false000170775300017077532023-11-302023-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 30, 2023

Elastic N.V.

(Exact name of registrant as specified in its charter)

The Netherlands

(State or other jurisdiction

of incorporation)

001-38675

(Commission File Number)

98-1756035

(I.R.S. Employer

Identification Number)

Not Applicable1

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: Not Applicable1

N/A

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange of which registered |

| Ordinary Shares, €0.01 Par Value | ESTC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1 We are a distributed company. Accordingly, we do not have a principal executive office. For purposes of compliance with applicable requirements of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, any shareholder communication required to be sent to our principal executive offices may be directed to the email address ir@elastic.co.

Item 2.02. Results of Operations and Financial Condition.

On November 30, 2023, Elastic N.V. (“Elastic” or the “Company”) issued a press release announcing its financial results for its second quarter ended October 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained herein and in the accompanying exhibit are “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 30, 2023

| | | | | |

| ELASTIC N.V. |

| | |

| By: | /s/ Janesh Moorjani |

| Name: | Janesh Moorjani |

| Title: | Chief Financial Officer and Chief Operating Officer |

Elastic Reports Second Quarter Fiscal 2024 Financial Results

Q2 Revenue of $311 million, up 17% year-over-year (16% in constant currency)

Q2 Elastic Cloud Revenue of $135 million, up 31% year-over-year (30% in constant currency)

SAN FRANCISCO, Calif., Nov 30, 2023 -- Elastic (NYSE: ESTC) (“Elastic”), the company behind Elasticsearch®, announced financial results for its second quarter of fiscal 2024 ended October 31, 2023.

Second Quarter Fiscal 2024 Financial Highlights

•Total revenue was $311 million, an increase of 17% year-over-year, or 16% on a constant currency basis

•Elastic Cloud revenue was $135 million, an increase of 31% year-over-year, or 30% on a constant currency basis

•GAAP operating loss was $22 million; GAAP operating margin was -7%

•Non-GAAP operating income was $41 million; non-GAAP operating margin was 13%

•GAAP net loss per share was $0.25; non-GAAP diluted earnings per share was $0.37

•Operating cash flow was -$2 million with adjusted free cash flow of -$3 million

•Cash, cash equivalents, and marketable securities were $966 million as of October 31, 2023

“We exceeded our expectations across both revenue and non-GAAP operating margin,” said Ash Kulkarni, CEO, Elastic. “Our thoughtful investments and innovation in AI has continued to drive customer excitement and engagement with Elastic, and this was visible in our business in Q2. Generative AI is driving a resurgence of interest in search as customers use semantic search, vector search, and hybrid search to ground large language models with their private business context, and Elasticsearch Relevance Engine provides the most comprehensive and enterprise-ready platform for these use cases.”

Second Quarter Fiscal 2024 Key Metrics and Recent Business Highlights

Key Customer Metrics

•Total subscription customer count was approximately 20,700 compared to approximately 20,500 in Q1 FY24, and over 19,700 in Q2 FY23

•Total customer count with Annual Contract Value (ACV) greater than $100,000 was over 1,220 compared to over 1,190 in Q1 FY24, and over 1,050 in Q2 FY23

•Net Expansion Rate was approximately 110%

Product Innovations and Updates

•Announced general availability of the updated Elastic Learned Sparse EncodeR (ELSER), a retrieval model trained by Elastic that enables customers to retrieve more relevant search results using semantic search

•Introduced Elasticsearch Query Language (ES|QL), a new piped query language designed to enable site reliability engineers (SREs), developers and security professionals to perform data aggregation and analysis across a variety of data sources from a single query

•Launched Universal Profiling into general availability for Elastic Observability, adding a new signal while eliminating the need for code instrumentation, recompilation, on-host debug symbols, or service restarts

•Collaborated with LangChain to deliver a set of reference architectures to build production-ready generative AI applications

•Delivered several updates to vector database capabilities to expand our use cases and support dense vectors with up to 4K dimensions, higher than what embedding models require

•Delivered Cloud Security Posture Management for Google Cloud, so customers can use Elastic to secure their workloads on Google Cloud

•Provided out of the box integrations with Wiz and Palo Alto Prisma Cloud to make it easier to get a view of the entire threat landscape in the Elastic platform

