false

N-2

0001392994

0001392994

2023-11-30

2024-11-30

0001392994

2024-11-30

0001392994

FGB:BusinessDevelopmentCompanyBDCRiskMember

2023-11-30

2024-11-30

0001392994

FGB:CurrentMarketConditionsRiskMember

2023-11-30

2024-11-30

0001392994

FGB:CyberSecurityRiskMember

2023-11-30

2024-11-30

0001392994

FGB:FinancialSectorConcentrationRiskMember

2023-11-30

2024-11-30

0001392994

FGB:IlliquidSecuritiesRiskMember

2023-11-30

2024-11-30

0001392994

FGB:IncomeAndInterestRateRiskMember

2023-11-30

2024-11-30

0001392994

FGB:LeverageRiskMember

2023-11-30

2024-11-30

0001392994

FGB:ManagementRiskAndRelianceOnKeyPersonnelMember

2023-11-30

2024-11-30

0001392994

FGB:MarketDiscountFromNetAssetValueMember

2023-11-30

2024-11-30

0001392994

FGB:MarketRiskMember

2023-11-30

2024-11-30

0001392994

FGB:OperationalRiskMember

2023-11-30

2024-11-30

0001392994

FGB:PotentialConflictsOfInterestRiskMember

2023-11-30

2024-11-30

0001392994

FGB:REITMortageRelatedAndAssetBackedSecuritiesRiskMember

2023-11-30

2024-11-30

0001392994

FGB:ReorganizationRiskMember

2023-11-30

2024-11-30

0001392994

FGB:SpecialityFinanceAndOtherFinancialCompaniesRisksMember

2023-11-30

2024-11-30

0001392994

FGB:ValuationRiskMember

2023-11-30

2024-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22039

First Trust Specialty Finance & Financial Opportunities Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address

of agent for service)

Registrant’s telephone number, including

area code: 630-765-8000

Date of fiscal year end: November

30

Date of reporting period: November

30, 2024

Form N-CSR is to be used by management investment

companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required

to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use

the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information

specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection

of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing

the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection

of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the

Act. |

First

Trust

Specialty Finance and

Financial

Opportunities Fund (FGB)

Annual Report

For the Year Ended

November 30, 2024

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Annual

Report

November

30, 2024

Caution Regarding Forward-Looking Statements

This report contains certain

forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current

expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Confluence Investment Management

LLC (“Confluence” or the “Sub-Advisor”)

and their respective representatives, taking into account the information currently available to them.

Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking

statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,”

“believe,” “plan,” “may,” “should,”

“would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve

known and unknown risks, uncertainties and other factors that may cause the actual results, performance

or achievements of First Trust Specialty Finance and Financial Opportunities Fund (the “Fund”) to be materially different

from any future results, performance or achievements

expressed or implied by the forward-looking statements. When evaluating the information

included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the

judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation

to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that the

Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that

the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than

what you paid for them. Accordingly, you can lose money

by investing in the Fund. See “Principal Risks” in the Investment Objectives, Policies,

and Risks section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents

past performance, which is no guarantee of future results, and current performance may be lower or

higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com

or speak with your financial advisor. Investment returns,

net asset value and common share price will fluctuate and Fund shares, when sold, may be worth

more or less than their original cost.

The Advisor may also periodically

provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

This report contains information

that may help you evaluate your investment in the Fund. It includes details about the Fund and presents

data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary

by the portfolio management team of the Fund, you may obtain an understanding of how the market

environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance

compared to that of relevant market benchmarks.

It is important to keep in mind

that the opinions expressed by personnel of First Trust and Confluence are just that: informed opinions. They

should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of

this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this

report and other Fund regulatory filings.

First

Trust Specialty Finance and Financial Opportunities Fund (FGB)

“AT A GLANCE”

As of November 30, 2024 (Unaudited)

|

|

|

Symbol

on New York Stock Exchange |

|

|

|

|

Common

Share Net Asset Value (“NAV”) |

|

Premium

(Discount) to NAV |

|

Net

Assets Applicable to Common Shares |

|

Current

Quarterly Distribution per Common Share(1)

|

|

Current

Annualized Distribution per Common Share |

|

Current

Distribution Rate on Common Share Price(2)

|

|

Current

Distribution Rate on NAV(2)

|

|

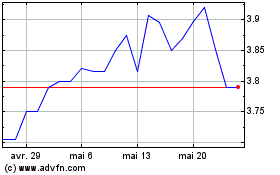

Common Share Price &

NAV (weekly closing price)

|

|

|

|

|

|

|

|

|

Average

Annual Total Returns |

|

|

|

|

|

Inception

(5/25/07)

to

11/30/24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI

U.S. Investable Market Financials Index(5)

|

|

|

|

|

|

|

|

Common

Stocks - Business Development Companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage

Real Estate Investment Trusts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Main

Street Capital Corp. |

|

Blackstone

Secured Lending Fund |

|

|

|

|

Sixth

Street Specialty Lending, Inc. |

|

New

Mountain Finance Corp. |

|

|

|

|

|

|

|

Blue

Owl Capital Corp. III |

|

|

|

|

|

|

|

(1)

Most

recent distribution paid through November 30, 2024. Subject to change in the future.

(2)

Distribution

rates are calculated by annualizing the most recent distribution paid through the report date and then dividing by Common Share Price

or NAV, as applicable, as of November 30, 2024. Subject

to change in the future.

(3)

Total

return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained

by the Dividend Reinvestment Plan and changes in NAV

per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales

load and are not annualized for periods of less than one year. Past performance is not indicative of future results.

(4)

The

Blended Benchmark consists of a 70/20/10 blend of the MVIS U.S. Business Development Companies Index, the FTSE NARIET Mortgage REIT

Index and the S&P SmallCap Financials Index. The Blended Benchmark return is calculated by using the monthly return of the three

indices during each period shown above. At the beginning of each month, the three indices are rebalanced, to account for divergence

from that ratio that occurred during the course of each month to the ratios noted above. The monthly returns are then compounded for

each period shown above, giving the performance for the Blended Benchmark for each period shown above. Since the MVIS U.S. Business

Development Companies Index had an inception date of August 4, 2011, the performance of the Blended Benchmark is not available for

all of the periods disclosed.

