Exceeded Q2 2024 Outlook; Announcing $50

Million Share Repurchase Authorization

FIGS, Inc. (NYSE: FIGS) (the “Company”), the global leading

healthcare apparel brand dedicated to improving the lives of

healthcare professionals, today released its second quarter 2024

financial results and published a financial highlights presentation

on its investor relations website at

ir.wearfigs.com/financials/quarterly-results.

Second Quarter 2024 Financial Highlights

- Net revenues(1) were $144.2 million, an increase of 4.4%

year over year, due to an increase in orders from existing

customers, partially offset by a decrease in average order value

(“AOV”).(2)

- Gross margin was 67.4%, a decrease of 2.1% year over

year, primarily from product mix shift related to outperformance of

limited edition scrubwear and limited edition non-scrubwear.

- Operating expenses were $95.7 million, an increase of

7.0% year over year. As a percentage of net revenues, operating

expenses increased to 66.4% from 64.7% primarily due to higher

selling and marketing expenses, including transitory expenses

associated with the transition to our new fulfillment center,

offset by lower general and administrative expenses primarily due

to lower stock-based compensation expense.

- Net income and Net income, as adjusted(3) were

$1.1 million (or $0.01 in diluted earnings per share), a

decrease of $3.5 million year over year as compared to net income

and net income, as adjusted(3) in the same period last year.

- Net income margin(4) was 0.8%, as compared to 3.4% in

the same period last year.

- Adjusted EBITDA(3) was $12.9 million, a decrease of $6.0

million year over year.

- Adjusted EBITDA margin(3)(4) was 9.0%, as compared to

13.7% in the same period last year.

Key Operating Metrics

- Active customers(2) as of June 30, 2024 increased 6.1%

year over year to 2.6 million.

- Net revenues per active customer(2)(5) were $210, a

decrease of 2.3% year over year.

- AOV(2)(5) was $113, a decrease of 1.7% year over year

primarily driven by the accounting reclassification between net

revenues and selling expense related to duty subsidies for

international customers.

“Our strong second quarter performance shows that our

investments are paying off,” said Trina Spear, Chief Executive

Officer and Co-Founder. “Both net revenues and adjusted EBITDA

margin(3) exceeded our outlook, and we saw continued momentum in

the business, including a positive year-over-year repeat frequency

trend. Our strategy of combining pioneering product innovation with

powerful top of funnel marketing is resonating. We look forward to

continuing our momentum into the second half of the year, spurred

by the biggest and most exciting campaign we have ever done – our

first-of-its-kind partnership outfitting the Team USA Medical

Team.”

$50 Million Share Repurchase Authorization

The Company’s Board of Directors has authorized a share

repurchase program for up to $50.0 million of the Company’s

outstanding Class A common stock, with no expiration date.

“Our strong financial profile and long-term business outlook

give us the confidence to evolve our capital allocation strategy,”

said Ms. Spear. “We believe we have sufficient liquidity and cash

flow generation to both invest internally for growth and also

return value to our shareholders through a share repurchase

program.”

Under the program, the Company may repurchase shares in the open

market, through privately negotiated transactions, by entering into

structured repurchase agreements with third parties, by making

block purchases, entering into derivatives contracts and/or

pursuant to Rule 10b5-1 trading plans, subject to market

conditions, applicable securities laws and other legal requirements

and relevant factors. The Company is not obligated to repurchase

any specific number of shares and the program may be modified,

suspended or terminated at any time, without prior notice. The

timing, manner, price and amount of any repurchases will be

determined at the Company’s discretion, subject to business,

economic and market conditions and other factors.

Financial Outlook

For Full-Year 2024, the Company now expects:

Net Revenues versus 2023

Flat to 2% Growth

Adjusted EBITDA Margin(3)(6)

9.5% - 10%

(1) Second quarter 2024 net revenues results reflect $1.8

million in international duty subsidies recorded as contra revenue,

whereas international duty subsidies were recorded in selling

expense in second quarter 2023. As a result, year over year net

revenues growth was negatively impacted by 1.3 percentage

points.

(2) “Active customers,” “net revenues per active customer” and

“average order value” are key operational and business metrics that

are important to understanding the Company’s performance. Please

see the sections titled “Non-GAAP Financial Measures and Key

Operating Metrics” and “Key Operating Metrics” below for

information regarding how the Company calculates its key

operational and business metrics and for comparisons of active

customers, net revenues per active customer and average order value

to the prior year period.