Other Business Highlights

•Acquired Opster, the creators of AutoOps, a platform for monitoring, managing and troubleshooting Elasticsearch and OpenSearch

•Signed a new global Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to accelerate the integration of Amazon Bedrock into the Elastic AI Assistant

•Recognized as a Leader in the IDC MarketScape: Worldwide General-Purpose Knowledge Discovery Software 2023 Vendor Assessment (doc #US49988523, October 2023)

•Published the second annual Elastic Global Threat Report, which reveals several trends on the expansion and diversification of ransomware

•Elected Paul Auvil to the Elastic Board of Directors and as Audit Committee Chair. Mr. Auvil brings more than 35 years of finance, technology, and corporate leadership experience to Elastic

Financial Outlook

The Company is providing the following guidance:

For the third quarter of fiscal 2024 (ending January 31, 2024):

•Total revenue is expected to be between $319 million and $321 million, representing 17% year-over-year growth at the midpoint (16% year-over-year constant currency growth at the midpoint)

•Non-GAAP operating margin is expected to be between 11.5% and 12.0%

•Non-GAAP earnings per share is expected to be between $0.30 and $0.32, assuming between 103.0 million and 104.0 million diluted weighted average ordinary shares outstanding

For fiscal 2024 (ending April 30, 2024):

•Total revenue is expected to be between $1.247 billion and $1.253 billion, representing 17% year-over-year growth at the midpoint (16% year-over-year constant currency growth at the midpoint)

•Non-GAAP operating margin is expected to be between 10.25% and 10.75%

•Non-GAAP earnings per share is expected to be between $1.06 and $1.15, assuming between 102.0 million and 104.0 million diluted weighted average ordinary shares outstanding

The guidance assumes, among others, the following exchange rates: 1 Euro = 1.089 US Dollars; and 1 Great British Pound = 1.249 US Dollars.

See the section titled “Forward-Looking Statements” below for information on the factors that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. We present historical and forward-looking non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section entitled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of these non-GAAP measures. A reconciliation of forward-looking non-GAAP measures to the corresponding GAAP measures for operating margin and net loss per share is not available without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of the costs and expenses that may be incurred in the future. These items necessary to reconcile such non-GAAP measures could be material and have a significant impact on the Company’s results computed in accordance with GAAP.

Conference Call and Webcast

Elastic’s executive management team will host a conference call today at 2:00 p.m. PT/5:00 p.m. ET to discuss the Company’s financial results and business outlook. A live audio webcast of the conference call will be available through Elastic’s Investor Relations website at ir.elastic.co. A presentation containing financial and operating information will be available at the same website. The replay of the webcast will also be available on the investor relations website.

About Elastic

Elastic (NYSE: ESTC) is a leading platform for search-powered solutions. Elastic understands it’s the answers, not just the data. The Elasticsearch platform enables anyone to find the answers they need in real-time using all their data, at scale. Elastic delivers complete, cloud-based, AI-powered solutions for enterprise security, observability and search built on the Elasticsearch platform, the development platform used by thousands of companies, including more than 50% of the Fortune 500. Learn more at elastic.co.

Elastic and associated marks are trademarks or registered trademarks of Elastic N.V. and its subsidiaries. All other company and product names may be trademarks of their respective owners.

Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties, which include, but are not limited to, statements regarding our expected financial results for the fiscal quarter ending January 31, 2024, and the fiscal year ending April 30, 2024, the expected performance or benefits of our offerings, and expected market opportunities. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements due to uncertainties, risks, and changes in circumstances, including but not limited to those related to: our future financial performance, including our expectations regarding our revenue, cost of revenue, gross profit or gross margin, operating expenses (which include changes in sales and marketing, research and development and general and administrative expenses), and our ability to achieve and maintain future profitability; our ability to continue to deliver and improve our offerings and develop new offerings (including innovations around AI use cases); customer acceptance and purchase of our new and existing offerings; the expansion and adoption of our Elastic Cloud offerings; our ability to realize value from investments in the business; our ability to maintain and expand our user and customer base; the impact of the evolving macroeconomic and geopolitical environments on our business, operations, hiring and financial results, and on businesses and spending priorities of our customers and partners; the impact of our pricing model strategies on our business; the impact of foreign currency exchange rate fluctuations and the uncertain inflation and interest rate environment on our results; our international expansion strategy; our operating results and cash flows; the sufficiency of our capital resources; our ability to successfully execute our go-to-market strategy, our forecasts regarding our business; and general market, political, economic and business conditions.

