Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Novembre 2024 - 5:32PM

Edgar (US Regulatory)

Eaton Vance

Risk-Managed Diversified Equity

Income Fund

September 30, 2024

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 1.2%

|

| HEICO Corp.(1)

|

| 30,602

| $ 8,001,811

|

|

|

|

| $ 8,001,811

|

| Biotechnology — 2.3%

|

| AbbVie, Inc.(1)

|

| 76,767

| $ 15,159,947

|

|

|

|

| $ 15,159,947

|

| Broadline Retail — 4.8%

|

| Amazon.com, Inc.(1)(2)

|

| 168,175

| $ 31,336,048

|

|

|

|

| $ 31,336,048

|

| Capital Markets — 7.2%

|

| Blue Owl Capital, Inc.(1)

|

| 443,088

| $ 8,578,184

|

| Intercontinental Exchange, Inc.(1)

|

| 59,133

| 9,499,125

|

| S&P Global, Inc.(1)

|

| 20,734

| 10,711,599

|

| Stifel Financial Corp.(1)

|

| 80,411

| 7,550,593

|

| Tradeweb Markets, Inc., Class A(1)

|

| 83,837

| 10,368,122

|

|

|

|

| $ 46,707,623

|

| Chemicals — 1.1%

|

| Linde PLC(1)

|

| 14,265

| $ 6,802,408

|

|

|

|

| $ 6,802,408

|

| Commercial Services & Supplies — 1.1%

|

| Waste Management, Inc.(1)

|

| 35,432

| $ 7,355,683

|

|

|

|

| $ 7,355,683

|

| Consumer Staples Distribution & Retail — 3.3%

|

| BJ's Wholesale Club Holdings, Inc.(1)(2)

|

| 93,281

| $ 7,693,817

|

| Walmart, Inc.(1)

|

| 172,480

| 13,927,760

|

|

|

|

| $ 21,621,577

|

| Containers & Packaging — 1.1%

|

| AptarGroup, Inc.(1)

|

| 43,120

| $ 6,907,393

|

|

|

|

| $ 6,907,393

|

| Electric Utilities — 1.5%

|

| NextEra Energy, Inc.(1)

|

| 111,270

| $ 9,405,653

|

|

|

|

| $ 9,405,653

|

| Security

| Shares

| Value

|

| Electrical Equipment — 1.6%

|

| AMETEK, Inc.(1)

|

| 59,996

| $ 10,301,913

|

|

|

|

| $ 10,301,913

|

| Entertainment — 2.0%

|

| Netflix, Inc.(1)(2)

|

| 14,899

| $ 10,567,414

|

| Spotify Technology SA(1)(2)

|

| 7,220

| 2,660,786

|

|

|

|

| $ 13,228,200

|

| Financial Services — 3.4%

|

| Shift4 Payments, Inc., Class A(1)(2)

|

| 108,501

| $ 9,613,189

|

| Visa, Inc., Class A(1)

|

| 46,221

| 12,708,464

|

|

|

|

| $ 22,321,653

|

| Food Products — 1.3%

|

| Hershey Co.(1)

|

| 44,235

| $ 8,483,388

|

|

|

|

| $ 8,483,388

|

| Ground Transportation — 1.8%

|

| Uber Technologies, Inc.(1)(2)

|

| 156,781

| $ 11,783,660

|

|

|

|

| $ 11,783,660

|

| Health Care Equipment & Supplies — 1.2%

|

| Intuitive Surgical, Inc.(1)(2)

|

| 16,071

| $ 7,895,200

|

|

|

|

| $ 7,895,200

|

| Health Care Providers & Services — 3.2%

|

| Elevance Health, Inc.(1)

|

| 27,633

| $ 14,369,160

|

| Tenet Healthcare Corp.(1)(2)

|

| 39,489

| 6,563,072

|

|

|

|

| $ 20,932,232

|

| Hotels, Restaurants & Leisure — 1.3%

|

| Marriott International, Inc., Class A(1)

|

| 34,477

| $ 8,570,982

|

|

|

|

| $ 8,570,982

|

| Insurance — 3.5%

|

| Allstate Corp.(1)

|

| 71,644

| $ 13,587,285

|

| W.R. Berkley Corp.(1)

|

| 163,860

| 9,295,778

|

|

|

|

| $ 22,883,063

|

| Interactive Media & Services — 6.9%

|

| Alphabet, Inc., Class C(1)

|

| 146,595

| $ 24,509,218

|

| Meta Platforms, Inc., Class A(1)