(3) “Net income, as adjusted,” “adjusted EBITDA” and “adjusted

EBITDA margin” are non-GAAP financial measures. Please see the

sections titled “Non-GAAP Financial Measures and Key Operating

Metrics” and “Reconciliations of GAAP to Non-GAAP Measures” below

for more information regarding the Company’s use of non-GAAP

financial measures and reconciliations to the most directly

comparable GAAP measures.

(4) “Net income margin” and “adjusted EBITDA margin” are

calculated by dividing net income and adjusted EBITDA by net

revenues, respectively.

(5) Net revenues per active customer and AOV results for the

second quarter 2024 each reflect international duty subsidies

recorded as contra revenue, which were not reflected in the results

for these metrics for second quarter 2023. As a result, year over

year growth in each of these metrics was negatively impacted by

approximately 1 percentage point.

(6) The Company has not provided a quantitative reconciliation

of its adjusted EBITDA margin outlook to a GAAP net income margin

outlook because it is unable, without making unreasonable efforts,

to project certain reconciling items. These items include, but are

not limited to, future stock-based compensation expense, income

taxes, expenses related to non-ordinary course disputes, and

transaction costs. These items are inherently variable and

uncertain and depend on various factors, some of which are outside

of the Company’s control or ability to predict. For more

information regarding the Company’s use of non-GAAP financial

measures, please see the section titled “Non-GAAP Financial

Measures and Key Operating Metrics.”

Conference Call Details

FIGS management will host a conference call and webcast today at

2:00 p.m. PT / 5:00 p.m. ET to discuss the Company’s financial and

business results and outlook. To participate, please dial

1-833-470-1428 (US) or +1-404-975-4839 (International) and the

conference ID 061510. The call is also accessible via webcast at

ir.wearfigs.com. A recording will be available shortly after the

conclusion of the call until 11:59 p.m. ET on August 15, 2024. To

access the replay, please dial 1-866-813-9403 (US) or

+1-929-458-6194 (International) and the conference ID 632451. An

archive of the webcast will be available on FIGS’ investor

relations website at ir.wearfigs.com.

Non-GAAP Financial Measures and Key Operating Metrics

In addition to the GAAP financial measures set forth in this

press release, the Company has included non-GAAP financial measures

within the meaning of Regulation G and Item 10(e) of Regulation

S-K. The Company uses “net income, as adjusted,” “diluted earnings

per share, as adjusted,” “adjusted EBITDA” and “adjusted EBITDA

margin” to provide useful supplemental measures that assist in

evaluating its ability to generate earnings, provide consistency

and comparability with its past financial performance and

facilitate period-to-period comparisons of its core operating

results as well as the results of its peer companies. The Company

uses “free cash flow” as a useful supplemental measure of liquidity

and as an additional basis for assessing its ability to generate

cash. The Company calculates “net income, as adjusted,” as net

income adjusted to exclude transaction costs, expenses related to

non-ordinary course disputes, other than temporary impairment of

held-to-maturity investments, stock-based compensation, including

expense related to award modifications, accelerated performance

awards and associated payroll taxes and costs, ambassador grants in

connection with its initial public offering, and expense resulting

from the retirement of a former CFO of the Company, and the income

tax impact of these adjustments. The Company calculates “diluted

earnings per share, as adjusted” as net income, as adjusted divided

by diluted shares outstanding. The Company calculates “adjusted

EBITDA” as net income adjusted to exclude: other income (loss),

net; gain/loss on disposal of assets; provision for income taxes;

depreciation and amortization expense; stock-based compensation and

related expense; transaction costs; and expenses related to

non-ordinary course disputes. The Company calculates “adjusted

EBITDA margin” by dividing adjusted EBITDA by net revenues. The

Company calculates “free cash flow” as net cash (used in) provided

by operating activities reduced by capital expenditures, including

purchases of property and equipment and capitalized software

development costs.

Reconciliations of non-GAAP financial measures to the most

directly comparable GAAP measures are included below under the

heading “Reconciliations of GAAP to Non-GAAP Measures.”

The Company has also included herein “active customers,” “net

revenues per active customer” and “average order value,” which are

key operational and business metrics that are important to

understanding Company performance. The Company believes the number

of active customers is an important indicator of growth as it

reflects the reach of the Company’s digital platform, brand

awareness and overall value proposition. The Company defines an

active customer as a unique customer account that has made at least

one purchase in the preceding 12-month period. In any particular

period, the Company determines the number of active customers by

counting the total number of customers who have made at least one

purchase in the preceding 12-month period, measured from the last

date of such period. The Company believes measuring net revenues

per active customer is important to understanding engagement and

retention of customers, and as such, the value proposition for its

customer base. The Company defines net revenues per active customer

as the sum of total net revenues in the preceding 12-month period

divided by the current period active customers. The Company defines

average order value as the sum of the total net revenues in a given

period divided by the total orders placed in that period. Total

orders are the summation of all completed individual purchase

transactions in a given period. The Company believes its relatively

high average order value demonstrates the premium nature of its

products. As the Company expands into and increases its presence in

additional product categories, price points and international

markets, average order value may fluctuate.