Any additional or unforeseen effect from the evolving macroeconomic and geopolitical environments may exacerbate these risks. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those expressed or implied in our forward-looking statements are included in our filings with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the fiscal year ended April 30, 2023 and subsequent reports filed with the SEC. SEC filings are available on the Investor Relations section of Elastic’s website at ir.elastic.co and the SEC’s website at www.sec.gov. Elastic assumes no obligation to, and does not currently intend to, update any such forward-looking statements, except as required by law.

Statement Regarding Use of Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S. GAAP, we believe the non-GAAP measures listed below are useful in evaluating our operating performance. We use these non-GAAP financial measures to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Investors are cautioned that there are a number of limitations associated with the use of non-GAAP financial measures and key metrics as analytical tools. Investors are encouraged to review the differences between GAAP financial measures and the corresponding non-GAAP financial measures, and not to rely on any single financial measure to evaluate our business.

Reconciliations of historical GAAP financial measures to their respective historical non-GAAP financial measures are included below. In relation to constant currency non-GAAP financial measures, the only reconciling item between GAAP financial measures and non-GAAP financial measures is the effect of foreign currency rate fluctuations. Further details on how we calculate such effects can be found in the definition of “Constant Currency” below.

Non-GAAP Gross Profit and Non-GAAP Gross Margin

We define non-GAAP gross profit and non-GAAP gross margin as GAAP gross profit and GAAP gross margin, respectively, excluding stock-based compensation expense and related employer taxes and amortization of acquired intangible assets. We believe non-GAAP gross profit and non-GAAP gross margin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations, as these metrics generally eliminate the effects of certain variables from period to period for reasons unrelated to overall operating performance.

Non-GAAP Operating Income and Non-GAAP Operating Margin

We define non-GAAP operating income and non-GAAP operating margin as GAAP operating loss and GAAP operating margin, respectively, excluding stock-based compensation expense and related employer taxes, amortization of acquired intangible assets, acquisition-related expenses, and restructuring and other related charges. We believe non-GAAP operating income and non-GAAP operating margin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations, as these metrics generally eliminate the effects of certain variables from period to period for reasons unrelated to overall operating performance.

Non-GAAP Earnings Per Share

We define non-GAAP earnings per share as GAAP net loss per share, excluding stock-based compensation expense and related employer taxes, amortization of acquired intangible assets, acquisition-related expenses, restructuring and other related charges, and the tax effects related to the foregoing. We believe non-GAAP earnings per share provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this metric generally eliminates the effects of certain variables from period to period for reasons unrelated to overall operating performance.

Adjusted Free Cash Flow and Adjusted Free Cash Flow Margin

Adjusted free cash flow is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities adjusted for cash paid for interest less cash used for investing activities for purchases of property and equipment. Adjusted free cash flow margin is calculated as adjusted free cash flow divided by total revenue. Adjusted free cash flow does not represent residual cash flow available for discretionary expenditures since, among other things, we have mandatory debt service requirements.

Constant Currency

We compare the percent change in certain results from one period to another period using constant currency information to provide a framework for assessing how our business performed excluding the effect of foreign currency rate fluctuations. In presenting this information, current and comparative prior period results are converted into United States dollars at the exchange rates in effect on the last day of our prior fiscal year, rather than the actual exchange rates in effect during the respective periods.