|

| 35,805

| 20,496,214

|

|

|

|

| $ 45,005,432

|

Eaton Vance

Risk-Managed Diversified Equity

Income Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| IT Services — 1.7%

|

| Gartner, Inc.(1)(2)

|

| 21,108

| $ 10,696,690

|

|

|

|

| $ 10,696,690

|

| Life Sciences Tools & Services — 2.1%

|

| Thermo Fisher Scientific, Inc.(1)

|

| 21,642

| $ 13,387,092

|

|

|

|

| $ 13,387,092

|

| Machinery — 1.0%

|

| Parker-Hannifin Corp.(1)

|

| 10,661

| $ 6,735,833

|

|

|

|

| $ 6,735,833

|

| Media — 0.9%

|

| Comcast Corp., Class A(1)

|

| 143,247

| $ 5,983,427

|

|

|

|

| $ 5,983,427

|

| Oil, Gas & Consumable Fuels — 2.0%

|

| ConocoPhillips(1)

|

| 125,762

| $ 13,240,224

|

|

|

|

| $ 13,240,224

|

| Pharmaceuticals — 3.3%

|

| Eli Lilly & Co.(1)

|

| 17,873

| $ 15,834,405

|

| Novo Nordisk AS ADR(1)

|

| 47,624

| 5,670,590

|

|

|

|

| $ 21,504,995

|

| Professional Services — 4.9%

|

| Automatic Data Processing, Inc.(1)

|

| 39,279

| $ 10,869,678

|

| Booz Allen Hamilton Holding Corp.(1)

|

| 42,849

| 6,974,103

|

| TransUnion(1)

|

| 134,626

| 14,095,342

|

|

|

|

| $ 31,939,123

|

| Real Estate Management & Development — 1.9%

|

| CoStar Group, Inc.(1)(2)

|

| 89,593

| $ 6,758,896

|

| FirstService Corp.

|

| 32,062

| 5,850,033

|

|

|

|

| $ 12,608,929

|

| Semiconductors & Semiconductor Equipment — 12.9%

|

| Analog Devices, Inc.(1)

|

| 43,767

| $ 10,073,850

|

| Broadcom, Inc.(1)

|

| 112,381

| 19,385,722

|

| Lam Research Corp.(1)

|

| 12,370

| 10,094,910

|

| NVIDIA Corp.(1)

|

| 367,961

| 44,685,184

|

|

|

|

| $ 84,239,666

|

| Software — 10.1%

|

| Fair Isaac Corp.(1)(2)

|

| 4,712

| $ 9,157,866

|

| Security

| Shares

| Value

|

| Software (continued)

|

| Microsoft Corp.(1)

|

| 118,744

| $ 51,095,543

|

| Palo Alto Networks, Inc.(1)(2)

|

| 15,302

| 5,230,224

|

|

|

|

| $ 65,483,633

|

| Specialty Retail — 2.7%

|

| Burlington Stores, Inc.(1)(2)

|

| 33,154

| $ 8,735,416

|

| TJX Cos., Inc.(1)

|

| 71,980

| 8,460,529

|

|

|

|

| $ 17,195,945

|

| Technology Hardware, Storage & Peripherals — 7.6%

|

| Apple, Inc.(1)

|

| 212,345

| $ 49,476,385

|

|

|

|

| $ 49,476,385

|

Total Common Stocks

(identified cost $362,488,895)

|

|

| $657,195,808

|

| Short-Term Investments — 0.5%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 4.83%(3)

|

| 3,149,705

| $ 3,149,705

|

Total Short-Term Investments

(identified cost $3,149,705)

|

|

| $ 3,149,705

|

Total Purchased Put Options — 0.2%

(identified cost $3,391,433)

|

|

| $ 1,174,744

|

Total Investments — 101.6%

(identified cost $369,030,033)

|

|

| $661,520,257

|

Total Written Call Options — (1.4)%

(premiums received $3,730,732)

|

|

| $ (9,152,973)

|

| Other Assets, Less Liabilities — (0.2)%

|

|

| $ (1,042,457)

|

| Net Assets — 100.0%

|

|

| $651,324,827

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Security (or a portion thereof) has been pledged as collateral for written options.

|

| (2)

| Non-income producing security.

|

| (3)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2024.

|

Eaton Vance

Risk-Managed Diversified Equity

Income Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Purchased Put Options (Exchange-Traded) — 0.2%

