UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Genco Shipping & Trading Limited

(Name of Issuer)

Common Shares, par value $0.01 per share

(Title of Class of Securities)

Y2685T131

(CUSIP Number)

Kleanthis Costa Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor, Office 21

1066 Nicosia, Cyprus

+30 210 8090429

with a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 16, 2024

(Date of Event which Requires Filing of this

Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| |

| |

| |

1. |

Names of Reporting Persons

GK Investor LLC |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,339,084(1)(2) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

584,749(1)(2) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,339,084(1)(2) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

5.5%(2)(3) |

| |

14. |

Type of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

|

(1) All reported Common Shares are held

by GK Investor LLC. GK Investor LLC is a controlled affiliate of each of Sphinx Investment Corp. and Maryport Navigation Corp. Sphinx

Investment Corp. is a controlled affiliate of Maryport Navigation Corp. Maryport Navigation Corp. is controlled by Mr. Economou.

(2) As of May 20, 2024, each of the

Reporting Persons shared the power to dispose of 584,749 Common Shares in the aggregate. As of March 28, 2024, the record date for

the Issuer’s 2024 Annual Meeting, each of the Reporting Persons had the shared power to vote 2,339,084 Common Shares at such meeting

(representing approximately 5.5% of the Common Shares issued and outstanding as of such record date), and the Reporting Persons retain

as of the date of this Amendment the shared power to vote all such Common Shares for purposes of the 2024 Annual Meeting as a result

of all such Common Shares having been held on such record date (notwithstanding that 1,754,335 of such Common Shares (including the power

to dispose, or to direct the disposition of, such Common Shares) (the “Sold Shares”)) have been sold by the Reporting

Persons after such record date), but do not otherwise have beneficial ownership of the Sold Shares as of the date of this Amendment.

(3) Based on the 42,751,752 Common Shares

stated by the Issuer as being outstanding as at March 28, 2024 in its proxy statement, filed with the United States Securities and

Exchange Commission (the “SEC”) on April 16, 2024 (the “2024 Proxy Statement”).

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,339,084(1)(2) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

584,749

(1)(2) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,339,084(1)(2) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

5.5%(2)(3) |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

(1) All reported Common Shares are held

by GK Investor LLC. GK Investor LLC is a controlled affiliate of each of Sphinx Investment Corp. and Maryport Navigation Corp. Sphinx

Investment Corp. is a controlled affiliate of Maryport Navigation Corp. Maryport Navigation Corp. is controlled by Mr. Economou.

(2) As of May 20, 2024, each of the

Reporting Persons shared the power to dispose of 584,749 Common Shares in the aggregate. As of March 28, 2024, the record date for

the Issuer’s 2024 Annual Meeting, each of the Reporting Persons had the shared power to vote 2,339,084 Common Shares at such meeting

(representing approximately 5.5% of the Common Shares issued and outstanding as of such record date), and the Reporting Persons retain

as of the date of this Amendment the shared power to vote all such Common Shares for purposes of the 2024 Annual Meeting as a result

of all such Common Shares having been held on such record date (notwithstanding that the Sold Shares have been sold by the Reporting

Persons after such record date), but do not otherwise have beneficial ownership of the Sold Shares as of the date of this Amendment.

(3) Based on the 42,751,752 Common Shares

stated by the Issuer as being outstanding as at March 28, 2024 in the 2024 Proxy Statement.

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,339,084(1)(2) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

584,749(1)(2) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,339,084(1)(2) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

5.5%(2)(3) |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

(1) All reported Common Shares are held by

GK Investor LLC. GK Investor LLC is a controlled affiliate of each of Sphinx Investment Corp. and Maryport Navigation Corp. Sphinx Investment

Corp. is a controlled affiliate of Maryport Navigation Corp. Maryport Navigation Corp. is controlled by Mr. Economou.

(2) As of May 20, 2024, each of the

Reporting Persons shared the power to dispose of 584,749 Common Shares in the aggregate. As of March 28, 2024, the record date for

the Issuer’s 2024 Annual Meeting, each of the Reporting Persons had the shared power to vote 2,339,084 Common Shares at such meeting

(representing approximately 5.5% of the Common Shares issued and outstanding as of such record date), and the Reporting Persons retain

as of the date of this Amendment the shared power to vote all such Common Shares for purposes of the 2024 Annual Meeting as a result of

all such Common Shares having been held on such record date (notwithstanding that the Sold Shares have been sold by the Reporting Persons

after such record date), but do not otherwise have beneficial ownership of the Sold Shares as of the date of this Amendment.

(3) Based on the 42,751,752 Common Shares

stated by the Issuer as being outstanding as at March 28, 2024 in the 2024 Proxy Statement.

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,339,084(1)(2) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

584,749(1)(2) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,339,084(1)(2) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

5.5%(2)(3) |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

(1) All reported Common Shares are held by

GK Investor LLC. GK Investor LLC is a controlled affiliate of each of Sphinx Investment Corp. and Maryport Navigation Corp. Sphinx Investment

Corp. is a controlled affiliate of Maryport Navigation Corp. Maryport Navigation Corp. is controlled by Mr. Economou.