(5)

Because

the index has an inception date of June 5, 2007, performance data is not available for all the periods shown.

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Annual Report

November 30, 2024 (Unaudited)

Proposed Reorganization

The First Trust Specialty Finance

and Financial Opportunities Fund (the “Fund”) called a special meeting of shareholders on August

29, 2024 to consider a proposed reorganization of the Fund with and into abrdn Total Dynamic Dividend Fund. Ultimately, this

proposal did not receive the requisite votes for approval. Subsequently, the Board of Trustees of the Fund approved the reorganization

(the “Reorganization”) of the Fund into FT Confluence BDC & Specialty Finance Income ETF, a newly created exchange-traded

fund (“ETF”) that will be traded on the NYSE and will be an actively managed ETF managed by First Trust Advisors L.P.

(“First Trust” or the “Advisor”) and sub-advised by Confluence Investment Management LLC (“Confluence”

or the “Sub-Advisor”), the Fund’s

current sub-advisor. Under the terms of the Reorganization, which is expected to be tax-free, the assets of the

Fund would be transferred to, and the liabilities of the Fund would be assumed by, the new ETF, and shareholders of the Fund would

receive shares of the new ETF with a value equal to the aggregate net asset value of the Fund shares held by them. A special meeting

of shareholders of the Fund has been scheduled for April 21, 2025 to consider and vote on the Reorganization. The record date

for determining shareholders eligible to vote at such meeting is January 10, 2025. There is no assurance when or whether shareholders

will approve the Reorganization or that any other approvals required for the Reorganization will be obtained. More information

on the proposed Reorganization, including the risks and considerations associated with the Reorganization, will be contained

in the proxy materials relating to the Reorganization. This note is not intended to solicit a proxy from any shareholder of the

Fund and is not intended to, and shall not, constitute

an offer to purchase or sell shares of the Fund or the new ETF.

First Trust serves as the investment

advisor to the Fund. First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio,

managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Confluence, located in St. Louis,

Missouri, serves as the sub-advisor to the Fund. The investment professionals at Confluence have an average

of over 20 years of portfolio management experience each. Confluence professionals have invested in a wide range of specialty

finance and other financial company securities during various market cycles, working to provide attractive risk-adjusted returns

to clients.

Confluence Portfolio Management Team

Chief Executive Officer and Chief Investment

Officer

Senior Vice President and Portfolio Manager

Senior Vice President and Chief Investment

Officer - Value Equity

First Trust Specialty Finance and Financial

Opportunities Fund (FGB)

The primary investment objective

of the Fund is to seek a high level of current income. As a secondary objective, the Fund seeks an attractive

total return. The Fund pursues its investment objectives by investing, under normal market conditions, at least 80% of its Managed

Assets in a portfolio of securities of specialty finance and other financial companies that the Fund’s Sub-Advisor believes offer

attractive opportunities for income and capital appreciation. Under normal market conditions, the Fund concentrates its investments

in securities of companies within the industries in the financial sector. “Managed Assets” means the total asset value of

the Fund minus the sum of its liabilities, other than

the principal amount of borrowings. There can be no assurance that the Fund’s investment

objectives will be achieved. The Fund may not be appropriate for all investors.

FGB is a financial sector fund

with a particular focus on a niche called business development companies (“BDCs”). BDCs lend to and invest

in private companies, oftentimes working with those not large enough to efficiently access the public markets. Each BDC has a unique

profile, determined by its respective management team. Some specialize in particular industries, while others apply a more generalized

approach and maintain a diversified portfolio. Both approaches can work effectively and offer shareholders a unique and differentiated

return opportunity derived from the private markets. During the 12-month period ended November 30, 2024, the Fund

Portfolio

Commentary (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Annual Report

November 30, 2024 (Unaudited)

had approximately

89% of its assets invested in 28 BDCs, with roughly 5% in mortgage-backed real estate investment trusts (“MBS REITs”)

and the balance in large cap financial companies.

|

|

|

|

|

|

|

|

|

Average

Annual Total Returns |

|

|

|

|

|

Inception

(5/25/07)

to

11/30/24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI

U.S. Investable Market Financials Index(3)

|

|

|

|

|

Performance figures assume

reinvestment of all distributions

and do not reflect the deduction

of taxes that a shareholder would

pay on Fund distributions or the redemption

or sale of Fund shares. An index

is a statistical composite that tracks a

specified financial market or sector. Unlike

the Fund, the indices do not actually

hold a portfolio of securities and therefore

do not incur the expenses incurred

by the Fund. These expenses negatively

impact the performance of the Fund.

The Fund’s past performance does not

predict future performance.

(1)

Total

return is based on the combination of reinvested dividend, capital gain and return of capital distribution, if any, at prices obtained

by the Dividend Reinvestment Plan and changes in NAV

per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load

and are not annualized for period of less than one year. Past performance is not indicative of future results.

(2)

The

Blended Benchmark consists of a 70/20/10 blend of the MVIS U.S. Business Development Companies Index, the FTSE NARIET Mortgage REIT Index

and the S&P SmallCap Financials Index. The

Blended Benchmark returns are calculated by using the monthly return of the three indices during each period shown above.

At the beginning of each month, the three indices are rebalanced, to account for divergence from that ratio that occurred during the course

of each month to the ratios noted above. The monthly

returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each

period shown above. Since the MVIS U.S. Business Development Companies Index had an inception date of August 4, 2011, the performance

of the Blended Benchmark is not available for all

of the periods disclosed.

(3)

Because

the index has an inception date of June 5, 2007, performance data is not available for all the periods shown in the table.

Portfolio

Commentary (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Annual Report

November 30, 2024 (Unaudited)

The market

value total return for the Fund during the 12-month period ended November 30, 2024 was higher than that of the Blended Benchmark,

as was its net asset value (“NAV”) total return. The Fund’s total return benefitted from a narrowing of its market price

discount to NAV. The Fund uses leverage because we

believe that, over time, leverage provides opportunities for additional income and total

return for common shareholders. However, the use of leverage exposes common shareholders to additional volatility. For example,

as the prices of securities held by the Fund decline, the negative impact of valuation changes on Common Share NAV and common

shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance Common Share returns during periods

when the prices of securities held by the Fund are generally rising. For the performance referenced above, the use of leverage had

a positive impact on returns.