Contact Information

Anthony Luscri

Elastic Investor Relations

ir@elastic.co

Madge Miller

Elastic Corporate Communications

PR-Team@elastic.co

Elastic N.V.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, | | Six Months Ended October 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Subscription | $ | 287,743 | | | $ | 241,211 | | | $ | 557,990 | | | $ | 473,025 | |

| Services | 22,869 | | | 23,190 | | | 46,375 | | | 41,457 | |

| Total revenue | 310,612 | | | 264,401 | | | 604,365 | | | 514,482 | |

| Cost of revenue | | | | | | | |

| Subscription | 59,996 | | | 55,101 | | | 117,262 | | | 108,652 | |

| Services | 20,093 | | | 19,656 | | | 40,304 | | | 39,084 | |

| Total cost of revenue | 80,089 | | | 74,757 | | | 157,566 | | | 147,736 | |

| Gross profit | 230,523 | | | 189,644 | | | 446,799 | | | 366,746 | |

| Operating expenses | | | | | | | |

| Research and development | 80,108 | | | 75,568 | | | 160,798 | | | 154,217 | |

| Sales and marketing | 133,230 | | | 128,179 | | | 266,399 | | | 253,185 | |

| General and administrative | 38,695 | | | 34,925 | | | 76,634 | | | 69,013 | |

| Restructuring and other related charges | 29 | | | — | | | 754 | | | — | |

| Total operating expenses | 252,062 | | | 238,672 | | | 504,585 | | | 476,415 | |

| Operating loss | (21,539) | | | (49,028) | | | (57,786) | | | (109,669) | |

| Other income, net | | | | | | | |

| Interest expense | (6,349) | | | (6,209) | | | (12,655) | | | (12,610) | |

| Other income, net | 8,239 | | | 14,975 | | | 15,539 | | | 15,314 | |

| Loss before income taxes | (19,649) | | | (40,262) | | | (54,902) | | | (106,965) | |

| Provision for income taxes | 5,147 | | | 7,043 | | | 18,402 | | | 9,891 | |

| Net loss | $ | (24,796) | | | $ | (47,305) | | | $ | (73,304) | | | $ | (116,856) | |

| Net loss per share attributable to ordinary shareholders, basic and diluted | $ | (0.25) | | | $ | (0.50) | | | $ | (0.74) | | | $ | (1.23) | |

| Weighted-average shares used to compute net loss per share attributable to ordinary shareholders, basic and diluted | 99,073,401 | | | 95,307,146 | | | 98,507,725 | | | 94,964,423 | |

Elastic N.V.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| As of

October 31, 2023 | | As of

April 30, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 589,685 | | | $ | 644,167 | |

| Restricted cash | 2,807 | | | 2,473 | |

| Marketable securities | 376,674 | | | 271,041 | |

| Accounts receivable, net of allowance for credit losses of $3,569 and $3,409 as of October 31, 2023 and April 30, 2023, respectively | 232,250 | | | 260,919 | |

| Deferred contract acquisition costs | 62,733 | | | 55,813 | |

| Prepaid expenses and other current assets | 37,620 | | | 39,867 | |

| Total current assets | 1,301,769 | | | 1,274,280 | |

| Property and equipment, net | 4,996 | | | 5,092 | |

| Goodwill | 303,494 | | | 303,642 | |

| Operating lease right-of-use assets | 18,236 | | | 19,997 | |

| Intangible assets, net | 21,008 | | | 29,104 | |

| Deferred contract acquisition costs, non-current | 95,627 | | | 95,879 | |

| Deferred tax assets | 6,824 | | | 7,412 | |

| Other assets | 5,892 | | | 8,076 | |

| Total assets | $ | 1,757,846 | | | $ | 1,743,482 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 35,382 | | | $ | 35,151 | |

| Accrued expenses and other liabilities | 63,873 | | | 63,532 | |

| Accrued compensation and benefits | 65,407 | | | 76,483 | |

| Operating lease liabilities | 11,588 | | | 12,749 | |

| Deferred revenue | 510,981 | | | 528,704 | |

| Total current liabilities | 687,231 | | | 716,619 | |

| Deferred revenue, non-current | 25,096 | | | 34,248 | |

| Long-term debt, net | 568,072 | | | 567,543 | |

| Operating lease liabilities, non-current | 12,160 | | | 13,942 | |

| Other liabilities, non-current | 10,151 | | | 12,233 | |

| Total liabilities | 1,302,710 | | | 1,344,585 | |

| Shareholders’ equity: | | | |

| Preference shares, €0.01 par value; 165,000,000 shares authorized, 0 shares issued and outstanding as of October 31, 2023 and April 30, 2023 | — | | | — | |