(2) As of May 20, 2024, each of the

Reporting Persons shared the power to dispose of 584,749 Common Shares in the aggregate. As of March 28, 2024, the record date for

the Issuer’s 2024 Annual Meeting, each of the Reporting Persons had the shared power to vote 2,339,084 Common Shares at such meeting

(representing approximately 5.5% of the Common Shares issued and outstanding as of such record date), and the Reporting Persons retain

as of the date of this Amendment the shared power to vote all such Common Shares for purposes of the 2024 Annual Meeting as a result of

all such Common Shares having been held on such record date (notwithstanding that the Sold Shares have been sold by the Reporting Persons

after such record date), but do not otherwise have beneficial ownership of the Sold Shares as of the date of this Amendment.

(3) Based on the 42,751,752 Common Shares

stated by the Issuer as being outstanding as at March 28, 2024 in the 2024 Proxy Statement.

This Amendment No. 4 to

Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D filed on December 29, 2023, as amended

and supplemented by Amendment No. 1 to Schedule 13D on January 10, 2024, Amendment No. 2 to Schedule 13D on April 8,

2024 and Amendment No. 3 to Schedule 13D on May 2, 2024 (the “Initial 13D”, and the Initial 13D as further

amended and supplemented by this Amendment, the “Schedule 13D”) by the Reporting Persons, relating to the common shares,

par value $0.01 per share (the “Common Shares”), of Genco Shipping & Trading Limited, a corporation formed

under the laws of the Republic of the Marshall Islands (the “Issuer”). Capitalized terms not defined in this Amendment

shall have the meanings ascribed to them in the Initial 13D.

| Item 4. |

Purpose of Transaction. |

Item 4 of the Initial 13D is

hereby supplemented by adding the following paragraph to the end thereof:

“On May 16, 2024,

GK Investor announced the withdrawal of its nomination of Mr. Robert M. Pons as a candidate for election to the Board, and

of the By-Law Repeal Proposal. GK Investor (i) no longer intends to nominate any candidates for election to the Board,

or to make any other proposals, at the 2024 Annual Meeting, (ii) has withdrawn its prior Notice (including all supplements thereto)

delivered to the Issuer in respect of the 2024 Annual Meeting, as well as the nominations and proposals made therein and (iii) no

longer intends to solicit any proxies in respect of the 2024 Annual Meeting or vote any third party’s proxies at the 2024 Annual

Meeting.”

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Initial 13D is hereby amended and restated

as set forth below:

“(a),

(b) The Reporting Persons each may be deemed to beneficially own all of the 2,339,084 Common Shares (the “Subject Shares”)

reported herein, which represent approximately 5.5% of Issuer’s outstanding Common Shares, based on the 42,751,752 Common Shares

stated by Issuer as being outstanding as of March 28, 2024 in the Issuer’s 2024 Proxy Statement.

GK Investor has the sole power

to vote or direct the vote of 0 Common Shares; has the shared power to vote or direct the vote of 2,339,084 Common Shares; has the sole

power to dispose or direct the disposition of 0 Common Shares; and has the shared power to dispose or direct the disposition of 584,749

Common Shares.

Sphinx has the sole power to

vote or direct the vote of 0 Common Shares; has the shared power to vote or direct the vote of 2,339,084 Common Shares; has the sole power

to dispose or direct the disposition of 0 Common Shares; and has the shared power to dispose or direct the disposition of 584,749 Common

Shares.

Maryport has the sole power

to vote or direct the vote of 0 Common Shares; has the shared power to vote or direct the vote of 2,339,084 Common Shares; has the sole

power to dispose or direct the disposition of 0 Common Shares; and has the shared power to dispose or direct the disposition of 584,749

Common Shares.

Mr. Economou has the sole

power to vote or direct the vote of 0 Common Shares; has the shared power to vote or direct the vote of 2,339,084 Common Shares; has the

sole power to dispose or direct the disposition of 0 Common Shares; and has the shared power to dispose or direct the disposition of 584,749

Common Shares.

As of March 28, 2024, the

record date for the Issuer’s 2024 Annual Meeting, each of the Reporting Persons had the shared power to vote 2,339,084 Common Shares

at such meeting (representing approximately 5.5% of the Common Shares issued and outstanding as of such record date), and the Reporting

Persons retain as of the date of this Amendment the shared power to vote all such Common Shares for purposes of the 2024 Annual Meeting

as a result of all such Common Shares having been held on such record date (notwithstanding that 1,754,335 of such Common Shares (including

the power to dispose, or to direct the disposition of, such Common Shares) (the “Sold Shares”) have been sold by the

Reporting Persons after such record date), but do not otherwise have beneficial ownership of the Sold Shares as of the date of this Amendment.