Throughout the period, the Fund

remained invested principally in BDCs and delivered another year of strong returns from the industry. In

recent years, many investors harbored concerns that as the Federal Reserve (the “Fed”) tightened, BDC borrowers would face

growing challenges from rising rates, and BDCs would

ultimately face high levels of credit problems. However, even after the Fed raised

short-term interest rates by over 5%, credit problems within BDC portfolios remained relatively benign. This allowed BDCs to benefit

from rising rates as their loan portfolios, which were predominantly floating rate, delivered higher levels of income and higher dividends.

Ultimately, these conditions set the stage for the Fund to increase its own distribution, which happened in the second fiscal quarter.

The constructive environment

for BDCs opened the door for several new BDCs to list initial public offerings during the fiscal year, while

other BDCs already in the public arena were able to raise incremental equity capital. We believe the growth in both the number and

size of BDCs is a very positive step in the evolution of the industry and reflects participation in a widespread trend where private lenders

are playing an increasing role in corporate lending.

The Fund’s allocation to

MBS REITs remained somewhat limited during the year. Although the industry delivered good results, its total

return was generally lower than BDCs. Still, we were pleased to see MBS REITs take advantage of lower levels of MBS market volatility,

while capturing attractive spreads. The Fund remained focused on MBS REITs with a substantial emphasis on Agency MBS. We

believe their high level of liquidity and broad access to financing are helpful during periods of high market uncertainty.

The Fund’s allocation to

large cap financials made positive contributions during the fiscal year, delivering returns higher than BDCs or MBS

REITs. Although this allocation is also quite limited, the positions provide high levels of liquidity and diversification, with lower

relative volatility. The allocation also made positive

contributions to growth of the Fund’s NAV during the fiscal year.

The Fund has a practice of seeking

to maintain a relatively stable quarterly distribution, which may be changed at any time. The practice

has no impact on the Fund’s investment strategy and may reduce the Fund’s NAV. However, the Advisor believes the practice

helps maintain the Fund’s competitiveness and

may benefit the Fund’s market price and premium/discount to the Fund’s NAV. The quarterly

distribution rate began the period at $0.0825 per share and ended the period at $0.10 per share. Based on the $0.10 per share quarterly

distribution, the annualized distribution rate November 30, 2024 was 9.13% at NAV and 9.35% at market price. The final determination

of the source and tax status of all 2024 distributions will be made after the end of 2024 and will be provided on Form 1099-DIV.

The foregoing is not to be construed as tax advice. Please consult your tax advisor for further information regarding tax matters.

The Fed began lowering short-term

rates at its September 2024 meeting and appears to be poised for continued reductions. Broadly speaking,

lower interest rates can benefit stocks with significant dividend yields as their yield profiles become relatively more attractive.

However, the dynamic is more nuanced for BDCs, given that their floating rate loans will generate incrementally lower levels

of income and possibly create challenges in earning enough income to sustain dividends. Fortunately, it appears many BDCs are reasonably

well-positioned to address this challenge. These BDCs have been operating at lower levels of leverage, creating a measure of

“dry powder” that may be deployed to increase the total size of their loan portfolios, thereby helping to offset declining

loan portfolio interest income. In addition, BDCs have

managed through several periods of low mergers and acquisitions volume. If transaction

volumes were to rise in coming quarters, many BDC managers would be well-positioned to benefit.

One topic of concern that has

arisen in recent quarters is related to the tremendous flow of capital into the private debt markets. We recognize

that oftentimes the stage can be set for speculative bubbles when capital flows in one direction or in large volumes. However,

we don’t believe that to be the case right now. Bubbles usually involve a combination of a disregard for risk along with outsized

return expectations. That condition isn’t apparent to us right now in the private debt markets. Credit standards reflect a reasonable

amount of lender caution, while return expectations appear grounded in reality. Therefore, we believe the capital flowing into

private credit is less about speculation and more about how private lenders are delivering better outcomes for borrowers. Private

Portfolio

Commentary (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Annual Report

November 30, 2024 (Unaudited)

lenders

are often able to tailor loans to accommodate the unique needs and circumstances of borrowers, while simultaneously incorporating

creative credit protections. In addition, private lenders lend from equity-centric capital bases as opposed to deposit-based ones.

This structure helps lenders avoid capital runs, like those that have plagued banks in the past. So, we believe the capital flowing into

private credit reflects a broad shift to an improved lending structure for both borrowers and lenders as opposed to a market bubble.

BDCs are part of the private

lending community and their performance and growth in recent years reflect many of the positive aspects of

the private debt markets. Substantial amounts of BDC equity capital have recently been raised in private, non-listed BDCs with a structure

that allows investors to focus more on changes in NAV rather than market prices. From our perch, we feel these private BDCs can

play a helpful role in investor portfolios. However, we don’t feel they are necessarily a replacement for publicly traded BDCs,

which continue to offer important utility, including

a higher level of liquidity. They also create an efficient way to diversify private debt allocations

across a wide range of managers, while also offering specific exposures to different sizes of middle-market borrowers and industries.

Therefore, we believe public and private BDCs can be complementary to one another.

We continue to believe BDCs are

an effective way to help fulfill investor allocations to the alternative investment class of private debt. The

BDC industry’s growth and high level of income are unique features that can benefit a wide range of investors. It remains our great

honor to manage FGB and its investments in BDCs.

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Portfolio of Investments

November 30, 2024

|

|

|

|

COMMON

STOCKS – BUSINESS DEVELOPMENT

COMPANIES

– 100.2%

|

|

|

|

|

|

|

|

|

|

|

Bain

Capital Specialty Finance,

Inc.

(a) |

|

|

|

|

|

|

|

Blackstone

Secured Lending

Fund

(a) |

|

|

|

Blue

Owl Capital Corp. III (a) |

|

|

|

Capital

Southwest Corp. (a) |

|

|

|

Crescent

Capital BDC, Inc. (a) |

|

|

|

|

|

|

|

Goldman

Sachs BDC, Inc. (a) |

|

|

|

Golub

Capital BDC, Inc. (a) |

|

|

|

Hercules

Capital, Inc. (a) |

|

|

|

|

|

|

|

Main

Street Capital Corp. (a) |

|

|

|

MidCap

Financial Investment

Corp.

|

|

|

|

Morgan

Stanley Direct Lending

Fund

|

|

|

|

New

Mountain Finance Corp. (a) |

|

|

|

Nuveen

Churchill Direct Lending

Corp.

