false000183617600018361762024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2024

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39994 |

|

40-0023833 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

er next two years Expanded mid-volume production of existing program $1.7 million in 2021; expect $4-$8 million in 2022 orders Prototype with mid-volume production follow-on $4.5 million over three-month period New cross-sell of sheet metal low-volume production $450k in 2021; expect over $1.5 million in 2022 orders Prototype & low-volume production Global healthcare company Global semiconductor company Disruptive electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Global leader in gas measurement instruments and technologies Leading subsea technology company $550K production order Expansion to higher volume production of existing program New Strategic Accounts Existing Strategic Accounts

Statement (preliminary unaudited) Repor

|

|

Item 1.01. |

Entry into a Material Definitive Agreement. |

On November 13, 2023, certain subsidiaries of Fathom Digital Manufacturing Corporation (the “Company”) entered into a Third Amendment to the Credit Agreement, dated as of December 23, 2021, as previously amended by the First Amendment and Second Amendment thereto, by and among Fathom Guarantor, LLC, Fathom Manufacturing, LLC, the Lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent. (such agreement as amended, the “Credit Agreement”).

The Credit Agreement required certain subsidiaries of the Company to obtain qualified equity capital to make a term loan paydown of $50,000 no later than (a) March 31, 2024 with qualified equity capital obtained pursuant to a binding commitment entered into on or before January 31, 2024 ( the “Outside Signing Date”) or (b) June 30, 2024 in the event a Credit Support (as defined therein) is executed and delivered to the Administrative Agent on or before January 31, 2024.

On January 31, 2024, certain subsidiaries of the Company, certain lenders under the Credit Agreement and JPMorgan Chase Bank, N.A., as Administraive Agent entered into a letter agreement (the “Extension Consent Letter”) that extended the Outside Signing Date from January 31, 2024 to February 16, 2024.

The foregoing description of the Extension Consent Letter does not purport to be complete and is qualified in its entirety by reference to a copy of the Extension Consent Letter, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

|

|

Item 9.01. |

Financial Statement and Exhibits |

(d) Exhibits.

|

|

|

|

Exhibit

Number |

|

Description |

|

|

|

|

10.1 |

|

Extension Consent Letter dated as of January 31, 2024, among certain subsidiaries of the Company, certain Lenders party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent, relating to the Credit Agreement, dated as of December 23, 2021, as previously amended by the First Amendment, Second Amendment and Third Amendment thereto, among Fathom Guarantor, LLC, Fathom Manufacturing, LLC, the Lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent. |

|

104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBR document |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

FATHOM DIGITAL MANUFACTURING CORPORATION |

|

|

By: |

|

/s/ Mark Frost |

Name: |

|

Mark Frost |

Title: |

|

Chief Financial Officer |

Date: February 1, 2024

Exhibit 10.1

EXECUTION VERSION

EXTENSION CONSENT LETTER

January 31, 2024

Fathom Manufacturing, LLC

1050 Walnut Ridge Drive

Hartland, WI 53029

Attn: Mark Frost, Chief Financial Officer

Re: Extension Consent to Outside Signing Date (as defined below)

Ladies and Gentlemen:

Reference is hereby made to that certain Credit Agreement, dated as of December 23, 2021 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Credit Agreement”), among Fathom Guarantor, LLC, a Delaware limited liability company, as Holdings (“Holdings”), Fathom Manufacturing, LLC, a Delaware limited liability company, as Borrower (the “Borrower”), JPMorgan Chase Bank, N.A., as administrative agent for the lenders (the “Administrative Agent”), and the lenders from time to time party thereto. Capitalized terms used in this Extension Consent Letter (this “Letter Agreement”) and not defined in this Letter Agreement shall have the meanings assigned to such terms in the Credit Agreement.