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| S&P 500 Index

| 91

| $

| 52,438,568

| $

| 5,275

| 10/2/24

| $ 910

|

| S&P 500 Index

| 92

|

| 53,014,816

|

| 5,210

| 10/4/24

| 3,450

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,200

| 10/7/24

| 5,915

|

| S&P 500 Index

| 93

|

| 53,591,064

|

| 5,175

| 10/9/24

| 12,787

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,415

| 10/11/24

| 40,495

|

| S&P 500 Index

| 92

|

| 53,014,816

|

| 5,420

| 10/14/24

| 51,980

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,410

| 10/16/24

| 65,975

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,505

| 10/18/24

| 126,945

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,530

| 10/21/24

| 155,250

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,550

| 10/23/24

| 195,750

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,580

| 10/25/24

| 254,700

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,540

| 10/28/24

| 260,587

|

| Total

|

|

|

|

|

|

| $1,174,744

|

| Written Call Options (Exchange-Traded) — (1.4)%

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| S&P 500 Index

| 91

| $

| 52,438,568

| $

| 5,660

| 10/2/24

| $ (922,740)

|

| S&P 500 Index

| 92

|

| 53,014,816

|

| 5,595

| 10/4/24

| (1,564,460)

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,580

| 10/7/24

| (1,702,610)

|

| S&P 500 Index

| 93

|

| 53,591,064

|

| 5,570

| 10/9/24

| (1,870,695)

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,750

| 10/11/24

| (586,495)

|

| S&P 500 Index

| 92

|

| 53,014,816

|

| 5,775

| 10/14/24

| (482,080)

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,775

| 10/16/24

| (519,610)

|

| S&P 500 Index

| 91

|

| 52,438,568

|

| 5,820

| 10/18/24

| (365,820)

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,850

| 10/21/24

| (271,800)

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,850

| 10/23/24

| (302,850)

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,880

| 10/25/24

| (249,300)

|

| S&P 500 Index

| 90

|

| 51,862,320

|

| 5,850

| 10/28/24

| (314,513)

|

| Total

|

|

|

|

|

|

| $(9,152,973)

|

| Abbreviations:

|

| ADR

| – American Depositary Receipt

|

At September 30, 2024, the Fund had

sufficient cash and/or securities to cover commitments under open derivative contracts.

The Fund is subject to equity price

risk in the normal course of pursuing its investment objectives. The Fund pursues a “collared” options strategy which consists of buying S&P 500 index put options below the current value of the index

and writing S&P 500 index call options above the current value of the index with the same expiration. The strategy uses the premium income from the written call options to buy an equal number of put options. In

buying put options on an index, the Fund in effect, acquires protection against decline in the value of the applicable index below the exercise price in exchange for the

Eaton Vance

Risk-Managed Diversified Equity

Income Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

option premium paid. In writing index call options,

the Fund in effect, sells potential appreciation in the value of the applicable index above the exercise price. The Fund retains the risk of lost appreciation, minus the premium received, should the price of the

underlying index rise above the exercise price. Under normal market conditions, the Fund’s use of option collars is expected to provide a more consistent level of market exposure and market protection.

Affiliated Investments

At September 30, 2024, the value of

the Fund's investment in funds that may be deemed to be affiliated was $3,149,705, which represents 0.5% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date ended

September 30, 2024 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $9,422,220

| $95,446,555

| $(101,719,070)

| $ —

| $ —

| $3,149,705

| $167,261

| 3,149,705

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value Measurements

Under generally accepted accounting

principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is

summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

In cases where the inputs used to

measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At September 30, 2024, the hierarchy

of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at fair value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3

| Total

|

| Common Stocks

| $657,195,808*

| $ —

| $ —

| $657,195,808

|

| Short-Term Investments

| 3,149,705

| —

| —

| 3,149,705

|

| Purchased Put Options

| 1,174,744

| —

| —

| 1,174,744

|

| Total Investments

| $661,520,257

| $ —

| $ —

| $661,520,257

|

| Liability Description

|

|

|

|

|

| Written Call Options

| $ (9,152,973)

| $ —

| $ —

| $ (9,152,973)

|

| Total

| $ (9,152,973)

| $ —

| $ —

| $ (9,152,973)

|

| *

| The level classification by major category of investments is the same as the category presentation in the Portfolio of Investments.

|

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semi-annual or annual report to shareholders.

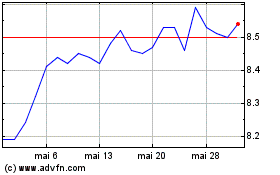

Eaton Vance Risk Managed... (NYSE:ETJ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Eaton Vance Risk Managed... (NYSE:ETJ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024