(a) |

|

|

|

Oaktree

Specialty Lending

Corp.

(a) |

|

|

|

|

|

|

|

Palmer

Square Capital BDC, Inc.

|

|

|

|

PennantPark

Investment Corp.

|

|

|

|

Portman

Ridge Finance Corp.

|

|

|

|

Sixth

Street Specialty Lending,

Inc.

(a) |

|

|

|

|

|

|

|

|

|

|

|

Total

Common Stocks -

Business

Development

Companies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial

Services – 3.5%

|

|

|

|

Berkshire

Hathaway, Inc.,

Class

B (a) (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage

REITs (Continued) |

|

|

|

Annaly

Capital Management,

Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Investments – 110.7% |

|

|

|

|

|

|

|

Outstanding

Loan – (13.7)% |

|

|

|

Net

Other Assets and

Liabilities

– 3.0% |

|

|

|

|

|

|

|

All

or a portion of this security serves as collateral for the

outstanding

loan. At November 30, 2024, the segregated

value

of these securities amounts to $38,257,730.

|

|

|

Non-income

producing security. |

Abbreviations

throughout the Portfolio of Investments: |

|

|

–

Real Estate Investment Trusts |

Valuation

Inputs

A summary of the inputs used

to value the Fund’s investments as of November

30, 2024 is as follows (see Note 2A - Portfolio Valuation

in the Notes to Financial Statements):

|

|

Total

Value

at

11/30/2024

|

|

Level

2

Significant

Observable

Inputs

|

Level

3

Significant

Unobservable

Inputs

|

Common

Stocks -

Business

Development

Companies*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

Portfolio of Investments for industry breakout. |

See

Notes to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Statement of Assets and Liabilities

November 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

and fees on loan |

|

|

|

|

Trustees’

fees and expenses |

|

Shareholder

reporting fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

distributable earnings (loss) |

|

|

|

|

NET

ASSET VALUE, per Common Share (par

value $0.01 per Common Share) |

|

Number

of Common Shares outstanding (unlimited number of Common Shares has been authorized) |

|

|

|

|

Foreign

currency, at cost (proceeds) |

|

See

Notes to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Statement of Operations

For the Year Ended November 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

and fees on loan |

|

|

|

|

Trustees’

fees and expenses |

|

Shareholder

reporting fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

INVESTMENT INCOME (LOSS) |

|

NET

REALIZED AND UNREALIZED GAIN (LOSS): |

|

Net

realized gain (loss) on investments |

|

Net

change in unrealized appreciation (depreciation) on investments |

|

NET

REALIZED AND UNREALIZED GAIN (LOSS) |

|

NET

INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

|

See

Notes to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Statements of Changes in Net Assets

|

|

|

|

|

|

|

|

Net

investment income (loss) |

|

|

|

|

|

|

Net

change in unrealized appreciation (depreciation) |

|

|

Net

increase (decrease) in net assets resulting from operations |

|

|

DISTRIBUTIONS

TO SHAREHOLDERS FROM: |

|

|

|

|

|

|

Total

increase (decrease) in net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Shares at end of period |

|

|

See

Notes to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Statement of Cash Flows

For the Year Ended November 30, 2024

Cash

flows from operating activities: |

|

|

Net

increase (decrease) in net assets resulting from operations |

|

|

Adjustments

to reconcile net increase (decrease) in net assets resulting from operations to net cash

provided

by operating activities: |

|

|

|

|

|

|

Sales,

maturities and paydown of investments |

|

|

Return

of capital distributions received from investments |

|

|

Net

realized gain/loss on investments |

|

|

Net

change in unrealized appreciation/depreciation on investments |

|

|

Changes

in assets and liabilities: |

|

|

Decrease

in dividends receivable |

|

|

Decrease

in prepaid expenses |

|

|

Decrease in interest and fees payable on loan

|

|

|

Increase

in investment advisory fees payable |

|

|

Decrease

in audit and tax fees payable |

|

|

Decrease

in legal fees payable |

|

|

Decrease

in shareholder reporting fees payable |

|

|

Decrease

in administrative fees payable |

|

|

Decrease

in custodian fees payable |

|

|

Decrease

in transfer agent fees payable |

|

|

Increase

in trustees’ fees and expenses payable |

|

|

Decrease

in other liabilities payable |

|

|

Cash

provided by operating activities |

|

|

Cash

flows from financing activities: |

|

|

Distributions

to Common Shareholders from investment operations |

|

|

Cash

used in financing activities |

|

|

Decrease

in cash and foreign currency |

|

|

Cash

and foreign currency at beginning of period |

|

|

Cash and foreign currency

at end of period |

|

|

Supplemental

disclosure of cash flow information: |

|

|

Cash

paid during the period for interest and fees |

|

|

See

Notes to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

Financial Highlights

For a Common Share outstanding throughout

each period

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

Income

from investment operations: |

|

|

|

|

|

Net

investment income (loss) |

|

|

|

|

|

Net

realized and unrealized gain (loss) |

|

|

|

|

|

Total

from investment operations |

|

|

|

|

|

Distributions

paid to shareholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

distributions paid to Common Shareholders |

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

Market

value, end of period |

|

|

|

|

|

Total

return based on net asset value

(b) |

|

|

|

|

|

Total

return based on market value (b)

|

|

|

|

|

|

Ratios

to average net assets/supplemental data: |

|

|

|

|

|

Net

assets, end of period (in 000’s) |

|

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

Ratio

of total expenses to average net assets excluding interest

expense

|

|

|

|

|

|

Ratio

of net investment income (loss) to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

loan outstanding (in 000’s) |

|

|

|

|

|

Asset

coverage per $1,000 of indebtedness (c) |

|

|

|

|

|

|

|

Based

on average shares outstanding. |

|

|

Total

return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices

obtained

by the Dividend Reinvestment Plan, and changes in net asset value per share for net asset value returns and changes in

Common

Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less

than

one year. Past performance is not indicative of future results.

|

|

|

Calculated

by subtracting the Fund’s total liabilities (not including the loan outstanding) from the Fund’s total assets, and dividing

by

the outstanding loan balance in 000’s. |

See

Notes to Financial Statements

Notes

to Financial Statements

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024

1. Organization

First Trust Specialty Finance

and Financial Opportunities Fund (the “Fund”) is a diversified, closed-end management investment company

organized as a Massachusetts business trust on March 20, 2007, and is registered with the Securities and Exchange Commission

under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund trades under the ticker symbol “FGB”

on the New York Stock Exchange (“NYSE”).