(c) Other than as described

herein or on Exhibit 99.2 filed herewith, which is incorporated herein by reference, no transactions of Common Shares were

effected by the Reporting Persons during the past 60 days.

(d) Except as set forth

above in this Item 5, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the

proceeds from the sale of, the Common Shares.

(e) Not applicable.”

| Item 7. |

Material to be Filed as Exhibits. |

* Previously filed

SIGNATURES

After reasonable inquiry and to the best of my knowledge

and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

| Date: May 20, 2024 |

GK Investor LLC |

| |

|

| |

By: |

Sphinx Investment Corp., its Manager |

| |

|

|

| |

By: |

Kleanthis Costa Spathias |

| |

|

Kleanthis Costa Spathias |

| |

|

Director |

| |

|

|

| Date: May 20, 2024 |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: |

Levante Services Limited |

| |

|

|

| |

By: |

Kleanthis Costa Spathias |

| |

|

Kleanthis Costa Spathias |

| |

|

Director |

| |

|

|

| Date: May 20, 2024 |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: |

Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis Costa Spathias |

| |

|

Kleanthis Costa Spathias |

| |

|

Director |

| |

|

| Date: May 20, 2024 |

GEORGE ECONOMOU |

| |

|

| |

By: |

/s/ George Economou |

| |

|

George Economou |

Exhibit 99.2

TRANSACTIONS

The

following table sets forth all transactions with respect to Common Shares effected in the last sixty days by the Reporting Persons on

behalf of the Reporting Persons in respect of the Common Shares, inclusive of any transactions effected prior to the filing hereof, on

May 20, 2024. All such transactions were purchases or sales of Common Shares effected

in the open market, and the table includes commissions paid in per Common Share prices.

| | |

Trade Date | |

Reporting Person

Effecting Transaction | |

Buy/Sell | |

Quantity | | |

Price ($)1 | |

| 1. | |

04/03/2024 | |

GK Investor LLC | |

Sell | |

| 28,429 | | |

$ | 21.01 | |

| 2. | |

04/11/2024 | |

GK Investor LLC | |

Sell | |

| 55,252 | | |

$ | 21.06 | |

| 3. | |

04/23/2024 | |

GK Investor LLC | |

Sell | |

| 74,494 | | |

$ | 21.15 | |

| 4. | |

04/25/2024 | |

GK Investor LLC | |

Sell | |

| 49,512 | | |

$ | 21.24 | |

| 5. | |

04/26/2024 | |

GK Investor LLC | |

Sell | |

| 120,032 | | |

$ | 21.47 | |

| 6. | |

04/29/2024 | |

GK Investor LLC | |

Sell | |

| 46,642 | | |

$ | 21.43 | |

| 7. | |

04/30/2024 | |

GK Investor LLC | |

Sell | |

| 87,971 | | |

$ | 21.45 | |

| 8. | |

05/01/2024 | |

GK Investor LLC | |

Sell | |

| 110,000 | | |

$ | 21.54 | |

| 9. | |

05/02/2024 | |

GK Investor LLC | |

Sell | |

| 125,000 | | |

$ | 22.08 | |

| 10. | |

05/03/2024 | |

GK Investor LLC | |

Sell | |

| 100,000 | | |

$ | 22.11 | |

| 11. | |

05/06/2024 | |

GK Investor LLC | |

Sell | |

| 65,700 | | |

$ | 21.93 | |

| 12. | |

05/07/2024 | |

GK Investor LLC | |

Sell | |

| 150,000 | | |

$ | 22.22 | |

| 13. | |

05/08/2024 | |

GK Investor LLC | |

Sell | |

| 111,892 | | |

$ | 22.48 | |

| 14. | |

05/09/2024 | |

GK Investor LLC | |

Sell | |

| 95,911 | | |

$ | 22.65 | |

| 15. | |

5/10/2024 | |

GK Investor LLC | |

Sell | |

| 86,400 | | |

$ | 22.80 | |

| 16. | |

5/13/2024 | |

GK Investor LLC | |

Sell | |

| 100,000 | | |

$ | 22.90 | |

| 17. | |

5/14/2024 | |

GK Investor LLC | |

Sell | |

| 100,000 | | |

$ | 22.80 | |

| 18. | |

5/15/2024 | |

GK Investor LLC | |

Sell | |

| 54,000 | | |

$ | 22.49 | |

| 19. | |

5/16/2024 | |

GK Investor LLC | |

Sell | |

| 100,000 | | |

$ | 22.91 | |

| 20. | |

5/17/2024 | |

GK Investor LLC | |

Sell | |

| 93,100 | | |

$ | 23.14 | |

1

Prices are rounded to the nearest cent.

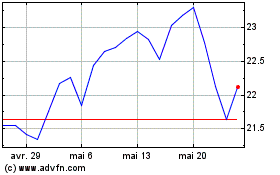

Genco Shipping and Trading (NYSE:GNK)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Genco Shipping and Trading (NYSE:GNK)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024