Gabelli Dividend & Income Trust Increases Annual Distribution 27% to $1.68 From $1.32 and Monthly Distribution Rate to $0.14 From $0.11

04 Décembre 2024 - 7:19PM

In light of the performance of The Gabelli Dividend & Income

Trust (NYSE: GDV) (the “Fund”) and the Fund’s $1.4 billion in

portfolio unrealized gains, The Board of Trustees has decided to

increase the annual distribution to $1.68 per share, which will be

paid $0.14 per share monthly. The increased monthly distributions

will commence with the previously announced distribution dates in

the first quarter of 2025.

|

Distribution Month |

Record Date |

Payable Date |

Distribution Per Share |

|

January |

January 16, 2025 |

January 24, 2025 |

$0.14 |

|

February |

February 13, 2025 |

February 21, 2025 |

$0.14 |

|

March |

March 17, 2025 |

March 24, 2025 |

$0.14 |

| |

|

|

|

The Fund’s distribution policy is subject to

modification by the Board of Trustees at any time, and there can be

no guarantee that the policy will continue. The distribution rate

should not be considered the dividend yield or total return on an

investment in the Fund.

Investors should carefully consider the

investment objectives, risks, charges, and expenses of the Fund

before investing. For more information regarding the Fund’s

distribution policy and other information about the Fund, call:

Carter Austin(914) 921-5475

About The Gabelli Dividend & Income

TrustThe Gabelli Dividend & Income Trust is a

diversified, closed-end management investment company with $3.1

billion in total net assets whose primary investment objective is

to provide a high level of total return with an emphasis on

dividends and income. The Fund is managed by Gabelli Funds, LLC, a

subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).

NYSE – GDVCUSIP – 36242H104

THE GABELLI DIVIDEND & INCOME TRUST

Investor Relations Contact:Carter Austin(914)

921-5475caustin@gabelli.com

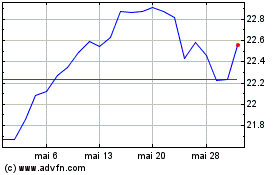

Gabelli Dividend and Inc... (NYSE:GDV)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Gabelli Dividend and Inc... (NYSE:GDV)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025