The primary investment objective

of the Fund is to seek a high level of current income. As a secondary objective, the Fund seeks an attractive

total return. The Fund pursues its investment objectives by investing, under normal market conditions, at least 80% of its Managed

Assets in a portfolio of securities of specialty finance and other financial companies that Confluence Investment Management

LLC (“Confluence” or the “Sub-Advisor”) believes offer attractive opportunities for income and capital appreciation.

Under normal market conditions, the Fund concentrates

its investments in securities of companies within industries in the financial sector.

“Managed Assets” means the total asset value of the Fund minus the sum of its liabilities, other than the principal amount

of borrowings. There can be no assurance that the Fund

will achieve its investment objectives. The Fund may not be appropriate for all investors.

2. Significant

Accounting Policies

The Fund is considered an investment

company and follows accounting and reporting guidance under Financial Accounting Standards Board

Accounting Standards Codification Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant

accounting policies consistently followed by the Fund in the preparation of the financial statements. The preparation of the financial

statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires

management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual

results could differ from those estimates.

The net asset value (“NAV”)

of the Common Shares of the Fund is determined daily as of the close of regular trading on the NYSE, normally

4:00 p.m. Eastern time, on each day the NYSE is open for trading. If the NYSE closes early on a valuation day, the NAV is determined

as of that time. Foreign securities are priced using data reflecting the earlier closing of the principal markets for those securities.

The Fund’s NAV per Common Share is calculated by dividing the value of all assets of the Fund (including accrued interest and

dividends), less all liabilities (including accrued expenses, dividends declared but unpaid and any borrowings of the Fund), by the total

number of Common Shares outstanding.

The Fund’s investments

are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair

value. Market value prices represent readily available market quotations such as last sale or official closing prices from a national

or foreign exchange (i.e., a regulated market) and

are primarily obtained from third-party pricing services. Fair value prices represent any

prices not considered market value prices and are either obtained from a third-party pricing service or are determined by the Pricing

Committee of the Fund’s investment advisor, First Trust Advisors L.P. (“First Trust” or the “Advisor”),

in accordance with valuation procedures approved by

the Fund’s Board of Trustees, and in accordance with provisions of the 1940 Act and rules thereunder.

Investments valued by the Advisor’s Pricing Committee, if any, are footnoted as such in the footnotes to the Portfolio of Investments.

The Fund’s investments are valued as follows:

Common stocks and other equity

securities listed on any national or foreign exchange (excluding Nasdaq, Inc. (“Nasdaq”) and the

London Stock Exchange Alternative Investment Market (“AIM”)) are valued at the last sale price on the exchange on which they

are principally traded or, for Nasdaq and AIM securities, the official closing price. Securities traded on more than one securities

exchange are valued at the last sale price or official closing price, as applicable, at the close of the securities exchange representing

the primary exchange for such securities.

Equity securities traded in an

over-the-counter market are valued at the close price or the last trade price.

Certain securities may not be

able to be priced by pre-established pricing methods. Such securities may be valued by the Advisor’s Pricing

Committee at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not

be publicly sold without registration under the Securities Act of 1933, as amended) for which a third-party pricing service is unable

to provide a market price; securities whose trading

has been formally suspended; a security whose market or fair value price is not available

from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the

value of the security after the market has closed but before the calculation of the Fund’s NAV or make it difficult or impossible

to obtain a reliable market quotation; and a security

whose price, as provided by the third-party pricing service, does not reflect the security’s

fair value. As a general principle, the current fair value of a security would appear to be the amount which the owner might reasonably

expect to receive for the security upon its current sale. When fair value prices are used, generally they will differ from

Notes

to Financial Statements (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024

market

quotations or official closing prices on the applicable exchanges. A variety of factors may be considered in determining the fair value

of such securities, including, but not limited to, the following:

1)

the

last sale price on the exchange on which they are principally traded or, for Nasdaq and AIM securities, the official closing

price;

3)

the

size of the holding;

4)

the

initial cost of the security;

5)

transactions

in comparable securities;

6)

price

quotes from dealers and/or third-party pricing services;

7)

relationships

among various securities;

8)

information

obtained by contacting the issuer, analysts, or the appropriate stock exchange;

9)

an

analysis of the issuer’s financial statements;

10)

the

existence of merger proposals or tender offers that might affect the value of the security; and

11)

other

relevant factors.

If the securities in question

are foreign securities, the following additional information may be considered:

1)

last

sale price on the exchange on which they are principally traded;

2)

the

value of similar foreign securities traded on other foreign markets;

3)

ADR

trading of similar securities;

4)

closed-end

fund or exchange-traded fund trading of similar securities;

5)

foreign

currency exchange activity;

6)

the

trading prices of financial products that are tied to baskets of foreign securities;

7)

factors

relating to the event that precipitated the pricing problem;

8)

whether

the event is likely to recur;

9)

whether

the effects of the event are isolated or whether they affect entire markets, countries or regions; and

10)

other

relevant factors.

The Fund is subject to fair value

accounting standards that define fair value, establish the framework for measuring fair value and provide

a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the measurement date. The three levels of the

fair value hierarchy are as follows:

•

Level

1 – Level 1 inputs are quoted prices in active markets for identical investments. An active market is a market in which transactions

for the investment occur with sufficient frequency and volume to provide pricing information on an ongoing basis.

•

Level

2 – Level 2 inputs are observable inputs, either directly or indirectly, and include the following:

o

Quoted

prices for similar investments in active markets.

o

Quoted

prices for identical or similar investments in markets that are non-active. A non-active market is a market where there

are few transactions for the investment, the prices are not current, or price quotations vary substantially either over time

or among market makers, or in which little information is released publicly.

o

Inputs

other than quoted prices that are observable for the investment (for example, interest rates and yield curves observable

at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates).

o

Inputs

that are derived principally from or corroborated by observable market data by correlation or other means.

