FICO UK Credit Card Market Report: November/December 2024

06 Février 2025 - 10:00AM

Business Wire

Spending and credit card balances reached the

highest averages since FICO records began in 2006

Spending, balances, payments, and cash usage on UK credit cards

followed expected seasonal trends in November and December 2024,

with spending and balances reaching the highest averages that

global analytics software provider FICO has ever recorded. While

missed payments fell in November and December, average balances

rose on accounts where payments have been missed.

Highlights

- Average credit card spend rose in the lead-up to Christmas

2024, reaching £860 in December; a 6.8% increase on November and a

1.5% increase on December 2023

- December saw the highest average balance since FICO records

began in 2006 at £1,860 - 4.5% higher than December 2023

- The percentage of overall balance paid fell by 3% in November

compared to October and by a further 0.5% in December, with 35.86%

of the balance being paid off in December 2024

- Fewer customers missed payments in November and December 2024

than across the same two months in 2023

- Customers using their credit card to withdraw cash fell for the

third month in a row, standing at 3.19% in December 2024

Average spending saw typical seasonal increases in the run-up to

Christmas. However, with average spend reaching £860 in December –

a 6.8% increase on November and the highest since FICO records

began in 2006 – the ongoing impact of continued inflation could

dent consumer affordability through 2025.

Similarly, average credit card balances reached an all-time high

in December at £1,860, with typical seasonal pressures seeing a 3%

month-on-month decrease in the percentage of balance paid in

November and a further 0.5% drop in December. If seasonal patterns

continue, the balance paid is expected to rise in January as

consumers focus on paying off Christmas spend.

For customers missing one, two or three payments, the average

balance increased year-on-year in November and December – another

indicator of the financial pressures faced throughout 2024. Average

balances for one missed payment are now £2,255, for two payments

£2,780 and for three payments £3,190.

The usual seasonal trend sees a reduction in customers missing

one payment in the run-up to Christmas, as people want to keep

lines of credit open. However, in December 2024 there was a 9.3%

increase compared to November. And after four consecutive decreases

in the percentage of customers missing three payments, there was a

1.2% increase in November month-on-month and a further 2.2%

increase in December. As indebted customers struggle with payments

in the new year, this trend is expected to continue in early

2025.

Given the continued financial pressures affecting households,

risk managers should review both limit management and collections

contact strategies in order to help customers avoid getting into

long-term debt.

These card performance figures are part of the data shared with

subscribers of the FICO® Benchmark Reporting Service. The data

sample comes from client reports generated by the FICO® TRIAD®

Customer Manager solution in use by some 80% of UK card

issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency. Learn more at

www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac

Corporation in the United States and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206421912/en/

For further press information please contact: FICO UK

PR Team Wendy Harrison/Parm Heer ficoteam@harrisonsadler.com

0208 977 9132

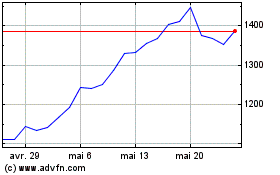

Fair Isaac (NYSE:FICO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Fair Isaac (NYSE:FICO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025