| Ordinary shares, par value €0.01 per share: 165,000,000 shares authorized; 99,599,262 shares issued and outstanding as of October 31, 2023 and 97,366,947 shares issued and outstanding as of April 30, 2023 | 1,048 | | | 1,024 | |

| Treasury stock | (369) | | | (369) | |

| Additional paid-in capital | 1,604,896 | | | 1,471,584 | |

| Accumulated other comprehensive loss | (23,808) | | | (20,015) | |

| Accumulated deficit | (1,126,631) | | | (1,053,327) | |

| Total shareholders’ equity | 455,136 | | | 398,897 | |

| Total liabilities and shareholders’ equity | $ | 1,757,846 | | | $ | 1,743,482 | |

Elastic N.V.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, | | Six Months Ended October 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | | | |

| Net loss | $ | (24,796) | | | $ | (47,305) | | | $ | (73,304) | | | $ | (116,856) | |

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and amortization | 4,728 | | | 5,216 | | | 9,781 | | | 10,430 | |

| Amortization of discounts or premiums on marketable securities | (1,178) | | | — | | | (3,646) | | | — | |

| Amortization of deferred contract acquisition costs | 18,380 | | | 18,230 | | | 35,952 | | | 35,674 | |

| Amortization of debt issuance costs | 266 | | | 254 | | | 529 | | | 506 | |

| Non-cash operating lease cost | 2,618 | | | 2,644 | | | 5,270 | | | 5,649 | |

| Stock-based compensation expense | 56,455 | | | 47,287 | | | 113,582 | | | 94,170 | |

| Deferred income taxes | 35 | | | (747) | | | 427 | | | (80) | |

| Foreign currency transaction (gain) loss | (778) | | | (1,731) | | | 422 | | | 48 | |

| Other | 16 | | | 45 | | | (18) | | | 67 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable, net | (48,899) | | | (20,798) | | | 26,972 | | | 25,193 | |

| Deferred contract acquisition costs | (22,276) | | | (23,893) | | | (43,421) | | | (43,569) | |

| Prepaid expenses and other current assets | (2,753) | | | 3,180 | | | 2,143 | | | 7,909 | |

| Other assets | 876 | | | 2,695 | | | 1,556 | | | 4,809 | |

| Accounts payable | 19,351 | | | 2,447 | | | 118 | | | 12,320 | |

| Accrued expenses and other liabilities | (982) | | | 15,096 | | | (1,393) | | | (1,645) | |

| Accrued compensation and benefits | (6,888) | | | 5,574 | | | (10,773) | | | (5,947) | |

| Operating lease liabilities | (3,094) | | | (2,369) | | | (6,194) | | | (5,573) | |

| Deferred revenue | 6,532 | | | 4,817 | | | (22,578) | | | (22,168) | |

| Net cash provided by (used in) operating activities | (2,387) | | | 10,642 | | | 35,425 | | | 937 | |

| Cash flows from investing activities | | | | | | | |

| Purchases of property and equipment | (896) | | | (343) | | | (1,528) | | | (822) | |

| Purchases of marketable securities | (94,722) | | | — | | | (178,301) | | | — | |

| Maturities of marketable securities | 46,176 | | | — | | | 75,292 | | | — | |

| | | | | | | |

| Net cash used in investing activities | (49,442) | | | (343) | | | (104,537) | | | (822) | |

| Cash flows from financing activities | | | | | | | |

| Proceeds from issuance of ordinary shares under employee stock purchase plan | 9,111 | | | — | | | 9,111 | | | — | |

| Proceeds from issuance of ordinary shares upon exercise of stock options | 6,800 | | | 4,327 | | | 10,643 | | | 7,724 | |

| Net cash provided by financing activities | 15,911 | | | 4,327 | | | 19,754 | | | 7,724 | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (4,832) | | | (7,152) | | | (4,790) | | | (12,854) | |

| Net decrease in cash, cash equivalents, and restricted cash | (40,750) | | | 7,474 | | | (54,148) | | | (5,015) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 633,242 | | | 851,148 | | | 646,640 | | | 863,637 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 592,492 | | | $ | 858,622 | | | $ | 592,492 | | | $ | 858,622 | |

Elastic N.V.