•

Level

3 – Level 3 inputs are unobservable inputs. Unobservable inputs may reflect the reporting entity’s own assumptions about

the assumptions that market participants would use in pricing the investment.

The inputs or methodologies used

for valuing investments are not necessarily an indication of the risk associated with investing in those

investments. A summary of the inputs used to value the Fund’s investments as of November 30, 2024, is included with the Fund’s

Portfolio of Investments.

B. Securities

Transactions and Investment Income

Securities transactions are recorded

as of the trade date. Realized gains and losses from securities transactions are recorded on the identified

cost basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the accrual basis.

Notes

to Financial Statements (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024

The Fund

holds shares of business development companies (“BDCs”). The Fund records the character of distributions received from the

BDCs during the year based on estimates available. The tax character of distributions received from these securities may vary when reported

by the issuer after their tax reporting periods conclude.

Distributions received from the

Fund’s investments in real estate investment trusts (“REITs”) may be comprised of return of capital, capital

gains, and income. The actual character of the amounts received during the year are not known until after the REITs’ fiscal year

end. The Fund records the character of distributions

received from the REITs during the year based on estimates available. The characterization

of distributions received by the Fund may be subsequently revised based on information received from the REITs after their

tax reporting periods conclude.

C. Dividends

and Distributions to Shareholders

Dividends from net investment

income of the Fund are declared and paid quarterly or as the Board of Trustees may determine from time

to time. Distributions of any net realized capital gains earned by the Fund are distributed at least annually. Distributions will automatically

be reinvested into additional Common Shares pursuant to the Fund’s Dividend Reinvestment Plan unless cash distributions

are elected by the shareholder.

Distributions from net investment

income and realized capital gains are determined in accordance with federal income tax regulations, which

may differ from U.S. GAAP. Certain capital accounts in the financial statements are periodically adjusted for permanent differences

in order to reflect their tax character. These permanent differences are primarily due to the varying treatment of income and gain/loss

on portfolio securities held by the Fund and have no impact on net assets or NAV per share. Temporary differences, which arise

from recognizing certain items of income, expense and gain/loss in different periods for financial statement and tax purposes, will

reverse at some point in the future. Permanent differences incurred during the fiscal year ended November 30, 2024, resulting in book

and tax accounting differences, have been reclassified at year end to reflect a decrease in accumulated net investment income (loss)

by $9,950 and an increase in paid-in-capital of $9,950. Accumulated distributable earnings (loss) consists of accumulated net investment

income (loss), accumulated net realized gain (loss) on investments, and unrealized appreciation (depreciation) on investments.

Net assets were not affected by this reclassification.

The tax character of distributions

paid by the Fund during the fiscal years ended November 30, 2024 and 2023, was as follows:

As of November 30, 2024, the

components of distributable earnings and net assets on a tax basis were as follows:

Undistributed

ordinary income |

|

Undistributed

capital gains |

|

Total

undistributed earnings |

|

Accumulated

capital and other losses |

|

Net unrealized

appreciation (depreciation) |

|

Total

accumulated earnings (losses) |

|

|

|

|

|

|

|

|

|

|

The Fund intends to continue

to qualify as a regulated investment company by complying with the requirements under Subchapter M of

the Internal Revenue Code of 1986, as amended, which includes distributing substantially all of its net investment income and net realized

gains to shareholders. Accordingly, no provision has been made for federal and state income taxes. However, due to the timing and

amount of distributions, the Fund may be subject to an excise tax of 4% of the amount by which approximately 98% of the Fund’s taxable

income exceeds the distributions from such taxable income for the calendar year.

The Fund intends to utilize provisions

of the federal income tax laws, which allow it to carry a realized capital loss forward indefinitely

following the year of the loss and offset such loss against any future realized capital gains. The Fund is subject to certain

Notes

to Financial Statements (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024

limitations

under U.S. tax rules on the use of capital loss carryforwards and net unrealized built-in losses. These limitations apply when

there has been a 50% change in ownership. At November 30, 2024, the Fund had $54,324,360 of non-expiring capital loss carryforwards

for federal income tax purposes.

Certain losses realized during

the current fiscal year may be deferred and treated as occurring on the first day of the following fiscal year

for federal income tax purposes. For the fiscal year ended November 30, 2024, the Fund did not incur any net late year ordinary losses.

The Fund is subject to accounting

standards that establish a minimum threshold for recognizing, and a system for measuring, the benefits

of a tax position taken or expected to be taken in a tax return. Taxable years ended 2021, 2022, 2023, and 2024 remain open to federal

and state audit. As of November 30, 2024, management has evaluated the application of these standards to the Fund and has determined

that no provision for income tax is required in the Fund’s financial statements for uncertain tax positions.

As of November 30, 2024, the

aggregate cost, gross unrealized appreciation, gross unrealized depreciation, and net unrealized appreciation/(depreciation)

on investments (including short positions and derivatives, if any) for federal income tax purposes were as follows:

|

|

Gross

Unrealized

Appreciation

|

Gross

Unrealized

(Depreciation)

|

Net Unrealized

Appreciation

(Depreciation)

|

|

|

|

|

|

The Fund will pay all expenses

directly related to its operations.

3. Investment

Advisory Fee, Affiliated Transactions and Other Fee Arrangements

First Trust, the investment advisor

to the Fund, is a limited partnership with one limited partner, Grace Partners of DuPage L.P., and one

general partner, The Charger Corporation. The Charger Corporation is an Illinois corporation controlled by James A. Bowen, Chief

Executive Officer of First Trust. First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio, managing

the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund. For these

services, First Trust is entitled to a monthly fee calculated at an annual rate of 1.00% of the Fund’s Managed Assets. First Trust

also provides fund reporting services to the Fund for

a flat annual fee in the amount of $9,250.

Confluence serves as the Fund’s

sub-advisor and manages the Fund’s portfolio subject to First Trust’s supervision. The Sub-Advisor receives

a portfolio management fee at an annual rate of 0.50% of the Fund’s Managed Assets that is paid by First Trust from its investment

advisory fee.