Active customers as of June 30, 2024 and 2023, respectively, net

revenues per active customer as of June 30, 2024 and 2023,

respectively, and average order value for the three and six months

ended June 30, 2024 and 2023, respectively, are presented below

under the heading “Key Operating Metrics.”

About FIGS

FIGS is a founder-led, direct-to-consumer healthcare apparel and

lifestyle brand that seeks to celebrate, empower, and serve current

and future generations of healthcare professionals. We create

technically advanced apparel and products that feature an unmatched

combination of comfort, durability, function, and style. We share

stories about healthcare professionals’ experiences in ways that

inspire them. We build meaningful connections within the healthcare

community that we created. Above all, we seek to make an impact for

our community, including by advocating for them and always having

their backs.

We serve healthcare professionals in numerous countries in North

America, Europe, the Asia Pacific region and the Middle East. We

also serve healthcare institutions through our TEAMS platform.

Forward Looking Statements

This press release contains various forward-looking statements

about the Company within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended, that are based on

current management expectations, and which involve substantial

risks and uncertainties that could cause actual results to differ

materially from the results expressed in, or implied by, such

forward-looking statements. All statements contained in this press

release that do not relate to matters of historical fact should be

considered forward-looking. These forward-looking statements

generally are identified by the words “anticipate”, “believe”,

“contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “intend”, “may”, “might”, “opportunity”,

“outlook”, “plan”, “possible”, “potential”, “predict”, “project,”

“should”, “strategy”, “strive”, “target”, “will” or “would”, the

negative of these words or other similar terms or expressions. The

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements address various

matters, including the Company’s strategy of combining product

innovation with top of funnel marketing; the Company’s expectation

of sustaining its momentum into the second half of the year; the

Company’s Olympics campaign; the Company’s share repurchase program

and growth and capital return plans; and the Company’s outlook as

to net revenues growth and adjusted EBITDA margin for the full year

ending December 31, 2024; all of which reflect the Company’s

expectations based upon currently available information and data.

Because such statements are based on expectations as to future

financial and operating results and are not statements of fact, the

Company’s actual results, performance or achievements may differ

materially from those expressed or implied by the forward-looking

statements, and you are cautioned not to place undue reliance on

these forward-looking statements. The following important factors

and uncertainties, among others, could cause actual results,

performance or achievements to differ materially from those

described in these forward-looking statements: the Company’s

ability to maintain its historical growth; the Company’s ability to

maintain profitability; the Company’s ability to maintain the value

and reputation of its brand; the Company’s ability to attract new

customers, retain existing customers, and to maintain or increase

sales to those customers; the success of the Company’s marketing

efforts; the Company’s ability to maintain a strong community of

engaged customers and Ambassadors; negative publicity related to

the Company’s marketing efforts or use of social media; the

Company’s ability to successfully develop and introduce new,

innovative and updated products; the competitiveness of the market

for healthcare apparel; the Company’s ability to maintain its key

employees; the Company’s ability to attract and retain highly

skilled team members; risks associated with expansion into, and

conducting business in, international markets; changes in, or

disruptions to, the Company’s shipping arrangements; the successful

operation of the Company’s distribution and warehouse management

systems; the Company’s ability to accurately forecast customer

demand, manage its inventory, and plan for future expenses; the

impact of changes in consumer confidence, shopping behavior and

consumer spending on demand for the Company’s products; the impact

of macroeconomic trends on the Company’s operations; the Company’s

reliance on a limited number of third-party suppliers; the

fluctuating costs of raw materials; the Company’s failure to

protect proprietary, confidential or sensitive information or

personal customer data, or risks of cyberattacks; the Company’s

failure to protect its intellectual property rights; the fact that

the operations of many of the Company’s suppliers and vendors are

subject to additional risks that are beyond its control; and other

risks, uncertainties, and factors discussed in the “Risk Factors”

section of the Company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024 to be filed with the Securities and

Exchange Commission (“SEC”), the Company’s Annual Report on Form

10-K for the year ended December 31, 2023 filed with the SEC on

February 28, 2024, and the Company’s other periodic filings with

the SEC. The forward-looking statements in this press release speak

only as of the time made and the Company does not undertake to

update or revise them to reflect future events or

circumstances.