Revenue by Type

(in thousands, except percentages)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | Six Months Ended October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Amount | | % of

Total

Revenue | | Amount | | % of

Total

Revenue | | Amount | | % of

Total

Revenue | | Amount | | % of

Total

Revenue |

| Elastic Cloud | $ | 134,989 | | | 43 | % | | $ | 103,237 | | | 39 | % | | $ | 256,161 | | | 42 | % | | $ | 200,966 | | | 39 | % |

| Other subscription | 152,754 | | | 50 | % | | 137,974 | | | 52 | % | | 301,829 | | | 50 | % | | 272,059 | | | 53 | % |

| Total subscription | 287,743 | | | 93 | % | | 241,211 | | | 91 | % | | 557,990 | | | 92 | % | | 473,025 | | | 92 | % |

| Services | 22,869 | | | 7 | % | | 23,190 | | | 9 | % | | 46,375 | | | 8 | % | | 41,457 | | | 8 | % |

| Total revenue | $ | 310,612 | | | 100 | % | | $ | 264,401 | | | 100 | % | | $ | 604,365 | | | 100 | % | | $ | 514,482 | | | 100 | % |

Elastic N.V.

Reconciliation of GAAP to Non-GAAP Data

Supplementary Information

(in thousands, except percentages)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | Three Months Ended

October 31, 2023 | | % Change Year Over Year | | % Change

Year Over Year Excluding Currency Changes | | % Change Quarter Over Quarter | | % Change

Quarter Over Quarter Excluding Currency Changes |

| Revenue | | | | | | | | | |

| Elastic Cloud | $ | 134,989 | | | 31% | | 30% | | 11% | | 11% |

| Other subscription | $ | 152,754 | | | 11% | | 9% | | 2% | | 3% |

| Total subscription | $ | 287,743 | | | 19% | | 18% | | 6% | | 7% |

| Total revenue | $ | 310,612 | | | 17% | | 16% | | 6% | | 6% |

| Total deferred revenue | $ | 536,077 | | | 24% | | 22% | | —% | | 1% |

| Total remaining performance obligations | $ | 1,117,496 | | | 24% | | 21% | | —% | | 1% |

| | | | | | | | | | | | | | | | | |

| |

| | Six Months Ended

October 31, 2023 | | % Change Year Over Year | | % Change

Year Over Year Excluding Currency Changes |

| Revenue | | | | | |

| Elastic Cloud | $ | 256,161 | | | 27% | | 27% |

| Other subscription | $ | 301,829 | | | 11% | | 10% |

| Total subscription | $ | 557,990 | | | 18% | | 17% |

| Total revenue | $ | 604,365 | | | 17% | | 17% |

Elastic N.V.

Reconciliation of GAAP to Non-GAAP Data

Adjusted Free Cash Flow

(in thousands, except percentages)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, | | Six Months Ended October 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by (used in) operating activities | $ | (2,387) | | | $ | 10,642 | | | $ | 35,425 | | | $ | 937 | |

| Less: Purchases of property and equipment | (896) | | | (343) | | | (1,528) | | | (822) | |

| Add: Interest paid on long-term debt | — | | | — | | | 11,859 | | | 11,859 | |

Adjusted free cash flow (1) | $ | (3,283) | | | $ | 10,299 | | | $ | 45,756 | | | $ | 11,974 | |

| Net cash used in investing activities | $ | (49,442) | | | $ | (343) | | | $ | (104,537) | | | $ | (822) | |

| Net cash provided by financing activities | $ | 15,911 | | | $ | 4,327 | | | $ | 19,754 | | | $ | 7,724 | |

| Net cash provided by (used in) operating activities (as a percentage of total revenue) | (1) | % | | 4 | % | | 6 | % | | — | % |

| Less: Purchases of property and equipment (as a percentage of total revenue) | — | % | | — | % | | — | % | | — | % |

| Add: Interest paid on long-term debt (as a percentage of total revenue) | — | % | | — | % | | 2 | % | | 2 | % |

| Adjusted free cash flow margin | (1) | % | | 4 | % | | 8 | % | | 2 | % |

(1) Adjusted free cash flow includes less than $0.1 million and $0.8 million of cash paid for restructuring and other charges during the three and six months ended October 31, 2023.

