mainly title examination expense, provision for claims, and depreciation and amortization). In our consolidated income statements, depreciation and amortization is recorded under the “other operating expenses” caption.

|

|

(3)

|

Net loss is made up of the components of revenue and expenses.

|

|

(4)

|

Retained premiums and fees, adjusted gross profit and adjusted EBITDA are non-GAAP financial measures.

|

Non-GAAP Financial Measures

Retained premiums and fees

The following table reconciles our continuing operations retained premiums and fees to our gross profit, the most closely comparable GAAP financial measure, for the periods indicated:

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited - in thousands)

|

|

|

Revenue

|

|

$ |

76,240 |

|

|

$ |

97,915 |

|

|

$ |

226,331 |

|

|

$ |

311,103 |

|

|

Minus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premiums retained by agents

|

|

|

60,815 |

|

|

|

75,874 |

|

|

|

180,122 |

|

|

|

238,296 |

|

|

Retained premiums and fees

|

|

$ |

15,425 |

|

|

$ |

22,041 |

|

|

$ |

46,209 |

|

|

$ |

72,807 |

|

|

Minus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct labor

|

|

|

3,289 |

|

|

|

7,655 |

|

|

|

10,424 |

|

|

|

32,186 |

|

|

Provision for claims

|

|

|

3,337 |

|

|

|

4,167 |

|

|

|

11,954 |

|

|

|

13,901 |

|

|

Depreciation and amortization

|

|

|

2,942 |

|

|

|

4,006 |

|

|

|

8,713 |

|

|

|

10,564 |

|

|

Other direct costs (1)

|

|

|

2,778 |

|

|

|

3,884 |

|

|

|

7,966 |

|

|

|

13,453 |

|

|

Gross Profit

|

|

$ |

3,079 |

|

|

$ |

2,329 |

|

|

$ |

7,152 |

|

|

$ |

2,703 |

|

__________________

|

(1)

|

Includes title examination expense, office supplies, and premium and other taxes.

|

Adjusted gross profit

The following table reconciles our continuing operations adjusted gross profit to our gross profit, the most closely comparable GAAP financial measure, for the periods indicated:

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited - in thousands)

|

|

|

Gross Profit

|

|

$ |

3,079 |

|

|

$ |

2,329 |

|

|

$ |

7,152 |

|

|

$ |

2,703 |

|

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

2,942 |

|

|

|

4,006 |

|

|

|

8,713 |

|

|

|

10,564 |

|

|

Adjusted Gross Profit

|

|

$ |

6,021 |

|

|

$ |

6,335 |

|

|

$ |

15,865 |

|

|

$ |

13,267 |

|

Adjusted EBITDA

The following table reconciles our continuing operations adjusted EBITDA to our net loss, the most closely comparable GAAP financial measure, for the periods indicated:

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited - in thousands)

|

|

|

Net loss (GAAP)

|

|

$ |

(25,626 |

) |

|

$ |

(84,113 |

) |

|

$ |

(103,626 |

) |

|

$ |

(192,791 |

) |

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

2,942 |

|

|

|

4,006 |

|

|

|

8,713 |

|

|

|

10,564 |

|

|

Interest expense

|

|

|

5,495 |

|

|

|

3,575 |

|

|

|

14,487 |

|

|

|

10,331 |

|

|

Income taxes

|

|

|

154 |

|

|

|

396 |

|

|

|

466 |

|

|

|

657 |

|

|

EBITDA

|

|

$ |

(17,035 |

) |

|

$ |

(76,136 |

) |

|

$ |

(79,960 |

) |

|

$ |

(171,239 |

) |

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations, net of taxes

|

|

|

3,387 |

|

|

|

45,209 |

|

|

|

25,901 |

|

|

|

71,775 |

|

|

Stock-based compensation

|

|

|

4,659 |

|

|

|

6,858 |

|

|

|

12,485 |

|

|

|

24,107 |

|

|

Severance and interim salary costs

|

|

|

2,118 |

|

|

|

3,072 |

|

|

|

9,459 |

|

|

|

6,696 |

|

|

Long-lived asset impairment

|

|

|

972 |

|

|

|

— |

|

|

|

1,413 |

|

|

|

— |

|

|

Change in fair value of Warrant and Sponsor Covered Shares liabilities

|

|

|

(263 |

) |

|

|

(1,438 |

) |

|

|

(386 |

) |

|

|

(20,531 |

) |

|

Accelerated contract expense

|

|

|

1,268 |

|

|

|

— |

|

|

|

1,268 |

|

|

|

— |

|

|

Change in fair value of Local Sales Deferred Earnout

|

|

|

(383 |

) |

|

|

— |

|

|

|

(383 |

) |

|

|

— |

|

|

Adjusted EBITDA

|

|

$ |

(5,277 |

) |

|

$ |

(22,435 |

) |

|

$ |

(30,203 |

) |

|

$ |

(89,192 |

) |

The following table reconciles our continuing operations adjusted gross profit to our adjusted EBITDA, for the periods indicated:

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited - in thousands)

|

|

|

(Unaudited - in thousands)

|

|

|

Adjusted Gross Profit

|

|

$ |

6,021 |

|

|

$ |

6,335 |

|

|

$ |

15,865 |

|

|

$ |

13,267 |

|

|

Minus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer acquisition costs

|

|

|

1,475 |

|

|

|

4,800 |

|

|

|

5,498 |

|

|

|

16,701 |

|

|

Other indirect costs (1)

|

|

|

9,823 |

|

|

|

23,970 |

|

|

|

40,570 |

|

|

|

85,758 |

|

|

Adjusted EBITDA

|

|

$ |

(5,277 |

) |

|

$ |

(22,435 |

) |

|

$ |

(30,203 |

) |

|

$ |

(89,192 |

) |

__________________

|

(1)

|

Includes corporate support, research and development, and other operating costs.

|

Doma Holdings, Inc.

Consolidated Statements of Operations

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

|

(Unaudited - in thousands, except share and per share information)

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net premiums written (1)

|

|

$ |

73,736 |

|

|

$ |

94,488 |

|

|

$ |

219,468 |

|

|

$ |

299,080 |

|

|

Escrow, other title-related fees and other

|

|

|

844 |

|

|

|

2,674 |

|

|

|

2,606 |

|

|

|

10,340 |

|

|

Investment, dividend and other income

|

|

|

1,660 |

|

|

|

753 |

|

|

|

4,257 |

|

|

|

1,683 |

|

|

Total revenues

|

|

$ |

76,240 |

|

|

$ |

97,915 |

|

|

$ |

226,331 |

|

|

$ |

311,103 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premiums retained by agents (2)

|

|

$ |

60,815 |

|

|

$ |

75,874 |

|

|

$ |

180,122 |

|

|

$ |

238,296 |

|

|

Title examination expense

|

|

|

969 |

|

|

|

1,810 |

|

|

|

2,943 |

|

|

|

6,809 |

|

|

Provision for claims

|

|

|

3,337 |

|

|

|

4,167 |

|

|

|

11,954 |

|

|

|

13,901 |

|

|

Personnel costs

|

|

|

15,521 |

|

|

|

36,288 |

|

|

|

58,363 |

|

|

|

132,124 |

|

|

Other operating expenses

|

|

|

11,479 |

|

|

|

16,147 |

|

|

|

34,694 |

|

|

|

50,532 |

|

|

Long-lived asset impairment

|

|

|

972 |

|

|

|

— |

|

|

|

1,413 |

|

|

|

— |

|

|

Total operating expenses

|

|

$ |

93,093 |

|

|

$ |

134,286 |

|

|

$ |

289,489 |

|

|

$ |

441,662 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss from continuing operations

|

|

$ |

(16,853 |

) |

|

$ |

(36,371 |

) |

|

$ |

(63,158 |

) |

|

$ |

(130,559 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of Warrant and Sponsor Covered Shares liabilities

|

|

|

263 |

|

|

|

1,438 |

|

|

|

386 |

|

|

|

20,531 |

|

|

Interest expense

|

|

|

(5,495 |

) |

|

|

(3,575 |

) |

|

|

(14,487 |

) |

|

|

(10,331 |

) |

|

Loss from continuing operations before income taxes

|

|

$ |

(22,085 |

) |

|

$ |

(38,508 |

) |

|

$ |

(77,259 |

) |

|

$ |

(120,359 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

(154 |

) |

|

|

(396 |

) |

|

|

(466 |

) |

|

|

(657 |

) |

|

Loss from continuing operations, net of taxes

|

|

$ |

(22,239 |

) |

|

$ |

(38,904 |

) |

|

$ |

(77,725 |

) |

|

$ |

(121,016 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations, net of taxes

|

|

|

(3,387 |

) |

|

|

(45,209 |

) |

|

|

(25,901 |

) |

|

|

(71,775 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(25,626 |

) |

|

$ |

(84,113 |

) |

|

$ |

(103,626 |

) |

|

$ |

(192,791 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations per share attributable to stockholders - basic and diluted

|

|

$ |

(1.66 |

) |

|

$ |

(2.98 |

) |

|

$ |

(5.84 |

) |

|

$ |

(9.30 |

) |

|

Net loss per share attributable to stockholders - basic and diluted

|

|

$ |

(1.91 |

) |

|

$ |

(6.43 |

) |

|

$ |

(7.79 |

) |

|

$ |

(14.82 |

) |

|

Weighted average shares outstanding common stock - basic and diluted

|

|

|

13,395,010 |

|

|

|

13,072,471 |

|

|

|

13,305,428 |

|

|

|

13,008,082 |

|

__________________

|

(1)

|

Net premiums written includes revenues from a related party of $35.1 million and $34.8 million during the three months ended September 30, 2023, and 2022, respectively. Net premiums written includes revenues from a related party of $98.5 million and $96.1 million during the nine months ended September 30, 2023, and 2022, respectively. |

|

(2)

|

Premiums retained by agents includes expenses associated with a related party of $28.3 million and $27.9 million during the three months ended September 30, 2023, and 2022, respectively. Premiums retained by agents includes expenses associated with a related party of $79.5 million and $77.5 million during the nine months ended September 30, 2023, and 2022, respectively. |

Doma Holdings, Inc.