FIGS, INC. BALANCE

SHEETS (In thousands, except share and per share

data)

As of

June 30, 2024

December 31,

2023

Assets

(Unaudited)

Current assets

Cash and cash equivalents

$

131,811

$

144,173

Short-term investments

136,719

102,522

Accounts receivable

12,719

7,469

Inventory, net

119,294

119,040

Prepaid expenses and other current

assets

16,697

12,455

Total current assets

417,240

385,659

Non-current assets

Property and equipment, net

35,266

24,864

Operating lease right-of-use assets

55,003

43,059

Deferred tax assets

16,300

18,291

Other assets

2,214

1,336

Total non-current assets

108,783

87,550

Total assets

$

526,023

$

473,209

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

19,910

$

14,749

Operating lease liabilities

11,749

8,230

Accrued expenses

21,610

7,906

Accrued compensation and benefits

4,104

7,312

Sales tax payable

3,217

3,149

Gift card liability

8,034

8,240

Deferred revenue

2,825

2,160

Returns reserve

3,514

2,989

Income tax payable

1,640

2,557

Total current liabilities

76,603

57,292

Non-current liabilities

Operating lease liabilities,

non-current

47,532

38,884

Other non-current liabilities

183

183

Total liabilities

$

124,318

$

96,359

Commitments and contingencies

Stockholders’ equity

Class A Common stock — par value $0.0001

per share, 1,000,000,000 shares authorized as of June 30, 2024 and

December 31, 2023; 162,392,991 and 161,457,403 shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively

16

16

Class B Common stock — par value $0.0001

per share, 150,000,000 shares authorized as of June 30, 2024 and

December 31, 2023; 8,283,641 shares issued and outstanding as of

June 30, 2024 and December 31, 2023

—

—

Preferred stock — par value $0.0001 per

share, 100,000,000 shares authorized as of June 30, 2024 and

December 31, 2023; zero shares issued and outstanding as of June

30, 2024 and December 31, 2023

—

—

Additional paid-in capital

337,447

315,075

Accumulated other comprehensive income

(loss)

(47

)

5

Retained earnings

64,289

61,754

Total stockholders’ equity

401,705

376,850

Total liabilities and stockholders’

equity

$

526,023

$

473,209

FIGS, INC. STATEMENTS

OF OPERATIONS (In thousands, except share and per share

data) (Unaudited)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Net revenues

$

144,225

$

138,132

$

263,518

$

258,364

Cost of goods sold

46,961

42,098

84,118

76,654

Gross profit

97,264

96,034

179,400

181,710

Operating expenses

Selling

36,934

33,739

65,393

64,896

Marketing

23,003

20,889

40,248

37,953

General and administrative

35,774

34,840

71,763

68,997

Total operating expenses

95,711

89,468

177,404

171,846

Net income from operations

1,553

6,566

1,996

9,864

Other income, net

Interest income

2,830

1,521

5,677

2,593

Other expense

—

(4

)

(10

)

(5

)

Total other income, net

2,830

1,517

5,667

2,588

Net income before provision for income

taxes

4,383

8,083

7,663

12,452

Provision for income taxes

3,283

3,501

5,128

5,961

Net income

$

1,100

$

4,582

$

2,535

$

6,491

Earnings attributable to Class A and Class

B common stockholders

Basic earnings per share

$

0.01

$

0.03

$

0.01

$

0.04

Diluted earnings per share

$

0.01

$

0.02

$

0.01

$

0.04

Weighted-average shares

outstanding—basic

170,393,480

167,423,656

170,158,479

167,100,292

Weighted-average shares

outstanding—diluted

179,688,524

183,332,560

180,195,183

183,094,950

FIGS, INC. STATEMENTS

OF CASH FLOWS (In thousands) (Unaudited)

Six months ended June

30,

2024

2023

Cash flows from operating

activities:

Net income

$

2,535

$

6,491

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

1,963

1,372

Deferred income taxes

1,991

(984

)

Non-cash operating lease cost

3,977

1,364

Stock-based compensation

22,108

22,309

Accretion of discount on

available-for-sale securities

(2,723

)

(260

)

Changes in operating assets and

liabilities:

Accrued interest

(231

)

—

Accounts receivable

(5,250

)

597

Inventory

(254

)

10,170

Prepaid expenses and other current

assets

(5,973

)

2,034

Other assets

(878

)

(1

)

Accounts payable

4,679

(9,100

)

Accrued expenses

11,310

(8,181

)

Accrued compensation and benefits

(3,208

)

951

Sales tax payable

68

(421

)

Gift card liability

(206

)

508

Deferred revenue

665

(2,009

)

Returns reserve

525

(144

)

Income tax payable

(917

)

3,290

Operating lease liabilities

(2,023

)