Computershare, Inc. (“Computershare”)

serves as the Fund’s transfer agent in accordance with certain fee arrangements. As transfer agent, Computershare is responsible

for maintaining shareholder records for the Fund.

The Bank of New York Mellon (“BNY”) serves as the Fund’s administrator,

fund accountant, and custodian in accordance with certain fee arrangements. As administrator and fund accountant, BNY is responsible

for providing certain administrative and accounting services to the Fund, including maintaining the Fund’s books of account, records

of the Fund’s securities transactions, and certain other books and records. As custodian, BNY is responsible for custody of the

Fund’s assets. BNY is a subsidiary of The Bank of New York Mellon Corporation, a financial holding company.

Each Trustee who is not an officer

or employee of First Trust, any sub-advisor or any of their affiliates (“Independent Trustees”) is paid

a fixed annual retainer that is allocated equally among each fund in the First Trust Fund Complex. Each Independent Trustee is also

paid an annual per fund fee that varies based on whether the fund is a closed-end or other actively managed fund, a target outcome fund

or an index fund.

Additionally, the Chairs of the

Audit Committee, Nominating and Governance Committee and Valuation Committee, the Vice Chair of the

Audit Committee, the Lead Independent Trustee and the Vice Lead Independent Trustee are paid annual fees to serve in such capacities,

with such compensation allocated pro rata among each fund in the First Trust Fund Complex based on net assets. Independent

Trustees are reimbursed for travel and out-of-pocket expenses in connection with all meetings. The Committee Chairs, the Audit

Committee Vice Chair, the Lead Independent Trustee and the Vice Lead Independent Trustee rotate periodically in serving in such

capacities. The officers and “Interested” Trustee receive no compensation from the Fund for acting in such capacities.

Notes

to Financial Statements (Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024

4. Purchases

and Sales of Securities

The cost of purchases and proceeds

from sales of securities, excluding short-term investments, for the fiscal year ended November 30, 2024,

were $18,640,597 and $17,918,917, respectively.

The Fund has a committed facility

agreement (the “BNP Facility”) with BNP Paribas Prime Brokerage International, Ltd. (“PBL”), which

currently has a maximum commitment amount of $25,000,000. Absent certain events of default or failure to maintain certain collateral

requirements, PBL may not terminate the BNP Facility except upon 179 calendar days’ prior notice. The interest rate under the

BNP Facility is equal to SOFR plus 95 basis points. In addition, under the BNP Facility, the Fund pays a commitment fee of 0.55% on

the undrawn amount of the facility.

The average amount outstanding

for the fiscal year ended November 30, 2024 was $8,600,000, with a weighted average interest rate of 6.16%.

As of November 30, 2024, the Fund had outstanding borrowings of $8,600,000, which approximates fair value, under the BNP Facility.

The borrowings are categorized as Level 2 within the fair value hierarchy. The high and low annual interest rates for the fiscal year

ended November 30, 2024 were 6.35% and 5.51%, respectively, and the interest rate at November 30, 2024 was 5.52%. The interest

and fees are included in “Interest and fees on loan” on the Statement of Operations.

The Fund has a variety of indemnification

obligations under contracts with its service providers. The Fund’s maximum exposure under these

arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of

loss to be remote.

7. Financial

Sector Concentration Risk

Under normal market conditions,

the Fund concentrates its investments (i.e., invests at least 25% of its total assets) in securities of companies

within industries in the financial sector. A fund concentrated in a single industry or sector is likely to present more risks than

a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual sector

may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock, or

regulatory changes. Specialty finance and other financial companies in general are subject to extensive government regulation, which

may change frequently. The profitability of specialty finance and other financial companies is largely dependent upon the availability

and cost of capital funds, and may fluctuate significantly in response to changes in interest rates, as well as changes in general

economic conditions. From time to time, severe competition may also affect the profitability of specialty finance and other financial

companies. Financial companies can be highly dependent upon access to capital markets and any impediments to such access,

such as general economic conditions or a negative perception in the capital markets of a company’s financial condition or prospects,

could adversely affect its business. Leasing companies can be negatively impacted by changes in tax laws which affect the types

of transactions in which such companies engage.

Management has evaluated the

impact of all subsequent events on the Fund through the date the financial statements were issued and has

determined that there were no subsequent events requiring recognition or disclosure in the financial statements that have not already

been disclosed.

Report

of Independent Registered Public Accounting Firm

To the Shareholders and

the Board of Trustees of First Trust Specialty Finance and Financial

Opportunities Fund:

Opinion on the Financial Statements and Financial

Highlights

We have audited the accompanying

statement of assets and liabilities of First Trust Specialty Finance and Financial Opportunities Fund

(the “Fund”), including the portfolio of investments, as of November 30, 2024, the related statements of operations and cash

flows for the year then ended, the statements of changes

in net assets for each of the two years in the period then ended, the financial highlights

for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial

highlights present fairly, in all material respects, the financial position of the Fund as of November 30, 2024, and the results of

its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then

ended, and the financial highlights for each of the

five years in the period then ended in conformity with accounting principles generally

accepted in the United States of America.

These financial statements and

financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion

on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with

the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the

Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission

and the PCAOB.

We conducted our audits in accordance

with the standards of the PCAOB. Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether

due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for

the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly,

we express no such opinion.

Our audits included performing

procedures to assess the risks of material misstatement of the financial statements and financial highlights,

whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on

a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November

30, 2024, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other

auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ Deloitte & Touche, LLP

January

23, 2025

We have served as the auditor

of one or more First Trust investment companies since 2001.

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024 (Unaudited)

Dividend Reinvestment

Plan

If your Common Shares are registered

directly with the Fund or if you hold your Common Shares with a brokerage firm that participates

in the Fund’s Dividend Reinvestment Plan (the “Plan”), unless you elect, by written notice to the Fund, to receive cash

distributions, all dividends, including any capital

gain distributions, on your Common Shares will be automatically reinvested by Computershare

Trust Company N.A. (the “Plan Agent”), in additional Common Shares under the Plan. If you elect to receive cash distributions,

you will receive all distributions in cash paid by check mailed directly to you by the Plan Agent, as the dividend paying agent.

If you decide to participate

in the Plan, the number of Common Shares you will receive will be determined as follows:

(1)

If

Common Shares are trading at or above net asset value (“NAV”) at the time of valuation, the Fund will issue new shares at

a price equal to the greater of (i) NAV per Common

Share on that date or (ii) 95% of the market price on that date.