Consolidated Balance Sheets

|

(Unaudited - in thousands, except share information)

|

|

September 30, 2023

|

|

|

December 31, 2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

75,074 |

|

|

$ |

78,450 |

|

|

Restricted cash

|

|

|

5,214 |

|

|

|

2,933 |

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Fixed maturities

|

|

|

|

|

|

|

|

|

|

Held-to-maturity debt securities, at amortized cost (net of allowance for credit losses of $207 at September 30, 2023 and $440 at December 31, 2022)

|

|

|

24,243 |

|

|

|

90,328 |

|

|

Available-for-sale debt securities, at fair value (amortized cost $58,311 at September 30, 2023 and $59,191 at December 31, 2022)

|

|

|

57,327 |

|

|

|

58,254 |

|

|

Mortgage loans

|

|

|

46 |

|

|

|

297 |

|

|

Total investments

|

|

$ |

81,616 |

|

|

$ |

148,879 |

|

|

Trade and other receivables (net of allowance for credit losses of $1,601 at September 30, 2023 and $1,413 at December 31, 2022)

|

|

|

26,827 |

|

|

|

20,541 |

|

|

Prepaid expenses, deposits and other assets

|

|

|

6,843 |

|

|

|

6,687 |

|

|

Lease right-of-use assets

|

|

|

3,976 |

|

|

|

4,724 |

|

|

Fixed assets (net of accumulated depreciation of $23,937 at September 30, 2023 and $16,685 at December 31, 2022)

|

|

|

32,883 |

|

|

|

37,024 |

|

|

Title plants

|

|

|

2,716 |

|

|

|

2,716 |

|

|

Goodwill

|

|

|

23,413 |

|

|

|

23,413 |

|

|

Assets held for disposal

|

|

|

4,614 |

|

|

|

53,141 |

|

|

Total assets

|

|

$ |

263,176 |

|

|

$ |

378,508 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,464 |

|

|

$ |

2,407 |

|

|

Accrued expenses and other liabilities

|

|

|

12,385 |

|

|

|

20,139 |

|

|

Lease liabilities

|

|

|

9,038 |

|

|

|

10,793 |

|

|

Senior secured credit agreement, net of debt issuance costs and original issue discount

|

|

|

155,477 |

|

|

|

147,374 |

|

|

Liability for loss and loss adjustment expenses

|

|

|

82,515 |

|

|

|

81,873 |

|

|

Warrant liabilities

|

|

|

81 |

|

|

|

347 |

|

|

Sponsor Covered Shares liability

|

|

|

98 |

|

|

|

219 |

|

|

Liabilities held for disposal

|

|

|

12,406 |

|

|

|

33,564 |

|

|

Total liabilities

|

|

$ |

273,464 |

|

|

$ |

296,716 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Common stock, 0.0001 par value; 80,000,000 shares authorized at September 30, 2023; 13,409,543 and 13,165,919 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively

|

|

$ |

1 |

|

|

$ |

1 |

|

|

Additional paid-in capital

|

|

|

589,107 |

|

|

|

577,515 |

|

|

Accumulated deficit

|

|

|

(598,413 |

) |

|

|

(494,787 |

) |

|

Accumulated other comprehensive income

|

|

|

(983 |

) |

|

|

(937 |

) |

|

Total stockholders’ equity

|

|

$ |

(10,288 |

) |

|

$ |

81,792 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

263,176 |

|

|

$ |

378,508 |

|

Investor Contact: Dave DeHorn | Chief Strategy Officer and Interim Head of Investor Relations for Doma | ir@doma.com

SOURCE Doma Holdings, Inc.

v3.23.3

Document And Entity Information

|

Nov. 07, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DOMA HOLDINGS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 07, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39754

|

| Entity, Tax Identification Number |

84-1956909

|

| Entity, Address, Address Line One |

101 Mission Street

|

| Entity, Address, Address Line Two |

Suite 1050

|

| Entity, Address, City or Town |

San Francisco

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94105

|

| City Area Code |

650

|

| Local Phone Number |

419-3827

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001722438

|

| CommonStockParValue00001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

DOMA

|

| Security Exchange Name |

NYSE

|

| WarrantsToPurchaseCommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase common stock

|

| Trading Symbol |

DOMAW

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=doma_CommonStockParValue00001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=doma_WarrantsToPurchaseCommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

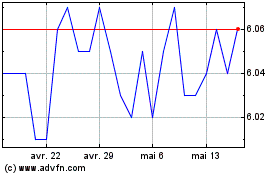

Doma (NYSE:DOMA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Doma (NYSE:DOMA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024