(1,466

)

Net cash provided by operating

activities

28,158

26,520

Cash flows from investing

activities:

Purchases of property and equipment

(9,489

)

(1,613

)

Purchases of available-for-sale

securities

(137,850

)

(38,343

)

Maturities of available-for-sale

securities

106,555

—

Net cash used in investing activities

(40,784

)

(39,956

)

Cash flows from financing

activities:

Proceeds from stock option exercises and

employee stock purchases

264

637

Tax payments related to net share

settlements on restricted stock units

—

(246

)

Net cash provided by financing

activities

264

391

Net change in cash and cash

equivalents

(12,362

)

(13,045

)

Cash and cash equivalents, beginning of

period

144,173

159,775

Cash and cash equivalents, end of

period

$

131,811

$

146,730

FIGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP

MEASURES (Unaudited)

The following table presents a reconciliation of net income, as

adjusted to net income, which is the most directly comparable

financial measure calculated in accordance with GAAP, and presents

diluted earnings per share (“EPS”), as adjusted with diluted

EPS:

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

(in thousands, except share

and per share amounts)

Net income

$

1,100

$

4,581

$

2,535

$

6,490

Add (deduct):

Expenses related to non-ordinary course

disputes(1)

—

—

—

1,256

Income tax impacts of items above

—

—

—

(707

)

Net income, as adjusted

$

1,100

$

4,581

$

2,535

$

7,039

Diluted EPS

$

0.01

$

0.02

$

0.01

$

0.04

Diluted EPS, as adjusted

$

0.01

$

0.02

$

0.01

$

0.04

Weighted-average shares used to compute

Diluted EPS and Diluted EPS, as adjusted

179,688,524

183,332,560

180,195,183

183,094,950

(1) Exclusively represents attorney's fees, costs and expenses

incurred by the Company in connection with the Company’s

now-concluded litigation against Strategic Partners, Inc.

The following table presents a reconciliation of adjusted EBITDA

to net income, which is the most directly comparable financial

measure calculated in accordance with GAAP, and presents adjusted

EBITDA margin with net income margin, which is the most directly

comparable financial measure calculated in accordance with

GAAP:

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

(in thousands, except

margin)

Net income

$

1,100

$

4,581

$

2,535

$

6,490

Add (deduct):

Other income, net

(2,830

)

(1,517

)

(5,667

)

(2,588

)

Provision for income taxes

3,283

3,501

5,128

5,961

Depreciation and amortization

expense(1)

1,113

713

1,963

1,372

Stock-based compensation and related

expense(2)

10,266

11,618

21,963

22,482

Expenses related to non-ordinary course

disputes(3)

—

—

—

1,256

Adjusted EBITDA

$

12,932

$

18,896

$

25,922

$

34,973

Net revenues

$

144,225

$

138,132

$

263,518

$

258,364

Net income margin(4)

0.8

%

3.4

%

1.0

%

2.5

%

Adjusted EBITDA margin

9.0

%

13.7

%

9.8

%

13.5

%

(1) Excludes amortization of debt issuance costs included in

“Other income, net.”

(2) Includes stock-based compensation expense, payroll taxes,

and costs related to equity award activity.

(3) Exclusively represents attorney's fees, costs and expenses

incurred by the Company in connection with the Company’s

now-concluded litigation against Strategic Partners, Inc.

(4) Net income margin represents net income as a percentage of

net revenues.

The following table presents a reconciliation of free cash flow

to net cash provided by operating activities, which is the most

directly comparable financial measure calculated in accordance with

GAAP:

Six months ended June

30,

2024

2023

(in thousands)

Net cash provided by operating

activities

$

28,158

$

26,520

Less: capital expenditures

(9,489

)

(1,613

)

Free cash flow

$

18,669

$

24,907

FIGS, INC.

KEY OPERATING METRICS

(Unaudited)

Active customers as of June 30, 2024 and 2023, respectively, net

revenues per active customer as of June 30, 2024 and 2023,

respectively, and average order value for the three and six months

ended June 30, 2024 and 2023, respectively, are presented in the

following tables:

As of June 30,

2024

2023

(in thousands)

Active customers

2,628

2,476

As of June 30,

2024

2023

Net revenues per active customer

$

210

$

215

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Average order value

$

113

$

115

$

115

$

115

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808318967/en/

Investors: IR@wearfigs.com

Media: press@wearfigs.com

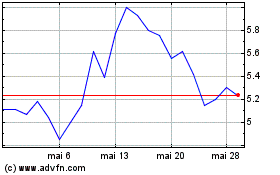

FIGS (NYSE:FIGS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

FIGS (NYSE:FIGS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024