(2)

If

Common Shares are trading below NAV at the time of valuation, the Plan Agent will receive the dividend or distribution in

cash and will purchase Common Shares in the open market, on the NYSE or elsewhere, for the participants’ accounts. It is

possible that the market price for the Common Shares may increase before the Plan Agent has completed its purchases. Therefore,

the average purchase price per share paid by the Plan Agent may exceed the market price at the time of valuation, resulting

in the purchase of fewer shares than if the dividend or distribution had been paid in Common Shares issued by the Fund.

The Plan Agent will use all dividends and distributions received in cash to purchase Common Shares in the open market

within 30 days of the valuation date except where temporary curtailment or suspension of purchases is necessary to comply

with federal securities laws. Interest will not be paid on any uninvested cash payments.

You may elect to opt-out of or

withdraw from the Plan at any time by giving written notice to the Plan Agent, or by telephone at (866)

340-1104, in accordance with such reasonable requirements as the Plan Agent and the Fund may agree upon. If you withdraw or the

Plan is terminated, you will receive a certificate for each whole share in your account under the Plan, and you will receive a cash payment

for any fraction of a share in your account. If you wish, the Plan Agent will sell your shares and send you the proceeds, minus brokerage

commissions.

The Plan Agent maintains all

Common Shareholders’ accounts in the Plan and gives written confirmation of all transactions in the accounts,

including information you may need for tax records. Common Shares in your account will be held by the Plan Agent in non-certificated

form. The Plan Agent will forward to each participant any proxy solicitation material and will vote any shares so held only

in accordance with proxies returned to the Fund. Any proxy you receive will include all Common Shares you have received under the

Plan.

There is no brokerage charge

for reinvestment of your dividends or distributions in Common Shares. However, all participants will pay a

pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases.

Automatically reinvesting dividends

and distributions does not mean that you do not have to pay income taxes due upon receiving dividends

and distributions. Capital gains and income are realized although cash is not received by you. Consult your financial advisor for

more information.

If you hold your Common Shares

with a brokerage firm that does not participate in the Plan, you will not be able to participate in the Plan

and any dividend reinvestment may be effected on different terms than those described above.

The Fund reserves the right to

amend or terminate the Plan if in the judgment of the Board of Trustees the change is warranted. There is

no direct service charge to participants in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge

payable by the participants. Additional information about the Plan may be obtained by writing Computershare, Inc., P.O. Box 43006,

Providence, RI 02940-3006.

Proxy Voting Policies and Procedures

A description of the policies

and procedures that the Fund uses to determine how to vote proxies and information on how the Fund voted

proxies relating to portfolio investments during the most recent 12-month period ended June 30 is available (1) without charge, upon

request, by calling (800) 988-5891 or emailing info@ftportfolios.com; (2) on the Fund’s website at www.ftportfolios.com;

and (3) on the Securities and Exchange Commission’s

(“SEC”) website at www.sec.gov.

The Fund files portfolio holdings

information for each month in a fiscal quarter within 60 days after the end of the relevant fiscal quarter

on Form N-PORT. Portfolio holdings information for the third month of each fiscal quarter will be publicly available on the

Additional Information

(Continued)

First Trust Specialty

Finance and Financial Opportunities Fund (FGB)

November 30, 2024 (Unaudited)

SEC’s

website at www.sec.gov.

The Fund’s complete schedule of portfolio holdings for the second and fourth quarters of each fiscal year

is included in the semi-annual and annual reports to shareholders, respectively, and is filed with the SEC on Form N-CSR. The semi-annual

and annual report for the Fund is available to investors within 60 days after the period to which it relates. The Fund’s Forms

N-PORT and Forms N-CSR are available on the SEC’s website listed above.

Of the ordinary income (including

short-term capital gain) distributions made by the Fund during the fiscal year ended November 30, 2024,

none qualified for the corporate dividends received deduction available to corporate shareholders or as qualified dividend income.

NYSE Certification Information

In accordance with Section 303A-12

of the New York Stock Exchange (“NYSE”) Listed Company Manual, the Fund’s President has certified

to the NYSE that, as of November 13, 2024, he was not aware of any violation by the Fund of NYSE corporate governance listing

standards. In addition, the Fund’s reports to the SEC on Form N-CSR contain certifications by the Fund’s principal executive

officer and principal financial officer that relate

to the Fund’s public disclosure in such reports and are required by Rule 30a-2 under the

1940 Act.

Submission of Matters to a Vote of Shareholders

The Fund held its Annual Meeting

of Shareholders (the “Annual Meeting”) on November 12, 2024. At the Annual Meeting, Richard E. Erickson

and Thomas R. Kadlec were elected by the Common Shareholders of First Trust Specialty Finance and Financial Opportunities

Fund as Class II Trustees for a three-year term expiring at the Fund’s annual meeting of shareholders in 2027. The number

of votes cast in favor of Mr. Erickson was 9,677,961, the number of votes withheld was 1,786,601. The number of votes cast in

favor of Mr. Kadlec was 9,647,782, the number of votes withheld was 1,816,780. Denise M. Keefe, Robert F. Keith, James A. Bowen,

Niel B. Nielson, and Bronwyn Wright are the other current and continuing Trustees.

The Fund called a special meeting

of shareholders on August 29, 2024 to consider the reorganization of the Fund with and into abrdn Total

Dynamic Dividend Fund (the “Acquiring Fund”) in exchange solely for newly issued common shares of beneficial interest of the

Acquiring Fund. The number of votes cast in favor was

3,828,247, the number of votes against was 1,936,313, the number of votes withheld

was 44,428.

Advisory and

Sub-Advisory Agreements

Board Considerations Regarding Approval

of the Continuation of the Investment Management and

Investment Sub-Advisory Agreements

The Board of Trustees of First

Trust Specialty Finance and Financial Opportunities Fund (the “Fund”), including the Independent Trustees,

unanimously approved the continuation of the Investment Management Agreement (the “Advisory Agreement”) between the Fund

and First Trust Advisors L.P. (the “Advisor”) and the Investment Sub-Advisory Agreement (the “Sub-Advisory Agreement”