Elastic N.V.

Reconciliation of GAAP to Non-GAAP Data

(in thousands, except percentages, share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, | | Six Months Ended October 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Gross Profit Reconciliation: | | | | | | | |

| GAAP gross profit | $ | 230,523 | | | $ | 189,644 | | | $ | 446,799 | | | $ | 366,746 | |

| Stock-based compensation expense and related employer taxes | 5,187 | | | 4,425 | | | 10,581 | | | 9,177 | |

| Amortization of acquired intangibles | 2,977 | | | 2,961 | | | 5,953 | | | 5,925 | |

| Non-GAAP gross profit | $ | 238,687 | | | $ | 197,030 | | | $ | 463,333 | | | $ | 381,848 | |

Gross Margin Reconciliation(1): | | | | | | | |

| GAAP gross margin | 74.2 | % | | 71.7 | % | | 73.9 | % | | 71.3 | % |

| Stock-based compensation expense and related employer taxes | 1.7 | % | | 1.6 | % | | 1.8 | % | | 1.8 | % |

| Amortization of acquired intangibles | 1.0 | % | | 1.1 | % | | 1.0 | % | | 1.2 | % |

| Non-GAAP gross margin | 76.8 | % | | 74.5 | % | | 76.7 | % | | 74.2 | % |

| Operating Income Reconciliation: | | | | | | | |

| GAAP operating loss | $ | (21,539) | | | $ | (49,028) | | | $ | (57,786) | | | $ | (109,669) | |

| Stock-based compensation expense and related employer taxes | 58,103 | | | 48,087 | | | 117,717 | | | 97,352 | |

| Amortization of acquired intangibles | 3,888 | | | 4,193 | | | 8,096 | | | 8,388 | |

| Acquisition-related expenses | 778 | | | 1,684 | | | 1,558 | | | 4,201 | |

| Restructuring and other related charges | 29 | | | — | | | 754 | | | — | |

| Non-GAAP operating income | $ | 41,259 | | | $ | 4,936 | | | $ | 70,339 | | | $ | 272 | |

Operating Margin Reconciliation(1): | | | | | | | |

| GAAP operating margin | (6.9) | % | | (18.5) | % | | (9.6) | % | | (21.3) | % |

| Stock-based compensation expense and related employer taxes | 18.7 | % | | 18.2 | % | | 19.5 | % | | 18.9 | % |

| Amortization of acquired intangibles | 1.3 | % | | 1.6 | % | | 1.3 | % | | 1.6 | % |

| Acquisition-related expenses | 0.3 | % | | 0.6 | % | | 0.3 | % | | 0.8 | % |

| Restructuring and other related charges | — | % | | — | % | | — | % | | — | % |

| Non-GAAP operating margin | 13.3 | % | | 1.9 | % | | 11.6 | % | | 0.1 | % |

| Net Income (Loss) Reconciliation: | | | | | | | |

| GAAP net loss | $ | (24,796) | | | $ | (47,305) | | | $ | (73,304) | | | $ | (116,856) | |

| Stock-based compensation expense and related employer taxes | 58,103 | | | 48,087 | | | 117,717 | | | 97,352 | |

| Amortization of acquired intangibles | 3,888 | | | 4,193 | | | 8,096 | | | 8,388 | |

| Acquisition-related expenses | 778 | | | 1,684 | | | 1,558 | | | 4,201 | |

| Restructuring and other related charges | 29 | | | — | | | 754 | | | — | |

| Litigation settlement | — | | | (10,150) | | | — | | | (10,150) | |

Income tax(2) | 183 | | | 3,676 | | | 8,768 | | | 3,528 | |

| Non-GAAP net income (loss) | $ | 38,185 | | | $ | 185 | | | $ | 63,589 | | | $ | (13,537) | |

Non-GAAP earnings (loss) per share attributable to ordinary shareholders, basic(1) | $ | 0.39 | | | $ | — | | | $ | 0.65 | | | $ | (0.14) | |

Non-GAAP earnings (loss) per share attributable to ordinary shareholders, diluted(1) | $ | 0.37 | | | $ | — | | | $ | 0.62 | | | $ | (0.14) | |

| Weighted-average shares used to compute earnings (loss) per share attributable to ordinary shareholders, basic | 99,073,401 | | | 95,307,146 | | | 98,507,725 | | | 94,964,423 | |

| Weighted-average shares used to compute earnings (loss) per share attributable to ordinary shareholders, diluted | 102,493,070 | | | 98,764,660 | | | 102,066,719 | | | 94,964,423 | |

(1) Totals may not sum, due to rounding. Gross margin, operating margin, and earnings (loss) per share are calculated based upon the respective underlying, non-rounded data.

