Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Juillet 2024 - 12:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

July 30, 2024

Commission File Number 1-15200

Equinor ASA

(Translation of registrant’s name into English)

FORUSBEEN 50, N-4035, STAVANGER, NORWAY

(Address of principal executive offices )

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

This Report on Form 6-K contains a press release issued by Equinor ASA on July 30, 2024, entitled "Equinor ASA: Share buy-back".

Equinor ASA: Share buy-back

Please see below information about transactions made under the third tranche of the 2024 share buy-back programme for Equinor ASA (OSE:EQNR, NYSE:EQNR, CEUX:EQNRO, TQEX:EQNRO).

Date on which the third tranche of the 2024 programme was announced: 24 July 2024. The duration of the third tranche of the 2024 programme: 25 July to no later than 22 October 2024.

Further information on the tranche can be found in the stock market announcement on its commencement dated 24 July 2024, available here: https://newsweb.oslobors.no/message/624015

From 25 July until 26 July 2024, Equinor ASA has purchased a total of 1,000,000 own shares at an average price of NOK 285.6493 per share.

Overview of transactions:

Date |

Trading venue |

Aggregated daily volume

(number of shares) |

Weighted average

share price (NOK) |

Total transaction

value (NOK) |

|

|

|

|

|

25 July |

OSE |

500,000 |

283.7742 |

141,887,100.00 |

|

CEUX |

|

|

|

| |

TQEX |

|

|

|

| |

|

|

|

|

| 26 July |

OSE |

500,000 |

287.5244 |

143,762,200.00 |

| |

CEUX |

|

|

|

| |

TQEX |

|

|

|

| |

|

|

|

|

Total for the period |

OSE |

1,000,000 |

285.6493 |

285,649,300.00 |

|

CEUX |

|

|

|

|

TQEX |

|

|

|

|

|

|

|

|

Previously disclosed buy-backs under the third tranche of the 2024 programme |

OSE |

|

|

|

CEUX |

|

|

|

TQEX |

|

|

|

Total |

|

|

|

|

|

|

|

|

Total buy-backs under third tranche of the 2024 programme (accumulated) |

OSE |

1,000,000 |

285.6493 |

285,649,300.00 |

CEUX |

|

|

|

TQEX |

|

|

|

Total |

1,000,000 |

285.6493 |

285,649,300.00 |

Following the completion of the above transactions, Equinor ASA owns a total of 27,482,551 own shares, corresponding to 0.98% of Equinor ASA’s share capital, including shares under Equinor’s share savings programme (excluding shares under Equinor’s share savings programme, Equinor owns a total of 19,805,579 own shares, corresponding to 0.71% of the share capital).

This is information that Equinor ASA is obliged to make public pursuant to the EU Market Abuse Regulation and that is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act.

Appendix:

A overview of all transactions made under the buy-back tranche that have been carried out during the above-mentioned time period is attached to this report and available at www.newsweb.no.

Contact details:

Investor relations

Bård Glad Pedersen, senior vice president Investor Relations,

+47 918 01 791

Media

Sissel Rinde, vice president Media Relations,

+ 47 412 60 584

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

EQUINOR ASA

(Registrant)

|

Dated: July 30, 2024 |

By: |

___/s/ Torgrim Reitan

Name: Torgrim Reitan

Title: Chief Financial Officer |

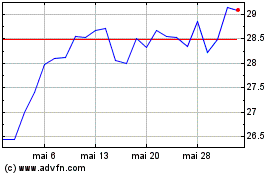

Equinor ASA (NYSE:EQNR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Equinor ASA (NYSE:EQNR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024