Pursuant to (i) Section 5.15 of the Credit Agreement on or prior to (a) January 31, 2024 (the “Outside Signing Date”) or (b) in the event a Credit Support is executed (if applicable) and delivered to the Third Amendment Consenting Term Lenders on or prior to the Outside Signing Date, June 30, 2024, the Borrower shall cause Ultimate Parent and the other parties thereto to have entered into the Binding Agreement and (ii) Section 2.11(h) of the Credit Agreement, the Borrower is required to prepay Term Loans of the Third Amendment Consenting Term Lenders in an aggregate amount equal to U.S.$50,000,000 on or prior to (A) March 31, 2024 or (B) in the event a Credit Support is executed and delivered to the Third Consenting Term Lenders in accordance with Section 5.15 on or prior to Outside Signing Date, June 30, 2024.

Now, pursuant to Sections 2.11(h) and 5.15 of the Credit Agreement, the Lenders party hereto, which collectively constitute the Majority Third Amendment Consenting Term Lenders as of the date hereof, hereby consent to extend each reference to January 31, 2024 set forth in Sections 2.11(h) and 5.15 of the Credit Agreement to be February 16, 2024 (the “Extension”).

The Borrower acknowledges and agrees that the Extension is limited precisely as written and shall not be deemed to (i) be an amendment, consent or waiver of any other terms or conditions of the Credit Agreement or any other Loan Document, (ii) constitute a waiver of any right or remedy of the Administrative Agent or any of the Lenders under the Loan Documents (all such rights and remedies being expressly reserved by the Administrative Agent and the Lenders), or (iii) establish a custom or course of dealing or conduct between the Administrative Agent and the Lenders, on the one hand, and the Borrower, on the other hand. All other agreements and other provisions of the Credit Agreement and the other Loan Documents shall remain in full force and effect after giving effect to this Letter Agreement. Without limiting the provisions of the Loan Documents, a breach of any agreement or covenant of the Borrower under this Letter Agreement and/or the failure of the Borrower to perform their obligations under this Letter Agreement shall constitute a Default and an Event of Default under the Credit Agreement.

THIS LETTER AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK. Sections 9.11 and 9.15 of the Credit Agreement are hereby incorporated by reference herein, mutatis mutandis.

This Letter Agreement may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original but all of which, when taken together, shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Letter Agreement that is an Electronic Signature transmitted by emailed .pdf or any other electronic means that reproduces an image of an actual executed signature page shall be effective as delivery of a manually executed counterpart of this Letter Agreement. The words “execution”, “signed”, “signature”, “delivery” and words of like import in or relating to this Letter Agreement shall be deemed to include Electronic Signatures, deliveries or the keeping of records in any electronic form (including deliveries by fax, emailed .pdf or any other electronic means that reproduces an image of an actual executed signature page), each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be. This Letter Agreement shall constitute a Loan Document.

[signature pages follow]

2

Sincerely,

jpmorgan chase, n.a.,

in its capacity as Administrative Agent and as a Lender

By: /s/ Sally Weiland

Name: Sally Weiland

Title: Authorized Officer

[Signature Page to Extension Consent Letter]

CIBC BANK USA, as a Lender

By: /s/ Peter B. Campbell

Name: Peter B. Campbell

Title: Managing Director

[Signature Page to Extension Consent Letter]

BMO BANK N.A. (F/K/A BMO HARRIS BANK, NA), as a Lender

By: /s/ Gregory P. Haar

Name: Gregory Haar

Title: Assistant Vice President

5

STIFEL BANK & TRUST, as a Lender

By: /s/ Daniel P. McDonald

Name: Daniel P. McDonald

Title: Vice President

6

Acknowledged and Agreed:

FATHOM MANUFACTURING, LLC,

as the Borrower

By: /s/ Mark T. Frost

Name: Mark T. Frost

Title: Chief Financial Officer

[Signature Page to Extension Consent Letter]

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

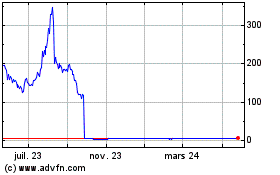

Fathom Digital Manufactu... (NYSE:FATH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

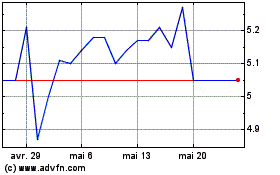

Fathom Digital Manufactu... (NYSE:FATH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025