(2) Non-GAAP financial information for the quarter is adjusted for a tax rate equal to our annual estimated tax rate on non-GAAP income. This rate is based on our estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating the non-GAAP financial measures presented above as well as other significant tax adjustments. Our estimated tax rate on non-GAAP income is determined annually and may be adjusted during the year to take into account events or trends that we believe materially impact the estimated annual rate including, but not limited to, significant changes resulting from tax legislation, material changes in the geographic mix of revenue and expenses and other significant events. Due to the differences in the tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to our estimated annual tax rates as described above, our estimated tax rate on non-GAAP income may differ from our GAAP tax rate and from our actual tax liabilities.

Elastic N.V.

Reconciliation of GAAP to Non-GAAP Data

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, | | Six Months Ended October 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue reconciliation: | | | | | | | |

| GAAP subscription | $ | 59,996 | | | $ | 55,101 | | | $ | 117,262 | | | $ | 108,652 | |

| Stock-based compensation expense and related employer taxes | (2,208) | | | (2,059) | | | (4,589) | | | (4,442) | |

| Amortization of acquired intangibles | (2,977) | | | (2,961) | | | (5,953) | | | (5,925) | |

| Non-GAAP subscription | $ | 54,811 | | | $ | 50,081 | | | $ | 106,720 | | | $ | 98,285 | |

| GAAP services | $ | 20,093 | | | $ | 19,656 | | | $ | 40,304 | | | $ | 39,084 | |

| Stock-based compensation expense and related employer taxes | (2,979) | | | (2,366) | | | (5,992) | | | (4,735) | |

| Non-GAAP services | $ | 17,114 | | | $ | 17,290 | | | $ | 34,312 | | | $ | 34,349 | |

| Operating expenses reconciliation: | | | | | | | |

| GAAP research and development expense | $ | 80,108 | | | $ | 75,568 | | | $ | 160,798 | | | $ | 154,217 | |

| Stock-based compensation expense and related employer taxes | (22,562) | | | (19,086) | | | (45,967) | | | (38,758) | |

| Acquisition-related expenses | (395) | | | (1,684) | | | (1,175) | | | (4,164) | |

| Non-GAAP research and development expense | $ | 57,151 | | | $ | 54,798 | | | $ | 113,656 | | | $ | 111,295 | |

| GAAP sales and marketing expense | $ | 133,230 | | | $ | 128,179 | | | $ | 266,399 | | | $ | 253,185 | |

| Stock-based compensation expense and related employer taxes | (18,730) | | | (16,279) | | | (38,399) | | | (32,701) | |

| Amortization of acquired intangibles | (911) | | | (1,232) | | | (2,143) | | | (2,463) | |

| Non-GAAP sales and marketing expenses | $ | 113,589 | | | $ | 110,668 | | | $ | 225,857 | | | $ | 218,021 | |

| GAAP general and administrative expense | $ | 38,695 | | | $ | 34,925 | | | $ | 76,634 | | | $ | 69,013 | |

| Stock-based compensation expense and related employer taxes | (11,624) | | | (8,297) | | | (22,770) | | | (16,716) | |

| Acquisition-related expenses | (383) | | | — | | | (383) | | | (37) | |

| Non-GAAP general and administrative expense | $ | 26,688 | | | $ | 26,628 | | | $ | 53,481 | | | $ | 52,260 | |

| | | | | | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

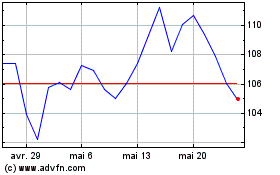

Elastic NV (NYSE:ESTC)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Elastic NV (NYSE:ESTC)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024